PORTFOLIO UPDATE:

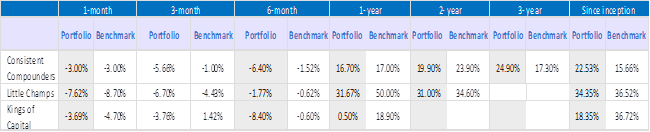

Performance data is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary date falls upto the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated upto 31st December, 2021. For Little Champs portfolio, since performance fees are charged on cumulative gains at the 3rd anniversary of the respective client account, the effect of the same has not been incorporated in the performance data.

Inception Date & Benchmark:

Consistent Compounders Portfolio: Inception: 1st Dec,2018 Benchmark: Nifty 50 TRI

Little Champs Portfolio: Inception:28th Aug,2019 Benchmark: S&P BSE Small Cap TRI

Kings of Capital Portfolio: Inception:28th July ,2020 Benchmark: Bank Nifty TRI

How can investors assess ever important Capital Allocation decisions of the company?

“Capital allocation is the CEO’s most important job.” William Thorndike, The Outsiders

“One major factor we analyse is capital allocation. If the company generates a lot of free cash flow and the management proceeds to waste it, that free cash flow has no value to investors.” Andrew Wellington

Capital allocation means distributing and investing a company’s financial resources in ways that will increase its efficiency, maximize its profits and increase the company’s future business value. The results of any capital allocation decision will typically be known only with the passage of time and hence it is important for investors to have a framework to analyze these decisions at the time they are taken. In one of our blogs (click here) we have discussed in detail about ‘Ansoff Matrix’ developed by H. Igor Ansoff in 1957 that investors can use to analyze and assess companies capital allocation decisions.

Using Ansoff Matrix in combination with capital committed by the company, an investor can try to assess the extent of risk in the new growth strategy i.e. risk associated with capital allocation decisions made by the company.

At Marcellus, our investment team spends a lot of time analyzing whether the company in question can manage its capital well because if a company manages capital well and delivers strong revenue, earnings and free cashflow growth, the stock will likely generate high returns to shareholders over the long-term.

Please find below links to our latest newsletters and presentations:

**For product/sales related queries please write to sales@marcellus.in**

OPERATIONS UPDATE:

1. Rising Giants AIF update:

We are opening Rising Giants AIF in the month of March 2022. Request you to please start the paperwork in case your clients are interested. Please note key dates:

• Last day to receive resident individual CIF – 24th Mar 2022

• Last day to receive non-resident individual CIF – 22nd Mar 2022

• Last day to receive error free resident individual form – 28th Mar 2022

• Last day to receive error free non-resident individual form – 25th Mar 2022

• Last day of funding 30th March 4pm

Minimum ticket size

• For new clients – INR 5,00,00,000 (INR Five Crore)

• For existing clients – INR 1,00,00,000 (INR One Crore) subject to overall AUM with Marcellus (including AIF) totaling to at least INR 5cr

We request you to please complete your client’s paperwork ASAP and fund the money only close to 30th March. Units will be allotted only after 30th March. Please reach out to your respective sales/ops RM for more queries.

2. Marcellus Web CIF – Resident Indian Investors

We have taken one step forward with digitization to deliver better user experience for our new investors and partners. We have gone live with online Web CIF (link below) for Resident Indian clients wherein all client details can be filled and submitted to Marcellus along with an upload of all the requisite KYC documents; you no longer need to fill in the excel spreadsheet for Resident Indian clients.

Process Steps to fill in the Web CIF (Resident Indian)

• Kindly keep a soft copy of all KYC documents in PDF/JPEG format handy before filling the form

• Link to access Web CIF – https://investor-resources.marcellus.in/generate-shorturl-cif-distributor

• Fill the basic details, enter email address where OTP is to be sent and click on generate URL

• Copy the URL and paste in new web page to access Client Information Form

• Fill in the mandatory details on the Web CIF page and upload all KYC documents, Investor details filled in the form should match with KYC documents

• At the end, select email ID where OTP should be sent and then click on ‘Submit’

• An acknowledgement email will be sent to you on receipt of Web CIF details at Marcellus

• Marcellus team will validate the complete information in CIF and KYC documents and proceed further with form preparation.

Note – The process for Non-Individual and Non-Resident Indian remains unchanged wherein the excel CIF is to be used for sharing Client information; resharing the excel link below for your reference.

Non-Individual: https://marcellus.in/new-cif-for-non-individual-clients-ver-2-0/

Non-Resident Indian: : https://marcellus.in/new-cif-for-nri-clients-ver-2-0/

- Non Individual – Document Update on Audited Financials.

• It is mandatory to provide Audited Financials for last 2 years i.e FY 2020 and FY 20214. Nominee Addition / Opt out Update

• As per NSDL, client who didn’t nominate anyone as their nominee at the time of opening account with us, would require the enclosed forms as per the Annexure’s mentioned below.

• Annexure A : To Add a Nominee. (Enclosed)

• Annexure B : To Opt out of a nominee. (Enclosed)

**For operational related queries please write to clientsupport@marcellus.in**

Copyright © 2022 Marcellus Investment Managers Pvt Ltd, All rights reserved

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services and as an Investment Advisor. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form