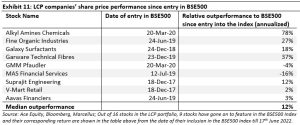

Most small caps that show early promise falter as they grow and eventually fade into oblivion. The most common reasons are dubious accounting/governance practices that come to fore as these companies are tracked closely by investors, capital misallocations (often a result of overconfidence or lethargy) and lack of delegation/institutionalisation which inhibits the franchise’s growth. At Marcellus, we track our Little Champs portfolio companies closely through intensive forensic checks alongside lethargy and succession planning frameworks to detect early signs of deterioration. The fundamentals as well as the track record of compounding demonstrated by the Little Champs companies that have entered BSE500 give us confidence that these companies, despite growing rapidly, remain on track to become long term compounders.

Performance update for the Little Champs Portfolio

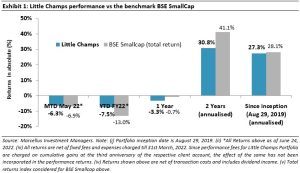

At Marcellus, the key objective of our Little Champs PMS is to own a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. While we intend to fill our portfolio with companies having the above attributes, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Most small caps falter before reaching full bloom

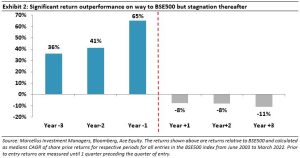

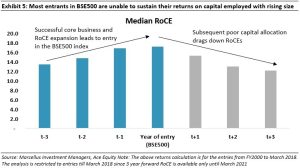

Indian small cap companies prior to entering the BSE500 are one of the most lucrative niches of the Indian stock market in terms of long-term returns. As shown in Exhibit 2 below, in the three-year run-up to entering the BSE500, these potential entrants outperform the index by 36% CAGR with the margin of outperformance increasing as they get closer to entering the benchmark index. However, this trend changes completely once these stocks enter the index. Quite contrary to their performance pre-entry, new entrants into the BSE500 on an average underperform the BSE500 by 11% p.a. over three years post the entry.

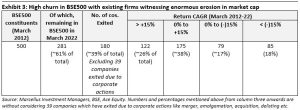

Another set of data which reflects the challenge brought upon by rising size is the historical churn in the BSE500 index: 9% p.a between March 2012-March 2022. This high churn signifies that most existing incumbents are unable to sustain their place in the index. If one were to look at BSE500 as it stood in March 2012, out of the total 500 member stocks then, about 281 stocks continue to remain in the index in March 2022. In other words, ~39% of the stocks have exited the index over the last ten years for reasons other than for corporate actions like mergers, acquisitions, delisting, etc. Furthermore, on their way out, most of these stocks saw significant erosion in their shareholders’ wealth.

All the above analysis suggests that most companies which otherwise enjoy a superb run when they are small are unable to sustain the momentum once they get bigger and enter the BSE500. An analysis of such companies points towards the following common reasons:

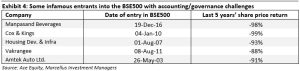

- Accounting/governance issues coming to the fore :

While the reward is enormous for picking the right small cap stocks, the associated risks and rigour required are manifold compared to that in large cap mid cap investing. In particular, the accounting/governance risks in a small cap are due to: (i) relatively high dependence on promoter(s) as generally the level of institutionalisation is relatively low in small caps given their stage of evolution; and (ii) relatively low level of analysts’ coverage and institutional ownership resulting in these companies not being subject to extensive diligence. Hence as these companies become bigger and form part of a prominent index like BSE500, they are necessary exposed to heightened scrutiny of analysts and investors. Thus, instances of financial frauds and/or governance unravel under the burden of heightened scrutiny and analysis.

- Capital misallocation:

Capital allocation becomes one of the biggest make or break events for a company particularly as it grows bigger in size and accruals start becoming sizeable. In most cases, the promoters or the people at the helm of capital allocation decisions demonstrate behaviours which are prejudicial to the interests of minority shareholders:

i) In one set of cases, the promoters/management teams, fuelled by past success, develop hubris and overconfidence in their abilities. In most such cases, either huge capital allocation bets are taken without regard to risk thresholds or sizeable capital is allocated to the non-core business where the company lacks competitive advantage. Jim Collins’ famous book ‘How the Mighty Fall’ provides a five-stage framework on how hubris driven capital allocation decisions become the source of company’s decline and in many cases eventual fade in oblivion. This framework is discussed extensively in our July 2021 blog ‘Staying on the Top of Everest is Harder than Getting There’. The end game is usually a significant decline in returns on capital due to failures in non-core ventures as well as the core business getting neglected.

ii) At another extreme, the promoters/management demonstrate extreme caution and show reluctance to deploy the surplus cash or return it to the shareholders (through dividends, buybacks, etc). The result is that returns on investments goes down.

- Issues around succession Planning:

As highlighted earlier, smaller companies typically involve a single person at the helm of the affairs with his/her skills (technical, sales and/or managerial) being the defining competitive advantage of the company for many years. However, as the company expands, the rising business complexities (managing newer units, newer geographies, etc) require delegation of key responsibilities to a wider set of people as well as an eventual passing of the leadership mantle to the new generation. However, there are many challenges involved in transitioning towards a decentralised management construct in smaller companies such as: (i) reluctance on the part of the founder to yield power and delegate responsibilities; (ii) complication arising from too many family members’ involvement in the business; and (iii) inability to attract top quality talent due to size. These HR issues eventually become the key roadblock to scaling up of the business. We have discussed this aspect in detail in our November 2021 Little Champs newsletter.

