Even as the global financial system is reeling from the stress created by the sharp increase in interest rates over the past year, the Indian banking system is well placed to overcome this crisis owing to its granular liability franchisee, well matched asset-liability (ALM) schedules and more calibrated monetary policy conduct by the central bank. That said, given that the current crisis in the US has similarities with the IL&FS crisis in India in 2018, we perform a litmus test on all the Kings of Capital (KCP) lenders. Specifically, we assess the risks from the ALM profile of our investee companies whilst qualitatively assessing the quality of their liability franchise. In our assessment, the KCP companies pass with flying colors owing to healthy capital position, well-matched ALM profiles and lower exposure to interest rate sensitive investments.

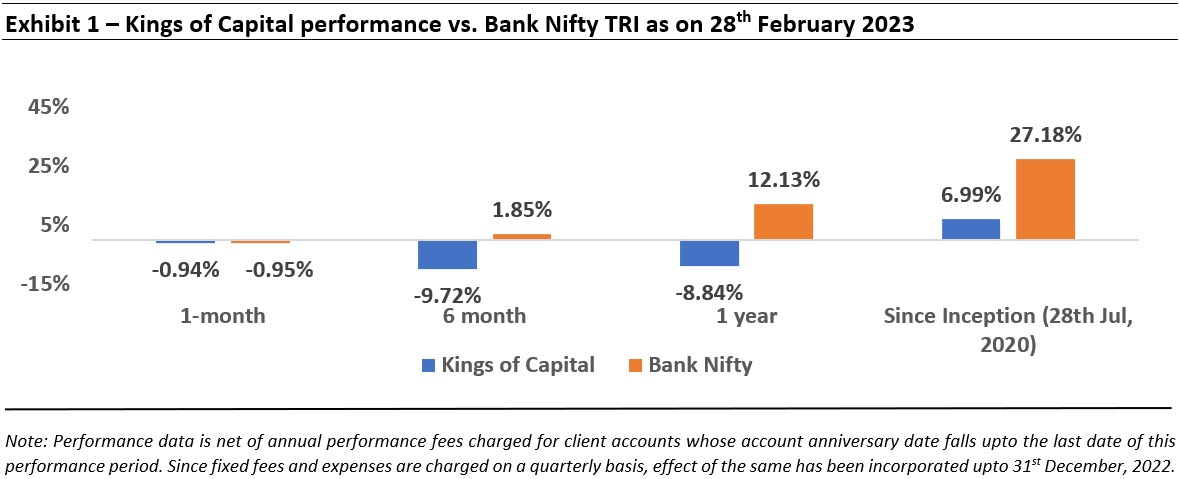

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

US banking system crisis exposes the often ignored aspects of non-linear risks in financial services

“Banking is a very good business unless you do dumb things” – Warren Buffet, Apr’09, Fortune Magazine

Warren Buffet’s quote nicely captures the non-linear risks currently playing out in the US banking system. To quote from the opening para of our Dec’22 dated newsletter:

“When the economic climate is benign, the share prices of financial services companies do not adequately capture the risks of aggressive lending and governance practices. The true intrinsic value of such companies becomes apparent only when such risk actually plays out. History shows that when the risk plays out, the market cap of such companies vaporise within a few days – one minute the investor is the shareholder of an outperforming stock and then, days later, he has lost 90% of his wealth.”

We had covered the non-linear risks pertaining to asset quality and corporate governance (and how avoid those risks) in our Dec’22 newsletter and our webinar on 29th Nov, 2022 (click here to watch). In this newsletter, we take a look at the third leg – risks arising from Asset-Liability Management (ALM).

To understand this topic, let’s take a quick look at what went awry with the Silicon Valley Bank (SVB) – once considered to a darling of the West Coast tech ecosystem.

![]()

#1: Silicon Valley Bank’s depositors (the ‘Liability’ side) consisted mainly of startups that deposited the cash they received from investors. These deposits were particularly high in 2020 and 2021 due to the flurry of private equity and venture capital investments in start-ups in 2020 and 2021.

