Given the leveraged business model of lenders, investors need to be even more vigilant about accounting quality when investing in banks and NBFCs. We find a clear correlation between accounting quality and share price returns of Financial Services companies. In specific, companies with only the highest accounting quality have managed to generate positive returns over CY16-19 (see Exhibit 2). Inspired by Howard Schilit’s legendary book on forensic accounting ‘Financial Shenanigans’, we at Marcellus use 11 accounting ratios to evaluate the accounting quality of Financial Services companies. In this newsletter we also highlight the case study of Dewan Housing Finance Ltd. and how investors could have avoided investing in its equity and debt instruments by analyzing its publicly available financial statements.

“You have to understand accounting and you have to understand the nuances of accounting. It’s the language of business and it’s an imperfect language, but unless you are willing to put in the effort to learn accounting – how to read and interpret financial statements – you really shouldn’t select stocks yourself” – Warren Buffett (Warren Buffett and the Interpretation of Financial Statements by Mary Buffett and David Clark, 2008)

Performance update of live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Under the TWRR method of calculating portfolio performance the initial performance looks optically lower in an upward trending market because of large inflows on a relatively small AUM. As on 15th Sep, the first customer of the Kings of Capital PMS had generated returns of 1.7% vs 1.6% for the Bank Nifty since inception.

Corporates will always have a strong desire to manipulate accounts

The desire of public companies to drive stock prices higher by misrepresenting the state of their financials has been around since the existence of stock markets themselves. Companies which are struggling in their businesses are particularly caught in the lure of trying to keep up with investor expectations by indulging in accounting malpractices. This results in an interesting dynamic – although the company is struggling in its

business, since the management team is trying to please the investor, stock prices keep rising until the fraud comes to light. Until then the investor is making money from a struggling business with a dishonest management team!

In the Indian context, the desire of companies to drive stock prices higher is even stronger because most listed Indian companies are family owned, family run businesses. The promoters of these companies have unadulterated power to run the businesses as their fiefdom while neglecting the interest of minority shareholders. This makes it imperative for Indian investors to arm themselves with accounting skills to tackle the landmines that lie ahead of them in the form of fraudulent accounts concocted by unscrupulous companies. While the companies get smarter in trying to fool investors, our attempt is to make investors savvier by helping them spot these accounting gimmicks (click here to view our 3rd September, 2020 forensic webinar).

Why is accounting quality central to investing in financial companies?

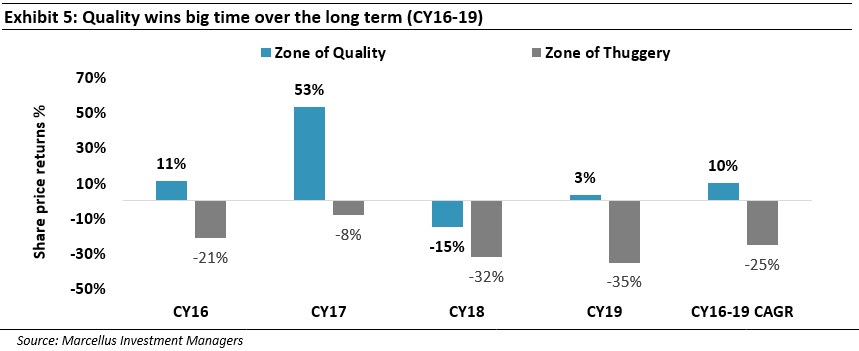

The rewards for picking the right Financial Services company are enormous as these companies reinvest almost 100% of their earnings back into the business i.e. they have a 100% reinvestment rate. The reinvested earnings are then used to raise more debt and the company is then able to earn returns on this larger capital base. While this can prove to be a virtuous cycle and lead to extraordinary results for a well-run Financial Services company, poor accounting quality and dishonest promoters of Financial Services companies are an existential threat for a bank or an NBFC. Unfortunately for Indian investors, about 70% of banks and NBFCs fall in the latter category i.e. these banks and NBFCs have poor quality accounting and have destroyed wealth during CY16-19. As seen in Exhibit 2 below, there is a strong correlation between accounting quality and shareholder returns – shareholder returns over CY16-19 have been the lowest for companies with the poorest quality of accounting and the highest for companies with the best quality of accounting.

In the case of financial companies with poor quality accounting, destruction of shareholder wealth is a question of ‘when’ and not ‘if’

We would like to break down the timeline of corporate fraud & accounting jugglery into three stages and provide more clarity to investors on how to deal with each of these.

Stage 1: The investor does not know that the lender has poor accounting quality

As seen in exhibit 2, there is a strong correlation between accounting quality and shareholder returns irrespective of whether the specific lender’s sub-par accounting practices are common knowledge or not. Therefore, in the next section we have given details of Marcellus’ proprietary forensic model to identify lenders which have weak quality accounting based on the publicly available financial data of listed companies. This framework will help investors clearly demarcate Financial Services companies with high quality accounting from companies which have poor quality accounting.

