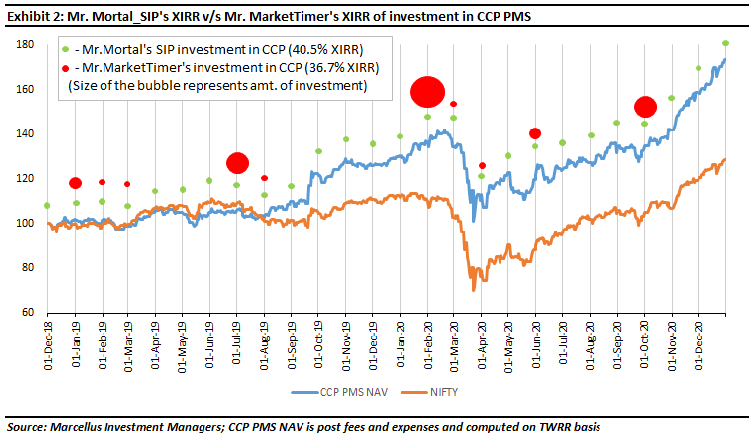

Over the past 25 months, investors who waited for a market correction before deploying top-ups from their recurring income into Marcellus’ CCP PMS would have experienced a significant drag (of at least 3-5% on annualized returns, if not more) vs SIP based investments. This is due to a combination of three factors: a) low correlation between CCP with Nifty50 during periods of weakness in the broader market; b) difficulty of predicting short term share price movements based on the expected outcome of a looming uncertainty; and c) the various psychological challenges around investing at a level higher than that of previous top-ups (eg. investing at 52-week high share prices, high P/E multiples, boring aspect of investing in the same set of stocks repeatedly etc). An SIP in CCP addresses these three challenges by taking away the ability of an investor to make judgement-based calls around market timing. Gains on monthly top-ups of an SIP investor in Marcellus’ CCP (since inception) would have been ~11% higher than those of an investor who waits for a market crash before deploying incremental monthly top-ups.

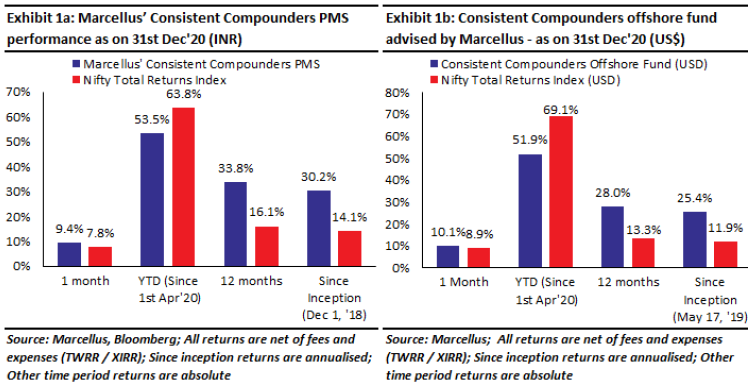

Performance update – as on 31st December 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of eleven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

The concept of ‘Systematic Investment Plan’ (SIP) is well known to most investors in India thanks to its popularity in the Mutual Funds industry over the last two decades. At Marcellus, we have recently introduced SIP as a tool for clients to top up their PMS accounts at regular intervals– click here for more details.

SIP serves two broad purposes in equities investing:

- It is a savings tool (rather than an investment tool) for investors who have recurring income. SIP encourages investors to set aside part of their recurring income as savings in a disciplined manner.

- It disables the investor from controlling the timing of top-ups in an equity portfolio. For investment in a highly volatile portfolio, this ends up providing ‘dollar cost averaging’. However, for investment in a consistently compounding portfolio, disabling control on market timing helps avoid ‘missing the bus’ by sitting on cash as the portfolio value goes up!

In this newsletter, we quantify the impact of the second bullet highlighted above for top-ups in Marcellus’ CCP PMS.

