OVERVIEW

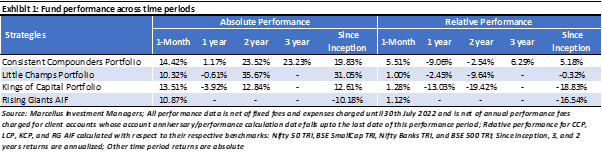

Marcellus was incorporated exactly four years ago, and the firm opened for business on 1st December 2018. That day Saurabh Mukherjea became Marcellus’ first client. This week, Saurabh’s monthly statement showed that Marcellus’ Consistent Compounders Portfolio – consisting primarily of large cap stocks – has doubled his corpus in 3 years and 8 months thanks to a 22.7% compounded annual return. Over the same period, the Nifty Total Return Index delivered 15.01%. A simple set of insights – which everyone can benefit from – underpins Marcellus’ simple but highly effective investment style.

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” – Charlie Munger (source: https://www.cnbc.com/2017/08/04/charlie-munger-the-power-of-not-making-stupid-decisions.html)

“Even if we think we know what’s in store in terms of things like inflation, recessions, and interest rates, there’s absolutely no way to know how market prices comport with those expectations. This is more significant than most people realize.” – Howard Marks’ memo to client, July 2022 (source: https://www.oaktreecapital.com/insights/memo/i-beg-to-differ)

Do you belong?

Are you one of those people who is:

- Completely on top of macro trends from the latest Federal Reserve announcement to the hottest data on fund flows?

- Keeping track of share prices and P/E multiples all the time?

- Up to date with the latest gossip in the corridors of power in Mumbai, Bengaluru, and Delhi?

Despite doing all this hard work do you find that none of this has helped you make money in the post-Covid 19 rally? If so, fear not. Help is at hand. On Marcellus’ fourth anniversary, we are revealing three simple techniques which can help almost anyone make money in India.

Three ways to make money without following macro news or share prices

- Benefit from the steady decline of Public Sector Undertakings (PSUs)

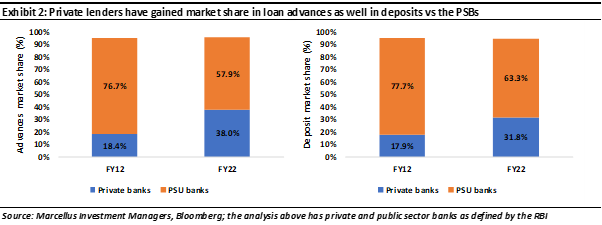

In many sectors of the Indian economy, PSUs still account for the majority of the market share. In a country where managerial talent is super scarce, the PSUs unfortunately cannot afford to hire and retain good talent. That in turn means that the private sector competitors of these PSUs are winning the war for talent, and therefore for market share – year after year, decade after decade. That is why we in Marcellus call PSUs the gift that never stops giving. Quoting from our Kings of Capital newsletter dated 19th July 2022 – The Never Ending Generosity of the Public Sector:

“The Indian banking industry is afflicted with a persistent issue of PSBs not being able to consistently generate RoE in excess of their cost of capital. This issue can be attributed to an inherent conflict regarding whether they should allocate capital to reward minority investors or work to achieve the social or political objectives of their majority shareholder which is the Government of India.

The result is that the RoEs of such banks have lagged materially behind RoEs of the more efficient private sector banks. Consequently, without exception, the PSBs have had to mostly depend on constant capital infusion from the Government in order to meet their capital adequacy ratios and to grow their loan book size…. Meanwhile, the strongest private sector lenders have been able to take market share away from PSBs (on both sides of the balance sheet) whilst creating shareholder value for minority shareholders.”

As in banking, so in life insurance and general insurance – the steady ceding of market share by giant PSU insurers enriches Marcellus’ clients via our holdings in well run general insurers (ICICI Lombard) and life insurers (HDFC Life).

