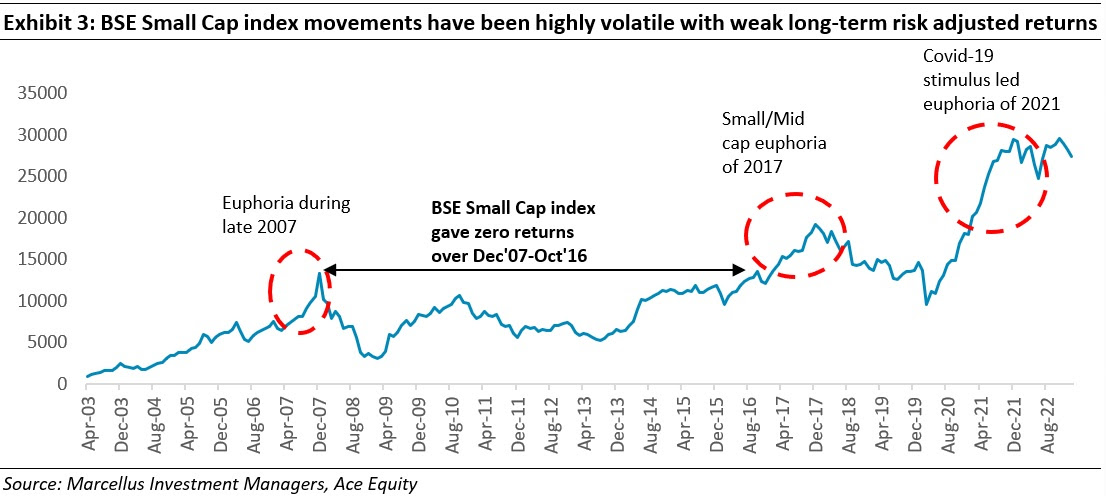

Over the last decade, while the BSE Small Cap index constituents have grown operating profits in low teens, the Little Champs constituents have consistently delivered 20%+ EBITDA growth. This has resulted in superior, consistent long term returns alongside sharper recoveries post drawdowns than the BSE SmallCap index. In recent quarters, while the fundamentals for Little Champs companies have continued to remain healthy, there has been a disconnect vis-à-vis returns due to quality investing being out of fashion in the broader market. With the LCP companies delivering growing their profits at a healthy rate quarter after quarter, we remain confident that portfolio returns would again converge with fundamentals.

