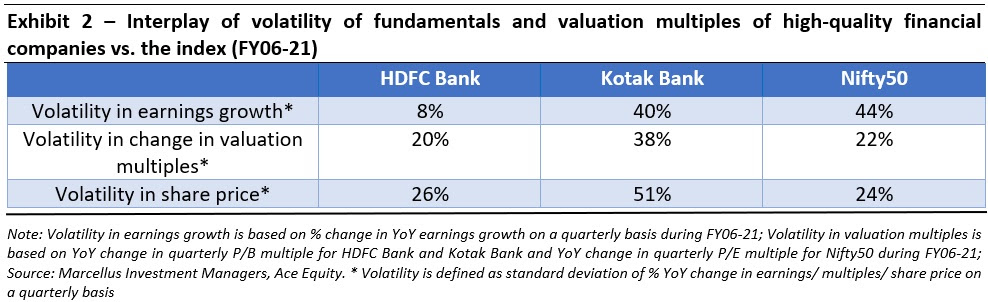

Easy access to information and incessant news flow around the economy, politics, Covid, Government policies and RBI regulations makes it difficult for investors to “do nothing” and hold on to high quality Financial Services companies. Data suggests that the impact of positive or negative news flow is further amplified in the case of Financials – the volatility in the valuation multiples of the Bank Nifty is ~1.5x of that of the Nifty. However, the impact of external newsflow on the fundamentals of a high-quality Financials company is much lower than what the change in P/B multiples suggest. For instance, since FY06 the volatility in the earnings growth of HDFC Bank is less than a fifth of that of the Nifty50; however, the volatility in its valuation multiples is similar to the Nifty50. This dichotomy of low volatility in fundamentals and high volatility in valuation multiples makes it essential for investors to build conviction in a concentrated portfolio of high-quality Financial Services companies which can be held for a long period of time [rather than building a sentiment/news flow driven high churn portfolio].

“One thing 50 years gives you the opportunity to do is to screw everything up every which way you can do it and then do it multiple times over and over again. And I would say it’s probably indisputable that the single biggest mistake we ever made as a firm was not buying more MasterCard on the day we bought it after the IPO. I think if you took a poll of our clients, very few of them would point to that. They would all have their episode of where we actually bought something, and it went down and it was an embarrassing result. What long-term ownership of great businesses teaches you over time is that every so often things can go right. And sometimes they can go really, really, right. And capturing a few of those situations over your career as an investor is just way more important than the overt mistakes that you make.” – John Harris, Managing Partner of Ruane, Cuniff & Goldfarb – an investor with a 50 year track record of running a highly concentrated equity portfolio. Click here to read the transcript of the complete interview.

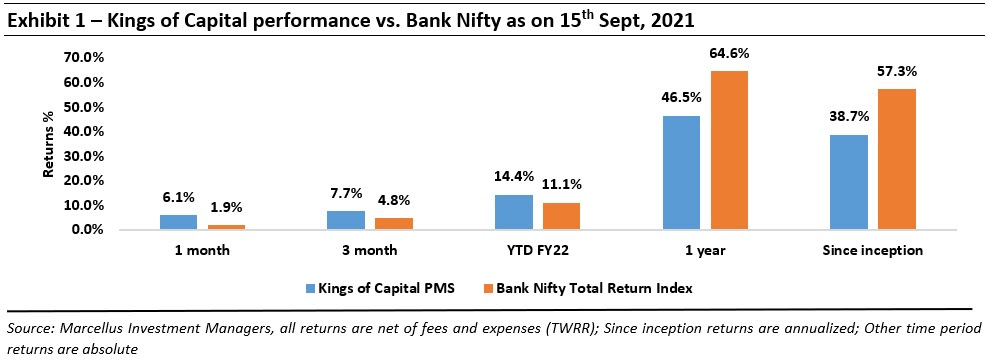

Performance update of the live fund

The key objective of our “Kings of Capital” Portfolio (KCP) is to own 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Volatility in fundamentals vs. volatility in share price

As we have discussed in our earlier newsletters, the share price of any stock is driven by two factors – (i) change in valuation multiples i.e. P/E or P/B multiple; and (ii) change in earnings per share (EPS) or book value per share (BVPS). The volatility of these two factors determines the volatility of the stock price.

- Volatility in fundamentals: High quality companies are able to consistently grow their profitability despite volatility in the external environment. We have therefore defined volatility in fundamentals as the volatility in the PAT growth of the companies/index. While Financials companies are linked to the macro economy, high quality Financial companies such as HDFC Bank and Kotak Bank have delivered lower volatility in fundamentals than the Nifty50 index over FY06-21.

- Volatility in valuation multiples: The inability of the stockmarket to reflect what impact newsflow will have on the fundamentals of a company leads to higher volatility in valuation multiples. Considering the fact that lenders are leveraged businesses which engage in complex financial transactions with hundreds of entities, it is difficult for the wider market to determine the impact of incremental newsflow on the fundamentals of these companies. This lack of clarity around how newsflow will impact the fundamentals of high-quality lenders leads the market to continuously underestimate the longevity and resilience of the better-quality businesses. This market inefficiency has been explained in the second part of this newsletter.

- Volatility in share prices: In a fully efficient market, companies with low volatility in their fundamentals should have low volatility in their share prices as well. However, as illustrated in Exhibit 2 below, this does not hold true for high quality Financial companies such as HDFC Bank and Kotak Bank. HDFC Bank and Kotak Bank have fundamentals which are less volatile than the Nifty but share prices which are more volatile than the Nifty. This makes it essential for investors to hold on to these high-quality Financial companies to benefit from the power of compounding over a long period of time.

