Consistent Compounders Portfolio (CCP)

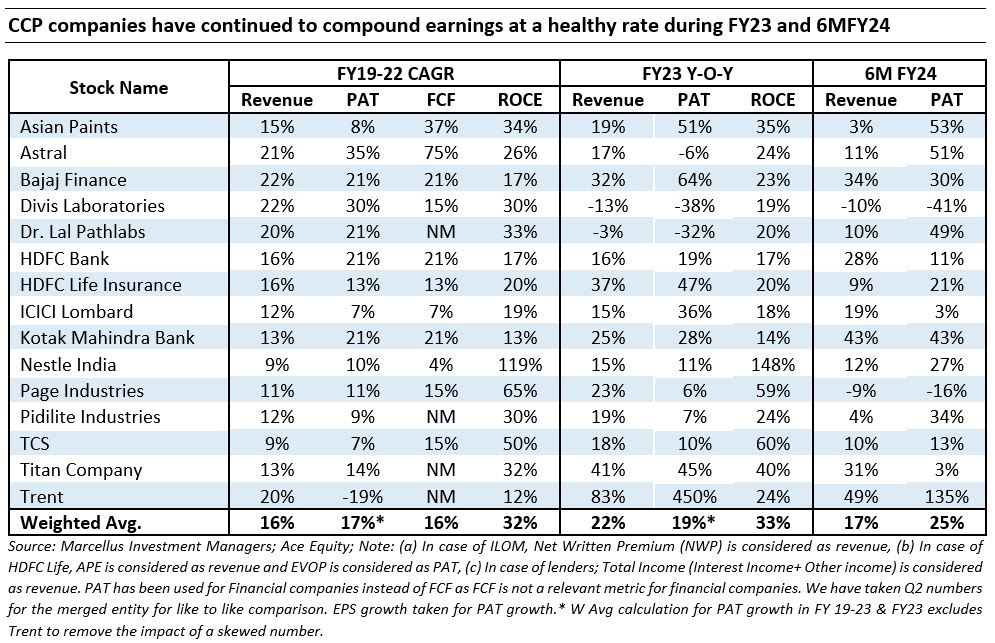

Companies in our Consistent Compounders Portfolio generated median PAT growth of 24% YoY in 2QFY24 and 27% YoY in 1HFY24. This acceleration in PAT growth is an outcome of both: a) accelerated market share gains and improved operating efficiencies as an outcome of capital allocation decisions taken over the last 3 years; and b) recovery in profit margins due to normalization of input costs for companies like Asian Paints, Pidilite, Nestle etc.

From a risk perspective, there are several pockets of changes in competitive intensity in the industries where our portfolio companies operate. Some of these are examples of potential rise in competitive intensity (e.g. Grasim’s entry in Paints), while others are examples of decline in competitive intensity (e.g. moderation in competition from e-pharmacies and aggregators in the diagnostics industry). There are also few possibilities of radical disruption of the industries in which our portfolio companies operate – e.g. lab grown diamonds in jewellery, fintech based lending, tech-based sales, distribution and supply chains etc. – and we are focused on ensuring that we remain invested with potential disruptors rather than being exposed to the businesses which might get disrupted in such industries.

The recent regulatory change around increase in risk weights in unsecured credit and NBFC credit in the banking system is likely to have an a positive impact on lenders in our portfolio due to reduction in competitive intensity allowing the prudent lenders with leeway on leverage to aggressively pursue higher market share. According to report from the brokerage firm UBS, disbursement to customers with credit scores below 577 (relatively high-risk customers) came to 22% for the overall industry. The same number was around 23% for PSU banks, about 29% for NBFC and only 13% for the large private banks. Given the rampant growth in unsecured loans by PSUs and NBFCs, some degree of rationality is warranted, though the extent and timing of the same is difficult to predict. Combined with CCP portfolio lenders’ historically low valuations, the current scenario presents a situation with asymmetrical payoff for investors.

We have implemented several changes to position sizing / stock selection in our CCP portfolio over the last few months to benefit from the opportunities presented by such disruptive opportunities, regulatory changes, valuation attractiveness and change in competitive intensity in various industries. The most notable changes to position sizing / stock selection include increase in exposure to companies like Trent and Astral and exit from companies like Berger from our portfolio (to maintain the concentration of the portfolio to 13-15 companies).

