The Rising Giants portfolio companies’ track record of sustaining healthy fundamental performance from FY12-21 despite several macro challenges gives us enormous confidence about the portfolio companies’ prospects. The earnings performance of these firms in FY22 (median portfolio PBT up 23% YoY) despite headwinds around cost inflation and supply chain issues further adds to our conviction. While FCF for most portfolio companies deteriorated in FY22 due to high inventory (due to increased prices and stocking) and capex levels (accelerated organic and inorganic investments to exploit growth opportunities), we don’t see it impacting their structural FCF acceleration trends. We also find the current market concerns around Dr Lal Pathlabs and L&T Technology Services, two portfolio stocks which have seen sharp share price corrections in the last six months, to be overdone.

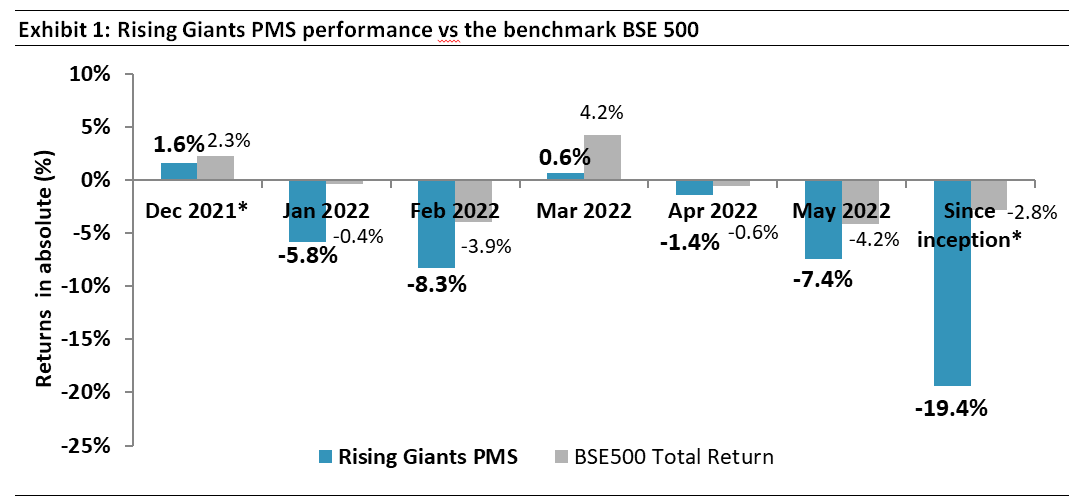

Performance update for the Rising Giants PMS

The Fund intends to invest primarily in quality mid-sized companies (less than INR75,000 crores market-capitalisation, predominantly in the INR 7,000 crores – INR 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

Source: Marcellus Investment Managers. Note: (i) *Portfolio inception date is December 27, 2021. (ii) Returns as of May 31, 2022. (iii) Performance data is net of annual performance fees charged for clients whose account anniversary falls upto the last date of the performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated up to 31st March, 2022. (iv) Returns shown above are net of transaction costs and includes dividend income. (v) Total returns index considered for BSE500 above.

Source: Marcellus Investment Managers. Note: (i) *Portfolio inception date is December 27, 2021. (ii) Returns as of May 31, 2022. (iii) Performance data is net of annual performance fees charged for clients whose account anniversary falls upto the last date of the performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated up to 31st March, 2022. (iv) Returns shown above are net of transaction costs and includes dividend income. (v) Total returns index considered for BSE500 above.

