OVERVIEW

In the early years of the 21st century, India became the IT outsourcing hub for the Western economies. However, over the past decade, as India’s talent pool has widened to sustain multiple functionalities beyond IT services, the West is also outsourcing audit, finance, HR, marketing, analytics, and other functions to India. As the West’s labour shortage deepens, Western firms are setting up Global Capability Centers (or GCCs) at the rate of one every five days, thus adding to the 1600 GCCs which are already functioning in India. If this GCC boom sustains, then five years hence, it will create a GDP uplift for India to the tune of $20 bn per annum (0.4-0.5% of GDP).

“Girls, when I was growing up, my parents used to say to me, ‘Tom, finish your dinner—people in China and India are starving.’ My advice to you is: Girls, finish your homework—people in China and India are starving for your jobs.” And in a flat world, they can have them, because in a flat world there is no such thing as an American job. There is just a job, and in more cases than ever before it will go to the best, smartest, most productive, or cheapest worker—wherever he or she resides.” ― Tom Friedman, The World is Flat: A Brief History of the Twenty-First Century (2005)

India’s transition from just IT outsourcing hub to ‘outsourcing of everything’

Throughout the 1990s and the noughties, India came to the fore as the back-end processor for all things IT and IT services. This happened mainly because in the new millennium for the first time ever, transfer of information over the internet from one corner of the world to the other became super-fast and super cheap. This change opened countless opportunities for businesses across the world to cost-effectively spread out their operations and earn outsized profits.

India emerged as a massive beneficiary in this trend with its relatively cheap, yet skilled labour being more than capable of handling IT services for global giants. According to a joint report by McKinsey and NASSCOM in 2005, India accounted for 65% of the total offshore IT industry and 46% of the global Business Process Offshoring (BPO).

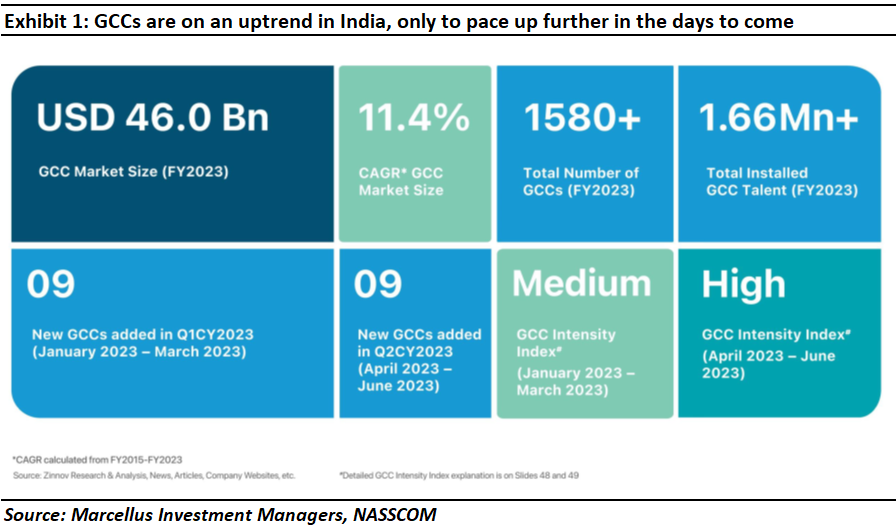

Fast forward 17 years, and India’s position as an outsourcing hub has only strengthened. According to NASSCOM, there are around ~1600 Global Capability Centers (GCCs) set up in India that employ approximately 2 mn people and generate revenues to the tune of roughly US$ 50 bn p.a. (see exhibit below).