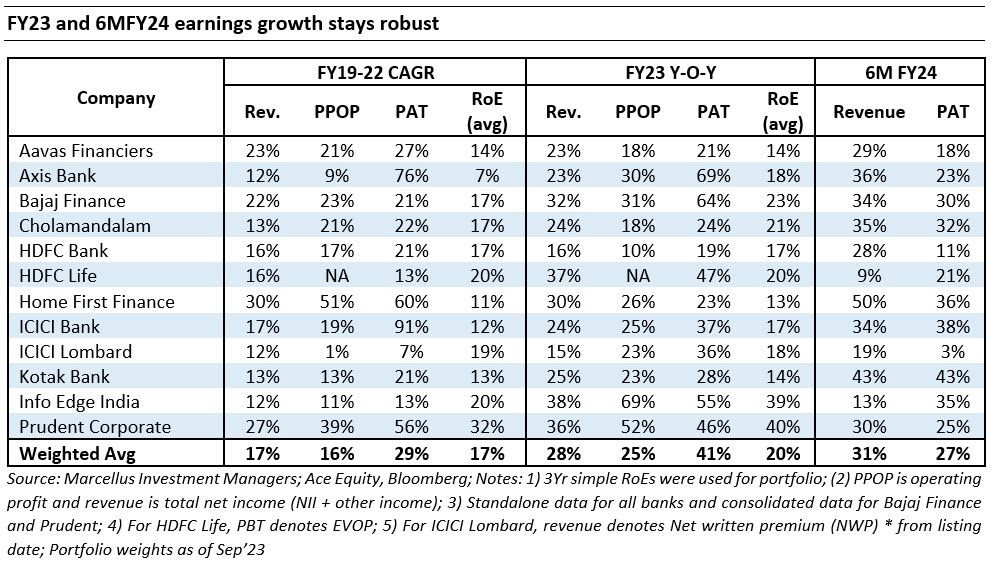

Kings of Capital Portfolio (KCP)

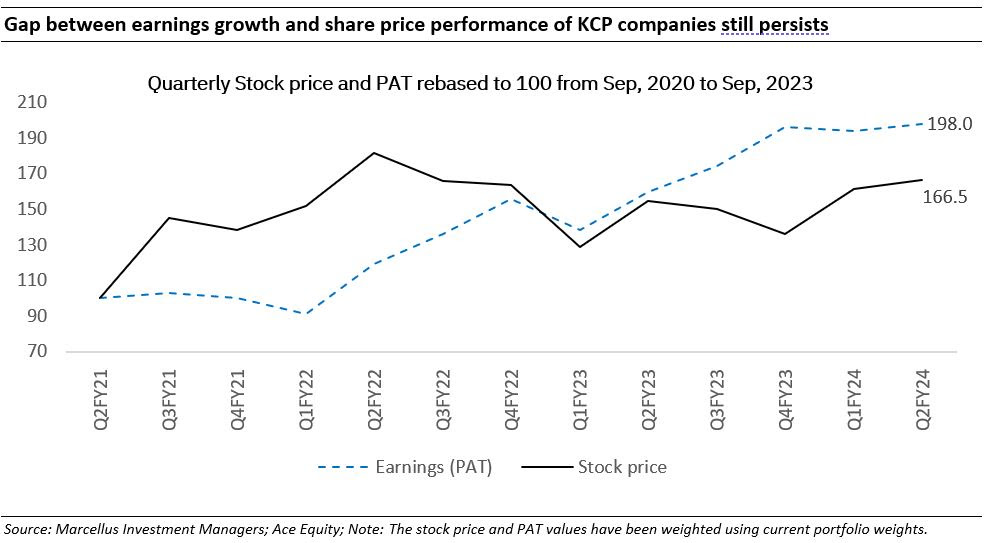

Kings of Capital portfolio companies have reported robust revenue and profit growth for H1FY24 with weighted average revenue growth of 17% and weighted average PAT growth of 25% for the portfolio. These numbers suggest strong market share gains for KCP companies as they reported better than industry growth across lending and insurance businesses. As seen in the table below, this trend of market share gains and strong fundamentals has been consistent through the past three years but FY23 was a year of significant share price dislocation as multiple stocks which reported 20%+ earnings growth saw a 10%-30% correction in their stock price. This resulted in fundamentals and stock prices going in opposite directions. In YTDFY24 we are seeing a reversal of this trend as stock prices are catching up with the strong fundamentals. However, we believe KCP stocks have still quite a bit of catching up to do as illustrated in the table below:

The RBI recently increased risk weights for unsecured loans and bank loans to NBFCs as a cautionary step to slow down unsecured consumer lending. As this was announced, the stock market painted all lenders with the same brush leading to a temporary stock price correction for all types of lenders. However, we believe this has multiple long term positive implications for KCP lenders.