Stage 2: The investor now knows that the lender has poor quality accounting, but accounting fraud is not public knowledge yet

In some cases, shareholders decide to invest in Financial Services companies with poor quality accounting despite being aware about the sub-par accounting quality of those companies. Such investors are of the view that either (i) the fraud won’t come to light, or (ii) they will be able to exit the stock before the fraud becomes public knowledge, or (iii) they will have enough time to exit the stock once the fraud is public knowledge. None of these arguments hold true, as illustrated in Exhibit 2 even if accounting fraud is not public knowledge, there is a gradual decline in the value of the company. As illustrated in exhibit 3, in the case of Financial Services companies once fraud becomes public knowledge there is overnight destruction of wealth without shareholders getting time to react to such events. Both Yes Bank and DHFL saw a 40% crash in share prices within a month of fraud becoming public knowledge. DHFL’s AAA credit rating in January 2019 was downgraded to D within a period of six months.

Stage 3: When accounting fraud is public knowledge

Even after the fraud becomes public knowledge, retail shareholders have the tendency to do bottom fishing i.e. invest in fraudulent companies at low prices hoping for a miraculous turnaround story. As seen in Exhibit 3, the retail shareholding in Yes Bank and DHFL more than doubled once the fraud became public knowledge and share prices declined. Many investors end up falling prey to the anchoring bias, the lure to invest in such companies is stoked by the fact that shares of these companies can be bought at a fraction of the price that they earlier traded at. However, turnaround stories in the case of financial companies are rare and even when such miracles do happen, the minority shareholders get substantially diluted before the new management is able to turn around such companies.

Therefore, the most prudent approach for investors would be to not invest in companies which have poor quality accounting irrespective of whether such accounting malpractices are public knowledge or not.

How to identify financial companies with poor quality accounting?

Marcellus has designed a set of 11 accounting ratios specifically for Financial Services companies in order to grade companies based on their quality accounting.

Some of the key ratios and rationale are shown in exhibit 4 below. These 11 ratios Forensic accounting means the use of accounting skills to investigate a potential fraud. This forensic model is our counter to the strong desire of companies to manipulate their accounts.

Our methodology is to evaluate 11 accounting ratios covering income statement (revenue/ earnings manipulation), balance sheet (incorrect representation of assets/liabilities), NPA recognition and audit quality checks at least for six years of historical financials. Financial Services companies are ranked on each of these 11 ratios individually from a D1 to D10 (D1 being the best score and D10 the worst). Then these ranks are cumulated across parameters to give a final pecking order of the accounting quality of Financial Services stocks.

There are several qualitative aspects of accounting and corporate governance which our forensic model may not be able to pick up due to lack of data uniformity across companies or where there are subjective judgements involved. Such areas are then evaluated by our analysts through a deep dive into the historical financial statements of the company and primary data checks around management integrity.

As illustrated in exhibit 5 below, companies in the zone of quality outperform companies in the zone of thuggery by a massive 35% over CY16-19. Investors can thereby improve their portfolio returns simply by avoiding companies with poor accounting quality.

Case study – Unravelling Dewan Housing Finance Ltd. (based on their FY13-18 annual reports)

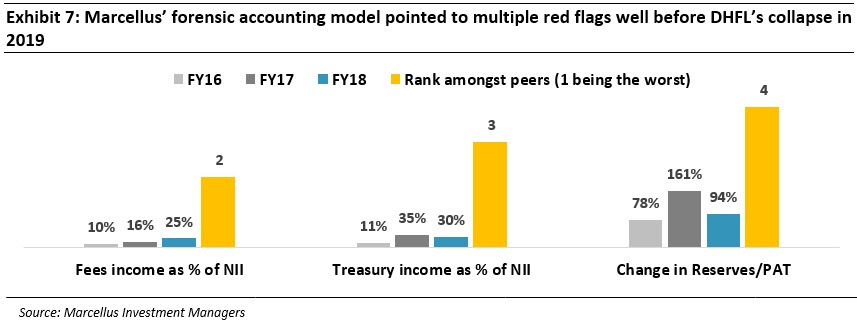

Dewan Housing Financing Limited (DHFL) is a prominent housing finance company. Founded in 1984, it had achieved a peak market cap of over Rs. 20,000 crores in 2018. In the six-year period from FY13-18, DHFL’s loan book had grown at a CAGR of 22% and its profit after tax had grown at a CAGR of 21%. While a plain reading of these numbers suggests that DHFL was growing its balance sheet and profits at a healthy rate, Marcellus’ proprietary forensic model showed a completely different picture. Based on DHFL’s FY13-FY18 annual reports, Marcellus’ forensic model ranked DHFL as a D10 i.e. the worst possible score in our forensic ranking.

