Structural changes in the economy (formalisation, access to low-cost technology, market share consolidation due to slowdowns & disruptions), significant reinvestments into the business (product, distribution, capacities, technology & expansion in addressable markets) and single-minded promoter focus/institutionalisation have enabled the Little Champs to sustain earnings growth through tough macro cycles over the last ten years. Further, it has helped these firms become formidable self-sustaining cash machines with immense growth opportunities around globalization and product adjacencies. Significant ramp-up in investments (organic and inorganic) in FY22 is a testimony of this evolution.

Performance update for the Little Champs Portfolio

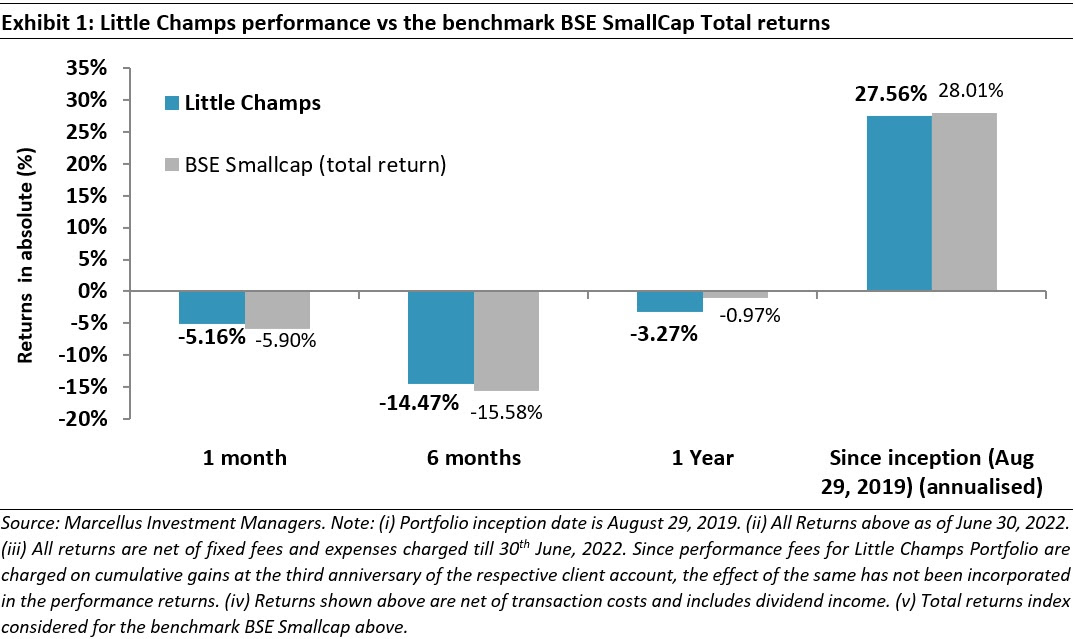

At Marcellus, the key objective of our Little Champs PMS is to own a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. While we intend to fill our portfolio with companies having the above attributes, we want to stay away from names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

|

Little Champs have gone from strength to strength over last ten years amidst challenging macros

