OVERVIEW

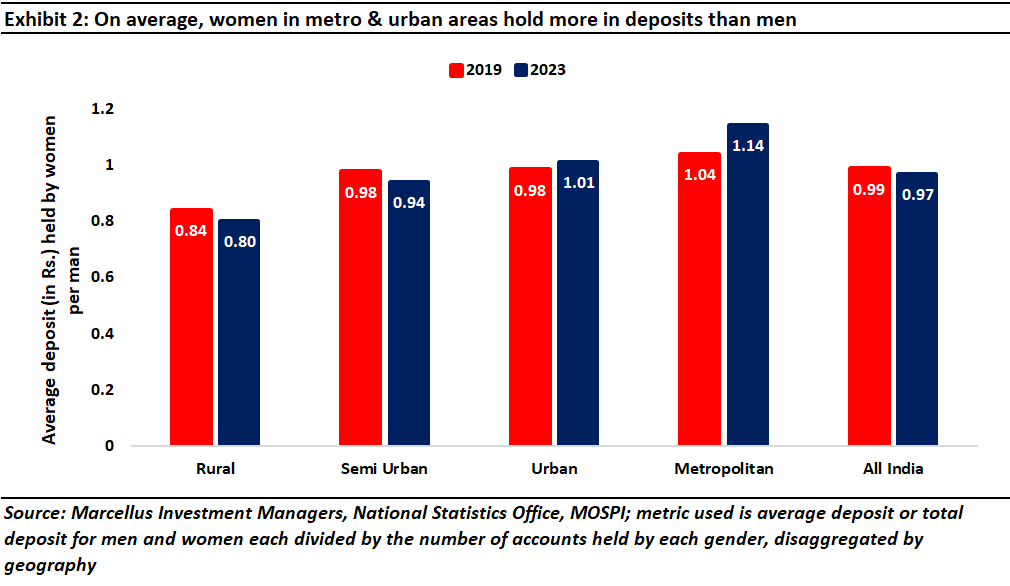

Data from the RBI shows that women in India’s urban areas have more money in their accounts than men. Across all levels of the education system, Indian women are outnumbering and outperforming Indian men. Both during our travels and through our number crunching, we can see that urban women are getting wealthier, thanks to a trifecta of greater access to consumer markets and beyond (via the internet), easier access to financing (courtesy financialization and the India Stack), and a growing target market of aspirational & affluent women. The result is that entrepreneurship is spreading far faster amongst Indian women than their male counterparts.

“A few years of high school catapulted a young woman from a life of drudgery and disrespect into a world of comfort and courtesy, or so it seemed to her. The young man, however, did not often see high school as having so positive an impact. The rather dead-end clerical and sales positions opened to young women were not the road to success for the young man. Machinists, electricians, and other tradesmen could enter their craft with far less than a high school diploma and little apparent loss. Thus the apparent private return for young women [of getting educated] was actually higher than for young men, even though the latter remained employed for a considerably longer fraction of their lives.” – Nobel Laureate Claudia Goldin, The U-Shaped Female Labor Force Function in Economic Development and Economic History. In: Schultz TP Investment in Women’s Human Capital and Economic Development. University of Chicago Press ; 1995. pp. 61-90.) [Square brackets are ours]

The rise of a celebrity from Jail Road Market

Nestled in the crowded bazaar of Jail Road Market in New Delhi is a tiny shop selling bedazzling kurtas and pants for women, a common scene in this neighborhood and in hundreds of similar markets across northern India. However, the owner of this shop and her story is anything but common. She is Jasmeen Kaur, the creator of the now famous phrase, ‘So beautiful, so elegant, just looking like a wow!’

Ms. Kaur shot to fame with this catchy phrase when Bollywood star, Deepika Padukone, recited it and made it famous instantaneously. The rise of Instagram and social media as well as the access it has given millions of Indians ensured that “looking like a wow” became ‘viral’ and made Ms. Kaur a celebrity, which could perhaps help her garner business from all corners of the country rather than just her locality or her city. She signifies the rise of a new India; an India where polished English and high-profile university degrees and MBAs are no longer a prerequisite for success.

