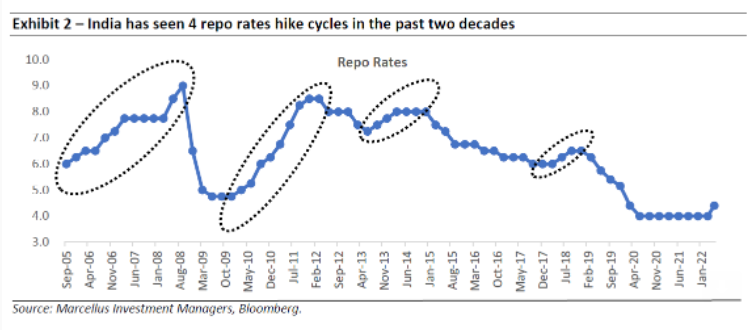

Even after the RBI’s 40bps repo rate hike on 4th May 2022, repo rates are still 70bps below pre-Covid levels while inflation is trending well above pre-Covid levels. Hence we expect interest rates to rise further over the next few quarters. During three of the four rising interest cycles over the past two decades, the Bank Nifty has outperformed the Nifty with large CASA backed private banks further outperforming the Bank Nifty during these cycles. We expect: (i) banks with strong CASA franchisees and good risk management to see an improvement in net interest margins (NIMs) alongside steady asset quality; and (ii) improved profitability for insurers as they make higher investment income on their float, leading to higher RoEs. Unlike banks and insurers, NBFCs do not see any benefit in absolute terms from interest rate hikes. However, NBFCs with good parentage and well-matched ALM have a significant competitive advantage over other NBFCs in a rising interest rate environment. Overall, the Kings of Capital portfolio is well placed to thrive in a rising interest rate environment.

Performance update of the live fund

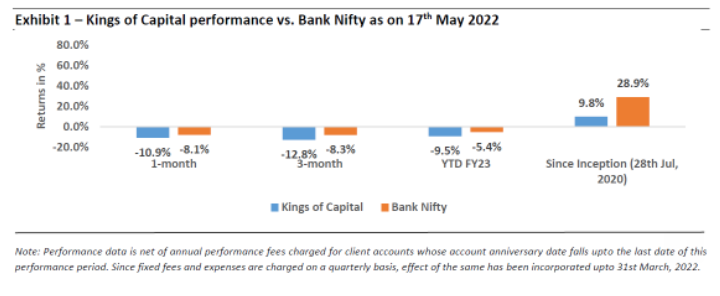

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

India has seen 4 rate hike cycles during the last 2 decades

- Dec-05 to Sep-08: The repo rate was hiked from 6.25% to 9%.

- Feb-10 to Mar-12: The repo rate was hiked from 4.75% to 8.5%. It touched 8.5% in Oct-11 and then was kept constant until Mar’12.

- Jun-13 to Dec-14: The repo rate was hiked from 7.25% to 8%. It touched 8% in Mar-14 and then was kept constant until Dec’14.

- May-18 to Jan-19: The repo rate was hiked from 6% to 6.5%. The repo rate touched 6.5% in Aug-18 and then was kept constant until Jan’19.

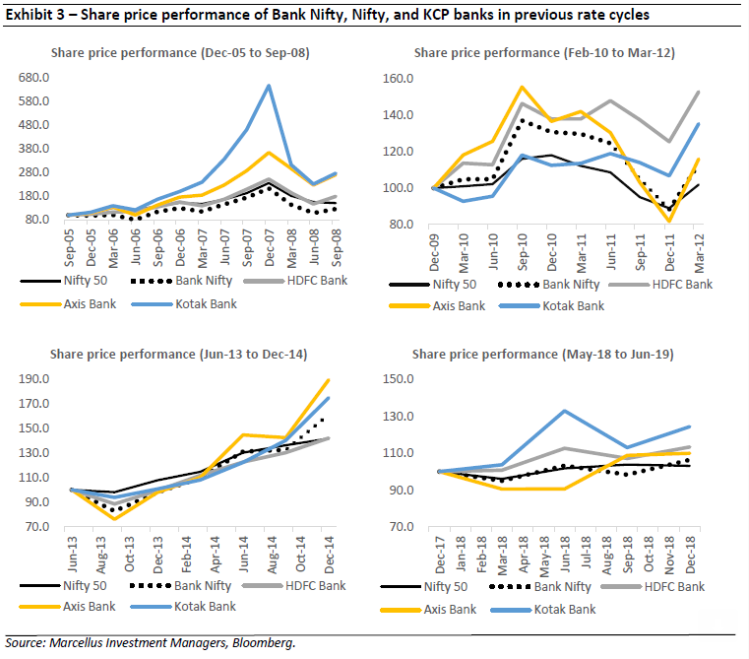

Performance of banks during rising interest rate cycles

As illustrated in Exhibit 3 below, during 3 out of the 4 rising interest rate cycles, the Bank Nifty has outperformed the Nifty. High quality lenders have further outperformed the Bank Nifty during these periods.

