Share price performance of the Nifty50 and Marcellus’ CCP portfolio constituents over the past two decades shows that the benefits of waiting for lower purchase prices fade away meaningfully as the quality of the portfolio’s fundamentals improves. Investors who make periodic investments in companies with weak fundamentals benefit substantially from timing the purchase prices – investments at ’52-week-low’ prices each year delivers around 8% XIRR (annualized returns) vs only 2% XIRR for randomly timed investments. On the other hand, perfect timing of purchase prices of great companies (like Consistent Compounders) in this fashion can only enhance an investor’s returns from, say, 30% XIRR to 32% XIRR – a reward that is not commensurate for the kind of effort and risk that it entails.

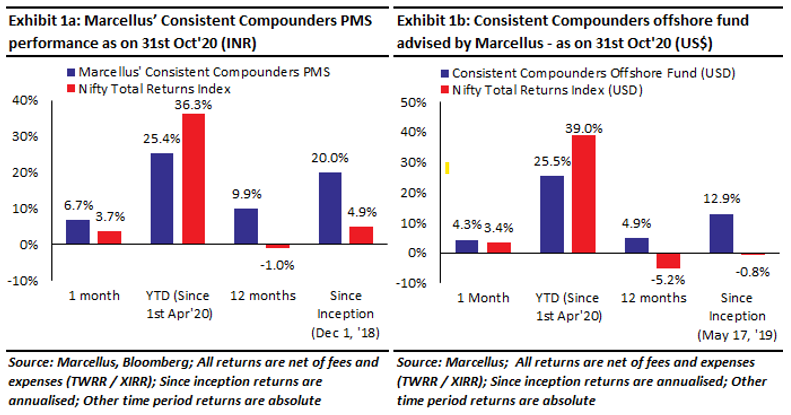

Performance update – as on 31st October 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Some of the most frequently asked questions related to our Consistent Compounders PMS include – “We want to top-up into our CCP PMS account, but markets have recently rallied upwards. Shouldn’t we wait for a lower purchase price?”; or “Most of your portfolio companies’ share prices are close their 52 week high. Shouldn’t we wait for a lower purchase price?”. We have tried to answer these questions in this newsletter.

Recollecting two constructs from our previous newsletters – Mr. Gifted vs Mr. Mortal; and Buckets A, B, C

In our 1st March 2019 newsletter, we had taken the examples of two different types of investors – both of whom invest Rs. 1 crore annually in shares of Asian Paints from their annual savings. The first investor is Mr. Gifted. He is skilled at timing share prices. Each year, he buys Rs 1 crore worth of Asian Paints shares at the lowest price of that year (i.e.at the ’52-week low’). The second investor is Mr. Mortal. He believes he cannot time share price movements, and hence he buys Rs 1 crore worth of Asian Paints shares on the 1st day of each year, regardless of the prevailing share price on this day. Any time in the past if the two investors had followed this process annually for 10 years in a row, the portfolio XIRR (annualized rate of return) for Mr. Mortal would have been around 30%, and that of Mr. Gifted would have been only 2% higher (i.e. around 32%).

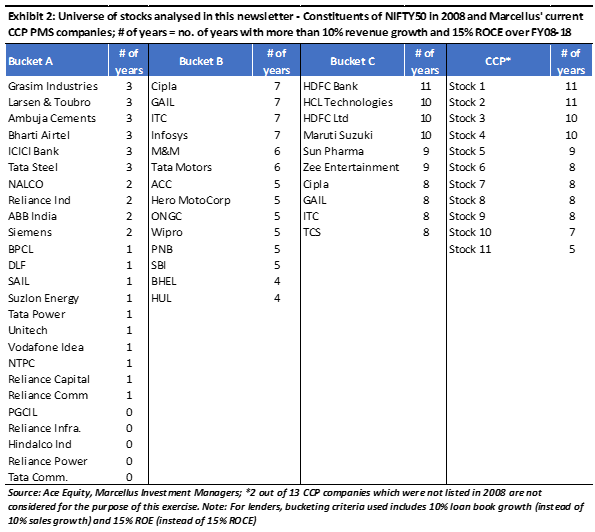

In our 1st May 2019 newsletter, we analysed the constituents of Nifty50 from a decade ago – 2008 – by dividing them into three buckets based on their revenue growth and ROCE delivered over FY08-18 (eleven years including both FY08 as well as FY18).