India today has millions of successful women entrepreneurs like Ms. Kaur. For example, 500 km away from Mumbai, in the buzzing industrial town of Dewas in Madhya Pradesh (population ~2 mn), a mother earns a livelihood by making and selling papads on Meesho, an online marketplace for selling goods especially in tier 3 and 4 cities. The profits she generates from selling this humble Indian snack enables her to not only pay for her daily expenses but also for her son’s tuition thus, making her financially independent of the men in her family (see more here).

Rather than being exceptions, such stories are the norm today in India. Women throughout the country are successfully launching their own businesses, so much so that the latest RBI data on bank balances shows women in urban areas as having more money in their bank accounts than men (see our note on the subject dated September 13th 2023, Urban Indian Women Have More Money Than Men).

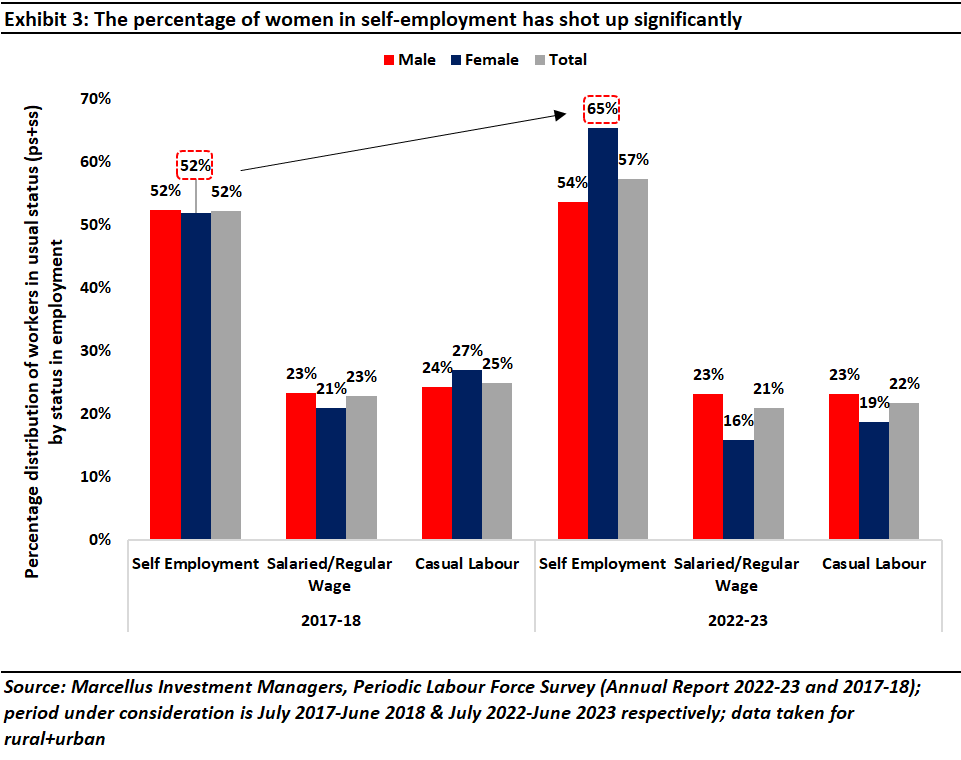

According to the Periodic Labour Force Survey (PLFS) data, women’s share in self-employment has been steadily rising, especially in rural areas, whereas that for men has been falling (see exhibit below).

