Every stock market crash causes a dislocation in a portfolio of high-quality companies, due to differential drawdowns in the share prices of constituent stocks. Rebalancing such a portfolio in the aftermath of the crash not only generates additional returns, it also crushes the risk of being left with uninvested cash. The biggest challenge faced by an investor while implementing this rebalancing is the test of conviction on fundamentals of some of the portfolio companies as they undergo significant drawdowns. In this newsletter, we: (a) highlight historical instances of such dislocations in the share prices of Marcellus’ CCP companies, and (b) quantify the enhancement of portfolio returns through rebalancing.

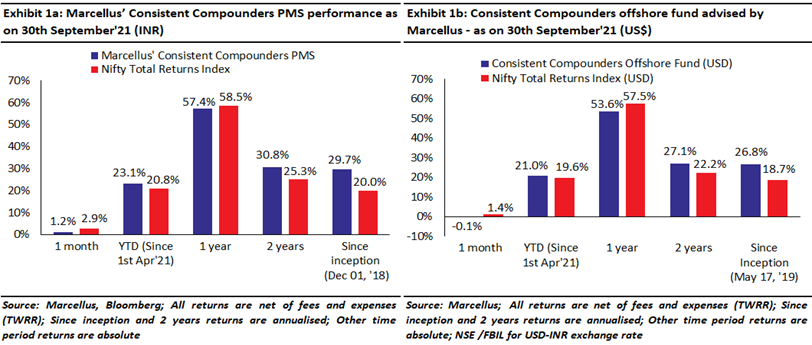

Performance update – as on 30th September 2021

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

‘How should an investor deal with the possibility of a stock market crash?” – Three available options for a portfolio of high-quality companies

‘How should an investor deal with the possibility of a stock market crash?” – Three available options for a portfolio of high-quality companies

We often face questions around ‘Given where stocks markets and valuations are, how do you plan to deal with a possible stock market crash’? As investors in portfolios of high-quality companies, we believe we have three options in front of us:

Preemptive timing:

Sit on cash in anticipation of a stock market crash, and deploy the cash at the bottom of the stock market crash.

Ride the tide:

Stay fully invested at all times since we can’t time the markets, and do nothing during the stock market crash.

Post-facto rebalancing:

Stay fully invested at all times, and rebalance the portfolio for position sizing dislocations caused by the differential in drawdowns across our portfolio constituents during the stock market crash.

At Marcellus, we do not follow the ‘Preemptive timing’ approach because neither can we predict the timing of a stock market crash, nor do we see all our portfolio companies falling with the market during a crash. As we had highlighted in exhibit 4 of our 1st September 2019 newsletter (click here – see exhibit 4), “Over the past 2 decades, in stock market crashes, stocks like Asian Paints and HDFC Bank have, more often than not, delivered positive and healthy returns. More importantly, in the few instances that these stocks have delivered negative returns during stock market crashes, their drawdowns have been smaller than that of the market, and the recovery has been sooner and sharper vs the market.” Hence, there are massive disadvantages of being left waiting for a stock market crash.

Instead, we follow the ‘Post-facto rebalancing’ option highlighted above – we stay fully invested at all times and rebalance our portfolio in two ways to benefit from a stock market crash. Firstly, after a crash, we rebalance the portfolio to increase our allocation to companies that have undergone high drawdowns (we finance this investment by shaving off our allocations to companies that have NOT undergone high drawdowns). Secondly, after the share prices of our portfolio companies have recovered, we again consider rebalancing the portfolio to sell some allocation in companies that have seen a sharper recovery than the rest of the portfolio. Such rebalancing is also carried out if share price dislocations happen without a broader stock market crash.

In this newsletter, we quantify the benefits of this ‘Post-facto rebalancing’ exercise by using both theoretical as well as practical examples, to see why there is no logical rationale for adopting the ‘Preemptive timing’ approach in a portfolio of high quality companies, even if an investor had some ability to time stock market crashes.

Quantifying the advantages of position sizing as a portfolio management tool to benefit from market dislocations

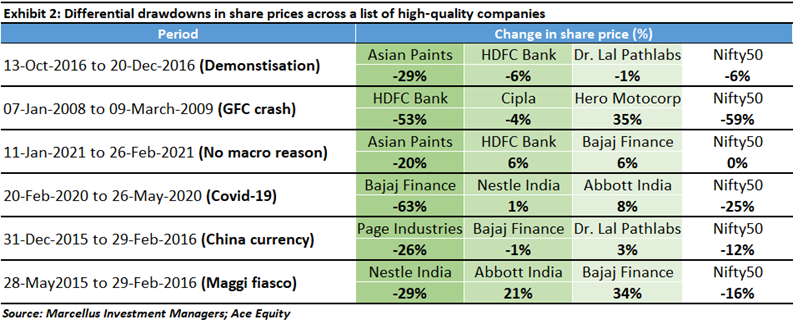

During every stock market crash, there are several instances of differential drawdowns in share prices across a list of high-quality companies. For example,

Covid-19:

During the stock market crash of March/April 2020, whilst Bajaj Finance fell by over 60%, Asian Paints and Nestle didn’t fall much, and Abbott went up by 6%!

