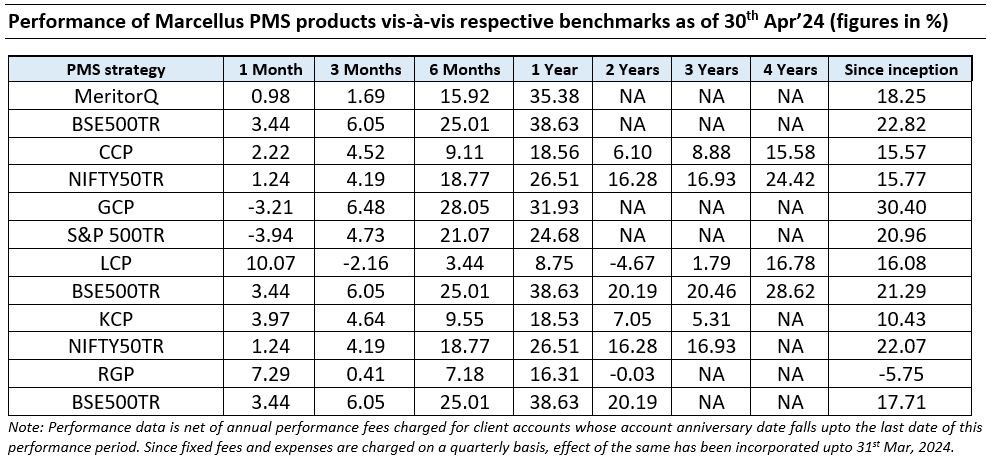

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/apmi/WSIAConsolidateReport.htm?action=showReportMenu Under PMS Provider Name please select Marcellus Investment Managers Private Limited and select your Investment Approach Name for viewing the stated disclosure

| Consistent Compounders Portfolio (CCP)