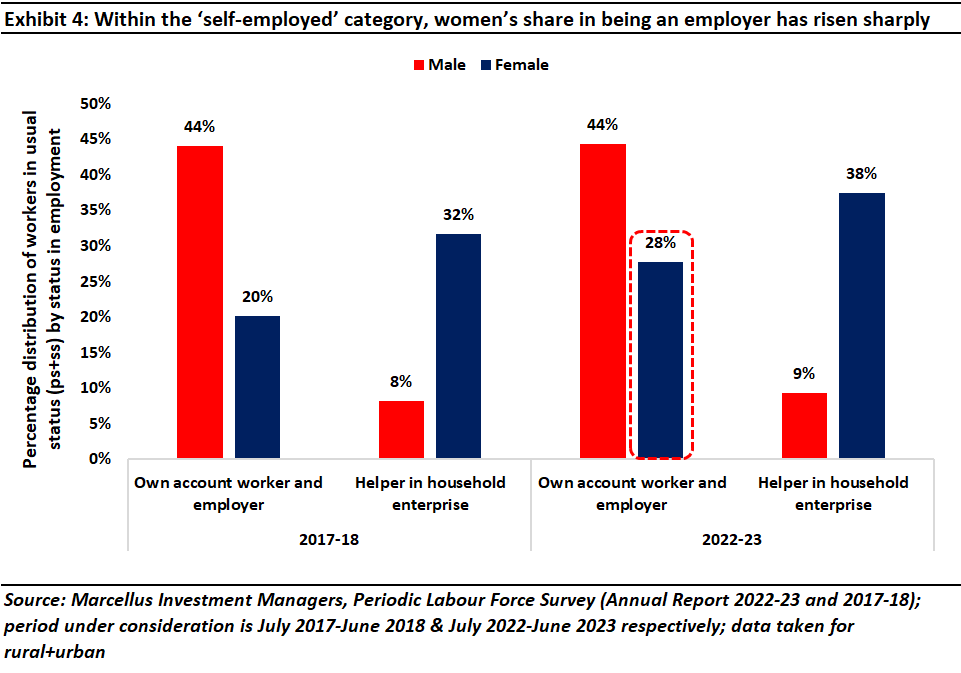

Whilst the self-employed category is vast and includes unpaid labour as well, if we go one level deeper and see the stratification within self-employed, the rise of women entrepreneurs (rather than ‘woman unpaid’ labour) is evident. In the exhibit below, for women, the share of self-employment by own account and self-employment as an employer has increased from 2017-18 (when PLFS started) to 2022-23. Even more remarkably, the share of women performing unpaid labour has gone down during this time period. The same conclusions cannot be drawn from the data for men.

So, what is going on here? What are the drivers of the rapid rise in entrepreneurship amongst Indian women? We believe there are three distinct forces that are driving the rapid rise of women entrepreneurs in India.

Greater access to the ‘market’ for women

India’s methodical build of the basic pillars required to undergird a modern economy started in 2009 when Mr. Nandan Nilekani, then CEO at Infosys, left his corner office in Bengaluru to work with a Government of India undertaking UIDAI (The Unique Identification Authority of India), to first envision and then implement the Herculean task of providing 1.21 billion Indians with a social security like number (or Aadhaar).

Not only did Aadhaar succeed in this endeavor (there are nearly 1.31 bn unique Aadhaar IDs today in India), but Mr. Nilekani’s successful demonstration of the concept of social infrastructure also opened doors for mass financialization, i.e., opening of a bank account for each Indian via the Jan Dhan scheme. In 2022, India had 3bn bank accounts, up 3x from 1.1bn in 2015.

