OVERVIEW

Amongst Emerging Markets, India and China have produced the greatest number of Consistent Compounders (i.e., companies which have delivered 10% YoY revenue growth and 10% RoCE consistently over a decade). However, not only does India produce more Consistent Compounders than China, Indian Consistent Compounders have also delivered more than twice as much shareholder return as their Chinese counterparts. In this note, we dig into the underlying drivers of the superiority of Indian Consistent Compounders.

KEY TAKEAWAYS:

- China and India have been the fastest growing EMs if measured by growth in real GDP over the past decade.

- India and China stand far above other EMs and the Indian companies significantly outperform the Chinese companies in terms of shareholder returns.

- A networked economy helps more efficient companies

- Companies that invest in technology benefit from increasing returns to scale

- Sunk costs drive industry concentration

“I know where I am going and I know the truth and I don’t have to be what you want me to be. I am free to be what I want.”–Muhammad Ali

As Marcellus turns three, we reaffirm our commitment to our 7,000 clients to make wealth creation simple and accessible, by being trustworthy and transparent capital allocators.

Marcellus is Latin for “Little Warrior”

When on 7th August 2018, the Ministry of Corporate Affairs gave Marcellus Investment Managers its incorporation certificate, half a dozen or so middle-class professionals pooled together their life’s savings to launch a firm which offered something unheard of in India – a portfolio management service which only charged fees if (and only if) returns were in excess of 8% per annum. Three years on, the 80-strong team at Marcellus thanks its 7,000 clients for trusting this young firm to look after nearly Rs 10,000 crores (US$1.3bn) of their hard-earned money.

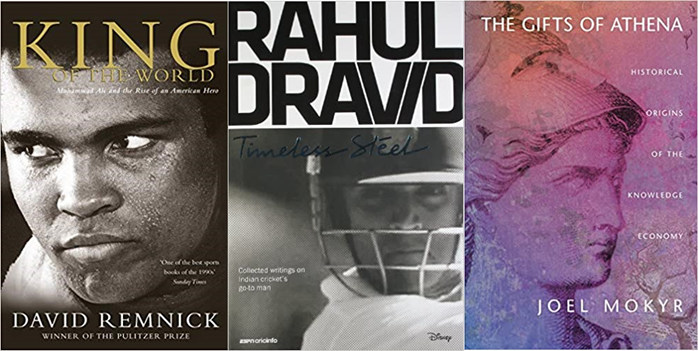

As we look back at our tumultuous ride, we highlight the three superb books which we believe best exemplify what we have tried to stand for and what we are trying to bring to the Indian asset management industry.

“King of the World: Muhammad Ali and the Rise of an American Hero” by David Remnick: We named our firm Marcellus in honour of Cassius Marcellus Clay, better known as Muhammad Ali. This man’s career, his beliefs, and his actions inside and outside the boxing ring make him an inspiration for ordinary people like us, who are trying to build something greater than ourselves with modest resources. The trajectory of Muhammad Ali’s life is memorably captured in David Remnick’s Pulitzer Prize winning 1999 biography “King of the World: Muhammad Ali and the Rise of an American Hero” (later made into a movie).

Ali became the World Champion in 1964. Then in 1966, he refused to be drafted into the US military, citing his religious beliefs, and opposition to the American involvement in Vietnam. Ali was arrested by the US authorities, found guilty of draft evasion, and stripped of his titles by the World Boxing Federation. Refusing to bow down, Ali took the authorities to the Supreme Court which overturned his conviction in 1971.

What followed was equally epic. Through the 70s, Ali beat 21 boxers for the world heavyweight title (a record shared with Joe Louis) and won 14 unified title bouts (a record shared with former welterweight champion José Napoles). These records remained unbeaten for 35 years!

David Remnick’s book highlights that Ali’s refusal to fight in Vietnam – at least three years before it became fashionable for young Americans to take such a stance – was driven out of conviction rather than by a desire to look like a liberal. His belief in his convictions did not falter when the World Boxing Federation unlawfully stripped him of his titles and robbed him of his income. He stood his ground and waited for the tide to turn and when it did, he took what was rightfully his. For the team at Marcellus, whose investment philosophy and business model often pits us against the mainstream, the courage of Muhammad Ali’s convictions is an ideal that we aspire to.

