After witnessing steep declines over CY18 and CY19 and continued woes in 1QCY20 with the onset of the pandemic, small caps had their proverbial ‘rising from the ashes’ moment with the BSE Smallcap index returning 114% from its March 2020 low. However, a downside of this has been unwarranted exuberance in low quality small caps. Against this backdrop, we reiterate that quality is non-negotiable and more so for smallcaps. Earnings growth, RoCE and corporate governance remain the key drivers of the long-term share price performance. Furthermore, the ever widening gap between strong and weak franchises brought upon by the economic slowdown and disruptions of recent years and the imminent near-term headwinds from an inflationary environment make investing fundamentally high quality more important than ever before.

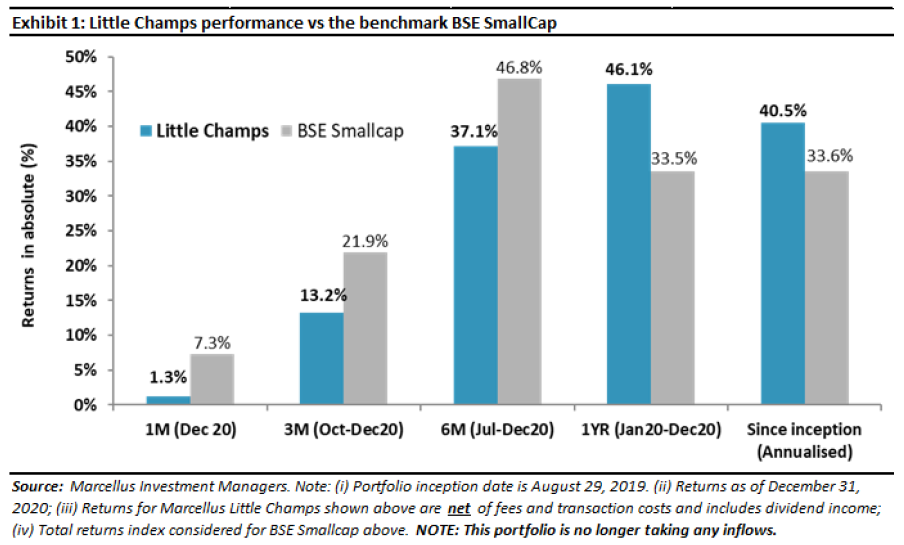

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

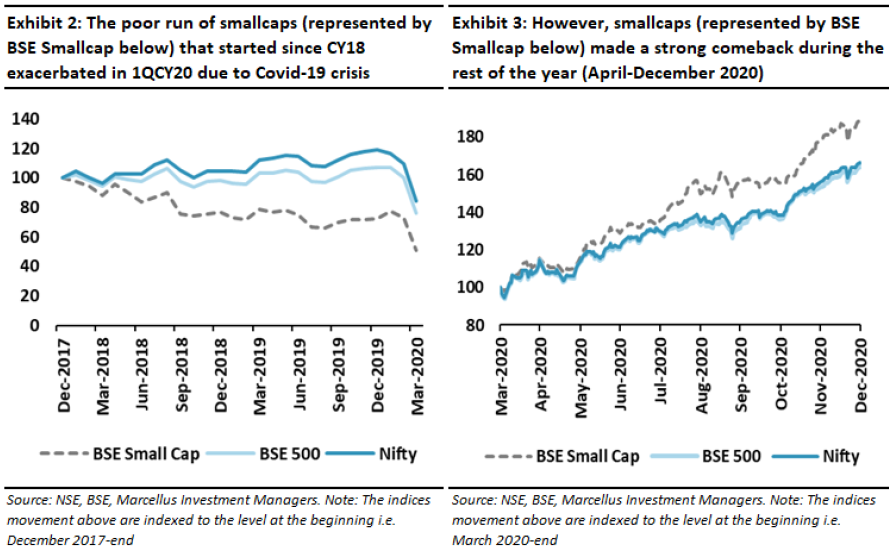

Defying odds, small caps made a comeback in CY2020

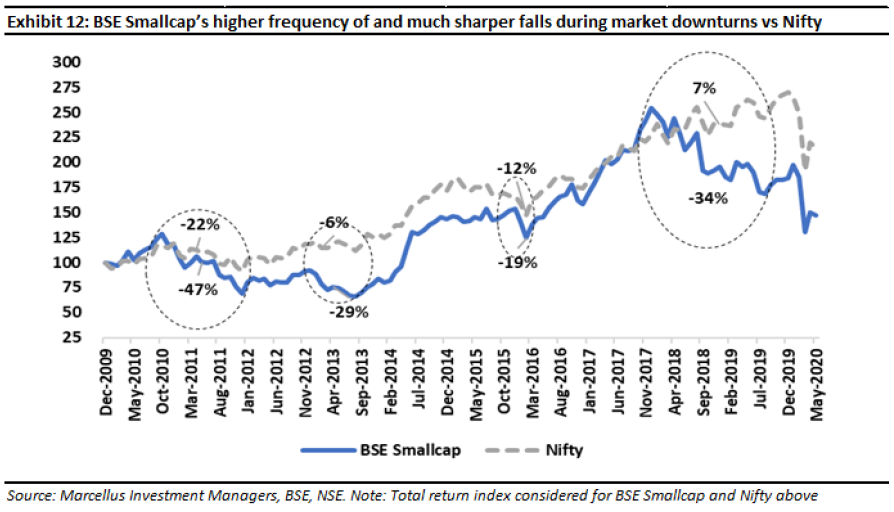

After falling sharply in both absolute terms as well as underperforming relatively to the larger cap indices (such as the Nifty and BSE500) over CY18 and CY19, there were expectations that small caps could make a comeback in CY20. However, the onset of Covid-19 pandemic put paid to that hopes with an across-the-board sharp fall in stock prices in the month of March 2020. Furthermore, small caps were the worst-hit with the BSE Smallcap index declining by nearly 30% in the month of March 2020 compared to 23% and 24% declines in Nifty and BSE500 indices respectively. By March 2020-end, BSE Smallcap had cumulatively declined by nearly 51% from its peak of mid-January 2018. With significant uncertainty surrounding both the extent and longevity of Covid-19’s impact, there was a general despondency surrounding smallcaps.