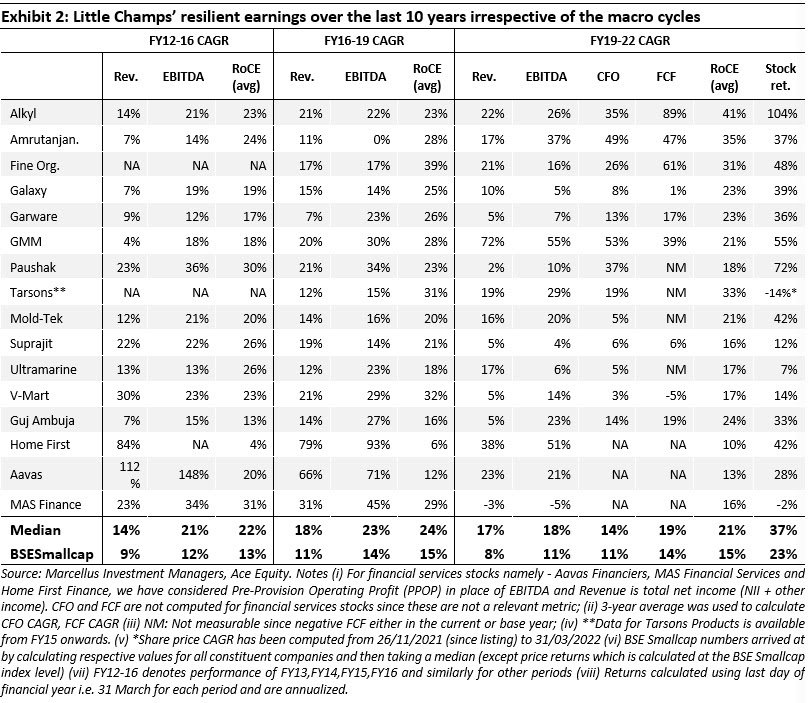

A salient feature of the Little Champs portfolio companies has been their ability to sustain fundamental performance through the various macro cycles. For instance, over FY13 to FY22, despite intermittent economic slowdowns and disruptions such as demonetisation, GST, Covid-19 and volatility in input prices, the portfolio companies have been able to consistently generate healthy earnings growth both on an absolute basis and relative to the benchmark BSESmallcap median.

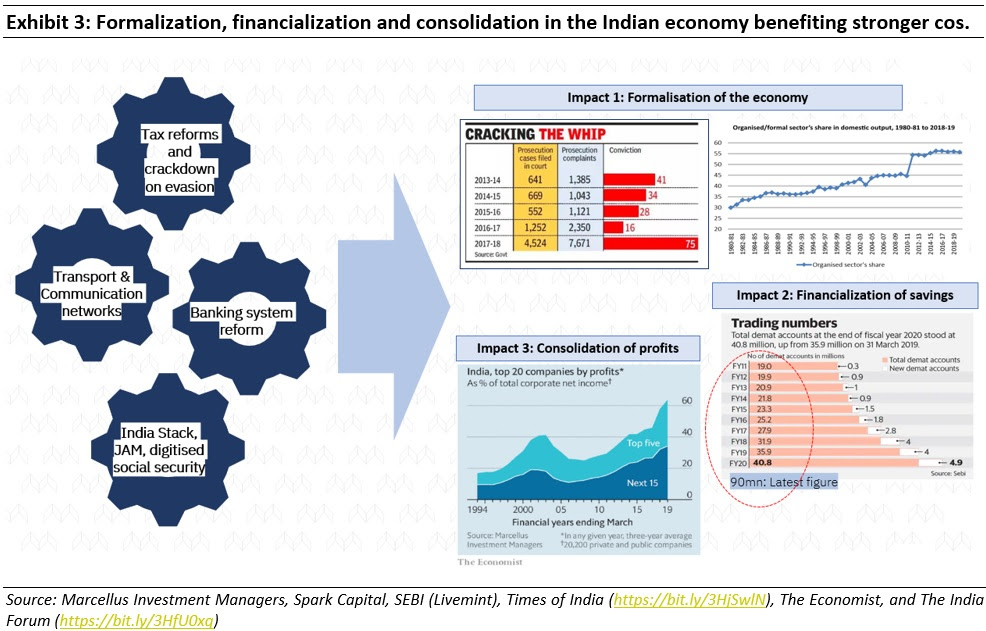

In the following sections we focus on the key drivers of resilience in the Little Champs earnings profile and why the portfolio companies have been able to largely decouple from the broader macro cycles. Success factor # 1: Structural changes in the economy benefitting efficient market leaders

|

- Improved networking of the economy has helped market leaders breach the fiefdoms of regional, local and unorganised players: Over the past ten years (FY11 to FY21), India’s national highways length has doubled to 136K kms implying a compound annual growth rate (CAGR) of 7%. The number of broadband users has increased from 20 million in FY11 to 687 million at the end of FY20 (CAGR of 48%). A decade ago, in 2010 India’s airports handled 80 million passengers. The corresponding figure in FY20 was 340 million implying a CAGR of 16%. 15 years ago, only 1 in 3 Indian families had a bank account; now nearly all Indian families have a bank account. As a result of this networking of the Indian economy, efficient market leaders with strong distribution systems have pulled away market shares from regional, local and unorganised players.

