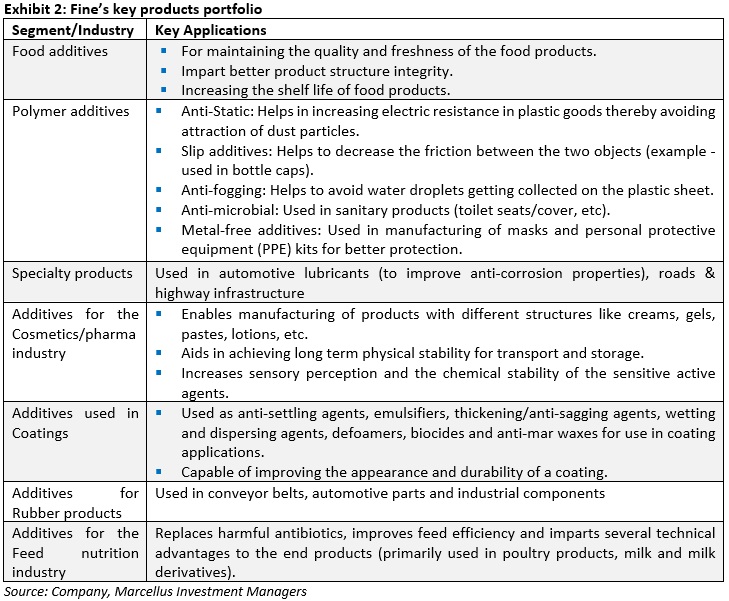

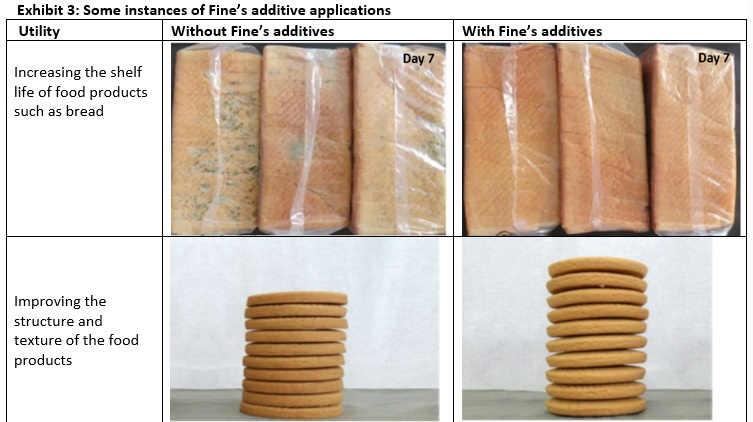

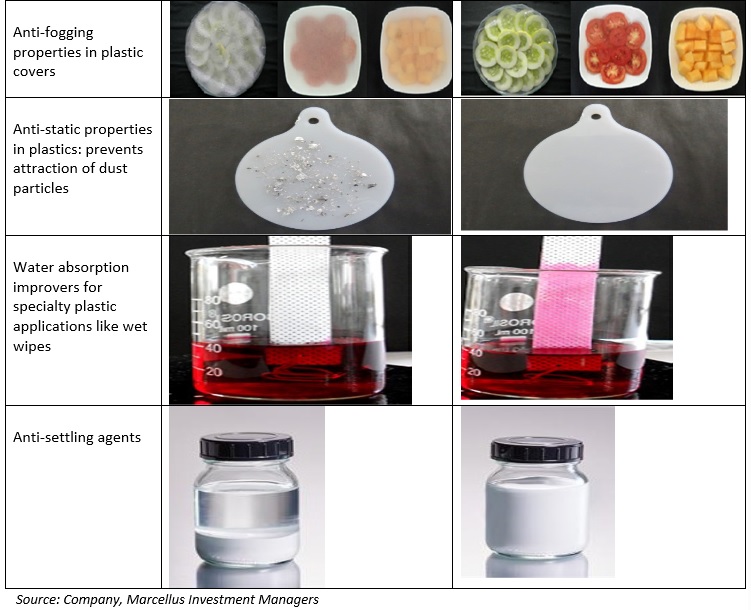

This month we place the spotlight on Fine Organic Industries Limited, by far the largest producer of oleo-chemical based food, polymer and certain special additives in India and amongst the leading players globally. Additives are ubiquitous and used in very small quantities (typically constitute <1% of the molecular weight of the end product) but lend critical functional characteristics to the end product. Hence, high quality alongside consistency, customisation, safety (since these are used in food products) and environmental considerations create strong barriers to entry. Furthermore, Fine’s competitive advantages are underpinned by its R&D prowess (in-house product development, process technology & engineering team) and customer orientation (providing customised reliable solutions, increasing share of products). Rising customer preferences towards green additives (like Fine’s oleo-chemical based products) is an added advantage. Any regulatory or customer actions surrounding products or production processes and volatility in raw material prices are key risks.

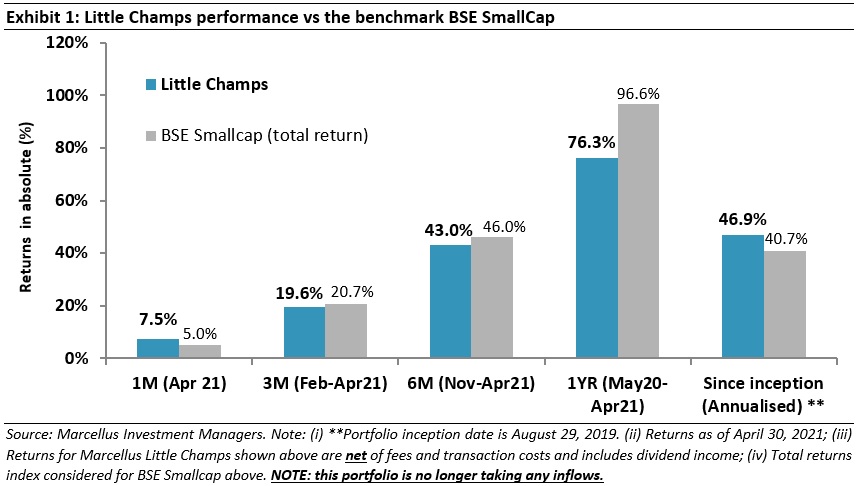

Performance update of the Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Stock in the Spotlight: Fine Organic Industries Limited

This month we detail our investment rationale for Fine Organic Industries Limited. In the previous months we have written on: Garware Technical Fibres (August 2020), GMM Pfaudler (September 2020), V-Mart Retail (October 2020), Alkyl Amines (November 2020), Suprajit Engineering (December 2020), Mold-Tek Packaging (February 2021) and Amrutanjan Healthcare (April 2021).

Company background

Fine Organic Industries Limited (hereinafter referred to as ‘Fine’) was started as a partnership firm by the late Ramesh Shah and Prakash Kamat in 1970 with an initial focus on substituting imports of emulsifiers for the local ice-cream makers and bakery chains in Mumbai. Over the next five decades, the Company worked actively on expanding its additives product portfolio across several new applications and significantly grew its customer base across India and export markets. Today, Fine is by far the largest producer of oleo-chemical based food, polymer and certain specialty additives in India and amongst the leading players globally. The Company has a wide range of 400+ products, 750+ direct customers (ranging from local to national to multi-national clients) and 170+ distributors across more than 70 countries. Exports accounted for ~55% of the Company’s revenues in FY20.

The Company’s oleochemical based additives are derived from a range of vegetable oils such as palm oil, palm kernel oil, castor oil, rice bran oil, sunflower oil, etc. Additives, whilst ubiquitous, lend important functional characteristics to the end products. The Company’s additives find application across several segments, but it has a particularly strong global presence in food and polymer additives. These two segments together account for nearly 60-70% of the Company’s revenues.

