It is widely believed that new technology leads to disruptive innovation. However, companies that have consistently innovated over longer periods of time have combined existing technologies using a recipe that is heavy on intangibles and difficult to replicate. It is this recipe which enables consistent compounding over long periods of time despite several disruptions in the external as well as internal environment of the firm. In this newsletter, we highlight how Marcellus’ CCP Portfolio companies use technology to delight their customers, target relevant consumers more precisely, increase operating efficiency, overcome scale related challenges, and disrupt their competitors.

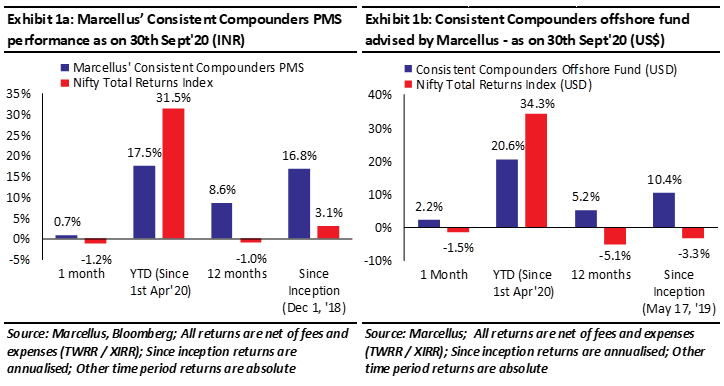

Performance update – as on 30th September 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of ten analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Exogenous technology vs endogenous technology based frameworks

In a 1994 publication (click here), Paul M. Romer, Professor of Economics at the University of California, explained that most economic models had incorrectly assumed that technology was an exogenous (i.e. external) factor driving growth. Instead, Romer demonstrated that growth is the result of endogenous (i.e. internal) factors.

Exogenous factors are external to a system. When it comes to technology, examples of exogenous technologies include hardware, software and other downloadable applications. Intel, IBM, Microsoft and Apple are examples of firms producing such exogenous technologies.

Endogenous factors are internal to a system. Combination of building blocks already existing in the system (some of these building blocks are exogenous factors) is an essential element of an endogenous framework. While the building blocks involved in such a framework could be tangible, the recipe for putting these blocks together is intangible and can be difficult to replicate. One of the most fashionable terminologies for endogenous technologies in the current times, is ‘network effects’. Amazon, Facebook and Google are examples of firms explicitly based on such endogenous technologies. [We are grateful to Michael Mauboussin of Morgan Stanley Investment Management for explaining this framework in his 15th September 2020 piece titled ‘Expectations and the Role of Intangible Investments’.]

Besides these two types of businesses, there is a third category of endogenous technology based businesses, which are not so explicit in their tech orientation. This category includes firms that are usually not selling tech-based products and services, but which have integrated technology into their DNA to such an extent that investments in technology help them sustain and deepen their competitive advantages. For these firms, technology is an integral part of the intangible recipe which makes it difficult to for their competitors to disrupt them. Most companies in Marcellus’ Consistent Compounders Portfolio belong to this category.

Consistent Compounders are endogenous technology based companies

Here are some of the common technology based ingredients of our portfolio companies’ competitive advantages.

Tech investments to delight the customer:

Most B2C (business to consumer) firms cater to two types of customers – firstly, the end consumers and secondly, intermediaries like distribution channel partners / franchisees / influencers. Ability to use tech investments to provide a substantially superior interface and experience to both these types of customers is one of the sources of competitive advantages for our CCP Portfolio companies. For instance, one of the biggest areas of differentiation for Dr. Lal Pathlabs against other national peers like Thyrocare, SRL and Metropolis is the quick turnaround time of diagnostic report generation after sample collection. The challenge involved here is that the demand for sample collections and for diagnostic reports spikes up at certain points of time during the day in a vast network of over 7,000 pickup points (third party hospitals, nursing homes etc), more than 3,000 collection centres (akin to exclusive brand outlets of retailer) and over 200 laboratories. Dr. Lal Pathlabs achieves this differentiation through substantial tech investments behind the hub and spoke network of supply chain, and behind the consumer interface on the internet / mobile phones.

Bajaj Finance and HDFC Bank use their tech investments behind customer data collection and analysis to help complete credit assessment and provide loan approval to a new customer in a substantially shorter time period compared to other lenders. This is one of the strongest areas of differentiation for these firms.