Demonetisation:

During the demonetization related stock market crash of 2016, whilst Asian Paints fell by 26%, HDFC Bank and Abbott did not fall much!

Global financial crisis:

During the global financial crisis (2008-09), whilst HDFC Bank fell by 47%, other high quality stocks of that time – such as Cipla and Hero Motocorp – did not fall much!

This phenomenon of differential drawdown can also occur without a broader stock market crash. For instance, in Jan-Feb 2021, when Asian Paints fell by 26%, Bajaj Finance and HDFC Bank went up by 6%!

Provided the long-term fundamental growth prospects of a high-quality company have not changed, such differential drawdowns in share prices subsequently reverts to the long-term rate of compounding of fundamentals of these companies. Hence, this phenomenon often offers portfolio rebalancing opportunities for investors to benefit from.

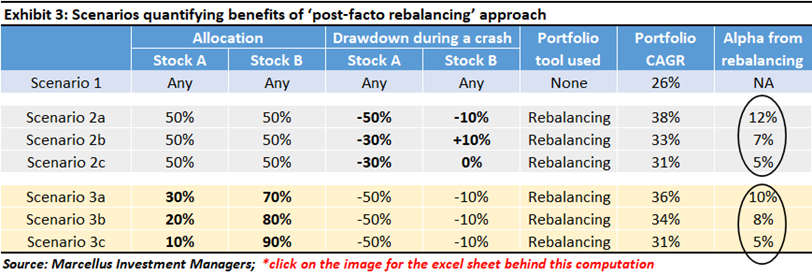

Let’s do a dummy computation to understand the quantum of benefit that ‘post-facto rebalancing’ can offer. Let’ say there are two stocks in a portfolio, Stock A and Stock B. Both stocks are equal in quality and growth prospects and hence each stock has 50% allocation in the portfolio. Over the long term, share prices of both stocks compound at the same rate – approx. 10x in 10 years / 2x in 3 years / 26% CAGR / 2% increase per month. However, whenever there is a stock market crash, let’s assume that:

Stock A undergoes a bigger drawdown compared to Stock B (quantified in different scenarios below); and

Stocks A and B fall during the month of the stock market crash (let’s call it the ‘drawdown month’), and both stocks fully recover from their share price falls over the subsequent four months

In such a portfolio, the following scenarios quantify the outcome of ‘post-facto rebalancing’ approach followed by an investor.

Scenario 1–‘ride the tide’:

If such a two-stock portfolio is left untouched over the long term (say 3 years or longer), then regardless of how many and how significant market crash events transpire over this period, the portfolio CAGR will be 26%. This is because if the two stocks deliver exactly the same share price CAGR over a 3-year period, and if the number of shares purchased for the two stocks remains unchanged throughout the 3-year period, then the portfolio CAGR for the entire 3-year period is not affected by the nature of volatility in share prices of the two stocks in the interim.

Scenario 2–‘post-facto rebalancing’ with 50%/10% drawdowns for Stock A/Stock B respectively, once every year:

Let’s assume that once every year, there is a stock market crash which leads to 50% drawdown in Stock A and 10% drawdown in Stock B. Let’s further assume that towards the end of the ‘drawdown month’, the portfolio manager rebalances allocations of the two stocks to 50% each, by selling shares of Stock B and using the sale proceeds to buy shares of Stock A. Lastly, after share prices of both the stocks have recovered over the next four months, the portfolio manager again rebalances allocations of the two stocks to 50% each by selling shares of Stock A (which has had a sharper recovery given the deeper drawdown) and using the sale proceeds to buy more shares of Stock B. Such a ‘post-facto rebalancing’ exercise results in the portfolio value compounding at a rate of 38% i.e. 12% points higher than that in scenario 1!

Scenario 3–‘post-facto rebalancing’ analysed in Scenario 2, but with 30% allocation to Stock A, and 70% allocation to Stock B (instead of 50:50) :

The analysis in scenario 2 above assumes 50% allocation to both stocks prior to a stock market crash, which led to one half of the portfolio undergoing a significantly greater degree of drawdown (50% drawdown) compared to the remaining half (10% drawdown). However, in certain market crashes, it could be that a smaller part of a high-quality portfolio undergoes a significant drawdown. For instance, in the March / April 2020 stock market crash, Marcellus’ CCP portfolio saw only the lenders in the portfolio (Bajaj Finance, HDFC Bank, Kotak) fall by around 50% when the rest of the portfolio saw less than 10% drawdown (including some part which went up during the crash). Hence, in Scenario 3, we assume 30% allocation to Stock A and 70% allocation to Stock B. In such a scenario, ‘post-facto rebalancing’ exercise results in the portfolio value compounding at a rate of 36% i.e. 10% points higher than that in scenario 1!