- Disruptions and crisis benefit market leading franchises like Little Champs: The big gap in the balance sheet, margins and return on capital between well managed market leading franchises and their weaker peers come to the play particularly in time of market distress. The former set of players can withstand near-term disruptions whereas weaker peers get structurally impacted with many going out of business thereby opening up market share gain opportunities to the survivors.

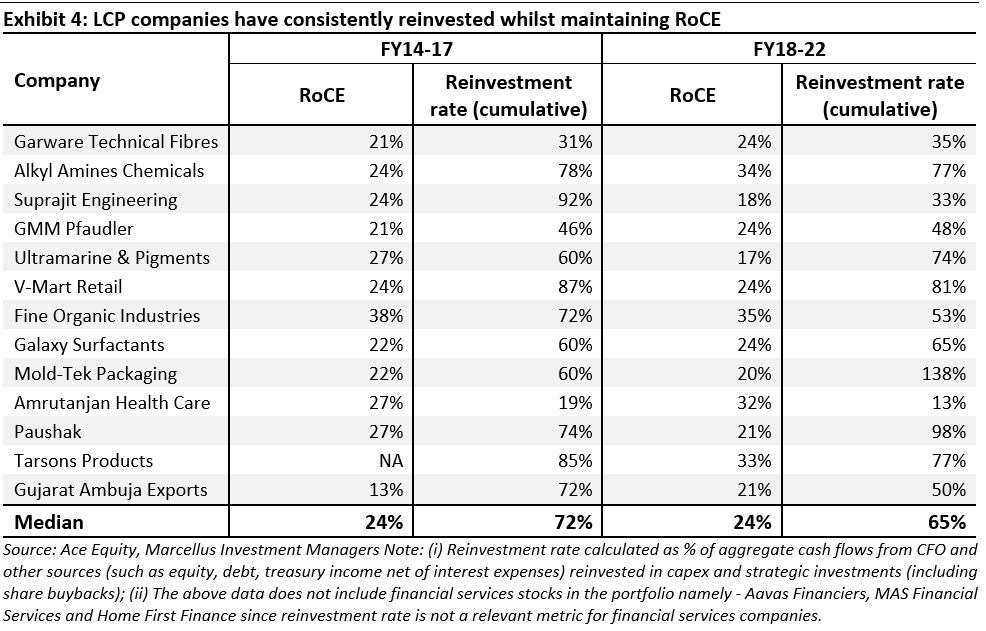

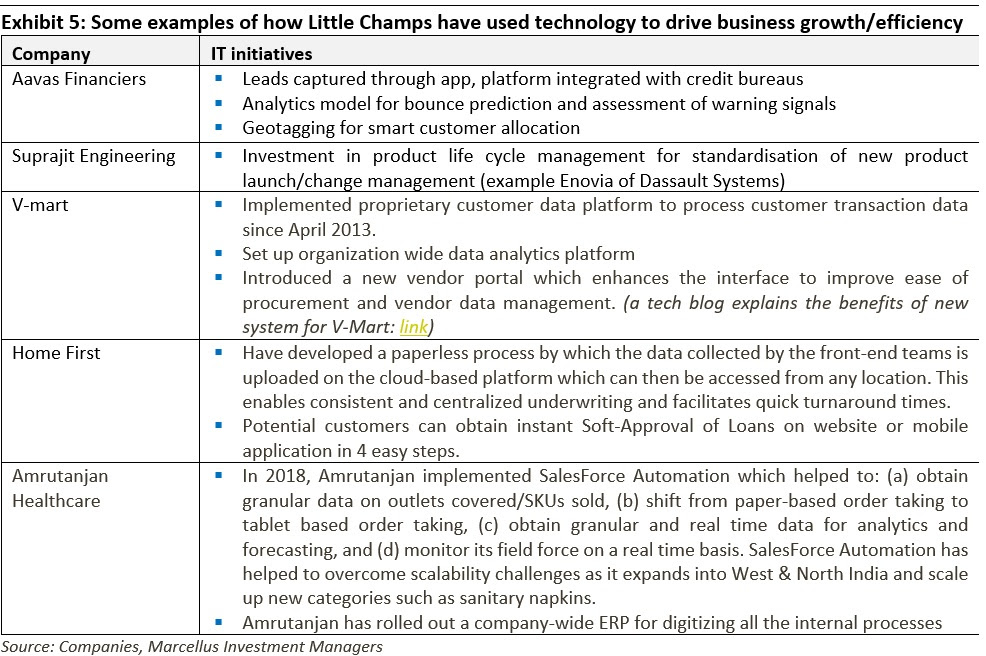

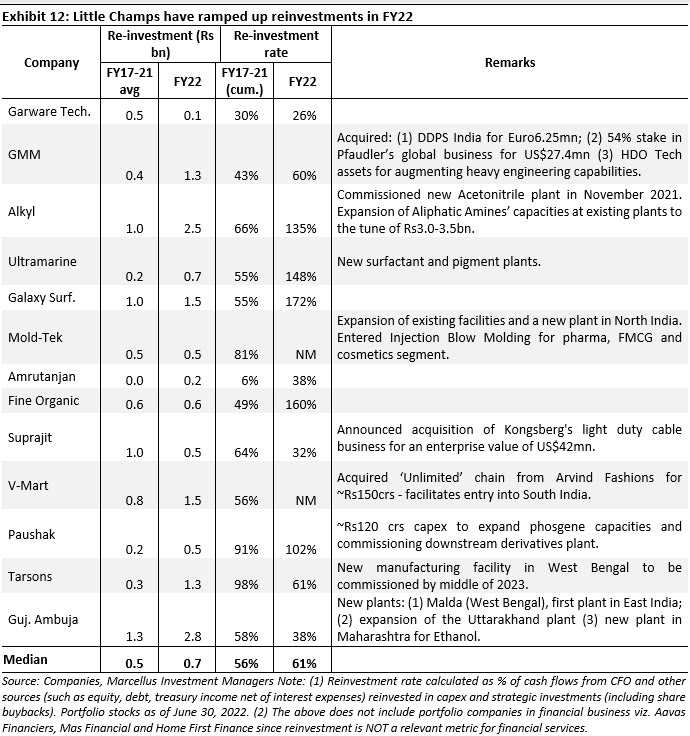

- Access to low-cost technologies: Until about a decade or so ago, using technology extensively to drive revenue growth or business efficiencies was largely the privilege of large companies. Due to the rise of cloud, mobile and software-as-a-service (SAAS), the technological landscape has evolved significantly over the past decade resulting in much wider access for smaller companies to world class technology.Success factor # 2: Capital allocation initiatives by Little ChampsOne of the defining success factors for the Little Champs vs their peers have been their high capital reinvestment initiatives to either strengthen the existing business (and thus gain market share) and/or add new growth drivers. As shown in the table below, the median reinvestment rate for the Little Champs portfolio companies has been around 65% over the last five years (FY18-22) while maintaining healthy RoCEs of 24% (on a median basis) over this period. What has been even more creditable has been ability of Little Champs to maintain a high reinvestment rate despite expanding operating cash flows in recent years. This is the financial equivalent of a T20 cricket batsman scoring more and more runs (i.e. a higher batting average) even as his strike rate (i.e runs per 100 balls) goes up.