Asian Paints uses proprietary historical demand data to accurately forecast demand for their products for every nook and corner of the country, for each day in a year. This helps Asian Paints delight the painters and paint dealers with ready availability of several thousand SKUs in a highly voluminous product category. That in turn delivers substantially higher inventory turns for these intermediaries (they are also the key decision makers who drive the end consumers’ choice of paint brand & colour).

The benefits highlighted for the lenders and Asian Paints here are akin to the ‘network effects’ that drive tech based businesses like Uber and Facebook. The more proprietary data Asian Paints and Bajaj Finance collect about customer demand, the sharper is their demand forecasting and customer understanding, and the wider is the gap between these CCP companies and their competitors.

Tech investments to more precisely target only the relevant customers with relevant products:

Superior understanding of the end consumers’ demand and preferences helps the manufacturer reduce dead inventory in its supply chain / distribution channel and convert working capital into cash much quicker compared to competition. Such faster cash conversion cycle then helps the manufacturer to carry out activities such as making quicker payments to raw material vendors, avoiding price hikes despite generating high returns on capital employed. Some of the best quality retailers across the world like Walmart and D-Mart (although not part of our CCP Portfolio) focus on such tech based increased inventory turns as their biggest moat, driven by a better understanding of which SKUs do not deserve much shelf-space in their stores compared to others given the kind of customers that walk into each store.

Dr. Lal Pathlabs, a pathlab chain which functions like a retailer, uses its tech based understanding of customer footfalls to decide the optimal location, size and merchandize of their collection centres and laboratories. This helps improve the profitability of these labs and collection centres, making the whole network more efficient and sustainable. For instance, if a franchisee proposes to open a collection centre at a location which Dr. Lal’s tech platform considers to be sub-optimal, the firm will readily decline such a proposal. Dr. Lal has intentionally stayed away from radiology based diagnostics. Also, while the local labs are equipped to handle mainly high frequency pathology tests (classification of which tests are high frequency vs others, is part of the tech based learning curve) the most advanced pathology testing infrastructure sits with the larger nodal labs and central labs. This is unlike most competitors of Dr. Lal who offer the entire gamut of services – across pathology and radiology – without much involvement in optimising the franchisee level network expansion.

Amongst NBFCs, one of Bajaj Finance’s competitive advantages is to use its proprietary consumer data to selectively target borrowers with higher credit quality, who might not have already got a substantially high rating on the commonly available credit rating agencies’ databases.

Similarly, Page Industries has recently invested in an Auto-Replenishment System (ARS) at the distributor and EBO (exclusive brand outlets) level, which moves the judgement call of merchandising, away from these intermediaries, towards Page’s centralized supply chain systems. Such tech investments have helped reduce cash conversion cycle of Page by more than 15% over the past 2 years and Page’s working capital cycle days are now less than half compared to other listed innerwear firms in India.

Tech investments to generate higher operating efficiencies:

In our 1st June 2020 newsletter (click here), we had highlighted how CCP Portfolio companies avoid price hikes to strengthen their pricing power by delivering superior operating efficiencies which are difficult for their competitors to replicate overnight. Whilst it is easy to visualize how tech investments in supply chain and sales functions of an organization bring about operating efficiencies, there exists immense scope for deriving operating efficiencies at the back-end i.e. in manufacturing processes and in raw material procurement. For instance, a 2019 article from a San Francisco based tech firm called Sight Machine (click here) highlights how one of the most tech savvy companies, Asian Paints, did not have comprehensive visibility into the interdependent factors affecting production. The complex interdependencies between machines, process parameters and materials made it difficult and time consuming to determine the root causes of the issues and optimize production cycles. Sight Machine’s platform transformed Asian Paints’ plant data into a digital twin of the entire production process, identifying and quantifying contentious areas and bottlenecks. Asian Paints was able to reduce cycle time on one of the key production lines at one of its plants by seven percent as a result.

Another blog on Cognizant’s website from 2018 (click here) written by Asian Paints’ VP-Information Technology and Systems highlights Asian Paints’ focus on raw material procurement optimization – “We were using JDA Software’s advanced supply chain planning solutions for over two decades to help us plan better; however, given the increasingly VUCA world (with its volatility, uncertainty, complexity and ambiguity), global events often disrupt availability and impact costs. Macro factors and directional trends, such as commodity demand fluctuations and price volatility in international markets, significantly influence our cost structure. Effectively handling these uncertainties required us to remap procurement that typically deals with unstructured data. We developed an advanced SCM application using IBM Watson, which informed more effective decision making amid continuing uncertainty.”

