OVERVIEW

In an era of growing protectionism and rising geopolitical tensions, the world’s two largest democracies – America and India – offer investors a chance to benefit from a golden decade of compounding. Given China and Russia’s belligerence vis-à-vis America and given China’s multiple assaults on India’s borders, the two giant free market democracies have little option but to embrace each other and create a mutually beneficial relationship around trade & defense. The investment proposition that this creates is compelling – a 50:50 Indo : American portfolio generates significant risk-adjusted returns compared to a standalone portfolio built around either country’s stock market. More specifically, a 50:50 Global Compounders : Consistent Compounders portfolio is an even more powerful combination.

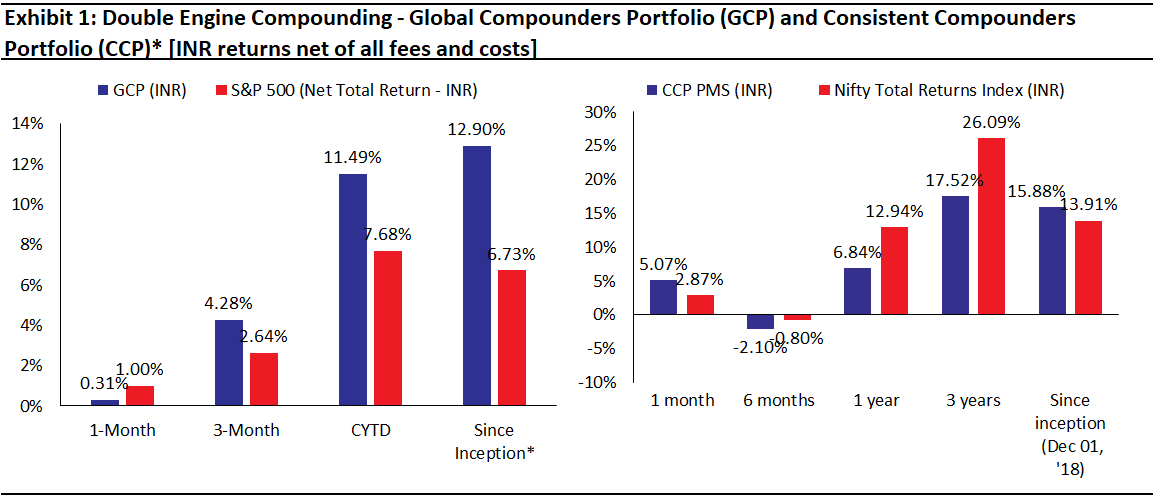

Source: Marcellus Investment Managers; for GCP, performance shown gross of taxes but net of fees and expenses charged until 21st May 2023 on client accounts; time period returns are absolute; USD returns are converted to INR using USD-INR exchange rate from NSE; * – since inception performance calculated from 31st October 2022, being the next business day after the account got funded on 28th October 2022; for CCP performance data is shown net of fees and taxes charged until 31st May 2023 and is net of annual performance fees charged for client accounts whose account anniversary/performance calculation date falls upto the last date of the performance period; since inception and 3 year returns are annualized; other time period returns are absolute; all returns in INR terms; For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/

“India is in a global sweet spot. It is now the world’s most populous country — home to more than 1.4 billion people—and has had robust economic growth for the past three decades, with GDP per capita having risen by 245%. And yet, it remains relatively underdeveloped on a global scale. As of 2019, more than 600 million people in India live on less than $3.65/day. Thus, there remains enormous potential for economic growth, and improvements in human welfare. And as the United States’ concerns about China grow, India shines as a promising alternative in supply chains, innovation hubs, and joint ventures. As the world’s largest democracy with an increasingly open economy and a strong technology sector, it has the potential to operate at scale.

This makes it the most important potential geo-economic partner for the United States today as it “re-globalizes” with greater concern for national security and resilience. As India considers its own leadership in the world, it must look toward becoming a stronger innovator in technology with a more comprehensive capacity to move up the value chain in software and hardware. This necessitates a much closer and deeper relationship with America, both at the governmental but also at the private–sector level.” – Hemant Taneja and Fareed Zakaria in Harvard Business Review, 17th April ’23 (source: https://hbr.org/2023/04/the-u-

Is your portfolio well positioned to benefit from the reset in geopolitics?

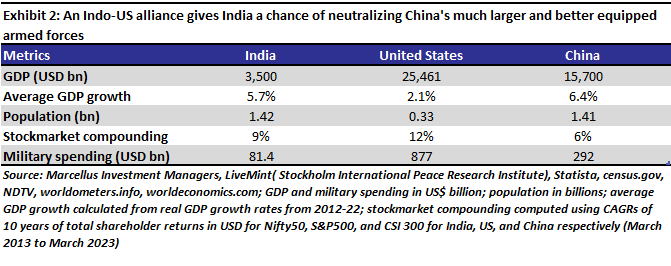

As is well known, America and India are the world’s two largest free market democracies – America with its colossal economy, the largest in the world (with a GDP of ~US$25 tn) and India with its massive population of 1.42bn (with a GDP of $3.4 tn).