- Reduced competition from fintechs players as they will be hit on both sides of the balance sheet: This increase in risk weights hits fintech players the hardest and reduces them to origination engines. This is because (a) Increase in risk weights on unsecured credit (only domain fintechs were targeting) reduces RoE potential by 25%. (b) Most of these fintechs do not have a high credit rating, the loans they used to get from banks will get even more expensive. This increase in cost of funds will further reduce their ability to compete in the market.

- PSU banks with low capital adequacy might need to raise capital or slow down growth: PSU banks are currently earning 1% RoAs but given that they are levered 15-20x, they have delivered healthy RoEs. With the increase in risk weights, capital starved PSUs will have to choose between two options i.e. curtail growth rates (and hence, preserve capital) or raise equity capital. Either ways it will be value destructive for shareholders of PSU banks as most PSU banks trade at 1x or less than 1x Price to book value and raising capital at these valuations will be massively dilutive for shareholders. Reduction in RoEs for PSUs will now also start presenting some differentiation within players which has been an issue for most investors in banks.

- Reduced competition for deposits: Overall if system loan growth rates slow down due to increase in risk weights, it could also ease pressure on the deposits side thus making it easier for private banks to raise deposits.

- Incremental capital into the sector might reduce, larger well capitalized players to benefit: A lot of VC/PE money should slow down given RoEs on unsecured credit has systematically come down for the sector. Even for existing private players who are capital starved (smaller private banks), it will become incrementally difficult to grow in the unsecured market. On the other hand, the large private sector banks are over capitalized today and hence will still be able to protect bank level RoEs as their leverage levels have room for improvement. Therefore, market share gains potential is better for well capitalized or over capitalized lenders. If the systems see pricing of unsecured credit increasing (it has been extremely competitive in last 24 months despite 250 bps repo hike) due to these risk weights increasing our portfolio lenders will also see an increase in their net interest margins.

