OVERVIEW

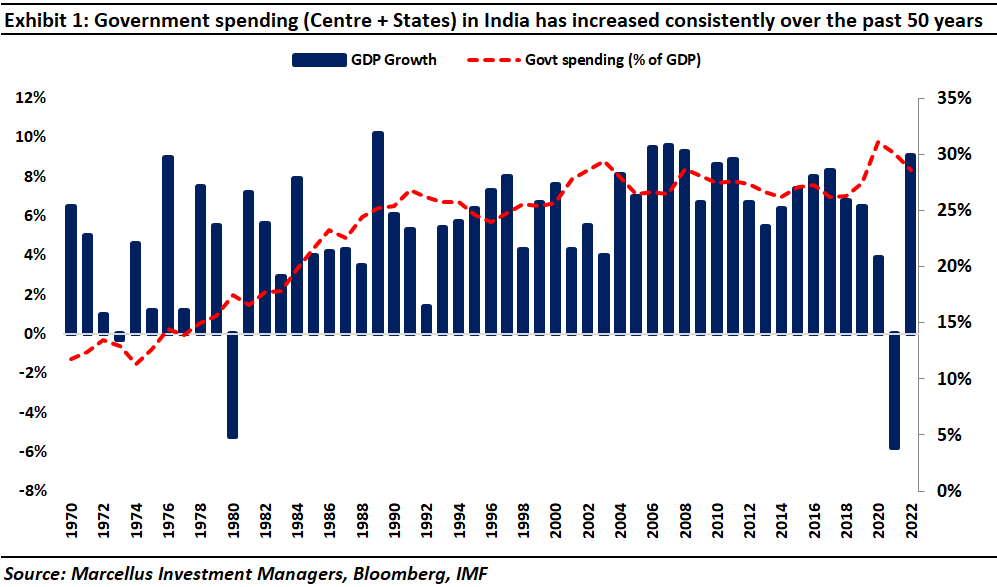

Post-1947, India’s economy has been through four distinct eras. Now, with socialism fading away and with the country increasingly operating as a free market economy, we see five distinct directions in which India’s economy will evolve over the next decade: (1) Profits will polarize in the hands of a few highly efficient companies; (2) Wealth will polarize in the hands of well-educated & well-connected businesspeople; (3) Economic growth will polarize in favour of a few highly developed states; (4) Fiscal transfers will have to increase [see Exhibit 1] to mitigate the polarizing effects of the preceding bullets; and (5) Foreign capital will flood into India.

“….how we use knowledge and science depends on vision—the way that humans understand how they can turn knowledge into techniques and methods targeted at solving specific problems…The bad news is that even at the best of times, the visions of powerful people have a disproportionate effect on what we do with our existing tools and the direction of innovation… society may even become gripped by visions that favor powerful individuals. Such visions then help business and technology leaders pursue plans that increase their wealth, political power, or status. These elites may convince themselves that whatever is good for them is also best for the common good.” – Simon Johnson & Daron Acemoglu in ‘Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity’ (2023)

Background

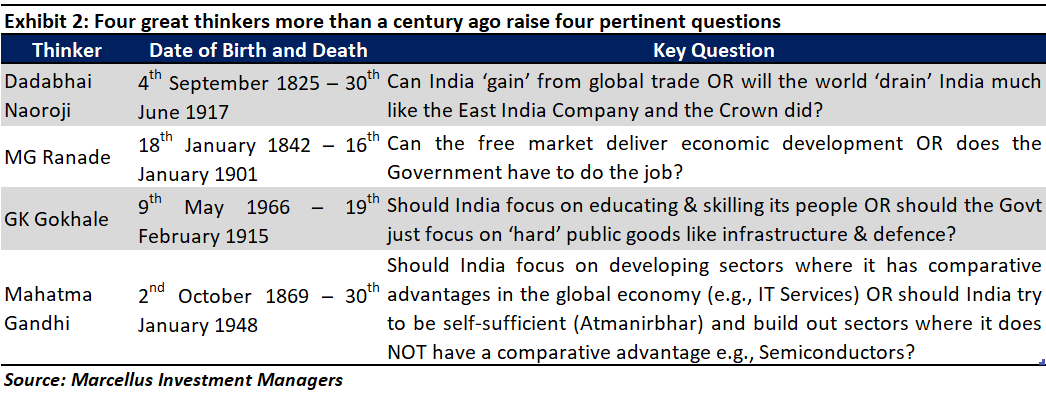

In our previous blog dated 10th November (A Century Spent Answering Four Questions), we have highlighted how over a century ago, four great thinkers – Dadabhai Naoroji, Mahadev Govind Ranade, Gopal Krishna Gokhale, and Mahatma Gandhi – had captured the four issues which have been at the heart of economic policymaking in India since the country gained independence – see the table below:

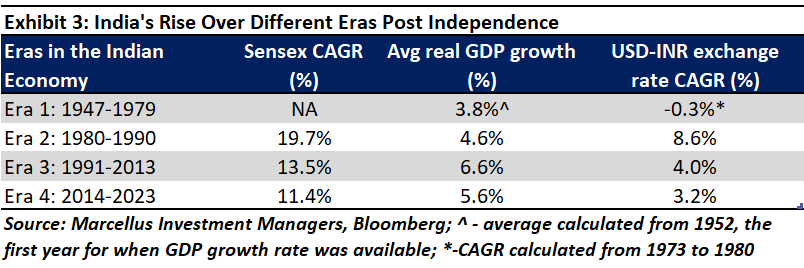

The attempts made by independent India’s elected governments to answer these questions resulted in India’s economy experiencing four distinct eras as demarcated in the table below. In this blog, we capture the crux of what happened in each era and then look forward to what the current policy dispensation in New Delhi implies for investors.

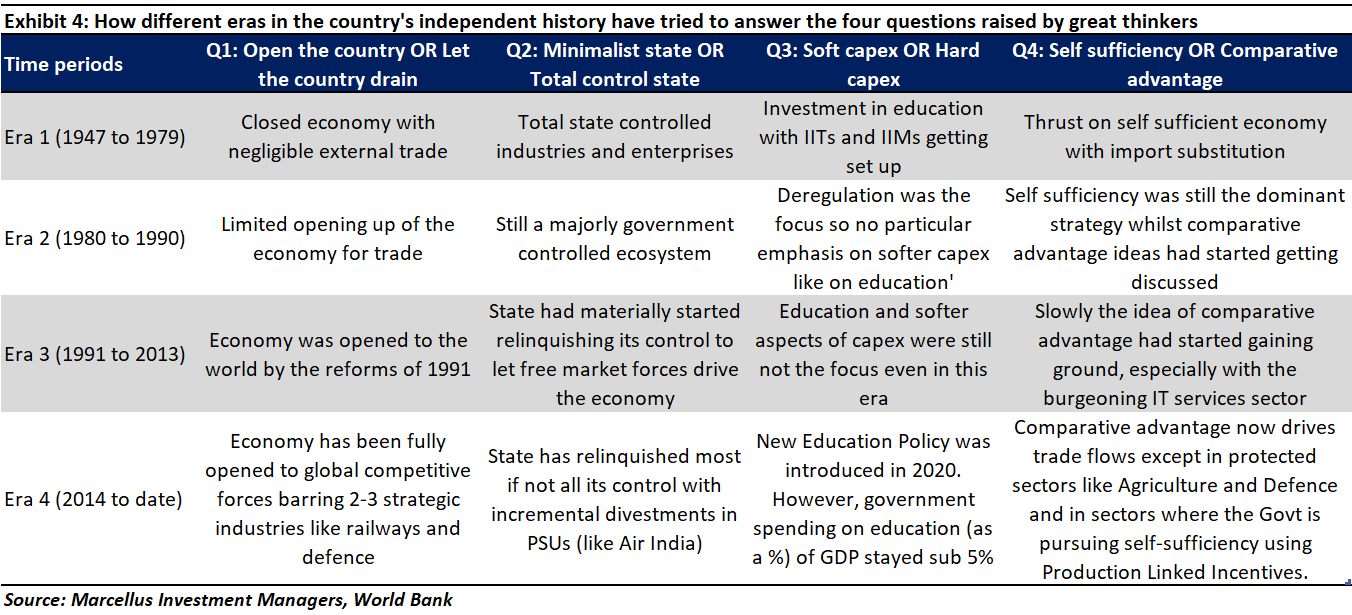

In case you don’t have time to read how the four eras played out for India, the table below summarizes Indian policymakers’ response to the four central questions in the first seven decades of India’s independence:

Evolution of the country in these four eras is key in understanding how India’s policymakers have intervened time and again, and their impact on the economy as a result. From our perspective as investors in the Indian stock market, the key implications of this policy analysis are the forward looking changes that we believe are likely to play out. We have listed the four eras and its policy implications next, followed by what are the changes we are seeing today and in the years to come.

Era 1: Full throttle Socialism and the ‘License Raj’ [1947-1979]

For a flavour of what life was like in pre-1980 India, we begin with an anecdote from the celebrated writer Gurcharan Das’ latest book, ‘Another Sort of Freedom’ (2023):

“There was a flu epidemic in India. As a result, sales of the entire line of Vicks cough and cold products shot through the roof. The factory workers worked overtime to meet the demand. At the end of the season, the company declared record profits. Everyone was happy, except the legal department. The company secretary, with fear in his eyes, came to my room, accompanied by two lawyers with long faces. Our sales had exceeded the production capacity authorized in our official licence. We had broken the law, and it might mean a jail sentence. They wanted my help to draft a defence. From heroes we had become criminals, and a pall of gloom descended on the office.