- Benefit from the erosion of the black economy

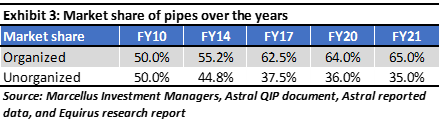

As we have explained in numerous notes and webinars, the launch of GST in 2017, followed by a steady increase in enforcement activities by the authorities, is forcing companies, which for decades evaded tax, to either shut shop (7.3 lakh companies shut shop in FY22 – see more here) or scale back their activities as their profit margins are curtailed by tax payments. This in turn means that efficient, well managed, tax paying companies are gaining market share – at the expense of the black economy – year after year. As we explained in our 25th June 2022 note – India’s Moment After a Decade of Structural Reforms:

“Over the past decade India has witnessed non-stop tax reforms (both on indirect and direct tax regimes), improved enforceability, compliance and hence collections. Both, direct and indirect taxes, as a percentage of GDP, have risen materially to record levels.

As evading taxes becomes increasingly difficult, we are seeing a steady decline in the share of the ‘unorganised’ i.e., tax evading part of the economy. For example, in the plastic pipes sector, the market share of unorganised sectors has fallen very significantly over the past decade (see exhibit below).”

So, all you have to do is identify sectors which are seeing rapid “formalisation” (the technical term for the hammering of the black economy) and invest in the most efficiently managed company in the sector. As the black economy shrinks, Marcellus’ clients are getting rich courtesy our investments in Asian Paints and Berger Paints (the most efficient paint manufacturers), Astral Poly (the most efficient CPVC pipe manufacturer), Pidilite (the most efficient adhesives and waterproofing manufacturer) and Titan (the most efficient jeweller).

- Benefit from the demise of China’s manufacturing prowess

During the 30-year period between 1985-2015 China was unstoppable. Chinese companies conquered sector after sector and laid to waste whole sectors of the Indian economy such as the manufacturing of Active Pharmaceutical Ingredients (APIs), Specialty Chemicals, synthetic textiles (and thus apparel), various types of plastics, footwear, electronics, etc. And then for reasons we don’t fully understand, around 2015 the Chinese juggernaut stopped and year-by-year the situation in China – economically and politically – has deteriorated.

China’s troubles seem deep rooted. Firstly, they seem to have built too many apartments, offices, etc., and as a result the Chinese real estate developers seem to be in financial trouble courtesy the excess unsold inventory on their balance sheets. Secondly, the Chinese public appears to be revolting against paying monthly instalments for flats which are supposed to be built (but are not being built because the developer has run out of money – source: https://edition.cnn.com/2022/07/14/economy/china-property-crisis-homebuyers-bad-debt-intl-hnk/index.html). Thirdly, the combination of the previous two points means that the banking system is stricken with bad debt, with NPAs rocketing to such levels that analysts now express NPAs as a % of GDP! Fourthly, Xi Jinping continues to hammer the Chinese economy with lockdowns precipitated by his zero-Covid policy.

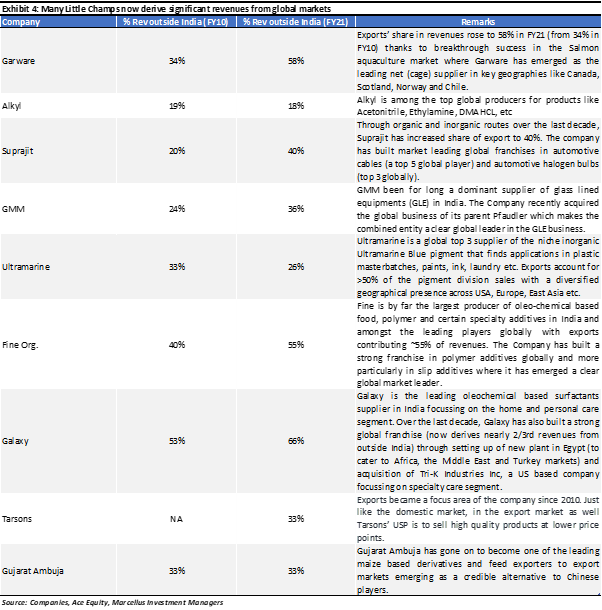

As China slides, knowledge intensive light industrial and specialty chemical manufacturers in India are finding that the local (Indian) and global market has opened up for them. Quoting from our Little Champs newsletter dated 28th July 2022 – The Evolutions Underpinning the Revolution:

“Little Champs portfolio companies’ dominant position in their niche markets forms the key basis for their superior pricing power, profitability and RoCE vs. peers. However, a key pitfall of ‘niche focus’ is a high probability of hitting a growth ceiling after reaching a dominant position in a niche industry – a concern often raised for Little Champs and more generally for B2B companies. Little Champs are successfully mitigating these growth concerns through their globalisation strategy – nearly 50% of the non-Financial Little Champs companies now derive more than 25% of their revenues from outside India. More importantly, these global forays are based on product innovations, process improvements and people management – these are more enduring moats than competitive pricing. Besides providing a significant growth runway, globalisation gives the Little Champs learnings which further enhance their domestic market dominance. The globalisation strategy has been an important pillar of expanding the addressable market and adding new growth drivers to many of the Little Champs’ business. For more details on the globalisation strategy see the July 2021 Little Champs newsletter.”

But “Hang on” I hear you say, “Hasn’t Marcellus Underperformed?”

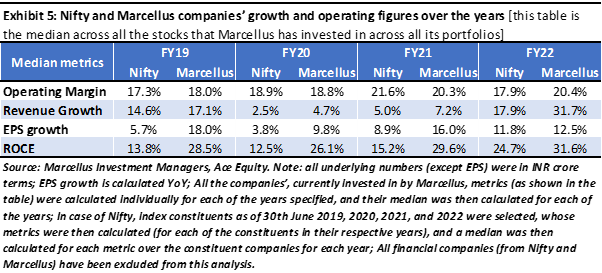

As our clients know, we invest in quality companies i.e., companies with clean accounts, sensible capital allocation across long periods of time and dominant franchises (which can charge product prices 20-40% higher than the competition without any loss of market share). Over the past 12 months whilst our investee companies have produced healthy results – see the exhibit below – their share prices have corrected as investors, especially FPIs, have taken fright at the scary macro situation in the West, the never-ending lockdown in China alongside the war being waged by Russia. The opening exhibit of this note gives you data on our performance. So why does Marcellus stay invested in these high-quality businesses which seemingly have ‘underperformed’?

Why do we invest in elite companies?

We don’t know where the broader economy will go next month or next year. We don’t know when Russia’s war in Ukraine will end or when the Federal Reserve will stop hiking rates. We don’t know where the USD-INR exchange rate will be next month or next year. What we do know is that: (a) the competitive advantages of our investee companies have not been impacted either by the Federal Reserve’s rate hikes or by Russia’s war in Ukraine or by Xi Jinping’s policies; and (b) simple calculations show that we will make more money from staying invested in these outstanding franchises (than from investing in other stocks which optically look cheap). Let’s delve further into this subject by taking one example from each of our portfolios:

HDFC Bank: HDFC Bank’s competitive advantages are evident on both sides of the balance sheet. In spite of the challenging macro conditions over last five years, the bank has been able to increase its market share in both advances (from 7% as of Mar-17 to 11.2% as of Mar-22) as well as in deposits (from 6% as of Mar-17 to 9.2% as of Mar-22); no other bank in India has made this sort of progress over this period. Further, the quality of its growth can be assessed from the fact that it generated best-in-class RoA/RoE in the range of 1.8-1.9%/16-18% over this period without diluting its asset quality (GNPA ratio of 1.3% is amongst the lowest for all banks). With the bank aggressively growing its branches (10% CAGR over the last 10 years) and commanding a very high share of mental recall amongst retail customers (highest website visits amongst all its peers), its cost of funds is likely to remain low, thus allowing the flywheel of high ROE and heavy reinvestment to drive rapid growth, which in turn drives strong growth in net worth (which in turn allows heavy reinvestment).