#2: These monies were invested by SVB in US Treasury bonds and mortgage-backed securities (MBS). As explained by Ben Thompson in his widely followed Statechery blog, while Silicon Valley Bank used to primarily make short term loans, in 2021 the bank shifted to longer-term securities in its search for higher yield (the ‘Asset’ side)

#3: As the US Fed hiked rates by 4.50% since early 2022, two things happened:

- venture capital funding dried up as the cost of money rose in line with rate hikes (implying that inflows into SVB dried up); and

- the market value of the fixed income securities – like US Treasury bonds and MBS – purchased by SVB plummeted (as rates go up, bond prices go down).

#4: SVB held most of the US Treasury bonds and MBS as Hold To Maturity (HTM) on its balance sheet. This meant that the bank aims to hold these bonds until maturity and would carry these assets at par value without the need to revise prices basis the ongoing rate hike action. This would’ve been fine if the bank continued its operations normally without the need to liquidate holdings prematurely.

#5: However, as venture capital funding dried up, SVB’s depositors (start-ups) started withdrawing their cash to fund their operations. To meet the cash needs, SVB first sold off its “available for sale” securities at a loss (as the price had fallen alongside rising rates). To further shore up its cash balances, the bank decided to (unexpectedly) raise equity capital. This sent alarm bells ringing in the Silicon Valley tech ecosystem around the liquidity condition of the bank – especially as majority of depositors of the bank had deposits well in excess of the Federal Deposit Insurance Corporation’s (FDIC) $250,000 limit! (This aspect is an important differentiator of liability franchise for financials, as we will discuss later in this note.)

#6: The key fear of SVB depositors was that if deposits fell further, SVB would be forced to sell its held-to-maturity bond portfolio and recognize a $15bn loss. This is in turn would move SVB closer to insolvency. This fear led startups to withdraw their money, prompting fears amongst others that the bank would run out of money, leading to more withdrawals. In other words, SVB was a textbook bank run.

Asset Liability Management (ALM) becomes important especially in times of rising interest rates

Our investors may remember a similar event playing out for the NBFC sector in general and for Housing Finance Companies (HFCs) in particular during the IL&FS crisis in 2018. To recap, IL&FS defaulted on repayment of commercial paper (short-term borrowing) around Jun-Sep’18 which led to the credit agencies downgrading the company’s debt and yields rising (increasing the rate at which NBFCs could borrow short term money).

IL&FS had been funding long term projects via short term borrowing. In normal circumstances, as its short-term debt matured, the company would repay such debt by borrowing anew from the markets. The default on its repayments resulted in short term liquidity available to IL&FS drying up further, as a result of which its ability to honor its future debt commitments came into question. The fear of debt repayments engulfed NBFCs operating on similar ‘borrow short term, lend long term model’ as the cost of short-term debt kept increasing through 2018.

Many institutions which were buyers of NBFC short term debt started dumping the commercial paper issued by lenders like DHFL and Indiabulls Housing Finance. This resulted in the sharp erosion in their share prices as well. In Jun’19 as a result of the aforementioned liquidity squeeze, DHFL defaulted on its repayment of short-term debt, further increasing the short-term borrowing rates and taking down a whole host of NBFCs that relied on short term funding for their sustenance.

The events that unfolded during the 2018 NBFC crisis is a great case in point of how Asset Liability (Mis)management can affect the survival of a lender. In normal circumstances, as short-term rates are lower than long term rates, lenders can borrow money short term and lend it out for long term (for e.g. borrow money at 3 month/1 year rates and lend it out 5 /10 year rates) thus earning a ‘spread’ in the process. When market conditions are benign, such short-term debt can be rolled over (by borrowing anew) at expiry without much difference in borrowing rates. However, whenever the cost of borrowing rises (as was the case in 2018 in India), the ability of lenders to honor their commitments without taking a hit on profitability reduces materially. This in turn can become a trigger for insolvency as IL&FS discovered in 2018 and SVB in 2023.

