Taking a call on a small cap company is, to a large extent, taking a call on the promoter(s). Besides the promoter’s track record of capital allocation and experience of dealing with crises, another important assessment of promoter quality is the extent to which she is financially & emotionally invested in single mindedly running the Company. Some of the parameters we use to evaluate this are % of the promoter’s shareholding, the extent to which her remuneration is linked to financial performance, her business interests outside the Company and whether she prioritises reinvestments over dividends. On these parameters, most Little Champs promoters do very well. While promoter dominance does raise risks surrounding governance and succession, we address these through our forensic & succession planning frameworks.

Performance update for the Little Champs Portfolio

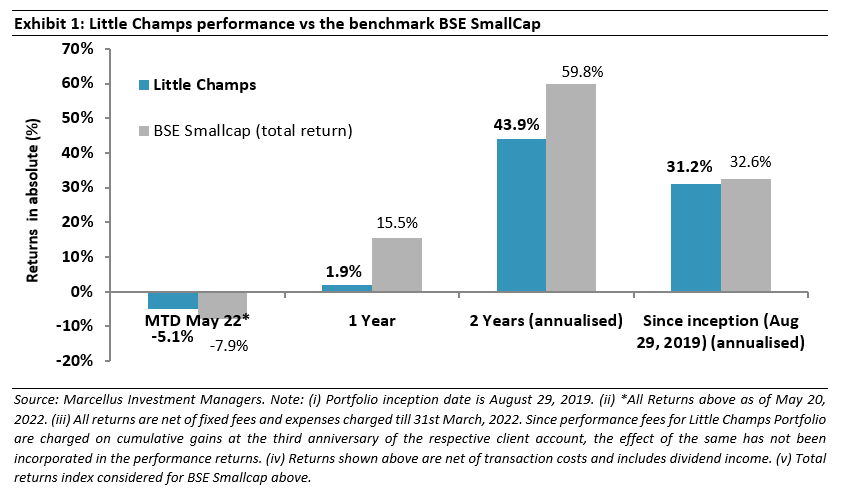

At Marcellus, the key objective of our Little Champs PMS is to own a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. While we intend to fill our portfolio with companies having the above attributes, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio updates: Exit from La Opala and addition of Home First Finance

We have made the following changes to portfolio in the recent months:

- Exit from La Opala: Biggest challenge in opalware industry is the learning curve of efficiently manufacturing opal glass and the barrier created by continuous manufacturing process where output from a furnace cannot be controlled, hence the manufacturer has no choice but to sell the output as fast as possible which needs a strong front-end to avoid piling up of stock. LaOpala’s biggest strength has been its learning curve of efficiently manufacturing opal glass and the challenges around manufacturing which present formidable entry barriers. However, our channel checks continue to indicate weakness in sales & distribution and under-investment in marketing. As a result, over the last 5 years, LaOpala’s market share has reduced from >80% to ~40-45% to new entrants like Borosil and CELLO. Hence, while LaOpala continues to have a strong backend around manufacturing of opalware, weaknesses in distribution & marketing have resulted in lowering of the longevity score and expected growth rate of LaOpala in our position sizing framework. Home First (which we discuss below) has an overall better scoring in our framework which has resulted in replacement of LaOpala with Home First.

- Addition of Home First Finance: Home First Finance Company (HHFC) is a technology-driven affordable housing finance company with AUM of Rs 50 bn+, that targets first-time home buyers in low and middle-income groups. The company specializes in leveraging technology in various facets of its business such as processing loan applications, managing customer experience and risk management. The company caters mostly to the salaried segment (~73% of AUM) and has a well spread-out business mix across 11 states. The company’s AUM has grown at ~50% CAGR over the last 5 years, while spreads have improved over the years and credit costs have been well under control. HFFC’s GNPAs have remained under control at below 2% levels over the last 5 years. We expect the company to post strong AUM and earnings growth, while return ratios are likely to be on an improving trajectory. Currently, True North holds an ~20% stake in the company and GIC holds ~13% and they are both designated as Promoters. Additionally, Warburg Pincus holds 29% in the company and Bessemer Venture Partners owns ~8%.