Tech investments to overcome scalability related challenges:

There are several challenges around scaling up a business without compromising on the firm’s growth momentum. Some of these challenges include managing an army or employees spread all over the country who are involved in ground level execution, lack of depth of consumption beyond the top 10-20 cities causing working capital challenges, supply chain challenges around poor road infrastructure, varied consumer tastes across demographics / geographies / socio-economic strata etc. As a result, businesses scaling up in India need substantially more tech investments to create systems and processes, compared to similarly sized businesses in a more homogenous economy elsewhere. In our 1st December 2019 newsletter (click here) we had highlighted that Relaxo Footwears already sells half as many (by volume) pairs of footwear in a year as Adidas does globally. HDFC Bank’s loan book will be bigger than JP Morgan within a decade if it continues to grow at 20-25% CAGR. The solution to all scalability oriented challenges faced by CCP companies comes from timely investments in tech based systems and processes, which help institutionalise execution capabilities at the ground level across the firm. Lack of timely investments break the consistency of healthy fundamentals in future and every pause in compounding gives room for competition to catch up.

Tech investments to drive a disruption rather than get disrupted:

Disruptions are becoming increasingly frequent, and are also a risk to incumbent dominance in several sectors. Most disruptions are either caused by new technology (like blockchain), or by regulatory changes (like GST / demonetisation) or by black swan events (like the ongoing COVID-19 pandemic). Interestingly, the solution to every such disruption includes timely investments in technology. For instance, firms which continued to strengthen during the disruptions of GST / demonetization / COVID-19 crisis had stronger systems and processes and were hence able to get back to normalcy much sooner than their competitors. Hence, we believe that if a firm has a DNA backed by tech investments, it is more likely to disrupt its peers rather than get disrupted. Such firms substantially reduce the speculative aspect of ‘investing in disruptive businesses’. For instance, if blockchain is a future disruption, rather than speculating on which new technology firm will create the blockchain disruption, we would prefer to invest in Asian Paints and HDFC Bank given that each of these two firms are the most the likely firms in their respective industries to lead technology disruption.

It is difficult to replicate the intangible recipe of consistent compounders

Most of the tech investment related competitive advantages highlighted above are difficult for competitors to replicate, either because they are based on proprietary data, or because they were done over a period of time as part of the DNA of the organization, rather than investments that were done at a single point of time in the past. In some cases, the tech capabilities need to be built from scratch in-house, rather than having the luxury of relying on tools created by global tech giants. For instance, our channel checks suggest that HDFC Life has built a team of over ‘data scientists’ in its head office. Most members of this team are experts in the fields of AI (artificial intelligence) and ML (machine learning). Other life insurance firms perhaps cannot catch-up on the solutions being built by this team at HDFC Life just by purchasing solutions from global tech giants, because IRDA restricts data sharing with companies based outside of India. Similarly, in one of our interactions with Bajaj Finance’s management last year, we were told that the firm uses some functionalities of AWS and Azure to do the data crunching and run credit algorithms, but several other functionalities have been built in-house. Additionally, one of the largest cloud based global CRM (Customer Relationship Management) solutions provider has a joint R&D capability with Bajaj Finance in Pune to develop cutting edge technology.

Investment implications

As technology becomes an increasingly bigger driver of competitive advantage, and as tech based disruptions become some of the biggest wealth creators, investors are increasingly are obviously inclined to look for the next winning tech stock. In this context, it is intuitive to look for either exogenous tech based firms (eg. Apple, IBM etc) or else explicit endogenous tech based firms (eg. Google, Facebook, etc). In this context, we find our CCP Portfolio companies to be some of the biggest, most sustainable (and hence least speculative) beneficiaries of this theme. This is because these firms have a technology based DNA which helps them to consistently and incrementally deepen their competitive advantages over time.

Disclosure: Asian Paints, HDFC Bank, Bajaj Finance, Page Industries, Dr. Lal Pathlabs, Relaxo and HDFC Life are part of most of Marcellus’ clients’ portfolios.

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.

Copyright © 2020 Marcellus Investment Managers Pvt Ltd, All rights reserved.