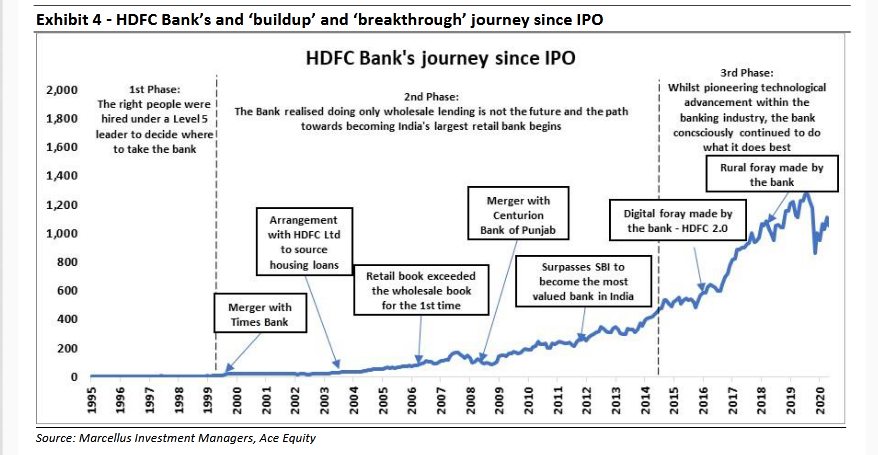

While we focused on the capital allocation skills of Uday Kotak (click here to read) and Deepak Parekh (click here to read) in our preceding pieces in this series, the genius of Aditya Puri lies in the fact that there have been no miraculous moments, no solitary lucky break or grand transition programs which have led to the success of HDFC Bank. Instead, a steady evolution over the years has meant that HDFC Bank now dominates virtually every segment of India’s lending landscape. Aditya Puri, one of India’s longest serving CEOs will retire later this month with a legacy of compounding shareholder wealth at 26% for over 25 years. Hence, we thought it apt to analyze the factors which led to the blazing success of HDFC Bank using the framework provided in Jim Collins’ bestselling book ‘Good to Great’ (2001) and put forth our view on why we believe HDFC Bank will be able to sustain this success.

“Aditya Puri told me he will achieve 50% higher profits than the target I give him, but he had only one condition – I should stop calling him every day. Aditya gave me very little scope for being tough on him, he was always on the top of his job in terms of revenues and budget numbers. He will take hard decisions on every loan the bank gives and that is why HDFC Bank is the biggest of the best.” – The late Nanoo Pamnani, erstwhile Chairman of Bajaj Finserv reminiscing about the times when Aditya Puri used to report to him at Citibank (Source: Business Today, 2014)

Performance update of live fund

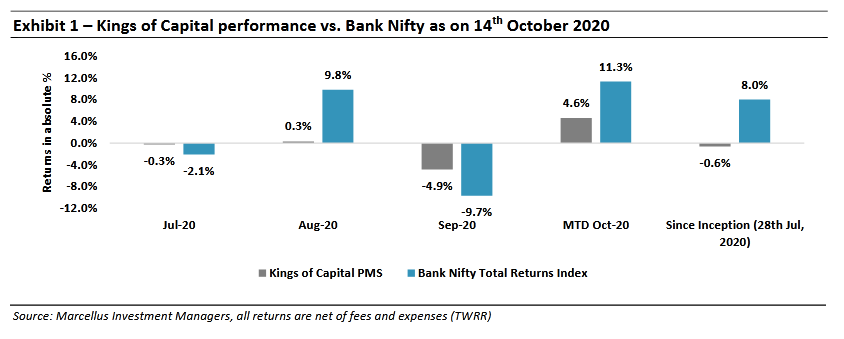

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Under the TWRR method of calculating portfolio performance the initial performance looks optically lower in an upward trending market because of large inflows on a relatively small AUM. As on 14th Oct, the first customer of the Kings of Capital PMS had generated returns of 2.0% vs 8.0% for the Bank Nifty since inception.

The early days of HDFC Bank

HDFC Ltd. was India’s only mortgage lender since its incorporation in 1977 until HDFC Ltd. itself created India’s next three housing finance companies in 1988! While HDFC Ltd. had become a pioneer in mortgage lending, it realized that it can further leverage its brand and reputation by venturing into other financial services businesses such as banking, insurance and asset management. It had been internally deliberating on the idea of getting into the banking business since the late 1980s. However, since the nationalization of private banks in 1969 and 1980, the RBI had not given a license to any private bank. This had resulted in government owned banks accounting for 85% of the business being done by the sector and the remaining market share was with the foreign banks and the older private sector banks which had largely regional franchises. In 1993, when RBI opened up the sector to private players, it received 113 applications and HDFC Bank was one of the 10 banks to receive a banking license. Other notable names which received a license then were ICICI Bank, Axis Bank (UTI Bank back then), Indusind Bank and two other banks which were later acquired by HDFC Bank itself – Times Bank and Centurion Bank.

