OVERVIEW

Over the past decade the Indian economy – fragmented into several regional economies a decade ago – has gradually been integrated by the doubling of highway networks, tripling of local airline traffic, the introduction of GST and – most importantly – rapid digitization of the economy. From Aadhaar (in 2010) to UPI (in 2016) and now on to ONDC (Open Network for Digital Commerce) – India is gradually building a digital economy which will ultimately give the country a global competitive advantage in how money and goods move around the country.

“…I believe that the most important driver for growth lies in expanding access to resources and opportunities…While this kind of access seems obvious as a goal, most countries are not designed to provide it. This dawned on me fully when I heard the Nobel Prize-winning economist-historian Douglass North speak on how economies limit such opportunities for citizens….He spoke…with passion on the immense importance of promoting what he called ‘open access societies’. ‘The limited access order is what we see now in most countries… It promotes policies that cut off easy entry into markets and institutions for everyone.’ These limitations include difficult access to capital that people need to start businesses and education systems …As a result we see existing elites consolidate their hold on power and wealth…For an economy to shift into an open access, we need competition and markets…” – Nandan Nilekani in his book, ‘Imagining India: Ideas for the new century’, 2010.

The trinity of JAM (Jan Dhan, Aadhaar, Mobile) started with a basic, foundational step

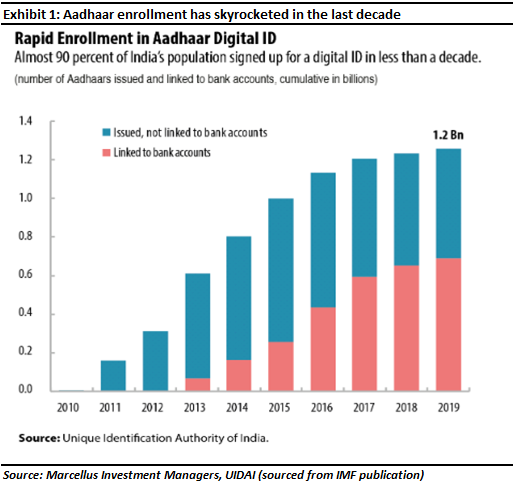

The foundations of India’s digital integration were laid when Aadhaar was conceptualized in 2006. In 2009, Nandan Nilekani quit his job as the CEO of Infosys to spearhead the launch of Aadhaar which was based on getting over a billion people registered correctly with addresses and biometrics. Aadhaar was launched in 2010 and since then around 1.2 billion people have signed up for Aadhaar and around half of them having linked their IDs to their bank accounts, making it arguably the world’s largest, most ambitious, and most national registry successful project – see exhibit below (source: https://www.imf.org/external/pubs/ft/fandd/2021/07/india-stack-financial-access-and-digital-inclusion.htm#:~:text=The%20India%20Stack%20is%20widening,fintech%20firms%2C%20and%20digital%20wallets.).

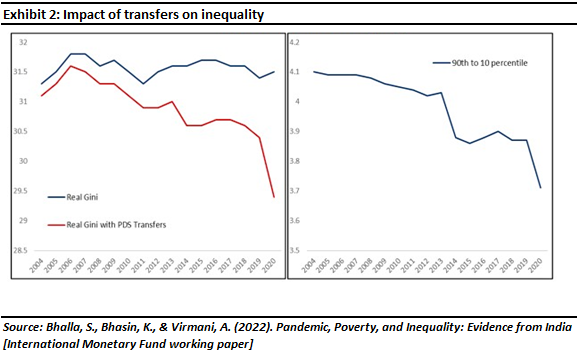

Thanks to Aadhaar, the rollout of targeted welfare programs has become easy for the Union and state governments. By directly targeting the beneficiaries of various welfare schemes, Aadhaar has minimized leakages in the system. Most recently, the benefit of Aadhaar was evident during the pandemic when the union and state governments rolled out relief packages worth Rs 26.3 trillion over the course of FY21 and FY22.

Whereas Aadhaar provides a way for preventing duplication of identity, Jan Dhan is responsible for the actual delivery of welfare payments directly into the accounts of claimants. Launched in 2014, Jan Dhan’s goal was getting every Indian a bank account.

Historically, India has been a country where people preferred dealing with cash and banking was restricted to the Metro and Tier 1 cities. With the Jan Dhan program, the Government sought to get the rest of India into the banking system. Deposits under the Jan Dhan scheme have surpassed Rs. 1.5 trillion as of January 2022 (source: https://www.business-standard.