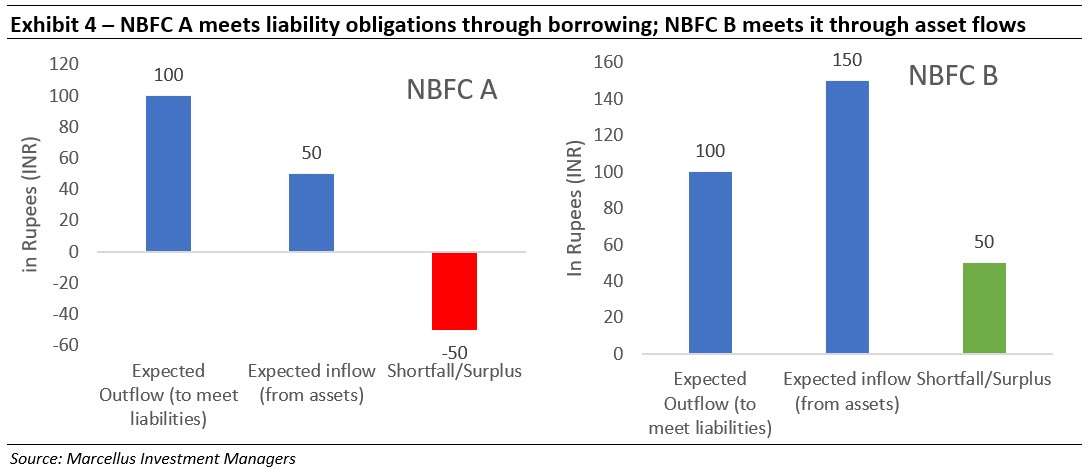

A simple way to understand how well a NBFC manages its assets and liabilities is shown in the chart below. NBFC A is contractually obligated to pay Rs.100 after 3 months to its debtholders. However, it has only Rs.50 coming in from the assets it owns in that period – hence leading to a shortfall of Rs.50 which it would need to cover by borrowing in the market. NBFC B on the other hand, also has Rs.100 of expected outflow after 3 months but has Rs.150 coming in from its assets – thus leading to a surplus of Rs.50, removing any market dependency to meet its liability obligations.