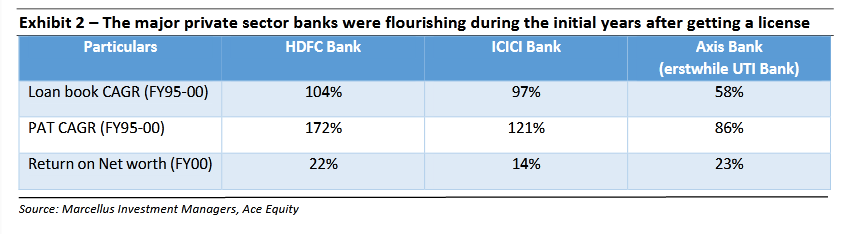

The biggest private sector banks in India today started out as equals in 1994 – ICICI, UTI and HDFC Ltd. had the capital as well as the brand to capitalize on the large opportunity in a sector which was dominated by inefficient PSU banks. In the first five years (1995-00) of getting a banking license, each of these private banks did well (see Exhibit 2) in an industry where the competitive dynamics were in their favour and banking credit itself was growing at a 16% CAGR during 1995-2000. However, with Aditya Puri at the helm, the wheels had started turning towards building an institution which, as time would tell, outperformed not only when the tide was in its favour but also during financial crises as well (please click here to read our newsletter on how HDFC Bank benefits from a financial crisis).

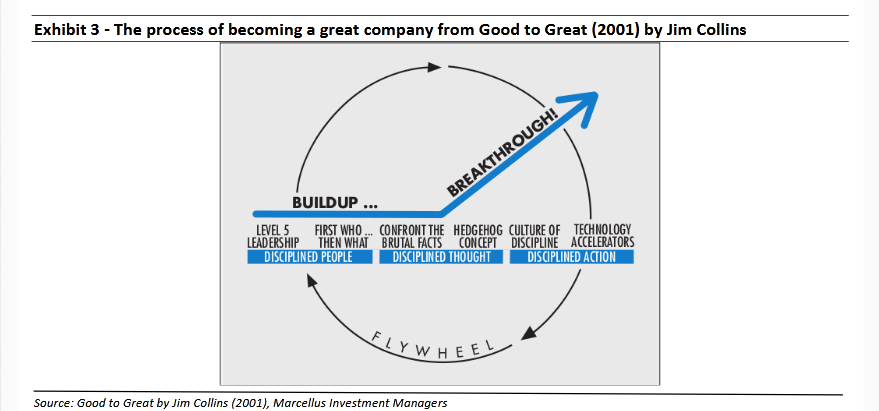

HDFC Bank’s journey from good to great

-

Level 5 leadership i.e. leadership with a blend of personal humility and professional will:

The type of leadership required to transform a good company to a great company is one which is a blend of personal humility and professional will. We came across an example of how Aditya Puri has embodied both these traits during his career while we were interacting with an erstwhile assistant manager of HDFC Bank. The said employee had joined HDFC Bank within a few months of the bank getting a banking license and the only task Aditya Puri had given him in the initial couple of months was to get a meeting with the CEO of a leading pharma company based in Delhi – the strategy of the bank was to provide cash management services to the company and earn float on it rather than take credit risk. After chasing the company for a couple of months the said assistant manager was to accompany Aditya Puri for the meeting in Delhi. Aditya Puri decided that they needed to stay in a five star hotel because they were meeting the CEO of a large corporation but they needed to share a room as that is what they could afford in the daily travel allowance. During their stay, Aditya Puri let his junior sleep on the bed while he himself slept on the sofa. While this paradoxical blend of personal humility and fanatic will to produce consistent results is rare to find, HDFC Bank has been fortunate to have such a leader for a period of over 25 years.