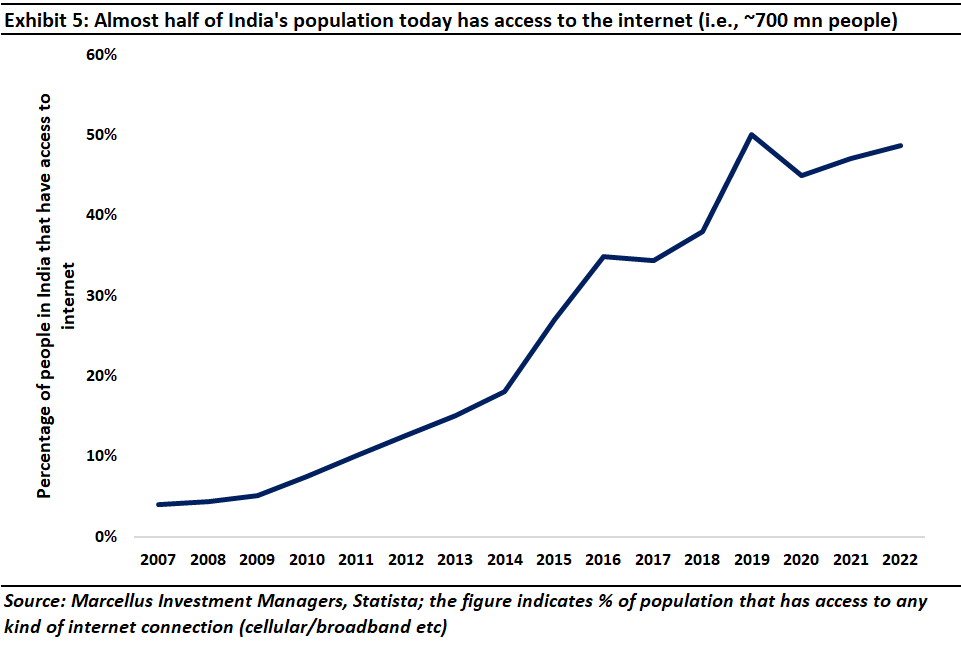

The simultaneous introduction of low cost and fast cellular internet in 2016, courtesy Jio, coupled with widespread smartphone penetration meant that every Indian now had a social identity (via Aadhaar), an economic identity (via a Jan Dhan bank account), and a digital identity (via smartphones and internet – see exhibit below to understand the sheer extent of this). This trinity of Jan Dhan, Aadhar and Mobile phones was soon dubbed as ‘JAM’.

Whilst the JAM trinity has enabled millions of Indians to lead better lives, women in particular have leveraged JAM very effectively to generate income. How so?

- Via their bank accounts, Indians now have access to Unified Payments Interface (UPI) that facilitates instant bank-to-bank money transfer (without any use of paper). UPI thus helps SMEs pay their suppliers and get paid by the customers instantaneously and with zero transaction costs.

- Given that Aadhaar numbers give Indians valid proof of residence and overall existence, Aadhaar eases the process of SMEs getting regulatory permits & licenses.

- Access to smartphones and cheap broadband (at 1/40th the cost prevalent in USA), helps Indian SMEs reach out to customers not just in their neighborhood but across the land via social media platforms like Instagram and YouTube thus increasing their total addressable market multifold.

This powerful combination of policy changes plus tech innovation has given the new Indian Women Entrepreneur access to the ‘market’ – both the market in which she buys her ‘inputs’ and the end-market in which she sells her wares.

Greater access to ‘financing’ for women

Financialization of the Indian economy has transformed how Indians deals with their monies and their investments. According to the data released by National Payments Corporation of India (NPCI) in the month of December 2023, the calendar year 2023 saw total transactions worth ~Rs. 2 tn+ happening via UPI (i.e., more than 50% of Indian GDP)!

