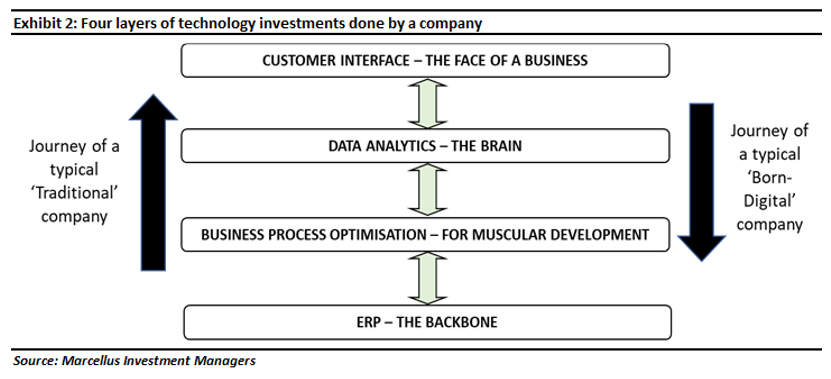

As technology adoption becomes ubiquitous, the competitive advantages of winning businesses will be determined by their quality of capital allocation across four distinct layers – Enterprise Resource Planning or ERP (backbone), operational optimization (muscles), data analytics (brain) and customer interface (face). While a traditional business begins its tech investment journey from the first layer (ERP) and progresses towards the last layer (customer interface), the journey of a ‘born-digital’ company around tech investments begins with the last layer and aims to progress towards the first layer. Regardless of the direction followed in this journey, timely investments across all four layers are essential for building sustainable moats. In this newsletter, we give examples of how CCP companies are investing in technology to deepen existing business moats and radically transform their businesses to disrupt their competitors.

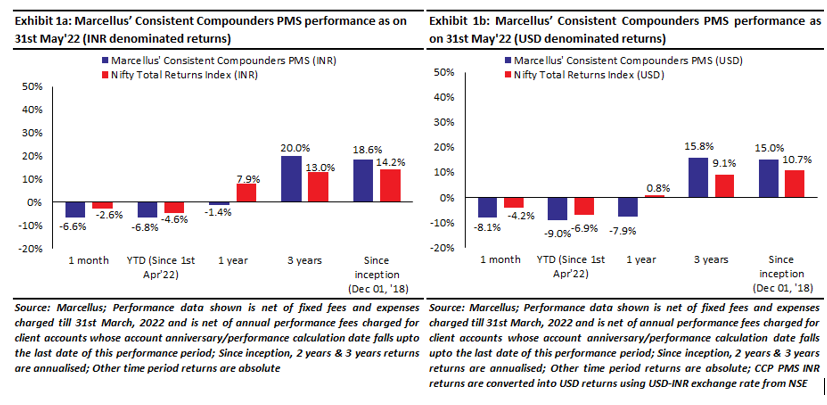

Performance update – as on 31st May’2022

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS portfolio is shown in the charts below.

Tech capex is increasingly replacing traditional capex in India

In our 30th April blog (link) titled India’s Capex Moves From Stability to Growth, we had quantified that one quarter of the total capex (capital expenditure) in India is being driven by rising technology capex: “India Inc’s spends on investing in intangible assets have grown at 15% CAGR over the past 6 years compared to only 7% CAGR in its spends on tangible assets. According to data from the CMIE, ongoing IT projects amount to 1.2% of all live projects in the country, and their CAGR from 2019 to 2021 has been around 16% p.a.”

The evolution of technology over the last two decades has radically changed the dynamics of various industries and hence the nature of competitive advantages of businesses that operate in these industries. There are two distinct ways in which companies are approaching this situation:

-

Born-digital companies:

These companies started life as online / digital / technology businesses at some stage over the last two decades. Since then they have acquired customers through capabilities built around digital attributes such as offering convenience through superior online customer interface, use of new technologies like Artificial Intelligence and Machine Learning to offer personalized recommendations, or superior visualization (3D visualization/ AR/ VR).

