In this newsletter, we discuss the consolidation which is taking place across the Financial Services sector in India. Indian public sector banks (PSBs) are plagued by conflict of interest wherein the largest shareholder wants to run the banks for benefit of the public at large, mostly at the expense of minority shareholder. Historically this has led to poor risk selection and anaemic RoEs which in turn has starved PSBs of growth capital eventually leading to market share losses to private banks. Public sector insurers have suffered a similar fate. Leading indicators of investments in technology, distribution and risk selection do not point to any material change in this state of affairs. Hence we expect consolidation in Indian Financial Services to continue with the most efficient players providing the shareholders with the highest rewards.

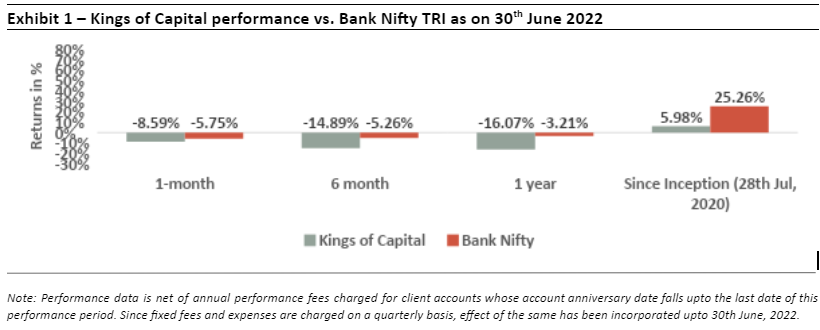

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Quality financials have gained over the last decade as the inefficient players lost their bearings

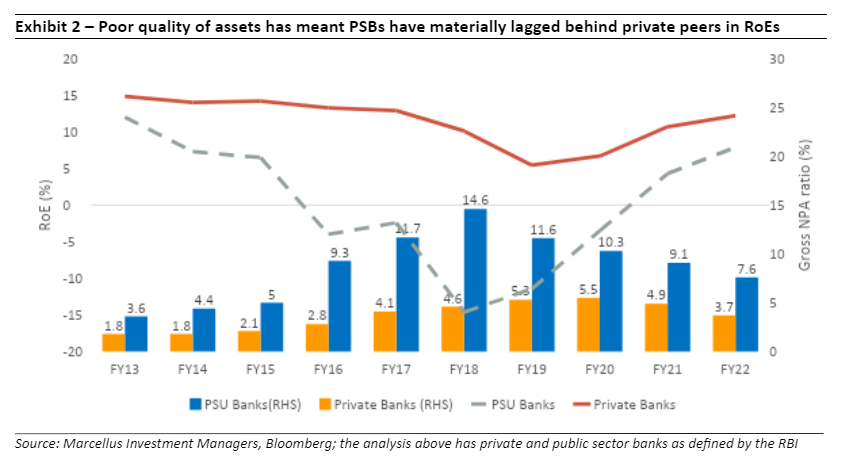

The Indian banking industry is afflicted with a persistent issue of PSBs not being able to consistently generate RoE in excess of their cost of capital. This issue can be attributed to an inherent conflict regarding whether they should allocate capital to reward minority investors or work to achieve the social or political objectives of their majority shareholder which is the Government of India.

The result is that the RoEs of such banks have lagged materially behind RoEs of the more efficient private sector banks. Consequently, without exception, the PSBS have had to mostly depend on constant capital infusion from the Government in order to meet their capital adequacy ratios and to grow their loan book size. We have highlighted below just three of the countless instances over the past 20 years when the Government has had to announce infusions of capital into the PSBs:

- “The government on Wednesday approved additional capital infusion of Rs. 6,000 crore in 10 public sector banks with an objective to raise its holding to a minimum 58 per cent in all State-run banks.