Sure enough, we received a summons from Delhi. It was a preliminary hearing, but I had to be present. Two lawyers accompanied me to the joint secretary’s office, where we were made to wait for hours. The officer was reading a newspaper as we entered. He gave a cold look that said he didn’t want to be disturbed. I was afraid but tried not to show it. Eventually, he looked up.

‘What?’ he asked impatiently.

One of the lawyers handed him a copy of the summons. He glanced at it irritably. ‘What?’ he repeated. I explained nervously that the flu epidemic had resulted in extra demand for our products. We had merely done our duty in keeping the shelves stocked at pharmacies. Our products had come to the rescue of millions of mothers whose children had suffered from the flu.

He stopped me, irritation showing in his voice. ‘But you have broken the law!’ he thundered. I replied politely that something was wrong with the law that punished one for producing things that had benefited millions of sick people. Anywhere else, one would be applauded for treating the sick, especially children. The joint secretary pushed his chair back noisily, signalling the end of the interview. We had broken the law, and the law would now take its course.

As I reached the door, I don’t know what came over me. I turned around defiantly and asked him how our country would appear to the world if news got out that our government had punished the executive of a foreign company for helping to produce products that alleviated peoples’ misery during an epidemic. Imagine such a story on page three of the New York Times.

‘Are you threatening me?’ he thundered.

‘No, sir. I was merely appealing to your common sense as a fellow citizen. By punishing us, you’d be making our prime minister a laughing stock of the world outside.’ He gave me a venomous look and gestured me to get out of his office.” – Gurcharan Das in his book ‘Another Sort of Freedom – A Memoir’ (2023).

Instances like these were the norm rather than exception during this time period. India had only recently gained independence and had been bloodied not just by Partition in 1947, but also by a war with China (in 1962) and then by two successive wars with Pakistan (1962 and 1971). These wars had sapped the impoverished Indian economy of the meagre resources it possessed after two hundred of extractive colonial rule by the British.

As a result, echoing Dadabhai Naoroji, India’s policymaking elite was utterly convinced during this era that closer global integration would act as a ‘drain’ on India. Thus, the decision was taken to ‘close’ the Indian economy to foreigners and let the Government control the ‘commanding heights’ of the economy i.e., critical sectors like mineral resources, metals, insurance, banking, machine tools, electricals, etc would be controlled by the state via public sector undertakings (PSUs). The result was paltry external trade, a fixed exchange (fixed obviously at a rate which overvalued the Indian rupee), GDP growth of 3.5% p.a. and per capita income growth of 1% p.a.

As famines (1966-67), civil strife (the Naxal uprising began in 1967 in north Bengal and then spread through eastern and southern India through the 1970s) and the imposition of Emergency (1975-77) destroyed the hopes & dreams of a generation of Indians, two constituencies prospered during this period.

Access to capital and access to the new political elite (who controlled the ‘License Raj’ referred by Gurcharan Das above) in the state capitals and in New Delhi was essential for success post-1947. Only two constituencies were able to pull this off:

- Giant PSUs that the successive socialist Governments – heavily influenced by the perceived success of Communism in the USSR – chose to cultivate and capitalize on (e.g., State Bank of India, Steel Authority of India, Coal India, Bharat Heavy Electricals Ltd). Many of these firms were actually private sector entities which the Government of India nationalized by fiat e.g., State Bank of India, Air India and Coal India.

- Family run conglomerates which had already attained scale, wealth, and success in the pre-Independence era e.g., Tatas, Birlas, M&M, Godrej, and TVS.

For pretty much everybody else, the first three decades after Independence was a really difficult time.

Era 2: Socialism Begins to Retreat, the First Signs of Economic Liberalisation [1979-1990]

After returning to power in the 1979 elections, Prime Minister Indira Gandhi began relaxing some of the draconian rules which constituted the License Raj. The result was a wave of entrepreneurial activity. At the forefront of this wave was Reliance Industries with Dhirubhai Ambani at the helm. Hamish McDonald’s book on the Ambanis has several examples of how Reliance navigated the tricky waters of the License Raj in the 1980s. For example:

“Indira Gandhi’s return to power opened a golden period for Dhirubhai Ambani. In 1979 he barely made it to the list of India’s fifty biggest companies, measured by annual sales, profits or assets. By 1984 Reliance was in the largest five. Dhirubhai himself had become one of the most talked- and written-about persons in India, gaining a personal following more like that of a sports or entertainment star than a businessman. It was also the period when Dhirubhai made the most rapid part of his transition, in the bitter words of a senior non-Congress politician in 1996, ‘from supplicant – the most abject kind of supplicant – to influencer and then to controller of Indian politics’…