- Bucket A (A for Airlines): Companies who have delivered >10% revenue growth and >15% ROCE in less than or equal to 3 financial years over FY08-18. These are companies which do not possess any moats, and hence are not able to sustain healthy ROCEs.

- Bucket-B (B for Buffett): Companies who have delivered >10% revenue growth and >15% ROCE in more than 3 financial years, but less than or equal to 7 financial years over FY08-18. These are companies with shallow moats that get challenged every now and then by aggressive competition.

- Bucket-C (C for Compounders): Companies who have delivered >10% revenue growth and >15% ROCE in more than 7 financial years over FY08-18. These are companies which perhaps possess deep moats that are difficult to break into.

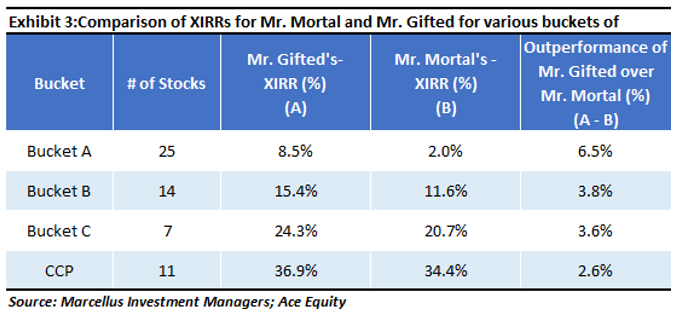

Bringing the two constructs together – quantifying the outperformance of Mr. Gifted over Mr. Mortal for different types of stocks

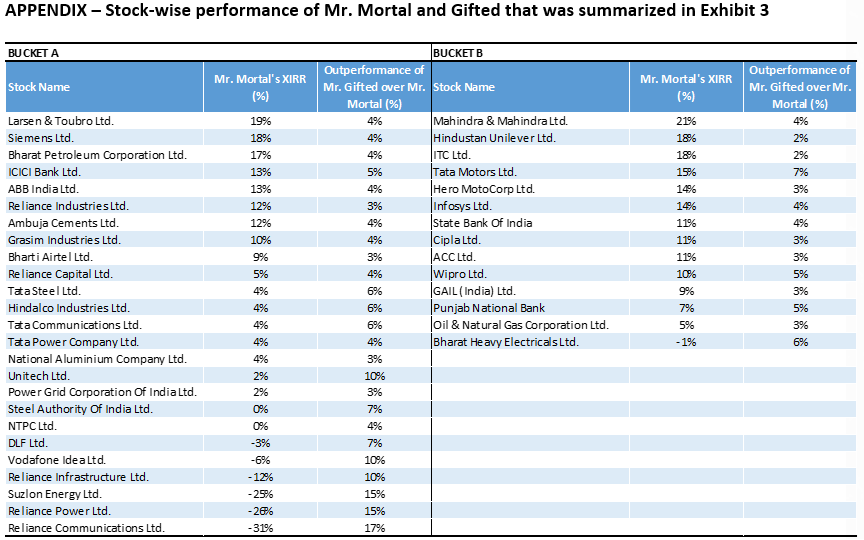

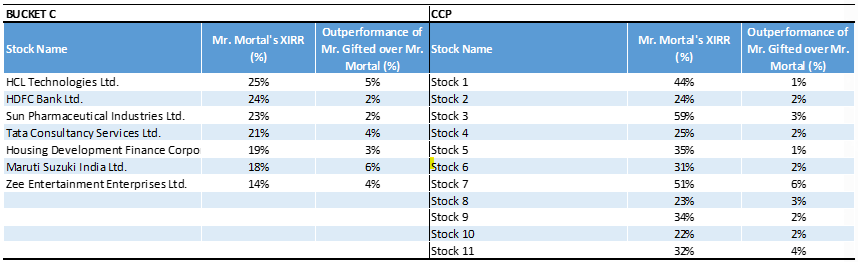

In our 1st March 2019 newsletter, we had compared Mr. Gifted’s performance with Mr. Mortal’s only for investment in Asian Paints. The analysis below extends this comparison to include stocks in Buckets A, B and C using the Nifty50 constituents of 2008 (note: the outcome is similar regardless of which year’s Nifty50 constituents are analysed) and for all the stocks in Marcellus’ current CCP PMS portfolio.

