To curb systemic risk posed by the sharp growth in unsecured credit and NBFC credit in the banking system, the RBI raised risk weights on both from 100% to 125%, effectively asking lenders to set aside more equity capital for these credit risks. This move is likely to have highest impact on business models of ‘fintechs’ with large unsecured books & will send a signal to lenders to curb excessive risk taking on unsecured loans. Given the strength of their operations, KCP lenders are likely to see negligible business impact due to this change; in fact, KCP lenders are likely to benefit from this shakeout.

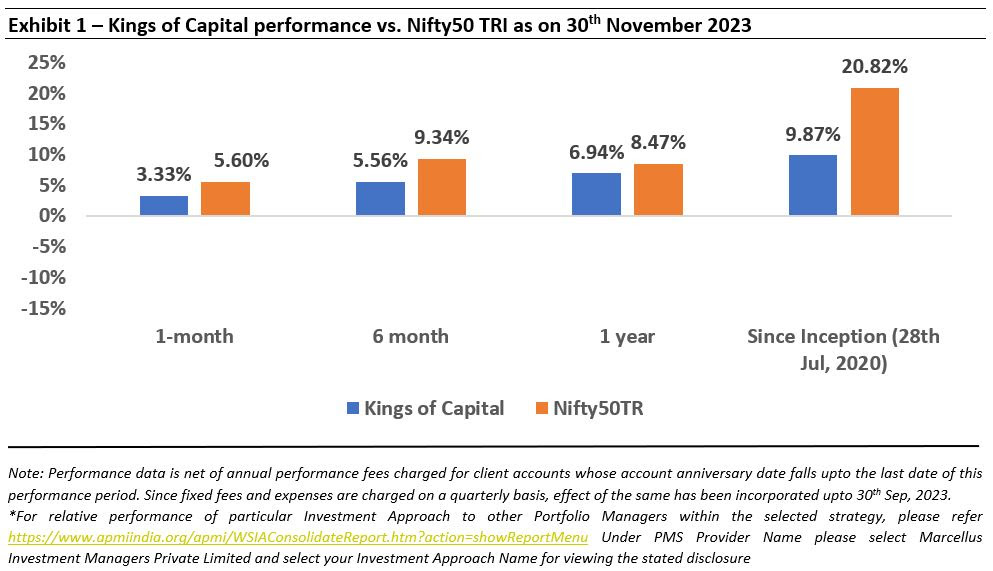

Performance update of the live fund

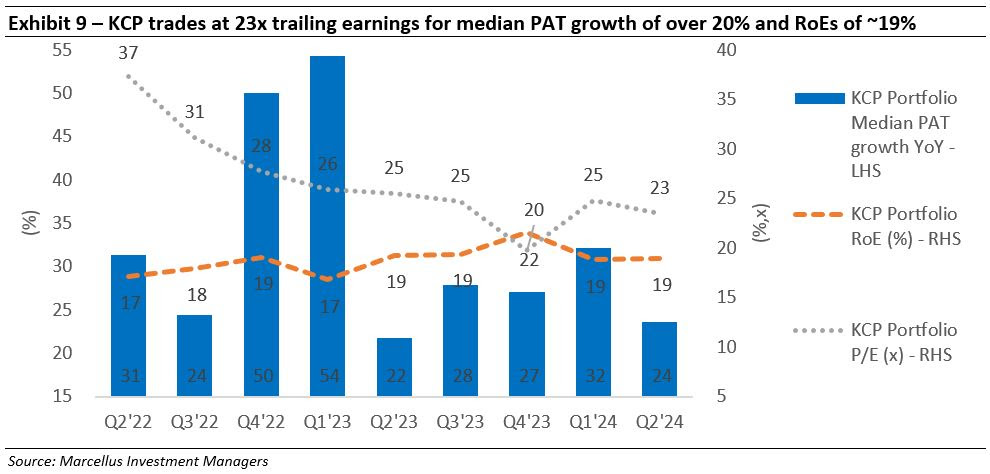

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

“The Indian banking system continues to be resilient, backed by improved asset quality, stable credit growth and robust earnings growth…Certain components of personal loans are, however, recording very high growth. These are being closely monitored by the Reserve Bank for any signs of incipient stress. Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest. The need of the hour is robust risk management and stronger underwriting standards”

– RBI Governor Shaktikanta Das in his Monetary Policy statement, Oct’23 (underline added by us)

RBI has taken steps towards tempering the risks associated with unsecured consumer lending

The Indian banking system continues to be in its most pristine shape over the last 15 years, with NPA levels (recorded as of H2FY24) at their lowest in over a decade.

