Over the past decade (FY11-21) Bajaj Finance (BAF) has grown its loan book at a CAGR of 35% and PAT at a CAGR of 33% with an average RoE of 20%. During this period credit growth in the Indian banking sector has been only 10% p.a. BAF has transformed itself from being largely a captive vehicle financier to India’s most diversified NBFC which now offers over 40 lending products and has established housing finance and broking subsidiaries. BAF’s success has been underpinned not just by its unique use of technology but also by access to low cost of funding courtesy its Bajaj group parentage. While business transformation 1.0 over the past decade has resulted in BAF building a customer franchise of ~50 million customers, in this newsletter we discuss how BAF’s business transformation 2.0 is likely to be one of the most radical transformations for an Indian listed company. Transformation 2.0 will enable BAF to not only double its existing customer base but also mine the wallet share of its existing customers in a cost-effective manner.

“We had been showing ALM data for the past five years. Two years ago, nobody paid much attention to it, so we pushed it back as an annexure in our presentations. Now when investors ask for it, I tell myself, ‘Thank God, I did not treat ALM as an annexure to my business model” — Rajeev Jain, MD, Bajaj Finance after the ILFS crisis.

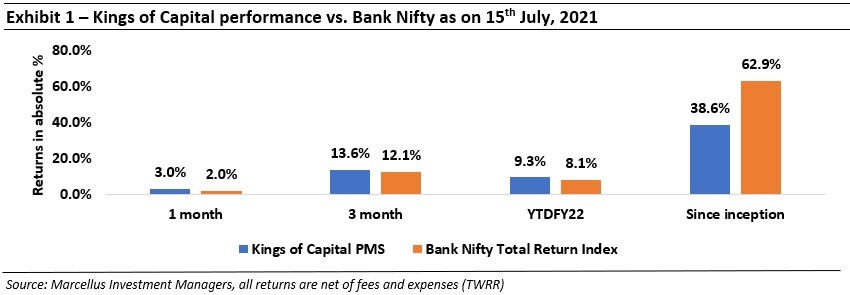

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Simplifying Bajaj Finance’s existing business model:

Bajaj Finance’s consumer financing proposition is a win-win-win:

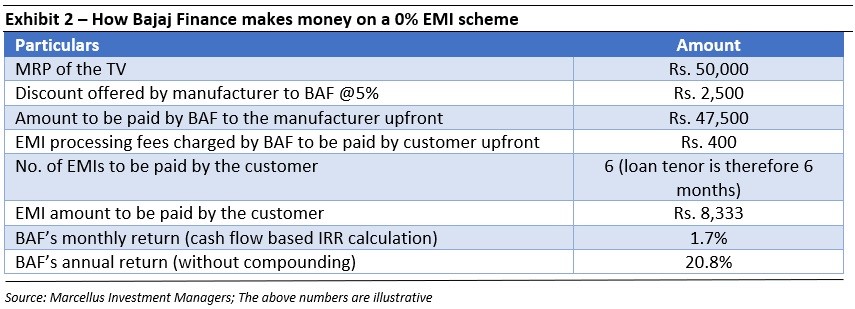

Bajaj Finance is India’s largest consumer durable financier and finances more than 70% of all consumer durables financed in India. BAF’s mainstay is no cost EMIs where a consumer who buys a TV, AC or a fridge is offered a 0% EMI with no/minimal processing fees. Exhibit 2 below explains how BAF makes money when a consumer buys a TV on 0% EMI. In such a transaction, BAF pays the manufacturer (eg. Samsung) upfront while it collects EMI’s from the customer over the tenor of the loan.

Such a transaction is a win-win-win for the customer, the manufacturer and for Bajaj Finance because:

. The customer

is able to pay for the product of his choice over a period of 6 months at zero or minimal additional cost. In the above illustration if we assume the processing fee of Rs. 400 as a cost to the customer, the customer is able to get 6-month financing at only 2.8% p.a.