Evaluating promoter quality in small caps

Smaller companies are, by and large, family owned and family operated businesses usually involving a single promoter or a few promoter family members who are at the helm of the affairs. For such companies, the promoter’s or group of promoters’ skills (technical, sales and/or managerial) becomes the defining competitive advantage of the Company. Furthermore, the promoter’s strategic and capital allocation decisions shape the destiny of the company. Thus, taking a call on a small cap company becomes akin to taking a call on the promoter(s). Besides the promoter’s track record on capital allocations and her ability to deal with crises, another important aspect of promoter quality is the extent to which promoter is financially & emotionally invested in single mindedly running the business of the Company i.e. does she have skin in the game which aligns her interests with that of the minority shareholders? In this month’s newsletter, we focus on the various parameters we use to evaluate promoter’s involvement in smaller companies and we describe how the Little Champs portfolio companies fare on those parameters.

- Extent of shareholding in the company and changes to that shareholding

The higher the promoter’s stake in the Company, the greater the likelihood that the promoter would think and behave in the best interests of the Company’s minority shareholders. Furthermore, how the promoter’s shareholding in the Company has been evolving can also provide vital clues regarding her view of the Company’s prospects.

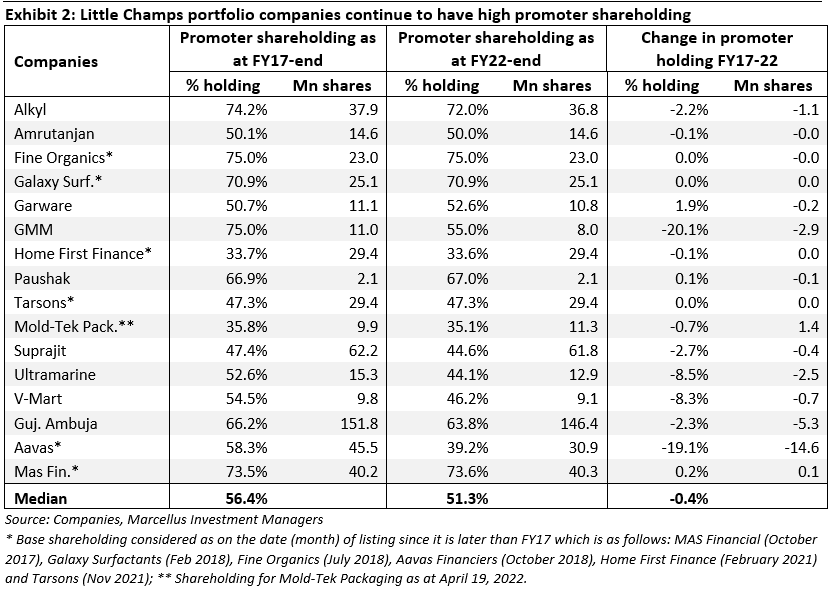

In the case of Little Champs companies, the median promoter shareholding as at FY22-end stood at 51.3% indicating a high level of ‘skin in the game’ for promoters. While the median promoter shareholding in these companies have come down compared to 56.4% as at FY17-end, this trend hides some very interesting details:

- In three such companies where the promoter shareholding % has reduced viz. Ultramarine, Gujarat Ambuja Exports and V-Mart Retail, the reduction is mainly due to exit of a set of promoters who were NOT running the business and consequent stake sale or reclassification of the exiting promoters’ shares from ‘promoter’ earlier to now ‘public’. In fact for these companies, the continuing promoters (who are running the business) have increased their shareholding.