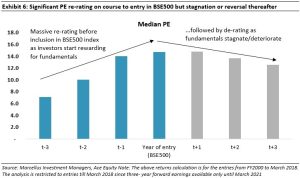

- Re-rating benefits ebbing off:

The return performance for promising small caps is not just a function of superior earnings growth delivered by these firms in the run-up, but also a result of their valuations getting re-rerated. When these stocks are small and still inventing the wheels of their business, they are largely unnoticed by the large investors’ and research analysts’ communities. This results in them trading at significant discounts to their larger counterparts. However, once they reach a particular size, they come under the ambit of more and more research analysts’ coverage and institutional investors’ ownership and thus move up the valuation band. However, the role of valuation re-rating in share price returns diminishes as the company becomes bigger and growth becomes the key driver thereof.

How do we monitor our Little Champs stocks for signs of stagnation or decline?

At Marcellus, based on the above lessons from the companies starting well but losing their way as they become bigger, we have developed the following frameworks and research process to continuously monitor our Little Champs portfolio for any signs of stagnation or decline:

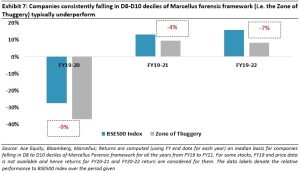

Forensic Accounting frameworks and checks to evaluate the accounting/governance quality: In our December 2019 newsletter, we had explained the forensic accounting framework employed by Marcellus to weed out companies at risk of destroying shareholders’ wealth. The framework, using a set of 12 forensic accounting ratios gives a decile-based accounting quality rank to the stocks universe. Stocks that consistently rank the lowest on this framework (typically in the lowest deciles D7-D10) generally don’t find a place in our portfolio. Besides clearing the forensic framework, on the narrow shortlist of companies that makes it past our quantitative filters, extensive due-diligence is also conducted by our research team including deep dive into financial statements, primary data checks into promoter integrity, channel checks including plant/branch visits, etc.

Evaluating stocks on the forensic framework or other financial checks is not just a one-time exercise at the time of portfolio construction but a periodical exercise that are conducted on the portfolio stocks (for instance once the annual reports are published). Stocks which see a significant slip up in its accounting rank are thoroughly investigated by the investments team and are retained in the portfolio only if backed by sound justification for such slippages.

- Capital allocation initiatives assessed through our Lethargy framework :

To understand the adequateness as well as soundness of capital allocation decisions of Little Champs, we utilise our proprietary lethargy framework – as highlighted in our October 2021 The lethargy framework analyses capital reinvestment initiatives being undertaken at periodic intervals by the firm to deepen its existing competitive advantages, add new revenue growth drivers and radically disrupt its own industry.

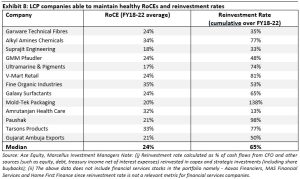

The Little Champs have differentiated themselves from their peers through high capital reinvestment initiatives to either strengthen the existing business (and thus gain market share) and/or add new growth drivers. As shown in the table below, the median reinvestment rate for the Little Champs portfolio companies has been around 65% over the last five years (FY18-22) while maintaining healthy RoCEs of 24% (on median basis) over this period. In addition to industry growth and market share, key avenues of growth for Little Champs have been globalisation (are based on product innovations, process improvements and people management) and related diversification (having strong linkages to the core business either in terms of product, manufacturing process and/or distribution). Both these aspects are discussed in detailed in our July 2021 and August 2021 newsletters respectively.

- Promoter’s focus and skin in the game:

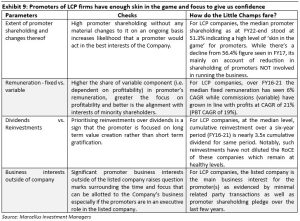

Given the disproportionate influence a company’s promoter has on the business operations of a small cap company, taking a call on a small cap company becomes akin to taking a call on the promoter(s). Besides the promoter’s track record on capital allocations and her ability to deal with crises, another important aspect of promoter quality is the extent to which promoter is financially & emotionally invested in single mindedly running the business of the Company i.e. does she have skin in the game which aligns her interests with that of the minority shareholders? To that end we utilise the following parameters which we detailed in our May 2022 Little Champs newsletter.

- Succession Planning:

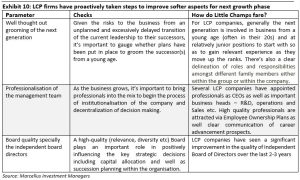

The final piece of the puzzle relates to more qualitative or softer aspects of business which is often overlooked by the investors. Marcellus’ succession planning framework discussed in detail in our November 2021 newsletter tracks such softer aspects which includes institutionalisation of the business at different levels i.e. decentralisation of decision making amongst members of the Board, CXOs, as well as ground level execution through systems and processes. In addition, especially relevant for Little Champs portfolio is getting a sense of the succession planning within the family – whether the roles and responsibilities within the next generation family members are unambiguously defined so that there no disputes when the family patriarch moves out of the picture eventually. The key checks and how Little Champs fare on the same are summarised in the below exhibit:

Conclusion

To summarise, most small caps that show enormous promise in early stage of their evolution falter as they get bigger and eventually fade into oblivion. The most common reasons are dubious accounting/governance practices that come to fore as these companies gets tracked closely by analysts/investors, capital misallocations (often a result of overconfidence or lethargy) and lack of delegation/institutionalisation which inhibits the business growth. At Marcellus, we track our Little Champs portfolio companies closely through intensive forensic checks and through our lethargy and succession frameworks to detect any early signs of decay. The fundamentals as well as the compounding track record (as shown in the exhibit below) of the Little Champs companies that have entered BSE500 gives us confidence that these companies, despite getting bigger, remain on track to become long term compounders.