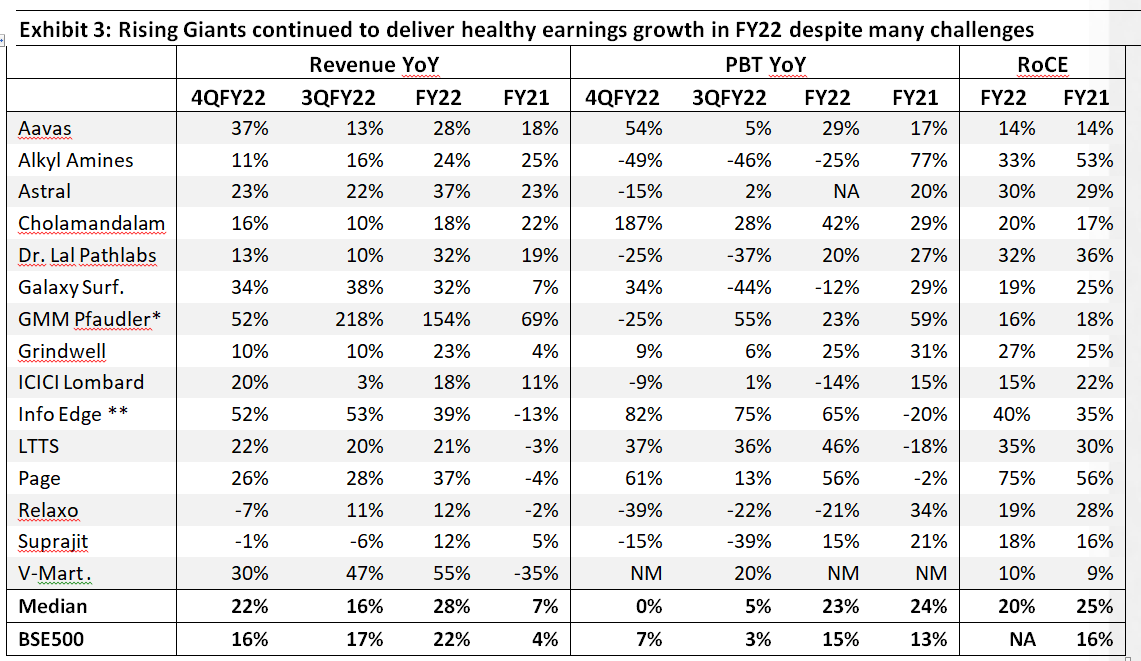

Rising Giants delivered healthy earnings growth in yet another challenging year (FY22)

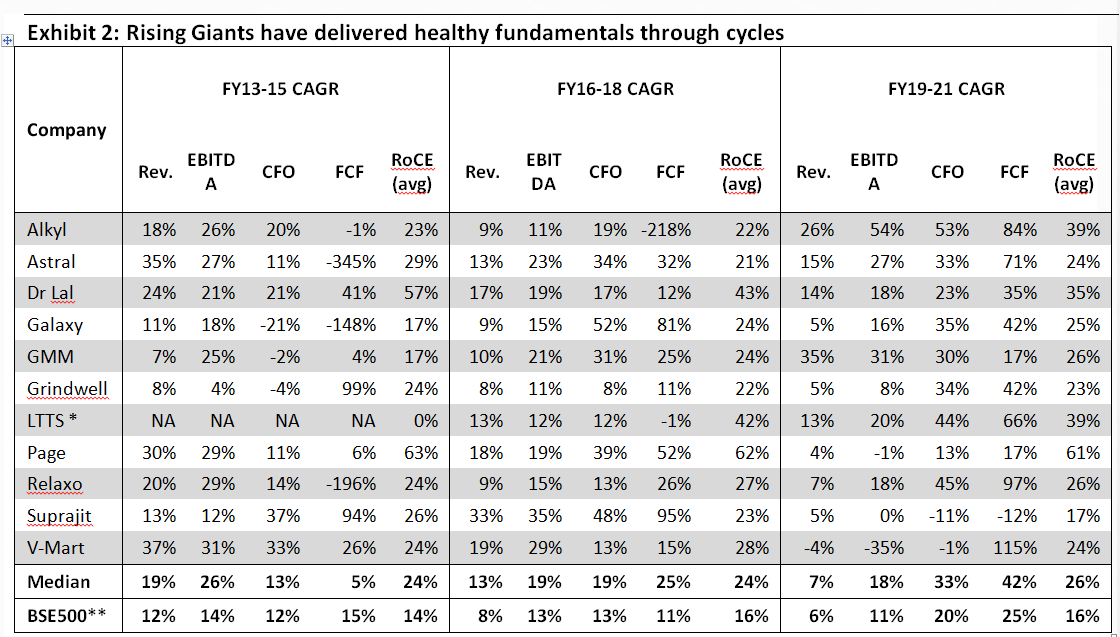

Track record of delivering healthy fundamentals through cycles

A salient feature of the Rising Giants portfolio companies has been their ability to sustain fundamental performance through the various macro cycles. For instance, over FY13 to FY21, despite intermittent macro slowdowns and disruptions such as demonetisation, GST & Covid-19, the portfolio companies generated healthy earnings growth both on an absolute basis and relative to benchmark BSE500 median.

