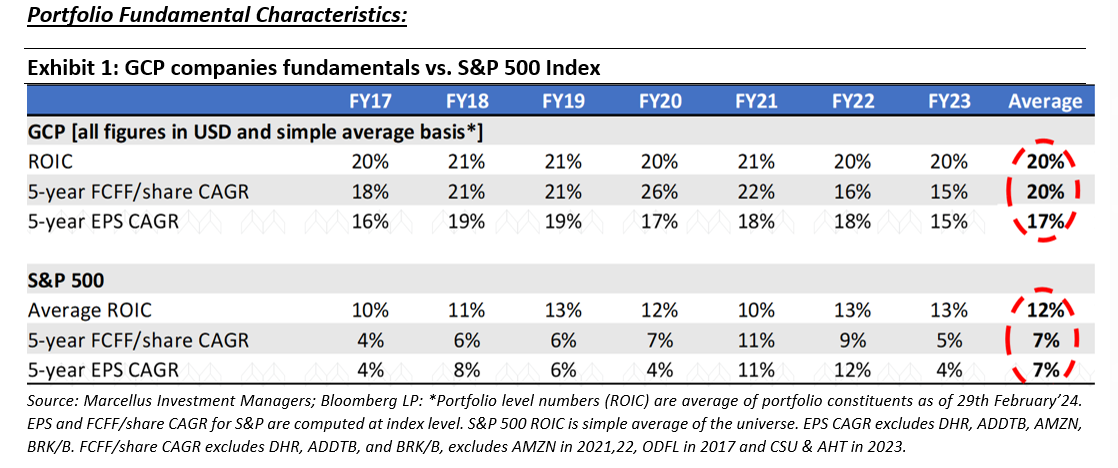

Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies aligned with megatrends, fostering a consistent mid to high teens compounding of free cash flow/earnings. A large part of our portfolio comprises of American firms, and for good reason. Over the last 30 years, US equities have demonstrated exceptional ability to generate wealth – underpinned by four pillars of American capitalism: Innovation, Best in Class Talent, Scale and Protection of Rights. We discuss how these factors allow US companies to compound investors’ wealth at a much higher rate than headline GDP growth figures and why an investor should consider allocating capital to not just one but both the economies with arguably highest potential in the world today – India and United States.

Permissible Accredited Investors* can now invests in GCP Strategy with minimum ticket size USD 25,000.

*Accredited Investors shall qualify eligible criteria as defined under IFSCA-IF-10PR/1/2023-Capital Markets dated January 25, 2023.

For non-accredited investors, Investment in Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA) with a minimum investment amount of USD 150,000.

Over the last many decades, US companies have compounded at much higher rate than GDP growth

“Today, many people forge similar miracles throughout the world, creating a spread of prosperity that benefits all of humanity. In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Beyond that, we retain our constitutional aspiration of becoming “a more perfect union.” Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so. Our unwavering conclusion: Never bet against America.” – Berkshire Hathaway 2020 shareholder letter (Underlining added by us)

One of the most commonly held beliefs in the wider investment community equates high/low GDP growth with high/low stock market returns. As a result, many investors feel more than happy staying invested in economies showing the promise of high GDP growth for years to come while shunning the ones with more modest growth prospects. However, stocks market returns are driven by more than just headline growth figures, as the example of US stock market returns vis-à-vis China and Japan exemplify.

The US presents an intriguing case considering that public equities in an economy which is growing at a modest low to mid single digit pace have been able to outperform almost all major markets globally over last many decades.

A key reason behind this divergence in GDP growth and stock returns relates to the strong foundation of the US capitalist ecosystem. As far back as the memory can take us, US companies have been at the forefront of value creation across industries, with the American ecosystem rolling out one global icon after another as the decades have passed. Whether it was IBM in its heydays of 1970s-80s, General Electric in ensuing decades or likes of Apple and Microsoft today, American companies have remained some of the most sought after by workers, vendors and customers alike.

In this newsletter we present a brief synopsis of the underlying factors that, in our opinion make American ecosystem so special.

