Lenders are leveraged business and have a unique business model very different from other non-financial companies. This makes it difficult to compare metrics of lenders with other companies. In this newsletter we delve deeper into such aspects of reinvestment rate, book value compounding and return on equity of lenders. For instance, for most non-financial companies, the earnings growth is lower than the return on capital employed as their reinvestment rate is usually less than 100%. On the other hand, the earnings growth of quality lenders is usually higher than their return on equity due to the ability of these firms to deploy large sums of capital profitably. Hence, the reinvestment rate of lenders cannot be simply calculated as 100% minus the dividend payout ratio. In this context, we discuss how HDFC Bank, Kotak Bank and Bajaj Finance have been able to grow their book value per share at a CAGR of 21%, 19% and 31% respectively over the past 10 years aided by reinvestment rates in excess of 100%.

Performance update of the live fund

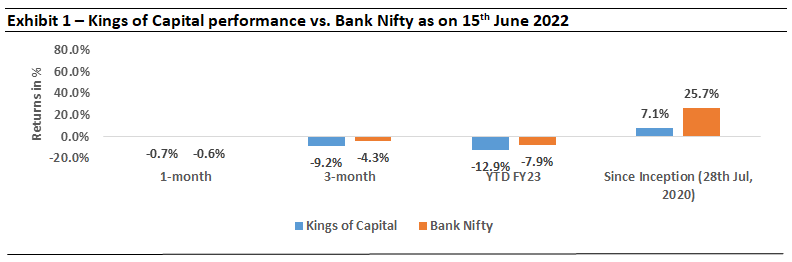

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Note: Performance data is net of annual performance fees charged for client accounts whose account anniversary date falls upto the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated upto 31st March, 2022.

Note: Performance data is net of annual performance fees charged for client accounts whose account anniversary date falls upto the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated upto 31st March, 2022.

India’s demographics and competitive dynamics make it possible for financial companies to deliver high RoEs and high reinvestment rates

For any company – in Financial Services or otherwise – to consistently grow profits, it needs two key ingredients – a) high RoEs and b) a high reinvestment rate. However, this combination is very hard to achieve because if a company is reinvesting large amounts of capital (and thus ramping up the scale of its business very fast) sooner rather than later, ROE tends to fall as the firm either encounters rising competition or runs out of addressable market space. In this context, it is interesting to note that quality lenders in India are able to generate high RoEs along with high reinvestment rates due to the following reasons:

- Banking sector growth supported by India’s nominal GDP growth: As India is still a developing economy with low credit penetration, not only does India’s GDP grow at a relatively healthy rate but credit growth is also higher than the nominal GDP growth which itself is 10-12% per annum.

- Competitive dynamics: As public sector (PSU) banks still have 60% of the market share of the banking sector in India, the private banks are able to gain market share year after year. All PSU players have an inherent conflict regarding whether they should allocate capital to reward minority investors or work to achieve the social or political objectives of their majority shareholder which is the Government (click hereto read our 19th Feb, 2020 blog on why PSU stocks disprove the efficient market hypothesis). This dynamic of PSU players losing market share is therefore structural in nature and holds true for the general and life insurance sectors as well.

- Quality lenders still have a long runway for growth: Despite PSU banks continuing to lose market share, some of the quality lenders in India still have a low single digit market share in advances and deposits. For instance, Kotak’s market share in banking sector’s advances/deposits stood at just 2.3%/1.9% as of Mar’22.

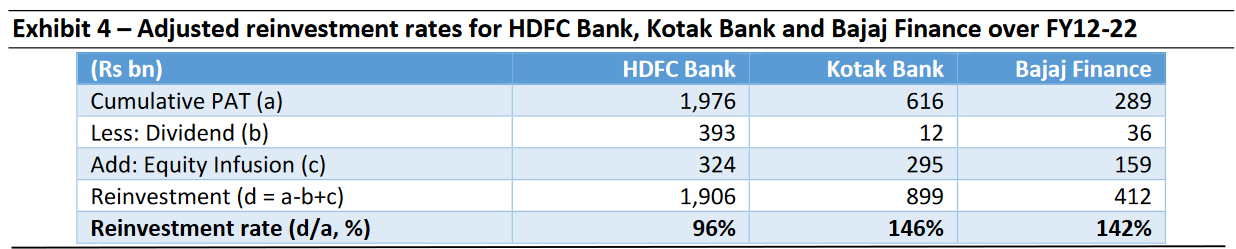

Given the above dynamics, the reinvestment rate of even India’s largest private sector bank, HDFC Bank, has been 96% over the last 5 years vs. the median reinvestment rate for the top 5 banks listed in the US was at 68% during CY17-21.