Source: Companies, Ace Equity, Marcellus Investment Managers

Source: Companies, Ace Equity, Marcellus Investment Managers

Note: (1) The above does not include financial services stocks in the portfolio namely – Aavas Financiers, Cholamandalam Investment, ICICI Lombard General Insurance and Info-Edge since FCF is not a relevant metric for such companies (2) * L&T Tech’s business kicked off meaningfully only in FY15 after it took over business divisions of L&T and L&T Infotech and hence analysis not presented for FY13-15 period above; (3) **CAGRs of yearly median for BSE500 companies excluding financial services companies for a like to like comparison.

From our previous months’ Rising Giants newsletters, we summarise the following key drivers of the above performance:

- Market share gains: A key driver of the absolute and relative healthy performances of RG companies is market share gain from their weaker sectoral peers. Persistent economic slowdown and disruptive events (like demonetisation, GST introduction, COVID-19) structurally benefit stronger companies. Market leading franchises like Rising Giants have leveraged their superior return on capital, better cash flows and stronger balance sheets to further strength their franchises through both organic investments (products, people, technology, and expanding distribution networks) and acquisitions. All of this helps the Rising Giants consolidate their market share. Examples of how Rising Giants companies have outpaced their peers in the recent years are illustrated in our March 2022 Rising Giants newsletter.

- Margin improvement: Profit margin improvement has been another key driver of earnings growth for the RG portfolio companies. For instance, out of the 11 non-financial companies in the RG portfolio, nearly 2/3rd (i.e. 7) of the portfolio companies have witnessed significant margin expansion in recent years. The key reasons for such margin expansion are: (i) Efficiency measures, initiated by these companies such as cost reduction initiatives (optimising power & fuel, logistics costs, value engineering etc); (ii) Improvement in the product mix; and (iii) Organic improvement in margin from higher pricing power (courtesy rising market shares) and operating leverage benefits from revenue/volume growth. We have discussed this aspect in detail in our April 2022 Rising Giants newsletter.

Besides, the healthy growth in earnings enabled by market share gains and margin improvements discussed above, what has been the icing on the cake has been strong free-cash flow (FCF) growth recorded by the portfolio stocks in the recent years. A key reason of FCF acceleration has been the margin improvement discussed above. Another important cause is reduction in working capital brought upon by: (i) superior bargaining power relative to customers and suppliers; and (ii) technology related investments in driving efficiencies at the backend like distributor management systems, supply chain tools, inventory management software, etc. More details on drivers of working capital improvement for the portfolio companies can be read in our April 2022 Rising Giants newsletter.

Sustained healthy growth in earnings in FY22 despite multiple headwinds

In continuation of the trend seen over FY12-21, the Rising Giants companies have delivered impressive earnings growth in FY22 despite multiple headwinds like sharp increase in input costs including power & fuel, supply chain issues (shortages of semi-conductors, pharma/chemical intermediates from China, containers, etc) and Covid second wave (at the beginning of the year which impacted 1QFY22 numbers). Despite these challenges, the portfolio saw median revenue growth of 28%, PBT growth of 23% with 20% RoCE in FY22 indicating the strength of these franchises (pricing power, market share gains) and result of the accelerated capital allocation decisions during the onset of Covid-19.

Source: Companies, Ace Equity, Marcellus Investment Managers * Including Pfaudler International’s numbers which have been consolidated ** For core business (which includes Naukri, Jeevansathi, 99 acres, Shiksha).

Source: Companies, Ace Equity, Marcellus Investment Managers * Including Pfaudler International’s numbers which have been consolidated ** For core business (which includes Naukri, Jeevansathi, 99 acres, Shiksha).

Some of the key highlights of FY22 performance are:

- Median Revenue growth of 28% compared to FY17-21 CAGR of 12%. A large part of the revenue growth has been due to raw material passthrough but this in turn indicates the strength of the pricing power of the portfolio companies.

- Median EBITDA margin of 17.2% for the portfolio (excluding financial companies) in FY22 higher than FY6-21 average of 16.4% despite several cost related challenges in FY22 highlighted above and higher raw material passthroughs (which optically pushes down the margins).

- The portfolio continued to outperform BSE500 on key fundamental metrics like Revenue and PBT.