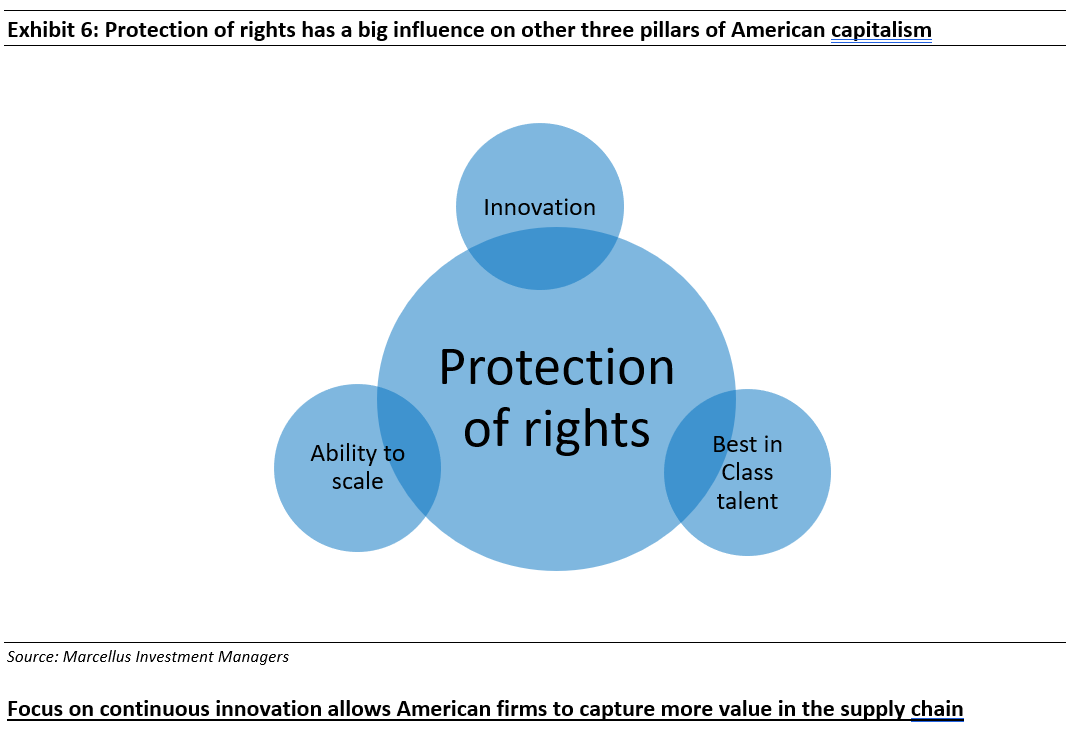

The strength of American commercial landscape is driven by four irreplaceable moats

The four corners of American ecosystem’s strength can be summarized as:

– Protection of rights: Strong legal and regulatory framework safeguarding assets of risk takers;

– Innovation: which allows for introduction of new products and services backed by strong R&D;

– Best in class talent: preferred destination for fertile, inquisitive minds to explore and introduce new ideas; and

– Scale: Enablement of fast introduction, testing and commercialization of ideas.

We discuss each of these in more detail below.

The beating heart of American Capitalism – Protection of Rights

The American capitalist ecosystem differentiates itself from other major economies on the back of two aspects which have become culturally ingrained over past decades. The first of these relates to protection of individual and corporate rights. As the champion of free markets globally, the US has established a strong rule of law that discourages theft of intellectual property. Without assurance of owning legal rights to their IP, no entrepreneur or VC would invest their time and resources into a project curbing the innovative spirit and talent influx we discuss in ensuing sections.

In addition to protection of IP rights, the US also benefits from a lighter regulatory touch vis-à-vis some of the other developed and emerging economies. This is an often-underappreciated point with respect to both value capture (which we discuss in the section on innovation below) as well as scaling up of business. Entrepreneurs working in countries with tight regulation and state interference often struggle to recoup fair rewards from their innovations as high margins/return on investment may induce the state to cap their potential returns. Across the globe many industries like airlines, Oil & gas and even software have seen application of penalties/windfall taxes etc. by governments and regulators that can act as a dampener for ambitious businessmen.