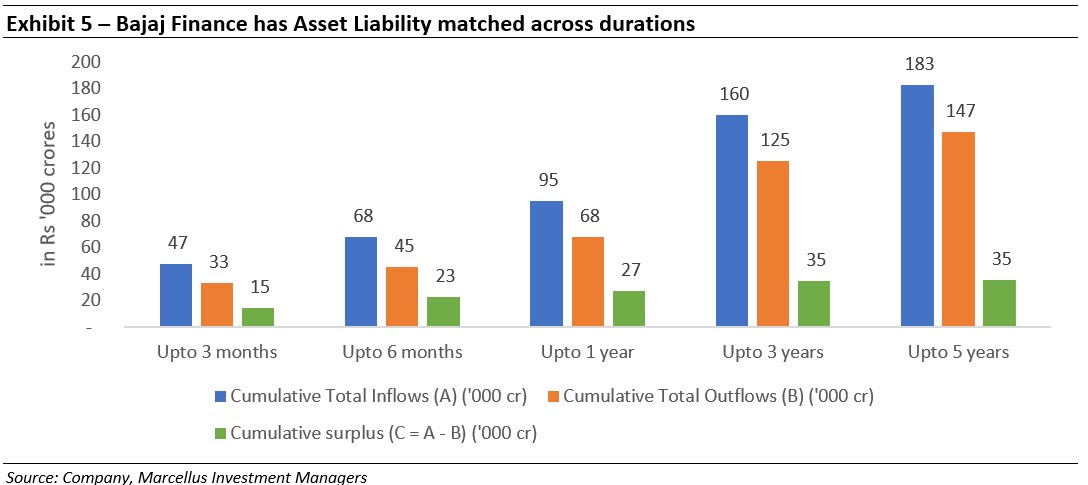

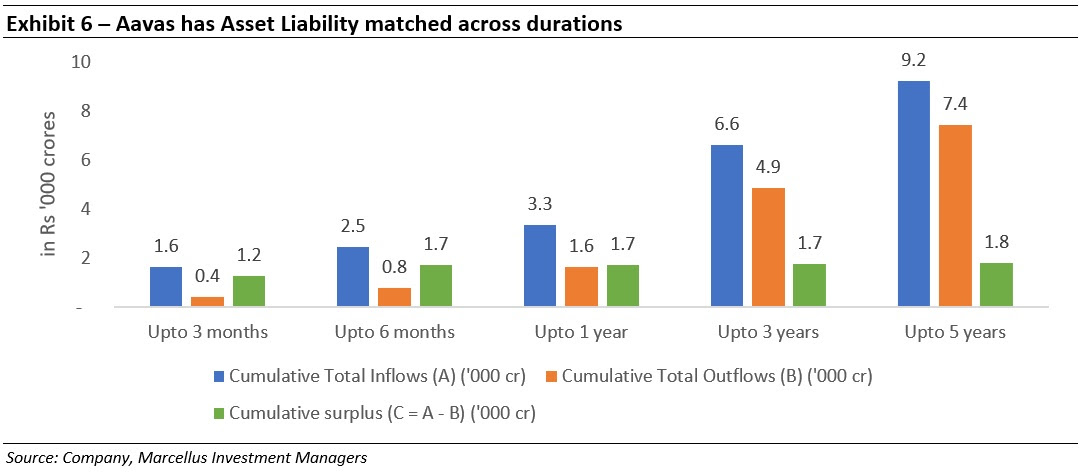

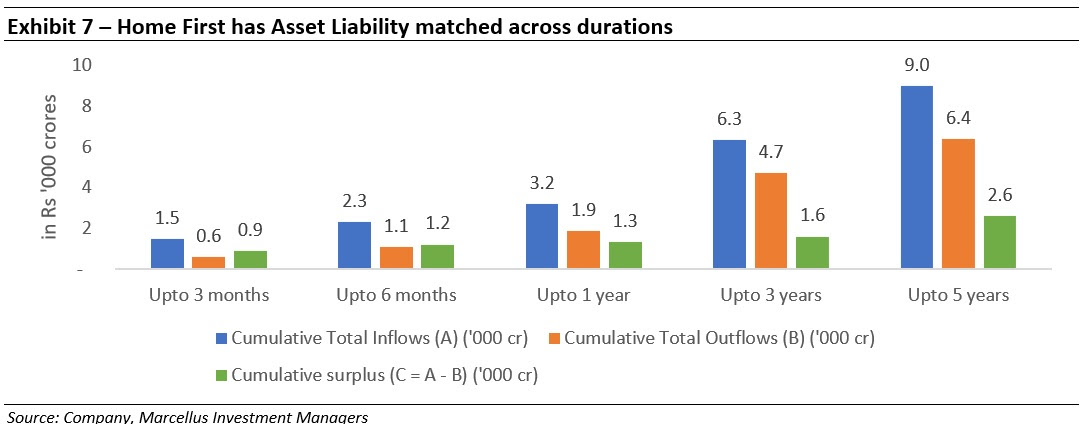

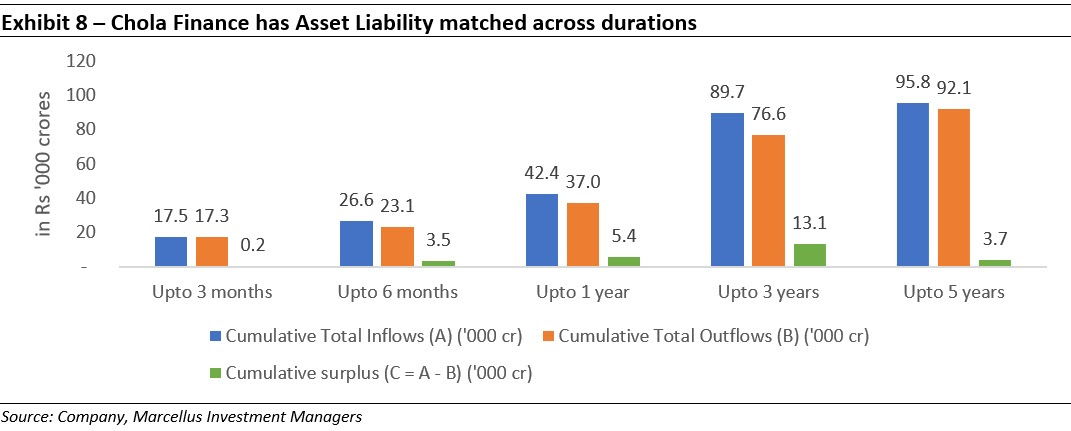

Understanding this ALM risk forms a key part of our research process and as shown in the charts below, the NBFCs in the KCP universe have a ‘surplus’ across the liability time periods.

Liability side for KCP banks is retail focused, well diversified while asset side has limited interest rate risk

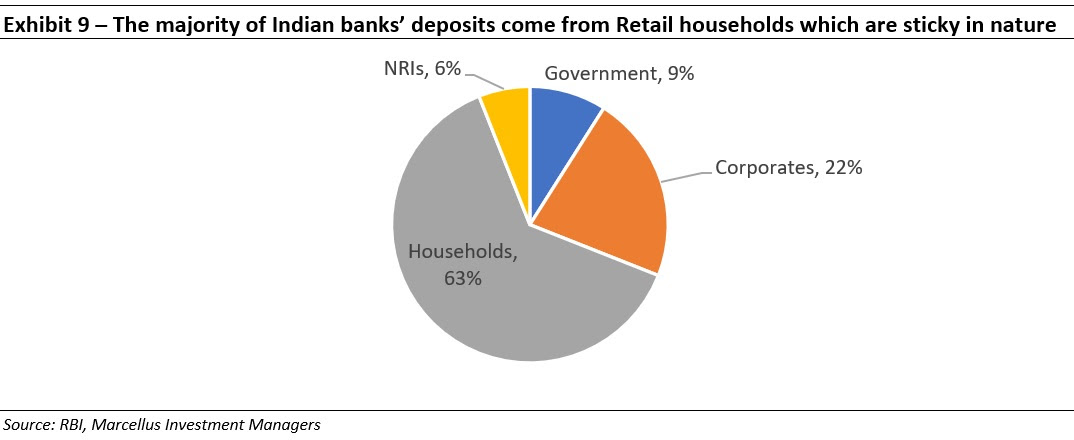