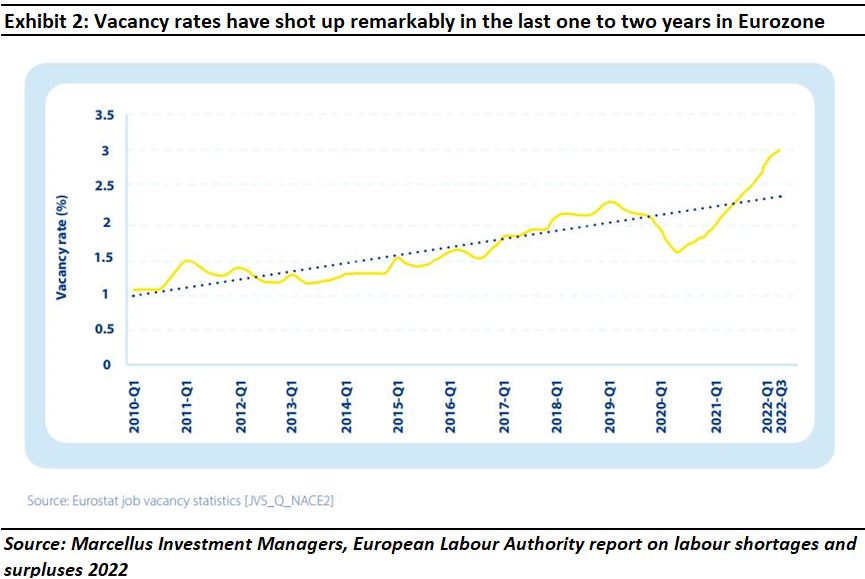

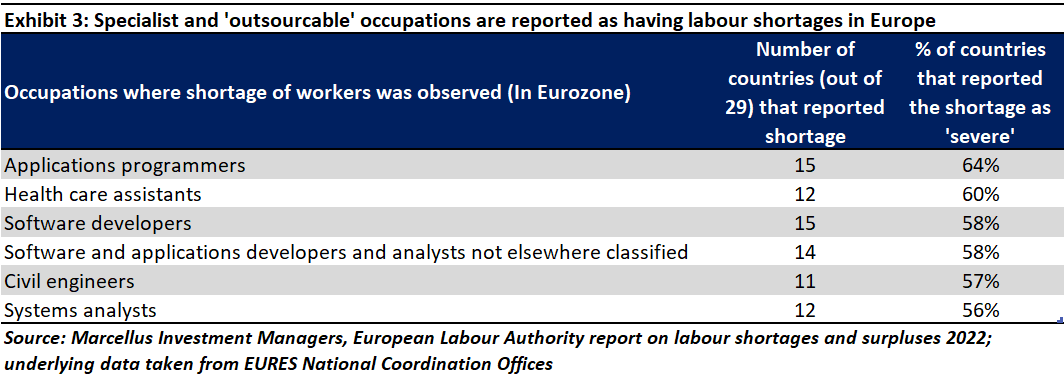

Interestingly, whilst all of this is happening in India, the West is grappling with massive labour shortages. With western economies coming back to normalcy after lockdowns and a structural lack of required skillsets amongst their citizens (see more on this here), job vacancy rates in the Western economies are shooting up (see exhibits 2 and 3 below for Europe and exhibit 4 for America).