Performance update for the Little Champs Portfolio

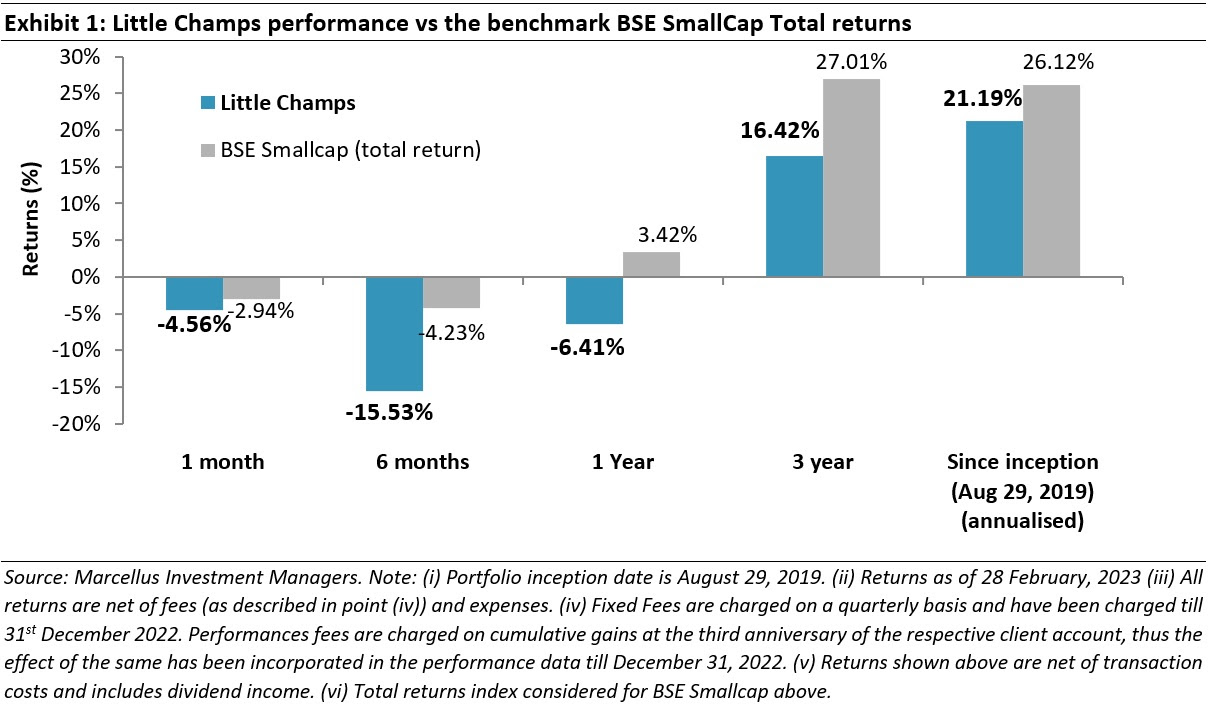

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio changes – addition of Prudent Corporate Advisory Services to the Little Champs portfolio

Prudent Corporate is an independent retail wealth management services group in India. It is the 2nd largest non-banking Mutual Fund distributor (based on commissions earned) and the 5th largest overall (up from 12th in FY17). Prudent is one of the fastest growing mutual fund distributors with its AUM recording 41% CAGR during FY17-22 versus industry CAGR of 14.5% for the same period.

Prudent’s sustainable competitive advantage is embedded in the trust it enjoys among the ~25K+ Independent Financial Advisors (IFAs) who operate on Prudent’s platform. This trust is underpinned around availability of a spectrum of financial services products under Prudent’s platform. This range of products allows Prudent to onboard more IFAs under its technology-enabled investment & financial services platform.

We expect Prudent to benefit immensely from the broader theme of ‘financialization’ of savings in India, while its unique B2B2C model offers massive operating leveraging possibilities. Prudent is scaling up its non-mutual fund distribution by leveraging upon its IFA channel. This should extend the longevity of growth in this business. The incremental capital requirement in this business is negligible and hence, the business throws off a lot of free cash which can be used for further inorganic opportunities (which are likely to emerge as smaller distributors get squeezed). We expect the company to report strong FCF growth along with solid return ratios.

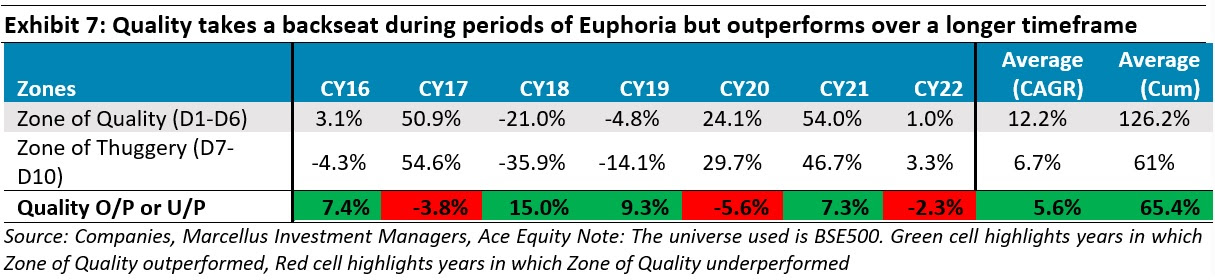

Little Champs perform consistently across cycles unlike most Smallcap stocks

In general, most small cap companies tend to go through couple of years of good earnings growth followed by prolonged periods of flat/negative earnings growth. Resultantly, across cycles and even on a 3-year basis, the BSE Small Cap index has delivered high single digit revenue growth/low double digit EBITDA growth (see exhibit 2 above).

