PORTFOLIO UPDATE:

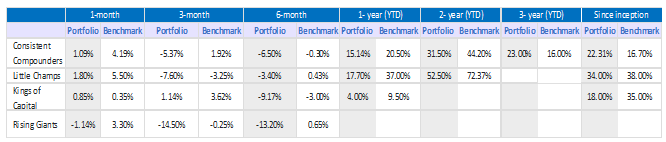

Performance data is net of annual performance fees (Except for Little Champs Portfolio) charged for client accounts whose account anniversary date falls upto the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated upto 31st December, 2021. For Little Champs portfolio, since performance fees are charged on cumulative gains at the 3rd anniversary of the respective client account, the effect of the same has not been incorporated in the performance data. (The returns are as on 30th March, 2022)

Inception Date & Benchmark:

Consistent Compounders Portfolio: Inception: 1st Dec,2018 Benchmark: Nifty 50 TRI

Little Champs Portfolio: Inception:28th Aug,2019 Benchmark: S&P BSE Small Cap TRI

Kings of Capital Portfolio: Inception:28th July ,2020 Benchmark: Bank Nifty TRI

Rising Giants Portfolio: Inception:27th Dec ,2021 Benchmark: BSE 500 TRI

How India’s greatest companies build strong BOARDS

The Board’s role is to pull management out of the trees to see the forest. – Pearl Zhu

The growth of a company and especially the sustainability of growth is driven by many factors and many of them are qualitative in nature. At Marcellus, we use our proprietary “Longevity Framework” to assess such qualitative factors and hence sustainability of cashflows which in turn helps us estimate the company’s intrinsic value and position sizing of stocks relative to others in our portfolio.

The factors that are part of our “Longevity Framework” to assess sustainability of the quality of the company include quality and depth of management not restricted to the CXO layer, the institutionalization of processes and culture and last but not the least, the quality of the Board of Directors. Since the quality, especially the independence of the board has a direct bearing on sustained financial success and hence share price returns of companies, we hosted a Webinar with Head of Financial Services at Egon Zehnder – Namrita Jhangiani who discusses How India’s Greatest Companies Build Strong Boards.

You can hear the recording of the Webinar here. Key highlights from our conversation with Namrita:

Namrita highlights that there are three key questions that help ascertain board quality. These are:

a) Who is on the board? A strong board should be Fit for Purpose which means that the composition of a strong board would vary for different companies. For instance, the focus for a smaller company should be to have a board that ensures strong compliance and processes whereas a larger company’s board could focus on optimizing performance, maintaining strong processes and systems. Some Questions to consider while evaluating this are: Do the board members bring a diverse set of skills? Are they domain experts? Do they represent the target markets and customers? Is the board independent?

b) What is the board’s agenda? Evaluate what does the board advise management on. Is it only regulatory issues or do they guide the management on strategy, risk, talent management, succession planning? Historically, Indian companies chose board members from a small pool of lawyers, bankers, chartered accountants who would mostly advise on regulatory and compliances but would add little value on strategic decisions.

c) How does the board work together? While the board could be diverse, does it work as a team? Do they meet pre and post-board meetings or without the presence of the management? How does the board avoid group think?

Succession planning: A good quality board starts succession planning as soon as they appoint a new CEO to ensure continuity in case of unforeseen events. Strong board maintains an active list of CEO succession candidates and identifies internal candidates for the future CEO position.

So the next time when you open any company’s Annual Report than please look for details that could give you a sense of the quality of the Board as it has a massive bearing on the long term compounding of your investments.

Please find below links to our latest newsletters and presentations:

**For product/sales related queries please write to sales@marcellus.in**

OPERATIONS UPDATE:

1. Aadhaar seeding with PAN

• Enclosed is the circular for your reference

Click on below link for Pan and Aadhar Linking status

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

2. Digital Sign-Up for Existing Client

• Existing Client Sign-up is basically for the clients who have an Active investment with Marcellus and wish to sign-up a new strategy through signing only an Investment Approach.

• With this utility all the Resident Individual clients who are signing the document in India can make use of this digital initiatives.

Key derived benefits from this Initiatives are:

Reduction in TAT for processing of Existing account

No paperwork involved, 100% digital

Eliminate Discrepancies with quick Fund Deployments

Less coordination with Distributors / Client

Better client onboarding experience

3. Tentative Date – Audited Financials FY21-22

• The Audited statements for FY21-22 will be tentatively available by the first week of June under the Investor’s login.