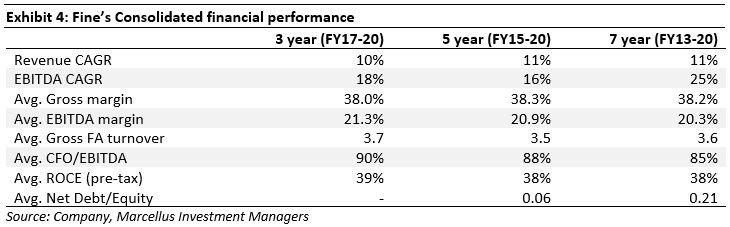

Financial performance: Over the last 3/5/7 years (ending FY20), the Company has witnessed a stable and healthy financial performance with strong double-digit growth in EBITDA as operating margins expanded faster due to scale benefits, improving product mix and stable raw material prices. The Company commands one of the best fixed assets turnover in the specialty chemicals space (the gross block turnover though declined in FY20 due to the commissioning of a new third facility at Ambernath (enhancing the total capacity by more than 40%). This together with decent cash conversion has enabled a healthy and stable RoCE over the years. The Company’s did face some margin headwinds in FY21 and 9MFY21 EBITDA margins stood at 18.6%, down 450bps YoY. This has been primarily because of the rising prices for the raw materials which are used by the company (various derivatives of edible oil). The price has been on account of multiple reasons such as: (1) shortage in global supply of edible oils owing to disruption from Covid-19, (2) levy by the Government of India of a new ‘Agricultural Cess’ of 17.5% on import of edible oils; and (3) removal of edible oils from essential commodities list resulting in hoarding of the same in anticipation of price increase. On the other hand, the Company had already concluded contracts with some of its large customers earlier (before raw material prices started rising) which restricted the pass-through of the raw material cost inflation. However, going forward, the contracts with customers are being renewed taking into consideration the higher raw material prices.

The Company’s did face some margin headwinds in FY21 and 9MFY21 EBITDA margins stood at 18.6%, down 450bps YoY. This has been primarily because of the rising prices for the raw materials which are used by the company (various derivatives of edible oil). The price has been on account of multiple reasons such as: (1) shortage in global supply of edible oils owing to disruption from Covid-19, (2) levy by the Government of India of a new ‘Agricultural Cess’ of 17.5% on import of edible oils; and (3) removal of edible oils from essential commodities list resulting in hoarding of the same in anticipation of price increase. On the other hand, the Company had already concluded contracts with some of its large customers earlier (before raw material prices started rising) which restricted the pass-through of the raw material cost inflation. However, going forward, the contracts with customers are being renewed taking into consideration the higher raw material prices.

Key success factors for Fine

1) Entry barriers surrounding high switching costs and stringent approval process

“Hidden Champions and their customers often develop relationships similar to a symbiosis. Hidden Champions may be little known to the general public, but they are well-known in their industry and enjoy a strong reputation amongst their customers. The customers’ demands are aimed at performance (quality, reliability, timely delivery) rather than low prices. The products and services supplied by Hidden Champions offer not only top quality but also increasingly comprehensive solutions which are hard for others to deliver (and thus become significant barriers to entry).” – Hermann Simon’s ‘Hidden-Champions of the 21st Century’

As mentioned earlier, Fine’s two main revenue contributors are Food and Plastic additives for which there is a limited competition globally. There are only 4-5 significant global peers each in food and plastic additives segment (no significant competitor in India). The main reason for this limited competition is the specialised nature of products and high entry barriers around product quality, consistency and reliability described below.

§ Additives have very low molecular weight (less than 1%) in the final products manufactured by the clients. However, any issue surrounding the quality of the additives can impact the quality of the entire product. Furthermore, since additives impart special characteristics to the final products, the quality must be consistent across different batches. Even a slight change could affect the final product in material way. Further, since these additives have a direct impact on human life and environment, the vetting process is very stringent.

§ The larger clients (in food, cosmetic & plastic industries) require customised additives to impart properties required by their product design team. This includes properties like smoothness, fluffiness, etc which is different for products from different manufacturers. This specialised nature of product creates entry barriers around know-how, a long gestation period for product development and highly technical sales skills.

§ To get the right additives, the procurement teams of clients give a description of their requirements to sales personnel of additive vendors who in turn are required to suggest possible solutions. For the shortlisted alternatives, the product team of the client works with the development team of vendors to test, measure, and improve the additives. This collaboration requires that client divulge the formulation of the product and the manufacturing processes which in turn requires the client to have a lot of trust in the additive supplier (since the client is divulging the core IP of the product).

Besides the above entry barriers emanating from the inherent nature of the products and processes, Fine’s senior management has also been able to build strong relationships with its clients. This has been done by successfully leveraging Fine’s R&D skills to address the customer needs (the new product development pipeline of Fine is driven by the marketing team of the Company) and increasing the number of products sold to a single customer over the years thereby increasing the customer’s stickiness.

2) Strong R&D and innovation focus:

“Innovation is one of the key pillars on which the market leadership of the hidden champions is based. Innovation applies not only to technology and products but more so to business processes. Further, process innovations are not just restricted to cost reduction but also applied in regard to quality, faster development cycles and thus help in in delivering higher value to the customers.” – Hermann Simon’s ‘Hidden-Champions of the 21st Century’

The high degree of customisation, integrated product development with clients, constant technical support, stringent focus on quality and need for product innovations to enter/penetrate a customer mean that R&D becomes a critical success factor. Here, Fine’s R&D prowess has played an integral role in the Company scaling up to more than 400 products across varied industries over the years.

Here are a few instances of product innovations from Fine: (i) The Company has been able to introduce oleochemicals based alternatives for many crude oil or animal fat-based products across food and plastic portfolios. For instance, Fine introduced oleo additives for the packaging industry which replaced additives that were derived from animal fats. As a result, the packaging manufacturers who uses Fine’s additives can now manufacture packing for vegetarian food items. (ii) Recently the Company has started working on commercialising additives which would impart antibiotic properties under the feed nutrition segment. These additives are serving to replace conventional antibiotics in the meat & poultry industry where organic and synthetic feed free products command a premium. Under this segment, Fine has developed a new additive which is to be mixed with cattle feed. On digestion by the cattle, this additive alters the enzymes and digestion process in cattle to lower the content of harmful saturated fats and increase unsaturated fat in the milk produced by the cattle.

Apart from product development and delivery capabilities, Fine’s in-house engineering team’s undertaking of plant design, fabrication, and debottlenecking projects has helped set-up manufacturing capacities and in-house process technologies at much lower costs and time than third party vendors. This also facilitated the Company’s entry into several new products. This aspect of Fine’s business was particularly relevant during the early part of its journey when the Company had only modest resources.

Fine’s R&D’s capabilities have been driven by a technocrat top management, an experienced R&D team built over the years (with recruitment from India’s top chemical engineering colleges) and the organisational expertise & know-how in oleo chemistry developed over decades of experience. Prakash Kamat (a founding partner), who is the current Chairman of the Board, is an Institute of Chemical Technology (ICT, formerly known as UDCT) alumnus, with almost 50 years of experience in chemistry and process technology. Over the years Fine has built a strong R&D team (consisting of 18 scientists, engineers and technologists now) to cater to product and process development. Graduates from the renowned ICT are preferred in the R&D team.

3) Rising preference across the world towards green additives augurs well for Fine

As mentioned earlier, Fine’s oleo-chemical based additives are derived from plants. Consequently, they are significantly safer and environment friendly compared to the petrochemical based additives. This has resulted in increased customer preferences towards green additives like oleo-chemical based compared to the synthetic ones. This trend is expected to continue across a wide range of industries such as plastics, packaging, foods, cosmetics, rubbers, coatings, etc. without compromising on the performance. Fine could be a major beneficiary of this trend given its first mover advantage and market leadership in this space.

Key risks

§ Any regulations/action surrounding products or production processes

Any stringent quality or product requirements imposed by the customers or regulators has the potential to create disruption in the Company’s business. Similarly, any regulatory actions surrounding the manufacturing facility or operations can be detrimental to the Company. For instance, Fine was issued a show cause notice by Maharashtra Pollution Control Board (MPCB) on 22nd December 2020, wherein the notice directed the company to stop the production process at one of its manufacturing capacities in Ambernath. Fine clarified that it had adhered to all environmental norms and the plant for which the notice was issued is a Zero Effluent plant. MPCB subsequently allowed the company to continue its manufacturing operations.

§ Significant volatility in Raw material prices

Any sharp fluctuation in the underlying raw material prices in the short term can impact margins over for a few quarters (as was the case in FY21). This could be due to mismatch in the duration and timing of the contracts entered into vendors and that with customers. Furthermore, given the global supply chain exposure for key raw materials used by Fine, any imposition of duties by the Indian Government or by foreign governments (such as exporting countries like Malaysia, Indonesia, etc) can also create uncertainties surrounding the raw material prices.