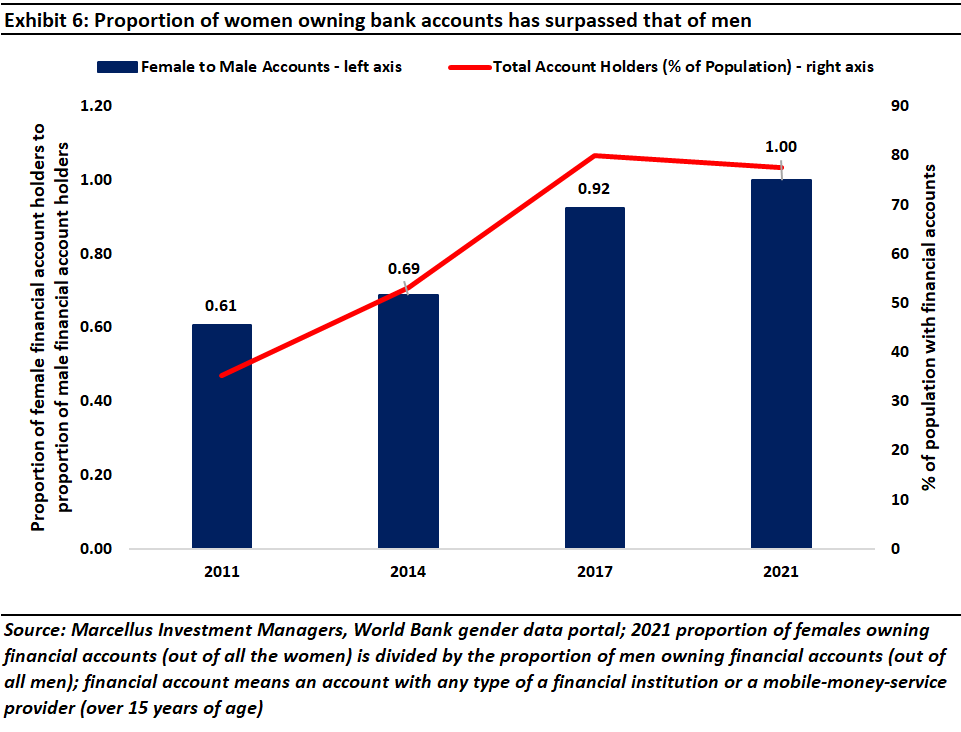

As a result of Jan Dhan and UPI, more women today hold bank accounts vis-à-vis their male counterparts. According to data by the World Bank, the proportion of women above 15 years of age holding any financial account divided by the proportion of men above 15 years of age holding a financial account has already crossed the ratio of 1 in 2021, meaning more proportion of women are in the financial system today (as a % of total women) than their male counterparts (as a % of total men; see exhibit below).

As more women are included in the financial system, they are finding it easier to get access to credit. That, in turn, means business expansion has become much easier than before (courtesy their bank statements containing hundreds of UPI transactions which validate the revenues being generated by the enterprise).

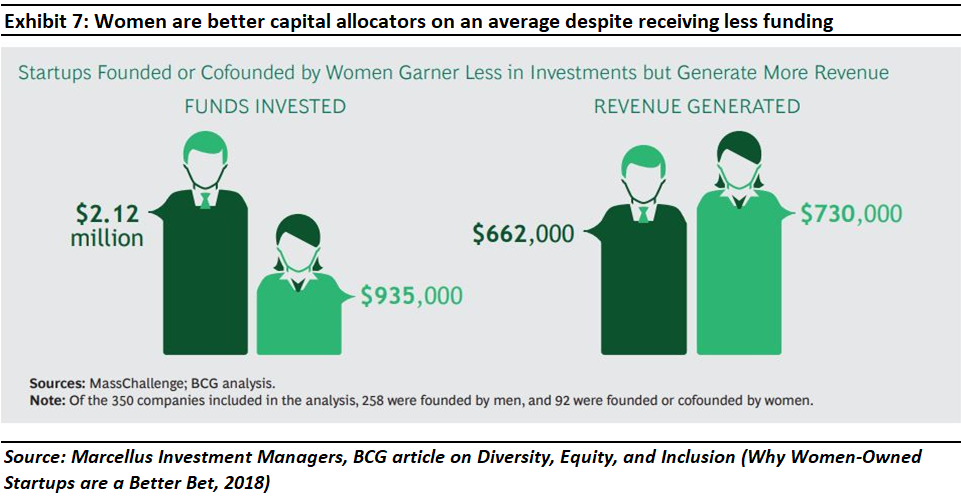

Furthermore, a study conducted by MassChallenge and BCG for multiple countries found that startups that were founded or cofounded by women got less funding but generated more revenues than ones founded or cofounded solely by men (see exhibit below). This implies that women are better capital allocators than men.