Whilst some portfolio companies did see some deterioration in profit margin in 3QFY22 and 4QFY22 due to the above factors, quarterly results are too short a time period for companies to fully pass on the impact of the raw material costs (since there is usually a time lag involved) and mitigating factors like operational efficiencies take time to show their beneficial impact. Having said that, some of the portfolio companies like Galaxy Surfactants and Suprajit Engineering witnessed strong QoQ rebound in profit margins in 4QFY22.

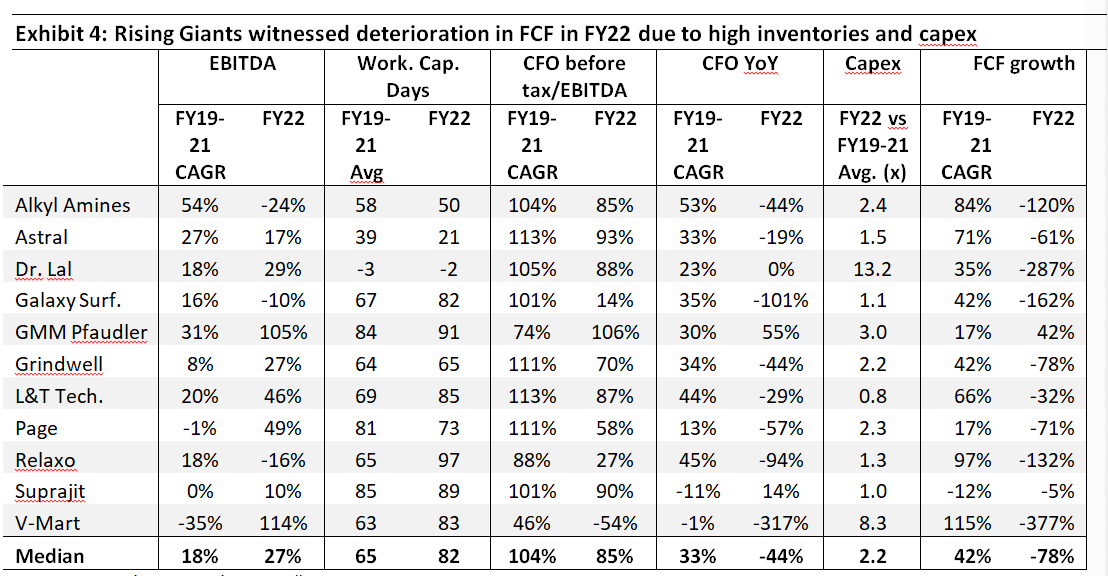

In contrast with the robust earnings growth, Free Cashflow (FCF) for Rising Giants did witness a significant decline in 4QFY22. This was a departure from FCF growth witnessed by most portfolio companies over FY19-21 which we have been highlighting for the Rising Giants portfolio. The key reasons for the FCF decline are:

Increase in working capital and more particularly inventory levels: The increase in inventories is because of increase in the raw material costs and many portfolio companies are stocking both the raw material as well as the finished goods inventories due to supply chain related issues. At the median level, the inventory level for the portfolio companies (excluding financial services stocks and LTTS, a service-oriented company) increased by 58% and on sales days basis from 68 days at FY21-end to 76 days at FY22-end. This inventory re-stocking is being witnessed globally as evidenced by this article in The Economist.

- Massive reinvestments in FY22: The median capex at the portfolio level for FY22 is more than 2x that of the FY19-21 average. Some companies that saw a massive jump in reinvestments are Dr Lal Pathlabs (on account of ~Rs9.25bn acquisition of Suburban Diagnostics), V-Mart (due to ~Rs1.5bn acquisition of ‘Unlimited’ brand stores and assets) and GMM (acquisition of HDO Technologies Limited’s assets for Rs685 mn).

Source: Companies, Ace Equity, Marcellus Investment Managers

Source: Companies, Ace Equity, Marcellus Investment Managers

Note: (1) The above does not include financial services stocks in the portfolio namely – Aavas Financiers, Cholamandalam Investment, ICICI Lombard General Insurance and Info-Edge since FCF is not a relevant metric for such companies

However, we do not see any cause for worry as regards deterioration in FCF in FY22. A degree of volatility in YoY movement in FCF is inherent due to the lumpy nature of capex and heavy dependency on balance sheet position on year-end dates. This volatility smoothens out over a longer time periods. Nonetheless, we expect the high inventory levels at FY22-end to unwind as these get translated to production/sales in FY23. Similarly, while higher capex/reinvestments can impact the FCF in the near term, it is an essential driver of future operating profits (and thus of future FCF growth). Rising Giants’ track record of generating high return on capital employed gives us confidence that these reinvestments could be important flywheels of free cash flow growth over the next 3 to 5 years.