By doing away with such concerns, the US allows risk taking entrepreneurs willing to sacrifice a large part of their time and capital to go the whole hog – laying the strong foundation for the three pillars we discuss next: Innovation, Attracting best in class talent and achieving scale.

Focus on continuous innovation allows American firms to capture more value in the supply chain

If one was to jog their memory a little bit, the number of truly path breaking innovations that have come of the US would be a testament to the innovative spirit of the American heartland. From the invention of electric bulb and the telephone in the 19th century to the invention of the internet and semiconductors in the 20th century followed by smartphones and electric vehicles in the more recent era, American entrepreneurs have been at the forefront of major technological changes across centuries. That’s all impressive one might say, but why is it important from an investment standpoint?

The reason it is important comes down to the intellectual property that’s owned by the innovator and which can capture maximum value within the price of a product/service. Such value capture is possible due to the high value additive, inimitable nature of the innovation in comparison to the more commoditized aspects that go into creation of a product. Let’s understand this using the example of Apple Inc.

As is well known, Apple products are designed in house but manufactured by their Taiwanese partner Foxconn/ Hon Hai Precision Industry with majority of its operations based in China. A quick look at the two companies’ financials reveals the value capture aspect discussed above. Using the latest full year results available (Dec’23 for Hon Hai and Sep’23 for Apple), one can see the stark difference in operating margins and resultantly the Price/Sale multiple given by the market to the two companies.

Exhibit 7: Apple captures much more of value from each sale of its products vis-à-vis Foxconn (Hon Hai)

| Revenue (in $bn) | Market Cap (in $bn) | Operating Margin (%) | Price to Sales (x) | |

| Hon Hai (in TWD) | 6162 | 2300 | 2.7% | 0.4 |

| Apple (in USD) | 383 | 2800 | 29.8% | 7.3 |

Source: Marcellus Investment Managers, Yahoo finance * market cap as of 3 May’24

This is not a sign of glaring market inefficiency but rather evidence of the value investors place on each $ of sale made by Apple Inc. While Apple makes close to 30% operating margin on its revenue on the back of its product design and brand IP, Hon Hai – even with its efficient operations eeks out a meagre 2.5-3% margin. This difference in margin is what innovation helps materialize. Apple’s product designs are revolutionary, IP protected and a key reason for the pricing power it enjoys amongst its fanbase, whereas Hon Hai’s operations as a contract manufacturer are much more commoditized in nature & depend a lot more on volume and turnover.

To conclude, while there may be excitement amongst investors when a new factory for manufacturing Apple products or semiconductors is set up in an emerging market, the question that needs to be answered is whether such operation would allow respectable value to be captured or not. In Apple’s case, the country of manufacture or even the vendor might change but thanks to the innovation led IP, Apple would keep capturing most value for each $ of sale.

Attracting an extremely valuable global asset – Talent

No amount of innovation discussed in the preceding section can come to fruition if not supported by the toil and smarts of innovators. And to do that in large enough quantities, a country needs to be an attractive destination for smart, ambitious immigrants looking to rise up in life. America has been exactly such a destination, in fact so much so that Pew Research Center deemed Immigration to be a key reason behind growth in U.S. working-age population through at least 2035:

“…the most important component of the growth in the working-age population over the next two decades will be the arrival of future immigrants. The number of working-age immigrants is projected to increase from 33.9 million in 2015 to 38.5 million by 2035, with new immigrant arrivals accounting for all of that gain.”- Pew Research Center (link)

This is not a surprising result as:

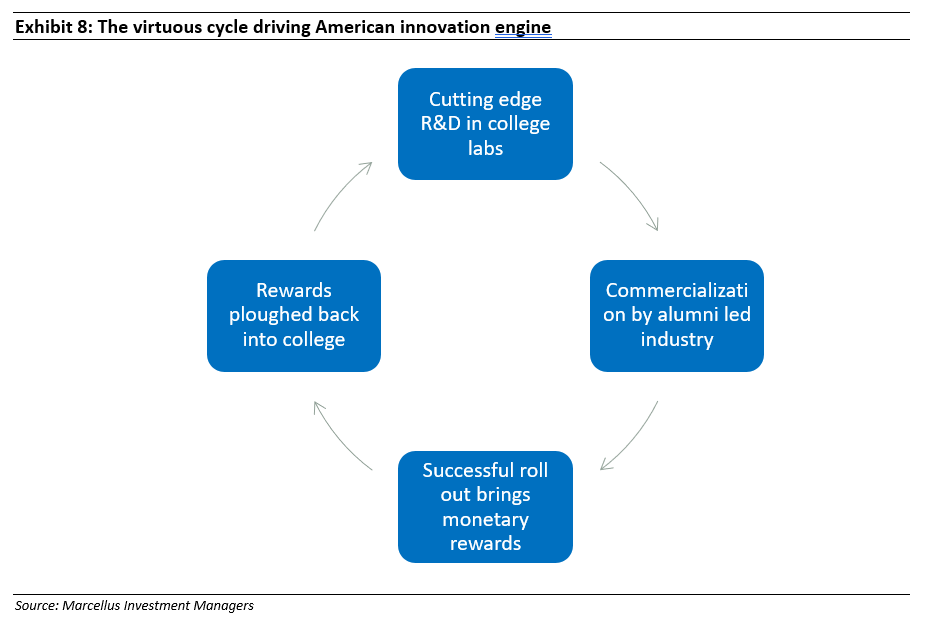

- The quality of education in the country is second to none, with 13 out of top 20 universities in the world based in the US (World University Rankings 2024)

- The students get a chance to interact frequently with the industry, many of which employ alumni from previous years who are also prominent donors to the university endowment funds. The availability of both industry alumni network for knowledge sharing as well as sufficient capital to carry out cutting edge R&D in labs sets up a really tempting proposition for smart young people across the globe.

In fact, as seen in the chart below, this virtuous cycle of Innovation in labs, commercialization by industry, and resulting rewards being ploughed back into colleges is one of the key levers of American innovation engine over last many decades.

Enablement of fast scaling of new ideas

The third pillar of American capitalism entails the ability of entrepreneurs to quick test, modify and commercially roll out their ideas – at scale! As good a business might be, it cannot be a decadal wealth compounder unless it is scalable. As the third largest country by population and fourth largest by size (source: Worldometer), the US offers entrepreneurs both diverse and affluent enough population base to test its products on as well as enough land to set up their operations. Further, the size of the population also enables a successful venture to reach a huge scale before reaching anything close to a saturation point. A good example of this is firms like Costco which opened its first warehouse in 1983 in Seattle. More than 40 years later, having expanded globally they continue to open incrementally more stores in the US itself.

In addition to the population size and land availability, the US is also the recipient of the largest chunk of venture capital money – something which has been extremely critical for taking a product from prototype to commercialization stage.

Exhibit 9: Global national ecosystems ranked by VC investments

| Country | 2023 | 2022 | 2021 | 2020 | 2019 |

| USA | $149B | $248B | $370B | $179B | $161B |

| China | $48B | $60B | $83B | $61B | $64B |

| UK | $21B | $31B | $41B | $18B | $18B |

| India | $11B | $24B | $42B | $14B | $17B |

| France | $9B | $16B | $14B | $6B | $6B |

| Germany | $8B | $12B | $21B | $7B | $9B |

| Canada | $7B | $12B | $16B | $6B | $7B |

| Japan | $6B | $6B | $8B | $6B | $7B |

| South Korea | $6B | $15B | $16B | $5B | $5B |

| Sweden | $5B | $6B | $9B | $4B | $3B |

Source: Dealroom.co, Marcellus Investment Managers

Interestingly, the story of scale doesn’t just stop at country of origin. Marquee brands have an ability to pull in customers not just in their core geography but thanks to widespread social media, even globally. Apple, Microsoft, Google, Amazon, Mc Donalds, Starbucks – the list can go on and on of brands that have successfully expanded outside of the US and in doing so have compounded wealth for shareholders magnificently.

Why should you as an investor care?

