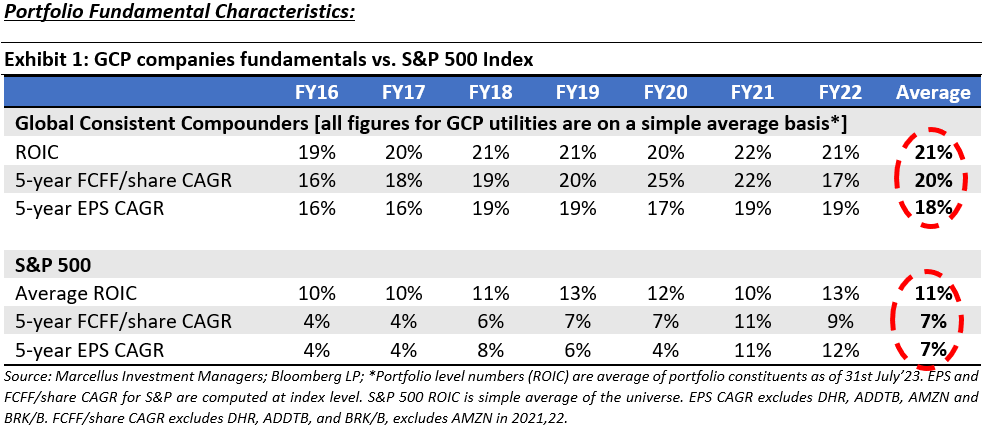

Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies aligned with megatrends, fostering a consistent mid to high teens compounding of free cash flow/earnings. As GCP reaches its first birthday, we reflect on our journey. Despite the brief time span, it’s reassuring to witness the portfolio’s progress aligning with our expectations, reaffirming the success of our unique, process-driven investment philosophy that consistently rewards long-term investors.

October 2022: The Genesis of GCP

October 2022 marked the inception of GCP, against the backdrop of a tumultuous global landscape. The year 2022 unfolded with the tragic incursion of Ukraine by Russia, compounded by persistent inflationary trends, reaching levels between 8-10%, a scenario reminiscent of the 1970s.The ensuing response from central banks, hiking key interest rates by as much as 5% points, reverberated across financial markets, impacting the valuation of a majority of assets.

By October 2022, signs of inflation cooling emerged. Despite the inherent unpredictability of market movements, compelling investment opportunities at more favourable valuations were emerging, leading us to launch the fund with our own capital. The economic landscape presented challenges, marked by contracting indices and rising interest rates, with the only silver lining being the indication of abating inflation.

Steering clear of predicting macro trends, our focus was/is on nurturing companies built to withstand challenges in the medium to long term. We favour businesses with a competitive edge. As highlighted in the GCP Introductory newsletter, we also champion prudence (in capital allocation) and meritocracy (in the selection of top talent for key management roles in our investee companies).

CY 2023 (YTD – Nov 30): Equities in a Goldilocks Stride

CY 2023 proved to be a remarkable year marked by higher interest rates leading to the bankruptcy of several regional banks in America, including, the notable implosion of Silicon Valley Bank. This financial turbulence was followed by a legislative impasse over the U.S. debt ceiling. Geopolitical tensions escalated, with conflicts such as the confrontation between Hamas and Israel in October.

Despite these concerns, companies deemed safe investments, coupled with a fervour for artificial intelligence, bolstered equity markets. A select group of powerhouse stocks, the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla), took centre stage, commanding a significant portion of the S&P 500’s gains and exerting outsized influence on the index.

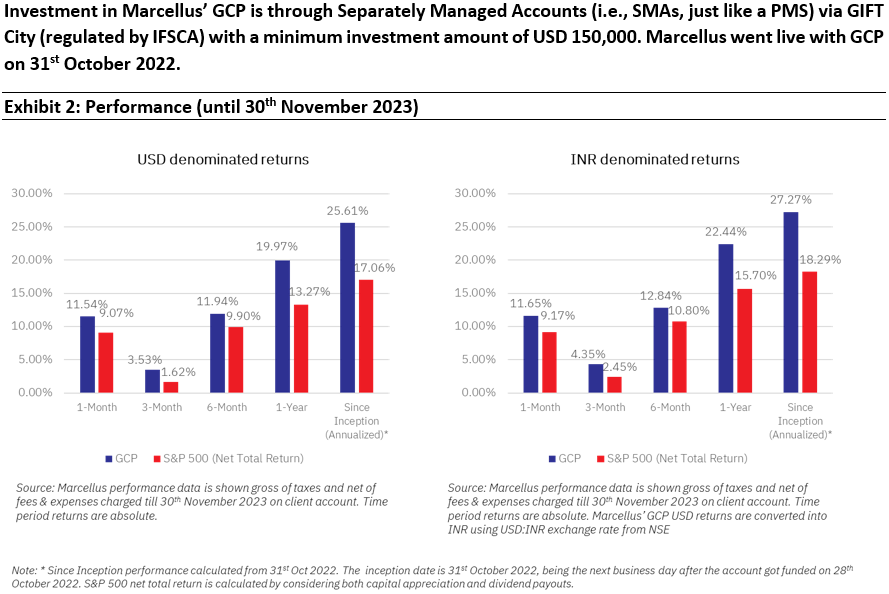

As a result, over 70% of S&P 500 stocks have underperformed the index YTD, setting the stage for a challenging year for U.S. Actively Managed Large Cap Core strategies. More than two-thirds of managers (Source: Jefferies’ equity strategy report) fell short of the benchmark. From this perspective, GCP’s noteworthy outperformance relative to the S&P500 (>7% YTD) is particularly encouraging, especially given its significant underexposure to the “Magnificent Seven.”.

Despite the headwinds, the year brought relief as inflation cooled and the economy weathered minimal damage despite the Federal Reserve’s rate hikes. The controlled trajectory of oil prices played a role in curbing inflationary pressures. Contrary to predictions, the economy managed to avoid a recession in 2023. The remained consistently positive, reflecting economic data outperforming expectations throughout the year (Link).

Breaking down the Relative Outperformance of GCP vs S&P 500

Both Stock Selection and Portfolio Construction in GCP has added significant value:

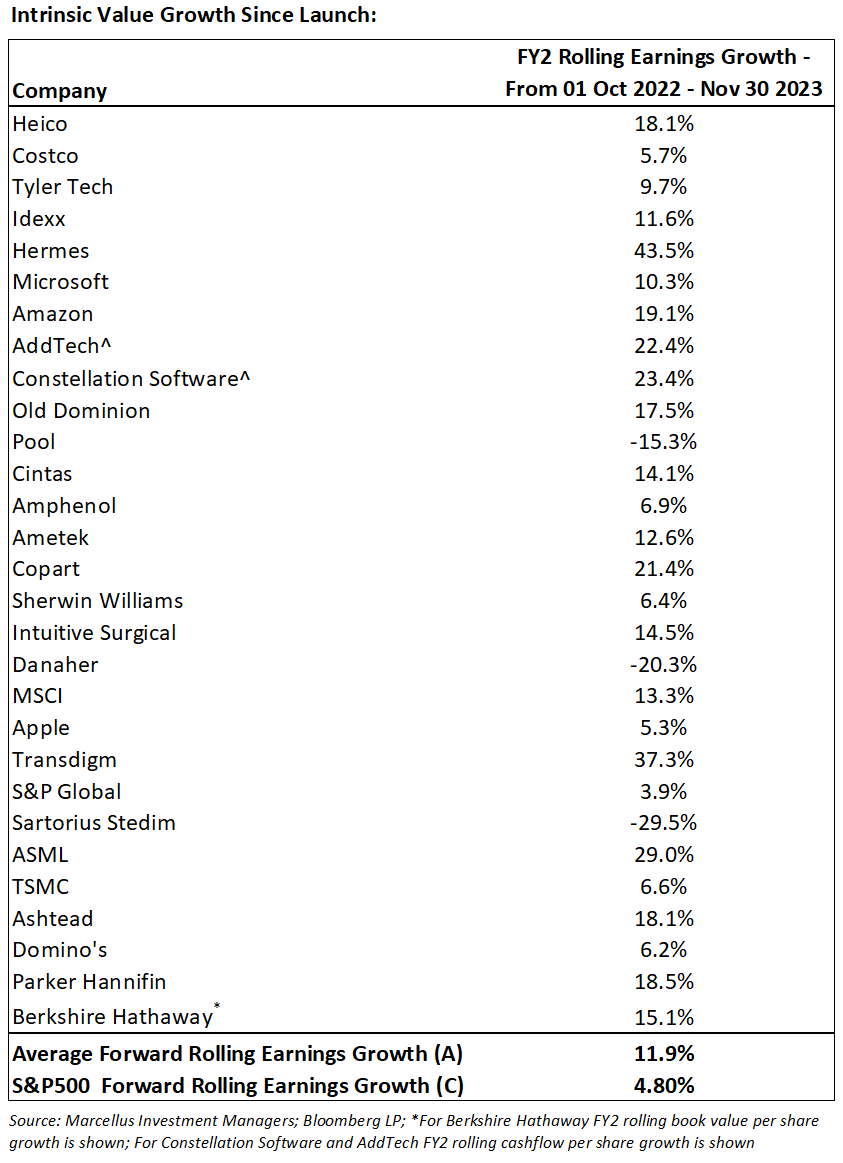

- GCP Companies average Intrinsic Value Growth of 11.9% since Oct 2022 exceeded that of S&P’s 4.8%. Note that this does not include dividends.

- ~55% of GCP stocks beat S&P 500 index vs. less than 30% of stocks in S&P 500 beating the S&P 500 index in Calendar YTD (Source: Bloomberg)

- GCP Proprietary Portfolio Construction Methodology – Torque – added ~2.6% additional outperformance relative to the S&P500:

- Among GCP’s top 15 positions (~75% of the portfolio), 11 companies or 74% of the top 15 portfolio companies have beaten the S&P 500 Index YTD (Source: Bloomberg).

- Among GCP’s top 15 positions (~75% of the portfolio), 11 companies or 74% of the top 15 portfolio companies have beaten the S&P 500 Index YTD (Source: Bloomberg).

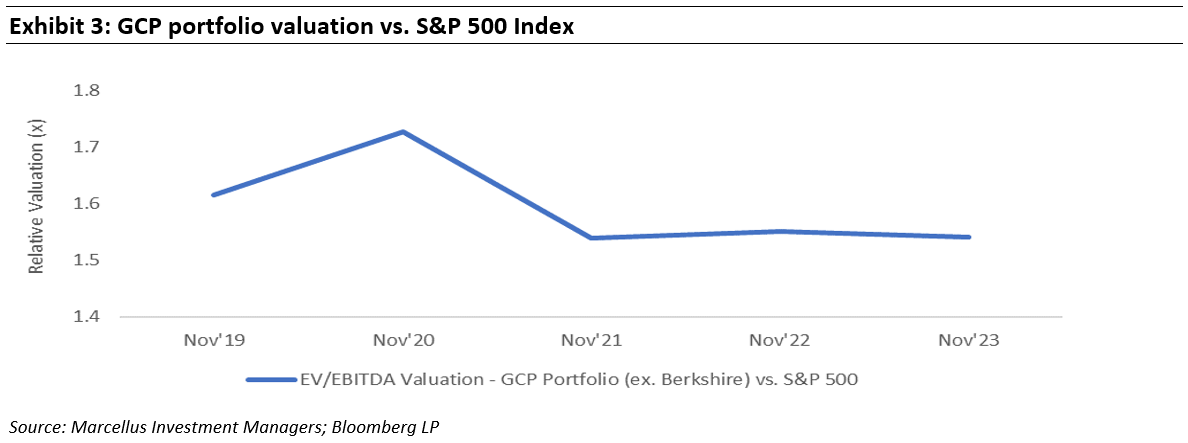

- The GCP portfolio hasn’t undergone any ‘relative’ valuation rerating in comparison to the S&P 500 since its inception. In the last four years, there hasn’t been any ‘relative’ realignment within the portfolio. Therefore, the alpha produced by GCP is solely credited to exceptional stock selection and portfolio structuring.

We employ a combination of ‘relative’ valuation framework and Discounted Cash Flow (DCF) analysis for our companies. Estimating the correct Cost of Capital is exceptionally challenging, if not impossible, and using the broad market as a starting point provides the best benchmark. The relative angle takes the cost of capital out of the picture (since the cost of capital is relevant for valuing both our investee companies and the broader index) and thus proves extremely valuable in our approach.

In simple terms, the current ‘relative’ Forward EV/EBITDA of the GCP portfolio is approximately 1.6x (i.e. portfolio is at 60% premium valuation to market). But that is where these companies have always traded on a relative basis in last-5 years. It’s important to note that GCP companies, on average, operate with lower capital intensity (relative to the broader index) —requiring significantly less capital for maintenance while delivering comparable or superior growth compared to an average company. This effectively reduces the ‘real’ valuation premium to around 40% relative to the market. We find this premium acceptable, given that GCP companies can consistently achieve 2-3 times the growth of the broader market over a sustainable period.

Navigating through volatile times…

In the realm of equity investing, uncertainties are inevitable. At Marcellus, rather than attempting to evade uncertainty, we believe in the art of selecting the right stocks and constructing a portfolio capable of withstanding the various challenges presented by the market. Just as our stock selection undergoes a rigorous process, so does our portfolio construction. While we acknowledge that perfection in a portfolio is elusive, we bring a structured process to the seemingly chaotic nature of investing.

…WHAT IF … An example of Torque Simulation

Our proprietary framework, Torque, has consistently signaled a defensive positioning since Autumn of 2021, a stance that remains unchanged. Consequently, our top three positions feature steadfast and reliable cash compounders—Berkshire Hathaway, Costco, and Heico.