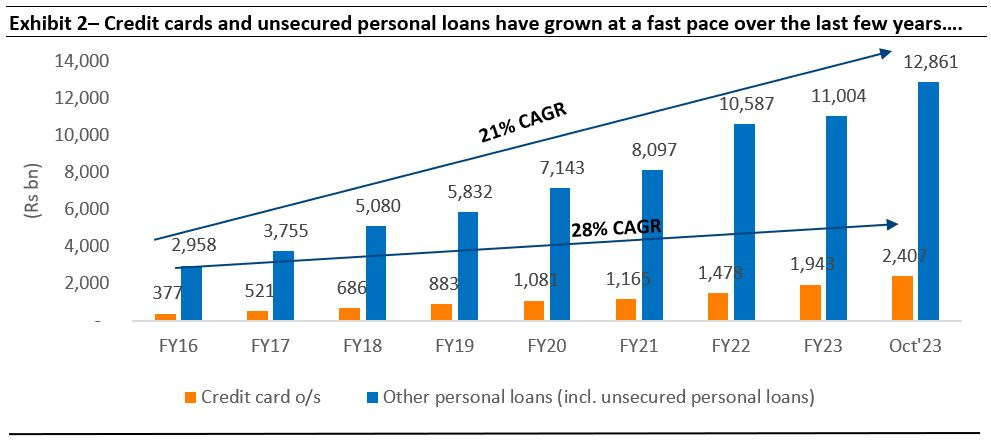

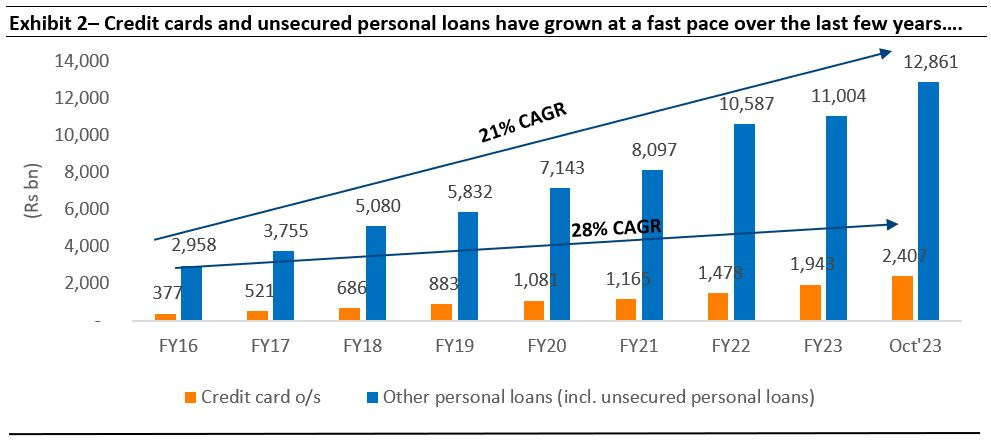

However, some pockets in the consumer lending space – especially personal loans have been showing initial signs of overindulgence. This sort of behaviour is nothing new for the banking system and as we’d discussed in detail in our Dec’22 dated newsletter and webinar, non-linearity of returns for lenders behoves investors to not lose sight of risk management practices during times of euphoria.

After publicly cautioning against heightened growth in unsecured and NBFC credit for a while, the RBI, on November 16, 2023 increased risk weights in unsecured credit (unsecured personal loans and credit cards) and NBFC credit from banks to 125% from 100% (click here for the RBI’s notification dated 16 November, 2023).

KCP lenders unlikely to face significant disruption from the increased risk weights

Before getting into the impact of aforementioned announcement on the lenders in KCP portfolio, let’s first understand what ‘risk weights’ mean.

What are risk weights and how does it impact a banks’ balance sheet?