However, the recovery in markets and more particularly in small caps since then has been remarkable. From April-December 2020, the BSE Smallcap returned 89% (vs the Nifty’s 64% and the BSE500’s 66%) and is now within touching distance of its all-time peak of mid-January 2018. Some of the key drivers of this sharp rally have been: (i) the unprecedented liquidity pumped in by the Central banks across the globe to mitigate the pandemic impacts; (ii) as Covid-19 fears started abating, expectations of an economic recovery and its particularly beneficial impact on small-caps’ earnings (due to the high operating and financial leverage involved in smaller companies) started gaining ground; and (iii) the massive underperformance of the last two years creating attractive value propositions or atleast the perception thereof in small caps.

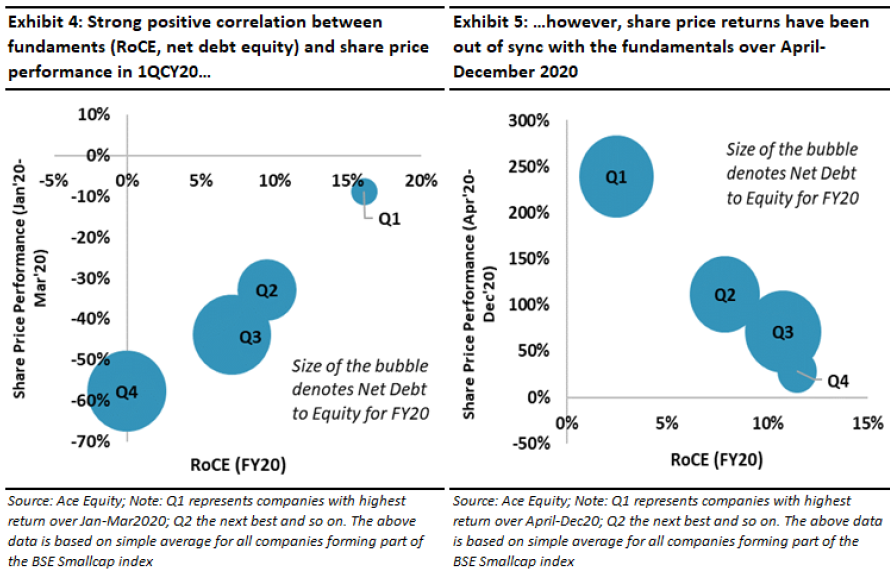

The quality of the current rally is suspect

The broad-based recovery in the markets over the last nine months has been a welcome change compared to the more polarised market movements of CY18 and CY19 (where large caps significantly outperformed mid and small-cap stocks). However, there are some concerns associated with the current rally. The companies with the lowest quality have moved up the highest over the last nine months. While the low RoCE high debt-equity companies significantly underperformed in 1QCY20 during the onset of the crisis, they have rallied the most from April-December 2020.