Private lenders better placed vs. state owned banks:

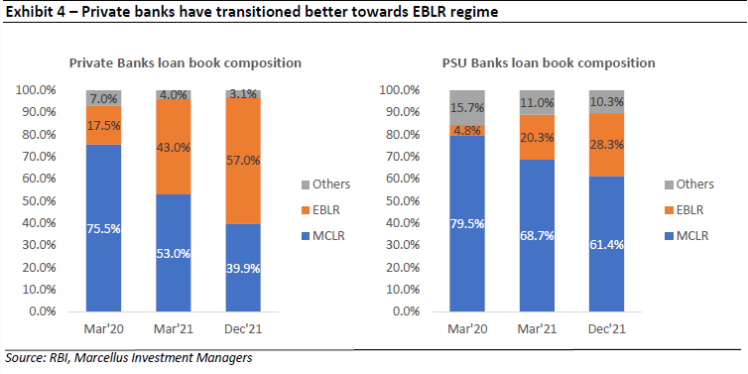

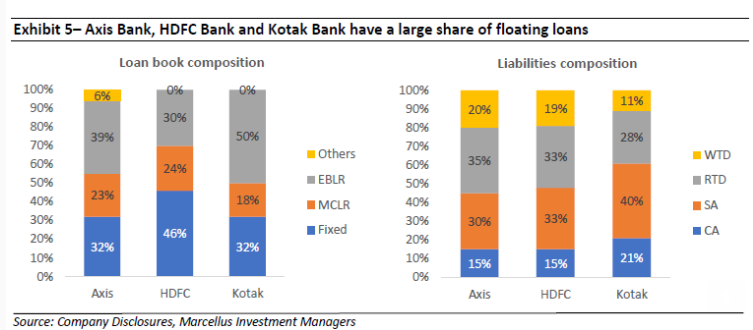

• Over the years, the Indian banking industry has seen a transition from a base rate regime to MCLR (Marginal Cost of Lending rate) regime and now to an EBLR (External benchmark linked rate) regime. Loans linked to external benchmarks are largely linked to the repo rate or T-Bills. In EBLR, since rates are linked to repo rate, as soon as the RBI raises rate, interest rate on loans which are linked to EBLR increases while the funding costs (interest rates on deposits) increase with a considerable lag, leading to higher spreads and NIMs for banks.

• As the current rate hikes and liquidity management by the RBI is being effected through the repo rate, banks with a larger proportion of EBLR linked loans will benefit the most. On the other hand, rates for MCLR based loans are dependent on operating costs for the bank, the marginal cost of funds, the negative carry due to the Cash Reserve Ratio (which the banks have to keep with the RBI and on which they get low returns) and the cost of equity for the bank. Hence, MCLR is expected to move upwards with a lag and is not solely dependent on the repo rate.

• Share of EBLR loans for private banks stood at 57% as of Dec’21 (from 43%/17.5% in Mar’21/Mar’20) while that for public sector (PSU) banks was at 28.3% in Dec’21 (vs. 20.3%/ 4.8% in Mar’21/Mar’20). Hence private sector banks are better placed than PSU banks to benefit from rising rates.

Analyzing the impact on rising interest rates on KCP stocks – banks, NBFCs and insurers

We believe large private banks will be the largest beneficiaries of the rising interest rate cycle. These banks have stronger CASA franchisees (SA rates are generally the last to get repriced higher) and have a high share of floating loans (which are the first to get repriced higher). Both of these factors will allow net interest margins to expand over the next few quarters.

• HDFC Bank: Whilst 46% of the book on fixed rates is higher than other peer banks, HDFC Bank runs a large part (15.7%) of its book in high yielding fixed rated loans – personal loans and credit cards – which due to their shorter duration can be repriced by the bank. Hence the share of fixed rated loans optically looks higher for HDFC Bank.

• Kotak Bank: Kotak is relatively better placed amongst the large banks in a rising interest rate environment with an industry leading CASA ratio (~60%) and ~70% share of floating rate loans. Additionally, within the fixed rate loans – ~15% of the loans have tenure of less than a year, giving Kotak significant ability to reprice the book higher.

• Axis Bank: Axis Bank is well placed for the rate hike cycle, with 39% of the assets on EBLR and total ~62% of assets on floating rate. On the liabilities side, the bank has seen CASA ratio inching up to ~45% with more gains expected from the Citibank retail portfolio acquisition. Axis Bank’s NIMs are expected to improve in the interest rate cycle.

