In this month’s newsletter we focus on the portfolio stocks that have witnessed significant drawdowns (>20%) since inception. For Dr Lal Pathlabs, we emphasise how turnaround time, quality and accuracy of reports are more important drivers of competitive advantage than pricing. Aavas’ asset-liability matching gives us confidence regarding the resilience of its spreads in a rising interest rate environment. For InfoEdge, the strength of its core business (particularly Naukri) and the firm’s investing track record are much bigger value drivers than the stakes in Zomato & Policybazaar. For L&T Technology Services, structural opportunities around outsourcing outweigh attrition concerns and a possible US recession. For Alkyl Amines, a strong growth runway (thanks to pharma supply chain diversification), continuous focus on R&D and capacity additions should drive long term value creation. Further, Astral’s expansion into sanitaryware and paints does not put its existing business at risk while VMart and Relaxo are facing transient inflation related disruptions.

Performance update for the Rising Giants PMS

This portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

Stock-wise attribution analysis for the Rising Giants portfolio

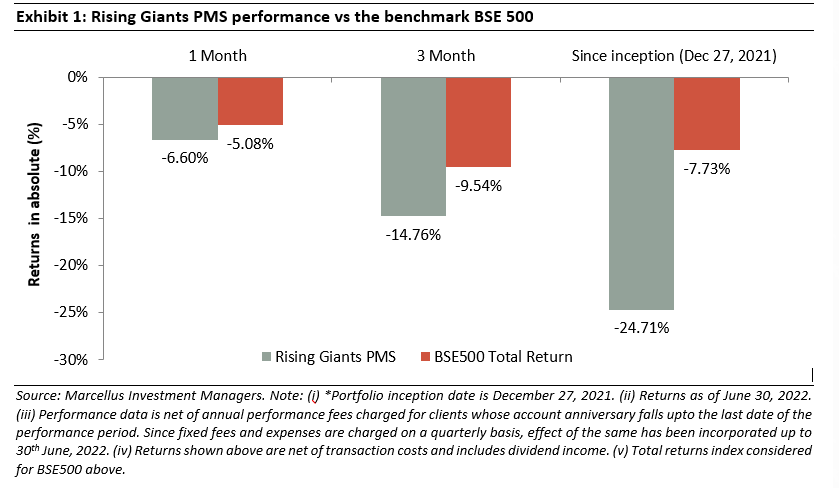

The Rising Giants PMS portfolio’s NAV has declined by 24.71% since inception until June 30, 2022 as shown in Exhibit 1. The stock-wise absolute returns for the above period are shown in the below exhibit:

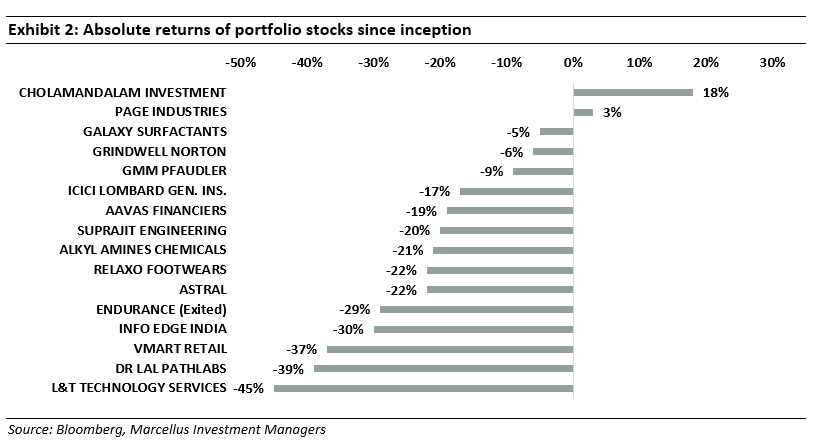

In the remainder of this note, we have addressed the concerns in the Indian stockmarket around the portfolio stocks which have witnessed significant drawdowns (>20%) as shown in the above exhibit.