Historically, the two countries have not seen eye to eye on anything which is of practical relevance. A divergence in ideological alignments and the geopolitics of the Cold War meant that until the fall of the Berlin wall in 1989, ties between the two countries were strained. The origins of these strains lie, at least in part, in the misguided actions in the 1970s of the then US President Richard Nixon (who was subsequently impeached) and Secretary of State Henry Kissinger. These two men all but ensured that the relationship between the two democracies went completely off the rails in the second half of the 20th century (see https://indianexpress.com/

Now, however, a different wind is blowing across the world. China’s growing belligerence vis-à-vis both of these great democracies is bringing America and India together. From floating hot air balloons with spying equipment to constantly pushing the envelope on India’s northern borders, the Chinese armed forces have aggressively upped their ante in recent years, much to India’s alarm and America’s chagrin (see here and here).

Therefore, America needs India to counter China’s muscle flexing in Asia. And India needs America to counter the gulf in military spending between Asia’s two largest countries (see exhibit below).

This long overdue Indo-American alliance has a clear investment implication for you – over the next decade wealth compounding for you and for us will be overwhelmingly driven by the mightiest compounders from these two countries. The question you therefore need to ask yourself is “Is my portfolio well positioned to capitalize not just on the growing financial muscle of well-known Indian compounding machines like Titan, Bajaj Finance, HDFC Bank, and Asian Paints but also of global compounding machines like Amazon, Microsoft, Berkshire Hathaway, Nvidia, and ASML?”

The math behind double engine compounding at the index level

[Note: all returns in this note are stated in INR terms. Where the indices or stocks in question are not denominated in INR, we have converted the returns to INR so that we can make an apple-with-apples comparison with Indian stocks and indices.]

To understand why double engine compounding is good for you, take the following historical data: over the past 20 years the Nifty50 has compounded in INR terms at 14.3%. Over the same period, the S&P 500 has compounded in INR terms at 12.5% (source: Bloomberg; see exhibit 4).

Had you started a 50:50 Indo : American portfolio 20 years ago (followed by annual rebalancing to maintain the 50:50 ratio), your risk adjusted return (i.e., return per unit of risk taken) would have been 0.95 and your CAGR return in INR would have been 13.9%. This is better than the risk adjusted returns from the standalone Nifty50 of 0.66 and standalone S&P 500 of 0.92. Note further that the 50% S&P500 : 50% Nifty50 portfolio’s 13.9% 20-year CAGR return is far higher than the MSCI World’s return over the corresponding period (10.6% p.a.).

Because the Indian and American stock markets are less than perfectly correlated (their correlation over the last 20 years is a mere 0.34), by running a double engine compounding portfolio, you can get the benefit of diversification i.e., your equity returns are more stable due to double engine compounding (see exhibits below).

From exhibit 3 it is evident that by investing in a simple 50:50 portfolio of Nifty50 and S&P500 indices, you benefit from the higher return of the Nifty50 AND the lower volatility of the S&P500. The result is far more stable portfolio compounding (as can be seen in the relatively smooth blue line in exhibit 3) than is possible from either of the national indices.

The math behind double engine compounding using Marcellus’ PMS portfolios…

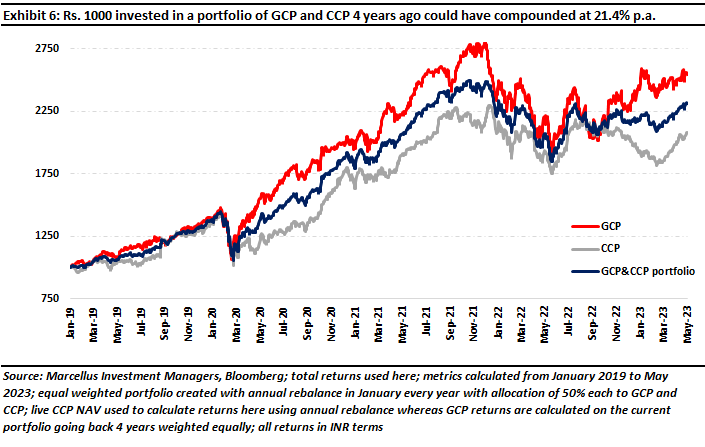

All of the above analysis was based on the broader market indices. What if you had Marcellus Investment Managers doing double engine compounding for you over the past four years? Would that have made a difference?

Live returns from CCP over the past four years (net of fees and taxes) have been 15.88%.

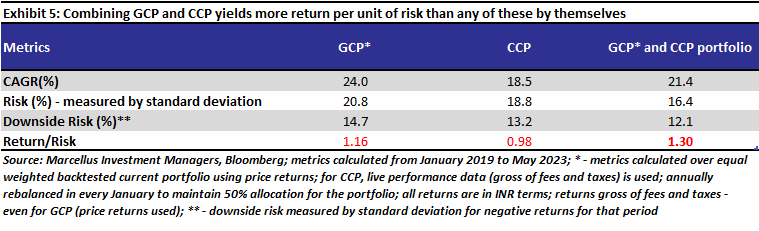

Marcellus’s Global Compounders Portfolio went live in October 2022. To date, GCP has generated in INR terms a return of 12.90% (gross of taxes but net of fees and expenses). A back test of the GCP algorithm shows that returns (gross of fees and expenses and taxes and price returns (rather than total returns)) over the past four years would have been 24% (see exhibit 5).