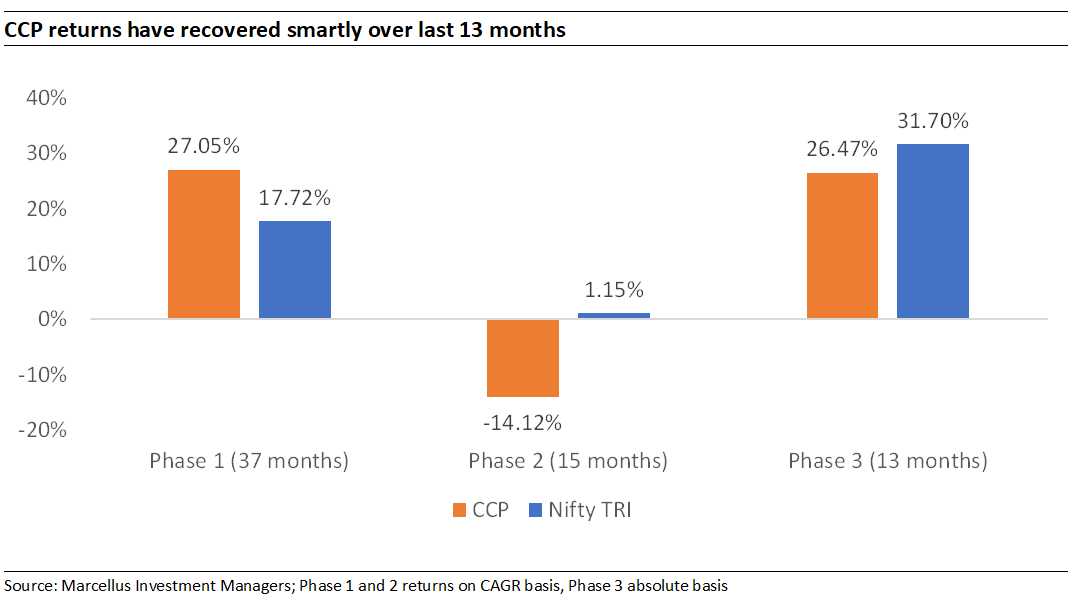

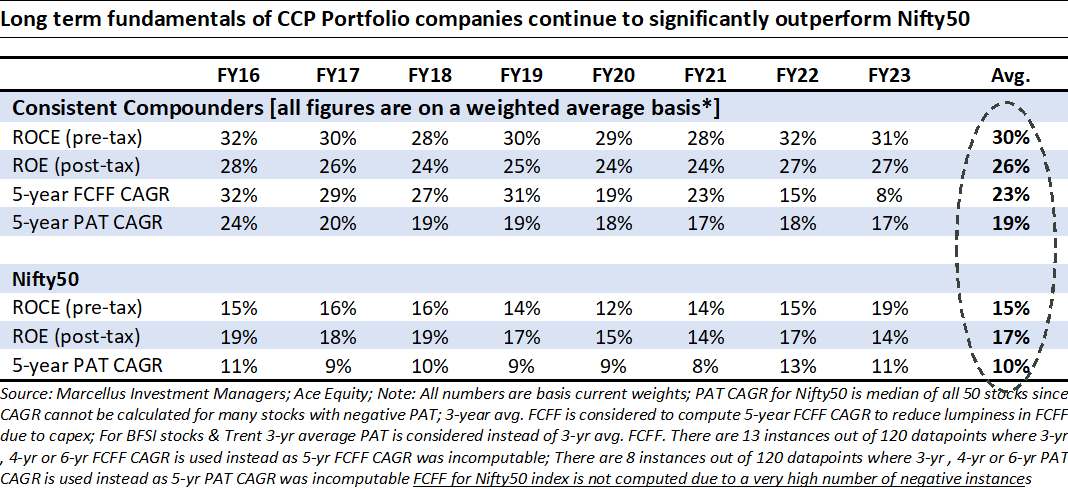

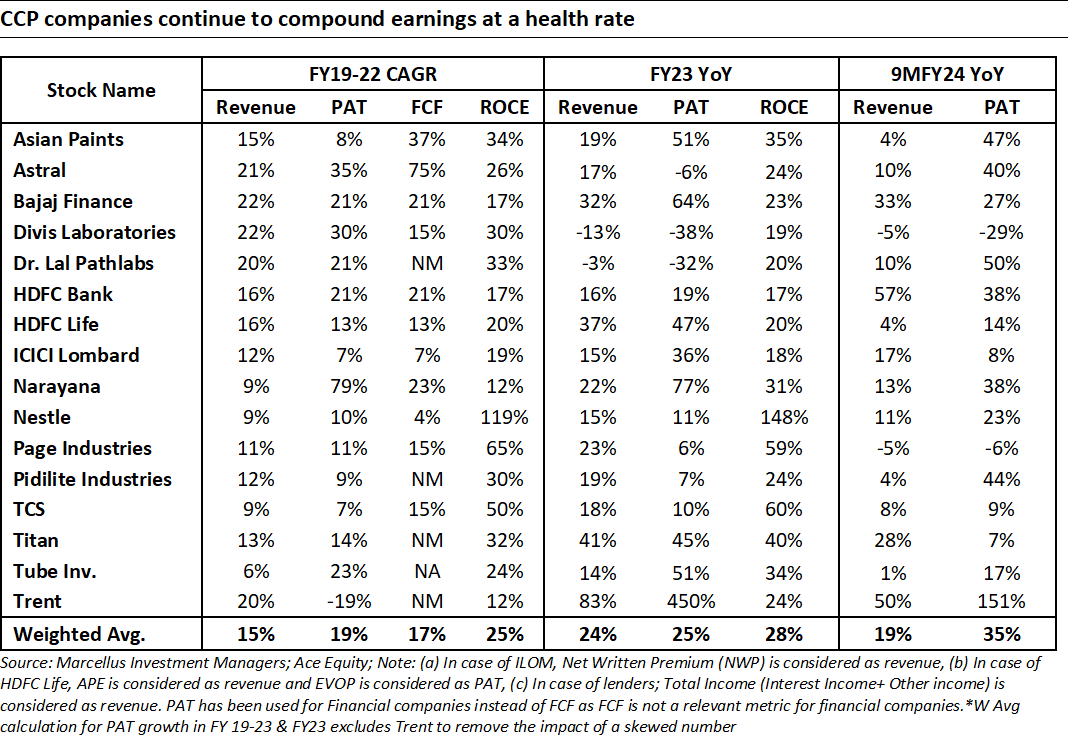

The investment philosophy at Marcellus’ CCP portfolio remains unchanged around portfolio concentration and orientation towards deeply moated high ROCE companies which reinvest their free cash flows back into moated businesses to drive consistent growth in future. Having said that, the portfolio has seen significant changes in allocations and list of stocks over the last 9 months (5 new stocks have been added). The common thread across these changes is an increase in focus towards businesses compounding their earnings at high growth rates (companies with mid-20s EPS CAGR, replacing stocks which have less than 18%-20% EPS CAGR as per our expectations) whilst also offering multiple optionalities of new revenue growth drivers in future. As a result, from a portfolio of 30-35% average ROCE and 60%-65% reinvestment rates, our portfolio is now oriented towards 25-30% ROCE and 75-80% reinvestment rates. All the new stocks that have been added over the last 9 months (e.g. Trent, Narayana, Tube Investments etc) share the common CCP attributes of deeply moated core businesses with high ROCEs, a strong talent proposition providing execution excellence at scale, and a capital allocation approach that is both prudent as well as enterprising to add disruptive new revenue growth drivers in future. Some