In October 1980 Reliance received one of the three licences given by the government for manufacture of polyester filament yarn, the location being stipulated as the ‘backward’ area of Patalganga in the hills of Maharashtra, inland from Bombay. In a field of forty-three contestants for the licences, Reliance beat many larger and longer-established business houses, including Birla. Its licensed capacity of 10,000 tonnes a year was by far the largest and, at the time, close to India’s entire existing polyester fibre output.” – Hamish McDonald in ‘Ambani & Sons’ (2010)

First Indira Gandhi and then after her assassination in 1984, her son Rajiv, began relaxing some of draconian restrictions which were suffocating the Indian economy. Amongst the key relaxations were:

- Relaxation in external trade: Throughout the 1980s, the number of goods that were placed on the Open General License (OGL) list steadily increased, which effectively meant more items could now legally be imported into the country. Apart from this, the ‘canalized’ imports (or imports that only the Government was permitted to do) were reduced, paving the way for private players to step into this space.

- Beginning of industrial deregulation and tax reforms: The Maruti 800 was introduced in 1982. After the 1950s, this was the first time a new car was introduced in India. This was emblematic of the slow yet definite reforms that were beginning to take shape in the form of delicensing of industries, permission to switch between similar production lines (like cars and trucks), the permission to expand by more than 2x if certain utilization levels were hit, and the raising of minimum asset value mentioned under the Monopolies and Restrictive Trade Practices (MRTP) Act which removed a lot of relatively mid-sized companies out of its purview. This along with shifting from multi point and increasingly complex excise duties to a value added tax further gave manufacturers impetus to set up shop.

- Emergence of a realistic exchange rate: By the dint of being a closed economy that was heavily regulated and practically run by the sovereign, free market forces were never allowed to play out. One perverse impact of this was the relative overvaluation of the Indian currency, which stayed elevated until the 1980s and as a result rendered India uncompetitive in the global context. Come the 1980, this situation started correcting itself as Indian rupee was allowed to depreciate and reach more realistic levels vis-à-vis the dollar and other currencies.

Why did India’s policymakers start opening up the economy to greater private sector participation in the early 1980s? The answer lies in the situation of the country in the closing years of the 1970s. The Janata government collapsed in 1979 and Indira Gandhi returned as PM. Meanwhile, the economy was hammered by major oil shocks on account of wars in the Middle East and a severe domestic drought. As a result, GDP fell by almost 6% in FY 1980 which meant that per capita income fell by more than 8 percent – leading to widespread anguish.

In a celebrated paper published in 2004, Dani Rodrik and Arvind Subramanian say:

“…the trigger for India’s economic growth was an attitudinal shift on the part of the national government in 1980 in favor of private business. The rhetoric of the reigning Congress Party until that time had been all about socialism and pro-poor policies. When Indira Gandhi returned to power in 1980, she re-aligned herself politically with the organized private sector and dropped her previous rhetoric. The national government’s attitude towards business went from being outright hostile to supportive. Indira’s switch was further reinforced, in a more explicit manner, by Rajiv Gandhi following his rise to power in 1984. This, in our view, was the key change that unleashed the animal spirits of the Indian private sector in the early 1980s….

A pro-business orientation, on the other hand, is one that focuses on raising the profitability of the established industrial and commercial establishments. It tends to favor incumbents and producers. Easing restrictions on capacity expansion for incumbents, removing price controls, and reducing corporate taxes (all of which took place during the 1980s) are examples of pro-business policies, while trade liberalization (which did not take place in any significant form until the 1990s) is the archetypal market-oriented policy…” (Source: https://www.imf.org/external/pubs/ft/staffp/2004/00-00/rodrik.pdf; Underlining is ours.)

The result of this modest opening up was a doubling of the economic growth rate. In fact, the 1980s was the first period of strong economic growth India had seen post-Independence (GDP growth was 5.5% p.a. through the 1980s). Economic growth awakened investors’ animal spirts and resulted in a massive stock market boom (the Sensex compounded at an astonishing 22% p.a. through the 1980s). Several of our relatives entered the stock market for the first time in this decade and pink newspapers started becoming visible inside the living rooms of Indian families alongside Maruti 800 cars parked outside.