Addressing questions/concerns around a couple of portfolio stocks

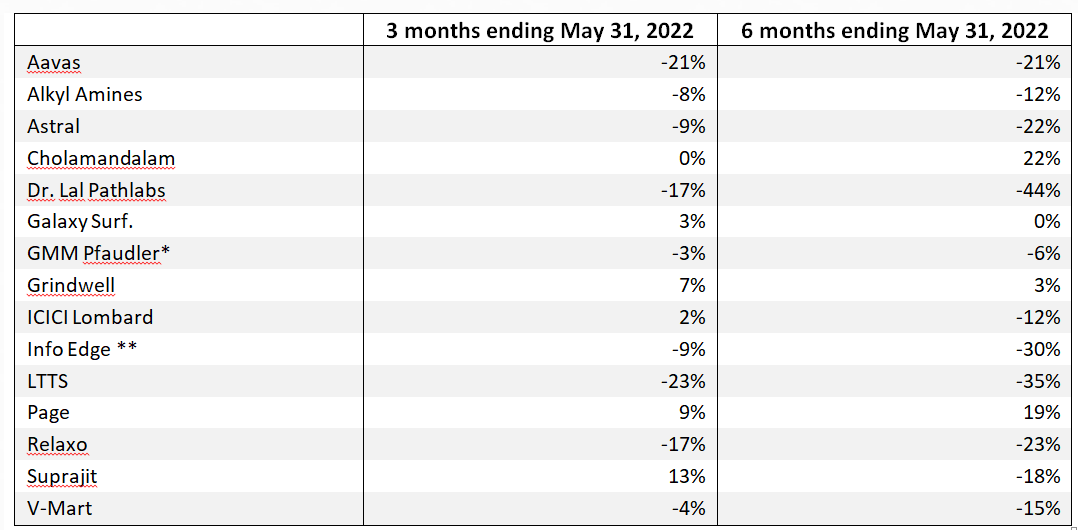

The Rising Giants portfolio’s NAV has declined by 19.4% since inception until May 31, 2022 as shown in exhibit 1. The stock-wise absolute returns for three and six months ending May 31, 2022 are presented in the exhibit below:

Source: Ace Equity, Marcellus Investment Managers. Please note that the above are absolute changes in share prices and not actual contribution to the portfolio returns since the latter is also determined by the allocation to respective stocks in the portfolio

Source: Ace Equity, Marcellus Investment Managers. Please note that the above are absolute changes in share prices and not actual contribution to the portfolio returns since the latter is also determined by the allocation to respective stocks in the portfolio

As can be seen in the above exhibit, the two stocks which have seen above average corrections in their share price in the last 6 months are Dr Lal Pathlabs and L&T Technology Services. We believe that the concerns around both of these stocks are overdone.

- Dr Lal Pathlabs

Concern #1 – weak 2HFY22 earnings: After recording 27% YoY PBT growth in FY21 and 100% YoY in 1HFY22, Dr Lal Pathlabs witnessed significant decline in PBT (down 31% YoY) in 2HFY22.

Our take: Dr. Lal has reported healthy numbers for FY22 with PBT up 20%. The fall in PBT in 2HFY22 is primarily on account of tapering down of Covid-19 testing related revenues in 2HFY22 (decline of 50% YoY) as Covid-19 cases dropped significantly in India. Covid-19 related revenues were never expected to be sustainable and hence tapering down was expected by us.

The more sustainable non-Covid revenues have grown by 35% YoY in FY22 (30% YoY even after excluding Suburban Diagnostics acquired in October 2021). Non-covid revenue growth of 30% YoY ex-Suburban is despite increase in Covid cases affecting normal business for around ~4 months during FY22. In Q4FY22, non-Covid sales have grown at 12% YoY. However, ex-Suburban growth is only 4% YoY which is a muted number. Moderation in non-Covid growth in 4QFY22 is due to: (a) Non communicable and chronic disease were largely not tested during covid; and (b) The short spike in the Omicron variant of Covid during Jan/ Feb affected non-Covid testing. In past too we have seen non-Covid moderate whenever there is increase in Covid cases. As Omicron reduced by mid-Feb, non-Covid sales grew in double digits in the month of March as per management commentary.