Unlike SVB (which had a high share of corporate deposits in its liabilities), the Indian banking system has a high share (more than 60%) of retail deposits which tend to be less fickle in nature than corporate deposits. Corporate deposits in fact form just one-fifth of the overall deposit base – reaffirming the core liability strength of the Indian banking system.

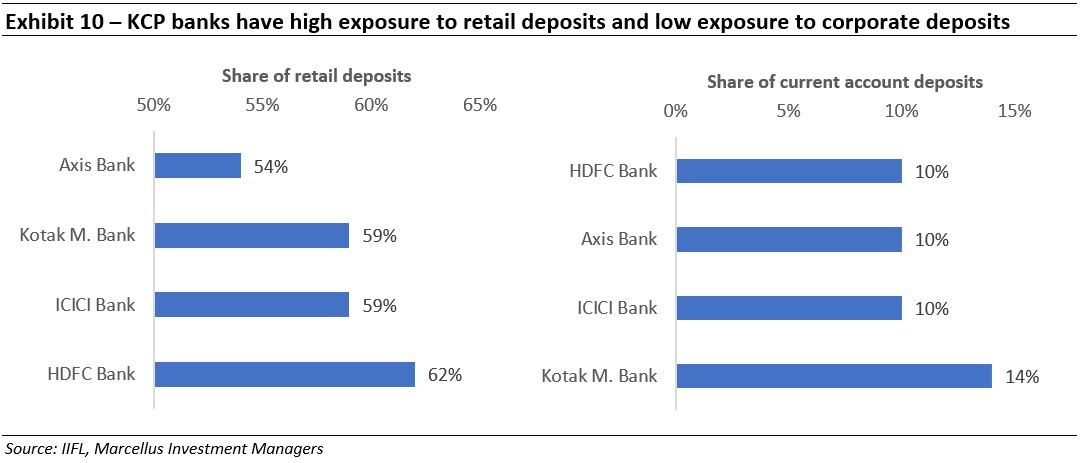

Coming to the banks in the KCP portfolio, one can see in the charts below that retail deposits dominate the liability base and corporate deposits (‘current account’ deposits) form just 10-15% of the pie.

