Consistent Compounders Portfolio (CCP)

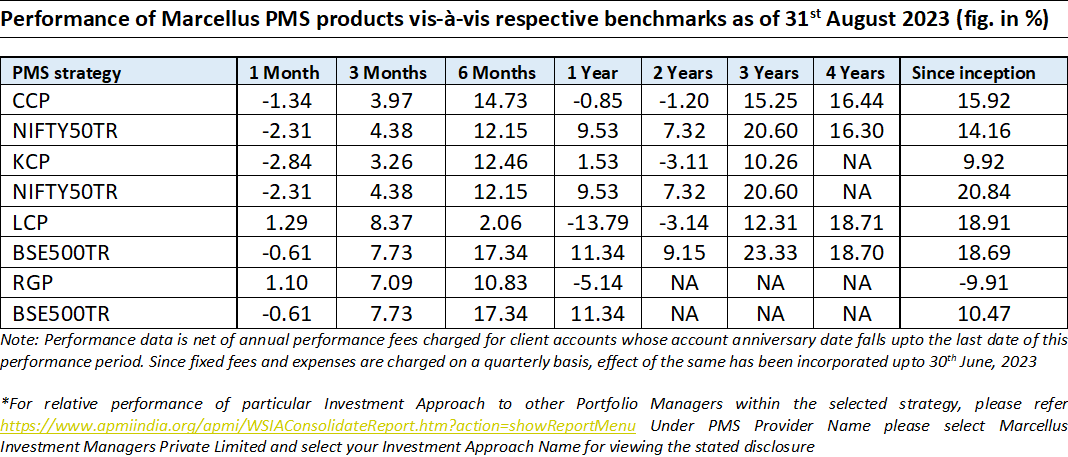

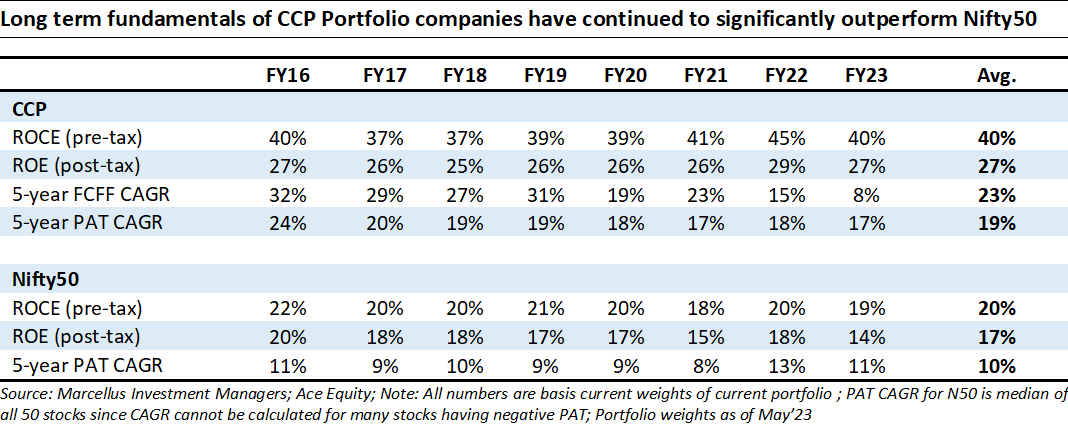

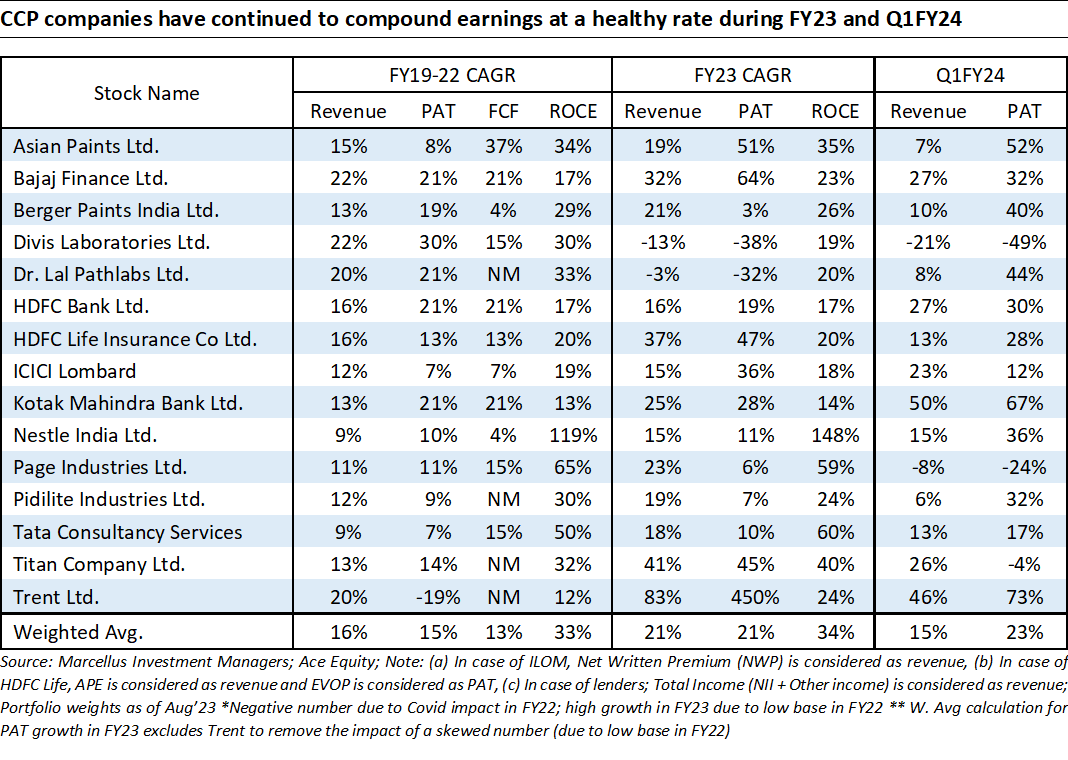

Marcellus’ Consistent Compounders Portfolio companies reported, on a weighted average basis, 20% YoY growth in profit after tax for both 1QFY24 (over 1QFY23) as well as for FY23 (over FY22). Financials sector companies in CCP (three lenders and 2 insurance companies) reported healthy topline as well as bottomline growth, reflective of market share gains. The only weakness amongst CCP lenders’ 1QFY24 results was HDFC Bank’s muted deposit growth, which we believe was a temporary blip that should normalise in the coming quarters. Profits for paints and adhesives companies were supported in 1Q by gross margin expansion as raw material costs eased YoY. Two companies in our portfolio – Divis Labs and Page Industries – continued to report declines in their profits. Page Industries’ profits were adversely affected by two temporary factors in the recent past – de-stocking of inventory in the distribution channel due to the implementation of tech initiatives like auto-replenishment system (ARS), and high base of athleisure revenues as households transitioned away from WFH over the last 18 months. For Divis Labs, the profit decline was due to the presence of Covid related drug Molnupiravir in its base quarter (1QFY23), which is starting to get offset by new revenue growth drivers such as nutraceuticals and contrast media products.