The government has already announced infusion of Rs. 15,000 crore in the budget to ensure that capital adequacy ratio of all the public sector banks increase to 7 per cent.”- The Hindu, December 01, 2010 (https://www.thehindu.com/business/Economy/Centre-to-infuse-additional-Rs.-6000-crore-in-PSU-banks/article15576628.ece?homepage=true)

- “As per Indradhanush plan, for FY 2015-16, 20 per cent of the earmarked capital infusion was to be allocated to PSBs based on their performance during three quarters in FY 2015-16, which was not adhered to on account of the Asset Quality Review by RBI. Even in FY 2016-17, DFS decided (March 2016) that 25 per cent of the capital to be infused in 2016-17 would be disbursed upfront and the balance 75 per cent would be disbursed based on achievement of quantitative targets by PSBs. This decision was reversed in July 2016. Eventually, as most of the PSBs fell short of the targets set, performance was not considered as the basis for capital infusion in 2016-17” – CAG report on recapitalization of Public Sector Banks, 2017 (Emphasis added by us)

- “Government has infused Rs 3,10,997 crore to recapitalise banks during the last five financial years i.e., from 2016-17 to 2020-21, out of which Rs 34,997 crore were sourced through budgetary allocation and Rs 2,76,000 crore through issuance of recapitalisation bonds to these banks” – Minister of State for Finance Bhagwat Karad said in a written reply in the Lok Sabha, Economic Times, Feb 07, 2022. (https://economictimes.indiatimes.com/industry/banking/finance/banking/govt-recapitalised-psbs-with-rs-3-10-lakh-crore-capital-infusion-over-last-five-years-minister/articleshow/89412699.cms)

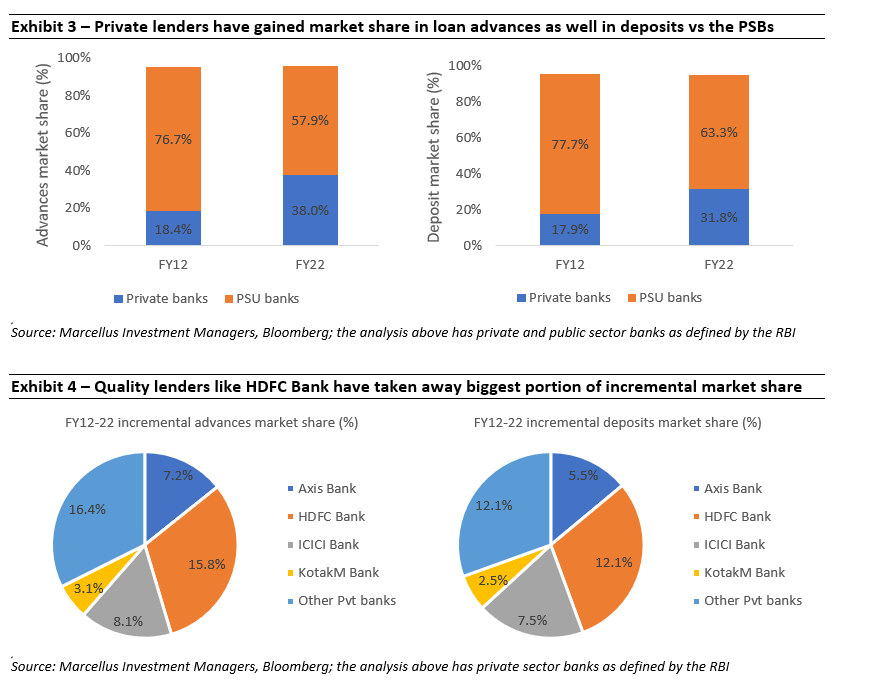

Meanwhile, the strongest private sector lenders have been able to take market share away from PSBs (on both sides of the balance sheet) whilst creating shareholder value for minority shareholders.

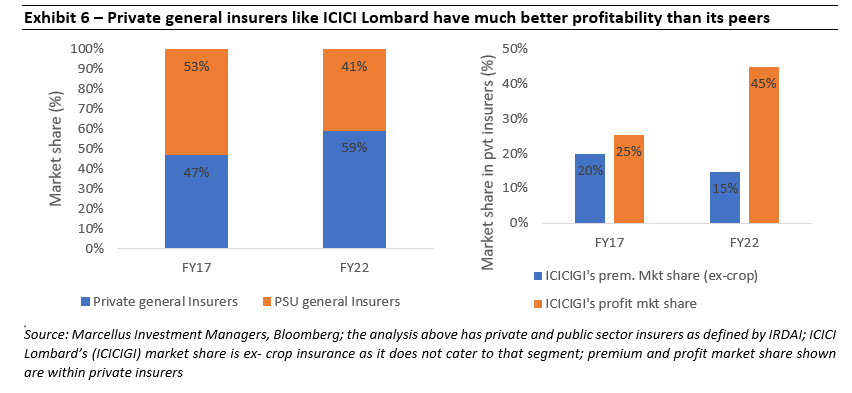

A similar story has played out in the insurance sector

The Indian insurance industry – life and non-life – is also moving in the same direction with private sector insurers rapidly gaining market share from their public sector peers.