However, the 1980s boom contained one fatal flaw – India’s fiscal deficit went from 5.7% in 1980 to 7.8% in 1991. As Government spending stoked economic growth in a country, imports started rising from the mid-1980s onwards putting pressure on India’s Balance of Payments. Saddam Hussain’s invasion of Kuwait in 1990 send oil prices soaring and thus pushed up India’s imports further and triggered a Balance of Payments crisis in 1991 as the country ran out of foreign exchange. The crisis that this triggered ushered in a new era for India.

Era 3: The End of the ‘License Raj’, the beginning of the Indian Renaissance [1991-2013]

For those of us who lived through the momentous summer of 1991, it was an unforgettable time. In the space of two months, Prime Minister Narsimha Rao and Finance Minister Manmohan Singh used the then dire balance of payments crisis to leave behind four decades of socialism and open up the Indian economy, both, to the private sector and to foreigners. The impact was immediate and electric as described by the economist, Shrayana Bhattacharya:

“As an uneducated working-class woman, you might have not had the words or jargon to sum up the phenomenon, but you knew something dramatic had happened in the mid ‘90s; the evidence was everywhere you looked. So, you wove images into a timeline of your own. You told me that your world, quite literally, started to shrink – the forests of Jharkhand, the textile factories of Gujarat, the farm yields of Bengal, the hemlines of Delhi’s skirts, the certainty of a man earning a monthly income. Your world expanded too: the government gave more grains; activists, panchayat meetings, new advertising billboards and polio camps dotted the year; roads began to connect every village to the rest of the country. The patwari, effectively the local land registrar, began to wear jeans. Well-meaning women visited every month, saying they were health workers. Your children started receiving meals at the new government school. The local store offered a buffet of creams and powders, choices one only imagined available to actresses and princesses. Phone booths became ubiquitous. Your call was almost certain to connect. And, as India turned the corner into a new millennium, Shah Rukh’s face was plastered everywhere.

Men started to move away from their fields and find jobs in the cities, bringing artefacts and diseases from the modern world as presents. Suddenly, everyone you knew worked on a construction site. The earth smelled of cement and rubber. Royals became hoteliers. You found yourself orphaned from all the familiar routines – everything had a price, farming was no longer an ideal way of life, news from other parts of the world travelled faster than ever before.” – Shrayana Bhattacharya in ‘Desperately Seeking Shah Rukh: India’s lonely young women and the search for intimacy and independence’ (2021).

After four decades of believing that foreigners will ‘drain’ India, India’s policymakers – under pressure from the IMF and the World Bank – now opened up the Indian economy to foreign investors. After four decades of trying to prop us PSUs to build the Indian economy, the government now allowed the private sector to invest capital across most parts of the economy.

Two different types of entrepreneurs emerged over this remarkable 20-year period:

- Larger-than-life entrepreneurs like Karsanbhai Patel (Nirma), Dhirubhai Ambani (Reliance), the Ruias (Essar), the Dhoots (Videocon), the Jindals (Jindal Steel) and the Hindujas (Ashok Leyland, IndusInd Bank, Gulf Oil) built pan-India scale & muscle (both financial and political). They were financed primarily by public sector banks over this period with domestic capital markets playing second fiddle. Private sector banks did NOT have meaningful financing capacity in this stage of India’s economic evolution. Access to polity remained critical for success as licenses, permissions, permits aplenty were still required. However, the new gen entrepreneurs were able to muscle into the corridors of power that mattered and get relevant access.

- Technocratic entrepreneurs educated either in India’s elite institutes of higher education (the IITs, IIMs, BITS, IISc, NCL) or educated abroad emerged and scaled up large businesses e.g., Deepak Parekh (HDFC), Narayana Murthy (Infosys), Ratan Tata (Tata group), Yusuf Hamied (Cipla), Anji Reddy (Dr Reddy’s), and Desh Bandhu Gupta (Lupin).

Whilst the old, established elites faced a challenge to establish their grip on the keys to the kingdom of wealth, their way of life (i.e., speaking BBC English, cultivating the ways of the West) was what everyone else aspired to. Symptomatic of this yearning for credibility in the eyes of the West is entrepreneur Kashyap Deorah’s description of his fellow IIT (Mumbai) students’ mindset in the closing decade of the previous century:

“We were blazing the trail for IIT Bombay to become another Stanford University and Powai to become another Silicon Valley. We were building a global company out of India when the only tech business that India was known for was IT services and outsourcing. We had raised equity capital when there were no venture capitalists investing in early-stage tech start-ups in India. We were starting a movement by staying back in India when everyone in our batch left for the US and those who stayed were the ones who could not go…” – Kashyap Deorah in ‘The Golden Tap’ (2015)

Poverty, relative to the West, was still triggering an inferiority complex in the Indian mind. For that to change, we needed the onset of a new era.