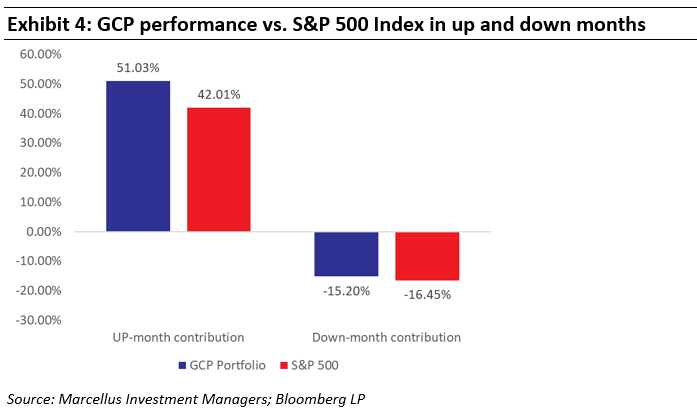

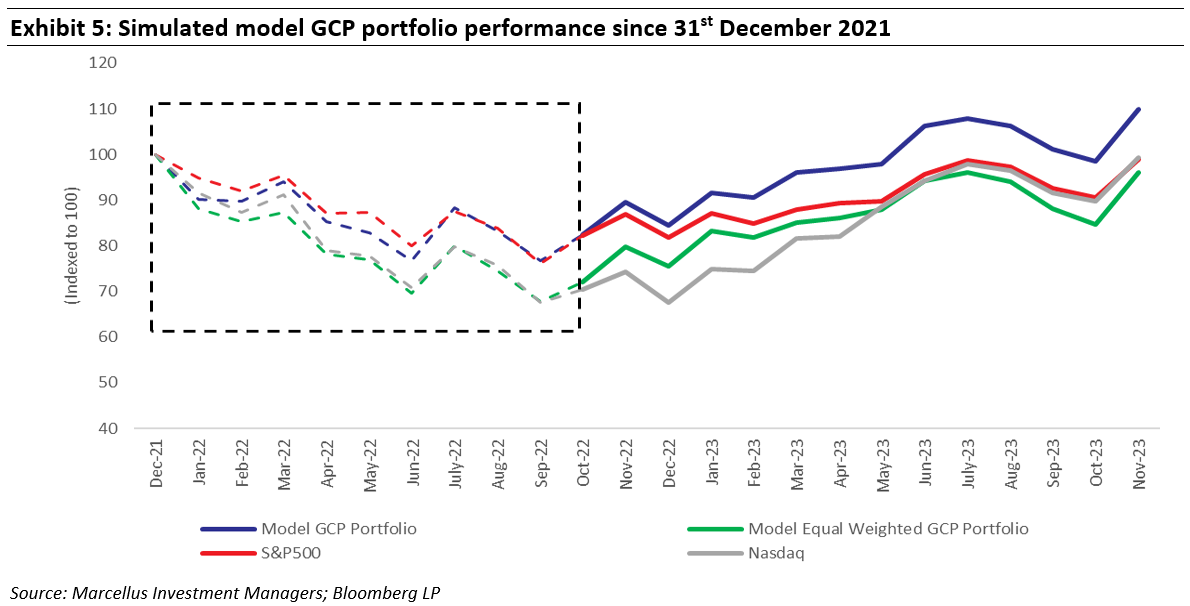

Let’s delve into a scenario simulation to comprehend the impact of Torque. If we had launched the GCP portfolio at the beginning of 2022, the returns would reflect Torque’s ability to outperform during market upswings and exhibit resilience in downturns.

In this simulated scenario, the model portfolio—a Torque-weighted compilation of GCP stocks—outperforms an equal-weighted GCP portfolio by a significant margin, surpassing the S&P 500 by 11.2% and Nasdaq by 10.7% with lower drawdowns. While we recognize that duplicating the exact outcome of CY2022-23 is unrealistic, this simulation provides comfort in our endeavor to shape GCP as an All-Weather portfolio

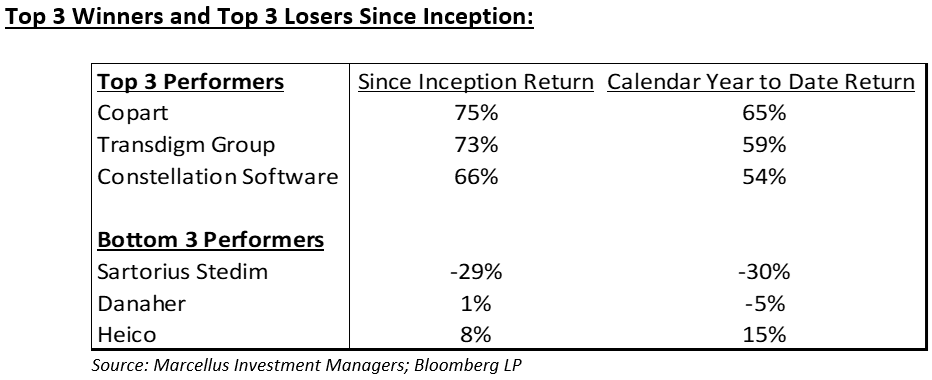

Outperformers:

Copart: Copart sustained robust growth in insurance salvage cars due to elevated Total Loss Ratio (TLR) and ASPs, outperforming the broader used market. We foresee continued strong performance over next 5+ years, supported by increasing TLRs and stabilizing used vehicle values. Copart’s successful entry into the wholecar market, exemplified by BluCar, positions it favourably for a cyclical recovery. The strategic move into online heavy equipment auctions, marked by a majority stake in Purple Wave, further broadens Copart’s market reach. Over a decade of observation reveals Copart’s strategic use of its vast network and land assets to expand geographically and across vehicle categories. With its intrinsic value growing by ~20%+ since Oct 2022 (Source: Bloomberg), calculated based on forward earnings/cash flow growth, Copart remains a high-conviction idea reflected in its substantial portfolio weight.

Transdigm Group: The Aerospace Aftermarket sector is still in the early stages of recovery and far from reaching its peak. Transdigm’s impressive organic revenue growth of 18% in FY23 (Source: Company filings) is indicative of this trend, and we anticipate several more years of sustained low double-digit revenue growth. The combination of monopolistic pricing power, consistent margin expansion, and effective capital return/deployment positions Transdigm to compound intrinsic shareholder value at a mid-teen rate for the next 3-5 years. Since October 2022, Transdigm’s intrinsic value, calculated based on forward earnings/cash flow growth, has surged by over 37% (Source: Bloomberg).

Constellation Software: Constellation remains a top-tier investment in our portfolio, consistently deploying its entire operating cash flow in strategic, high-return-on-investment acquisitions. In FY22 alone, Constellation invested over 100% of its cash flow in M&A activities (Source: Annual report). The company’s unique model of permanent ownership, coupled with its adeptness at innovative deal structuring (such as spin-offs), is gradually evolving into a competitive advantage, especially in larger deals. Contrary to the market sentiment, we believe Constellation’s substantial deals, such as Optimal Blue and Empower, have the potential to generate over 20% return on equity, a factor currently underappreciated by investors. Since October 2022, Constellation’s intrinsic value has grown by more than 20% (Source: Bloomberg).