Addressing stock specific concerns

1. Dr Lal Pathlabs – turnaround time, accuracy and quality of diagnosis more important than price

A key current concern in the stockmarket for Dr Lal is the impact from new entrants like Tata 1mg which are supposedly ‘digitally savvy’ and have announced aggressive pricing campaigns in certain metro cities.

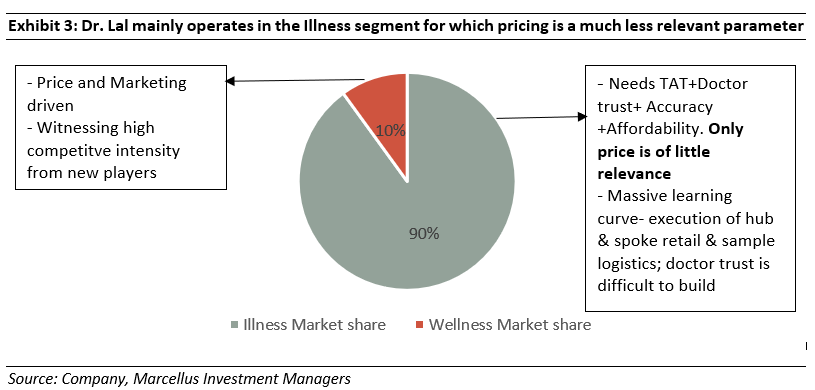

The diagnostics sector can be divided into two main segments: (1) testing related to an illness which is 90% of the market; and (2) testing related to wellness (preventive measure) which is 10% of the market.

In cases, where a patient is suffering from an ailment, the test results/diagnosis become the starting point for treatment. Also, the costs associated with diagnostics is relatively low compared to the total treatment costs such as hospitalisation charges, doctor fees, medicines etc. Thus, the Turn Around Time (TAT) of test reports, their accuracy and doctor’s trust in them become the most important drivers in the patients’ decision making behind choosing a diagnostics partner.

The wellness segment (which accounts for just 10% of the market), on the other hand, is more about preventive healthcare and hence is discretionary in nature. As a result, pricing of the tests (and discounts offered) become the most critical decision-making parameter for deciding on a diagnostic partner rather than the three factors mentioned above. This is where most of the competitive intensity is being felt.

With respect to any edge that new age ‘digital’ firms may have over Dr. Lal from a technological standpoint, it is important to reiterate the importance of TAT, the accuracy of results and the doctor’s trust in the test results – these are key variables which determine the patients’ decision making in the Illness segment about which vendor to choose. These factors in turn are dependent on the efficiency of back-end processes. Our channel checks suggest that Dr. Lal has been implementing automation in sample testing with intelligence fed from in-house data analytics to enable faster & less variable TAT and further improving accuracy of results. For example, the firm’s ‘control tower’ initiative which enables monitoring of a sample lifecycle and identification/correction of bottlenecks has allowed Dr. Lal to meet the ETR (Estimated Time for Report) more than 90% of the time vs. 80% earlier. Additionally, the scope for real time tracking of samples by hospitals has also been increased substantially allowing for better management of the doctor’s time, further building the stickiness of the firm with these doctors.

Secondly, price competition has for a long time been commonplace in the diagnostics space and Dr. Lal has successfully warded off aggressive price competition in the past as well. As discussed in our May’22 Consistent Compounders newsletter, “even as Dr. Lal Pathlabs’ share price has compounded at an impressive 20% CAGR between Dec’15 to Apr’22, the stock delivered an absolute return of negative 8% over the 3 years from Oct’16 to Jul’19. One of the key reasons was that Dr Lal Pathlabs faced a major price war during 2016-2017 from Thyrocare, which it was able to defend successfully due to the moats created around convenience to the customer. Over subsequent two years from Aug’19 to Aug’21, Dr. Lal Pathlabs delivered share price CAGR (i.e., annualized return) of ~80%, catching up with the fundamental progress made over the preceding three years.”