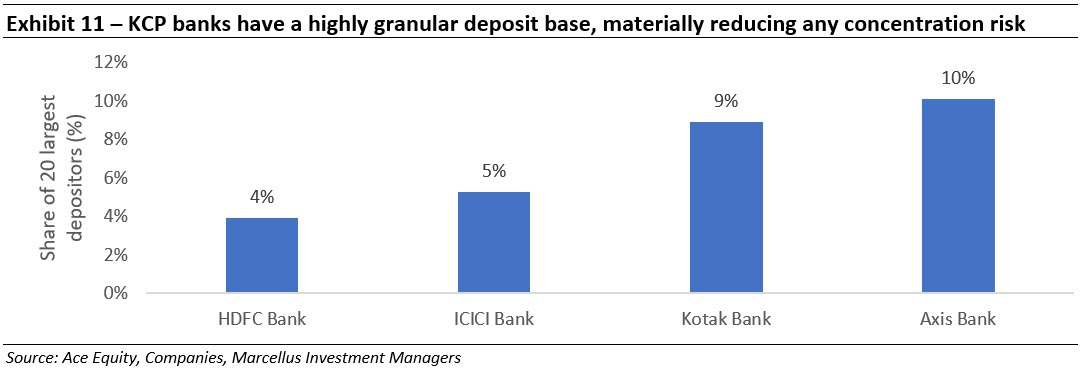

The retail deposits of KCP banks is are also well diversified – meaning the P&L risks from any one or two big depositors pulling money out suddenly is quite low. As shown in the chart below, at an aggregate level the top 20 depositors form just one -tenth of the deposit base of KCP banks at most.

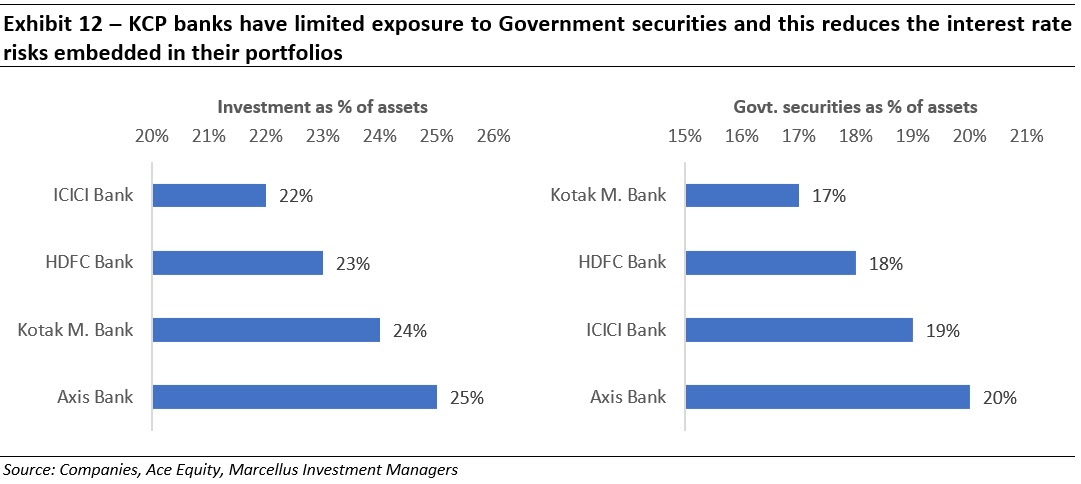

On the asset side, these banks have higher exposure to loans and much lower exposure (<25%) to fixed income securities. In comparison, SVB had ~55% of its balance sheet in bonds and most of these bonds were long dated implying that they were more vulnerable to value erosion as the Fed hiked interest rates.