Underperformers:

Danaher, Sartorius Stedim: With the downturn in startup biotech funding following the blockbuster years of CY20/21, suppliers of biotech, biopharma, and bioprocessing equipment, such as Danaher and Sartorius, faced a prolonged period of reduced demand and inventory destocking. Despite the challenging market conditions, our confidence in the Biopharma sector remains strong. Between Danaher and Sartorius, we hold a higher conviction in Danaher, driven by our belief that inorganic and M&A-driven capital allocation will play a more significant role in the industry of biotech, biopharma, and bioprocessing equipment suppliers. Consequently, we made the decision to exit our position in Sartorius Stedim.

Heico: Heico’s recent underperformance lacks a fundamental basis, and it remains one of our top conviction ideas. The Wencor deal, which we find to be an excellent fit both financially and strategically, is expected to strengthen Heico’s position in distribution/MRO. Heico’s unparalleled value proposition to airlines, coupled with a low penetration of generic spare parts in the aerospace aftermarket, positions it to compound intrinsic value at a comfortable mid-teen CAGR (Source Company Filings).

Anticipating the Path Ahead…

The U.S. economy may encounter challenges due to the cumulative impact of the Federal Reserve’s 525 basis points of tightening. Leading Economic Indicators have been urging caution for the past 12-18 months, yet the economy shows surprising stability. Rather than trying to time the market, we advocate for a systematic approach to capital deployment for general investors. Our focus is on identifying attractive opportunities during market volatility. Currently, we are working on high-quality ideas in industries such as medical technology and Data Center REITs. Both sectors have faced performance impacts tied to what we perceive as short-lived factors, presenting an exciting investment opportunity for us.

Despite economic ups and downs, the American economy keeps creating wealth through a robust system. Looking at the past 30/50 years, the S&P 500 has given returns of ~17x/~200x (Source: Bloomberg) respectively, growing at an annual rate between 9-10% (USD). We’re hopeful about not just meeting but exceeding these benchmarks, leading to more wealth for us and our investors!

As we wrap up this month’s GCP newsletter, it would be remiss not to mention the passing of Charlie Munger on November 28th at the age of 99. Some of us were fortunate enough to attend Berkshire Annual Meetings and hear his wisdom firsthand. His investment principles are widely known, but there’s often less discussion about his personal journey. At the risk of going into detail, we can’t help but share this insightful piece from a 2011 note by Joshua Kennon:

“In 1949, Charlie Munger was 25 years old. He was hired at the law firm of Wright & Garrett for $3,300 per year, or $29,851 in inflation-adjusted dollars as of 2010. He had $1,500 in savings, equal to $13,570 now.

A few years later, in 1953, Charlie was 29 years old when he and his wife divorced. He had been married since he was 21. Charlie lost everything in the divorce, his wife keeping the family home in South Pasadena. Munger moved into “dreadful” conditions at the University Club and drove a terrible yellow Pontiac, which his children said had a horrible paint job. According to the biography written by Janet Lowe, Molly Munger asked her father, “Daddy, this car is just awful, a mess. Why do you drive it?” The broke Munger replied: “To discourage gold diggers.”

Shortly after the divorce, Charlie learned that his son, Teddy, had leukemia. In those days, there was no health insurance, you just paid everything out of pocket and the death rate was near 100% since there was nothing doctors could do. Rick Guerin, Charlie’s friend, said Munger would go into the hospital, hold his young son, and then walk the streets of Pasadena crying.

One year after the diagnosis, in 1955, Teddy Munger died. Charlie was 31 years old, divorced, broke, and burying his 9 year old son. Later in life, he faced a horrific operation that left him blind in one eye with pain so terrible that he eventually had his eye removed.

By the time he was 69 years old, he had become one of the richest 400 people in the world, been married to his second wife for 35+ years, had eight wonderful children, countless grandchildren, and become one of the most respected business thinkers in history.”

—Joshua Kennon

A life, we were fortunate to witness and celebrate, leaving behind a legacy that will forever be cherished and remembered.

Happy Investing!

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/