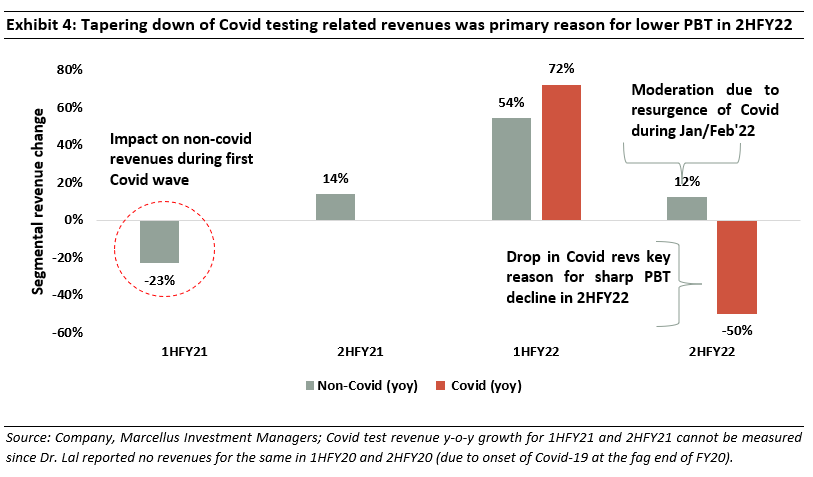

The other concern on Dr Lal Pathlabs is surrounding its recent quarterly results. In 2HFY22 Dr Lal Pathlabs witnessed a significant decline in PBT (down 31% YoY), after recording 27% YoY PBT growth in FY21 and 100% YoY PBT growth in 1HFY22. We have already addressed this point in our June 2022 newsletter. The fall in PBT in 2HFY22 was primarily on account of tapering down of Covid-19 testing related revenues in 2HFY22 (decline of 50% YoY) as Covid-19 cases dropped significantly in India. Covid-19 related revenues were never expected to be sustainable and hence tapering down was expected by us and by the broader market. The more sustainable non-Covid revenues have grown for Dr.Lal by 35% YoY in FY22 (30% YoY even after excluding Suburban Diagnostics acquired in October 2021). This growth was despite the increase in Covid cases affecting normal business for around four months during FY22.