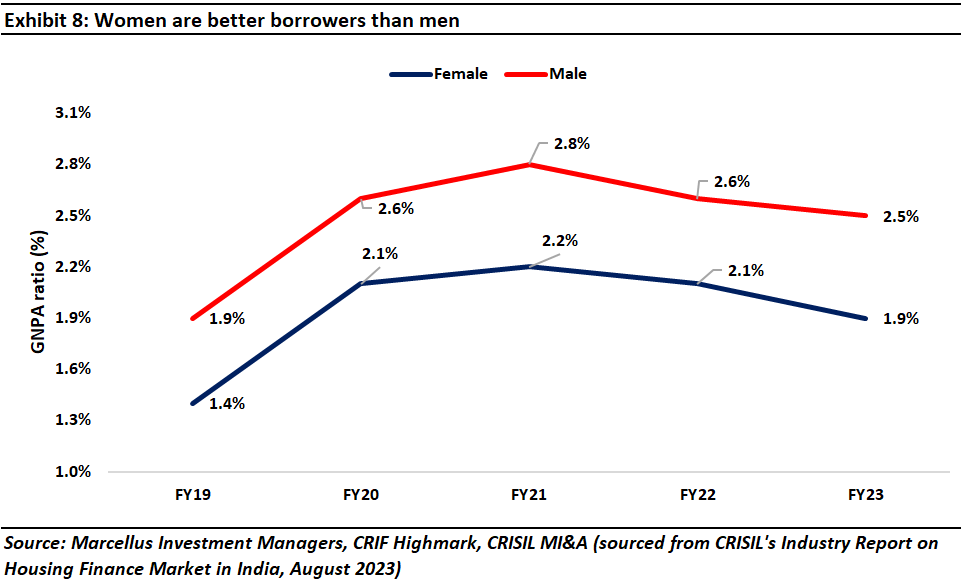

Basis the debt default (Gross Non Performing Asset or GNPA) data, women are better borrowers (see exhibit below). From a lender’s perspective, women entrepreneurs are the perfect conduit through which a lender can lock into the flywheel of higher credit resulting in greater investment into business, greater revenues and profits, and therefore, greater payback of credit and lower delinquencies, leading to higher credit uptake again.

Growing addressable market of women, by women, for women

Women – as a category of buyers – is also burgeoning thanks to digitization and greater access to markets (the same factors which are allowing women to become successful entrepreneurs). But arguably the greatest enabler that has underpinned this revolution, where women are taking control of their financial situation via the self-employment route, is their higher level of education.

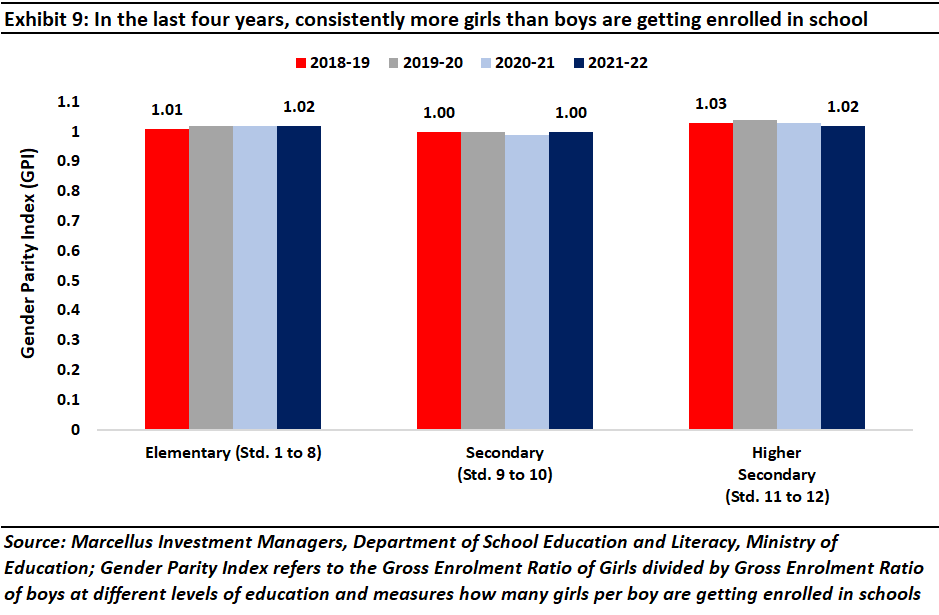

As we had noted in our previous note on the subject in September 2023, Urban Indian Women Have More Money Than Men, “Over the last four years, across all levels of the Indian educational system, the GPI has been greater than 1 (see exhibit below) indicating that more girls than boys are getting enrolled in schools at all levels of education!”