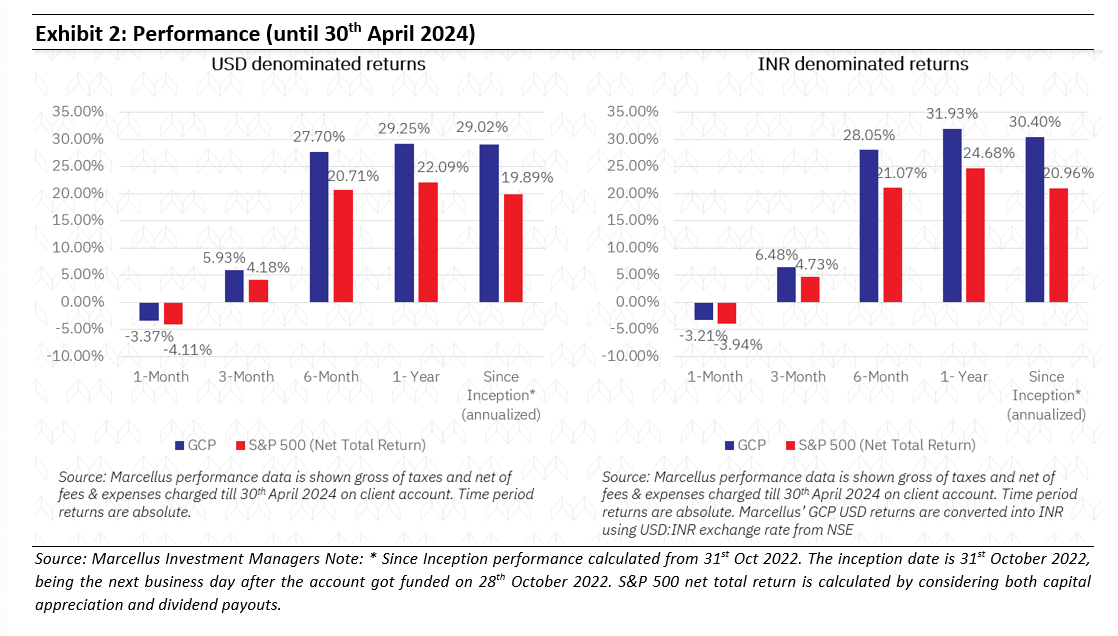

It is rare that an investor gets an opportunity to have exposure to two fundamentally strong, high stock returns economies (with such returns having low correlation with each other) allowing them to compound their wealth with relatively low volatility. Let’s understand this idea using a simple example of two high return (20% CAGR over 5 years) but less correlated stocks A & B (i.e. their up and down movement are not in tandem). The table and chart below show how an investor’s wealth with 50% exposure to each stock varies with time.

Exhibit 10: A 50:50 portfolio with less correlated, high return stocks allows smoother return trajectory

| Value of portfolio | Years | |||||

| 0 | 1 | 2 | 3 | 4 | 5 | |

| Stock A | 100 | 80 | 150 | 200 | 180 | 249 |

| Stock B | 100 | 120 | 150 | 130 | 200 | 249 |

| Portfolio (50% in A&B) | 100 | 100 | 150 | 165 | 190 | 249 |

Source: Companies, Marcellus Investment Managers

As is quite evident from the chart above, the dashed grey line (representing 50:50 portfolio) has a much smoother trajectory vis-à-vis the black (Stock A) and red (Stock B) lines for the same CAGR of 20% over 5 years. Other than the peace of mind that such a (50:50) trajectory brings to an investor, it also plays a big role in removing the impact of ‘timing’ on incremental investments. Unlike in case of stocks A&B wherein entering post high return might dilute returns in future periods, a combined portfolio (on account of its less volatile trajectory) is less affected by it.

Coming back to real world implications, in our Jun’23 blog, we’d discussed how having a 50:50 allocation to US and Indian equity markets would’ve allowed an investor to witness a smoother wealth compounding journey (as measured by risk adjusted returns – the higher the value, smoother the returns trajectory).

For instance, the table below (reproduced from aforementioned blog) showcases how a 50:50 allocation to Marcellus’ Consistent Compounders Portfolio (CCP) and Global Compounders Portfolio (GCP) would’ve generated smoother returns trajectory as compared to each of them individually.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Copyright © 2024 Marcellus Investment Managers Pvt Ltd, All rights reserved