PSU non-life insurers are constrained by lack of capital (3 out of 4 multi-line PSU insurers have solvency levels below the regulatory requirement), negligible product innovation, inferior risk selection (crop insurance, mass government health insurance, etc.) and lack of ability to manage their ‘float’ diligently (thanks to high level of defaults in their fixed income book). Furthermore, the Government is likely to continue using these insurance companies for achieving its social objectives (i.e. for the roll out of public schemes). All of this means that focused private insurers should continue to gain market share in the retail profit pools.

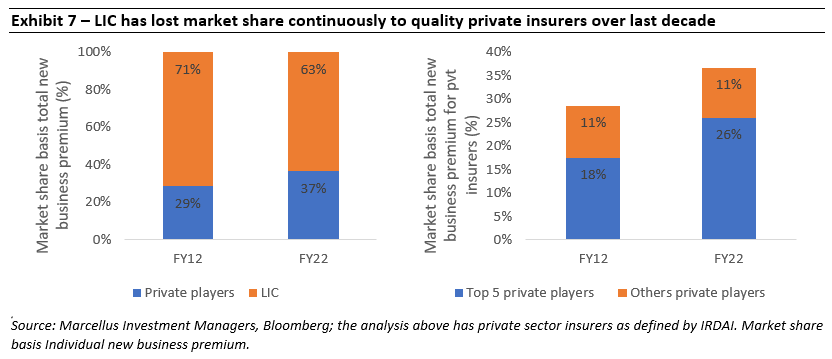

In life-insurance, LIC has been consistently losing market share to its private peers owing to its single product offering (participating) and distribution strategy (agency). Owing to decades of experience in only selling a single product, it is difficult to assume that the same distribution channel will be able to sell far more complex life insurance products (which is the current demand from the consumer). This institution also faces conflict of interest because the company has been run for decades for the betterment of the policyholder and NOT the shareholder, resulting in sub-par returns for the shareholder. This impairs LIC’s ability to innovate and grow. Amongst the private players, large insurers have continued to gain market share.

Why do we expect large to get larger in the future?