“Rahul Dravid: Timeless Steel” edited by Sambit Bal: As we highlight in our forthcoming book ‘Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth” (to be published by Penguin on 23rd August): “Many people perceive investing as something involving constant action, including watching share prices all the time and reacting quickly to news flow and market movements. The general belief is that such ‘active’ investing yields result in the immediate future. However, it seldom works like that. Investing is not like a T20 match where you attempt to hit every ball out of the park. It is more like Test cricket, where you do not even attempt to play every ball, let alone try to hit it to the boundary. In Test cricket, you choose your shots carefully, leave the deliveries outside the off stump alone, score your ones and twos regularly, and dispatch the occasional loose ball to the boundary. The key to successful investing, therefore, is to first leave the risky stocks alone, then to identify the ones that can grow earnings and cash flows steadily, and once you find such stocks, to bet big on them. Also, as in Test cricket, investing requires the player to not just possess the relevant skills and training but also the mental conditioning and discipline to apply those skills and training consistently. More crucially, investing requires the patience to play a long innings, which, as in Test cricket, is the assured way to victory. The difference between successful and unsuccessful investing is, in many ways, the difference between Test cricket and T20.”

When it comes to Test cricket the records show that Rahul Dravid is not just India’s greatest Test batsmen, he is one of the giants across all eras and all countries. There is a lot to learn from Dravid but what is most evident from “Timeless Steel”, a high-quality collection essays on the great man, is his ability to understand his weaknesses and then train hard to rectify them. In particular, the former Test opener Akash Chopra highlights how Dravid ironed a specific technical weakness – which in a lesser cricketer would have terminally jammed the cricketer’s career: “The knowledge of where his off stump was, coupled with immense patience, ensured that Dravid continued to score bucketfuls of runs in Test cricket, in spite of the bowlers finding him out. But though the runs were coming they were not coming as briskly as he would have liked. He had to stay longer at the crease to accumulate his runs, and that eventually cost him his place in the ODI team. He needed [to] find ways to open up his off-side play . . .” In order to tempt you to read this book, we won’t give away to the answer to how Dravid fixed this technical issue and upgraded his batting.

“The Gifts of Athena: Historical Origins of the Knowledge Economy” by Joel Mokyr: It is fashionable these days to talk about the knowledge economy. However, to really understand how learning, science, knowledge and technology powers modern economies, Joel Mokyr’s book is indispensable. Using the United Kingdom during the Industrial Revolution as a case study, Mokyr highlights that:

a) Knowledge” and “Technology” are very different concepts – the former refers to the laws of science which permeate the world (eg. Newton’s Laws of Motion) whilst the latter refers to the application of science to day-to-day life (eg. the steam engine created by Robert Stephenson);

b) The Industrial Revolution – and economic transformation more generally – was driven more by Technology rather than by Knowledge (eg. Newton’s Laws preceded the steam engine by more than 100 years, and it is the steam engine which powered the Industrial Revolution);

c) The propulsion of economic growth by science and technology is rarely a broad-based phenomenon. Mokyr highlights that across the entirety of Europe, no more 2,000 scientists, intellectuals, inventors and businessmen drove the Industrial Revolution. It took another century for the benefits of the Industrial Revolution to spread beyond these 2,000 people.

d) The reason the Industrial Revolution took place first in the United Kingdom, and not in Continental Europe, is because of the greater availability of upside incentives for British inventors and businessmen compared to what was available on the Continent (where the aristocracy and clergy believed that upside was something that they were more entitled to).

Joel Mokyr’s book should be read by anyone who wants to understand how India will rise in the world thanks to the knowledge and enterprise of its inventors, its scientists and its entrepreneurs provided the Indian state does not get in the way.

Our Purpose

At Marcellus, our Purpose is to make wealth creation simple and accessible, by being trustworthy and transparent capital allocators. Whilst the years ahead will bring their share of challenges, this young team – with an average age of 31 years – is here to build an institution which, with your support, will act as a ‘Little Warrior’ for millions of Indian families who seek a fair return from the stock market.

Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date information. The enclosed material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. The contents and information in this document may include inaccuracies or typographical errors and all liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this website is provided “as is;” no representations are made that the content is error-free.

No reader, user, or browser of this site should act or refrain from acting on the basis of information on this [site/newsletter] without first seeking independent advice in that regard. Use of, and access to, this website or any of the links or resources contained within the site do not create an portfolio manager -client relationship between the reader, user, or browser and website authors, contributors and their respective employers. The views expressed at, or through, this site are those of the individual authors writing in their individual capacities only.

Saurabh Mukherjea is the Founder and Chief Investment Officer of Marcellus Investment Managers. Saurabh was educated at the London School of Economics where he earned a BSc in Economics (with First Class Honours) and an MSc in Economics (with distinction in Macro & Microeconomics). In London, Saurabh was the co-founder of Clear Capital. Prior to setting up Marcellus, Saurabh was the CEO of Ambit Capital. Saurabh is a Founding Director of the Association of Portfolio Managers in India, a trade body. He continues to be part of multiple SEBI working groups whose role is to review and reform the rules governing portfolio management in India.