Source: Marcellus Investment Managers

Source: Marcellus Investment Managers

Quality lenders are able to generate high RoEs on large sums of capital without making mistakes:

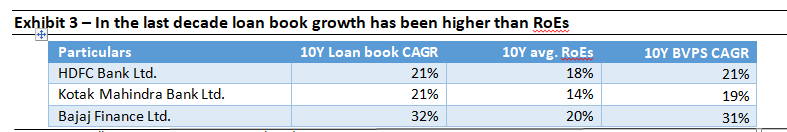

- A robust self-sustaining business model is a must: Over the last 10 years, quality Indian lenders have done something which is actually very difficult to do i.e. reported growth in BVPS (book value per share) which is well ahead of RoE generation thanks to being able to raise fresh equity capital to fuel growth – see Exhibit 3. These lenders have been able to raise capital at high P/B multiples because of their proven ability to deploy large amounts of capital profitably. Had these lenders raised capital at P/B multiples closer to 1, growing BVPS faster than RoE would not have been possible. Therefore, a fundamentally strong business model and robust asset quality – which in turn drives a high P/B multiple – are a must to generate rapid BVPS growth.

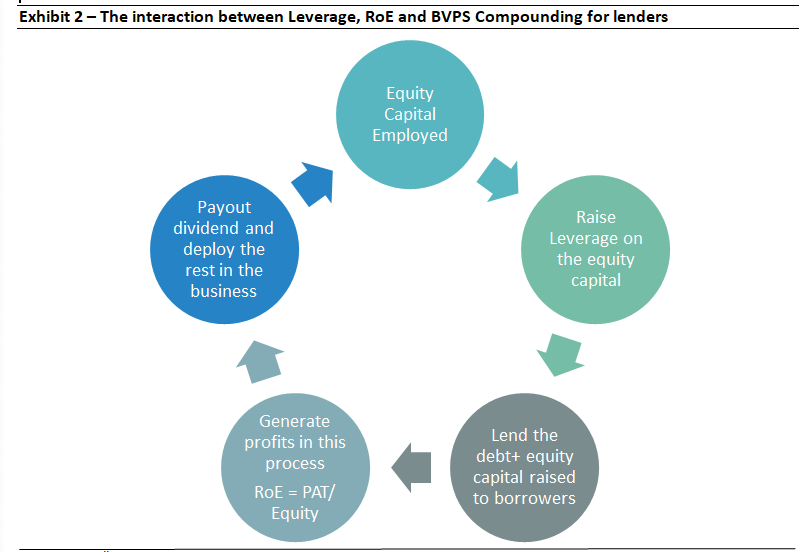

- Share price compounding follows BVPS compounding: In the long run, share prices for financial services companies tend to follow their BVPS growth. As explained in Exhibit 2 and 3, a lenders’ BVPS can compound through (i) RoE generation and (ii) equity capital raises.

- Capital will eventually be available only to those lenders which are able to consistently compound BVPS: As the ability to raise capital which is BVPS accretive is linked to the ability to consistently generate high RoEs, there are only a select few lenders who have been able to do this consistently over a long period of time. As depicted in Exhibit 3 below, loan book growth for quality lenders has been ahead of the RoEs leading to reinvestment rates of 100% or higher. As the market realizes the inability of most other lenders to compound BVPS consistently, the availability of equity capital for such lenders is likely to become more and more scarce. This will lead to capital being available only to a select few lenders who have demonstrated the ability to generate consistent RoEs.

Different approaches followed by quality lenders to compound BVPS:

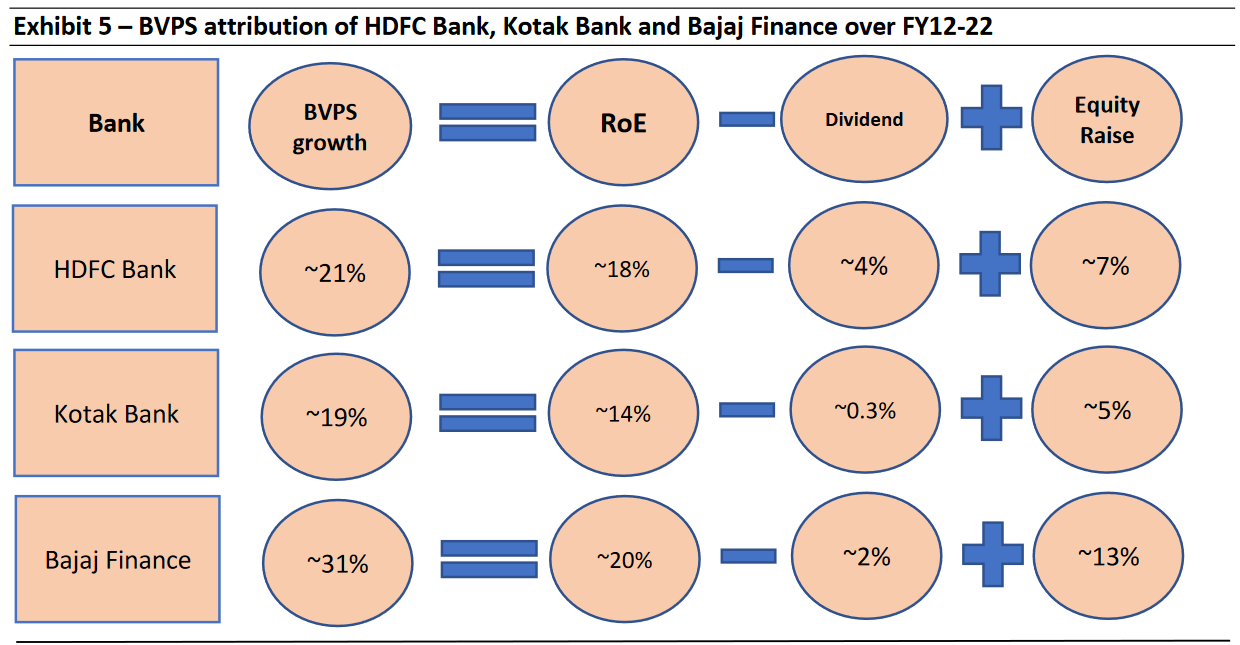

Over the last 10 years, BVPS growth has been at 21/19/31% respectively for HDFC Bank, Kotak Bank and Bajaj Finance. The majority of this compounding is led by organic RoE; however, equity fund raises have also contributed to this compounding. These lenders have taken different paths to achieve the ~20% BVPS compounding.

- HDFC Bank – the true consistent compounder: HDFC Bank has consistently paid dividends using ~20% of its profits over the last decade. However, the bank raised capital twice during the last 10 years. Given these large capital issuances at high P/B multiples and stable RoEs (at 18%), the bank was able to post 21% BVPS compounding.

- Kotak Bank – the master capital allocator: Like HDFC Bank, Kotak bank also compounded its BVPS at a healthy rate of 19% CAGR, however, the bank adopted a different route. Over the last 10 years, Kotak Bank paid negligible dividends but raised large amounts of equity capital – the bank has raised capital 4 times (once for the ING merger and thrice otherwise) – at high P/B multiples. The bank scaled up its subsidiaries in the last 10 years and allocated capital prudently across all its financial services businesses. Along with HDFC Bank, Kotak was the only other large bank to come out unscathed from the corporate asset quality cycle of FY05-15.

- Bajaj Finance – the high growth engine: Bajaj Finance has paid out ~12% if its profits as dividends over the last 10 years. Bajaj Finance was the fastest growing lender over the last 10 years (32% loan book growth vs. 21% each for HDFC Bank and Kotak) and also the lender with the highest RoE (around 20%). It was thus able to compound its BVPS at a rate of 31% over the past 10 years.