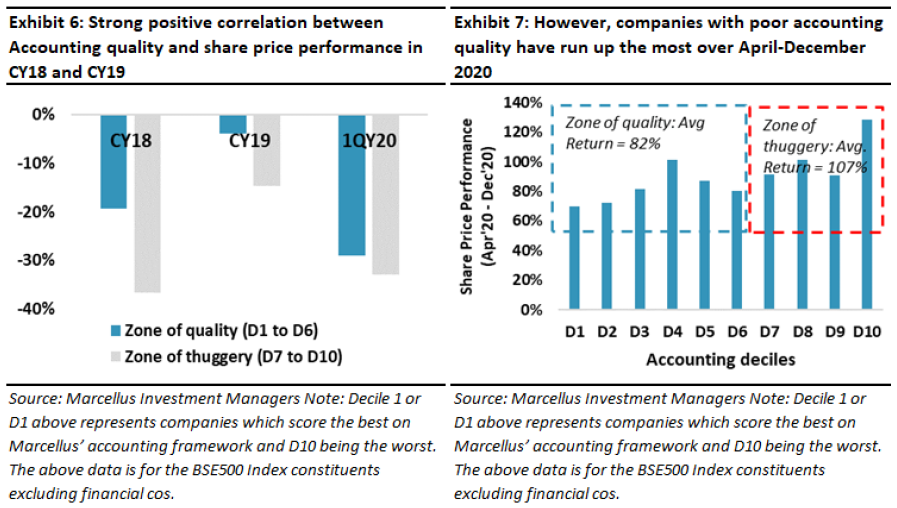

Similarly, companies that rank low on accounting quality (D7 to D10 in Marcellus’ accounting frameworks) have given the highest returns over April-December 2020 again raising concerns surrounding the quality of the stocks that are witnessing the sharpest price rally. Details on Marcellus’ Forensic accounting approach can be accessed in Little Champs December 2019 newsletter (click here) and our September 3rd, 2020 webinar (click here).

Quality is non-negotiable especially for small caps

While riding the momentum is always alluring, unless current market rally sustains for a long period of time or one is gifted with an uncanny ability to time the entry and exits to perfection, investing in sub-par quality stocks often results in heavier losses than gains. While we have highlighted this in our earlier newsletters, we reiterate it again through the following points.

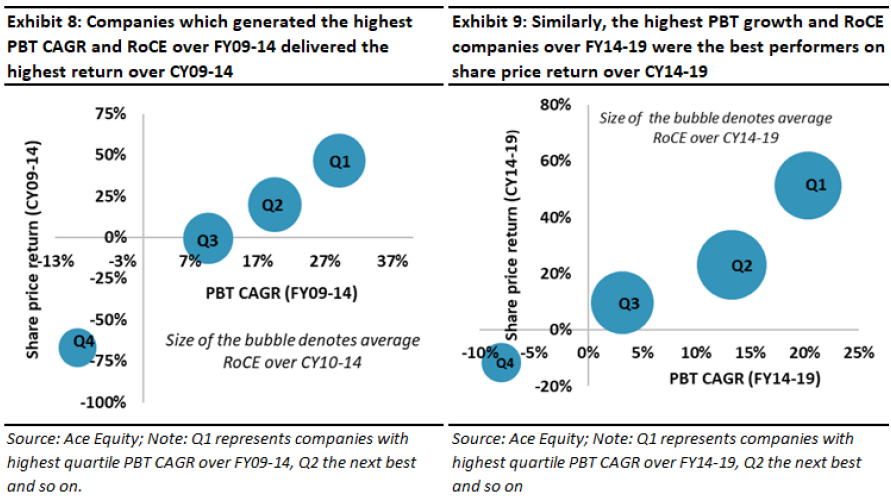

- Earnings growth and returns on capital employed have been the sustainable drivers of the long-term share price returns: When one considers a reasonably long period of time (say, 5 years or more), earnings growth and RoCE turn out to be the key determinants of the share price returns. For instance, for both time periods FY09-14 and FY14-19, the companies with a combination of highest PBT growth and highest RoCEs ended up delivering the highest share price returns as shown in the below exhibits.