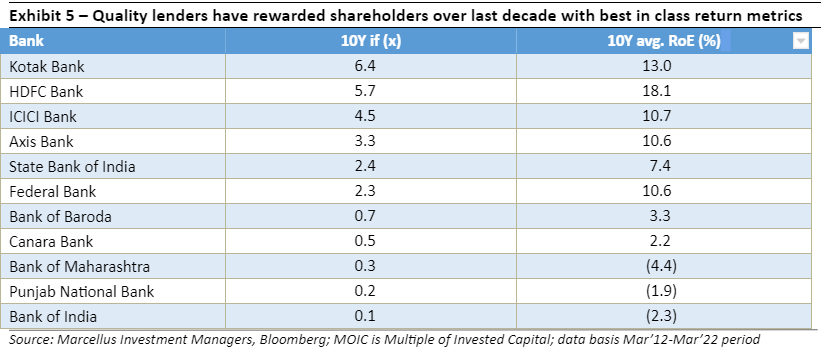

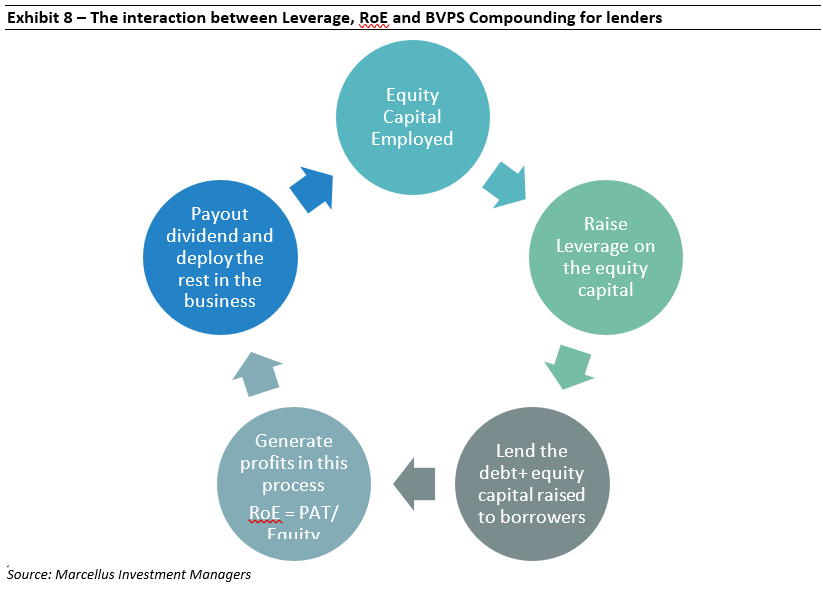

In our last newsletter (link) we’d discussed how a bank’s book value growth is a function of three key elements: high RoEs, high reinvestment rates and capital raises at high P/B multiples. As we’d written in the newsletter “Over the last 10 years, quality Indian lenders have done something which is actually very difficult to do i.e. reported growth in BVPS (book value per share) which is well ahead of RoE generation thanks to being able to raise fresh equity capital to fuel growth. These lenders have been able to raise capital at high P/B multiples because of their proven ability to deploy large amounts of capital profitably.”

We believe a similar story is likely to pan out over the next decade too as the best lenders will be rewarded for consistently deploying incremental capital at high RoEs via availability of cheap capital even as it becomes scarcer for most others who’ve been unable to show similar compounding of book value at high rates. Furthermore, at a time when there is plenty of chatter that the best franchises in the Indian Financial Services sector have become too big to repeat the kind of growth seen over past decade, we expect their strong growth to continue over the next decade as:

a. Ecosystem credit growth take places at a healthy rate over the next decade: As we’d discussed in our recent webinar-‘India: A decade of structural reforms’ (link), the reforms undertaken over the last decade or so have laid the foundation for India’s high growth trajectory over the upcoming decades. As the country’s nominal GDP grows at a healthy double digit rate, we expect the credit uptake to grow at an even faster rate thus increasing the loan book pie for the overall industry.

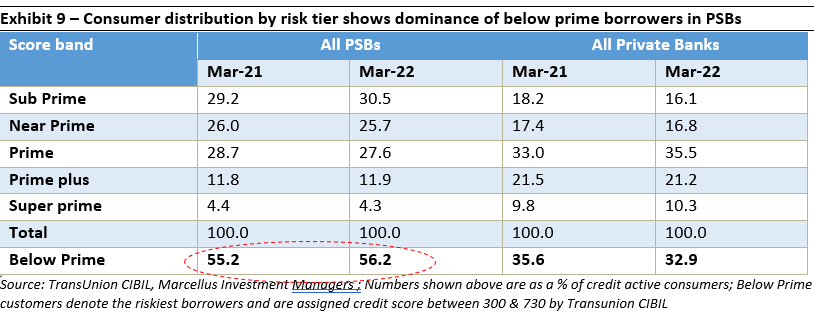

b. Market share gain vis-a-vis weaker lenders continues: Even though PSBs in India have lost market share over the last two decades, they still enjoy ~60% share in loan advances. We expect the key competitive advantages that’ve thus far allowed high quality lenders to keep growing at the expense of PSBs to remain intact (and even strengthen) especially as the PSBs remain conflicted between value add for minority shareholders versus the Government’s public welfare objectives. In fact, quite astonishingly, as per the RBI’s data, for PSBs, even in FY22 around 60% of the credit active customers were classified as ‘below prime’ (see exhibit below).

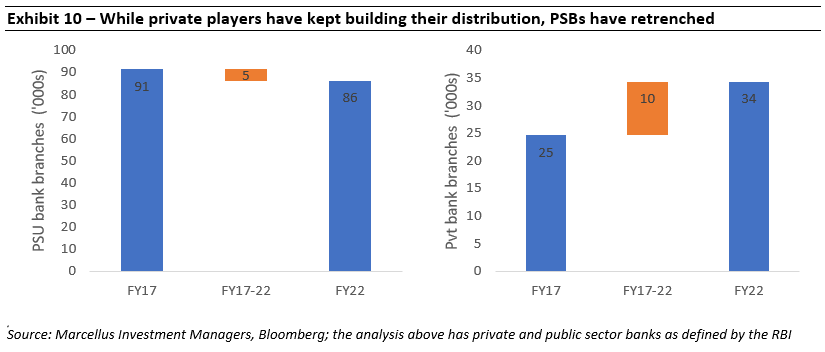

c. Strong liability franchise: Further, the private banks have built strong liability franchises and continue to increase their distribution touchpoints via addition of branches as shown in the exhibit below, while the PSBs are retrenching the same.