Key accounting red flags

What do these accounting ratios imply?

Fee income as a % of net interest income:

A high fee income as a proportion of net interest income compared to its peers suggests that the lender maybe booking a higher upfront fee income to inflate profitability. To take a simple example, a lender who wants to inflate its short term profitability may lend money to a high risk borrower because the borrower is willing to pay a large upfront processing fee – that way the high risk borrower is able to raise debt and the lender is able to book the fee

-

income upfront thereby boosting its profitability.

This sort of lending practice usually leads to adverse selection – in the quest to increase short term profitability, the lender ends up lending to only those borrowers who are willing to pay a large upfront fee income which would naturally be borrowers to whom no other lender wants to lend to. This leads to a build-up of risky loans on the lender’s balance sheet and while the P&L looks glossy, the risk keeps stacking up on the balance sheet. This ratio raises a clear red flag but needs to be corroborated with primary data checks and other checks such as lending mix, fee generating capabilities of the business, nature of fees being booked, etc. However, post the implementation of IndAS for NBFCs (IndAS was implemented by DHFL in December 2018), fee income cannot be recognized upfront and has to be amortized over the residual loan tenor using the effective interest rate accounting method.

-

Treasury income as a % of net interest income:

A consistently high treasury income as a % of net interest income implies a high portion of revenues being generated from non-core assets. A higher treasury income might be because of investments in riskier assets or profit booking by selling investments during lean quarters. Apart from the quantum of fee income, volatility of fee income should also be closely analyzed as a higher volatility implies a larger number of one-off transactions. In this context, the treasury book of DHFL during FY13-18 made for an interesting read – it consisted of investments in NCDs of Reliance Home Finance, perpetual bonds of Yes Bank and investments in the debt funds of its own joint venture DHFL Pramerica Asset Management while these debt funds in turn held bonds of DHFL itself.

-

Change in reserves as a % of profit after tax (PAT):

The retained profit after deducting appropriations such as dividend on equity shares, dividend on preference shares, interim dividends, etc. is added to reserves and surplus on the balance sheet. This results in usually the year on year change in reserves and surplus being equal to the transfer from the profit and loss account post appropriations which implies that change in reserves as % of PAT will is usually 100%. This ratio was not 100% in the case of DHFL because of multiple adjustments to its reserves:

- A one-off appropriation of Rs. 270 crores in FY17 for a capital reduction scheme in one of its joint ventures

- Appropriations of profits to the statutory reserve, which is a legal requirement, however in FY15 appropriations to the statutory reserve were less than the required 20% of profits and

- Utilization of securities premium towards premium on redemption of zero coupon NCDs which is allowed as per the Companies Act however it artificially reduces the interest expense, thereby improving net interest margins, profitability and return on equity. Below is a disclosure from DHFL’s FY18 annual report for the same:

“In accordance with Section 52 of the Companies Act, 2013, during the year the Company has utilized Securities Premium Account towards premium on redemption of Zero Coupon Secured Redeemable Non-Convertible Debentures and Securities issue expenses amounting to Rs. 9,891 Lakh (Rs. 11,465 Lakh) net of tax of Rs. 5,235 Lakh (Rs. 6,068 Lakh)”

In addition to the above red flags pointed out by Marcellus’ forensic framework, further accounting and corporate governance checks which are usually employed by Marcellus’ research team during deep

diligence on specific stocks yielded many other significant red flags which are listed below:

-

Frequent change in auditors:

DHFL’s auditors were changed thrice between FY13 and FY19. In FY13, the company replaced BM Chaturvedi and Co. with two joint auditors citing “the operations of the company have been growing steadily over the past few years, this has resulted in substantial increase in accounting and financial transactions” in its FY13 annual report. In FY16, the joint auditors which were appointed in FY13 did not offer themselves for reappointment “in view of their pre-occupation with other work” as per the FY16 annual report and therefore Chaturvedi & Shah were appointed as the sole auditors. In FY18, Deloitte Haskins & Sells was appointed as the joint auditors. Eventually, in August 2019 both the joint auditors, Deloitte as well as Chaturvedi & Shah resigned.

-

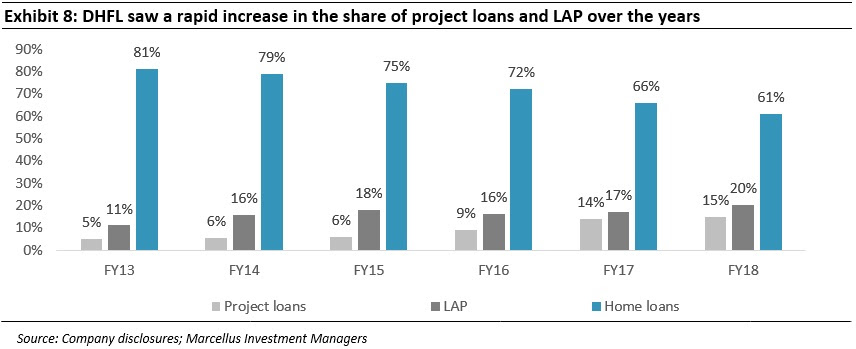

Rapid increase in chunky loans:

As seen in Exhibit 8 below, the proportion of project loans increased from 5% in FY13 to 15% in FY18. When this is corroborated with the gradual increase in fee income as a % of net interest income, it is a worrying sign.