-

First who, then what:

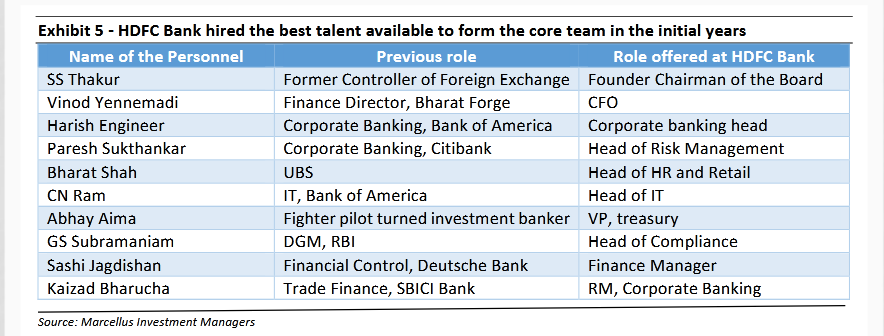

Great companies focus on hiring the best talent to build strong and deep executive teams first rather than first building a grand vision for the company and then getting people committed to that vision. Initially every employee at HDFC Bank was handpicked by Aditya Puri and Deepak Parekh, they focused on recruiting the best available talent and gave those employees the freedom to bring in their own people to the Bank. This was similar to the strategy Wells Fargo followed in the 1980s when its CEO Dick Cooley and Chairman Ernie Arbuckle focused on hiring the best talent possible, in some cases without having any specific job description in mind. In its early days, HDFC Bank could not match the pay the team of new recruits were earning in their previous jobs; hence they incentivized them with ESOPs. As illustrated in Exhibit 5, HDFC Bank recruited the best talent from diverse organizations and in some cases created roles to accommodate outstanding talent. 3.

3.

Confronting and accepting the brutal facts:

Great companies retain absolute faith in their overarching vision regardless of the difficulties but also confront the brutal facts of their reality. We have seen HDFC Bank retain unwavering faith in its belief that regardless of what the macro economic scenario might look like, India is a credit starved country where the demand for credit exceeds supply and the country therefore needs an efficient, well run bank. However, that has not stopped HDFC Bank from recognizing the fact that they need to continuously keep evolving to prepare themselves for upcoming disruptions. For example, HDFC Bank wanted to be a corporate bank – its business plan submitted to the RBI specifically mentioned this fact. The first step for HDFC Bank to make the decision of entering retail banking was to accept the brutal facts that despite starting out with the objective of building a corporate bank, having a CEO who had no experience in retail banking and not having a large branch network, the future of the bank lay in building a diversified retail + corporate loan book.

4. Hedgehog concept i.e. a deep understanding of what your organization can be the best at:

This is a continuation of the previous step of accepting the facts and then arriving at the intersection of: (i) what an organization can be the best at; (ii) what drives the economic engine of the organization; and (iii) what the organization is deeply passionate about. It may take years for even great companies to find out where this intersection lies as it is more of an iterative process. However, once a company is able to get clarity on this, many complex decisions become simple and every incremental decision becomes easier.

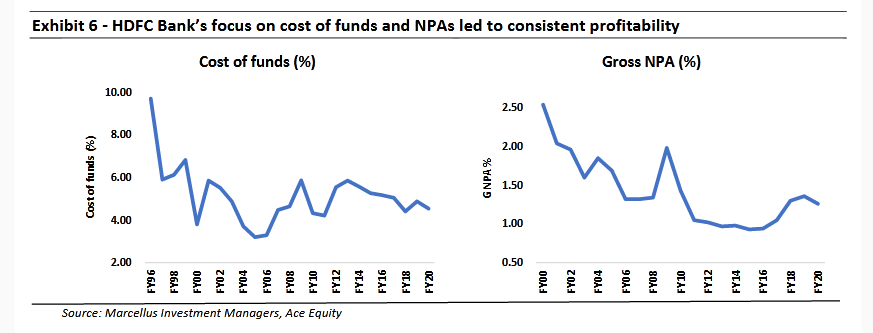

HDFC Bank realized early on that it can be the best at building a low-cost liability franchise and managing risk on the asset side. This is what has driven HDFC Bank’s economic engine over the years and once the bank realized this, other decisions such as foraying into retail lending, branch expansion in rural areas, push towards digital banking etc. became much easier. As illustrated in Exhibit 6, the clarity on what can be done and what cannot be done has led to these consistent results. In 2008-09, the portfolio of most banks and NBFCs got decimated but HDFC Bank was an exception because of its deep understanding of the hedgehog concept.