Source: Marcellus Investment Managers, Bloomberg Note: Above equity infusion doesn’t include infusions on account of exercise of ESOPs

Source: Marcellus Investment Managers, Bloomberg Note: Above equity infusion doesn’t include infusions on account of exercise of ESOPs

Source: Marcellus Investment Managers, Bloomber

Source: Marcellus Investment Managers, Bloomber

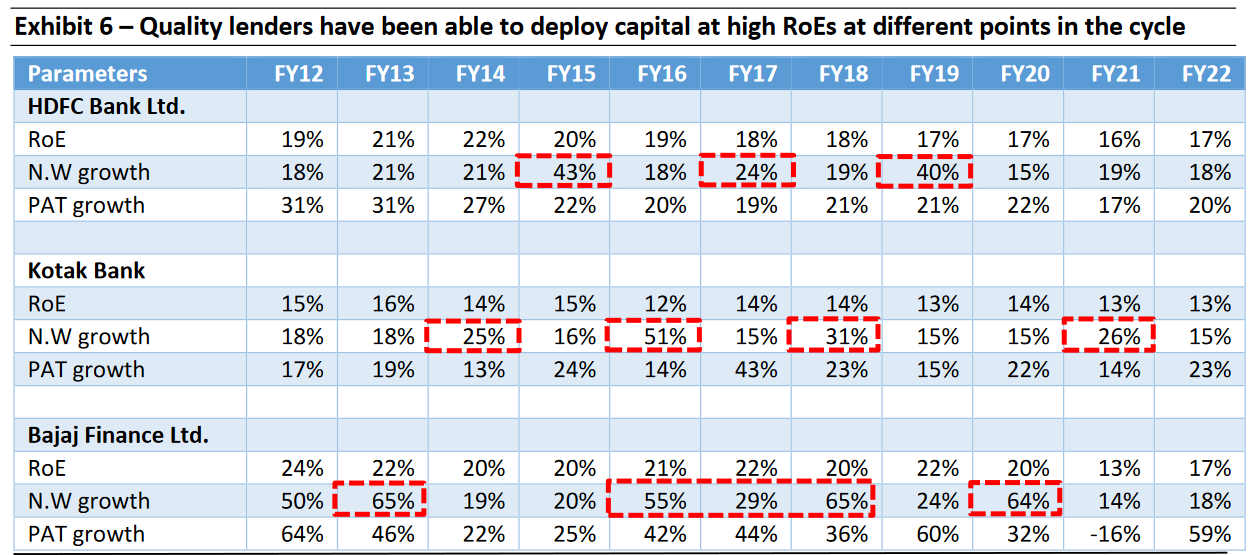

Source: Marcellus Investment Managers Note: Red box signifies equity fund raise during the year; N.W refers to Net Worth

Source: Marcellus Investment Managers Note: Red box signifies equity fund raise during the year; N.W refers to Net Worth

Higher growth, High RoE and equity raise at high P/B multiples = a virtuous cycle!

- Companies which can consistently generate ROE much higher than the cost of equity, tend to trade at prices much higher than their BVPS. As these companies reinvest profits back in the business and raise equity capital to support growth, BVPS compounds faster (vs. organic RoE generation).

- This creates a virtuous cycle where strong lenders continue to generate high RoEs, growth and raise equity at prices much higher than BVPS, leading to sustainable long term wealth creation for the shareholders. Availability of capital for these lenders also allows them to gain disproportionately higher market share.

- As illustrated in Exhibit 6 above, if we were to look at the last 10 years, quality lenders have raised massive amounts of equity capital at different points in the cycle and have been able to deploy it profitably across time periods, leading to adjusted reinvestment rate shooting upwards of 100% for Kotak Bank and Bajaj Finance. Because companies which can continuously deploy massive amounts at capital at high incremental ROEs are scare in any country or sector, quality Indian lenders will continue to enjoy a scarcity premium.

Changes to the Kings of Capital portfolio: Exiting HDFC Asset Management

Owing to reduction in our expected long term earnings growth forecast for HDFC AMC, our position sizing framework has suggested an exit from the stock. Click here to read our detailed note on how Marcellus’ Longevity Framework works.

Note: HDFC Bank, Kotak Bank, Bajaj Finance are part of many of Marcellus’ portfolios.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/