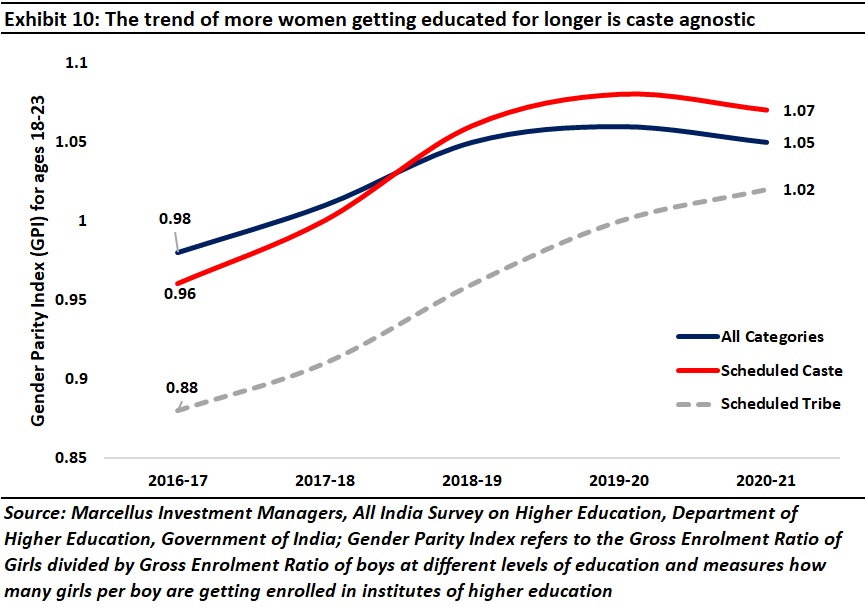

“In fact, if we go one step further and look at the GPI for higher education (i.e., for the age group 18-23 years), not only is the GPI greater than 1 across all social categories (see exhibit below), but the improvement has also been most rapid for Scheduled Castes and Scheduled Tribes indicating that women in the most disadvantaged sections of Indian society are powering ahead the fastest.”

Because of this twin benefit of ‘access’ (to the market and to financing) and knowledge of what to do with that access (courtesy better education), women today have greater financial freedom to embark on an income generation and consumption journey of choice. In essence, these changes have enabled women to have an opportunity to decide what they wish to do, especially from the comfort of their homes – an option that didn’t exist even a decade ago.

India’s women entrepreneurs are best suited to cater to the needs of India’s women customers because they understand the pain points of this demography better than anyone else. Case in point is the emergence of multi-billion dollar companies like Nykaa (promoter: Falguni Nayar), Mama Earth (promoter: Ghazal Alagh), and Sugar (promoter: Vineeta Singh), who have taken the beauty and personal care market by storm. From a standing start in 2012, Nykaa’s revenue share of the total beauty and personal care online market was at ~27% in 2022.

Historically, the most discriminated communities resort to newer, more rewarding opportunities

“Negotiating between American and Jewish identities, they operated with a sense of empowerment. They did not believe that they had to accept America as it was, nor did they see Judaism as a fixed entity that they could not mold to fit their needs. They could put their impress on both to ease the traumas of accommodation and to bring the two into harmony” – Hasia R. Diner, professor of American Jewish History at New York University (Diner, H. R. (2004). The Jews of the United States, 1654 to 2000 (Vol. 4). Univ of California Press.)

A community that has for centuries faced discrimination in the Western world – thanks to the prevalence of antisemitism going back a couple of millennia – are the Jews. In that context, the rise of the Jews in America to the point where they dominate the commanding heights of American capitalism is testament to the fact that in a free market economy, once a community has access to financing and to the ‘market’, it will be able to rise. If American Jews are Exhibit #1 of this phenomenon, India’s women are on their way to becoming Exhibit #2.

As mentioned in our 13th September 2023 blog, Urban Indian Women Have More Money Than Men, we continue to tilt our portfolios towards stocks where women are the main target customer. Stocks like Nestle, Titan, and Rainbow Hospitals form a prominent part of several of our portfolios.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). Amongst the companies mentioned in this note, Titan, Nestle, and Rainbow Hospitals are part of Marcellus’ portfolios. Nandita and Saurabh may be invested in these companies and their immediate relatives may also have stakes in the described securities.

If you want to read our other published material, please visit https://marcellus.in/pms-investment-blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.