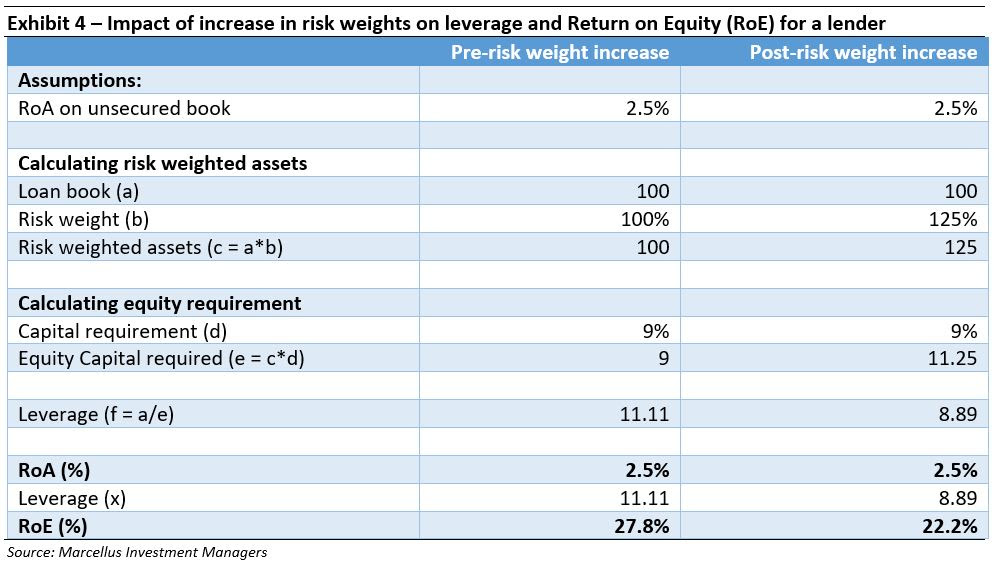

As per the RBI’s regulations, banks are required to keep equity capital to the tune of Rs 9 (9%) for every Rs 100 of risk weighted assets.

Risk-weighted assets are calculated by multiplying the loan amount on books of banks/ NBFCs by RBI prescribed risk weights for corresponding asset class. For example, the risk weight of unsecured credit is 125% vs. 50% for mortgages.

Now for a bank with a mortgage loan book of Rs 100, the risk weighed assets worked out to be Rs 50 (Rs 100 x 50%) and therefore the minimum equity capital requirement for such a bank would be Rs. 4.5 (9% of Rs. 50). For a bank with Rs.100 of unsecured loan book, the risk weighted assets would be Rs. 125 (Rs100 x 125%) with minimum equity capital requirement of Rs. 11.25 (9% of Rs125).

All else equal, an increase in risk weighted assets implies a higher equity capital requirement for a lender, thus restricting its ability to underwrite more loans for the same amount of equity capital.