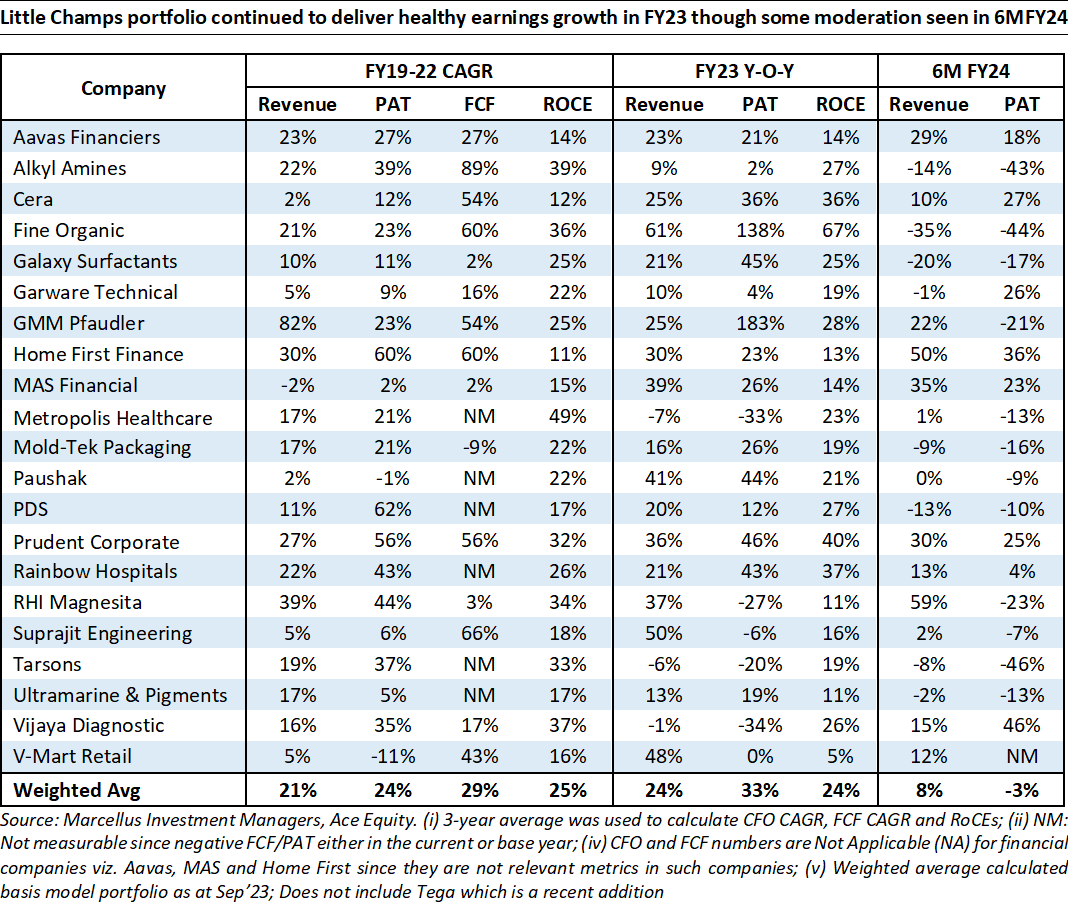

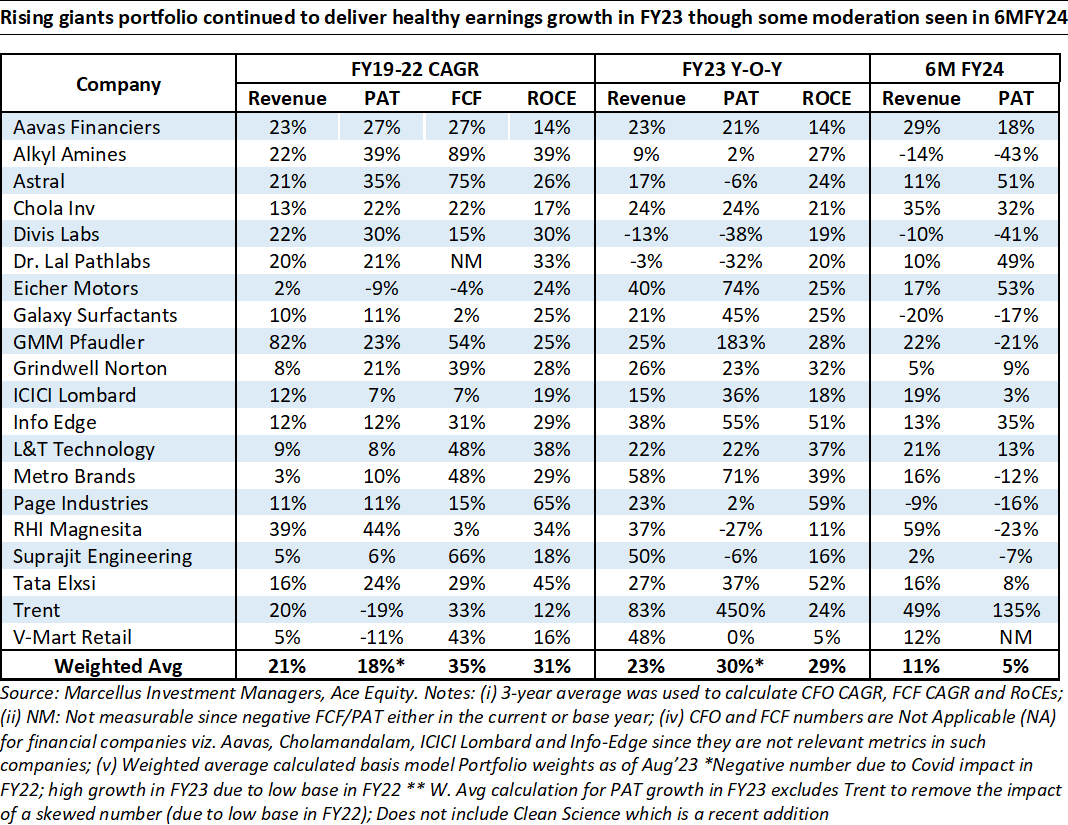

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

We had highlighted in the last month’s newsletter that 2QFY24 was a challenging quarter for the Little Champs portfolio emanating from earnings headwinds faced by the chemical stocks, weakness in the global markets generally impacting the export-oriented portfolio companies and one-offs in last year’s base optically impacting the earnings for couple of stocks. For similar reasons, the Rising Giants portfolio also witnessed a modest growth in earnings (though better than Little Champs portfolio).