• Please click on this link (https://marcellus.in/how-to-access-your-audited-financials-and-invoices/ ) to see step by step instructions on accessing audited statements online in Investor’s login.

• The complete guidance on accessing portfolio online for Investors, below is the link.

• https://marcellus.in/wp-content/uploads/2020/03/Marcellus-Client-Portal-Guide-march2020.pdf

4. Availability of Statements for the Year End.

For the upcoming quarterly billing cycle, we would be keeping our accounting books open for 31 Mar-22 till 4th April,2022. Hence, all the statements as on 31st March,2022 shall be available from 5th April,2022.

5. Marcellus Web CIF – Resident Indian Investors

We have taken one step forward with digitization to deliver better user experience for our new investors and partners. We have gone live with online Web CIF (link below) for Resident Indian clients wherein all client details can be filled and submitted to Marcellus along with an upload of all the requisite KYC documents; you no longer need to fill in the excel spreadsheet for Resident Indian clients.

Process Steps to fill in the Web CIF (Resident Indian)

• Kindly keep a soft copy of all KYC documents in PDF/JPEG format handy before filling the form

• Link to access Web CIF– https://investor-resources.marcellus.in/generate-shorturl-cif-distributor

• Fill the basic details, enter email address where OTP is to be sent and click on generate URL

• Copy the URL and paste in new web page to access Client Information Form

• Fill in the mandatory details on the Web CIF page and upload all KYC documents, Investor details filled in the form should match with KYC documents

• At the end, select email ID where OTP should be sent and then click on ‘Submit’

• An acknowledgement email will be sent to you on receipt of Web CIF details at Marcellus

• Marcellus team will validate the complete information in CIF and KYC documents and proceed further with form preparation.

6 . Extended 100 % Form Filling support for NRI and Non-Individual client offered by Marcellus.

• In our endeavor to smoothen the process of NRI Account opening, we have taken it upon ourselves to pre-fill the NRI application forms for our Partner/Distributor clients.

• We have facilitated a separate process wherein, based on the “Client Information & KYC documents”, we at Marcellus, will prepare the PMS Account opening booklet for your clients.

• The Prefilled Forms with all the requisite Sign & IPV markings, will be couriered to the preferred address of the Partners/Client.

Key benefits of this Process are listed down:

Enable KRA check and identify need for IPV/OSV upfront and filter AML Validation.

Improvise TAT of account opening and enable clients to invest sooner.

Eliminate Re-iteration of seeking information and ratification from client to solve

observations.

Service & Operations efficiency at both Marcellus and Business Partner end.

Process Steps for the Marcellus Form Support:

Download the Client Information Form [CIF] for NRI client through link shared below.

NRI (Non-US): https://marcellus.in/new-cif-for-nri-clients-ver-2-0/

US-NRI Partner: https://marcellus.in/new-cif-for-nri-US-partner-clients-ver-2-0/

US-Resident Foreign Nationals Partner: https://marcellus.in/new-cif-for-fnr-USpartner-clients-ver-2-0/

Non Individual : https://marcellus.in/new-cif-for-non-individual-clients-ver-2-0/

Fill in complete client (s) details in CIF and refer to supporting KYC documents to be

shared along with CIF.

Ensure to share CLEAR scan copies of supporting documents & confirm dispatch

address details.

Email CIF and Supporting KYC documents to clientsupport@marcellus.in for

validation.

Respective SRM will validate the complete information in CIF and supporting KYC

documents.

If Validation is complete, team will carry of necessary KRA AML checks and prepare

the Prefilled form based on the CIF & KYC documents.

In case of need for IPV & OSV respective SRM will reach back to Partners.

Prefilled forms will be couriered to the requested address with T+1 days of the

complete validation date.

Important Notes:

All information in CIF is mandatory and will be used in filling of complete form.

Incomplete CIF, or missing info. or unclear documents will be rejected by SRM at the time of validation process and will not be processed for form preparations.

Request clients to share clear images of the proof scan copies requested and in the readable format, unclear copies will not be accepted.

All CIF submitted before 12:00 pm will be considered for validation on same day and dispatch by next working day.

All CIF Received after 12.00 PM will be considered for dispatch on T+2 working day.

Ensure to mention the “Dispatchment Address” in the CIF.

**For operational related queries please write to clientsupport@marcellus.in**

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.