- In two of such companies viz. GMM Pfaudler and Aaavas, the strategic investors (classified as ‘promoters’) have trimmed their shareholding (Pfaudler Inc in case of GMM and Kedaara Capital & Partners Group in case of Aavas Financiers) while the operating promoter/management team have largely maintained their stake holding.

- In case of Mold-Tek Packaging, the promoters’ shareholding in absolute numbers (in terms of number of shares held) has increased between FY17-end to FY22-end even though it has come down as a % of shares outstanding due to a qualified institutional placement in December 2021 (which diluted all shareholders, including the promoters).

Thus, Little Champs companies have and continue to maintain high promoter shareholding.

- Remuneration – fixed vs variable

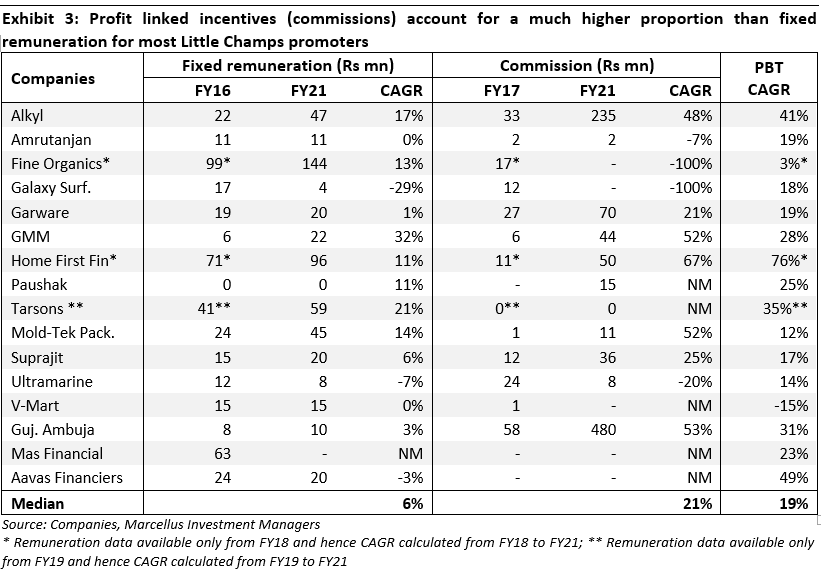

Another measure of the promoter’s skin in the game is the proportion of their remuneration which is variable (i.e. dependent on profitability) rather than fixed. The higher the share of variable (vs fixed), the greater the promoter’s incentives to focus on profitability, the greater the alignment with the interests of minority shareholders.

In this regard, investors in Little Champs should know that the median fixed remuneration for the LCP companies have grown at a CAGR of only 6% over FY16-21. In contrast PBT for these companies has grown at 19% CAGR over the corresponding period (on a median basis). On the other hand, commission, which is linked to the profits of the company, have grown at a much faster clip of 21% CAGR over FY16-21. While the healthy growth in LCP companies’ profitability have generally resulted in a higher take home for the promoters, there have also been in instances where the deterioration in profits in some years means a decline in commission payouts or no such payouts. For example, (i) La Opala’s commission payouts to promoters have declined significantly over FY16-21 due to a decline in profits in FY20 and FY21. (ii) Garware Technical Fibres’ promoters gave up their commission in FY20 in view of the Covid-19 situation (even though Garware saw only a marginal decline in PBT of 2%).

Thus, most Little Champs companies’ promoters’ incentives are aligned to the financial performance of their companies which we believe is a win-win for both promoters as well as other shareholders.