Going forward, we see normalised revenues and profit growth (i.e. normalised for Covid base effects, commodity price base effects etc) being reported by our portfolio companies from 2QFY24 onwards, which should reflect the outcomes of initiatives taken by the management teams to strengthen their businesses during the last three years. During the first five months of FY24, we have witnessed a strong performance of Marcellus’ CCP portfolio as share prices catchup with underlying fundamental progression of the portfolio companies. Despite this, the gap between fundamentals of our portfolio companies and their share prices is over 25% currently. We expect this gap to narrow down significantly in the coming quarters.

In August 2023, we have made one change to the list of stocks in Marcellus’ CCP Portfolio with the addition of Trent Ltd. Trent is a retail business with successful formats like Westside and Zudio, and a JV with Zara (49% owned by Trent). The competitive advantages of Trent lie in its end-to-end control of supply chain (back-end – direct from manufacturer to stores) and product development – which translates into greater value-for-money proposition for customers, relevant of the merchandise and hence inventory turns (6x) which are the best in the industry. Once these strengths were developed for Westside, formats like Zudio have subsequently been built on the same tenets through usage of common vendors, warehousing, and logistics at the back end and common store opening teams at the front-end. Capital efficiency is maintained despite rapid scalability of Zudio due to its unique store expansion business model of running the store as COCO (company owned, company operated) in the first year and then transitioning to FOCO (franchisee owned, company operated) from the second year onwards.

