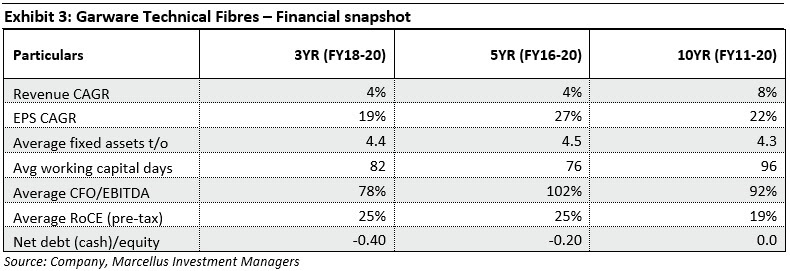

In this month’s newsletter, we disclose the stock specific holdings in Marcellus Little Champs strategy. Besides the obvious requirements of clean accounting and prudent capital allocation, common traits across Little Champs are dominant positions in respective niches, high RoCEs & high reinvestment rates and consequent high earnings growth alongside a healthy balance sheet. In this newsletter, we place the spotlight on Garware Technical Fibres, a long-standing leader in the domestic fishing nets space, which has successfully built world leadership in the supply of nets to Salmon aquaculture. The key success factor has been its unflinching focus on product innovations that address customer needs and enable Garware to earn premium pricing and healthy profits on such products.

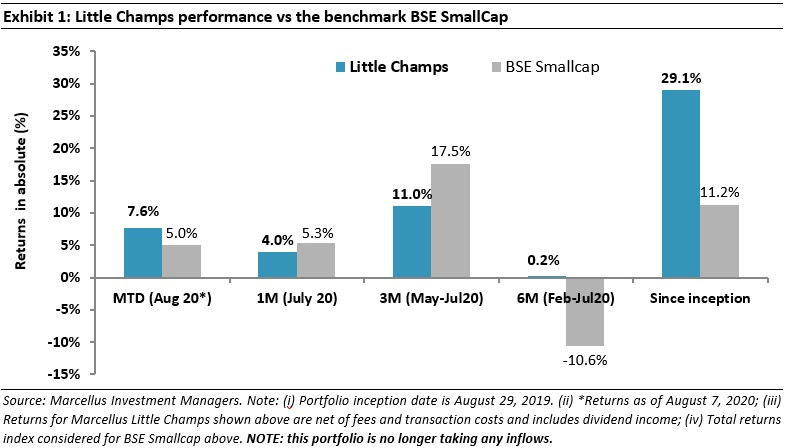

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table:

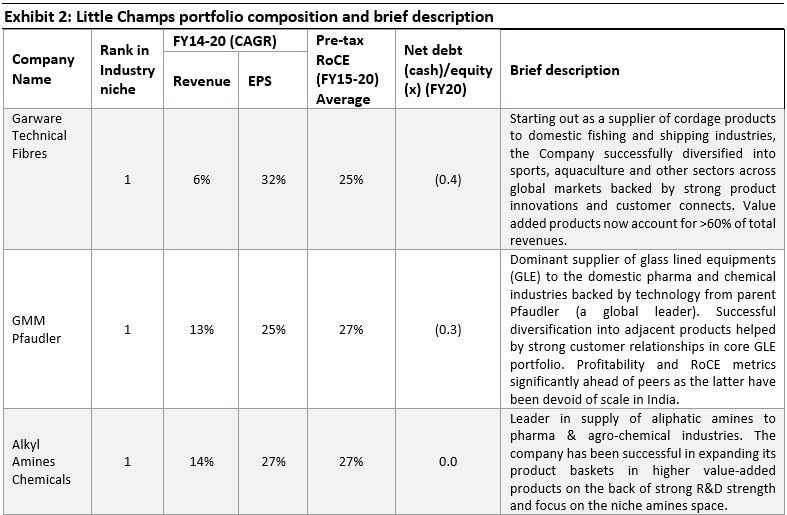

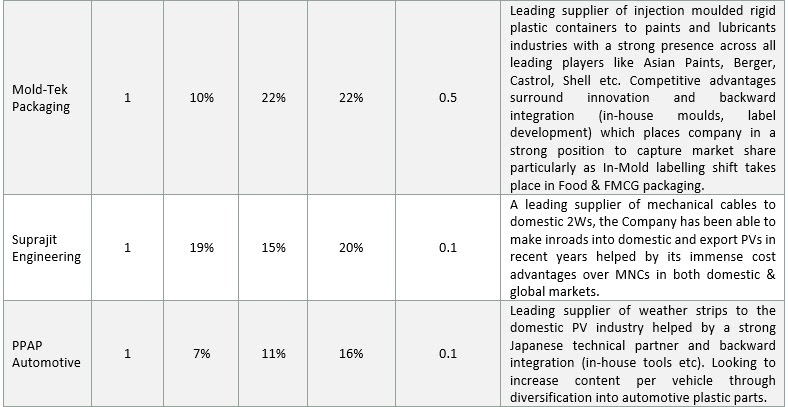

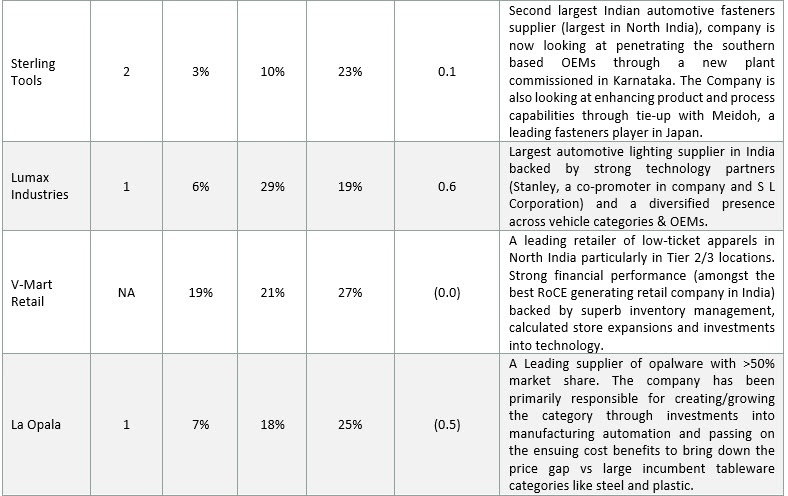

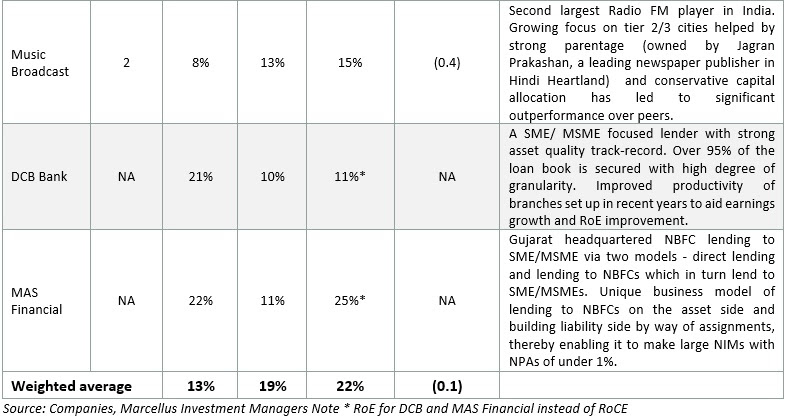

Performance composition and brief description

As announced last month, thanks to the faith reposed in us by investors, our Little Champs PMS reached its full capacity and we have now closed the portfolio to fresh inflows. We have also almost completed the deployment of the funds. The portfolio composition is as shown in exhibit 2 below. All investors in the PMS can now view their live portfolios on our portal using their login details. Furthermore, we would also be sharing the investment rationale for each one of our portfolio stocks once every 2-3 weeks. In this month’s newsletter, we start with Garware Technical Fibres (see the section on ‘Stock in the spotlight’).

|