- Dividends vs Reinvestments

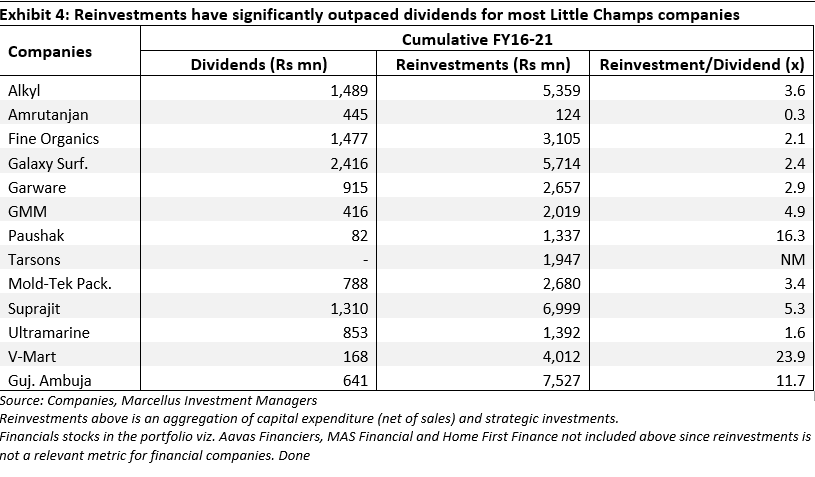

Promoters have an option to either take out the profits of the Company through dividends or reinvest it back in the business for growth. Prioritising reinvestments over dividends is a sign that promoters are not driven by short term gratification but by long term value creation through fully exploring the business potential. The only caveat here is that reinvestment should not be return dilutive or below the opportunity cost of capital for the shareholders.

In the case of the Little Champs portfolio, at the median level, cumulative reinvestment over a six-year period (FY16-21) is nearly 3.5x that of the cumulative dividend for the same period. This indicates the long-term orientation of the promoters and their implicit faith in the growth prospects of the Little Champs companies. Even more encouragingly, despite high level of reinvestments, the return on capital employed of these companies have sustained at healthy levels.

- Business interests outside of the listed Company

Significant business interests of promoters outside of the listed company, notwithstanding the high shareholding in the latter, raises question marks surrounding the time and focus that can be allotted to the Company’s business. This is particularly concerning where promoters are involved in an executive role in the listed company’s business as is the case with most smaller companies.

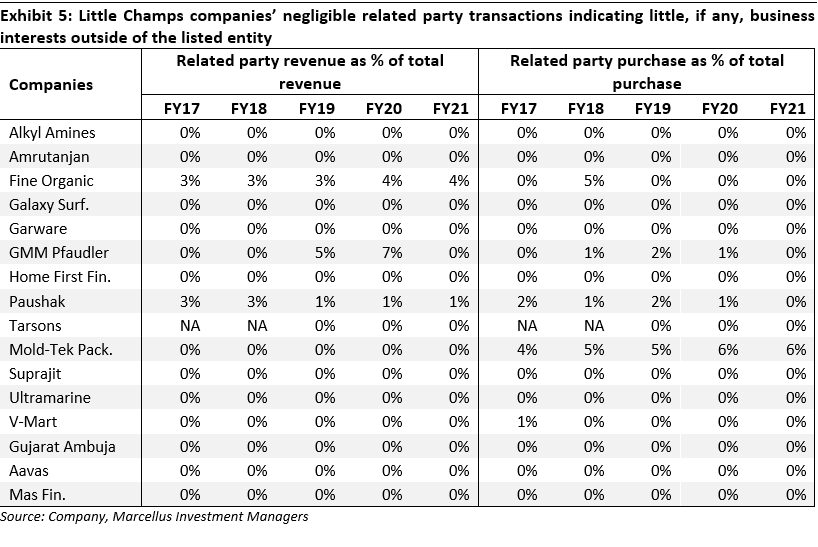

For all the Little Champs companies, the listed company is the main business interest for the promoter. In other words, the promoter’s interests outside of the listed company’s business are minimal. This is also evident in the nil or minimal related party transactions for most Little Champs companies – as shown in exhibit below. The only exception is Paushak Limited which has a much larger flagship group entity called Alembic Pharma (a listed company). However, we understand that there is appropriate delineation of responsibilities amongst promoter family members towards both businesses i.e., two of Mr Chirayu Amin’s sons run Alembic and the other son runs Paushak.