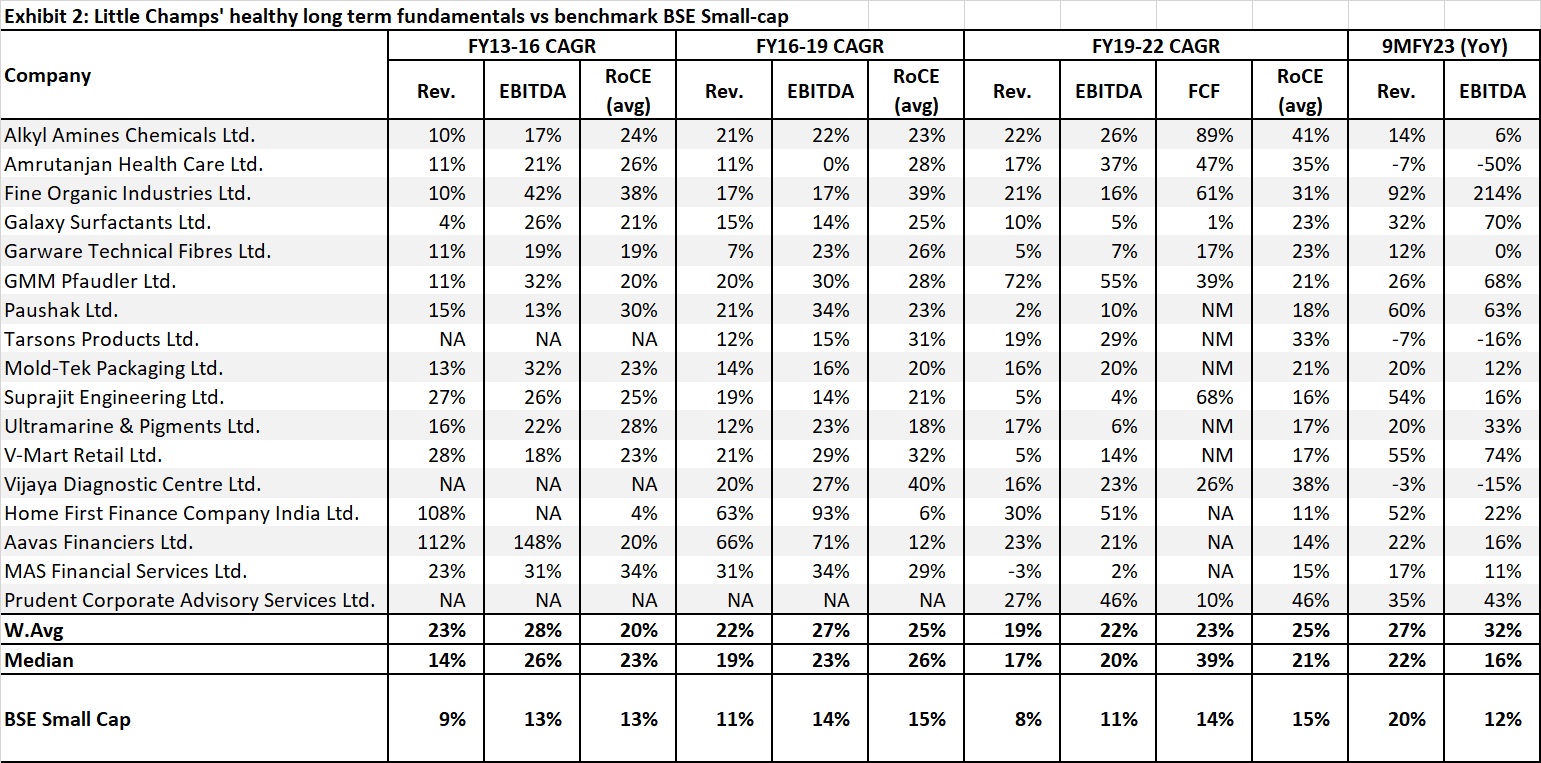

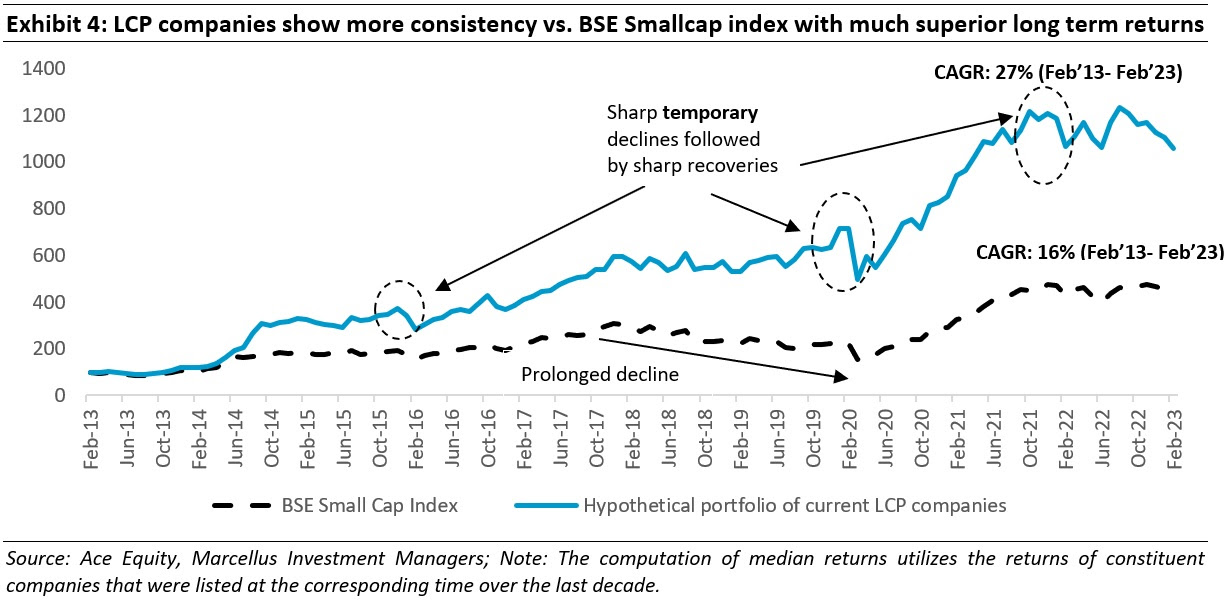

The impact of such inconsistency in fundamental performance is visible in the chart below, which clearly showcases how the BSE Small Cap index is susceptible to lackluster performance (it went through an almost 10-year period of no returns over December 2007- October 2016!). It is only during periods of euphoria that the index has made a sharp move upwards. Even after the recent euphoric phase during 2020-21, the 10/15-year CAGR for the BSE Small Cap index stands at 16%/7% respectively (for the period ending Feb’23)

We had discussed in detail the factors leading to severe volatility and drawdown in the BSE SmallCap index in our earlier newsletters. In summary, the key reason for this is the preponderance of companies in the small cap index with: (i) fragile business models (debt laden, high dependence on a handful of customers, low pricing power, etc) that are not able to stand the test of market slowdown; and (ii) questionable accounting & governance which usually unravels during periods of market crisis.

However, unlike typical small cap companies, Little Champs has delivered healthy and consistent fundamental performance across different time periods. Over the last decade, while the Small Cap index has struggled to generate EBITDA growth in the low teens, the Little Champs companies have consistently delivered 20%+ EBITDA growth irrespective of ongoing macroeconomic scenario thanks to the strength of the franchise (sustainable competitive advantages, high quality management teams) and the resultant fundamentals (strong unit economics, cash surplus balance sheet).