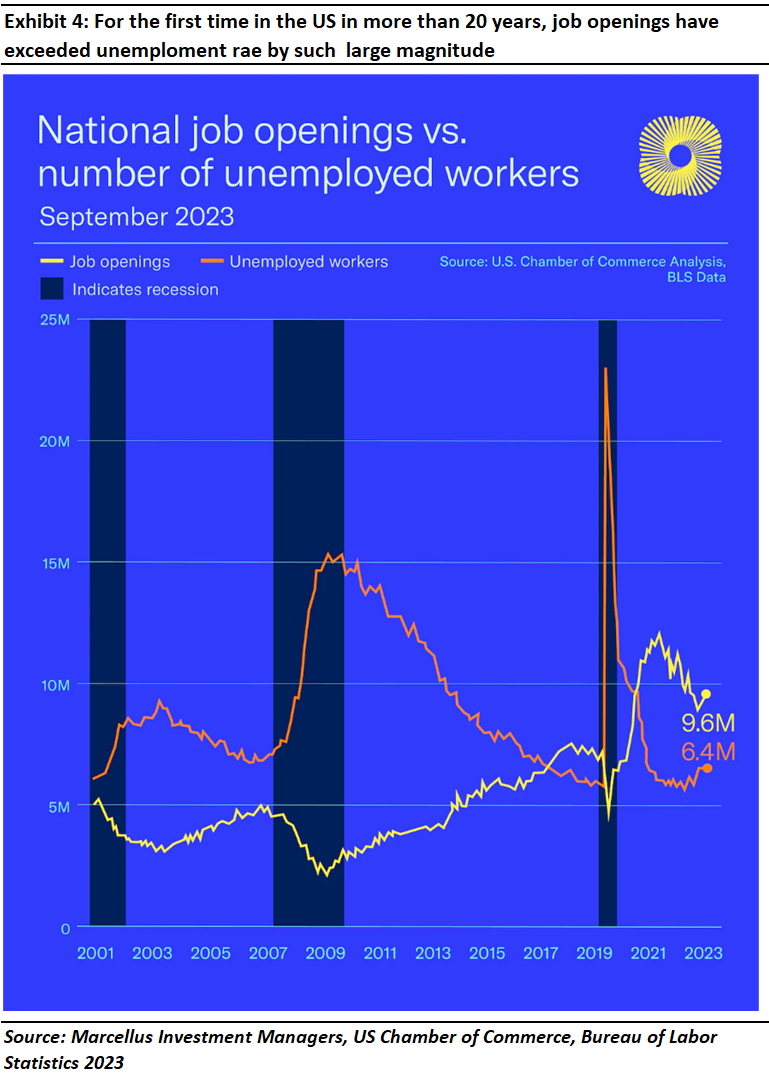

The US is also reeling under similar labour shortage issues, where post the pandemic, people are simply choosing not to go back to work (see more here). If we look from the supply side, the data shows that employment opportunities are well over the unemployment rate (see exhibit 4 below) which means that people willing and able to work are employed but the requirement for personnel has exceeded than what is available in the country.

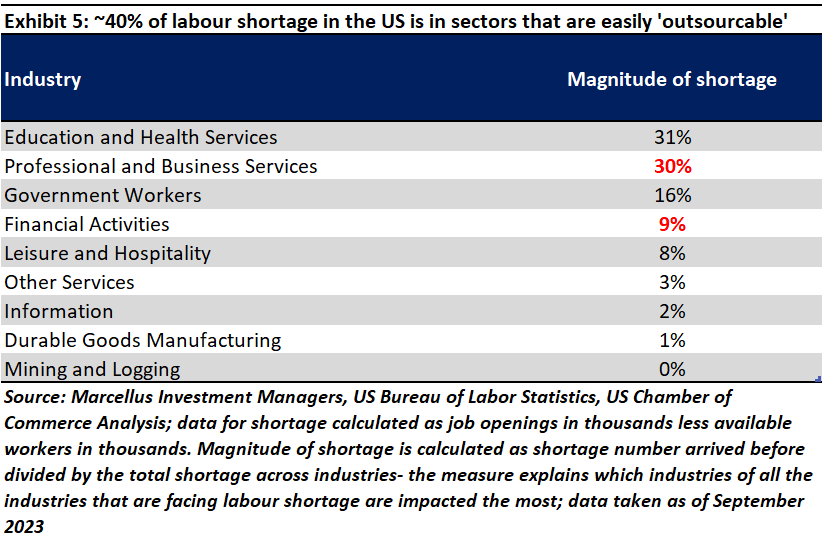

Moreover, the European trend of shortage of skilled workers is more or less true for the American economy as well, with around 40% of the shortage in workers being in professional and business services and financial activities (see exhibit below).

Given the kind of jobs for which the West is facing labour shortages and given the West’s hostility to migration from Asia, it is but inevitable that many of these jobs will end up being outsourced to India.

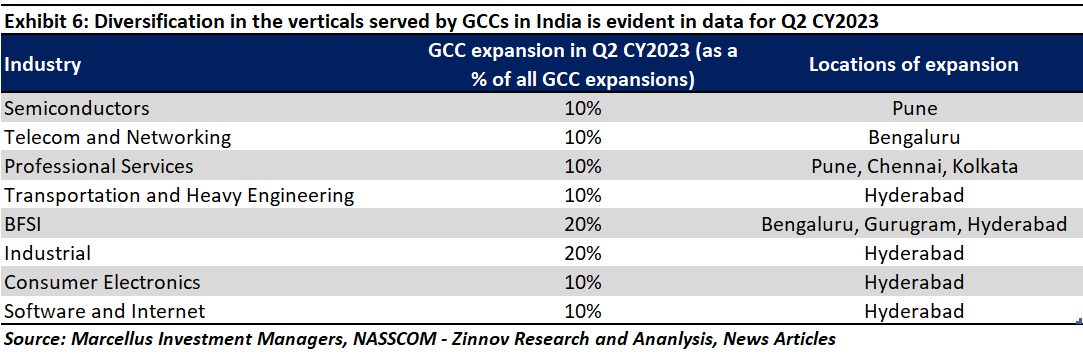

Indian GCCs are now serving a diverse set of functionalities (beyond IT services)

GCCs today in India can handle functionalities like HR, payroll, marketing, manufacturing etc. (see exhibit below).