The company also has an incubation in the Food & Grocery retail space called Star Bazaar. Star was started more than a decade back and in 2014 the company converted it into a JV with Tesco UK. Today the JV has 63 stores under operations primarily in West & South India. Near term earnings growth prospect for Trent will be linked to Westside (more of the same), Zudio (propelled by store network expansion) and Star Bazaar (profitability turnaround and store network expansion). However, Trent continues to incubate newer retail formats, some of which could become as successful as Zudio in future. Four new formats are already under incubation viz. Misbu (cosmetics), Utsa (ethnic wear), Samoh (Occasion wear), & JV with MAS brands for athleisure & innerwear. Scalability of Trent’s business across as well as within retail formats is supported by the depth and width in its management talent – expats hired from reputed foreign retailers like M&S, Woolworths etc and several layers of internally groomed talent, including those recruited from TAS (Tata Administrative Service). Whilst at first glance, Trent’s P/E multiple looks rich, there are three factors which have to be incorporated while considering its valuations – a) INDAS 116 impact (accelerated store count expansion of any retailer leads to P&L reflecting up-fronted costs of rentals – non-cash item); b) drop in losses and potential turnaround of Star Bazaar format at a store level; and c) the impact of rapid growth of Zudio on Trent’s forward P/E multiple in the near future.

Kings of Capital Portfolio (KCP)