Era 4: Capitalism, Increasingly Unfettered [2014 – date]

As the Government increasingly withdrew from being a provider of goods and services, India’s policymakers became more focused on improving the country’s physical and tech infrastructure. The impact of this on the economy was transformational as this excerpt from Nandan Nilekani and Viral Acharya’s book, ‘Rebooting India’ (2015) shows:

“Seventy-year-old Basudeb Pahan lives in a densely forested, remote area of Jharkhand. In order to receive his old-age pension from the Government of India, Pahan had to journey fifteen kilometers through hills and jungles to reach Ramgarh, the nearest settlement with a bank branch. And this was only half the story. To collect the 400 rupees a month owed to him, Pahan had to spend hours standing in line. Sometimes he needed to come back the next day. Factoring in the cost of travel and food, Pahan was spending 12 per cent if his pension even before he received it. To add to his woes, he often had to wait two to three months for his payment to be processed. Pahan, the local government, and indeed the entire pension disbursement system were stuck in a time warp.

Then, in 2011, Pahan found himself transported from a dusty backwater of history into the forefront of India’s technological revolution. He achieved this feat by walking a short distance to the local panchayat office in his village and using a device called a microATM, under the supervision of the local business correspondent appointed by a bank. The microATM, a handheld wireless device, required only an active mobile data connection in order to function. The business correspondent entered Pahan’s twelve-digit Aadhaar number into the device. Pahan pressed his fingers on an attached fingerprint reader and, seconds later, the business correspondent was handing Pahan his money, just as a bank teller might.” – Nandan Nilekani and Viral Shah in their book Rebooting India: Realizing a billion aspirations (2015).

The combination of the Government focusing on building physical infrastructure and providing the enabling legislation and institutions for a massive digital buildout has resulted in India becoming a ‘networked’ economy over the past decade:

- The national highway network saw a near doubling from ~79K km in 2012 to ~140K km in 2022, domestic air travel passengers more than trebling from ~54 mn in 2009 to ~170 mn in 2019 (pre pandemic), households with broadband connections grew ~7x from ~20 mn in 2013 to ~137 mn in 2023, the number of bank accounts grew ~3x from ~100 crores in 2015 to ~300 crores in 2023.

- The India stack was built. It began with Aadhaar (UIDAI or Unique Identification Authority of India) in 2009 which gave a digital identity to all the citizens of the country. This was followed by Jan Dhan bank accounts introduced in 2014 which successfully gave every Indian family a bank account. This combined with the proliferation of mobile phones in India and the launch of Jio’s ultra cheap mobile broadband services in 2017 networked India digitally. This in turn paved the way for the creation Unified Payments Interface (UPI), where anyone with a bank account, a smartphone with an internet connection can transfer any amount of money to anyone in the country instantly! Today, more than 9 bn UPI transactions are taking place each month and over half of India’s GDP is being transacted via UPI. As we had written in one of our previous notes dated 23rd September 2022, From Aadhaar to ONDC: India’s Methodical Build of Digital Assets Creates Competitive Advantages, “Over the past decade the Indian economy – fragmented into several regional economies a decade ago – has gradually been integrated by the doubling of highway networks, tripling of local airline traffic, the introduction of GST and – most importantly – rapid digitization of the economy. From Aadhaar (in 2010) to UPI (in 2016) and now on to ONDC (Open Network for Digital Commerce) – India is gradually building a digital economy which will ultimately give the country a global competitive advantage in how money and goods move around the country.”

- The cost of capital dropped sharply measured not just by the 10 year-Government of India bond yield (which has dropped from ~9% in Aug ’13 to ~7% now) but also by the large pools of PE and VC money which now flow into India each year [anywhere between $20-70bn p.a. depending on what the Federal Reserve is doing with its monetary policy]. Alongside foreign capital, the rapid financialization of savings (e.g., the number of brokerage (Demat) accounts has grown 8x over the past decade) drove a structural downtrend in the cost of both debt and equity capital.

However, one area where the country stayed puzzlingly backward is health & education. As a % of GDP, spending by the states and by the central government went from 5.2% in FY15 to 4.7% in FY23. This combined with the economic impact of Covid-19 meant that by 2023, items linked with the lower income sections of the population (e.g., FMCG, 2-wheelers, apparel, Hawaii chappals) were showing annual volume growth of barely 2-3% i.e., broadly the same as India’s population growth implying that on a per capita basis, low income Indians’ ability to purchase the essentials of life was stalling.

How is the Indian economy likely to change going forward?