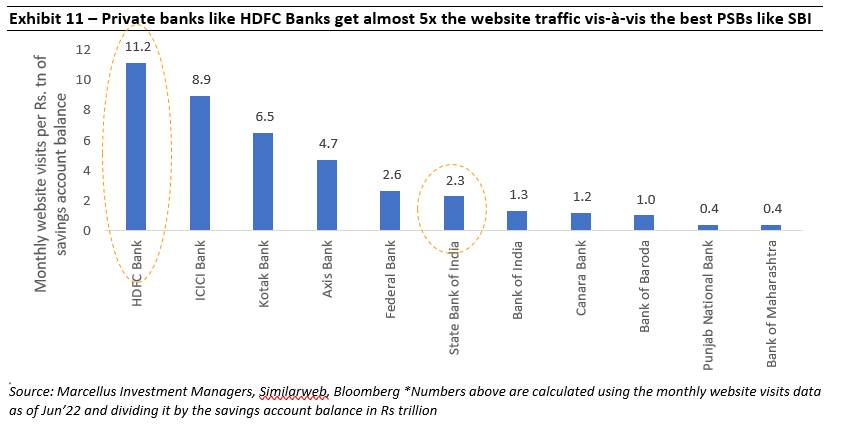

The technological lead of the most efficient lenders – especially the likes of HDFC Bank can be gauged from the fact that its number of monthly website visits is ~1.6x that of SBI (for Jun’22). This is inspite of HDFC Bank having a savings account balance which is one-third that of SBI’s (Mar’22). On a normalized basis, this translates into a monthly visits per trillion of savings account balance figure at ~5x that of SBI as shown in the chart below.

This aspect highlights the difference in ‘mental recall’ that a technological edge can provide for the retail customers of well managed private sector banks. Superiority in mental recall driving a stronger liability franchise is likely to end up giving the private sector banks something that they don’t yet enjoy vis a vis the PSBs – a lower cost of funds.

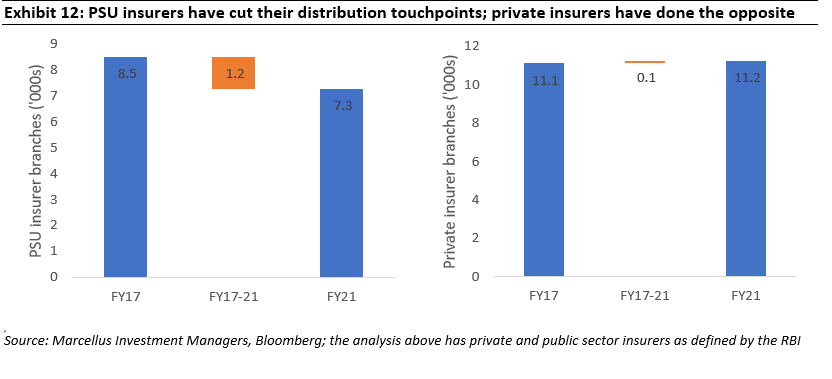

We see similar trends in the insurance ecosystem as well wherein whilst the private sector has increased the distribution touchpoints, PSU insurers have actually reduced their distribution footprint.

Also, private life insurers have been at the forefront of product innovation (credit life, term insurance, long term guaranteed products) and have made investments for their channel partners (easier on boarding, skilling and improvement in engagement), while LIC has been focused on selling a single product for several decades now. Moreover, private non-life insurers have technology in place which allows easier claims settlement (especially motor insurance), advanced health insurance add-ons (addition of Out Patients Department treatment, tele consultancy for patients, etc.) which are likely to create a differentiation in a competitive general insurance market in India.

Given the kind of structural advantages that the best lenders and non-lenders enjoy over their peers (as highlighted above) we expect their dominance to continue over the next decade. The growth runway available to India’s largest private sector banks and the country’s largest private sector insurers – both in terms of industry tailwinds from macroeconomic forces and capturable market share from an inefficient public sector – provides us assurance that their growth trajectory will remain stellar over the next decade.