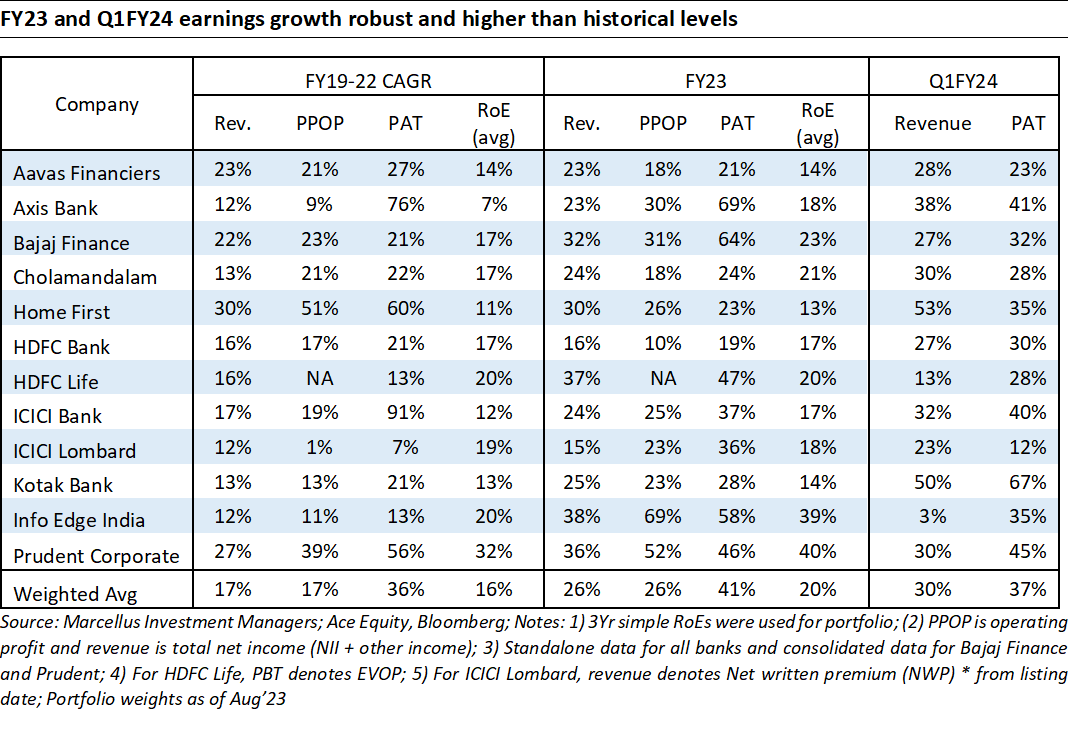

During Q1FY24, Kings of Capital portfolio companies continued their robust loan and profit growth performance with portfolio’s weighted average Q1FY24 revenue growth of 30% and weighted average PAT growth of 37%. The record high net interest margins (NIMs) seen during Q3 and Q4FY23 saw some moderation during Q1FY24 albeit at a pace lower than earlier expected. This trend of NIM moderation is likely to continue for the next couple of quarters but we currently believe that NIMs for full year FY24 for most lenders in the portfolio will be similar to FY23 NIMs. Q1FY24 was characterized by further market share gains for most lenders in the portfolio led by Cholamandalam Inv & Finance (40% YoY loan growth), Bajaj Finance (32% YoY loan growth) and Home First Finance (33% YoY loan growth). The savings plays in the portfolio – ICICI Lombard, HDFC Life and Prudent Corporate also reported healthy growth and profitability despite Q1 being a seasonally soft quarter. There have been no additions/ deletions to the portfolio during YTDFY24.

Q1FY24 positives:

- Kotak Bank launched a differentiated deposit strategy – Activmoney which garnered Rs. 55bn (22% of incremental term deposits) in the very first quarter of its launch.

- HDFC Life reported 13% YoY premium growth which might not look impressive on an absolute basis but was significantly ahead of expectations. The recent change in the budget of taxing guaranteed insurance policies above a ticket size of Rs. 5lacs impacted HDFC Life the most amongst large life insurers (~25% of exposure to guaranteed products). However, HDFC Life did not get as impacted as earlier expected by the markets. Additionally, the HDFC-HDFC Bank merger is likely to lead to HDFC Life increasing its share to 70% within the HDFC Bank channel vs. 55% currently.

- Bajaj Finance delivered 9% sequential loan growth and 32% YoY loan vs market’s expectations that Bajaj’s growth will start trending lower than its history given its increasing size. Along with the robust growth, Bajaj also increased its long term RoE guidance to 21%-23% vs. 19%-21% historically.

- Home First Finance for the first time reported a 15% RoE on the back of healthy loan growth and steady margins. Given the overcapitalised nature of Aavas and Home First, we believe the 15% reported RoE is an important milestone in the journey of these companies. They will have to continue to focus on robust execution and razor sharp underwriting to further build on the 15% RoE.

Q1FY24 misses/ monitorables:

- Aavas saw an abrupt succession event play out as its founder CEO Sushil Agarwal resigned after running the firm successfully for 10+ years. We believe his successor Sachinder Bhinder who has been with the company for 3 years is well qualified and Aavas is a well run institution with an experienced senior team. Sachinder has earlier spent 16 years at Kotak building its self-employed housing portfolio.

HDFC Bank posted muted deposit growth during the quarter. While HDFC Bank’s YoY deposit growth was 21% which is almost 2x that of the industry, incremental deposits garnered during the quarter were Rs. 380bn vs. Rs. 1 trillion in Q4FY23. This is of significance given the upcoming merger which requires HDFC Bank to raise Rs. 4-4.5 trillion of deposits during FY24 as per our estimates. Given HDFC Bank’s execution strengths and recent branch addition, we believe we should see a better show on deposits in the coming quarters.