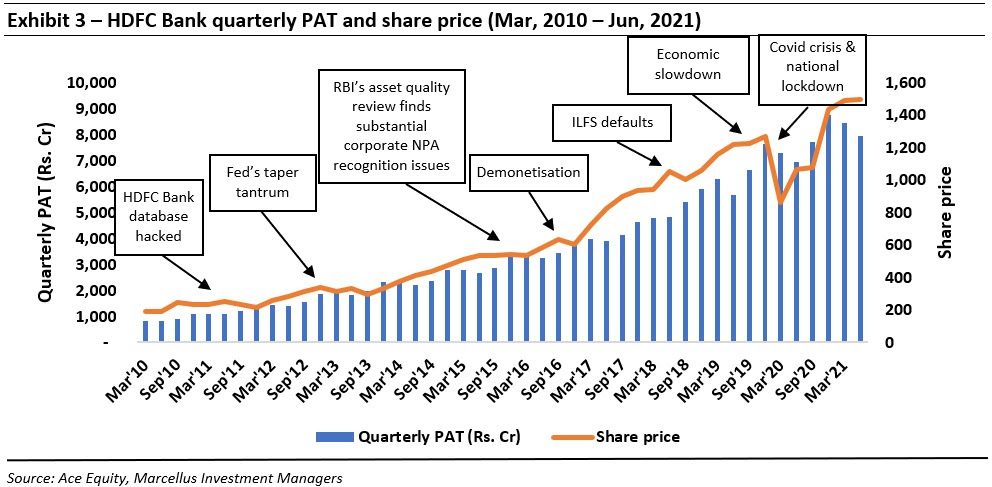

The HDFC Bank example

To illustrate the point around how newsflow continuously challenges the conviction of investors in Financial companies, we take the example of the various narratives around HDFC Bank over the past five years. - Nov 2016 narrative– Demonetisation will lead to high NPAs and as India’s GDP growth will come off, credit growth in the country will be subdued for the next couple of years.

- Fundamental performance– HDFC Bank delivered a 15% YoY PAT growth during the quarter ended Dec 2016 and 18% during the quarter ended Mar 2017.

- June 2017 narrative– HDFC Bank is trading at more than 4.5x P/B – one of the highest in a long period of time; hence the stock is bound to correct from here on.

- Fundamental performance– HDFC Bank reported 20% YoY PAT growth in the June 2017 quarter.

- Sep 2018 narrative– ILFS entities have defaulted on their borrowings and this is a systemic risk; HDFC Bank being one of the largest banks will have some exposure to entities related to ILFS.

- Fundamental performance– HDFC Bank reported 31% YoY PAT growth in the Sep 2018 quarter.

- 2019 narrative– NPAs are rising all around, economy is slowing down, most banks and NBFCs are in deep trouble. A Financial Services sector in such bad shape along with a slowing economy will eventually spell trouble for HDFC Bank.

- Fundamental performance– HDFC Bank grew its PAT at 20% during FY19.

- Feb, 2020 narrative– There is yet no clarity on who Aditya Puri’s successor will be. If Sashi Jagdishan is appointed the CEO, will other contenders leave the bank?

- Mar, 2020 narrative– The first wave of Covid strikes and HDFC Bank has the largest portfolio of unsecured loans amongst the large banks, this might lead to a severe deterioration in asset quality.

- Fundamental performance– In the quarter ending March, 2021 HDFC Bank delivered 16% YoY PAT growth after making upfront Covid provisions.

- May, 2020 narrative– The initial 21 day lockdown is extended for a longer period of time, this should hamper not only the retail asset quality now but all parts of HDFC Banks’ loan book now especially given it was the fastest growing bank over the past few years. Also, one of the largest international research firms has given a sell rating on HDFC Bank due to risks in its unsecured book.

- Fundamental performance– In the quarter ending Jun, 2020 HDFC Bank delivered 22% YoY PAT growth.

- Jul, 2020 narrative– Aditya Puri sells off his stake in HDFC Bank and it coincides with improper lending practices and conflict of interest in HDFC Banks’ vehicle financing business. Are these two issues interlinked, is there a large NPA recognition on the anvil?

- Aug, 2020 narrative– Berkshire Hathaway is selling banking stocks and buying a gold mining company instead. If the worlds’ greatest investor is selling banking stocks, surely it must be the worst time to invest in banks.

- Fundamental performance– In the quarter ending Sep, 2020 HDFC Bank delivered 16% YoY PAT growth.

- Dec, 2020 narrative– RBI bans HDFC Bank from issuing new credit cards, it is the most profitable and highest RoE generating business of the bank. What if the credit card ban is not lifted for a long period of time, are there other issues which RBI might have spotted and will it impose further penalties on HDFC Bank?

- Fundamental performance– In the quarter ended Dec, 2020 HDFC Bank delivered 15% YoY PAT growth.

- Apr, 2021 narrative– Covid second wave strikes and the RBI credit card ban is still not lifted, there will be a further impact on growth and profitability.

- Fundamental performance– In the quarter ended June, 2021 HDFC Bank delivered 14% YoY PAT growth after making further provisions for the second Covid wave.

Despite the newsflow and apprehensions above, HDFC Bank has delivered a PAT CAGR of 20% during FY16-21. If shareholders of a well-established financial firm like HDFC Bank have gone through such a journey over the past few years, the list of such apprehensions will be even longer for smaller, less known Financials firms. Hence, as described in our August 2021 newsletter (click here to read), while the Kings of Capital portfolio companies have delivered consistent fundamentals over the past decade, the journey of holding on to these high quality companies for long periods of time will continue to be filled with apprehensions and negative newsflow. However, the right thing to do on most of these occasions might be to “do nothing”.

Note: HDFC Bank is a part of most Marcellus’ client’s portfolios.

Regards

Team Marcellus