5. A culture of discipline:

Sustained great results are built by creating a culture of discipline at an operational level as well as in capital allocation decisions. This disciplined, process-oriented culture which has been created at HDFC Bank seems boring and replicable from the outside. However, it has been a gradual build up over years and upon closer inspection it becomes apparent that it is driven by processes which make people diligent in their approach. The lengths to which Aditya Puri has gone to drive this intensity and discipline from the top is exceptional. In what has now become an oft quoted example, immediately after Aditya Puri’s bypass surgery, he tried convincing the surgeon to open a HDFC Bank account. This drive and disciplined culture have visibly percolated through the ranks at HDFC Bank as it has relentlessly executed its goals over the years.

6. Technology accelerators:

Great companies use technology proactively to disrupt themselves rather than using technology reactively in the fear of being left behind. It is the right application of technology to accelerate momentum and build competitive advantages that has differentiated HDFC Bank from its competitors. For a long period of time, ICICI Bank was the leader in introducing the latest technology to the banking industry; HDFC Bank on the other hand has approached a more cautious approach on introducing latest technologies. Great companies become pioneers in the application of technology rather than pioneers in introducing the technology itself.

HDFC Bank after Aditya Puri – will the greatness endure?

We attempted to answer this question with two distinct approaches: (i) Marcellus’ succession planning framework; and (ii) learning from leadership transitions at other large Indian banks. Our research leads us to believe that HDFC Bank will continue to deliver consistent earnings growth at least over the next 3-5 years.

-

Marcellus’ succession planning framework

We evaluate portfolio companies on our proprietary 4-part succession planning framework (please click here to read the newsletter on our succession planning framework):

(a) Evidence of decentralisation of power and authority:

When it comes to execution of its day-to-day business, HDFC Bank has one of the best systems and processes across India’s banking industry. Our interactions with various people who have worked at HDFC Bank for a long time, suggest that the bank’s focus on systems and processes has made manual intervention redundant across most of its day-to-day functions. We believe the strengths of well-established SOPs, robust credit underwriting and a resilient balance sheet will hold HDFC Bank in good stead for the next few years as the company goes through a leadership transition.

(b) Quality and tenure of CXOs in the organisation:

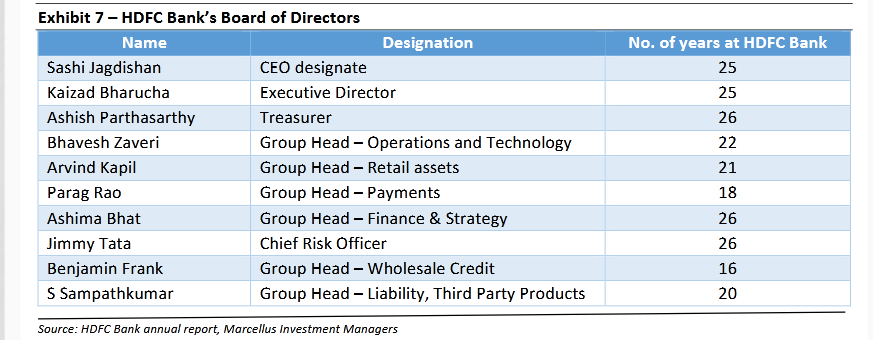

Arguably the most difficult part to execute for enduring greatness is to preserve the core values and purposes while business strategies and operating practices keep changing. The art of sticking to the core and stimulating progress in adjacent areas can be implemented only if there is a large pool of high quality internal talent which is continuously groomed and elevated within the organisation to maintain continuity in culture. For example, even though Jack Welch is the most celebrated CEO of General Electric, it is a much lesser known fact that Jack Welch ranked in fifth place out of seven when ranked against other GE CEOs on pre-tax RoEs. Similarly, when measured on share price performance, the Jack Welch era ranked in fifth place out of seven. Jack Welch was someone who had been at GE for twenty years before he was promoted to the CEO role, GE remained a great company for over a hundred years because of its ability to groom such talent. Enduring great companies prosper not because of a single great leader, but because they are able to consistently produce great leaders from within the organisation. While Aditya Puri has been a phenomenal CEO, we believe that HDFC Bank as an institution has groomed multiple leaders. As seen in Exhibit 7, even though there has been a spate of CXO level exits in the past three years, there are multiple business heads who have been at the Bank for more than 15 years which will ensure continuity of culture at HDFC Bank.

