PORTFOLIO UPDATE:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

All returns are post fees & net of expenses (TWRR). The returns are as on 23rd July 2021.

Inception Date & Benchmark:

Consistent Compounders Portfolio:Inception: 1st Dec,2018 Benchmark: Nifty 50

Little Champs Portfolio: Inception:28th Aug,2019 Benchmark: S&P BSE Small Cap

Kings of Capital Portfolio: Inception:28th July ,2020 Benchmark: Bank Nifty (Inception returns are absolute in nature since portfolio has not completed one year)

How longevity of a business drives its valuation:

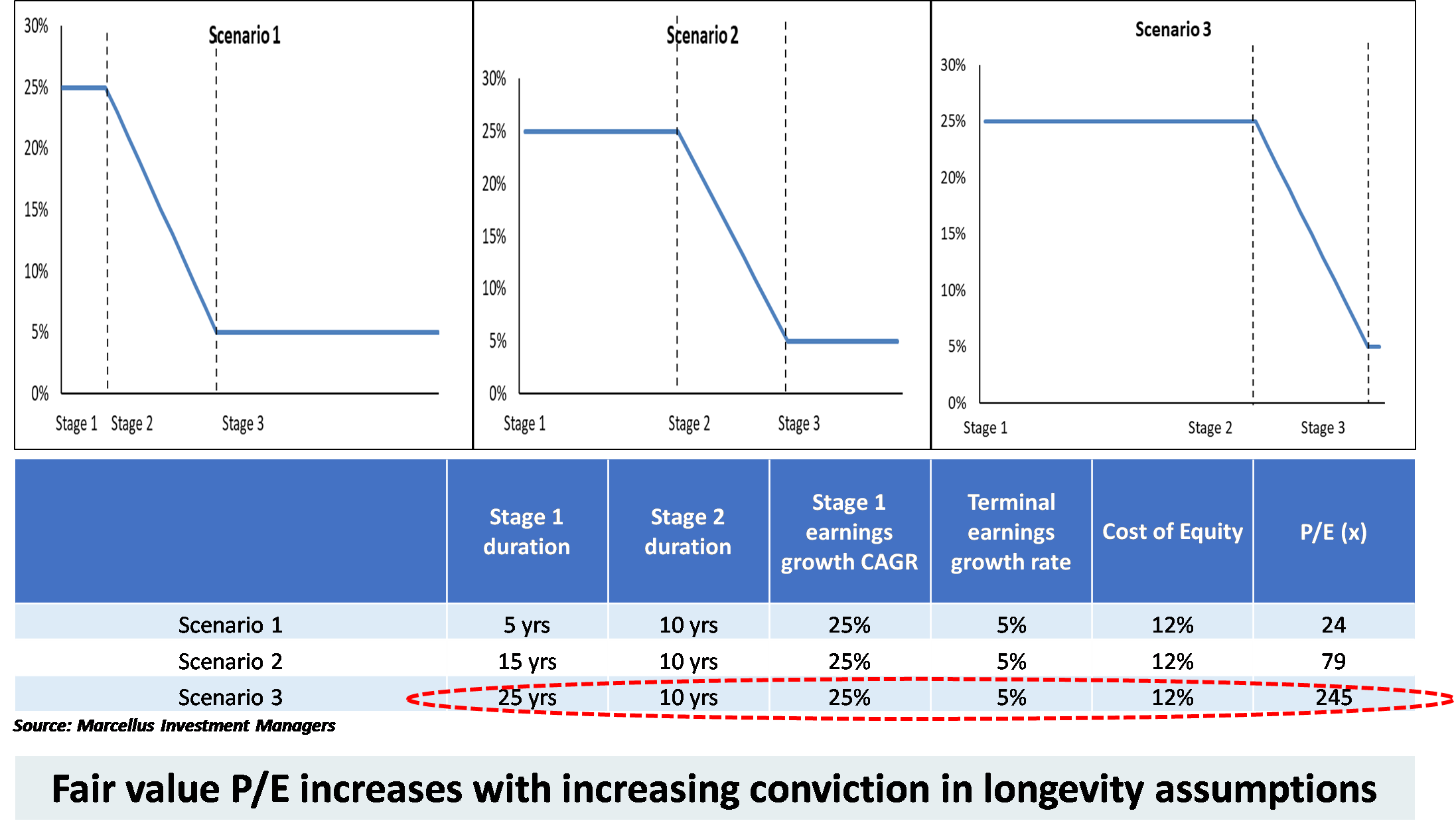

Some of our investors and partners have a common concern pertaining to Marcellus portfolio – VALUATION. Their concern arises due to use of multiples based valuations which don’t factor in the longevity or sustainability of growth given they are based on one year’s earnings. The few who use cash flow based valuation also use a conventional DCF method which undervalues longevity of business. In the below example, we can see how a company’s valuation changes dramatically if we change the assumption of its longevity.

So, if it is longevity that drives valuation than the next important question is – how does Marcellus build conviction on the company’s business longevity?