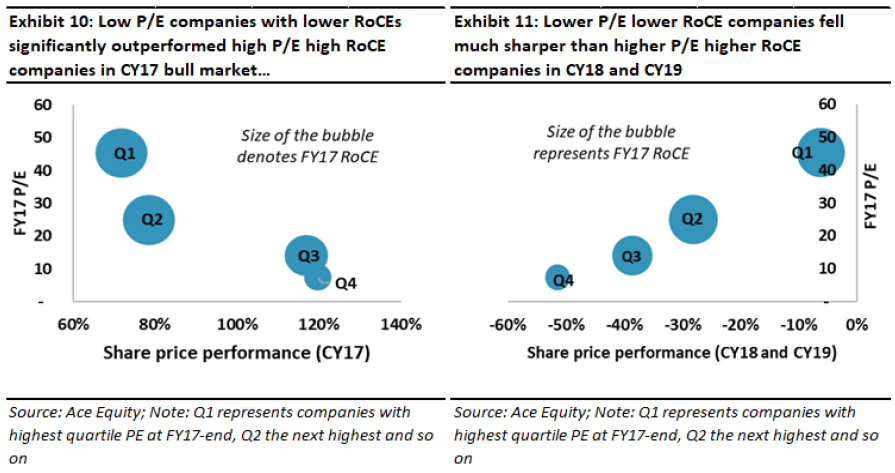

On the other hand, there is hardly any correlation between lower P/E multiples (unless these companies also generate healthy earnings growth and RoCEs) and higher share price returns except in short periods of irrational exuberance (where factors such as abundant liquidity rather than company fundamentals drive share price performance). For instance, in CY17, somewhat akin to the current scenario of abundant liquidity and low risk aversion, low RoCE and poor accounting quality companies witnessed speculative excesses being created. However, as the cost of the capital rose, liquidity started drying up and equity markets turned volatile, investors became more selective bringing back the focus on accounting quality and RoCEs. As a result, poor quality stocks that did very well in CY17 more than lost all the previous years’ gains in CY18 and CY19.

- Sharp drawdowns and higher volatilities associated especially with low quality small caps: Minimising drawdowns and reducing volatility is central to generating returns. This is because sharp drawdowns negate all the returns investors may have generated previously. Similarly, though theoretically, higher volatility does not necessarily mean negative returns, practically speaking in the investment world, more often than not, higher volatilities imply frequent periods of negative returns and hence negative impact on the ultimate portfolio value. Unfortunately, the small cap investing in India is fraught with extensive periods of sharp drawdowns and volatilities – also corroborated in the long-term underperformance of the BSE Smallcaps compared to Nifty and BSE500 indices.

We believe key factors driving the higher volatilities and drawdowns in the small caps in general are:

- Small firms’ revenues and profits tend to be more volatile than those of larger firms due to dependence on: (a) a single line of business; (b) a small group of people running the show; and (c) limited free float & trading volumes which accentuates the good or bad impacts of any macro/company specific developments.

- Most small caps are unable to survive the periods where the business cycle turns downwards. In fact, a cyclical economic downturn often structurally damages small cap companies (for example – as they enter a persistent cycle of indebtedness).

- The preponderance of fraudulent companies (shoddy corporate governance and poor capital allocation) in the small caps space which typically comes to the fore during bear markets.

Given the above pitfalls, assessing the quality of both fundamentals as well as corporate governance is central to small cap investing.

- Weak macros and disruptions have only heightened the inequality between strong and weak companies in recent years: A persistent economic slowdown in the recent years marked by disruptive events like demonetisation, GST introduction and the recent Covid-19 crisis has only widened the gaps between stronger and weaker companies. Superior quality companies like Little Champs have been able to better tide over the crisis on the strength of their superior RoCEs. The consequent surplus cash flows have been deployed into strengthening their franchises by investing in products, people, and technology, expanding distribution networks and gaining market share from weaker players. On the other hand, weaker smaller peers have got structurally impacted as most of them face existential issues. Hence, stronger cash generating companies are able to benefit more from both an economic crisis as well as economic recovery. More details of the rising gap between the Little Champs and their peers can be read in our July 2020 newsletter (click here).

- Companies with strong balance sheet and healthy RoCEs better able to weather the imminent near-term inflationary headwinds: One headwind which has emerged recently is the sharp spike in the commodity prices like steel, copper, aluminium, precious metals as well as crude-based derivatives like PVC. While some of the spike is attributable to the logistical/supply side issues and maybe transient in nature but there is no doubt that it threatens to spoil the otherwise positive impacts of the top-line recovery. Here too, we believe companies like Little Champs would be able to weather the commodity inflation headwinds much better than most small caps because of the strong pricing power (enforced by their dominant market share) and in some cases presence in the resilient end-use industries. Furthermore, just like their inherent quality of turning a crisis into opportunity, Little Champs with their strong balance sheet, much superior margins/RoCEs and constant endeavour to generate operational efficiencies may tactically choose to absorb the price hikes to stifle their weaker peers resulting in further opportunities for market share gains. This underlying attribute of dominant franchises to turn an inflationary environment to suffocate their competition and deepen their competitive advantages is discussed in detail in our June 2020 Consistent Compounders newsletter (click here).

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.