As socialism fades away and the Indian economy moves towards an increasingly unfettered pan-India free market, the gap between the winners and losers will widen along multiple dimensions:

- Profits will polarize in the hands of a few highly efficient companies

In an increasingly integrated large economy, SMEs are struggling to compete against larger, better capitalized companies. SMEs, who for decades had survived by evading taxes, found it hard to deal with the Exchequer’s scrutiny once India moved to a common indirect tax (GST) for the entire country in 2017. Post-2017, tens of thousands of such SMEs started shutting down – see https://thewire.in/economy/a-bad-year-for-msmes-over-10000-closed-in-2022-23

As we had pointed out in one of our previous notes dated 24th December 2022, ‘Winner Takes All’ in in India’s New, Improved Economy, “improvements in transport infrastructure (e.g., the highway network has doubled over the past decade), the introduction of GST (in 2017) and new business models which have migrated from the developed world to India over the past decade, are resulting in India’s 20 largest profit generators earning a staggering 80% of the nation’s profits as compared to around 40% a decade ago.”

- Wealth will polarize in the hands of well educated, well connected people

India’s GDP has risen from US$ 607 bn in 2003 to US$ 3.75 tn in 2023. This 6x jump in national income over a 20-year period has been unevenly distributed. To be specific, a tiny elite of around 200,000 Indian families (or 1 million individuals) have become incredibly wealthy over the past 20 years. According to BCG, in the two decades between 1999-2019, the Indian elite’s wealth grew 15.8x. We can see the rapid rise of the super-rich Indian from different types of data.

One such data source is the Income Tax Department. “Over 2.69 lakh income tax returns were filed for income above Rs 1 crore for the financial year 2022-23, an increase of 49.4 per cent from the pre-pandemic year of 2018-19, while returns filed for income up to Rs 5 lakh rose by 1.4 per cent in the same period, as per e-filing data of the Income Tax Department. In absolute terms, 2.69 lakh income tax returns were filed for income above Rs 1 crore for financial year 2022-23 as against 1.93 lakh for 2021-22 and 1.80 lakh for 2018-19.” (Source: Indian Express, https://indianexpress.com/article/business/i-t-returns-filed-for-income-above-rs-1-crore-up-49-4-from-fy19-level-8879865/. (Underlining is ours).

To understand this dynamic in more detail please refer to our 4th Sept ’23 blog: https://marcellus.in/blogs/the-octopus-ascends-the-rise-of-crazy-rich-indians/

- Economic growth will polarize in favour of a few highly developed states

Thanks to significantly higher levels of education, superior social indicators (in terms of law & order, infant mortality, women’s labour force participation) and superior physical infrastructure, peninsular India now accounts of around a quarter of India’s population, half of India’s GDP and almost three-quarters of India’s economic growth. Peninsular states like Telangana now boast per capita income levels of $4K, almost twice the national average, and have seen their per capita income double in the past 6-7 years. Almost all of India’s private sector capex is going to peninsular India (with Gujarat and the NCR being the only parts of the country outside the peninsula to see significant investments).

Whilst within peninsular India, the seven states are increasingly seeing convergence in per capita income (around the $4K mark), these states are pulling away from the rest of the country i.e., the northern and eastern states are increasingly falling behind. Quoting from our 17th Aug ’23 blog on this subject (see https://marcellus.in/blogs/the-explosive-ascent-of-southern-india/):

“Per capita income for seven ‘southern’ states (Tamil Nadu, Telangana, Andhra, Kerala, Karnataka, Goa, and Maharashtra) has grown at an average 10% CAGR between FY14-22. These states, which account for 30% of India’s population and 45% of India’s GDP, now have an average per capita income of ~Rs 2.7 lakhs ($3,300), 50% higher than that of the Rest of India. A decade ago, the corresponding ‘South vs Rest’ gap was 35%.” - Fiscal transfers will have to increase