-

Traditional businesses attempting digital transformation:

These companies are ‘incumbents’ who have built their competitive advantages historically around executing physical-but-challenging aspects of businesses such as logistics, manufacturing, supply chain, and distribution at scale. Particularly over the last two years of the Covid-19 pandemic, the lockdowns have led to two disruptive outcomes. Firstly, the adoption of technology within the ecosystems of various businesses has accelerated – be it the consumer’s acceptance of the tech interface, or the raw material vendor’s adoption of systems and processes for working capital cycle management. Secondly, few businesses have treated the last two years as an opportune time to radically overhaul their business models around ‘new-age technology’ to help strengthen or redefine their competitive advantages.

Framework to analyse technology investments carried out by traditional companies vs born-digital companies

“Amidst the incessant drumbeat of digital transformation, too many leaders overlook and under-appreciate the traditional competencies of physical incumbents – things like logistics, manufacturing, customer service, and quality control. The rigid dichotomy between digital and physical is not only over-done, but dangerous to companies trying to succeed.” – quote from the book ‘The Brains and Brawn Company: How Leading Organizations Blend the Best of Digital and Physical’ (2021) by Robert Siegel. In this book the author concludes that today’s true competitive advantage for high quality firms is in marrying digital innovation (referred to as ‘brain’) with traditional business operations (referred to as ‘brawn’).

Based on our discussions with management teams and industry experts, we understand that there are four layers of tech investments that are needed for a business to build and sustain tech oriented competitive advantages.

-

Enterprise Resource Planning – The backbone:

ERP is the backbone of a business which helps synchronise and link various functions across the entire operations of a company. As the business scales up across geographies and the number of stakeholders increases, ERP tools help break silos and better coordinate the functioning of various parts of an organization – such as manufacturing, warehousing, logistics, sales, etc.

-

Business process optimisation tools – For muscular development:

These tools help execute business processes at the ground level in an efficient manner. They could help reduce working capital cycles and improve asset turnover (sweating of assets harder) through automation / production planning / raw material procurement planning etc. One of the best examples of such optimization tools is supply chain planning software – such as those offered by companies like O9 or BlueYonder.

-

Data analytics – the brain:

Data analytics benefits in two ways. Firstly, it helps in improving customer delight by offering personalization or in doing more sharper marketing to exploit cross-sell opportunities. Secondly, the use of data analytics also helps to develop better understanding of consumer preferences to deliver the right product at the right time thereby reducing slow moving inventory.

-

Customer interface – The face of a business:

This is the interface that the customer uses to interact with the products or services of a company This includes the website / mobile application / omni channel infrastructure at the point-of-sale.

Although both types of companies cater to the same end consumer in the same industry, differences in context and priorities leads to completely opposite chronological order of tech investments by born-digital companies vs traditional businesses.

Mindset of traditional companies –

The mental conditioning of the firms who have already mastered the physical attributes and have an existing traditional customer base – is to first use technology to drive incremental operational efficiencies then go for aggressive ‘new-age’ customer acquisition. This explains why investments by traditional businesses are first made around ERP or Optimisation tools for Supply Chain Planning or Plant/ Warehouse Automation or in-house Logistics platforms and only later-on in customer-facing digital attributes.

On the other hand, the mindset of a born-digital firm is to first acquire a customer base before attempting operational efficiencies and cash generation. Hence, these firms start their tech investment journey through a high-quality customer interface (website / app) and spend heavily on marketing to acquire customers. Naturally, as a digital first firm gets lots of data from online channels by directly interacting with the customer, the natural progression for these firms is use this data to personalize or cross-sell. Initially, the focus is to acquire customers rapidly by using funds raised from private equity or venture capitalists. The implementation of scalable ERP solutions like SAP is usually the final step in evolution of any new age firm as most start their lives using basic tools like Zoho books or Tally.

Eventually, for a business to build sustainable competitive advantages through technology investments, the journey across all four layers has to be completed and nurtured over time, regardless of whether the business is born-digital or traditional.