Key avenues of reinvestments by the Little Champs: a) Strengthening the core through investments in R&D, tech, distribution and capacities/acquisitions: A significant part of Little Champs’ investments have gone into strengthening the core business through continuous investments into enhancing the quality/functionality of products, new product development, expanding the distribution network, creating new capacities and acquisition of weaker peers. The Little Champs companies have also been at the forefront of adopting technologies like the modular low-cost Software-as-a-Service solutions which are hosted on the cloud (eg. Salesforce, SAP) and IOT (eg. Industry 4.0). These technologies have not only helped drive significant business value on the front end (eg. – better customer insights through datamining) but has also helped these companies to improve their working capital cycles, asset turns, profit margins and hence RoCE.

Key avenues of reinvestments by the Little Champs: a) Strengthening the core through investments in R&D, tech, distribution and capacities/acquisitions: A significant part of Little Champs’ investments have gone into strengthening the core business through continuous investments into enhancing the quality/functionality of products, new product development, expanding the distribution network, creating new capacities and acquisition of weaker peers. The Little Champs companies have also been at the forefront of adopting technologies like the modular low-cost Software-as-a-Service solutions which are hosted on the cloud (eg. Salesforce, SAP) and IOT (eg. Industry 4.0). These technologies have not only helped drive significant business value on the front end (eg. – better customer insights through datamining) but has also helped these companies to improve their working capital cycles, asset turns, profit margins and hence RoCE. b) Strengthening the core through investments in R&D, tech, distribution and capacities/acquisitions: A significant part of Little Champs’ investments have gone into strengthening the core business through continuous investments into enhancing the quality/functionality of products, new product development, expanding the distribution network, creating new capacities and acquisition of weaker peers. The Little Champs companies have also been at the forefront of adopting technologies like the modular low-cost Software-as-a-Service solutions which are hosted on the cloud (eg. Salesforce, SAP) and IOT (eg. Industry 4.0). These technologies have not only helped drive significant business value on the front end (eg. – better customer insights through datamining) but has also helped these companies to improve their working capital cycles, asset turns, profit margins and hence ROCE.

b) Strengthening the core through investments in R&D, tech, distribution and capacities/acquisitions: A significant part of Little Champs’ investments have gone into strengthening the core business through continuous investments into enhancing the quality/functionality of products, new product development, expanding the distribution network, creating new capacities and acquisition of weaker peers. The Little Champs companies have also been at the forefront of adopting technologies like the modular low-cost Software-as-a-Service solutions which are hosted on the cloud (eg. Salesforce, SAP) and IOT (eg. Industry 4.0). These technologies have not only helped drive significant business value on the front end (eg. – better customer insights through datamining) but has also helped these companies to improve their working capital cycles, asset turns, profit margins and hence ROCE.