of these additions to the portfolio also benefit from macro tailwinds around acceleration in private capex, healthcare spends and a building materials boom across the country. Valuations for these companies are either low (e.g. Narayana) or need to be normalized for high growth rates and optionalities (e.g. Trent and Tube). The areas where we have cut down our exposure in the portfolio include companies which although have had consistency of healthy earnings historically, but now face headwinds around macro environment and regulatory changes, and are trading at rich valuations. Last but not least, position sizing changes continue to add significantly positive value to portfolio performance of CCP when compared against an equal-weighted portfolio of the same constituent stocks. Following these changes, we expect the recovery in portfolio performance, that has been visible in the last 13 months, to continue in future. |

Global Compounders Portfolio (GCP)

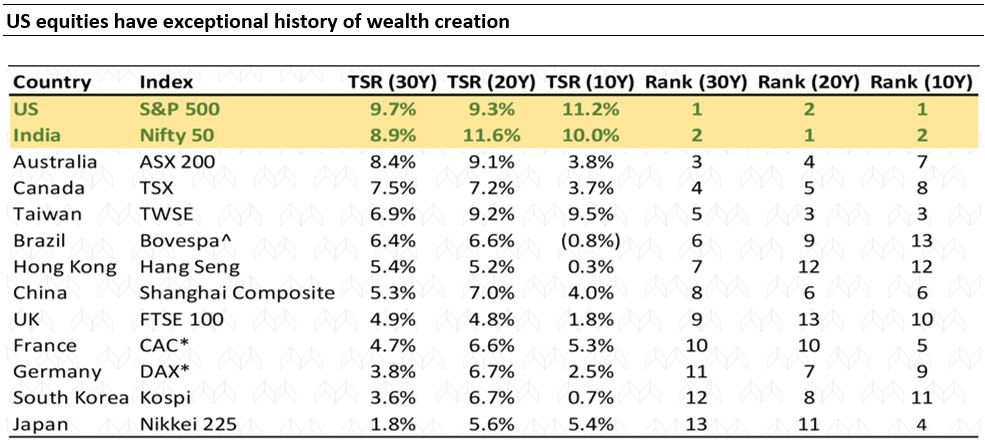

One of the most commonly held beliefs in the wider investment community equates high/low GDP growth with high/low stock market returns. As a result, many investors feel more than happy staying invested in economies showing the promise of high GDP growth for years to come while shunning the ones with more modest growth prospects. However, stocks market returns are driven by more than just headline growth figures.

