The Little Champs portfolio delivered a PBT growth of 1% in FY20 (compared to the BSE Smallcap’s median decline of 10-15%), a resilient show despite an economy disturbed by Covid-19 towards the year end. Furthermore, with their cost and cash focus, Little Champs have been able to maintain healthy RoCE (19% pre-tax) and debt levels (net cash equity of 0.1x) in FY20 at the portfolio level. Our channel checks and recent management commentaries indicate demand recovery across most of our portfolio companies particularly those catering to the pharma, chemical and auto sectors. We compare and contrast Little Champs portfolio companies’ performance over FY14-19 against their nearest peers and believe that such outperformance can only get stronger in the coming years as Little Champs use the current crisis to their advantage.

Performance update of the live Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

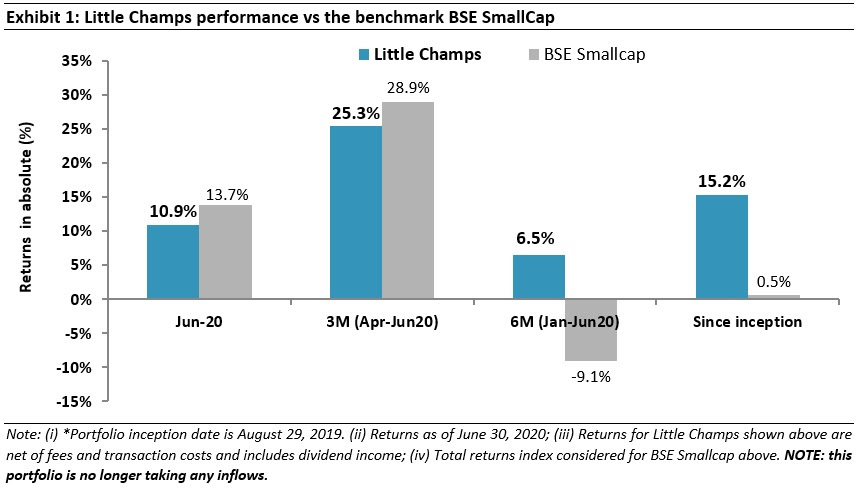

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Little Champs Portfolio is NOT taking any more inflows

As communicated earlier, we are committed towards restricting the corpus of Little Champs PMS to around Rs3 bn as we believe that this would enable us to limit investments into only the highest quality small caps and also keep our position in each of the portfolio companies limited (on an average around 1% of the market cap). Since we have reached our targeted corpus, we have closed the fund to new applications and topups. We would like to thank the all the investor and distributors for their overwhelming response to Little Champs.

Portfolio update

We exited the only pharma stock in our portfolio (~8% model portfolio allocation) in June 2020 on account of the following reasons:

- Deterioration in cash generation and RoCE- The Company has recorded healthy earnings growth in the recent years (Profit after tax CAGR of 47% over FY16-20). However, there has been significant deterioration in working capital of the company from ‘negative’ 91 days (annualised excluding cash) in FY16 to ‘positive’ 131 days average in FY20 emanating from a sharp rise in trade receivables coupled with a steep decline in payables. This has resulted in average RoCE (pre-tax) declining from 66% in FY16 to 33% in FY20.

- Concerns surrounding recent acquisitions- The company announced a few acquisitions in FY20 which resulted in nearly Rs200cr increase in inventory (FY20-end inventory rose to Rs238 crores from only Rs37 crores at FY19-end). These acquisitions have raised further concerns about whether the working capital days and RoCE could see an improvement or even stabilise going forward.

Little Champs’ resilient performance in a tough year (FY20)

On an allocation weighted basis, Little Champs portfolio delivered Revenue, EBITDA and PBT growth of 0%, 1% and 1% respectively in FY20 (the YoY PAT figures are not comparable due to the reduction in the income tax rates announced in September 2019). On the other hand, BSE Smallcap index witnessed a median PBT decline of between 10-15% in FY20.

At the portfolio level, Little Champs delivered resilient performance in FY20 despite:

- A persistent macro slowdown through FY20 exacerbated by the lockdown in the crucial last fortnight of March 2020 (a lot of sectors normally witness accelerated demand towards March end due to the onset of the marriage season in North India, vehicles purchased towards year end for depreciation benefits, higher uptake from dealers to avail annual incentive schemes, etc). The lockdown in March 2020 also impacted the earnings of some of our portfolio companies with strong order books as they had to close down their manufacturing operations.

- Some of our portfolio companies in the auto component spaces were specifically impacted in FY20 by an unprecedented demand showdown in the auto sector coupled with higher capex investments in the recent years ahead of BSVI emission norms (effective from April 2020).