The biggest challenge in tech investments is the lack of timely investments in tech across the four layers highlighted in Exhibit 2 above. Traditional businesses delay their investments customer interface and data analytics typically due to the time and effort it takes to change their mindset towards tech-based front-end execution. ‘Born-digital’ businesses delay their investments in ERP and business process optimization due to lack of availability of enough external capital to fund growth during the long time that is required to invest and derive operating efficiencies in business processes.

Investment implications – acceleration in tech investments for CCP companies over the past few years

Most of our investee companies follow the ‘bottom-up’ approach through the four layers of tech investments highlighted in Exhibit 2. After building strong competitive advantages around physical attributes relevant for the offline world, most of the CCP companies are now well on their way to building digital attributes.

There are two separate dimensions along which we have seen CCP companies being agile and awake to the need for tech investments:

Dimension 1 – Operating efficiencies to accelerate free cashflow generation:

As highlighted in our Nov’20 CCP newsletter (link) , over the last 5 years, 10 years and 15 years, the free cash flows of our portfolio companies have consistently compounded at 6-7% higher CAGR compared to their earnings (profit after tax) growth. This is entirely due to their ability to use tech investments in ERP and operational excellence to compress working capital cycles and expand asset turnovers. For example:

Asian Paints

is an example of a firm which has made extensive investments in ERP, Demand forecasting, Production Planning, Plant automation, Warehouse automation, Logistics Optimisation & Distribution over the years to generate operating efficiencies. Asian Paints first invested in SAP in the year 2000 when it was a Rs1,000 crores revenue company. Asian Paints is one of the few companies we know which invested in a Supply Chain tool by i2 technologies (today known as BlueYonder) more than two decades, even before it got an ERP. This obsession with supply chain efficiencies has always been part of Asian Paints’ capital allocation decision making. Over FY99 to FY09, Asian Paints cash conversion cycle fell from ~85 days to ~40 days thanks to the investments in i2 and ERP made over 1999-2000.

Page Industries

first invested in ERP when it the year 2008 when it was a Rs 200 crores revenue company. While there have been multiple upgrades to the first version of ERP, proactive investments in applying tech to internal systems & processes have helped Page grow without compromising on efficiency. Page Industries invested in RFID technology more than a decade ago with a system called GSD (Global Sewing Data) to identify areas of inefficiency in its labour workforce and provide relevant training to enhance their productivity levels. As a result, between 2011 and 2016, Page’s volume of production per unit labour employed increased consistently at 4% CAGR.

Dimension 2 – Incremental tech investments to benefit from Covid-19 related challenges:

Several firms in our portfolio either have radically transformed their business models from traditional to ‘new-age’ (e.g. Asian Paints’ Home Décor foray or Bajaj Finance becoming a fintech company) or have automated their manufacturing plants and supply chains to almost double their distribution reach across the length and breadth of the country (e.g. Page Industries, Pidilite and Asian Paints). Here are some examples:

Over the past three years, Page Industries has transformed its IT infrastructure and its systems and processes across all its functions to create a seamless & automated supply chain. Page’s FY21 annual report talks of the following benefits of BlueYonder: “With this, our agility and nimbleness in various areas of demand forecasting, customer responsiveness, improved fulfilment, productivity improvement, cost improvement and inventory optimization shall be a reality”. As a result of such investments, Page Industries has doubled the number of multi-brand outlets it services in its distribution channel from 55,000 in March 2020 to over 110,000 in March 2022.

Over the last 3 years, Asian Paints has accelerated investments in a platform for end consumers to avail ‘Painting Services’ which will be delivered through its vast network of dealers & empanelled painters. Not only does this service offer the convenience & trust of a branded service to customers, it also improves dealer captivity by offering dealers a chance to earn higher margins (by providing extra services to customers) thereby strengthening its core business.

