Overview

Marcellus’ MeritorQ PMS takes a rules-based approach to screen for companies with low leverage, consistent profitability and which pass the Marcellus’s quantitative forensic accounting framework. From this list of companies, approximately 35-45 companies which are both profitable as well as relatively mispriced are selected to form the final portfolio.

The portfolio is reconstituted Quarterly based on stated portfolio construction rules, effective on the first trading date of every quarter.

Key features

- Long only portfolio with a Quantitative + fundamentals approach based on good investing principles.

- Stocks selected into the portfolio are typically held for at least one year. Roughly 50% annualized turnover observed across 16-year backtest period.

- Holds 35-45 stock portfolio diversified across large, mid and small cap segment and factors (quality and value).

- ~40-60% allocation to small and mid-caps seen over backtested history.

- ~20-30% allocation to top 5 stocks.

- No allocation constraints on single stock or sectors as the objective is to select best companies which are both profitable as well as undervalued.

- Minimal discretion in portfolio construction process. No star portfolio manager risk.

- Suitable for investors with > 3 years investment horizon.

Fee Structure

Marcellus’ MeritorQ PMS comes with zero entry load/exit load and with no lock-in.

| Regular Plan | Direct Plan | |||||

|---|---|---|---|---|---|---|

| Fixed | Variable | Hurdle | Fixed | Variable | Hurdle | |

| Fixed only | 2% | 0% | NA | 0.75% | 0% | NA |

Backtested Performance

| Period: July-2006 to Aug-2022 | BSE 500 | Strategy |

|---|---|---|

| CAGR(%) | 11.6 | 20.3 |

| Risk (%) | 23.2 | 22 |

| Downside Risk (%) | 16.9 | 16.2 |

| Return/Risk | 0.5 | 0.92 |

| Return/Downside Risk | 0.29 | 0.84 |

| Maximum Drawdown (%) | -66.4 | -59.4 |

| Rolling Returns | ||

| Average 36months rolling returns | 10.2 | 21.9 |

| Average 36months rolling risk | 21.3 | 20.4 |

| Average 36months rolling return/risk | 0.57 | 1.22 |

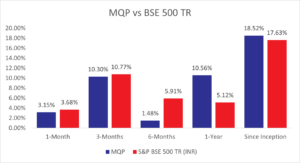

Performance

Performance as on 30th June 2025 (figures in %)

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu. Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure. Performance data shown is net of fixed fees and expenses charged till June 30, 2025 and is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary/performance calculation date falls upto the last date of this performance period. Since, for Little Champs Portfolio, performances fees are charged on cumulative gains at the third anniversary, of the respective client account, the effect of the same has been incorporated for client accounts whose third account anniversary falls upto the last date of this performance period. Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission.

FUND MANAGER

Omkar Sawant, CA

Portfolio Manager

BCom, CA

Interested to know more?

Talk to an advisorPRODUCT PRESENTATION

PMS Fees Calculator

Invest with Marcellus’ MeritorQ PMS

Get in Touch