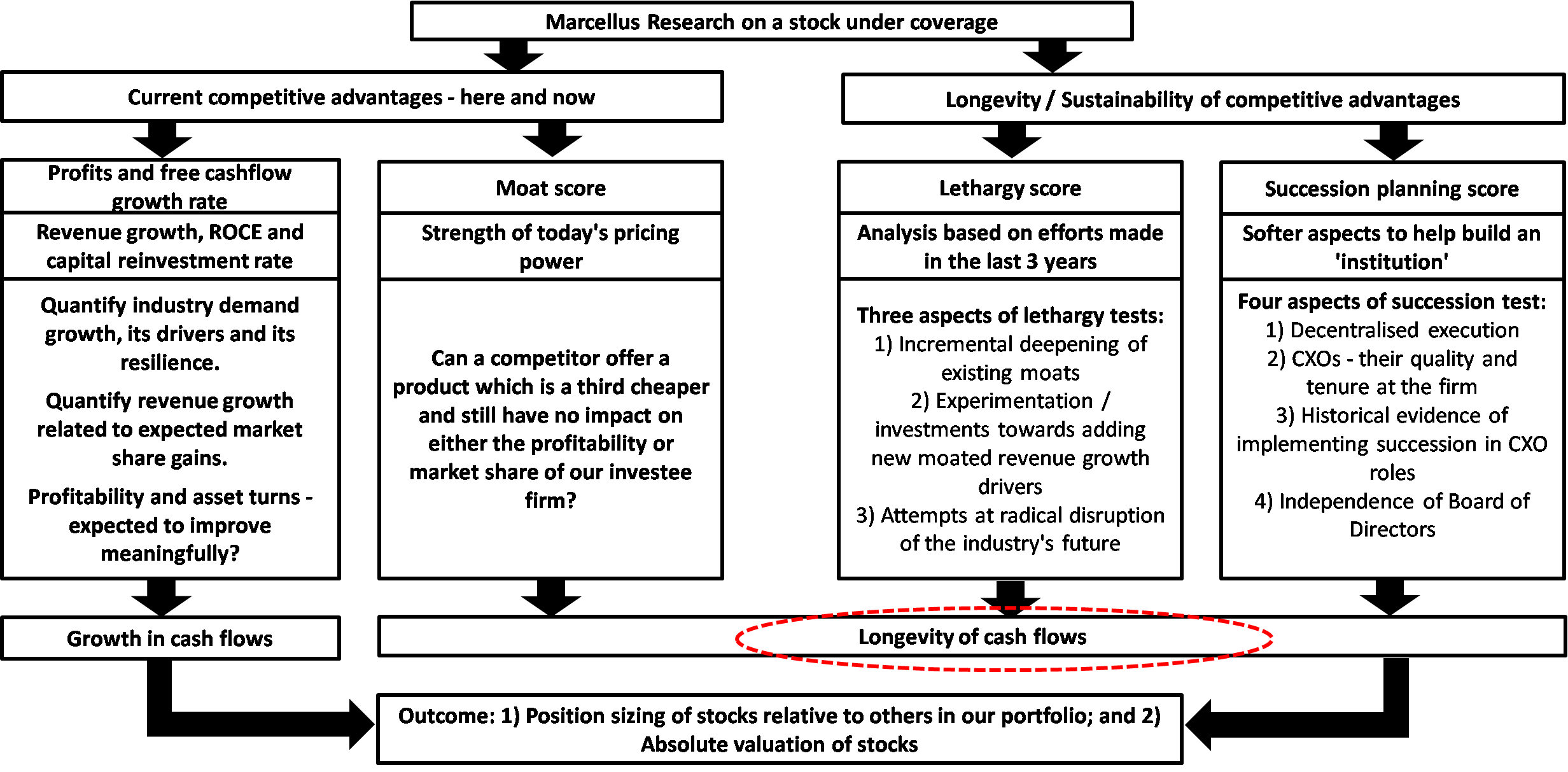

Marcellus research team over the years have developed proprietary Longevity Framework which helps us to build our conviction on the company’s business longevity.

Our Longevity Framework not only helps us build our conviction on a company’s business longevity and hence intrinsic value of the business but also helps in determining position sizing of stocks relative to others in our portfolio (i.e., higher the score higher the allocation).

Please find below links to our latest newsletters and presentations:

**For product/sales related queries please write to sales@marcellus.in**

OPERATIONS UPDATE:

1. KYC Change/ Update Forms

- To update/modify KYC details for Individual and Non Individual in PMS and Custody, we would require the forms mentioned in the below links.

- The links include a word document which has a detailed explanation of forms and the document requirements.

- Website : https://marcellus.in/marcellus-forms/

2. Nomination Form

- To Add/Change Nominee in PMS and Custody, would require the forms mentioned in the below links.

3. Support Email ID

- We have our support email ID to address any queries, concerns with regards to Onboarding or Account opening of the client.

- Our Email ID : clientsupport@marcellus.in

- Query routed through our Support ID has:

- Fastest Response Time

- No Delay in response

- Open-ended discussion and active problem-solving.

**For operations related queries please write to clientsupport@marcellus.in**