Leaving aside the near-term results, three-year CAGR (FY20-22) in operating profits is 24% and in operating cash Flows is 21% (FCF is impacted due to Suburban acquisition as discussed in a preceding section).

Concern #2 – New entrants and disruptive pricing thereof: The Indian diagnostics space has seen some new entrants like Tata 1mg. Furthermore, these new entrants have announced aggressive prices in certain metro cities.

Our take: Although not enough to build a loyal consumer base of customers, these discounted offers are common to gain new customers and has been going on for many years. Even Dr. Lal has similar offers in micro clusters in new geographies it is entering. Pharmeasy had similar offers when it entered diagnostics (these offers were subsequently rolled back).

What gives us additional confidence about Dr Lal’s ability is to deal with the competition are: (i) Swasthfit (bundled tests/ health packages) contribution to Dr Lal’s revenues has increased to ~18% of sales v/s ~15-16% pre-Covid. This is a good sign because this is where price competition is the hardest from competitors (competitors would offer full body check-up at Rs 500 vs Rs 1,500 for Dr Lal Pathlabs); (ii) Home sample collection share in revenues for Dr Lal has increased from 5% to 12% of sales. (iii) Aggressive expansion of physical collection centres by 23% YoY from (ex-Suburban) during FY22.

To summarise, neither do we expect meaningful market share loss, nor do we expect any weakness in margins in core non-Covid business. Further, management has set an aggressive target of doubling of non-Covid revenues from Suburban in two-three years with a sharp focus on Mumbai & Pune which should also improve Suburban’s non-Covid EBITDA margins from current levels of 7-8%. Evolution of the firm on various aspects over the last 2-3 years has been encouraging and we remain convinced on the fundamentals despite the recent share price correction.

- L&T Technology Services

LTTS reported strong set of results for 4QFY22 (INR revenues up 21.9%, EBITDA up 30% YoY). All segments reported strong revenue growth led by transportation (up 30%), plant engineering (21%) and industrial products (22%). However, despite this seemingly strong 4QFY22, the firm’s share price has witnessed significant correction in the recent months due to the following concerns.

Concern #1 – potential impact of US recession on LTTS’ growth: Given that LTTS derives 60-65% of its revenues from US, a US recession has the potential to significantly impact its growth prospects.

Our take: In the results call, LTTS management indicated that the overall demand outlook remains robust and there has been no indication of any change in budgets from the clients. From a structural standpoint India is likely to be a big gainer due to the cost optimization drive across the globe in a rising inflation or a slowing global growth scenario. While engineering services is a relatively younger industry, data from the Indian IT sector shows that slower growth in US/Europe has a limited impact on outsourcing. Moreover, with a lag of a year, Indian IT companies have actually seen a sharp acceleration in the rate of their revenue growth. Further, LTTS continues to benefit from the cross-pollination advantage by being present across multiple industries. Moreover, the company has been taking active steps over the last two years to sign up larger deals, which provide longer-term revenue visibility. On the back these steps, LTTS has signed two back-to-back $100 million plus deals in the last two years. In FY21, it signed a $100 million plus deal with an Oil & Gas company based out of North America. In Q4FY22, the company signed a large deal the with Jaunt Air Mobility (electric aircraft manufacturer) to provide engineering services for the electric Vertical Takeoff and Landing air taxi.

Concern #2 – lack of availability of talent and impact thereof on execution and margins: Given high demand for talent in the industry and labour supply issues in USA.

Our take: While LTTS did witness an attrition of 20.4% in 4QFY22 due to widespread supply issues in the industry, the attrition rate was the lowest amongst the pure play Indian ER&D players. The reason for people moving out from LTTS or broader IT services companies was the high salaries being offered by start-ups and the product companies. However, in the last one month, things have changed – increasing lay-offs by start-ups have led to easing of supply of the talent in the industry. LTTS also continues to focus on employee learning and development which can help retain talent. LTTS has recently carved out a new business unit and Centre of Excellence for Metaverse and visual reality products. The company hired around 3,000 freshers in FY22 and would largely benefit from deploying them for the projects. Working in LTTS provides the exposure of core engineering and allows passionate engineers to work for innovative products.

Overall, we consider LTTS is well-positioned to benefit from increasing ER&D spend and offshoring by the customers across the globe.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/