- Our Philosophy

-

Offerings

Portfolio Management Services (PMS)

Asset Allocation Services

- Insights

Videos

Just Released

Our most recent videos

Strategy Series

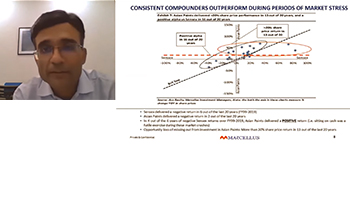

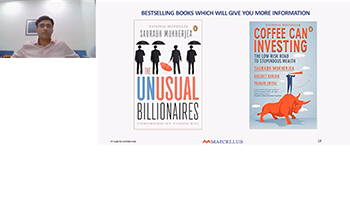

This playlist will have videos that will give you insight into

the strategies/product offerings by Marcellus

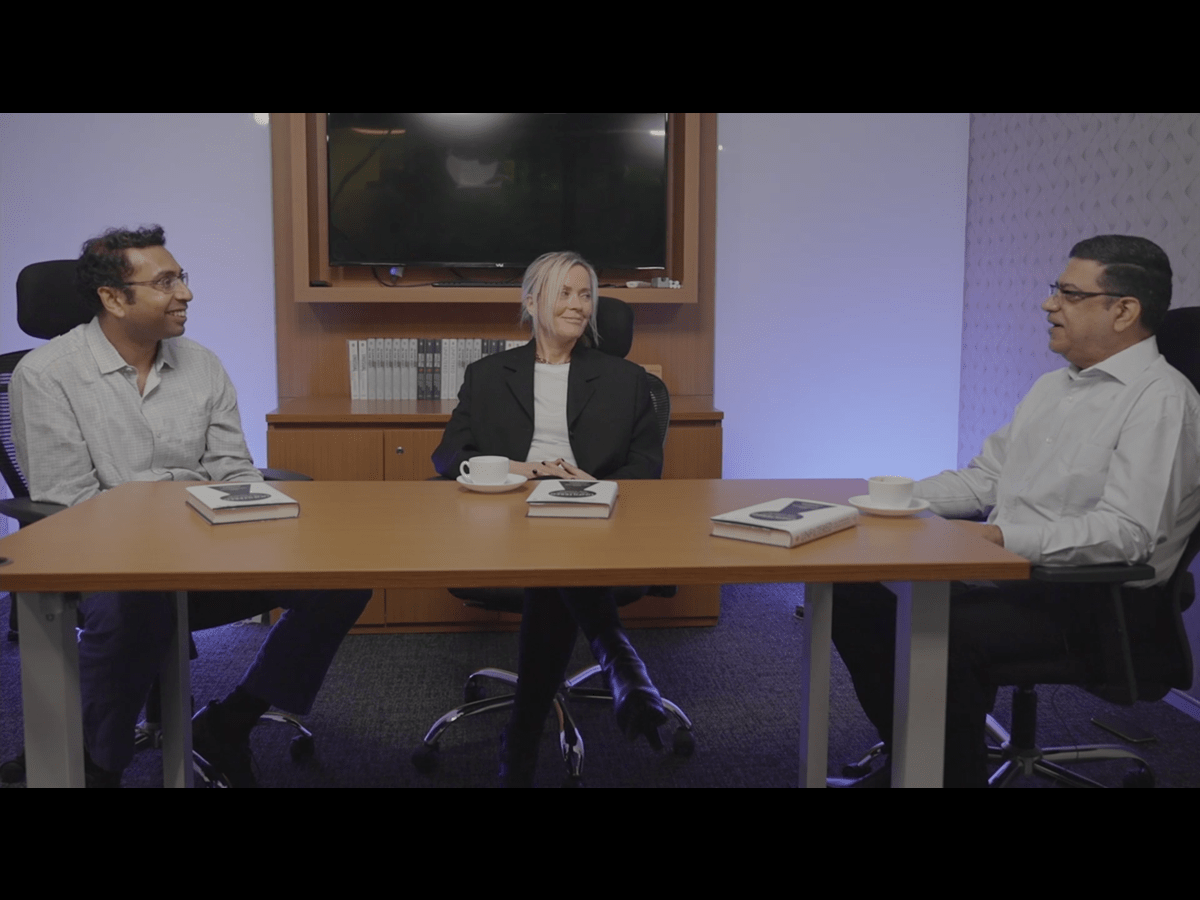

Our Playlists

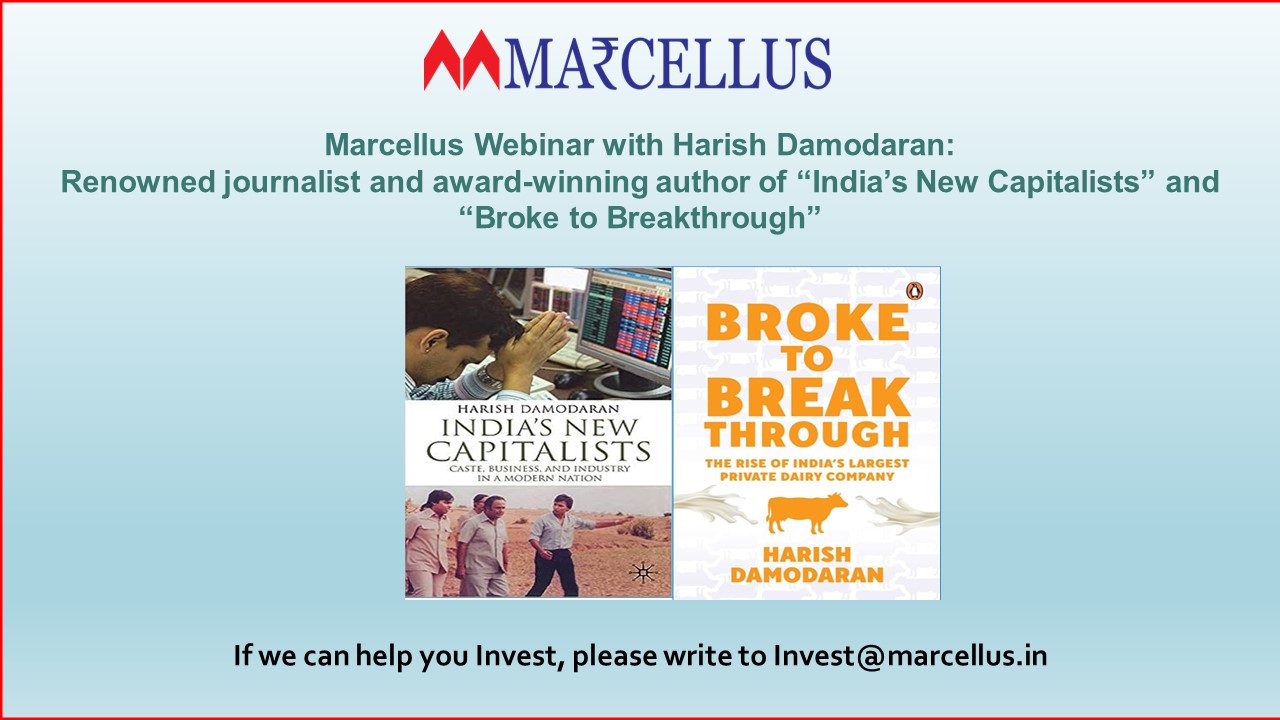

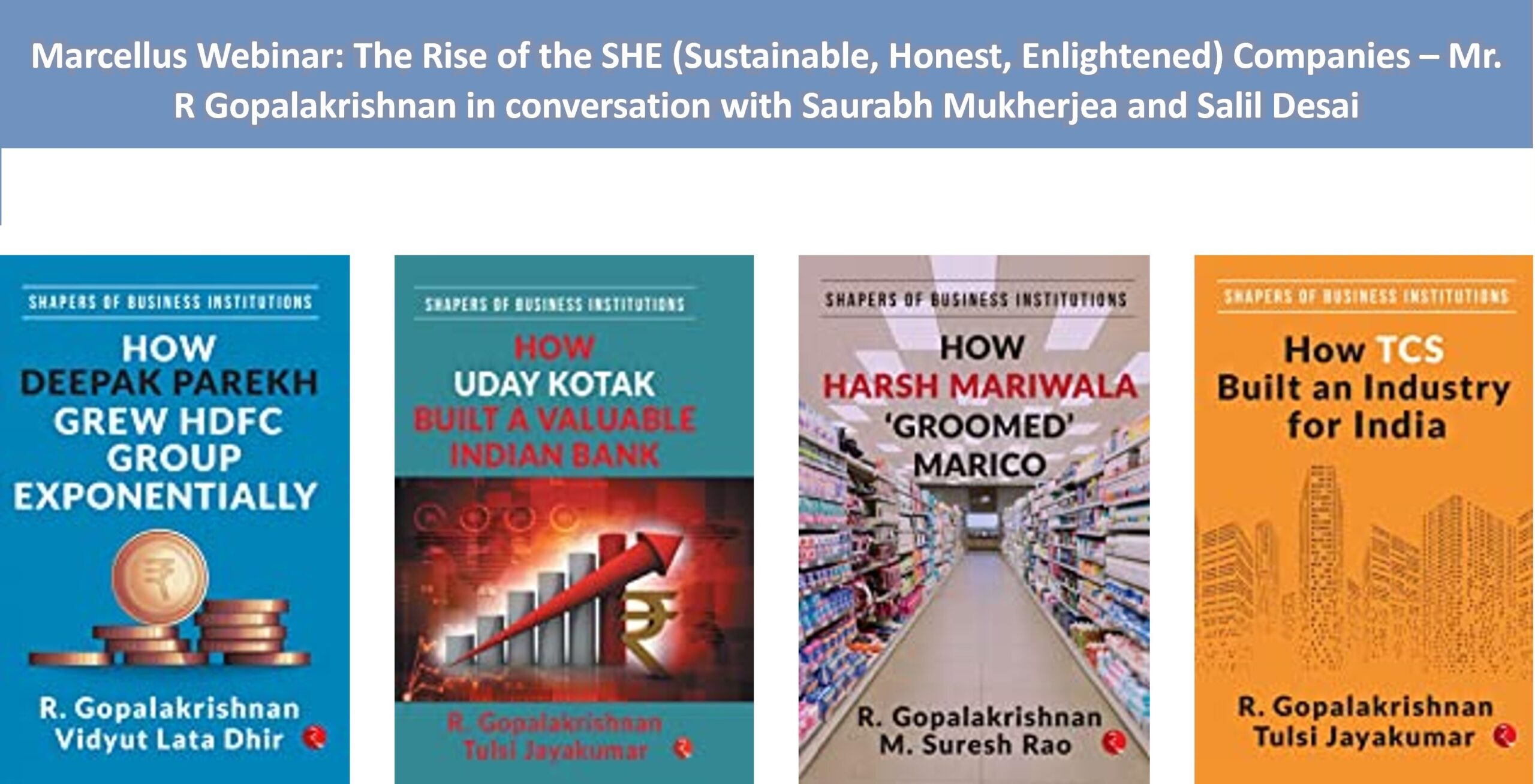

Two of our curated playlists that highlight our interactions with industry experts and management teams.