Dr Lal PathLabs: The company is the largest diagnostic player in India by revenues and has built mindshare amongst doctors and customers over many years on the back of three key aspects: Turn Around Time (TAT), the accuracy of results, and the doctor’s trust in the test results. All three aspects – especially the ‘trust’ aspect – are hard to replicate. Secondly, Dr. Lal mainly operates in the illness segment which is 90% of the diagnostic market and is much less sensitive to price competition vs. the wellness (preventive care) segment which forms the other 10%. Finally, Dr. Lal has been further augmenting its lead in TAT and test accuracy vs. competitors through process automation and real time tracking of results – further increasing the stickiness of the firm with doctors & patients.

GMM Pfaudler: The company enjoys a technological edge relative to the competition (thanks to Pfaudler’s hundred-year-old innovation engine) as the end customers (large pharma companies) do not compromise on the quality of glass-lined equipment both due to the required purity of the process as well as the need for minimal equipment replacement. Secondly, GMM has five decades of long-standing customer relationships which keep generating recurring orders, repeatedly augmented by Pfaudler’s technological edge. Thirdly, the company enjoys huge scale benefits with revenues that are almost four times that of the second-largest player in India. High profitability and cash generation (10-year average ROCE 22.3%) has further allowed company to keep expanding its scale through organic and inorganic routes in new products and geographies.

Amrutanjan: The company enjoys a dominant legacy position in South India in the pain management category. This dominance underpins the firm’s high profitability and high cash generation. Further, most of Amrutanjan’s products are small ticket essential items commanding high gross margins of ~50-60%, thus providing comfort against any inflationary pressures. Capital allocation has been measured and surplus cash has been used to: (a) increase its addressable market through product adjacencies (launching body pain & congestion management products) as well as product innovation (innovative formats such as roll-ons); (b) expand its distribution reach by shifting from pharma to FMCG type model; and (c) increase tech capex allowing for SKU level supply chain management and better scalability opportunity for business. Resultantly, the RoCE of the business has expanded from 11% to 30% over FY10-22.

Courtesy these competitive advantages, our investee companies grow their revenues and profits consistently faster than the broader market – see Exhibit 5. When we invest in these stocks, we pay share prices which reflect, in part (and only in part), this superiority. So, for example, Divis Laboratories had been trading at ~40x earnings in in 2018/19 thus reflecting market’s view that Divis’ high growth period of 20%+ would last only for the next 5-6 years (and fade-off thereafter). However, given the kind of extended growth runaway available to the company from its dominant position in the pharma API segment and given the immense growth opportunities available from API manufacturing shifting out of China, the share price quoted underestimates (we believe) the potential length of high growth period available to Divis. Increasing the length of high growth (20%+) period to just 10 years (vs the 5-6 years expected by market) implies an intrinsic fair value P/E for Divis which is ~50% higher than what the stock is trading at.

Therefore, the reason we are able to buy these great companies without paying share prices which FULLY REFLECT THEIR SUPERIOR COMPETITIVE ADVANTAGES is because the conventional three stage DCF employed by most investors tends to undervalue the longevity of a great business (see our Jan’20 CCP newsletter which explains this in detail). Given the depth of research and conviction required to hold such a view (regarding an extended high growth period), most investors seek comfort within a narrow band of P/E multiples. We thank them for doing so because that gives us the opportunity to continue compounding our clients’ wealth at a brisk rate.

Note: All the stocks mentioned in this note are a part of Marcellus’ portfolios. Many of Marcellus’ staff members and their families are also heavily invested in these stocks.

Saurabh Mukherjea, Nandita Rajhansa, and Prashant Mittal work for Marcellus Investment Managers (www.marcellus.in). Marcellus’ book, “Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation” has been published by Penguin.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee.