|

|

|

|

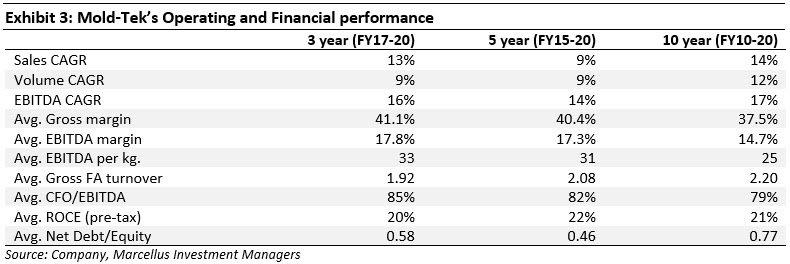

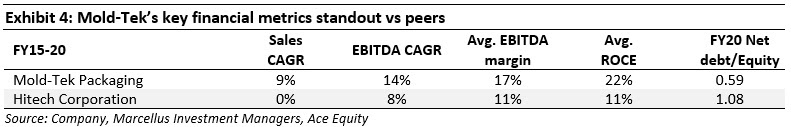

Financial performance: Mold-Tek enjoys superior margins compared to its peers in the packaging industry due to the cost advantage emanating from backward integration. EBITDA per kg, a key indicator of the operational efficiency, has risen 20% over FY17 to FY20 due to the rising share of Food & FMCG (F&F) segment which enjoys higher margins than paints & lubes. As a result, the Company has maintained a healthy RoCE despite a failed foray in RAK (UAE) (brought upon by a misreading of the demand dynamics of the Middle Eastern markets and accentuated by weakening economic conditions). However, the company was quick to contain the damage by winding up the RAK facility within two years of its setting up and recouping a large part of the capital invested by shifting most of the machineries to its Indian facilities.

|

|