. The manufacturer

is able to increase the inventory turnover for the retailers by offering 0% EMI schemes. The 5% discount offered by the manufacturer in the above example is a marketing expense for the manufacturer. There is also a likelihood of the customer making a higher value purchase i.e. buying a 45-inch TV instead of a 40-inch TV because there is 0% financing available.

. Bajaj Finance

in this process is able to make 20%+ yields on loans to affluent Indians. In addition to making money on the first loan, Bajaj Finance is also able to get more data on these customers by taking minimal risk as these are 6 month loans with a relatively small ticket size.

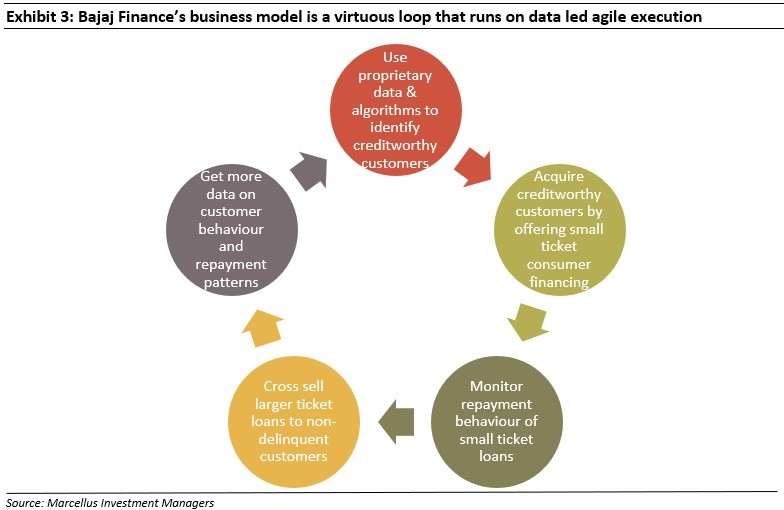

The consumer financing business is Bajaj Finance’s customer acquisition funnel:

The subvention model explained above works well not only for consumer durables but also for mobile phones, electronics, furniture and because of its compelling proposition is likely to be used for apparel, fashion and other small ticket purchases as well. Bajaj Finance already moves about 30% of electronics, 15% of smartphones and 10% of organised furniture sold in India. This financing construct provides Bajaj Finance with massive amounts of customer data which is used to filter out the good customers from the bad and take a call on what sort of a product should be offered to which customer.

For example, there over a million doctors in India and Bajaj Finance has mapped out the data on each of these doctors so as to take accurate credit decisions. Some of the data points Bajaj Finance captures are repayment history of the customer, which bank does the customer have a relationship with, where does the customer reside (Tier-1 city where cost of collections can be relatively lower or somewhere else), field of specialisation in medicine, quality of graduation college (is it a top10 medical college?), etc. Using these data points Bajaj Finance has created hundreds of clusters for every segment that it lends to. Basis these clusters, Bajaj Finance takes a decision on:

· Amount of loan,

· Rate of interest,

· Tenor of loan, and

· Whether to give a pre-approved loan.

BAF can waive off some verification or background check requirements and save on opex as it knows that if the customer already has a relationship with a large bank then the bank would have already done the background checks so BAF doesn’t need to spend on that again.

It is difficult for other lenders to replace Bajaj Finance

There are significant execution related challenges for a new entrant. The advantages of scale that Bajaj Finance enjoys in this business are :

· Geographical presence:

A manufacturer such as a Samsung, LG, Sony, etc. would want to deal with a consumer financier which has the widest geographical presence so that all its retail touch points are able to benefit from the sales boost of a 0% EMI scheme. Today, Bajaj Finance offers the widest geographical presence to any manufacturer. Bajaj Finance offers a simple plug and play model financing model across hundreds of locations to large manufacturers such as Samsung, LG etc.

