OVERVIEW

Over the past century, every politician and policymaker who has governed India has wrestled with four critical questions: (a) Can the free market deliver economic development OR does the Government have to do the job? (b) Can India gain from opening itself to the wider world OR will the world act as a ‘drain’ on it? (c) Should India be a self-sufficient economy OR should India focus on its comparative advantages? and (d) Should the Government focus on ‘soft’ public goods like education & healthcare OR is it enough if the Government simply provides ‘hard’ infrastructure like roads & ports? In first of two blogs on these questions, we identify the four thinkers who began India’s search for answers to the issues at the heart of modern economic policy making.

“India did not possess well-developed capital and labour markets in the nineteenth century. It did have cheap labour, cheap material, and community-bound entrepreneurial resources, but the capital was expensive, largescale labour markets non-existent, transportation costs of material high, and the merchants did not understand machinery. India’s colonial connection was instrumental in overcoming these barriers to industrialization.” – Tirthankar Roy in his book ‘The Economic History of India, 1857 to 2010’ (4th edition – 2020).

Introduction

Over the past century, Indian political discourse has taken many turns in its approach to policymaking, ranging from a socialist and redistributive setup (in the pre-1980 era) to an infrastructure-focused capex heavy one (in the current dispensation). Multiple dispensations at the Centre have, to this end, advocated both verbally and via policy actions, what they felt the economic discourse in the country should ideally look like with the last decade witnessing exceptional infrastructure development (read more about this in our blog dated June 25th 2022 India’s Moment After a Decade of Structural Reforms).

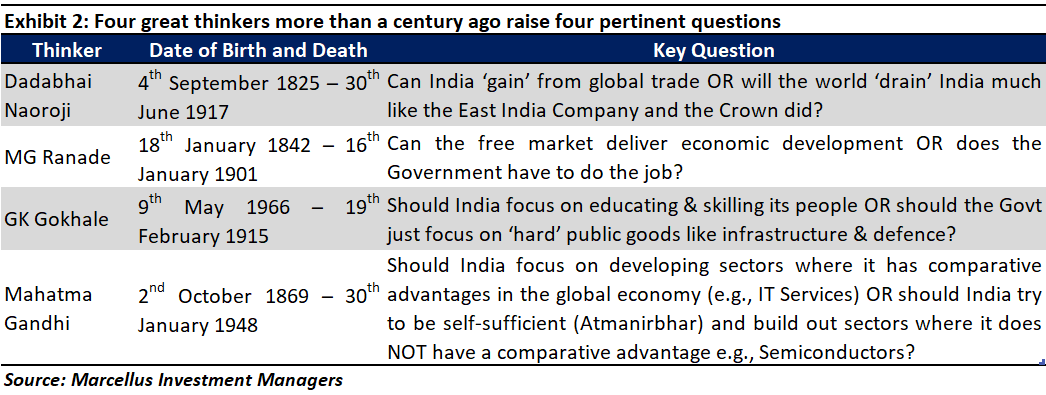

The critical questions around economic policy-making that ought to be debated in any vibrant free market economy, were first raised by four towering personalities at the beginning of the 20th century. Those people were Dadabhai Naoroji (1825 – 1917), Mahadev Govind Ranade (1842 – 1901), Gopal Krishna Gokhale (1866 – 1915), and Mahatma Gandhi (1869 – 1948).

The table below captures the essence of the questions that these thinkers posed to India’s freedom fighters in the years prior to independence. And post 1947, India’s policymakers have continued to wrestle with these four questions (with varying degrees of success in finding the answers).

To give you a sense of the enormity of the intellectual depth required to pose such questions in the colonized India of a century ago, John Maynard Keynes’ definitive book on economic policymaking ‘The General Theory of Employment, Interest and Money’ – the first clear guide to how nations should think about managing their economy and their finances – was published only in 1936. Long before that and several decades before macroeconomics became an academic discipline in the universities of the West, the four Indian thinkers had thought about the four critical issues which sit at the heart of modern economic policymaking.

In this blog we will discuss the origins of these four questions asked by these thinkers. In the next blog we will look at how various Indian governments have answered the same four questions in utterly divergent ways and in so doing changed the course of the Indian economy and the fortunes of various sectors.

For instance, PV Narsimha Rao’s and Manmohan Singh’s decision to open up the Indian economy to the world at large in July 1991 transformed the prospects of India’s IT Services sector and directly resulted in the burgeoning of giant IT Services companies like TCS (now the world’s second largest IT Services firm) and Infosys. However, the same policy decision put paid to the prospects of India’s then largest domestic car manufacturers, Hindustan Motors and Premier Padmini (both of whom were part of the Sensex in 1991).

In a similar vein, the National Democratic Alliance’s (NDA’s) decision to incentivize self-sufficiency (Atmanirbharta) through Production Linked Incentives (PLI) has resulted in the creation of a burgeoning EV 2-wheeler industry in India, whilst diminishing the growth prospects for the manufacturers of conventional 2-wheelers.

Notwithstanding these inevitable tradeoffs that riddle policymaking the world over, we believe that policy decisions are an effective way to find and test answers to the core issues that underpin economic development. And so, if Indian policymaking – and the impact it has on companies’ prospects – is to be understood, understanding the basic tenets of the aforementioned four questions becomes crucial. Let’s delve further into each of the four foundational questions that were raised over a century ago.

Dadabhai Naoroji: Can India ‘gain’ from global trade OR will trade with the world ‘drain’ India?

The busiest street in downtown Mumbai, DN Road in Fort, is named after Dadabhai Naoroji. A leading politician who was the president of the Indian National Congress (INC) three times between 1886-1907. The idea he is most famously known to have developed is the ‘Drain Theory’ which essentially postulated that if the country has no power to stand up to its buyers/stakeholders in the global market, it is going to be a net loser from global trade.

The British, first under the East India Company and then directly under the Crown, governed the Indian subcontinent for almost 200 years. In these couple of centuries, they left a lasting legacy in the form of the railways, the telegraph, the English language, and the game of cricket. However, this was not all – there were a few who thought the British were unfairly extracting resources that were not benefiting India. In fact, as B.R. Tomlinson writes in his book ‘The Economy of Modern India: From 1860 to the Twenty First Century’ (2013):

“The crucial point for the nationalists was that British rule brought about a ‘drain of wealth’ as India met a large deficit in goods and services with Britain, plus interest charges and capital repayments in London. Nationalists fiercely contested the assumptions on which such calculations were based, arguing in particular that India’s defence establishment was designed to meet Britain’s needs, and that the railways were an expensive military asset rather than an appropriate piece of developmental infrastructure.”

To a degree this made sense as well because the colonial rulers did focus on resource extraction, especially for their military, with no commensurate benefits for Indians.

“Lord Salisbury described India as ‘an English barrack in the Oriental seas from which we may draw any number of troops without paying for them’” – as quoted by Tomlinson ‘A History of Economic Thoughts in India’ by Ajit Dasgupta (2002).

There is some merit in the argument against outward remittances of the British working in India that Naoroji was putting forth; foreigners worked in India and used all the resources of the country but sent remittances to England, therefore draining India of what could have been spent and/or invested in India.

However, it was not only the remittances which bothered proponents of the Drain Theory but also the relatively disadvantageous terms on which foreign trade would take place between India and England. In fact, John Stuart Mill, the English philosopher and economist, had explained this succinctly – “A country which makes regular (non-commercial) payments to foreign countries, besides losing what it pays, loses also something more, by the less advantageous terms on which it is forced to exchange its production for foreign commodities.” – John Stuart Mill in his book Principles of Political Economy (1848; also see Jacob Viner’s Studies in the Theory of International Trade, 1937).

Not everyone was convinced that the drain theory was the primary explanation for poverty in India. Bankim Chandra Chatterjee thought that the Drain Theory was largely incorrect. He believed that quite contrary to the ‘draining’ of resources from the country, because of the British and the resultant introduction of formal banking system and processes, safeguards against losing money had already put in place. In 1892, he wrote – “If someone wishes to save, he can be confident that he and his progeny would be able to enjoy the fruits of it” – Bankim Chandra Chatterjee; A History of Economic Thoughts in India by Ajit Dasgupta (2002).

Furthermore, quite contrary to the general idea that drain theory had put forth, Bankim Chandra believed that an increase in trade does not mean a loss of wealth:

“If we spend 6 rupees in buying British cloth we are getting a commodity in exchange for it. If we spend more than a fair price for it, we lose. But if we cannot buy that cloth for less than Rs. 6 from elsewhere the price is not unfair. Hence, the country does not lose.” – Bankim Chandra Chatterjee in ‘A History of Economic Thoughts in India’ by Ajit Dasgupta, (2002).

Therefore, whilst the Drain Theory as proposed by Naoroji had merit, there were other drivers of India’s poverty. Furthermore, if the terms of trade (between India and the wider world) could be improved, the country could benefit from foreign trade. As a result, throughout the history of independent India, we have seen governments grappling with the question of whether India should remain a closed economy or open up to the world at large with terms of trade that are fair from an Indian perspective (more on this in the part 2 of this blog).

Contemporaneous to Naoroji, was another stalwart thinker who revolutionized not only the social discourse in the country but also made the case for massive industrialization and resultant acceleration of growth – Mahadev Govind Ranade.

Justice Ranade: Free market driven economic development OR State driven development?

“Global economic expansion and the global shift in terms of trade in favour of agriculture encouraged expansion in cultivation. The agricultural expansion was a combined story of commercialization, industrialization, and banking growth. During the colonial era, a pattern of economic change emerged in which land, trade, finance, and manufacturing became interdependent parts of a single system. Growth of trade enabled merchants to make enough money to invest in modern industry.” – Tirthankar Roy in his book ‘The Economic History of India, 1857 to 2010’ (4th edition – 2020).

Born in Niphad in the Nashik district of Maharashtra in 1842, Justice Mahadev Govind Ranade spent a large part of his life trying to bring social reform to India. To this end, he campaigned for widow remarriage and their emancipation by establishing ‘Widow Marriage Association’ in 1861. Furthermore, he was also instrumental in founding the Maharashtra Girls Education Society which started one of the oldest schools in Pune for girls, Huzurpaga. Apart from this, he was also a notable politician (one of the founding members of the INC), a justice at the Bombay High Court, and also the editor of an Anglo-Marathi daily in Bombay named Induprakash.

A stalwart in economic thought and way ahead of his times, Justice Ranade articulated the pressing need for capital infusion in the economy. He was of the opinion that for India to grow beyond the meagre rate that it had attained over the last few centuries, it needed to pivot away from agriculture and towards industry – towards manufacturing and capital-intensive industries specifically.

In order for this to happen the cogs of a free-market economy have to function effectively. A free market economy primarily functions on the idea of profit maximization. If people see the chance of earning outsized profits, they will enter the market (by becoming producers) thereby driving private capex into the economy.

However, with the British introducing their mass produced, cheap and better-quality products in India, many homegrown Indian producers had gone out of business. Therefore, justice Ranade explained that initially at least, industry would need government directed capital infusion and protection to help firms gain the resources and confidence to compete with imported goods. In his inaugural address at the first Industrial Conference in Pune in 1890 Ranade set forth steps in which the State could help indigenous or domestic private enterprise to grow in the country –

“While we put forth our energies in these directions, we can well count upon the assistance of the State in regulating our Co-operative efforts by helping us to form Deposit and Finance Banks, and facilitating recoveries of advances made by them, by encouraging New Industries with Guarantees and Subsidies, or loans at low interest, by pioneering the way to new Enterprises, and by affording facilities for Emigration and Immigration, and establishing Technical Institutes and buying more largely the Stores they require here and, in many cases, by producing their own Stores.” – ‘A History of Economic Thought in India’ by Ajit Dasgupta (2002).

Ranade believed it was essential that the country shift from being an agrarian economy to a manufacturing powerhouse driven by domestic industries if it were to grow at a healthy pace, where the State’s role was to encourage private investment but not run the business themselves.

In ‘A History of Economic Thought in India’, Ajit Dasgupta summed up what Ranade stood for – “To conclude, Ranade’s approach to economic policy was guided by an over-riding objective: the development of productive capacity. This applied to agriculture as much as to industry. In both, government had a vital role to play, but its role was to initiate, encourage and allow, rather than direct, take over or control.”