The US presents an intriguing case considering that public equities in an economy which is growing at a modest low to mid single digit pace have been able to outperform almost all major markets globally over last many decades.

A key reason behind this divergence in GDP growth and stock returns relates to the strong foundation of the US capitalist ecosystem. As far back as the memory can take us, US companies have been at the forefront of value creation across industries, with the American ecosystem rolling out one global icon after another as the decades have passed. Whether it was IBM in its heydays of 1970s-80s, General Electric in ensuing decades or likes of Apple and Microsoft today, American companies have remained some of the most sought after by workers, vendors and customers alike.

The strength of American commercial landscape is driven by four irreplaceable moats namely Protection of rights, Innovation, Best in class talent and Scale.

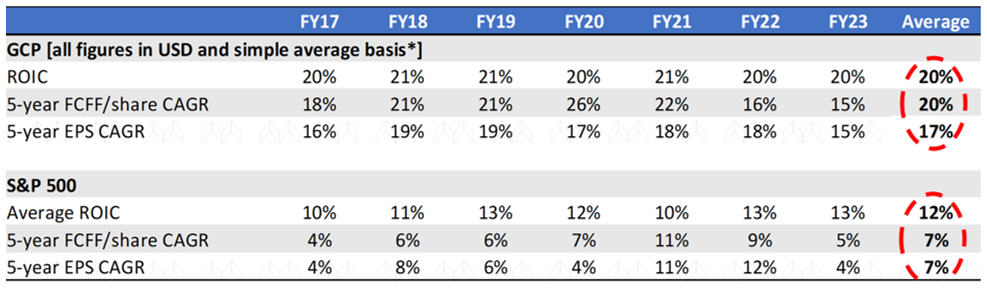

Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies aligned with megatrends, fostering a consistent mid to high teens compounding of free cash flow/earnings. A large part of our portfolio comprises of American firms, and for good reason. Over the last 30 years, US equities have demonstrated exceptional ability to generate wealth – underpinned by four pillars of American capitalism: Innovation, Best in Class Talent, Scale and Protection of Rights.

Below table depicts how GCP companies fare fundamentally against the Index S&P 500

| We have explained these aspects in detail in our recent newsletter and webinar and also why it is rare that an investor gets an opportunity to have exposure to two fundamentally strong, high stock returns economies US and India (with such returns having low correlation with each other) allowing them to compound their wealth with relatively low volatility. |

| Kings of Capital Portfolio (KCP)