· Ability to approve a large proportion of loans:

The retailer/ manufacturer would also want the financier to approve a large percentage of loans at a high velocity so as to convert customer footfall in their stores to actual sales. A conservative financier with a high loan rejection rate would not be preferred by the manufacturer/ retailer. It is difficult for most banks and NBFCs to not only a approve a high percentage of customers but also to know which customers to approve at a high velocity. Bajaj Finance offers the highest approval rate because it is focused on the customer’s overall wallet share and does not look at the consumer durable loan in isolation – once BAF acquires the customer it is able to cross sell multiple other products to the customer. Bajaj Finance’s extensive database allows it to access underwriting analytics on prospective borrowers faster and make underwriting decisions faster than any other NBFC.

· Collection infrastructure to collect small ticket loans:

Because these are small ticket unsecured loans, it is extremely important to have a delinquency bucket wise granular collections infrastructure which is able to collect overdues in a cost-efficient manner. As seen in Exhibit 2, because EMIs in consumer durable financing are of a few thousand rupees, if the unit cost of collection exceeds a few hundred rupees then this becomes an unviable business to run at scale. Over 25% of Bajaj Finance’s staff of over 25,000 employees is in the collections team. These employees in turn work with hundreds of collection agencies across India.

Bajaj Finance’s ground level execution and meritocratic culture is hard to replicate

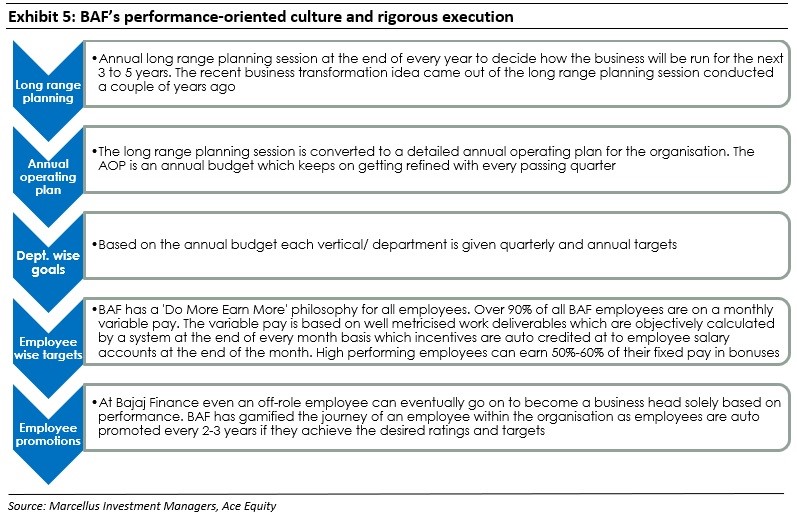

Ground level execution and employee empowerment at Bajaj Finance is driven through the process described in Exhibit 5 below:

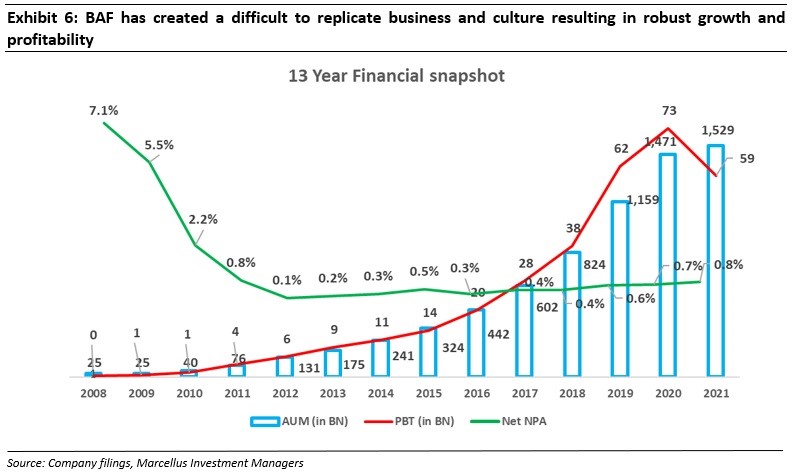

This sort of rigorous ground level execution combined with its competitive advantages has resulted in Bajaj Finance’s robust, profitable growth illustrated in Exhibit 6 below.