The consequent impact is visible in the chart below which compares the returns trajectory of a hypothetical portfolio comprised of current Little Champs companies (with returns computed using median of constituent companies’ monthly returns) to that of the BSE Small Cap index over last decade.

Two things clearly stand out in Exhibit 4:

- The long term returns clearly move in line with the underlying fundamentals. While the portfolio with LCP companies would have returned ~27% share price CAGR over last decade (in-line with 20%+ EBITDA growth), the corresponding return for the BSE Small Cap index is ~16% CAGR (again in-line with low teens EBITDA growth).

- While the LCP portfolio may also go through temporary periods of sharp declines (eg. Dec’2015-Feb’2016, Feb’2020-Mar’2020, Oct’21-Feb’22 – encircled in exhibit 4), the recovery in the value of the portfolio is usually sharp as returns realign with fundamentals. The BSE Smallcap index, on the other hand, is prone to elongated periods of declines as the fundamentals are unable to justify the increase in price during euphoric phase – besides the 10-year drought highlighted earlier, Dec’17-Mar’20 also saw the Small Cap Index decline by ~30% while the LCP portfolio would have returned ~20% (both cumulatively) during this phase.

Little Champs continue to chug along healthy earnings

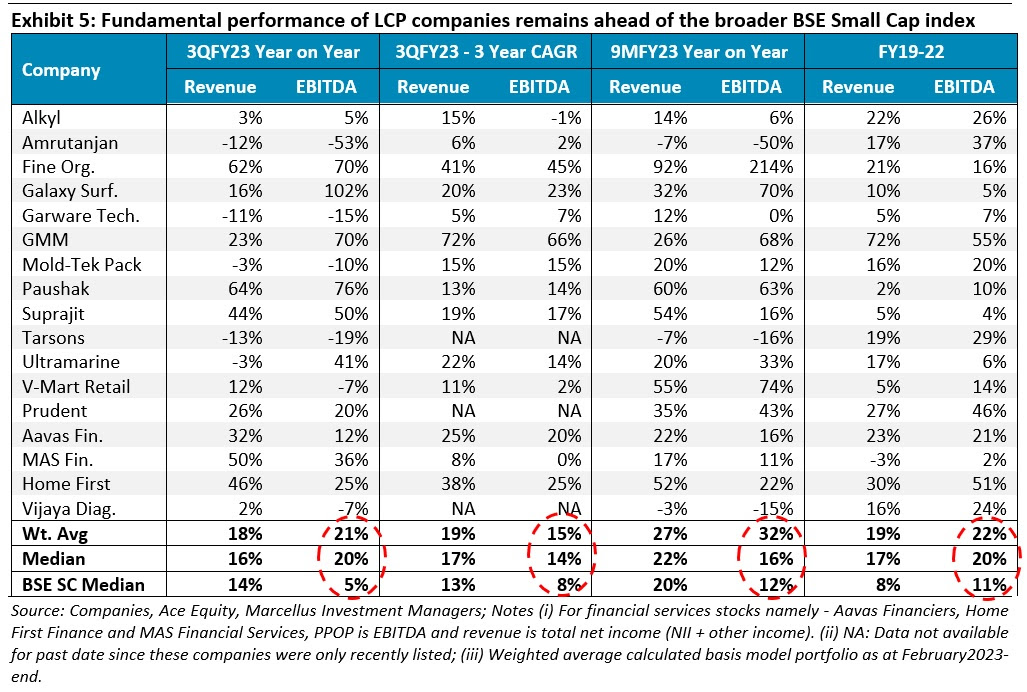

The strong fundamental performance for LCP companies has continued in the recent quarters as well. At the overall portfolio level, the median YoY EBITDA growth in 3QFY23 was 20% and the allocation weighted EBITDA growth was 21%. This is despite headwinds such as the normalisation of Covid-19 related additional revenues (for Tarsons, Amrutanjan, Alkyl, Vijaya Diagnostics) and inventory destocking arising from both deflationary raw material environment and correction of excesses built through the Covid-19 period (particularly impacting companies like Alkyl, Amrutanjan, Tarsons).