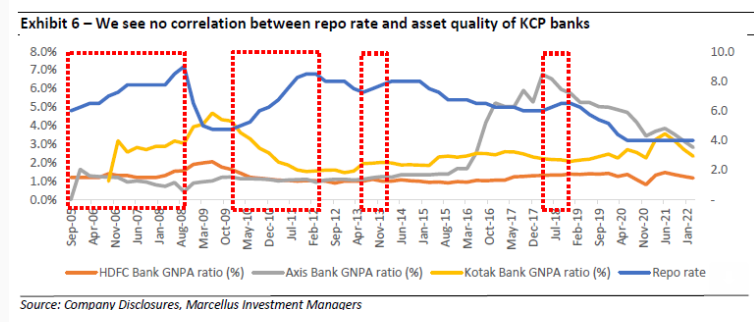

One concern during a rising interest rate cycle is that NPAs could potentially increase for lenders as the EMI outflow of borrowers increase. However, for high quality banks we have historically not seen any correlation between NPAs and interest rates. Well run banks where risk management capabilities are well established have showcased steady asset quality across cycles.

Non-Banking Financial Companies:

Bajaj Finance (BAF)

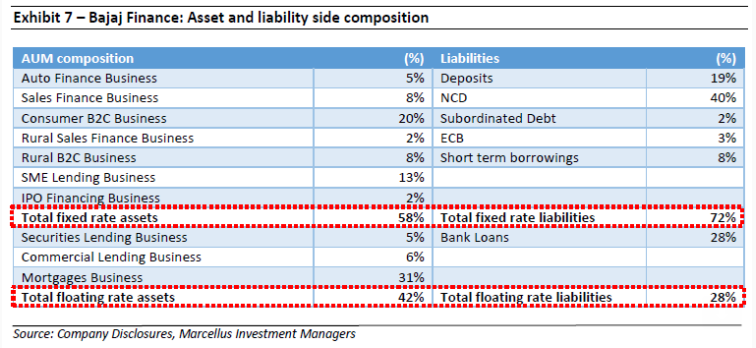

• We don’t see any material challenge for Bajaj Finance in a rising interest rate cycle. The company has 28% of its liabilities on floating rate but it has a higher share (42%) of its assets on floating rate which will allow for easy transmission of an increase in rates to its customers.

• Additionally, BAF has 8% of its liabilities in short term borrowings which will have to be raised again in the near term (as the borrowings mature). Even if we were to adjust for that, shorter tenure liabilities and floating rate loans put together (at 36%) will still be lower than (42%) of the assets on floating rates.

• Over the past year when long term rates were low, BAF raised more than Rs ~5,000 crores of 10-year duration funds. This is more than the cumulative amount of 10-year money BAF has raised in the past 14 years.

• BAF’s short duration book, the Bajaj group’s parentage, BAF’s healthy NIMs of 8%+, its capital adequacy of 27% and its demonstrated ability to raise liabilities during previous crises such as the Covid and ILFS crisis makes it one of the most well placed NBFCs during the rising interest rate cycle.

Chola Investment and Finance Co. (CIFC)

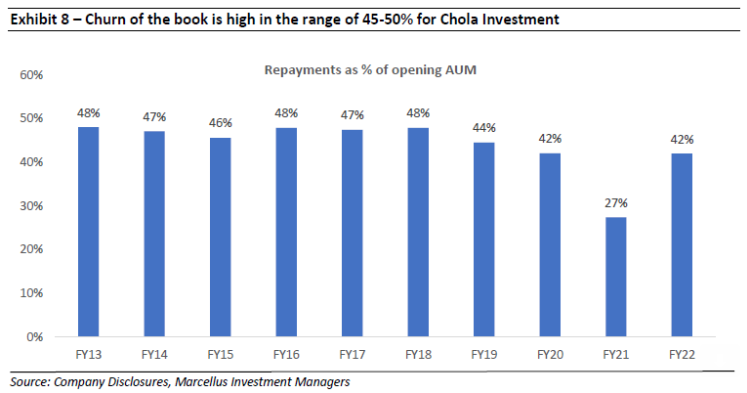

• CIFC may see some margin moderation in the initial period of a rising rate cycle as vehicle loans are fixed rate loans while its liabilities are on a floating rate.

• However, run-off (repayments as % of opening AUM) of the existing book is quick in this business, allowing the company to reprice the asset side higher and improve margins.

• Similar to BAF, Chola’s long standing group parentage, shorter duration book, healthy NIMs of 7%+ and demonstrated ability to raise liabilities during previous crises gives us conviction around its ability to manage the rising interest rate cycle.