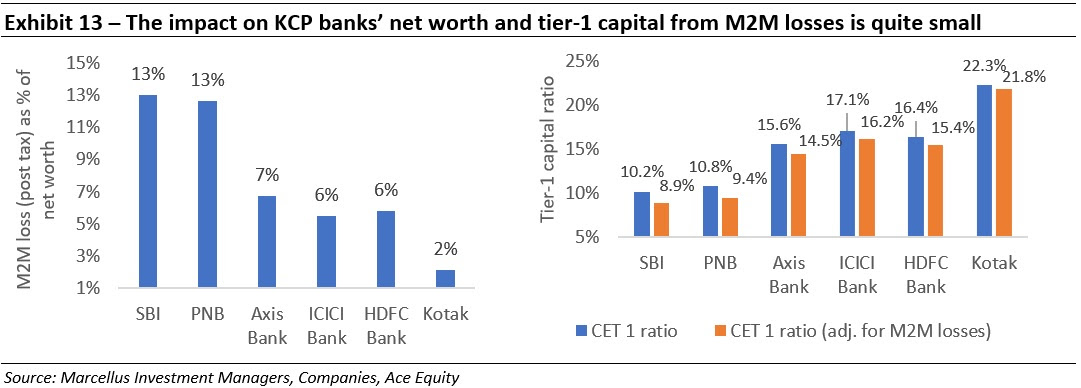

In fact, if one was to do sensitivity analysis of the Held to maturity (HTM) portfolio of the KCP banks (assuming a bond duration of ~5 years, and a 140 bps rate increase in the 5-year G Sec yield since end of 2021), the mark to market impact (post tax) is less than 10% of the book value of these KCP. The impact on the tier -1 capital ratio is similarly muted. The CET 1 ratio shown below represents the bank’s core capital. It includes ordinary shares, retained earnings, stock surpluses from the issue of common shares and common shares held by the subsidiaries of the company.

The current crisis unfolding in the western world is a grim reminder of the excesses that tend to buildup time and again in the Financial Services sector. After a decade long clean-up and supervision by arguably one of the best regulators in the world, the Indian banking ecosystem however is at its strongest in a long time.

That being said, one should remember that banking is mainly a game of survival and trust. Every successive crisis allows for the best lenders to gain mindshare with the depositors leading to healthy deposit growth alongside lower cost of funds. Armed with high quality risk management/customer analytics, the best lenders then mobilize these deposits to earn best in class RoA/RoE, the foundation of long-term wealth compounding (see our Feb’23 newsletter). Within the healthy Indian financial ecosystem, we remain confident that KCP companies are the gold standard.

Portfolio changes – addition of Prudent Corporate Advisory Services to the KCP portfolio

Prudent Corporate is an independent retail wealth management services group in India. It is the second largest non-banking Mutual Fund distributor (based on commissions earned) and the fifth largest overall (up from 12th in FY17). Prudent is one of the fastest growing mutual fund distributors with its AUM recording 41% CAGR during FY17-22 versus an industry CAGR of 14.5% for the same period.

Prudent’s sustainable competitive advantage is embedded in the trust it enjoys among the ~25K+ Independent Financial Advisors (IFAs) who operate on Prudent’s platform. This trust is underpinned around availability of a spectrum of financial services products under Prudent’s platform. This range of products allows Prudent to onboard more IFAs under its technology-enabled investment & financial services platform.

We expect Prudent to benefit immensely from the broader theme of ‘financialization’ of savings in India, while its unique B2B2C model offers massive operating leveraging possibilities. Prudent is scaling up its non-mutual fund distribution by leveraging upon its IFA channel. This should extend the longevity of growth in this business. The incremental capital requirement in this business is negligible and hence, the business throws off a lot of free cash which can be used for further inorganic opportunities (which are likely to emerge as smaller distributors get squeezed). We expect the company to report strong FCF growth along with solid return ratios