For every stock analysed here (and shown in the table above), we have taken 10 sets of 10-year periods of investment starting with 1st April 2000. For example, for L&T, the first 10-year period starts on 1st April 2000 and ends on 31st March 2010. The second set starts on 1st April 2001 and ends on 31st March 2011. The tenth set starts on 1st April 2010 and ends on 31st March 2020. In each of these 10 sets, Mr. Mortal invests Rs. 1 crore annually on 1st April of each financial year, and Mr. Gifted invests Rs. 1 crore annually at the 52-week low price of each financial year. XIRRs computed for all the sets of 10 year periods are then averaged to get Mr. Gifted’s and Mr. Mortal’s average XIRR comparison for each stock.

The outcome of this exercise for Buckets A, B and C, and for Marcellus CCP portfolio is summarized in the exhibits below. Stock-wise outcome of the exercise is detailed in the appendix towards the end of this newsletter.

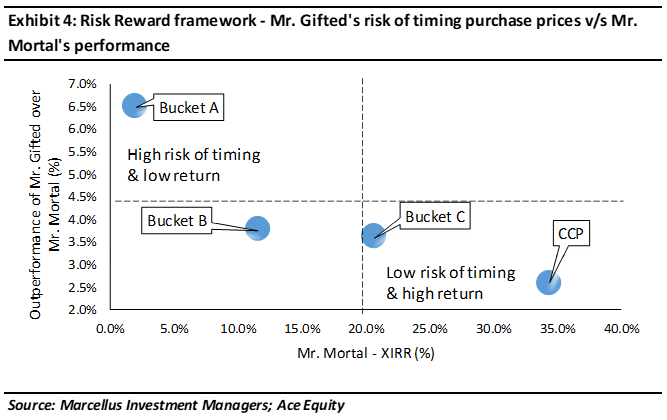

Key observations from the two exhibits shown above

Buckets A, B, C and our CCP Portfolio differ from each other around the health and consistency of their fundamental compounding (measured by revenue growth and ROCE). Since fundamentals drive more than 80%-90% of the share price of a firm over the long term, therefore:

- Bucket A (weak and volatile fundamentals) delivers weak performance for Mr. Mortal (horizontal axis in exhibit 4) and a high quantum of outperformance for Mr. Gifted over Mr. Mortal. As a result, successful timing of low purchase prices in Bucket A changes both the nature and quantum of performance for the investor. Gifted manages to beat the risk-free rate of return through Bucket A, while Mr. Mortal doesn’t.

- Bucket C and Marcellus’ CCP portfolio deliver healthy and consistent performance for both Mr. Mortal as well as for Mr. Gifted, with a very narrow gap between their XIRRs. Hence, both the quantum as well as the nature of performance for Mr. Gifted is similar to that of Mr. Mortal i.e. healthy compounding. Hence, it is NOT worth timing low purchase prices in in Bucket C and in CCP.

Some investors in Bucket C and CCP portfolio might look at exhibit 3 and say that “Even though the gap between XIRRs of Mr. Mortal and Mr. Gifted is as low as 2-3% for Bucket C and CCP Portfolio, I want to benefit from this gap and be like Mr. Gifted”. Such investors should bear in mind the two risks associated with an attempt to become Mr. Gifted in Bucket C and CCP.

Firstly, the analysis above shows only the favourable outcome of ‘waiting for a lower purchase price’. In practice, in some instances the investor will also have to face the unfavourable outcome of ‘waiting for a lower purchase price’ i.e. in some instances she will end up investing at a higher purchase price vs Mr. Mortal. Moreover, since the fundamentals of Bucket C and CCP companies are compounding consistently at a healthy rate, the mathematical (i.e. based on luck) probability of getting a favourable outcome is lower than the mathematical probability of getting an unfavourable outcome.

Secondly, most investors who ‘wait for a lower purchase price’ drive these decisions based on their view of when the broader stock market will fall. This is misleading because as highlighted in our 1st Sept 2019 newsletter, on a 12 month basis, in 70-80% of the historical stock market crashes, share prices of CCP portfolio companies have delivered a positive return. Hence, even if the investor’s call on a stock market crash is right, the attempt to be like Mr. Gifted might NOT fructify for Bucket C and CCP stocks.