Affordable Housing Finance companies:

• Amongst the AHFCs, both Aavas Financiers (Aavas) and Home First Finance (HFFC) have loan books dominated by retail home loans with an average ticket size of ~Rs. 1Mn (Rs 10 lakhs).

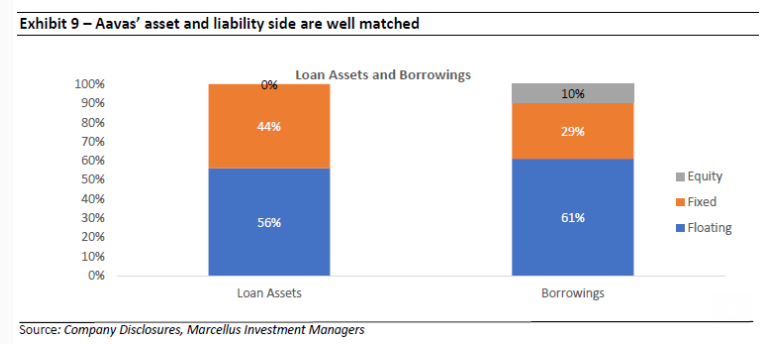

• Aavas: The fixed rate loan book is backed by fixed rate liabilities and equity, while floating rate assets are backed by floating rate liabilities thus posing limited margin dilution risk. In fact, Aavas has already raised its prime lending rate by 25 bps effective 5th June’22.

• Home First: Majority of the book is on floating rate assets backed by floating rate liabilities. A limited part of the book is on fixed rate which is backed by fixed rate liabilities from NHB posing limited risks to margins. Hence, interest rate risks are immaterial for HFFC.

• Moreover, both Aavas and HFFC have a well-diversified liability side with comfortable ALM position and high capital adequacy ratios (50%+). Both the lenders have average tenure of borrowings largely matched with the behavioral tenure of assets and have no exposure to short term borrowings (such as CPs).

• Both companies have enough sources of raising liquidity through NCDs, banks (both PSU and Private), Direct Assignment (from both PSU and Top private Banks), DFIs (specifically for Aavas) and NHB. In fact, HDFC Bank’s first Direct Assignment (DA) transaction in housing loans (other than with HDFC Limited) was with HFFC.

Insurers

• ICICI Lombard: General insurers in India make negligible money on underwriting. The majority of their profits are generated out of investment income and hence, an increase in investment yield is likely to be beneficial for profitability of well-run general insurers. Our calculations suggest that every 25 bps increase in investment yields leads to a 4% increase in the PAT estimates of the company. Additionally, irrational pricing from players who are not focused on profitability can reduce as in a rising interest rates environment showing a path to profitability even for new age players.

• HDFC Life: Life Insurance products are long dated products where companies earn large sums of money on float. A rising interest rate environment generally works in favor of Life Insurance companies as margins on the new business (especially in protection products) is expected to increase with higher investment yields. There is a likely ~2% negative impact on Embedded Value (EV) because of higher discounting rates and the mark-to-market impact on the bond portfolio. However, the improvement in the margin profile on the incremental business is expected to be a larger long term positive for the business.

Changes to the Kings of Capital portfolio: replacing AU SFB with Home First Finance Company (HFFC)

Home First Finance Company (HFFC): HFFC is a technology-driven affordable housing finance company with AUM of Rs 50 bn+. The company targets first-time home buyers in low and middle-income groups. Home First specializes in leveraging technology in various facets of its business such as processing loan applications, managing customer experience and risk management. The firm’s loans cater mostly to the salaried segment (~73% of AUM) and Home First has a well spread-out business mix across 11 states. The company’s AUM has grown at ~50% CAGR over the last 5 years, while spreads have improved over the years and credit costs have been well under control. HFFC’s GNPAs have remained under control (at below 2% levels) over the last five years. We expect the company to post strong AUM and earnings growth, while return ratios are likely to be on an improving trajectory. Currently, True North holds an ~20% stake in the company and GIC (of Singapore) holds ~13%. Both of these investors are designated as Promoters. Additionally, Warburg Pincus holds 29% in the company and Bessemer Venture Partners owns ~8%. HFFC has a higher longevity score than AU Small Finance Bank resulting in the exit of AU SFB from the Kings of Capital Portfolio. Click here to read our detailed note on how Marcellus’ Longevity Framework works.

Note: Change in repo rate has no direct financial impact on Info Edge and ICICI Securities. Hence, we have not discussed these stocks in this note.

Note: HDFC Bank, Kotak Bank, Axis Bank, Bajaj Finance, CIFC, Aavas Financiers, Home First Finance, HDFC Life and ICICI Lombard are part of many of Marcellus’ portfolios.