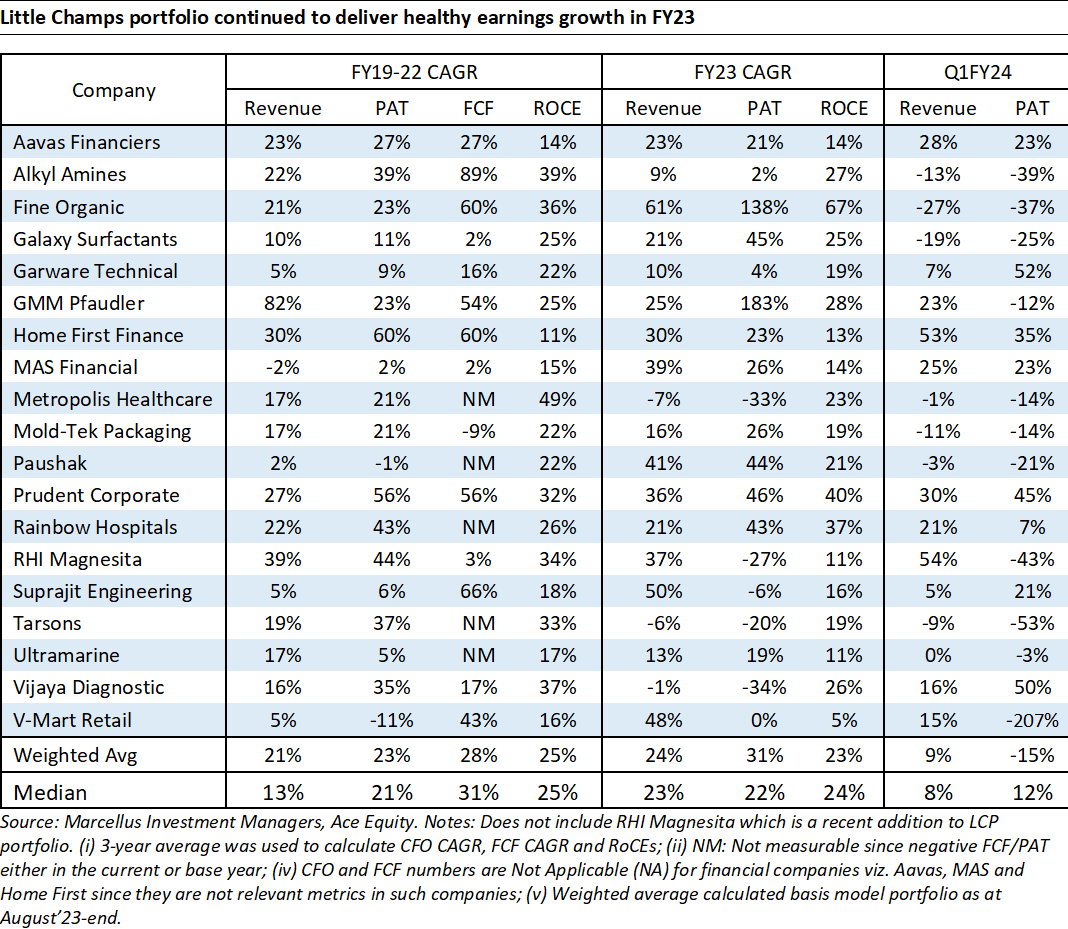

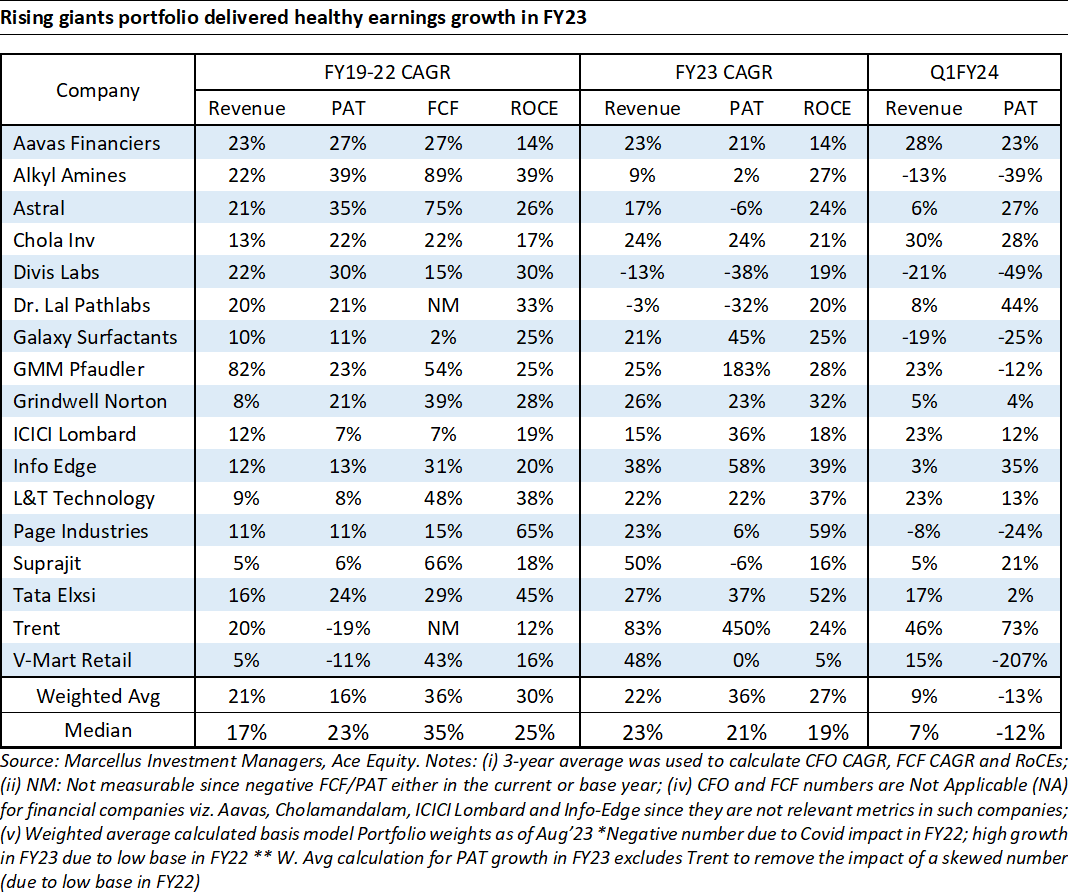

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

For 1QFY24, the Little Champs portfolio witnessed 12% growth in the median portfolio net earnings. This is lower compared to the 22% (median) net earnings growth seen in FY23. While the financial stocks (Aavas, MAS Financial, Home First and Prudent Corporate) in the portfolio witnessed healthy earnings growth, stocks in the chemicals space (Alkyl, Galaxy, Ultramarine and Fine Organics) witnessed challenging times driven by global demand weakness and clearance of excess inventory built during Covid-19 years.

On the other hand, the Rising Giants portfolio’s earnings de-grew by 12% YoY (median) in 1QFY24 after growing by 21% in FY23. Besides the financial stocks (Aavas, Cholamandlam), companies like Astral, Info-Edge, Dr Lal and Suprajit witnessing healthy YoY net earnings trend. However, here too, the chemicals (Alkyl, Galaxy) and Pharma (Divis) stocks dragged down the overall portfolio level earnings growth.

For both the portfolios, beyond the near- term headwinds we don’t see any structural concerns in the industry or the portfolio companies. The high level of reinvestments in FY23 and recent years (click on Aug’23 update ) has provided enhanced visibility on the earnings performance for the portfolio over the next 3-5 years.

Changes to the Little Champs portfolio: Addition of Rainbow Children’s Medicate Ltd.

Rainbow Children’s Medicare Ltd was founded in Hyderabad in 1999 by Dr. Ramesh Kancharla (pediatrician) & Dr. Dinesh Kumar Chirla (neonatal surgeon) as a pediatric multi-specialty hospital (today pediatrics forms 70% of revenue). In 2007, Dr. Pranithi Reddy joined Rainbow to lead the company’s foray in maternity segment (today gynae & obstetrics forms 30% of revenue). As of today, Rainbow operates 16 hospitals with a capacity of 1,655 beds and 3 outpatient clinics in six cities viz. Hyderabad, Bangalore, Chennai, Vijayawada, Vizag, and Delhi NCR.