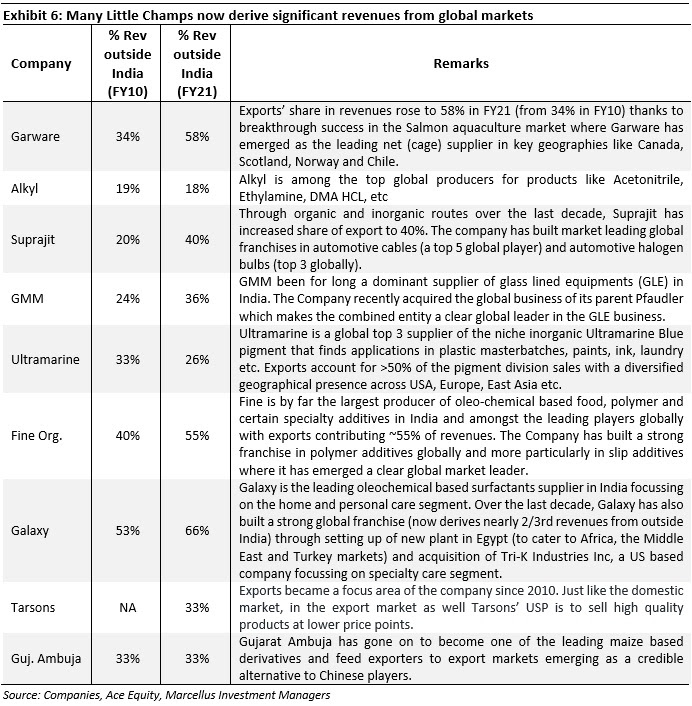

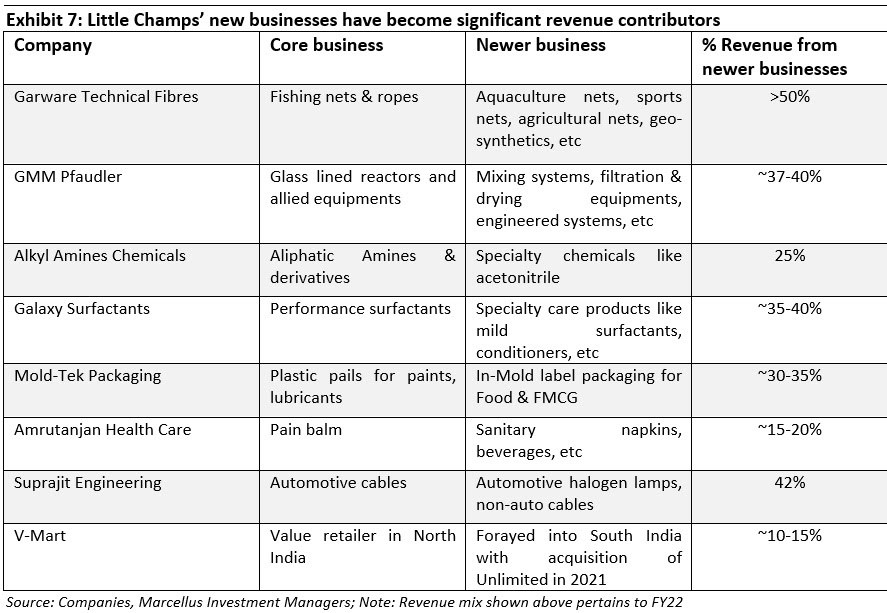

c) New product adjacencies (soft diversification): Product segment diversification has been another important feature of Little Champs’ growth strategy. Unlike what we see in the broader corporate world, Little Champs’s diversification strategies have been successful with new forays over the past decade now contributing in excess of 20% of revenues for most portfolio companies. More details on how Little Champs’ use soft diversification as a growth strategy can be read in August 2021 Little Champs newsletter.

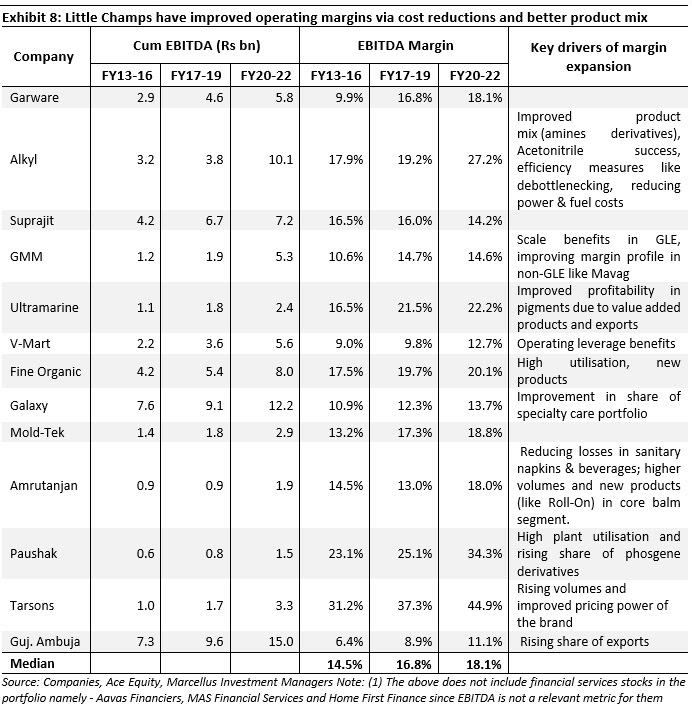

The capital allocation initiatives have also helped in bringing in new revenue growth drivers improving profitability and efficiencies – important drivers of earnings and cash generation.