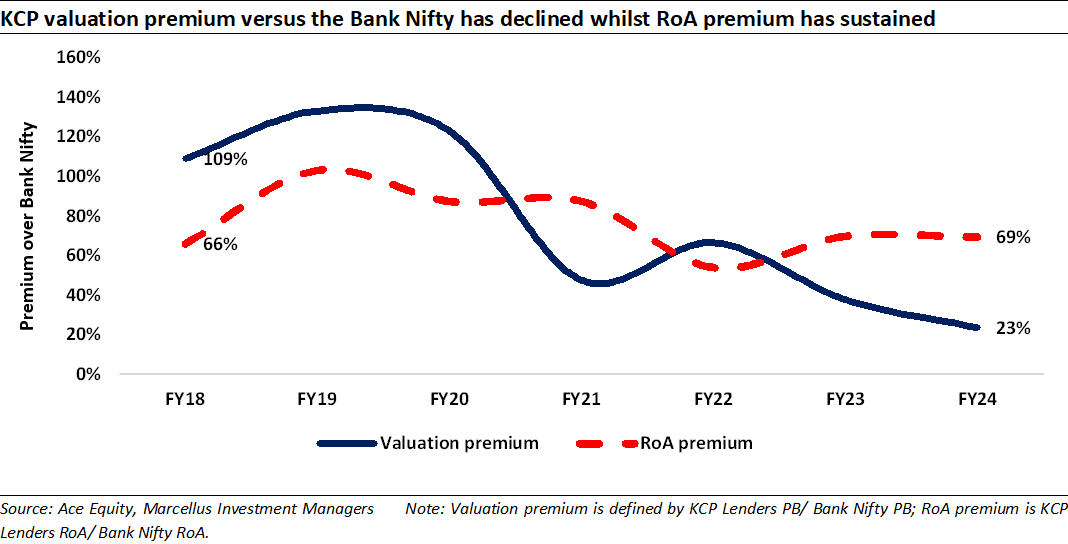

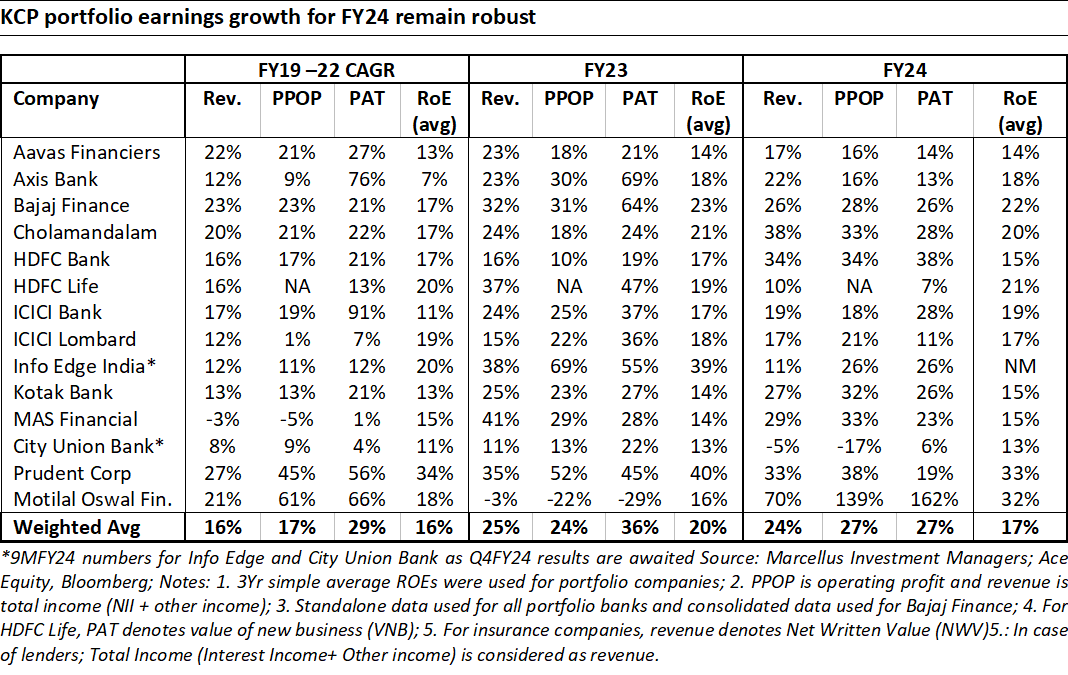

During FY24 (12 months ending 31st March, 2024) the Kings of Capital portfolio delivered 19% returns post fees and expenses. The 19% return was lower than the Nifty50 return of 30% as the financial services sector underperformed the broader indices – this was evidenced by the fact that Nifty Financial Services Index delivered 16% returns during FY24. Over the past month, all KCP portfolio companies (except Info Edge and City Union Bank whose results are awaited) have reported Q4FY24 results. We believe quarterly results provide a good checkpoint to investors to assess progress of investee companies, relative performance versus competition and also their progress vis-à-vis our expectations. Below are some of the relevant insights and data points from the Q4FY24 results and recent events for KCP investors: a. ICICI Lombard: ICICI Lombard reported ended FY24 on a strong note with better than expected combined ratios and profitability along with a solid outlook for FY25. After losing market share in the motor insurance business over the past couple of years due to intense competition and irrational pricing, ICICI Lombard has started recouping some of the lost market share as market participants have become more rational and pricing has improved without any material change in underlying claims ratios for the industry. In hindsight it appears that ICICI Lombard’s rationale of consciously losing market share in the motor segment and capitalising when competition recedes has proven to be correct. b. Kotak Bank: Recently the RBI ordered Kotak Bank to cease and desist, with immediate effect from (i) onboarding of new customers through its online and mobile banking channels and (ii) issuing fresh credit cards as they found concerns arising out of Reserve Bank’s IT Examination of the bank for the years 2022 and 2023. During its quarterly results, Kotak Bank quantified the impact of this ban to be Rs. 350-400Cr on FY25 PBT which comes to less than 2% of FY25e consol PBT. We believe that more than the financial impact, it is the reputational impact and perception that the bank will have to work on. c. Capital market players : Companies linked to capital markets including asset managers, market infra players, brokers and wealth managers have reported healthy earnings growth on the back of strong mark to market gains and record high financial investments from retail investors. Prudent Corporate and Motilal Financial in our portfolio were beneficiaries of this trend and reported robust earnings growth in Q4FY24. d. Banks : During Q4FY24, banks reported another quarter of healthy numbers and ended FY24 with all time high RoAs, no significant deterioration in NIMs and healthy loan growth. During Q4FY24, all banks reported lower than expected compression in net interest margins and better than expected sequential deposit growth. However, we believe strong deposit growth during this quarter was seasonal in nature and will sustainably improve only as and when banking system liquidity improves. Changes to the portfolio: During the past couple of months, we have gradually built a position in Motilal Oswal Financial Services. The rationale for adding Motilal Oswal to the portfolio is as below: Motilal Oswal Financial Services (MOFS) is a financial services group which runs various businesses like asset management (both private and public), retail and institutional broking, wealth management and affordable housing finance. The group has been in existence for over 3 decades run by 2 promoters (~70% shareholding) who have been able to compound book value per share at 22% CAGR over the last decade after paying out 20-25% of operating PAT as dividends/doing buy backs. The company’s asset management business is seeing a turnaround in fund performance with 89% of funds delivering alpha resulting in resurgence of flows and increase in market share. MOFS has significantly invested in its wealth management business which is now bearing fruits with AUM growth upwards of 35% YoY, its HFC has also seen a turnaround with RoE expected to be above CoE in FY25. Valuations for the group are attractive, adjusted for treasury investments (at 1x book value), core business is available at mid-teens FY25E PAT. Risks – any sharp downturn in capital markets could impact profitability as most businesses within the group are linked to capital markets. |