Gokhale: Should the Government focus on ‘hard’ infrastructure OR ‘soft’ infrastructure?

“To expect the government to be an effective agent in mass literacy would mean not only a much larger scale of investment but also a battle against social prejudices and biases that derived from caste sentiments and the low status of women in society.” – ‘The Economic History of India, 1857-2010’ by Tirthankar Roy (2020).

Born in the coastal region of Maharashtra in Ratnagiri in 1866, Gopal Krishna Gokhale was a social reformer, a professor of political economy at Fergusson College in Pune, and a politician of great repute in the pre-Independence era. He was committed to serving the underprivileged and to this end founded Servants of India Society in 1905. A moderate politician, he was an active member of the INC and left an indelible mark on the political discourse by protesting against the ill-treatment of the underprivileged in India. His interest in and contributions to India’s political economy are such that the famous Gokhale Institute of Political Science and Economics (GIPE) in Pune is named after him.

As a prolific thinker and an eminent economist, Gokhale emphasized the need for compulsory elementary education in India. He believed that overall growth of the economy can happen only when its population is literate.

“Mass education contributes to economic growth directly because education improves the capability and productivity of human beings, and thus adds to resource endowment, and indirectly by increasing the choice of occupations, making it more likely that the person with the right aptitude for a line of work would learn and perform that work.” – Tirthankar Roy in his book The Economic History of India, 1857-2010 (2020).

The principles of finance that he religiously believed in were quite old school but effective – the Government should cut costs wherever possible and keep corporate taxes low so that private investment does not get hindered, and the nation gets a chance to benefit from the fruits of private ventures. From this vantage point, he saw public spending on education as an investment by the nation in the productive capacity of its people.

More generally, Gokhale believed in giving impetus to private investment rather than in the State collecting higher taxes from private firms and then using those monies to drive development. This is evident in the following excerpt from what he said in 1902:

“The true guiding principle of Indian finance ought to be a severe economy, a rigorous retrenchment of expenditure in all branches of administration consistent with efficiency, keeping the level of taxation as low as possible so as to leave the springs of national industry free play and room for unhampered development.” – as quoted in 1942 in Lokanathan ‘A History of Economic Thought in India’ by Ajit Dasgupta (2002).

With the benefit of hindsight what both Ranade and Gokhale focused on i.e., the hard (capex on factories & machines) and soft infrastructure (human capital development), were complementary requirements for economic development – one cannot exist without the other but a century or more ago these thinkers were pioneers in articulating India’s developmental requirements.

Mahatma Gandhi: Should India be ‘atmanirbhar’ OR should it focus on Ricardian comparative advantage?

As if being the leader of India’s freedom struggle wasn’t enough, the Mahatma was also a deep and remarkably original thinker about the economic challenges facing India.

Mahatma Gandhi’s thinking on what India needed to become developed was distinct from the point of view articulated by Justice Ranade. Specifically, Gandhi wanted India to be a self-sufficient economy and bring its rural economy to the forefront of the drive for development.

“Gandhi, on the other hand, did not regard industrialization as a goal that India should adopt. The overall vision which led Gandhi to his doctrines of the limitation of wants and swadeshi also led him to oppose modern industrial development” – A History of Economic Thoughts in India by Ajit Dasgupta (2002).

Incredible as it sounds with the benefit of hindsight, even a century ago, the Mahatma’s primary concern was machines displacing India’s labour leading to unemployment. Therefore, in his world view of becoming self-reliant where everyone benefits from the fruits of their labour, the modern model of machine-based production that effectively was the hallmark of the Industrial Revolution in Europe did not seem like one that could be usefully adopted for independent India.

Over the past 70 years, as the free-market principles propagated by liberal Western economists (the so called ‘Washington Consensus’ thanks to the role of World Bank and IMF in propagating this point of view) have gained currency, policymakers the world over have veered away from self-sufficiency and focused on comparative advantage, an economic construct first articulated by David Ricardo in the year 1817.