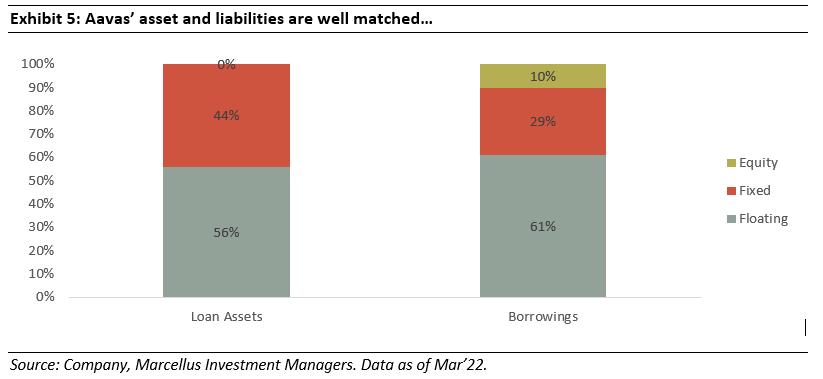

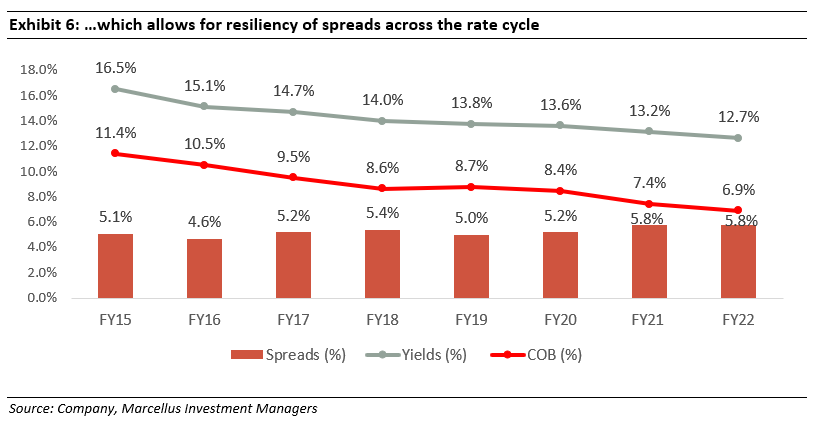

2. Aavas Financiers: Asset-liability duration matching leads to resilience in spreads

The key concern in the stockmarket for Aavas appears to the narrowing of spreads for NBFCs in a rising interest rate environment. For Aavas, the fixed rate loan book is backed by fixed rate liabilities and its shareholders’ equity, whereas the lender’s floating rate assets are backed by floating rate liabilities. In the event of floating rate liabilities getting repriced (due to rising interest rates), the floating nature of the loan book (~60% of the assets) means that they too can be repriced accordingly. This would allow spreads to revert to the mean, albeit with a slight lag. In fact, the management has shown evidence of being agile and has already raised its prime lending rate by 25 bps effective 5th June’22.

Moreover, over the last eight years, Aavas’ spreads have consistently remained upwards of 5% as the matched loan book and liability composition (fixed vs. floating) allows for resilience across the rate cycles. While there may be quarter-to-quarter volatility in spreads, over longer time horizons, we expect Aavas’ spreads to remain over 5%+.

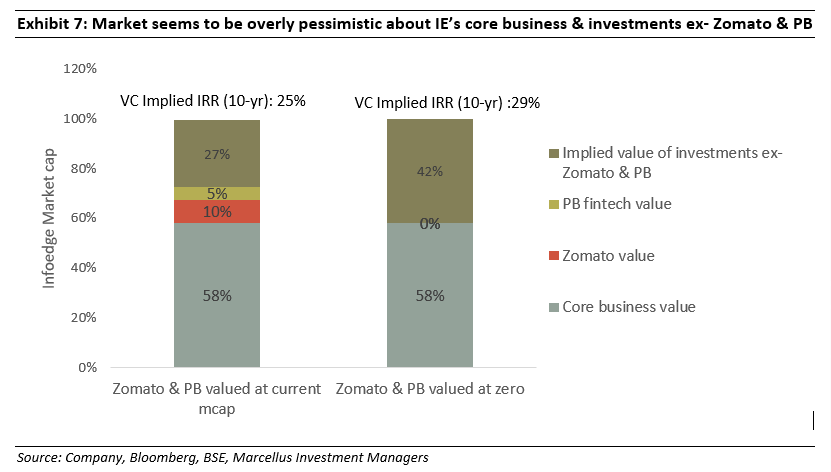

3. InfoEdge: Comfort on the stellar quality of the core business and the firm’s VC investing skills

The key concern in the stockmarket appears to be the impact on InfoEdge from the deep correction seen in the share prices of its investee companies, Zomato and Policybazaar (PB Fintech Ltd).

Our Take: To understand the legitimacy of market concerns around the impact of Zomato and PB Fintech’s valuations on InfoEdge, we did a Sum of The Parts (SOTP) analysis using: (1) InfoEdge’s stake in these two firms (net of the holding company discount of 25%), (2) InfoEdge’s core classifieds business (Recruitment, Real Estate, Matrimony and Education); and (3) The value of other investee companies (ex- Zomato & PB) held by the VC arm of InfoEdge.