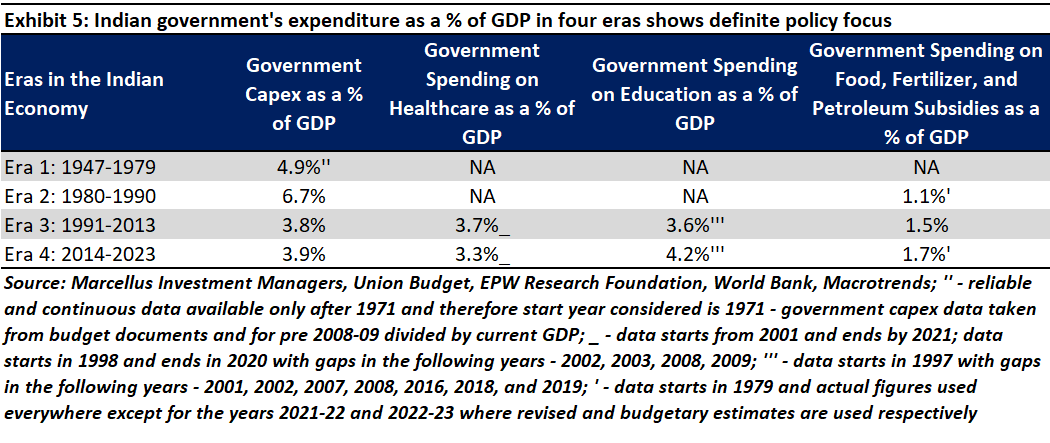

Given that India is a democracy, in order to win elections parties across the political spectrum will have to transfer money into the bank accounts of voters left behind by the groundswell of economic growth sweeping across this vast land. This can be seen in Exhibit 1 (which shows how Government spending as a % of GDP has steadily increased) and in Exhibit 5 (which shows how Government spending on Education, Food, Fuel & Fertilizers has risen over the past decade).

The electoral compulsion to spend money can also be seen in the assembly election campaigns currently underway in the states of Rajasthan, MP, Chhattisgarh and Telangana. As award winning journalist and author Shankkar Aiyar writes:

“It is instructive that the contest in the poll bound states is less about ideas and ideology and more a competition of schemes. In state after state, political parties have designed schemes to contain discontentment.

“…Unlike in the past the schemes are targeted to harvest votes — based on parameters of caste, class and gender. Women voters — who constitute 78 million of the 161.4 million voters — are deemed the X factor, game changer The instrument of endearment is direct cash benefit transfer. In Madhya Pradesh the Shivraj Chauhan regime has promised to up the cash transfer under the Ladli Behna scheme from 1250 to Rs 1500 and raise it to Rs 3000 per month.

“…There is the promise of direct cash transfer and then there is the top-up strategy where states add to the payments/subsidies provided by the Centre with additional allocations from the state kitty.

“…Cash benefit transfers and top ups for subsidies have been enabled by the availability of the Aadhaar-based DBT-Bharat. Indeed state governments have registered over 7500 user codes for a plethora of transfers on the NPCI grid. For sure there is no free lunch but political parties are not obliged to outline the costs of the promises or how the additional expenditure will be funded. …” (Source: https://www.bqprime.com/

opinion/the-politics-of- economics-signals-from-the- election-campaign) - Foreign capital will flood inForeign investors have invested roughly $3.5 trillion in the Chinese stock market. The said market has produced a total return CAGR over the past decade (in US$) of 4.7% (source: Bloomberg). In contrast, foreign investors have invested $0.6 trillion in the Indian stock market which has produced a total return CAGR over the past decade (in US$) of 12.6% (source: Bloomberg) i.e., more than 2x the return generated by the Chinese market. If you stretch this data back to 20 years or 30 years, the conclusion remains the same. The only large stock market in the world which has been able to keep up with India over the past 30 years is USA. With rising concerns around the Chinese economy and geopolitics, western allocators have turned their attention to India as an alternative market in which to invest capital.A similar story seems likely to play out on the FDI front. Over the past decade, foreign investors have on average pumped in around US$ 120 bn p.a. vs only US$ 12 bn p.a. into India. With the Chinese and American governments now at loggerheads, these FDI inflows into China have stopped altogether. With America keen to use India as a counterweight to China, it is likely that some of these flows will come into India.India needs these – both FPI and FDI – flows to finance its current account deficit which oscillates between 2-3% of GDP ($60-100 bn p.a.) as India’s domestic financial savings hitting a 50-year low.Unlike the East Asian economies (which grew by exporting goods made by low-wage workers), India’s growth is fueled by a large Services economy (55% of GDP) and by the export of knowledge intensive services (IT Services exports are $250 bn p.a.) & products (Pharma exports are $25 bn p.a.). Remittances from Indians living abroad bring in more than $100 bn of inflows. Therefore, with around $400 bn per annum (9% of GDP) coming into India every year thanks to the intellectual horsepower of India’s well-educated middle class, the INR tends to be an overvalued currency. This makes it almost impossible for India to be an exporter of low-end manufactured goods like clothes, shoes and sports goods. The overvalued INR also makes imported goods (especially electronic items, overseas holidays and overseas education) relative cheap for Indians thus fueling the current account deficit and a low domestic financial savings rate (see https://marcellus.in/blogs/

midnight-approaches-for- indias-retail-lending-boom/). To square this circle, India needs to continue attracting foreign capital. Given the disappointing experience foreign investors have had in China, if they swing towards India even 10% of the amounts that they have invested in China over the past decade, the impact on the Indian economy will be transformational.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). Amongst the companies mentioned in this note, HDFC Bank (after the merger) and Infosys are part of Marcellus’ portfolios. Nandita and Saurabh may be invested in these companies and their immediate relatives may also have stakes in the described securities.

If you want to read our other published material, please visit https://marcellus.in/pms-investment-blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.