In 9MFY23 too, the weighted average revenue and EBITDA have grown at 26% and 32% respectively (on YoY basis). These figures are significantly better than the median figures for BSE Small Cap Index (Revenue growth: 20%; EBITDA growth:12%) as well as the corresponding figures over FY19-22 for the LCP portfolio (weighted average Revenue growth: 19%; EBITDA growth: 22%) suggesting that our investee companies are only going from strength to strength.

While stabilisation of gross margins have helped (as raw material prices started correcting from their peaks in the last quarters), the key reason why portfolio companies have been able to sustain their performance – as highlighted in our earlier newsletters and webinars – is the heavy reinvestments made by the companies over the last two years in both organic and inorganic expansion. These investments have now started bearing fruit and are helping the LCP companies develop an additional stream of revenues (eg. new products, new geographies) and/or gain market share from competitors weakened by Covid-19 and its chaotic aftermath.

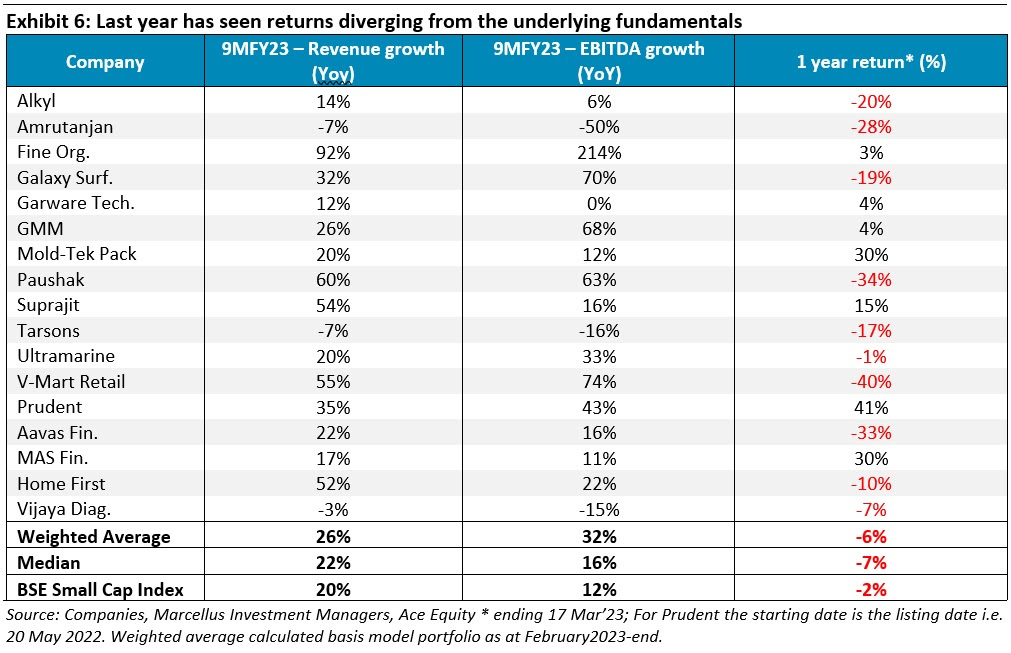

However, fundamentals and market performance have diverged over the last year

While the fundamental performance of the portfolio has been healthy, the share price performance has been lackluster (see the table below). In fact, over the last year or so, the divergence between LCP fundamentals and share price performance is opposite to that seen for the broader BSE Small Cap index (which has fallen less than the Little Champs inspite of relatively weaker fundamental performance over 9MFY23).

|