The final leg of the JAM trinity – the mobile phone – acts as the communication medium which links Aadhaar holders with their Jan Dhan bank accounts. The commencement of mobile services by of Jio (with 4G data at the lowest prices seen anywhere in the world) in 2016, the mass usage of mobile data (India now uses more mobile data than any other country) and smartphones laid the foundation for not only JAM but also for much of what we will discuss further on in this note.

The culmination of JAM is a system that has reduced scope for leakages and/or corruption and at the same time ensured increased financialization. According to an IMF working paper by Arvind Virmani, Surjit Bhalla, and Karan Bhasin, “The Food Security Act (2013) and the increased use of Aadhar accelerated the declining proportion of leakage(s) in the program” (source: Bhalla, S., Bhasin, K., & Virmani, A. (2022). Pandemic, Poverty, and Inequality: Evidence from India [International Monetary Fund working paper]).

After JAM came UPI

The creation of JAM in 2015 paved the way for UPI (Unified Payments Interface) in 2016. UPI is a real-time payment system wherein a user can instantaneously transfer funds to someone using any bank account that they hold and is registered on the UPI app on a smartphone. Furthermore, there are multiple apps which offer this service, but the transactions are not app-dependent, meaning a user with one UPI app can send money to another user who has an account on another UPI app seamlessly, thus making the system truly interoperable. UPI was developed by National Payments Corporation of India (NPCI) and is regulated by the RBI.

To give some context regarding the mammoth scale at which UPI operates, UPI transactions amounted to around USD 1.1 trillion by April 2022, which is approximately 37% of India’s GDP (source: https://www.livemint.com/mint-

To understand the implications of this, a decade ago, the clearing of cheques (which was the preferred way of non-cash transfers then) took approximately two days. Today, because of UPI, one can easily transfer amounts up to Rs. 1 lakh instantaneously. In fact, this is the way most of Marcellus’ staff now pays for coffee, groceries, taxi & three-wheeler rides and newspapers. Not surprisingly, this has increased the velocity with which transactions are taking place in the country.

The simplest way to understand the impact of UPI on the broader economy, consider the most basic equation in monetary economics (called the Friedman version of the quantity theory of money equation):

where M stands for money supply in the economy, V stands for velocity of money or the number of times currency is exchanged in the economy (in a given time period), P stands for prevailing prices in an economy, and Y stands for GDP.

Using the Friedman equation, one can see that when the velocity of money is rising (courtesy digital transfers of money), the left-hand side of the equation will rise. To balance the equation, if on the right-hand side of the equation, you hold P constant then Y has to go up i.e., economic growth has to go up (provided prices are held constant). In short, the faster a given amount of money (M) moves around the economy (V), the quicker an economy should grow.

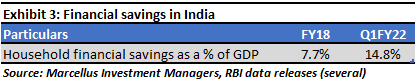

So, how does that happen in practical terms? As companies and individuals get paid quicker, they have more cash in their bank accounts. Companies can use this cash to invest more in their businesses (as explained in our Little Champs Newsletter dated 28th July 2022 – The Evolutions Underpinning the Revolution) and individuals can use this cash to save more – see table below.

|

From UPI to ONDC With UPI having simplified and accelerated the way we pay each other in India, the next logical step for the digital integration of the economy is the transformation of the ecommerce marketplace. Ecommerce, as it stands today, is dominated by a few big integrated platforms that hold the power to decide which seller gets to list their items on their platform and at what price. This undermines the ability of smaller producers to list their products on the platform – with deep-pocketed vendors (usually well-known brands owned by large companies) getting the most visibility on these platforms. The second issue with the established monolithic platforms is that they offer the customer a ‘bundled’ proposition. E.g., currently, if a consumer finds a book that they wish to buy on Amazon, they have to necessarily choose the ‘bundled’ package, where each step from paying for the book to getting it delivered is controlled by Amazon. The third issue with the established monolithic platforms is that they lock-in small businesses who sell their wares on these platforms – if the SME vendor leaves the platform, it loses all its customers and it loses the ratings that customers would have given the vendors over the years. ONDC seeks to address these challenges. Conceptualized as an interoperable facilitator of trade, ONDC aims to democratize the way goods are bought and sold via ecommerce. Under ONDC, a consumer can choose which seller to buy the book from (e.g., Flipkart, Amazon, Crossword, local bookstore, etc.), which payment method to use (e.g., Google pay, Paytm, Razorpay, your high street bank, etc.), the delivery agent (e.g., Blue Dart, Delhivery, etc.), and so on. This should give greater control to the consumers to choose the best combination of steps in purchasing any product (rather than locking the customer into a pre-specified ‘bundle’ as the incumbent monolithic platforms do). Furthermore, because of ONDC, one can view products from multiple ecommerce platforms in one place (implying greater visibility for smaller vendors who are currently frozen out by the big platforms). ONDC should – if things go to plan and if vested interests don’t throw a spanner into the works – manifest into one big marketplace with hundreds of millions of buyers and sellers transacting with each other in an unbundled manner. ONDC is currently undergoing a trial in 16 cities and is slated to be functional in 100 cities by October 2022. To find out more about ONDC and who owns it, click here. Why is ONDC a good thing? Competition leads to economic growth Increased competition, intuitively, should increase the efficiency of the producers in the economy whilst also increasing consumption (via lower prices). Both these factors, therefore, should boost economic growth. Several economists have done empirical work on this straightforward theory. A World Bank working paper authored by Mark Dutz and Aydin Hayri uses cross country data to prove that effective competition policy implementation and a country’s growth are positively correlated (source: https://openknowledge. Now, whilst ONDC sounds great and should, as explained above, boost economic growth, there are a few issues that have to be dealt with before we reach the promised land. There are largely 3 key issues pertaining to how ONDC would operate:

In answer to the above questions, ONDC has been envisaged as an enabler of trade; what ONDC will essentially do is help increase visibility for sellers who hitherto have had neither the ability nor the resources to access larger markets. In this context, ONDC will help in market expansion rather than market substitution – the big monolithic ecommerce players don’t have to shut down their existing platforms to join ONDC; the existing monolithic platforms and ONDC can function in parallel and continue to function independently. As a result, the reach of the monolithic platforms increases – sellers on the monolithic platform get increased visibility and buyers on the monolithic platform get a wider range of options to choose from. Secondly, when it comes to disaggregation, because ONDC can help record data at each step of the process – i.e., what has been dispatched, what has been received and in what condition – the likelihood of the right agent in the system assuming the liability of the product is high. For example, if tomorrow I buy a coffee mug sold by seller Joe Bloggs listed on Flipkart while searching for the product on Amazon’s site, the default and resultant return of the delivered product will be Joe Bloggs’ and Flipkart’s responsibility. Furthermore, under ONDC, if I decide that the product be shipped via some logistics firm which is NOT Flipkart’s recommended logistics service provider, and if the product gets damaged in transit, the liability will be that of the logistics firm (not of Flipkart nor of Joe Bloggs). All of this can be tracked easily due to the process of recording explained earlier. Lastly, the way ONDC is likely to be implemented, the buyer catalogue will, at any point in time, be independent of seller catalogue. This means that neither party (neither the buyer app nor the seller app) can get hold of the data of the other party and misuse it. Furthermore, any order placed will be considered as a digitally signed micro contract, ensuring that the signatories fulfill their side of the commitment. Implications for investors As we said in our blog dated 25th June 2022, India’s moment after a decade of structural reforms: “The networking on the US economy in the half a century prior to World War II transformed how business & industry functioned in that country. The emergence and completion of railroad networks by the 1880s, the advent of the telegraph at the turn of the century, the arrival of the Model-T Ford in 1908 and the creation of a tarmac road network by 1940 joined up an economy which until then was a cluster of rural and regional economies. As a result, giant American companies emerged with superior R&D capabilities and with national sales & distribution networks. These companies were increasingly funded by a booming stock market and the first generation of investment banks (JP Morgan, Lazard, Goldman, etc.). India today is in a similar situation today as USA was between 1870-1940…Massive improvements in transport & communication networks, in the banking system, in the tax regime and in the way social security benefits are dispensed have allowed enterprising companies to capitalize on these changes and create mouth-wateringly valuable franchises.” The digital networking of India helped the JAM construct become the backbone of India’s nascent social security system and it has also helped UPI become the largest real time payments system in the world. ONDC is a natural extension of UPI with both, SMEs seeking to sell their wares online and customers seeking to buy online, as the intended beneficiaries. No other country in the world has conceptualized or implemented anything akin to ONDC. In fact, because other countries neither have Aadhaar nor UPI, they can’t implement ONDC until they get these foundational networks in place. That’s why the step-by-step construction of India’s digital economy can over the next decade become a competitive advantage for the country. Nandita Rajhansa and Saurabh Mukherjea are part of the Investments team in Marcellus Investment Managers. If you want to read our other published material, please visit https://marcellus.in/blog/ Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form. |