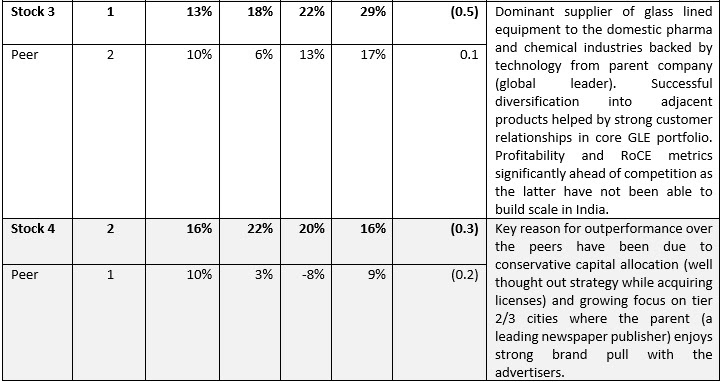

- The Financial Services stocks in our portfolio went in for conservative provisioning on account of the potential impact of Covid-19 on their loan book in 4QFY20.

However, the Little Champs continued to mitigate the above demand slowdown impacts on their earnings through cost control measures and conserving cash wherever required. As a result, on a weighted basis, the pre-tax RoCE of the portfolio remained 19% in FY20, significantly ahead of the cost of capital. Similarly, the portfolio continued to be net cash (0.1x equity) at March 2020-end.

Little Champs well placed for the years ahead

Our channel checks/recent management commentary suggest demand recovering quickly across a significant number of our portfolio companies:

1. Companies exposed to pharma, chemicals recovering very fast:

“We have an order backlog of Rs350 crores on April 1st which is 40% higher than previous year” – A leading supplier of process equipments to pharma/agro-chem industries (a portfolio company) in 4QFY20 results conference call;

“In the pharma industry, more and more intermediates that go into the API could be manufactured in India (shift from China). That can give good long-term growth to the industry”– Executive director of a raw material supplier to Pharma/Agro-chem industry (a portfolio company).

Our channel checks and recent management commentary from the results season suggest that pharma companies, agrochemicals and personal care industries have witnessed significant normalisation in the operations as the demand for these industries continue to be resilient. Hence a significant part of our portfolio (~21% weight) which cater to these end user industries (supply of intermediates, process equipments) is normalising much faster than others.

2. Channel checks and June monthly volume trends point towards a recovery in rural dominant automobile categories like two wheelers, tractors and – to some extent – small cars:

“Was able to clock nearly 60% of last year’s sales in the month of May 2020 which is quite credible given the absence of marriage season this year”– a leading Honda 2W dealer in Patna

“The dealerships (which have opened) attained nearly the pre-COVID level of bookings towards the end of May 2020” – Royal Enfield May 2020 volumes press release

“Retail inquiries, bookings are back at 80-85 per cent of pre-Covid levels” – Shashank Srivastava, ED, sales and marketing at Maruti Suzuki (Indian Express, July 2, 2020)

In June 2020, wholesale volumes of key two-wheeler players (Hero, Bajaj, HMSI, TVS, Royal Enfield amongst others) reached in excess of 60% of last year June’s sales after reporting nearly negligible sales in the month of April and May 2020. As per press articles, the sales could have been higher but for disruption in supply chains due to gradual ramp-up after reopening and impact on imports from China due to recent geopolitical issues. Similarly, Maruti Suzuki and Hyundai which together account for a bulk of small-compact car sales in India together witnessed a decline of 54% YoY in June wholesales indicating a significant sequential improvement compared to May 2020 levels. In fact, all the key tractor players witnessed strong positive growth during June 2020 indicating the robust sentiments in rural India. All the four auto component stocks (19% weight in our portfolio) in the portfolio are largely exposed to these vehicle categories which augurs well for the recovery in their earnings going forward as demand/production continue to normalise.

3. Some greenshoots in the Financial Services sector

While it may be still early days, but we also hear newsflow (from the media as well as from management of Financial Services companies) about more and more MSMEs opting out of the moratorium particularly in the southern part of India. Similarly, our checks also suggest that banks and NBFCs are starting to lend in sectors where they are gaining confidence about the recoverability of the loans – for instance, the tractor segment. Financial Services have a weight of 16% in the Little Champs portfolio.

An opportunity for Little Champs to further consolidate their market share

While some companies in the portfolio could see a recovery ahead of others depending upon the nature of their end user industry, one theme which we believe would benefit most of our portfolio companies is the opportunity to consolidate their market share from weaker peers.

Little Champs portfolio companies have generated weighted net earnings CAGR of 21% over FY14-19. This healthy earnings growth is during a period where the broader corporate earnings have been hard to come by (Nifty net earnings CAGR for the same period has been only 3%) marked by disruptive events like demonetisation, GST introduction and the economic slowdown. A key part of this earnings outperformance for Little Champs has been thanks to their superior RoCEs they have surplus cashflows which they have deployed into strengthening their franchises by investing in products/people/technology, expanding distribution networks and thereby gaining share from weaker peers.