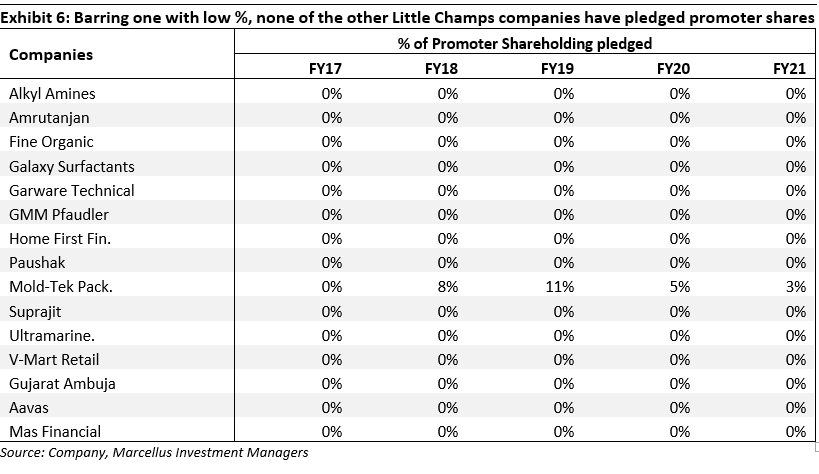

The promoter shareholding pledge data as shown in the below exhibit also points toward limited business interests outside of Little Champs companies.

How do we address the pitfalls of ‘high’ skin in the game?

While plenty of skin in the game indicates a high level of promoter involvement, a potential pitfall is the spectre of governance lapses in such companies. For instance – a promoter with a very high shareholding in a company arguably wields much greater influence relative to a promoter with a relatively distributed shareholding. Similarly, profitability linked remuneration may create a perverse incentive to report higher than actual profitability. Hence it becomes imperative to not only look at the positive side of a fully committed and engaged promoter but also to closely scrutinise the potential flip side of the same. We at Marcellus tackle this issue through the following steps in our investment process:

1. Forensic framework & checks: Evaluating the accounting quality of a company needs to be a cornerstone of any investment process in India and more particularly for small caps. We at Marcellus have developed a set of 12 ratios that help to grade companies on their accounting quality. The selection of these ratios has been inspired by Howard M. Schilit’s legendary book on forensic accounting called ‘Financial Shenanigans’. These 12 forensic accounting ratios cover checks around key financial statement categories like income statement (revenue/ earnings manipulation), balance sheet (correct representation of assets/liabilities), cash pilferage and audit quality checks. The companies that score below a particular threshold don’t make it or remain in the portfolio. Besides this quantitative framework, the deep pool of accounting talent in our team also closely scrutinise the Company’s financial statements to look for accounting/governance red flags. Finally, we also weave in forensic checks in our primary data interactions and on ground checks.

More details on our forensic accounting ratios and methodology can be read in December 2019 Little Champs newsletter and can also be viewed in our September 2020 webinar.

2. Succession planning framework: While our investment process rewards high quality promoters who are ambitious, driven and possess sound judgement, our succession framework tracks softer aspects such as the institutionalization of the business at different levels i.e. decentralization of decision making amongst members of the Board, CXOs, as well as ground level execution through systems and processes. In other words, our succession framework assesses whether the greatness of a company is institutionalised or driven by one or few people. This is essential to avoid the risks of governance as well as succession associated with super-star driven organisations. The detailed succession planning framework (alongside the key parameters used to score the companies on the framework) is discussed in the Little Champs November 2021 In the same newsletter, we also discuss how most Little Champs portfolio companies have made rapid strides in succession planning in recent years thanks to a well thought through succession roadmap, the proliferation of professionals in key roles, the democratisation of company ownership through stock options and through high-quality independent director appointments.