Asian Paints is also foraying into the ‘Home Décor’ space through its network of 30 Beautiful Homes stores and Home Décor service which is currently offered in the top 8 cities. The Beautiful Homes stores offer a ‘digital’ element to customers through its state-of-the-art 3D visualization platform along with touch & feel aspect for all home décor products under one roof. Home Décor service is a customised ‘design to execution’ service offered as a form of convenience in the top 8 cities where the firm has partnered with multiple designers, architects, and end-delivery contractors to offer end-to-end services – from personalised interior design to professional execution – by leveraging its core strength of dealer network and contractors. Compared to ‘born-digital’ companies like Livspace and Home Lane, Asian Paints’ Home Décor offerings are wider, more customizable and backward integrated to help generate profitability.

Another example is of Titan which accelerated its ‘bottom-up’ journey in an inorganic manner through the acquisition of a majority stake in Caratlane over the last 3 years. Caratlane was started online and hence has built much superior ‘digital’ skills than Titan in terms of offering personalization to customers or offering virtual try-on and video commerce. Although acquiring Caratlane to learn digital attributes might not be the intent, Titan has benefitted immensely from Caratlane to accelerate its own ‘digital’ journey.

Bajaj Finance’s

(BAF) biggest strength is use of its proprietary consumer data to selectively target borrowers with higher credit quality, who might not have already got a substantially high rating on the commonly available credit rating agencies’ databases. Our KCP newsletter dated 17th July’21 (link) highlights “Out of BAF’s 49 million customers, 27 million customers are its best customers with whom BAF is willing to do business. BAF has another 90 million prospects that they are willing to do business with today and who in general have 80-90% approval rate. The digital infrastructure under business transformation 2.0 is being built to tap these 117 (90+27) million Indians who Bajaj Finance want to do business with. While BAF’s loan book size is only Rs 1.5 lac crores, the 27 million good quality customers have Rs. 6 to 7 lac crores of outstanding credit in India’s lending sector (in addition to the amount outstanding with BAF) thus providing significant headroom to mine wallet share of existing customers.”

The biggest advantage that Bajaj Finance has relatively to the multiple fintech’s who operate in a similar space is the cost of customer acquisition. While most other fintech players which spend large amounts of money on customer acquisition and make money on the customer only after the customer transacts with them 2-3 times, Bajaj Finance acquires customers through its consumer durable financing business and rather than spending money on customer acquisition it makes money the first time a customer transacts with BAF. BAF’s app has already seen 14 million downloads of which there are 8 million active users

It is worth noting that historically whenever some of our portfolio companies have had long phases of low or no capex towards technology their fundamentals have suffered adverse consequences. For example, as highlighted in our April’22 CCP newsletter (link), “Supporting the strong growth rates was the widening of its product portfolio, initially from men’s innerwear to women’s innerwear, and subsequently from innerwear to outerwear and loungewear. However, behind the scenes, the firm didn’t invest adequately enough in technology, systems & processes around its distribution and supply chain over the period 2014-2018. Our research carried out until FY19 did not pick up this lack of tech investments and hence the risk of operating inefficiencies in a business which was fast expanding its range of SKUs. This risk played out after GST introduction as working capital of the channel was adversely impacted and Page couldn’t resolve such challenges faced by their dealers and distributors. To make matters worse, some new competitors also capitalised on the opportunity to expand their distribution network by targeting disgruntled channel partners of Page Industries. By the time we became aware of the root cause of the problem (inadequate capital allocation towards systems and processes), the firm’s fundamental growth rates had started moderating significantly – 9% average annual revenue growth reported over the next six quarters (from 2QFY19 to 3QFY20)”

Very few ‘born-digital’ firms have been able to successfully complete their ‘top-down’ journey across the four layers of tech investments highlighted in Exhibit 2 above. This is because the learning curve behind physical attributes is very long and cannot be replicated overnight. Last, but not the least, recent newsflow around the crunch in private funding (read here the advice by Sequoia to its investee companies: link) could further reduce aggressive competitive intensity for our investee companies over the next few years.