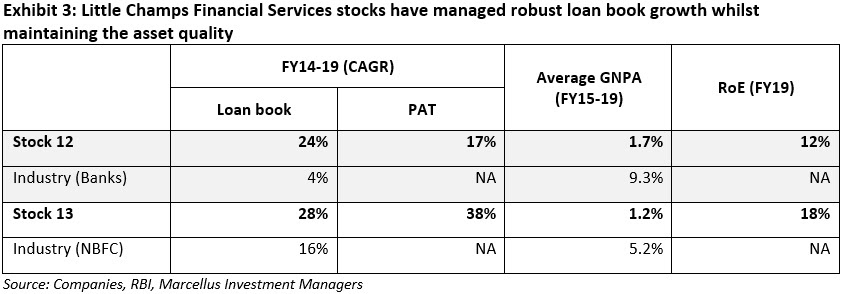

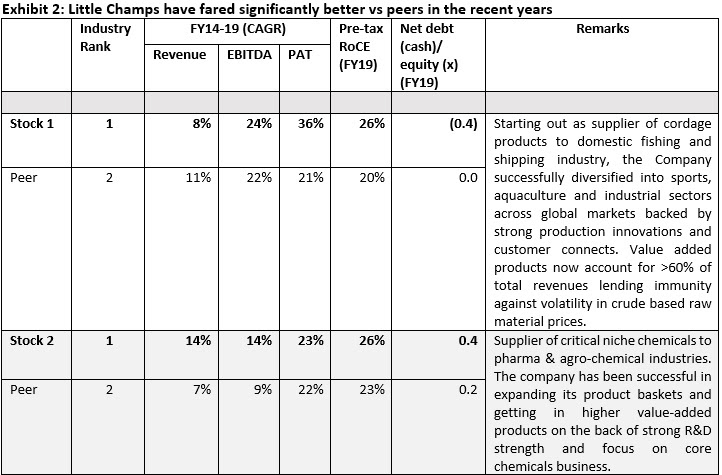

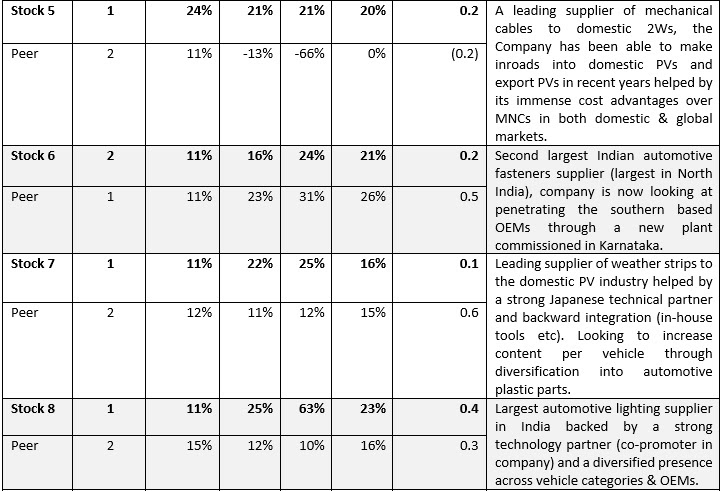

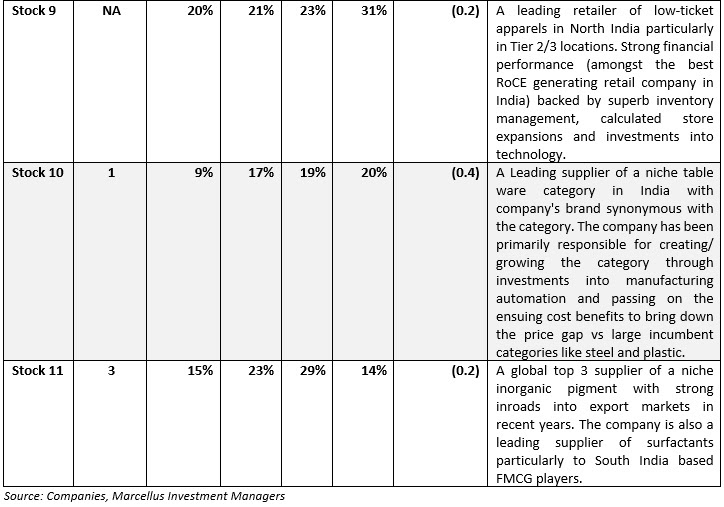

We compare and contrast Little Champs portfolio companies’ performance with their nearest peers in the respective sector over FY14-19 in the below table (most of the Little Champs’ peers are unlisted with FY20 numbers not reported so far and hence we cannot do a FY14-20 comparison as of now).

|

|