- Improved profitability: Most LCP companies have seen margin expansion over the last decade mostly on the back of cost reduction initiatives (optimising power & fuel, logistics costs, value engineering etc), improvement in the product mix and organic improvement in margin from higher pricing power (courtesy rising market shares, and operating leverage benefits from revenue/volume growth).

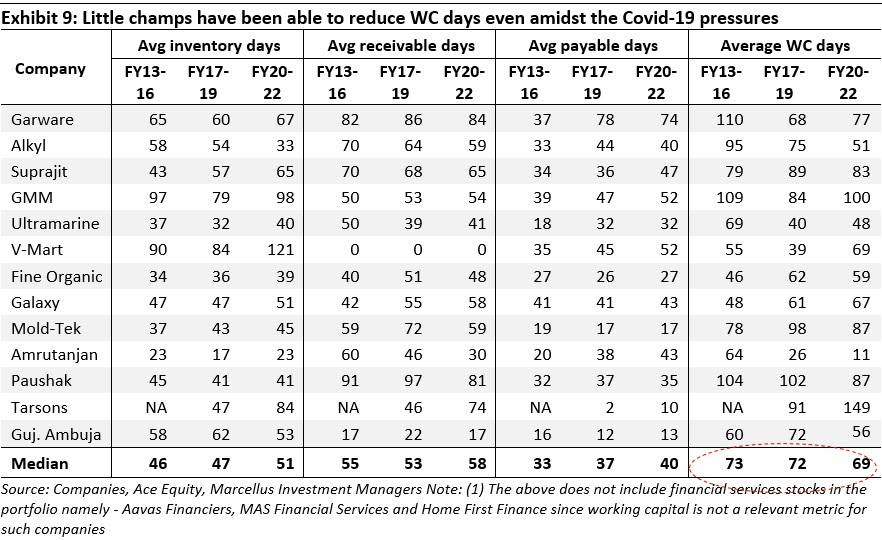

- Working capital improvement: Alongside margin expansion, Little Champs have also been able to show an improvement in their working capital days thus freeing up more cash to be reinvested in available opportunities. Broadly, working capital reduction can be attributed to rising market share which has resulted in better bargaining power vs customers and vendors, and significant technology related investments in driving efficiencies at the backend like distributor management systems, supply chain tools, inventory management software, etc. Having said that, the supply chain distortions in the last three years due to Covid-19 (for example, companies forced to build up on inventory, the high price of inputs and thus inventory, giving working capital support to vendors, etc) have inhibited the positive impact on working capital and hence there is not much improvement visible when one looks the median figures in the exhibit below. However, for 7 out of 13 non-financial companies show below, there has been marked improvement in working capital days. Furthermore, we believe as supply chain normalises, the positive impact of the technology and efficiency measures undertaken by the Little Champs will come through.

Success factor # 3: Unwavering focus, skin in the game and succession planning

All the commercial aspects of the business highlighted in the preceding sections that separate the Little Champs from a run of the mill small cap company would fail to materialize if it were not for the softer elements of the business- especially related to the Promoter’s skin in the game and succession planning.