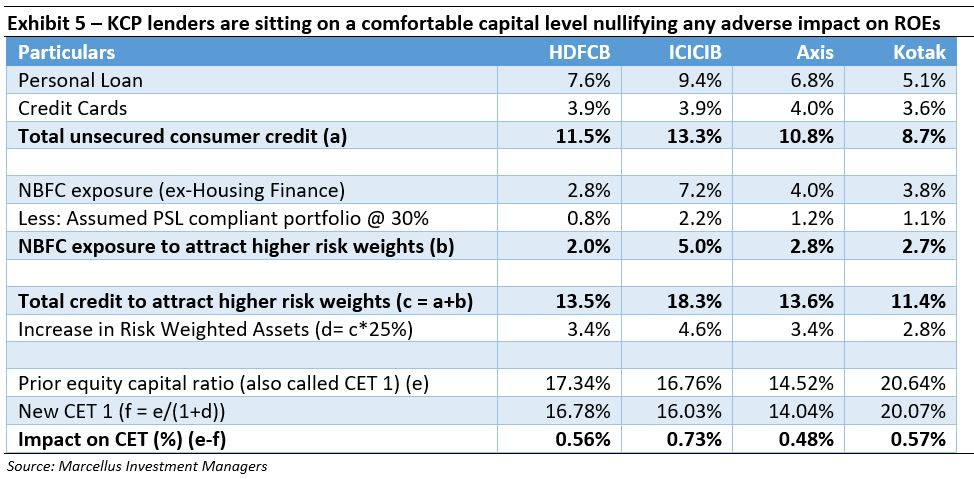

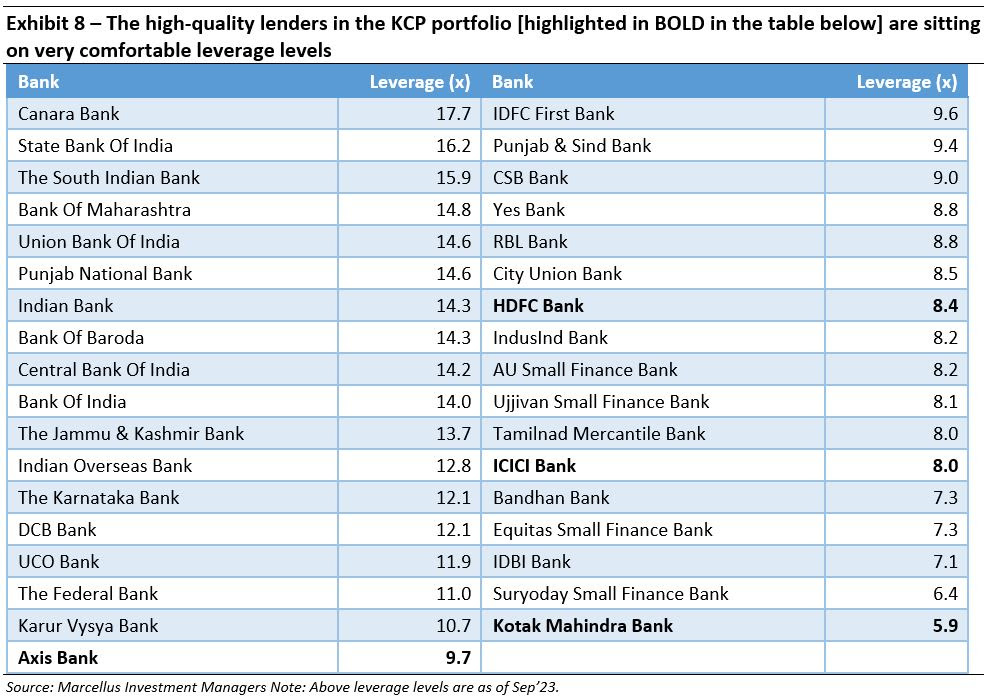

Unsecured loans as % of overall loan book for the four private sector banks in KCP – HDFC Bank, Kotak Mahindra Bank, ICICI Bank and Axis Bank – is in the range of 9-14%. With a 25% increase in risk weight, there is only a 50-70 bps reduction in their respective capital ratios (% of equity needed in above examples). Also, given these banks are underleveraged (see Exhibit 8 below) and sitting on excess equity capital (reducing any need to raise equity to meet RBI’s capital requirement), their RoE will not see any impact.

With respect to increase in risk weights by 25% on banks’ loans to NBFCs (e.g. HDFC Bank lending to Chola or Sundaram Finance etc.), it’s worth noting that the part of portfolio lending that qualifies for Priority Sector Lending (PSL) compliance will not see any increase in risk weights. Even if one assumes on a conservative basis that only 30% of the banks’ NBFC portfolio is PSL compliant, the total impact on these banks’ capital ratios would be minimal (see the working below).

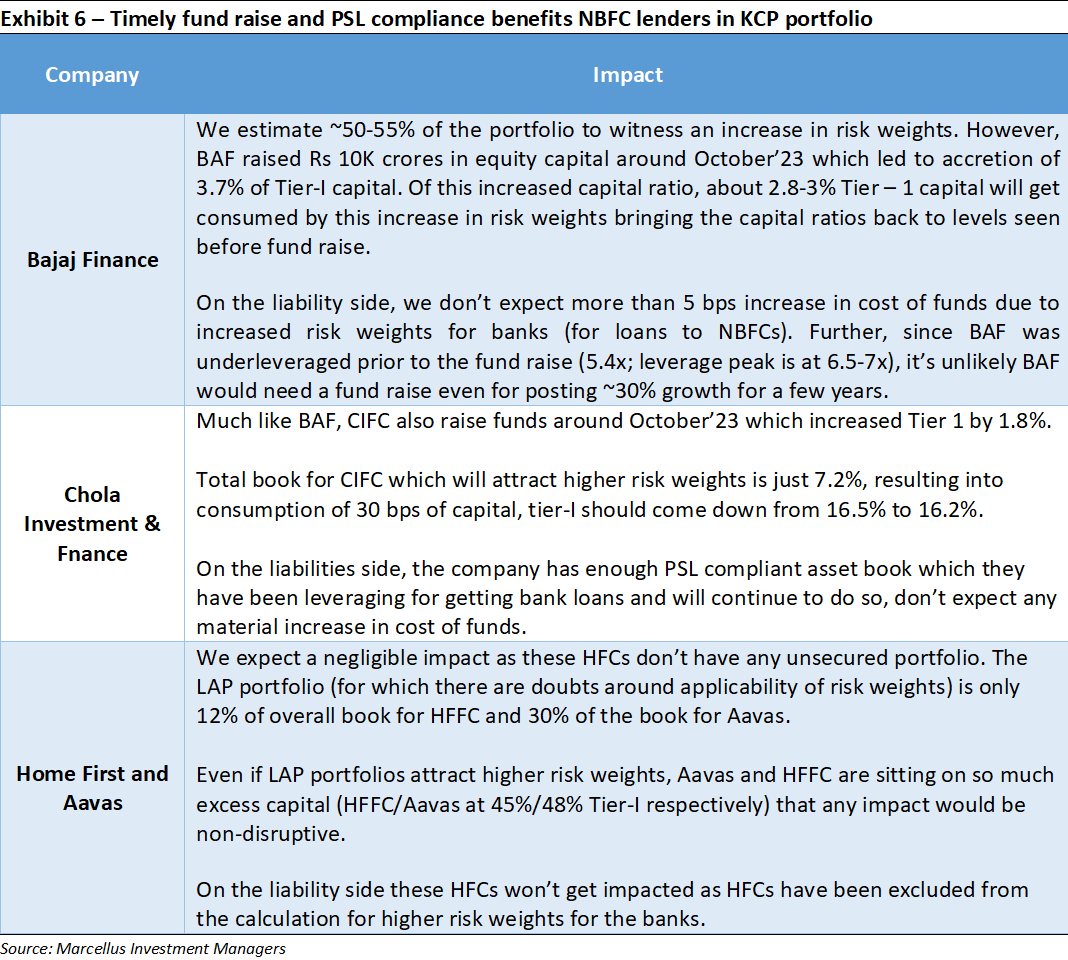

Coming to the NBFCs in our portfolio, we detail our analysis in the table below. To summarize, two of our investee companies (BAF and CIFC) have already raised equity capital, which should nullify the impact of increased risk weights and will lead to NIL impact on business growth, return ratios and growth plans. The other 2 HFCs are in secured businesses and hence, should not see any material business impact.

Optionality from High RoA/ low leverage & low valuations create an asymmetrical payoff in KCP

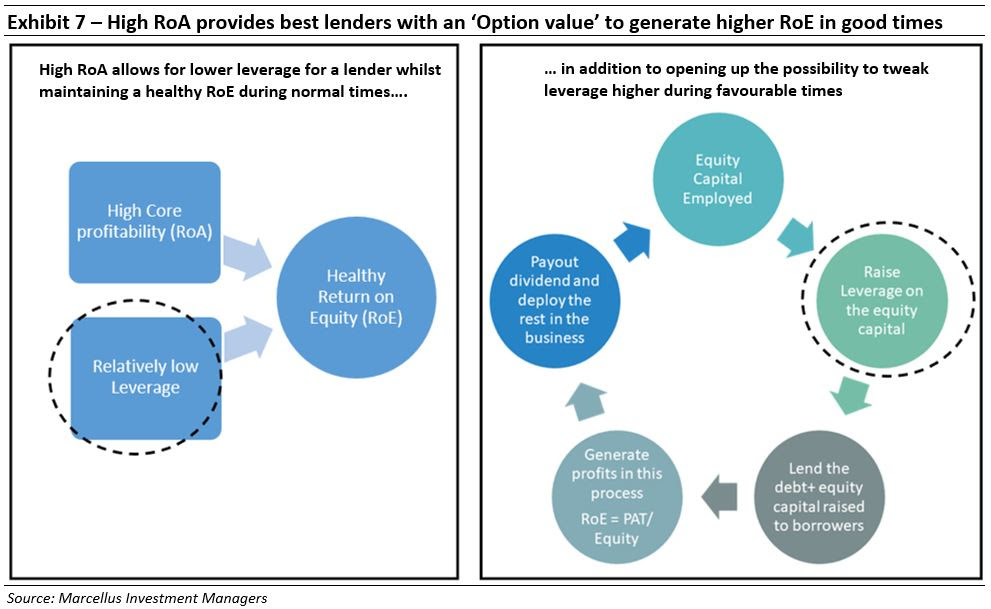

Coming to broader and more longer term impact of the increase in risk weights, we refer our clients to our Feb’23 dated newsletter which highlighted the long term benefits that accrue to prudent, high quality lenders due to their goldilocks combination of high RoA and low leverage.

The high RoA allows for such lenders to keep making high RoEs even without levering up their balance sheet too much. Further, the low leverage provides an ‘optionality’ for such lenders to increase leverage when they wish to be aggressive and take market share away from peers (something we expect to happen in coming months and years)

Thinking through the second order impact of the RBI’s announcement

Fintechs

“On the back of recent macro development and regulatory guidance, in consultation with lending partners, in line with its continued focus on driving a healthy portfolio, the company has recalibrated the portfolio origination of less than ₹50,000, which is prominently the postpaid loan product and will now be a smaller part of its loan distribution business going forward,” – Paytm, 06 Dec’23 (Business Today)

The most adverse impact from the RBI notification is likely to be felt by lenders with outsized exposure to unsecured lending/loans to NBFCs and/or high leverage on the balance sheet. For instance, the so called ‘Fintech’ companies which wanted to become lenders would likely face two-pronged impact from the increase in risk weight:

- Increase in risk weights on unsecured credit (the only domain that the fintechs were targeting) reduces leverage (as we saw in an illustration earlier), thus reducing the RoE potential of the fintech considerably.

- Due to inherent asset risks, many of the Fintech firms are not rated highly by the credit rating agencies. Thus, whatever credit they used to get from banks will get more expensive after the increase in risk weights for banks loans to NBFCs. The increase in cost of funds is likely to substantially reduce their ability to compete in the market vs. high quality NBFCs.

PSU Banks

Similarly, PSU banks which have historically relied more on high leverage rather than high RoAs to post decent RoEs would likely face a conundrum between raising funds and equity dilution to chase growth or tone down growth aspiration to preserve capital.

Deposit growth

Overall if system credit growth rates slow down due to this risk weights increase, this could also ease pressure on the deposits side, leading to stable margin profile for lenders.

Incremental capital into the sector, larger players to benefit

Incremental VC/PE money may be harder to get for the fintechs given the RoEs on unsecured credit have now systematically come down for the sector. Mainstream lenders which were capital starved or optimally capitalized today (Federal Bank, IDFC First Bank), may not be able to participate in the unsecured market aggressively vis-à-vis the large private sector banks who are over capitalized today and hence may still be able to protect bank level RoEs (by tweaking leverage levels higher). Therefore, the RBI’s announcements have increased the scope for the top private sector banks to gain market share.

According to report from the brokerage firm UBS, disbursement to customers with credit scores below 577 (relatively high-risk customers) came to 22% for the overall industry. The same number was around 23% for PSU banks, about 29% for NBFC and only 13% for the large private banks. Given the rampant growth in unsecured loans by PSUs and NBFCs, some degree of rationality is warranted, though the extent and timing of the same is difficult to predict.

In light of aforementioned disruptions, we expect the competitive intensity in the consumer lending space to tone down in the coming months allowing the prudent lenders with leeway on leverage to aggressively pursue higher market share. Combined with their historically low valuations, the current scenario presents a situation with asymmetrical payoff for investors.

Regards,

Team Marcellus