As we travel around India and speak to real estate developers (who are busy finding office space for the GCCs), bankers (who are busy building banking lines into the GCCs) and recruiters (who are busy finding talent for the GCCs), we can see the ongoing surge in GCC numbers in India.

To give some context here, if we take the 85 GCCs set up in the last 12 months (source: NASSCOM report), it will appear that India is on a run-rate wherein a brand new GCC is setting up shop every 5 days.

Investment implications

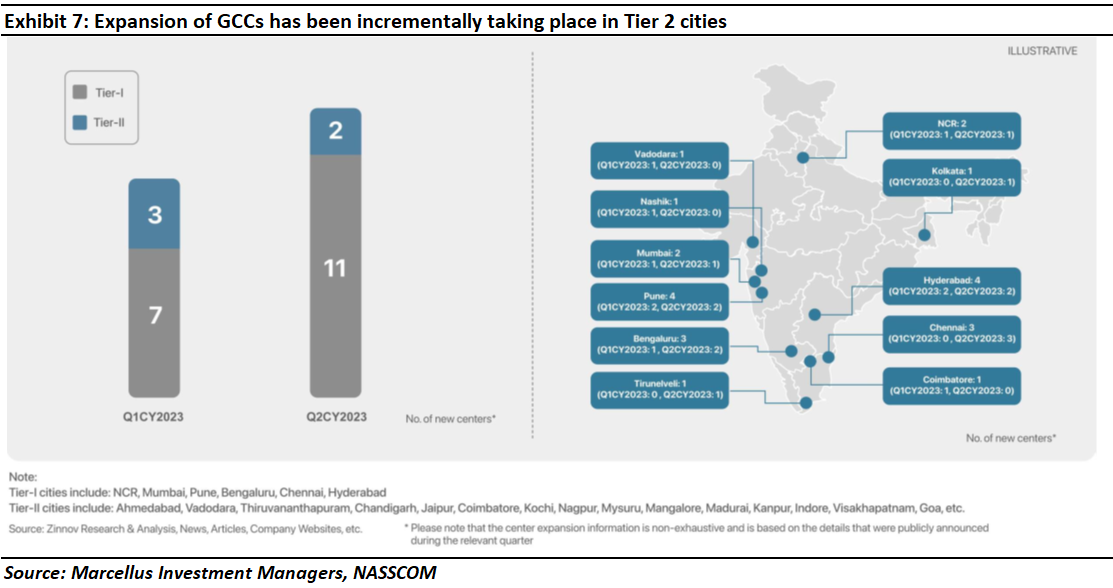

Given the infra & lifestyle issues posed by the Tier 1 cities (e.g., long commutes, high population density, high cost of living) and given the improvement in road & airline connectivity to Tier 2 cities, it is but natural that we are now seeing GCCs coming up in cities like Indore, Nashik, Tirunelveli, Coimbatore and so on (see exhibit below).

Note in the exhibit below, the preponderance of GCCs in India’s ‘southern seven’ states underscoring the preference of foreign investors to set up shop in those parts of the country where: (a) law & order is a given, (b) there is high availability of skilled talent, and (c) physical infrastructure is in a relatively much better shape. As explained in our August 2023 blog The Explosive Ascent of Southern India, southern India ticks all of these boxes.

With more such GCCs being set up in tier 2 towns in the country, more employment opportunities are going to be created. Going by NASSCOM’s estimate that around 2mn people currently work in India in GCCs, if GCCs continue growing at the rate that they have (i.e., adding ~100 GCCs each year) then five years hence it is likely that a further 600K Indians will find employment in GCCs.

Assuming that each of these jobs pays on average Rs 7 lakhs p.a. and assuming the GCC boom sustains over the next five years, such employment will inject into the Indian economy an additional $9 bn per annum (for the next five years). Applying on this the standard Keynesian fiscal multiplier of 2.3x (to account for the spillover benefits of these GCC employees’ spending on leisure & consumption) suggests a benefit to the Indian economy of $20 bn per annum i.e., 0.4% p.a. of GDP five years out. Our clients will benefit from this augmentation of economic activity via investments in companies whose products & services the GCC workers will buy.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in).

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.