Understanding Bajaj Finance’s business transformation 2.0

In November 2019, in one of its long-range planning sessions BAF had envisaged that it will take about four years to build a complete app based ecosystem. While the pandemic year put pressure on asset quality and slowed down disbursals, BAF’s proactive management team saw this as an opportunity to accelerate its business transformation agenda. What was initially envisaged as a four-year transformation journey has been significantly accelerated and is now likely to be implemented in phases, between July 2021 and October 2021. The key theme is to create an app based omni-channel ecosystem which will provide flexibility to customers to move online to offline and vice versa in a frictionless manner.

How will the business transformation help Bajaj Finance?

While Bajaj Finance’s revamped consumer facing app will be launched later this year, we have learnt the following from our channel checks and the Company’s public disclosures about the app’s functionality, UI and what it is seeking to achieve. The app will consist of five different marketplaces that will be hosted on a single platform, thereby enabling customers to review, compare and buy a host of products & services across the electronics, insurance, investments and health categories. The five screens visible to users after they login to the app are, (i) The ‘EMI store’; (ii) The ‘Insurance Marketplace’; (iii) The ‘Investment Marketplace’ (iv) ‘BFL Health’; and (v) the ‘Broking App’. In addition to these 5 marketplaces customers will be able to checkout with Bajaj Pay which will offer all modes of payment including its EMI card, QR code, UPI, etc.

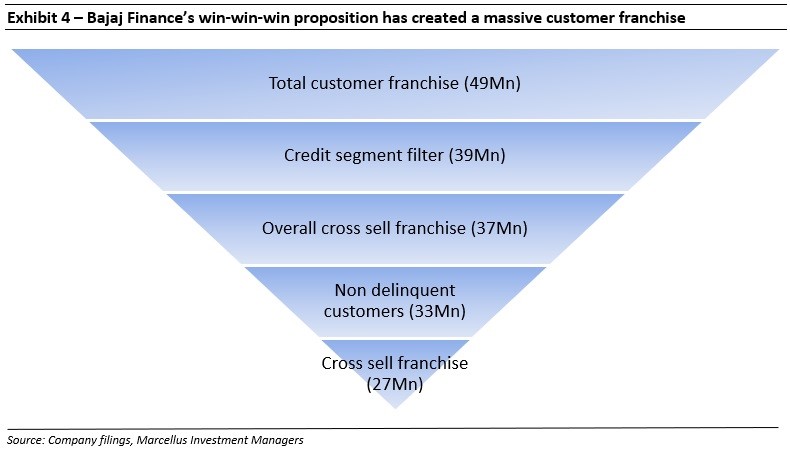

· New customer acquisition and mining wallet share of existing customers:

Out of BAF’s 49 million customers, 27 million customers are its best customers with whom BAF is willing to do business. BAF has another 90 million prospects that they are willing to do business with today and who in general have 80-90% approval rate. The digital infrastructure under business transformation 2.0 is being built to tap these 117 (90+27) million Indians who Bajaj Finance want to do business with. While BAF’s loan book size is only Rs 1.5 lac crores, the 27 million good quality customers have Rs. 6 to 7 lac crores of outstanding credit in India’s lending sector (in addition to the amount outstanding with BAF) thus providing significant headroom to mine wallet share of existing customers. The app based ecosystem will help in mining this wallet share not only on the lending side but also on the savings side through the investment and insurance marketplaces and the brokerage app.

· Cost efficiency:

Financial services is usually a linear business where operating revenues and operating expenses largely rise at the same pace. However, the digital infrastructure and app based architecture will bring in non-linearity to the business and cost of doing incremental business will reduce. In its current avatar, even though Bajaj Finance has acquired a customer once it needs to spend some money and effort to reengage with the customer and cross sell products to him. However, under the app based ecosystem once a customer is acquired and is active on the Bajaj Finance application, incremental spend for BAF on the customer reduces.