Investment implications

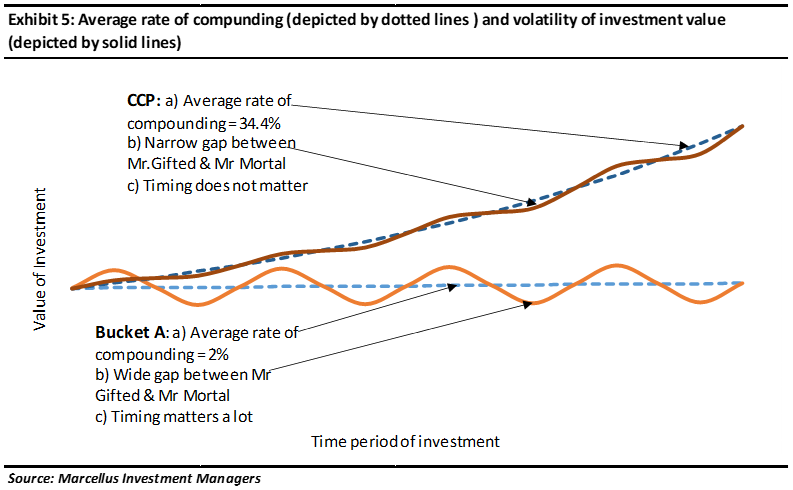

Investors who expect their portfolio fundamentals (earnings or cash flows) to compound at a healthy rate (depicted by the slope of the straight lines in the chart above) with low volatility (depicted by the amplitude of the curved lines in the chart above), should NOT attempt to time their investments and their top-ups. Such timing related attempts will more often than not lead to unfavourable outcomes. Even if the investor is skilled at successfully timing entry points in such portfolios, the benefits will not materially change the nature and quantum of the portfolio’s compounding. For such portfolios (Bucket C or CCP), being Mr. Gifted entails risks which can be avoided if investors are happy with the performance of Mr. Mortal!

On the other hand, investors who expect their portfolio fundamentals (earnings or cash flows) to compound at a weak rate with high volatility (bulk of the stock market constituents meet this criteria) should attempt to time their investments and topups based on their expectations of a stock market crash.

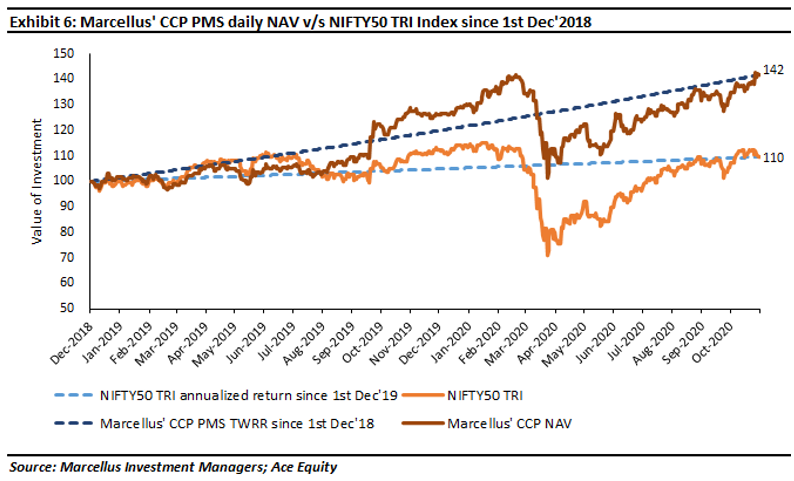

Over the last four years, equity markets in India have had no shortage of disruptions and uncertainties – demonetization, GST, regulatory changes (like the introduction of long term capital gains tax in 2018 or corporate tax rate cut in 2019), ‘surgical strikes’, IL&FS crisis, Covid-19 crisis, several union budgets, elections and more. Being Mr. Mortal with our CCP Portfolio has helped compound the portfolio’s NAV in a healthy and consistent manner during this period, without the risk of ‘timing the market’. The chart below shows Marcellus’ CCP PMS NAV since inception vs Nifty50.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this publication in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.

Copyright © 2020 Marcellus Investment Managers Pvt Ltd, All rights reserved