The exhibit below highlights more such variants of scenarios 2 and 3.

Practical example of ‘post-facto rebalancing’ carried out by Marcellus in CCP PMS:

The March / April 2020 stock market crash led to more than 60% drawdown in the share price of Bajaj Finance when other portfolio stocks like Nestle, Abbott India, Divis Labs delivered a minor positive share price return during the months of stock market crash. Our Research team’s analysis of the impact of the Pandemic on the company’s business suggested no change in our conviction levels on Bajaj Finance’s fundamentals relative to other stocks in the portfolio. Hence, we more than doubled the number of shares of Bajaj Finance in our clients’ portfolios in the month of May 2020, by shaving off certain small proportions of allocation in few stocks such as Nestle, Abbott India, etc. Over the past 15 months, as the recovery in share prices of various stocks in our portfolio has happened, we have continued to rebalance the portfolio by trimming some allocations in stocks which have had a steeper recovery than others in the portfolio.

Pros and cons of executing ‘post-facto rebalancing’ exercise

There are several benefits of the ‘post-facto rebalancing’ exercise: a) the investor is not left with uninvested cash if the stock market crash doesn’t occur as expected; b) the investor benefits from share price dislocations during the stock market crash, as highlighted in the scenarios above; and c) the investor crushes risk of timing entry-exits in the portfolio, because all portfolio actions are carried out post-facto and nothing is pre-emptive.

However, there is one significant challenge faced by investors in adopting this approach of rebalancing –the investor’s conviction on fundamentals of the portfolio companies gets tested while trimming the portfolio’s winners and investing in the portfolio’s weak performers. During the demonetization crash of 2016, Asian Paints’ share price fell more than other high quality stocks perhaps because the concern was that some part of the decorative paint demand in India was due to black money stashed in the wardrobes. Similarly, during the Covid-19 stock market crash of 2020, Bajaj Finance’s significant share price fall was caused by concerns around the impact of the pandemic on its unsecured lending book. Nestle India’s significant drawdown during the Maggi fiasco was due to concerns around long term impact of the crisis on Nestle’s overall product portfolio. In hindsight it seems obvious why investors should not have been worried about fundamentals of these companies during such times of crisis. However, it requires significant clarity of thought and conviction on fundamental strengths and weaknesses of the business to help make the right decision of either exiting from a company with weakening fundamentals or buying more of a company with strong fundamentals. Concepts such as ‘stop loss’ are a complete opposite of the rebalancing exercise highlighted above and are highly detrimental to the performance of a high-quality portfolio.

It is also worth highlighting that frequent rebalancing exercise carried out in a portfolio leads to significant transaction costs around brokerage, capital gains taxes, and also the risk of sitting on cash for the 2-3 days period between execution of a sell trade and buy trade (due to the time it takes for cash to be realized after a sell transaction is executed). Hence, at Marcellus, such rebalancing exercise is carried out only if the share price dislocation is greater than a certain tolerance band defined for the portfolio.

Investment implications: Benefit from your conviction on fundamentals rather than from luck of timing the stock market

With markets at all-time highs, several investors in portfolios of high-quality companies try to follow the ‘preemptive timing’ approach of sitting on cash. However, it is futile waiting for a stock market crash not only because of the uncertainty around the timing of such a crash, but also because the quantum of drawdowns of high quality stocks during a stock market is uncertain.

‘Post-facto rebalancing’ significantly lower the contribution of ‘luck’ while benefitting from a stock market crash. This is because the portfolio manager takes action to derive these benefits only after a share price fall has occurred and makes decisions purely based on conviction on fundamentals of portfolio companies during a crash (rather than on luck of timing entry and exits correctly).

It is also worth understanding that when it comes to equity investing, stock picking is not the only driver of portfolio returns. Portfolio management tools can significantly enhance the rewards and reduce the risks of a portfolio. Hence, just like portfolio concentration and position sizing, rebalancing of position sizes can be used as a tool to significantly benefit from share price dislocations within a portfolio on an ongoing basis. At Marcellus, we deploy several such portfolio management tools to enhance the risk-reward tradeoff of the overall portfolio.

If you want to read our other published material, please visit https://marcellus.in/

Copyright © 2021 Marcellus Investment Managers Pvt Ltd, All rights reserved.