· High business velocity and real time data capture:

The app based ecosystem will provide a frictionless customer experience leading to a high velocity and volume of transactions. For example, ~20% of the users will have a pre-approved personal loan and will be able to avail the loan at a tap of a button. The remaining 80% users will get a call within a few minutes once they apply for a personal loan on the app. This app based ecosystem will enable BAF to collect large volumes of data based on customer activity on the lending and savings marketplaces. This data will be ingested on a real time basis and using those insights its credit models can be tweaked on a real time basis.

How will BAF compete with other fintech players?

Penetration of smart phones, growing number of internet users, availability of data due to multiple credit bureaus and easy access to capital have led to the advent of multiple fintech players in the past few years. The fintech landscape in India is spread over numerous businesses including retail lending, insurance, brokerage and wealth management, payment wallets, etc. and the five in one application that BAF is coming up with will compete with multiple fintech players in these spaces. However, BAF will not be going down the path that other fintech players have taken because it has a unique customer acquisition model. Unlike most other fintech players which spend large amounts of money on customer acquisition and make money on the customer only after the customer transacts with them 2-3 times, Bajaj Finance acquires customers through its consumer durable financing business and rather than spending money on customer acquisition it makes money the first time a customer transacts with BAF. BAF’s app has already seen 14 million downloads of which there are 8 million active users

While we have explained BAF’s lending business in some of the sections of the newsletter above, below is a summary of the wallet, broking and insurance distribution businesses:

Wallet business-

Paytm’s ecosystem covers payments (wallet/UPI), merchant acquiring, credit savings, wealth management and Insurance with an active user base of 50mn and 20mn+ merchant base. Over the last 4 years (FY18-21), Paytm has spent Rs.6,500 Crores on promotional activities to generate a cumulative revenue of Rs.12,400 Crores. The gross transaction value on Paytm’s application has grown at a CAGR of 68% and active users have grown at a CAGR of 24% from FY18-21. However, the revenue has remained flat from FY18-20 and dropped in FY21. On the other hand, Bajaj Finance has seen its opex to net interest income drop from 40% in FY18 to 31% in FY21 even though its customer franchise doubled to 49 Million customers and net interest income grew at a 28% CAGR during the period. Because BAF already has 49 Million customers, a cost effective customer acquisition engine and 8 Million active app customers, its app based architecture is a much more effective way of engaging customers and mining the wallet share of these customers.

Broking business–

BAF incubated Bajaj Securities – its broking business in December 2019. This business has three parts – Loan against Securities, margin trade financing for HNIs and discount broking. It is aiming to build a dominant broking business in India over the next three-to-five-years. Out of BAF’s 120 Million prospective customers, 8 Million are KRA certified and will be able to open a broking account on BAF’s new app with one click. Bajaj Securities is currently opening around 20,000 to 25,000 accounts a month. Bajaj Securities can become a 100,000 new broking accounts a month business by December of this year with reasonably deep experience in LAS lending. Just to put this into context, Zerodha currently opens around 200,000 accounts a month and has an annual PAT of over Rs, 1,000 Cr. This can therefore become a large profit pool where BAF will be competing with Zerodha and other bank backed brokers.

Insurance marketplace–

Today a customer can visit BAF’s website and buy from a variety of 500 pocket insurance products. There are 40,000 customers who purchase pocket insurance from BAF every month – this number can increase exponentially as with the new app, customers will be able to buy these products with the click of a button. Annually gross written premiums of $700mn is driven by InsureTech companies against a traditional industry size of $77bn life insurance premium and $30bn general insurance premium. This can therefore become another large profit pool where BAF will be competing with PolicyBazaar which has a 90% market share in third party online insurance sales.

Note: Bajaj Finance is a part of most Marcellus’ portfolios