Qualitative red flags

-

Lack of independence on board committees:

The promoter, Kapil Wadhwan himself was the Chairman of the risk management committee and the finance committee. It was the responsibility of the risk management committee to ensure that the credit exposure of the company to any single borrower or group of borrowers did not exceed internally set limits. In addition to other powers, the finance committee had the power to grant loans above Rs. 200 crores and issue corporate guarantees in favor of any person. Until FY15, the finance committee had the power to grant approval for project loans up to Rs. 400 crores. However, that was changed in FY16 and power was given to grant approval for loans above Rs. 200 crores.

-

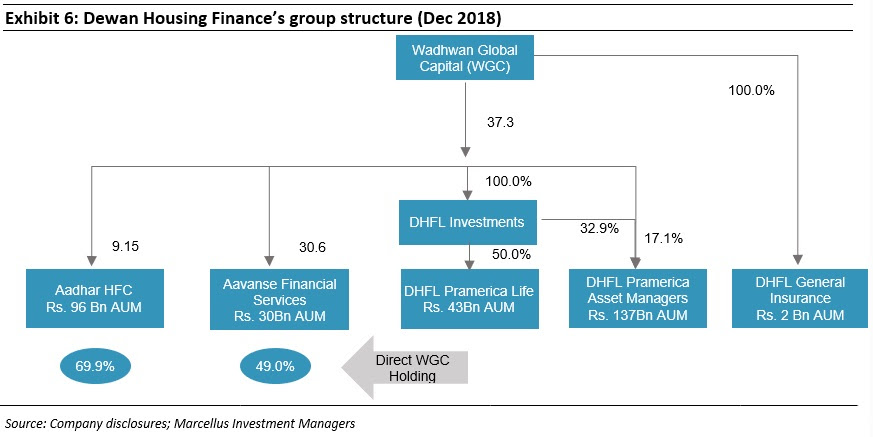

Related party transactions with multiple subsidiaries, joint ventures and associates:

As shown in exhibit 6, DHFL had JVs, subsidiaries and associate companies and shareholding in these companies was held by DHFL as well as its parent company. DHFL also had many related party transactions with these entities.

-

Inconsistency in creating debenture redemption reserve:

As per the Companies (Share Capital and Debenture) Rules, companies were earlier required to create a debenture redemption reserve of 25% of the amount raised by way of public issue of debentures. DHFL created a debenture redemption reserve which was lower than the required 25%. DHFL was eventually fined by SEBI in 2020 for failing to transfer sufficient amounts to the debenture redemption during FY16-18.

-

Tie ups for loan distribution with other lenders with poor asset quality:

DHFL had entered into tie-ups with Dhanlaxmi Bank, Yes Bank, Central Bank, Punjab & Sind Bank and United Bank of India for loan distribution and syndication. The GNPA ratios of these banks in FY18 were Dhanlaxmi Bank 7.4%, Yes Bank 1.3% (but it rose to 17.3% in FY21), Central Bank 21.5%, Punjab & Sind Bank 11.2% and United Bank 24.1%. Assets to the tune of Rs. 1,650 crores were generated through alliances with these banks.

Climax time

On 21st September 2018, DSP Mutual Fund store sold ‘AAA’ rated DHFL papers worth Rs. 300 crores at a yield of 11%. DHFL’s share price fell by 60% on that day, eroding over Rs. 8,000 crores in market capitalization. In February 2019 credit rating agencies downgraded their ratings on DHFL’s various debt instruments by a notch. By May 2019, DHFL had stopped accepting and renewing fixed deposits and had also stopped withdrawals of fixed deposits. On 4th June 2019, DHFL delayed interest payments on its bonds and bond repayments worth Rs. 960 crores leading to ICRA, CRISIL, CARE and Brickworks downgraded DHFL’s credit rating to ‘D’ on the next day. An initial forensic audit of DHFL’s books conducted by Grant Thornton has revealed that over Rs. 17,000 crores were siphoned off between 2006 and 2019. DHFL has now become the first financial company to be admitted into NCLT under the Insolvency and Bankruptcy Code and financial creditors have made claims of over Rs. 86,000 crores. To put it mildly, it looks unlikely that the creditors will be paid off in full.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.