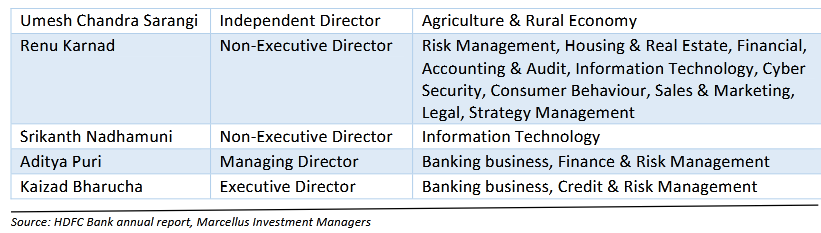

(c) Board of directors:

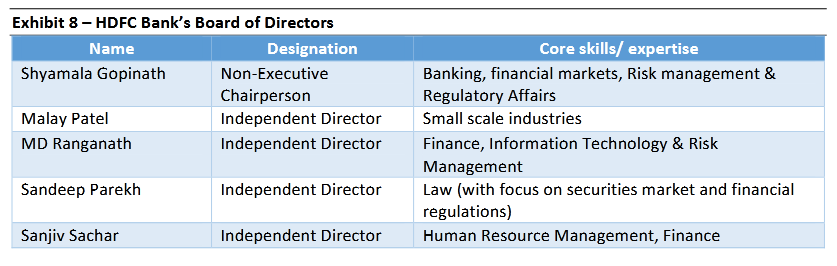

As illustrated in Exhibit 8, HDFC Bank has an illustrious board of directors consisting of independent directors from diverse and relevant backgrounds. A board which is empowered and consists of experts in the field of finance, risk management, law, HR, IT, agriculture and rural economy etc. can provide a balanced view on the bank’s strategy, capital allocation and succession planning. What gives us additional comfort is the consistency in culture, philosophy, and direction that the Bank benefits from because of the presence of nominee directors from its parent HDFC Ltd. on its board.

(d) Historical experience of succession planning: Because in the case of HDFC Bank we do not have historical evidence of succession at the CEO level, we will closely monitor not only the banks’ financial performance but also continue evaluating how it progresses on the softer aspects listed above under its new CEO.

(d) Historical experience of succession planning: Because in the case of HDFC Bank we do not have historical evidence of succession at the CEO level, we will closely monitor not only the banks’ financial performance but also continue evaluating how it progresses on the softer aspects listed above under its new CEO.

-

Learning from leadership transitions at other large Indian banks

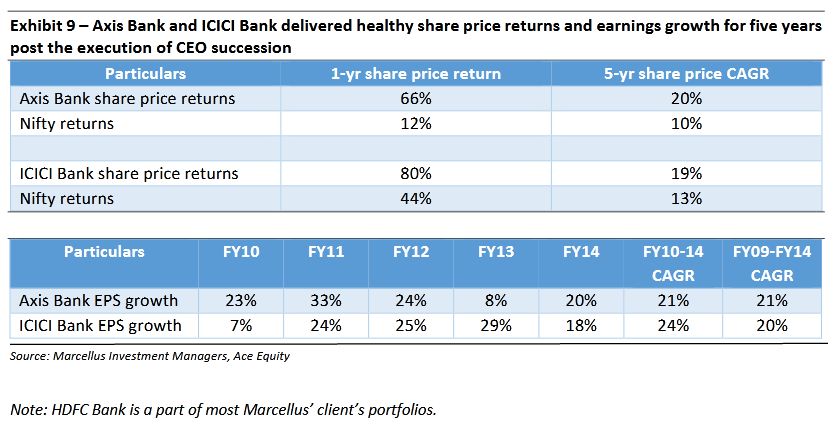

We have examples of two large Indian banks – Axis Bank and ICICI Bank – which saw long standing CEOs i.e.

Dr PJ Nayak and KV Kamath respectively retire in 2009 i.e. just after the financial crisis. As illustrated in Exhibit 9, during the five years following the retirement of these two long-standing CEOs, the share prices of Axis Bank and ICICI Bank compounded at a CAGR of 20% and 19% respectively.

Large Indian banks deliver healthy returns post a new CEO coming in irrespective of whether an external candidate (Shikha Sharma for Axis Bank) or an internal candidate (Chanda Kochhar for ICICI Bank) have replaced a long-standing CEO. As seen in Exhibit 9, on the earnings front as well, Axis and ICICI Bank continued to deliver consistent performance post the leadership transition. While the fundamentals of Axis Bank and ICICI Bank deteriorated after the change in leadership, it took over 5 years for the fundamentals to change. We therefore believe that changing the earnings trajectory of a large Indian bank whether for the better or for the worse is a long-term journey. Given the fundamental strengths of HDFC Bank, we believe that it is well positioned to deliver consistent earnings growth at least over the coming 3-5 years despite the fact that it is going through a CEO succession for the first time in its history.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.