We also highlighted in the newsletter why we believe the above factors are transient in nature and we continue to be sanguine about the medium-long term prospects of our portfolio companies.

However, it seems the market is extrapolating the current headwinds much deeper into the future for the portfolio companies. For instance, the LCP portfolio’s current P/E (on FY24 projected earnings) is close to 28x – down >20% from the level 2 years back. A P/E of <30x implies that the market believes the firms in the Little Champs portfolio would continue their dominance (i.e. longevity of healthy earnings/cash flow growth) for just about 8 years in the future – which highly underappreciates the level of moats and capital allocation skills these firms enjoy. (Note the key assumptions in calculation of 8 years above: Free Cash Flow growth of 22%, cost of equity of 12%, terminal growth of 5% with a fade of 5 years). Similarly, the Rising Giants portfolio currently trades, on a median basis, at 34x FY24 projected earnings, again severely undermining the compounding power and longevity thereon of the portfolio companies.

We believe given the current valuation levels, any uptick in earnings can result in disproportionate gains in the share prices for the portfolio companies.

We have made the following changes to the Little Champs and Rising Giants portfolios:

Addition of Tega Industries to the Little Champs portfolio:

Tega Industries (Tega) is a leading manufacturer of specialized critical-to-operate and recurring consumable products for the global mineral beneficiation, mining and bulk solids handling industry. Tega is the world’s second-largest manufacturer of polymer-based mill liners and fourth largest player in the overall mill lining market. Its DynaPrime range of mill lining has been designed specifically for the bigger size of the mills where modern liner handlers are available and it helps in reducing the number of pieces being installed inside the mill, thereby reducing the installation downtime. It has few non-mill lining products include Trommels & Screens, Hydrocyclones and Conveyor Products. Tega’s competitive advantages include:

- Technology Barrier as the quality of lining, designing the lining and proper timely installation is extremely important to protect the mill, achieve the adequate discharge to get the required mill performance, reducing the downtime during the replacement, etc. The application is so niche that products not having sound technical standards tend to fail leading to the large downtime and Mill damage costs to the customer.

- Long Approval process and stickiness as mining companies consider Mill as the engine of their operations without which the operations will come to a stand-still.

- High Switching Costs as lining is critical to protect the Mill which costs around $3-6 million (a small one-stage SAG mill). The cost of failure is not only the mill’s cost but also the downtime costs. Tega has been investing in R&D since many years and have developed many products in-house Dyna range of mill liners, Rapido Screeners, Trommels, Tega Cyclone (Hydro-cyclones), etc. It has manufacturing presence at Chile, South Africa and Australia (only assembling). The proximity to customers helps in tapping new customer opportunities, providing support to existing customers, ensuring continuity of repeat orders, etc.

The company acquired McNally Sayaji Engineering in Feb’2023 for Rs.165 crores. McNally, an 80-year-old company which was undergoing insolvency proceedings. It is engaged in manufacturing of crushers, screening equipments, grinding equipment, material handling and mineral processing equipment, etc. The said acquisition will expand Tega’s addressable market, provide manufacturing base in Southern India, and provide with cross-selling opportunities.

Addition of Clean Science to the Rising Giant portfolio:

Clean Science and Technology Ltd. (CSTL) is a leading manufacturer of chemicals for polymer, packaged food, pharma and cosmetics industry. It is the global market leader in manufacturing of MEHQ, which is a polymerization inhibitor and also in manufacturing of BHA & Ascorbyl Palmitate which are used as antioxidants in edible oil and packaged food industries. CSTL’S advantage lies in its proprietary catalytic manufacturing processes which have alternate starting points compared to conventional processes used by peers and which have higher yields and lower waste / effluent generation. Company has also done forward and backward integration for its core products which has allowed it to have better control on its cost structures and also to drive better value from its portfolio. In addition to the products which have global leadership (in terms of market share), CSTL has been building its product portfolio very aggressively by getting into adjacencies where the addressable market size is multi-folds larger than core products, and which are more technically complex. This provides both – greater moats and longer growth runway for the company.

In the last five years, company has delivered revenue CAGR of 31% and PAT CAGR of 43%. The company is debt free and its average ROCE and ROE in last five years have been 51% and 40% respectively.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/