The strength of InfoEdge’s core business can be gauged from the fact that Naukri is the market leader in online recruitment classifieds in India, with a traffic share of 65-70% and a profit share of close to 100%. The business has an established flywheel, where the largest number of resumes/jobseekers attracts the most number of recruiters and the largest recruiter base attracts more jobseekers (and thus the virtuous cycle keeps spinning year after year). A 3-year revenue CAGR of 14% and EBITDA CAGR of 16% through the tough Covid years is an indicator of this franchise’s strength. Secondly, InfoEdge also has the highest traffic in real estate classifieds, which is largely a two-player market, and is the no.3 player in matrimonial classifieds. An EBITDA of Rs6.7bn in FY22 from Naukri gives the company material firepower to fund the other businesses.

Info Edge has also been making strategic investments in businesses related to its core recruitment, real estate, matrimony and education, in order to create an ecosystem of ventures with connected synergies. In recruitment, for example, the firm has acquired iimjobs in FY20 to add strengths in the BFSI and senior management hiring space. In real estate, the firm has acquired start-ups that help in the due diligence of properties. And in education InfoEdge has invested in businesses like exam preparation, university admissions counselling, etc.

Coming to the VC business, since InfoEdge started VC investing, it has achieved an IRR of ~29% over FY09-22 even if we: (a) value Zomato and PB at their current market prices; (b) deduct a Holding Company discount of 25%; and (c) value all other investments at book value.

If we consider the implied market value of some of the recent VC investments made by InfoEdge based on the latest fund-raising rounds of the investee companies, the IRR generated by InfoEdge’s investment team increases to over 30%.

Assuming that Zomato & Policybazaar fail to appreciate further, the rest of the investment portfolio needs to compound at 25% over a 10-yr period (assuming 50% profit distribution as dividend and balance 50% invested in VC portfolio). If we take a worst-case scenario, that the value of Zomato & PolicyBazaar goes down to 0 (i.e. market cap drops to Rs 0), then the portfolio needs to compound at 29% to justify the current value. The question therefore is whether InfoEdge’s VC arm can generate a 25% IRR in the best case and 29% IRR in the worst case. As per our lethargy test on the VC business which was based on parameters such as capital discipline inculcated into the investee companies, need for incremental capital, talent at the fund, longevity of capital and the size of the AIF fund (i.e. the VC fund), we remain confident that InfoEdge would be able to generate around 25% IRR for its VC business. A combination of a super solid core franchise and a high quality VC portfolio makes InfoEdge a very attractive investment.

4. L&T Technology Services – structural opportunities around outsourcing outweigh near term US recession and attrition concerns

LTTS reported a strong set of results for 4QFY22 (INR revenues up 21.9%, EBITDA up 30% YoY). All segments reported strong revenue growth led by transportation (up 30%), plant engineering (21%) and industrial products (22%). However, despite this seemingly strong 4QFY22, the firm’s share price has witnessed significant correction in recent months due to the following concerns.

A key concern in the stockmarket surrounding LTTS is the potential impact of a US recession on LTTS’ growth. Given that LTTS derives 60-65% of its revenues from US, a US recession has the potential to significantly impact its growth prospects. Our take: In the results call, LTTS management indicated that the overall demand outlook remains robust and there has been no indication of any change in budgets from clients in the Western world. From a structural standpoint, India is likely to be a big gainer due to the cost optimization drive across the globe in a rising inflation or a slowing global growth scenario. While engineering services is a relatively younger industry (compared to IT Services), data from the Indian IT Services sector shows that slower growth in US/Europe has a limited impact on outsourcing business flows to India. Moreover, with a lag of a year, Indian IT Services companies have actually seen a sharp acceleration in the rate of their revenue growth. Further, LTTS continues to benefit from the cross-pollination advantage by being present across multiple industries. Moreover, the company has been taking active steps over the last two years to sign up larger deals, which provide longer-term revenue visibility. On the back these steps, LTTS has signed two back-to-back $100 million plus deals in the last two years. In FY21, it signed a $100 million plus deal with an Oil & Gas company based out of North America. In Q4FY22, the company signed a large deal the with Jaunt Air Mobility (electric aircraft manufacturer) to provide engineering services for the electric Vertical Takeoff and Landing air taxi.