However, what’s really interesting is that a 50% CCP : 50% GCP portfolio would have given better risk-adjusted returns over the past four years of 1.30 (gross of fees and taxes) i.e., significantly higher than the risk-adjusted returns that GCP and CCP generated individually.

As is evident from the exhibits above, combining the two strategies in a simple 50 : 50 ratio could massively add value in terms of reduction in risk whilst not foregoing a meaningful amount of return. Why does this happen? There are largely three drivers of this ‘free lunch’ that investors in a 50% CCP : 50% GCP portfolio get treated to:

- Diversification

Given that GCP and CCP are less than perfectly correlated (correlation coefficient of ~0.38 over the last 4 years), by combining the two, the return is sustained with relatively low downside risk (see exhibit 5). This is a textbook case of effective diversification whereby return per unit of risk taken (as measured by return/risk in exhibit 5) jumps up to 1.30 for the combined strategies vis-à-vis 1.16 for GCP and 0.98 for live CCP.

- Currency effects

The diversification benefits of a 50% US : 50% India portfolio are juiced up further by currency effects which broadly pan out as follows. Typically, every five years or so, the Federal Reserve hikes rates for 12-18 months. These rate hikes strengthen the US$ and weaken the INR. The result of this currency movement is two-fold: (a) foreign investors stay away from the Indian market during such periods thereby causing CCP-type stocks to derate during such periods as was evident in FY23 when the CCP corrected by 15% (as the INR slid from Rs 72 to Rs 82 to the USD); and (b) GCP stocks’ returns in INR terms is juiced up as the INR depreciates. This offsetting currency effect drives powerful currency diversification benefits in a 50:50 Indo : American portfolio.

- Asset-liability matching

As Indians are becoming more affluent, incrementally ever larger amounts of their spending is in US dollars. Indians now routinely go to holiday abroad. Almost all affluent Indians use imported phones, pads and laptops and spend their evenings watching media content from American media companies (Netflix, Amazon Prime, Disney/Star) and most of their children go to study abroad. This essentially means that increasingly Indians’ liabilities are increasingly denominated in US dollars, a trend that will become ever more powerful as we get richer. Logically therefore it makes sense for Indians to also have US dollar denominated assets to their name. In short, if you know that increasingly your future outgoings will be in US dollars, you should have a part of your savings in that currency rather than only having rupee denominated assets.

More about the Global Compounders Portfolio (GCP)

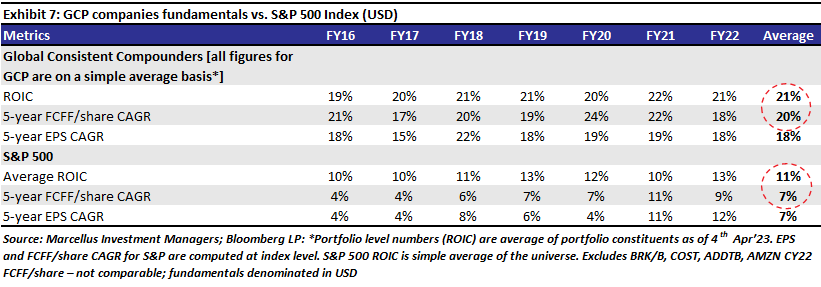

Marcellus’ Global Compounders Portfolio (GCP) invests in 25-30 deeply moated global companies which are listed in developed countries. The nature of the products and services – which cater to global economic megatrends – and the moats developed around process capacity, R&D, and capital allocation, are the key factors that contribute to the consistency of free cashflow compounding for GCP companies. Free cashflows per share have increased at a rate of roughly 20% (USD) per annum for GCP companies.

Investment in Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA) with a minimum investment amount of USD 150,000. Marcellus went live with GCP on 31st October 2022.

The GCP Introductory newsletter deeply discusses how Marcellus’ GCP was conceptualized and constructed.

More about Marcellus’ Consistent Compounders’ Portfolio (CCP)Marcellus’ CCP has a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of 13-15 companies with an intended average holding period of stocks of 8-10 years or longer.

More about Marcellus’ Consistent Compounders’ Portfolio (CCP)Marcellus’ CCP has a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of 13-15 companies with an intended average holding period of stocks of 8-10 years or longer. Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). All the stocks mentioned in this note are part of Marcellus’ portfolios. Nandita and Saurabh’s families have invested in these portfolios. Saurabh is also personally invested in these portfolios.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). All the stocks mentioned in this note are part of Marcellus’ portfolios. Nandita and Saurabh’s families have invested in these portfolios. Saurabh is also personally invested in these portfolios.

Note – Consistent Compounders Portfolio (CCP) is a strategy offered by Marcellus Investment Managers Private Limited and Global Compounders Portfolio (GCP) is a strategy offered by GIFT City branch of Marcellus Investment Managers Private Limited.

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.