Rainbow’s multi-specialty children’s hospital along with maternity is one of its kind models in India and ticks all the boxes from a customer convenience and experience perspective. Rainbow’s 24*7 doctor availability and its ability to attract & retain high quality pediatricians across specialties led to its stellar brand creation in Hyderabad and is their competitive advantage. Rainbow’s scale allows it to retain the existing talent (high volumes means more money for doctors) as well as run one of India’s largest govt. approved fellowship programmes for DNB pediatrics to create a continuous talent pipeline for fresher pediatric specialists. This flywheel is difficult to replicate for any new entrant in Rainbow’s core markets.

In the last 5 years Rainbow has entered 4 new clusters and has shown signs of initial success viz. Andhra Pradesh (Vijayawada, Vizag), Tamil Nadu, and Delhi NCR. Share of revenue from Hyderabad has reduced from 70% to ~55-60% over the last 5 years. Rainbow is also widening its focus from doing only high-risk pregnancies in-house to regular deliveries as it has built entire spectrum of gynae, obstetrics, vaccinations in-house to widen its revenue base and create a funnel for NICU and beyond. There exists no other integrated model like Rainbows and the business model can be termed as disruptive for Indian healthcare industry. While firm has taken baby steps towards professionalization, Dr Ramesh Kancharla is a key man for the firm. We have accounted for this risk in our scores & valuation of the firm.

Changes to the Rising Giants portfolio: Addition of Trent Ltd.- For rationale please refer to the CCP section at start of the newsletter.