Another concern surrounding LTTS is the lack of availability of talent and impact thereof on execution and margins given high demand for talent in India and labour supply issues in USA. Our take: While LTTS did witness attrition of 20.4% in 4QFY22 due to widespread labour supply issues in the industry, the firm’s attrition rate was the lowest amongst the pure play Indian Engineering R&D players. The reason for staff moving out from LTTS or broader IT Services companies was the higher salaries being offered by start-ups and the product companies. However, in the last one month, things have changed – increasing lay-offs by start-ups have led to the easing of supply of talent in the industry. LTTS also continues to focus on employee learning & development which should help the firm retain talent. LTTS has recently carved out a new business unit and Centre of Excellence for Metaverse and visual reality products. The company hired around 3,000 freshers in FY22 from no incremental hiring in FY21. Working in LTTS provides core engineering exposure and allows talented engineers to work for innovative products.

Overall, we consider LTTS is well-positioned to benefit from increasing Engineering R&D spend and offshoring by large companies across the world.

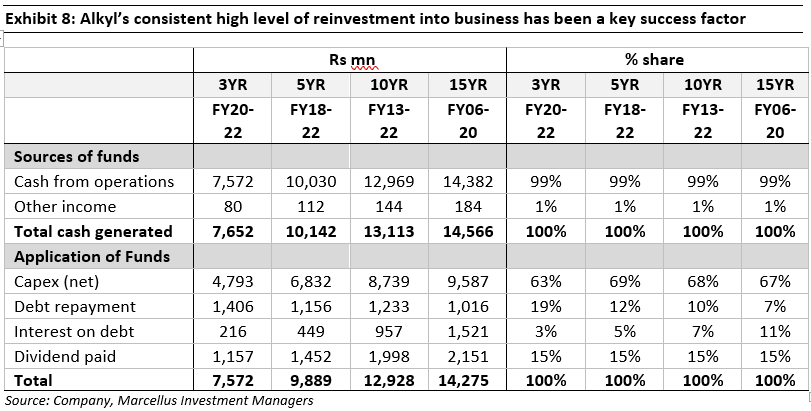

5. Alkyl Amines – long term story remains intact

After witnessing robust growth in the recent years (Revenue and EBITDA CAGR of 24% and 54% respectively over FY19-21), Alkyl witnessed a drop of 48% YoY in EBITDA in 2HFY22 (24% drop for FY22 as a whole). This has resulted in stock price declining by 45% from its peak in July 2021.

Our checks point towards the following factors behind the YoY decline in EBITDA in 2HFY22:

- High margin base of FY21 when prices of key raw material inputs like ethanol, acetic acid and methanol corrected sharply or remained constant through the Covid-19 first wave but at the same time the realisation of some of Alkyl’s final products like Acetonitrile and Ethylamines improved sharply (due to supply constraints) – thus resulting in sharp gross margin improvement in FY21. On the other hand, the situation reversed in FY22 with the prices of the key raw materials jumping sharply – for instance Ammonia prices rose by 233% between Jan-Dec 21 and Acetic Acid prices rose by 42% for the same period. While Alkyl has passed on to its customers significant increases in raw material prices (revenue up 24% in FY22 thanks to higher prices being charged by Alkly), it has not been able to do so fully due to time lag involved in passing the same.

- Alkyl also faced production cuts in a few important products like DMA HCL (an intermediate which goes into Metformin, a popular antidiabetic drug) due to the shortage of matching intermediaries like Dicyandiamide or DCDA from China (which led to a reduction in Metformin production by pharma companies in India) and thus resulted in an impact on Alkyl’s DMA HCL uptake.

- Realisation of some products like Ethylamines corrected from previous highs due to increased supplies coming from the commissioning of competitor Balaji’s new plant in FY22.