Ricardo said that countries should produce only those goods (or services) which they are comparatively good at (i.e., the goods that they can produce comparatively cheaper than other countries) and then trade this for other goods with other nations. This, as per Ricardo, makes all the countries involved better off (rather than each country producing everything to the best of its capacities).

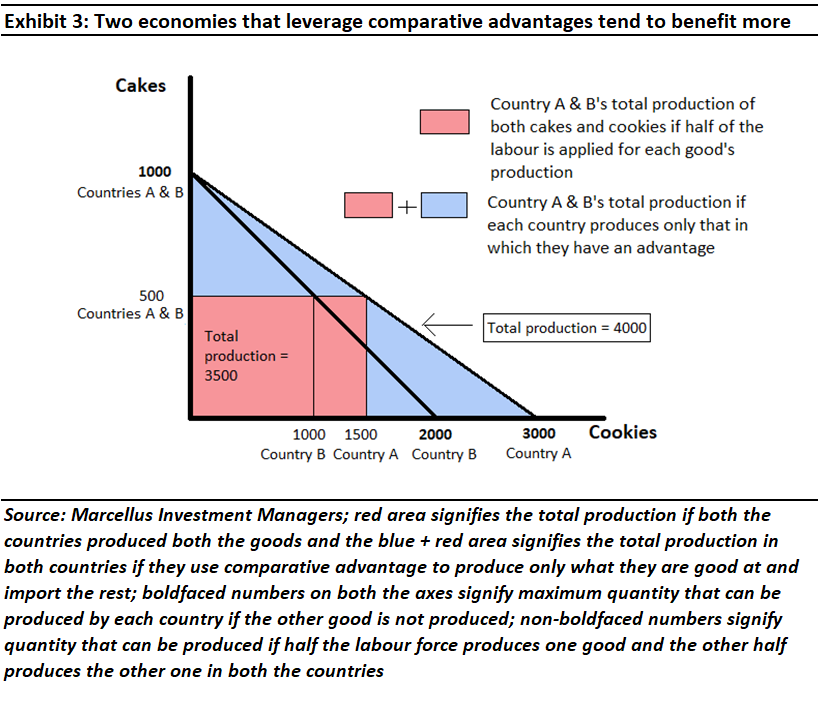

To illustrate this using an example, let’s consider that Country A can produce 1,000 units of cakes or 3,000 units of cookies. Or it could split its workers into half and produce 500 cakes and 1,500 cookies. Country B on the other hand, with the same number of workers, could also produce 1,000 cakes, but if they were to make only cookies, they could produce only 2,000. Now, if both the countries decided to produce both cakes and cookies they could produce 1,000 cakes and 2,500 cookies. However, if Country B could make 1,000 cakes (enough for both the countries) and Country A made 3,000 cookies, the total production between the two countries would be higher than what they could each produce without trade. Thus, thanks to trade, both the countries are better off because each country is specializing in what it does most efficiently (see exhibit below; source: http://bit.ly/49r5Oup).

Ricardo’s economics of comparative advantage is in direct contradiction of Gandhi’s idea of self-sufficiency. However, Ricardo’s economics assumes that each country is able to negotiate fair terms of trade for itself in the global economy. The Mahatma knew from bitter experience that that is not how the world worked especially for a British colony like India.

“Colonial rule broke down the autonomous economy of independent handicraft workers and self-sufficient peasants, and directed domestic economic activity towards two main areas – export oriented agriculture with very small returns to provide primary products for the West at bargain prices before Independence, and limited industrialisation dependent on alliances with foreign firms for technology since then.” – B.R. Tomlinson in ‘The Economy of Modern India: From 1860 to the Twenty First Century’ (2013)

Investment implications to follow in part 2 of this blog.

In the next part of this blog, we will explain how different Indian governments have answered the four questions highlighted in this blog differently. We will show how those varying answers have impacted India’s economy. We will conclude by explaining how we believe the people in charge of India today are answering these four questions. That in turn will give investors a sense of how we see India’s economy shaping up in the years to come.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). Amongst the companies mentioned in this note, TCS and Infosys are part of Marcellus’ portfolios. Nandita and Saurabh may be invested in these companies and their immediate relatives may also have stakes in the described securities.

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.