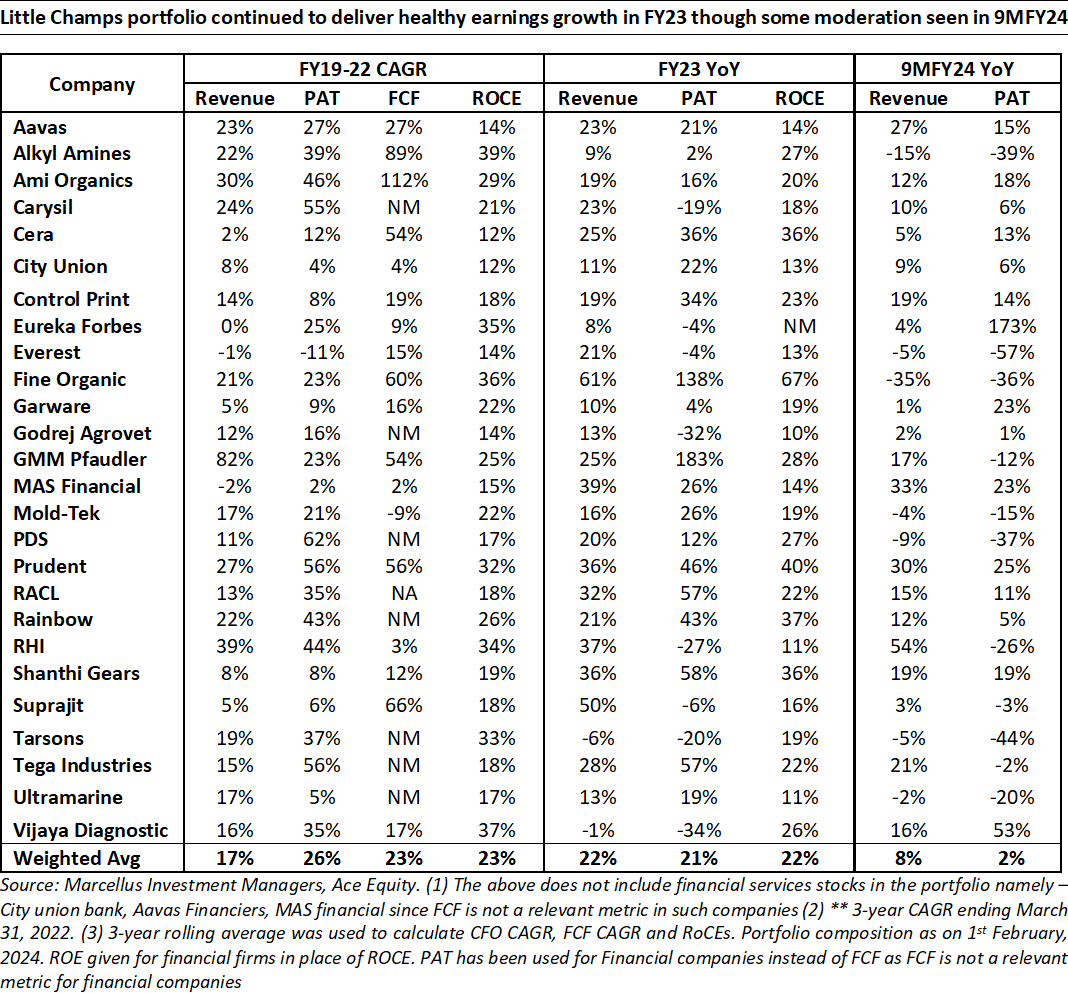

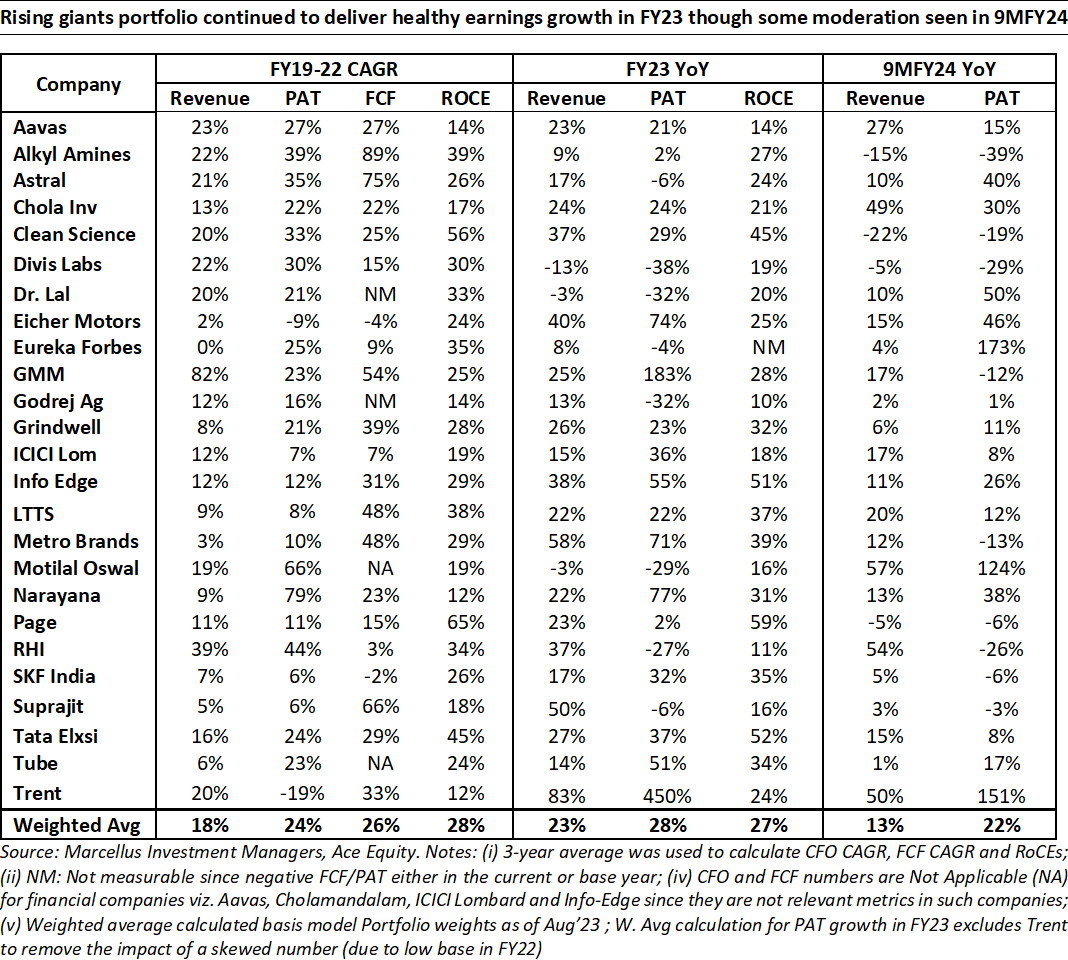

| Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

Most of the Little Champs and Rising Giants companies are yet to report their 4QFY24 earnings. However, early trends (basis limited number of companies which have reported) indicate a much better YoY trend in net earnings growth compared to the recent quarters. As we have been highlighting in the recent newsletters, the reasons for improvement are driven by: Recovery in the export demand as destocking cycle ends (as interest rates stabilise); We continue to reiterate that as we head into FY25, the portfolio earnings should recover. Any positive development (cut) on interest rates can be an icing on the cake in terms of significant improving the consumer sentiments for the stocks with global market exposure. However, a risk factor is any major escalation in the geopolitical issues such as the current tensions in the Middle East region and the ensuing volatility in key macro parameters like inflation. We continue to make the necessary changes in the portfolio bringing in more diversity in the portfolio and companies which are likely to witness healthy earnings trajectory over the coming years. To that end, we actioned the following changes the portfolio in the month of April 2024. |

| Additions to the portfolio:

RACL Geartech RACL has built a formidable customer base of premier global auto/tier 1s driven by: Strong technical expertise and proficiency in gear manufacturing thanks to technocratic promoter, three decades of experience and focus on processing engineering excellence. A customer centric approach resulting in heavy reinvestments in dedicated plants, supply chain solutions (warehouses near customers for just in time inventory) In return, RACL commands premium pricing to its peers, generates nearly 3x the nearest peers’ operating margin which more than makes up for the high balance sheet requirements (RoCEs are closer to the 20-22% mark). The Company has witnessed strong growth in recent years (revenue CAGR of 21% over FY18-24), escaping broader global auto slowdown, thanks to snowballing in existing clients like BMW Motorrad, KTM and addition of new customers like ZF. We expect continued healthy revenue growth – as it deepens its relationship with existing customers (current share of business indicates enough headroom) and ramps up presence in EVs and global PV space. |

| Changes to the Rising Giants PMS model portfolio (as at April 30, 2024)

Additions to the portfolio: Godrej Agrovet Since its Initial Public Offer in October 2017, the Company witnessed muted trends in profitability (FY18- 23 EPS CAGR of 6%) impacted by Covid-19 and volatility in commodity prices (finished products as well as inputs). However, we expect a much better outlook for the Company’s earnings going forward driven by: a. Favourable government policies such as National Mission on Edibile Oils – Oil Palms (NMEO-OP); |