We believe all the above factors that impacted Alkyl’s earnings performance in FY22 are short term in nature. In fact, the prices of key raw materials seem to have stabilised in recent months – down 20-30% from the recent highs. Alkyl’s new Acetonitrile plant has been commissioned recently which should contribute significantly to volumes in FY23 – Alkyl has definitive advantage in its industry and much higher margins in Acetonitrile due to its innovative cleaner manufacturing route using Acetic acid unlike the conventional Acrylonitrile route (which is derived as a by-product during ABS polymer manufacturing).

Over the medium to long term, we remain positive on Alkyl due to a strong growth runway for the industry (any diversification of the pharma supply chain from China to India will be an added advantage), the R&D focus to both drive value added products as well as manufacturing efficiencies and continuously high reinvestments in the business.

More details on our investment thesis on Alkyl can be read at https://marcellus.in/newsletter/little-champs/spotlighting-alkyl-amines/

6. Astral: Low risk expansion, market share gains provide comfort

A key concern in the stockmarket for Astral has been around its entry in the faucets and sanitaryware business in FY21, followed by its entry into the Paints business in FY22. Both these segments are competitive, with strong incumbents and no apparent competitive advantages for a new entrant like Astral.

Our take: Astral entered the paints business by acquiring a 51% stake in Gem Paints, a south India based company, at a valuation of Rs400 crores. Gem Paints is a profit-making business, with revenues of Rs215crs, EBITDA margin of 15% and a recently completed capacity expansion program. Although the paints business is highly competitive, we believe Astral has adopted a strategy that mitigates, to a large extent, the associated risks. Firstly, its acquisition does not require setting up manufacturing and distribution from scratch (remember, distribution is the key barrier to entry in this sector). Secondly, according to their purchase agreement, the existing promoters of Gem will continue to run the company for another five years, during which Astral has the opportunity to learn about the paint business. Thirdly, by buying a profit-making business, Astral has to manage only operational improvement rather than driving a financial turnaround. And finally, with a total acquisition cost of Rs400crs, the company has kept the absolute capital commitment under control (Astral has net cash of Rs557crs on its balance sheet), and not put the other businesses at risk. Additionally, the acquisition gives Astral the ability to leverage around 3,000 retail touchpoints in four southern states, for its pipes and adhesives business.

For the faucets and sanitaryware business, Astral has launched a wide range of products and is leveraging its existing large pipes distribution network (1,000+ distributors and 35,000+ dealers) to reach the consumer. To run the business, the company has hired the former CEO of Cera, Mr. Atul Sanghvi, an industry veteran, which we believe is the right strategy that brings in the required expertise and focus necessary for a new business and does not stretch the promoter’s and management’s bandwidth. Further, while retaining the design element in-house, manufacturing has been outsourced currently, with a plan to gradually build capacities as the business scales. In this business too, we believe that such a calibrated approach to capital allocation is appropriate.

Another concern for Astral was related to its lower growth in Q4F22 relative to peers. Astral’s Revenues from pipes grew at 22% YoY whereas pipe revenues of peers like Supreme and Finolex grew by 37% and 42% respectively. EBIT margins of Astral Pipes were 15%, down by 140bps QoQ and by 530 bps YoY. Margins of Astral Adhesives too fell to 10.7% in Q4FY22.

Our take: While Q4 was a relatively weak quarter for Astral, for the full year FY22, Astral grew its revenues from the pipes business by 39% yoy, whereas revenues of Supreme, Finolex and Prince Pipes grew by 23%, 46% and 28% respectively. These numbers indicate market share gains for Astral versus Supreme and Prince. Even in the case of Finolex, we believe that its revenue growth was led largely by agri pipes, a segment in which Astral has a limited presence. In turn, this implies overall market share gains for Astral. Astral has also remained the margin leader across the pipes industry with 15% EBIT margins in FY22 (for the pipes segment).