A high degree of the promoters’ financial & emotional investment in single mindedly running the companies has driven: (a) consistent high reinvestment rate; and (b) the ability to double down on business investments specially in weak market conditions. Most Little Champs companies are characteristised by high promoter shareholding, higher share of variable pay (vs. fixed pay) in the promoters’ remuneration as well as prioritization of reinvestment rather than cashing out via dividends. Also, for most companies, promoters do not have any major business interests outside the company as evidenced from minimal related party transactions and shareholding pledge. More details on this can be read in Little Champs’ May 2022 newsletter

Little Champs have also done a commendable job towards improving the longevity of the business via not only grooming the next leadership generation from a young age but also getting the ball rolling for institutionalization of their business. By appointing professionals in key posts (like CEO and business heads) as well as improving the quality of independent board of directors, these companies have started the process for the next high growth phase. More details on these softer aspects can be found in our November 2021 and May 2022 newsletters.

Little Champs set for a take-off

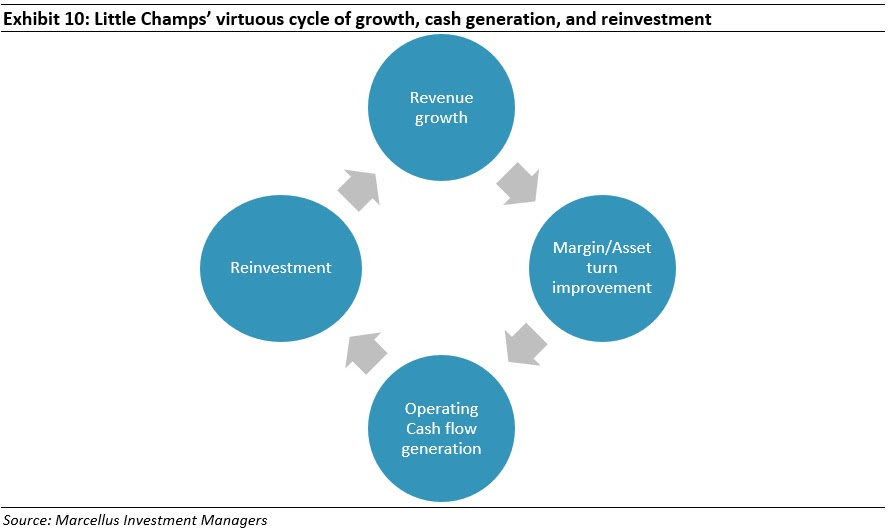

As explained in the preceding sections, Little Champs have built a snowballing dynamic of generating cashflow from market share gains and efficiency improvements (on both P&L and balance sheet) and then reinvesting the ensuing cash in creating further future earnings and cashflow drivers as shown below.

Through repeating the above process over the last decade, not only have Little Champs sustained earnings growth, but also generated ever-expanding internal accruals/operating cashflow which have enabled multifold expansion in their addressable markets through globalisation and product adjacencies. This is expected to provide a growth runway for many years to come.

Specifically, Little Champs have ramped up their reinvestments in FY22, capitalizing on the war chest built through strong cash generation in the preceding years, significant step-up in internal accruals and exploiting the market opportunities for consolidation (domestic as well as global) brought upon by Covid-19. This also gives us confidence about earnings and free cash generation for the coming years.

To summarize, consistent reinvestment in high return on capital opportunities is the lifeblood of a typical high quality franchise in which Marcellus aims to invest on behalf of its clients. Little Champs have done so admirably over the last decade either to further strengthen their core business and/or to add new growth drivers (via soft diversification in related products and global expansion). Additionally, the Little Champs have also been able to generate operational efficiencies leading to margin and working capital improvement – all of which adds to the FCF growth for the business. Such a singular focus on value accretive growth has resulted in the Little Champs generating higher shareholder returns vis-à-vis the BSE Small cap universe over last decade. In FY22, even as the overall ecosystem has been marred with multiple macro headwinds, the Little Champs have upped the ante of their reinvestment intensity utilizing the cash corpus and increased internal accruals built during preceding years. We expect such proactive capital allocation to pay rich dividends for the shareholders in the years ahead as the gap with competitors widens further.