Coming to the adhesives business, the fall in Astral’s adhesive margins in Q4FY22 was mainly because of the increase in prices of inputs. Astral has taken price hikes which should be visible in margins with a lag of a quarter.

7. V-Mart: Margins intact in a high inflation environment

The key concern in the stockmarket for V-Mart has been around the impact of inflationary pressures on demand and margins. While V-Mart reported sales growth of 30% YOY in Q4FY22 and 10% CAGR over 3-years, on an organic basis (i.e. excluding Unlimited) V-Mart reported a weak sales growth of 4% CAGR vis-à-vis store count growth at 12% CAGR over 3-years. In a weak demand environment, V-Mart’s ability to pass on increase in input prices without impacting sales is limited.

Our take: V-Mart’s typical consumer has a monthly household income of less than Rs.25,000 to 30,000. This cohort of the population has felt the pinch of price inflation in day-to-day essentials which has led to additional outlay for these households of Rs 2,000-3,000 (monthly) ultimately leading to cuts in their discretionary budget. V-Mart has taken price hikes of ~16-17% to pass eon inflation in yarn prices so as to preserve margins which has further accentuated the adverse impact on demand.

While it is difficult to predict the timing of demand revival, we see signs of inflation softening in recent times for e.g. cotton prices have declined by 20-30% in recent weeks. Meanwhile, V-Mart has continued its focus on store expansion which has grown by 36% yoy (including Unlimited) and 10% yoy (excluding Unlimited) in FY22.

On the margin front, V-Mart offset the impact of more than 50% increase in yarn prices via a mix of aforementioned price hikes of ~16-17% and operating efficiencies. Resultantly, V-Mart’s gross margins have not seen any adverse impact over the last 6 quarters. In fact, its gross margins have expanded by ~400 to 500bps due to the price hikes undertaken and an improved sales mix (using high value products in Unlimited).

Our confidence in V-Mart stems from the huge opportunity in value retail and V-Mart’s execution capabilities underpinned by its strengths in supply chain, robust merchandise selection driven by data and vendor management.

8. Relaxo- Structural story of shift from unorganized to organised intact

The key concern in the stockmarket around Relaxo is also around the impact of inflationary pressures on demand and margins: After reporting robust 6.5% yoy volume growth and 21% yoy EBITDA growth in FY21 (despite the Covid related disruption), in FY22, Relaxo reported a volume degrowth of 8% yoy and EBITDA decline of 16% yoy.

Our take: We believe Relaxo’s weak performance in FY22 was a result of following factors:

- Relaxo’s typical consumer belongs to the bottom of the pyramid and is feeling the pinch of generalised price inflation. Over & above the general inflation in staples, Relaxo hiked prices by ~30-40% YOY (over last one year) to pass on increase in raw material prices which led to a slight increase in the replacement cycle of chappals or downtrading to a cheaper alternate.

- There is reduction in inventory in the channel due to frequent price hikes – Relaxo has hiked prices more than 3-4 times over last year. Firstly, retailers cannot have two products with the same MRP on the shelf which created confusion. Secondly, working capital of channel has not increased in the same similar proportion to price hikes by ~30-40%. Hence, there is a delay in replenishment until the time old stock is cleared.

- Operating margin of 21% in FY21 was exceptionally high due to decline in raw material prices and cuts in advertising/ marketing spends. In FY22, Relaxo reported an operating margin of ~15.7% (~16.5% after excluding one-time support to channel partners for GST rate hike from 5% to 12% in Jan’22) which is in line with historical average of ~15.5% seen over FY18-20.

We believe the issues facing Relaxo are temporary in nature and unlikely to persist over the long term. In recent years, as raw material prices have declined, Relaxo has passed on the benefit by cutting prices by around 10-15%. Over the medium to long term, we expect Relaxo to benefit from the structural shift in footwear from unorganised to organised sector, underpinned by its strengths in in-house manufacturing & distribution.