Defining two types of investors – Mr. Mortal_SIP and Mr. MarketTimer

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know”– J.K. Galbraith, Harvard economist, diplomat and public official (1993).

Let us define two types of investors here, both had recurring monthly cash inflows on the 1st day of each month, of which they had set aside Rs 5 lakhs per month for investment in Marcellus’ CCP PMS over the past 25 months.

The first investor is Mr. Mortal_SIP who, as the quote above says ‘doesn’t know’. He invested Rs 5 lakhs through a monthly SIP in Marcellus CCP PMS on the 1st day of every month.

The second investor is Mr. MarketTimer who, as the quote above says ‘doesn’t know that he doesn’t know’. He decides to invest based on the following algorithm revisited on the 1st day of every month:

- If Nifty50 has delivered a positive return over the past month, then Mr. MarketTimer accumulates funds in his bank account for another month before revisiting the algorithm on the 1st day of the next month.

- If Nifty50 has delivered a negative return over the past one month, then Mr. MarketTimer invests all accumulated funds into Marcellus’ CCP PMS.

The outcome (based on the last 25 months of actual data): 40.5% XIRR for Mr. Mortal_SIP on his investment’s vs 36.7% XIRR for Mr. MarketTimer

It is interesting to note that despite both investors investing the same amount in the same portfolio whilst only timing few tranches of top-ups, come out with very different XIRR returns on their top-ups. Mr Mortal_SIP and Mr MarketTimer both deploy Rs 1.25 crores in total over the last 25 months (5 lakhs per month). Mr. Mortal_SIP generates an XIRR of 40.5% which amounts to a gain of Rs ~59.5 lakhs on 25 months of investments, whereas Mr. MarketTimer generates an XIRR of 36.7% which amounts to a gain of only Rs ~53.6 lakhs over the same period (Note: Interest on funds accumulated in Mr. MarketTimer’s bank account is not considered in the amount of gain above)

Mr. MarketTimer waits for market corrections, and then decides to invest. However, he generates a lower return than Mr. Mortal_SIP! Why is that?

-

Reason #1: Left waiting when the market didn’t perform, but Marcellus’ CCP did.

As shown in exhibit 2 above, MarketTimer did NOT make any investments between 1st Aug 2019 and 1st Feb 2020. Over this period, while Nifty50 delivered only 6% return, Marcellus’ CCP PMS NAV went up by 30%. During this period, Marcellus’ CCP had very low correlation with the broader stock market. In our 1st September 2019 newsletter, we had explained why this happens very frequently to stocks in our portfolio. Over the last 25 years, during more than 7 out of 10 stock market corrections (on a financial year basis), CCP stocks have delivered a positive return, making it futile to try and invest in CCP stocks AFTER a stock market correction. It is also worth highlighting that Marcellus’ CCP PMS NAV at the bottom of the March 2020 stock market crash was higher than the NAV on 1st Aug 2019, when Mr. MarketTimer stopped investing, waiting for a lower entry point. In fact, in FY20, Marcellus’ CCP NAV delivered 8% positive return when Nifty50 delivered -25% (negative) return over the same period.

-

Reason #2: Left waiting when both Marcellus’ CCP as well as the market went up despite being inundated by negative newsflow.

MarketTimer continued investing during the stock market crash between February 2020 and June 2020. However, his investments stopped from July 2020 to October 2020 as the stock market kept going up, despite the fact that Covid-19 pandemic accelerated its spread across India particularly during those 3-4 months, 1QFY21 results announcement by corporates was exceptionally weak, India’s GDP growth rate was reported at -24% for 1QFY21 and -8% for 2QFY21 etc. And over the period of 1st July 2020 to 1st October 2020, Marcellus’ CCP NAV went up by ~8%. Similarly, Mr. MarketTimer has been sitting on cash with the 1st Nov 2020 and 1st Dec 2020 top-ups because the market has been going up since 1st Oct 2020 (Marcellus CCP has delivered ~29% return between 1st Oct 2020 and 31st Dec 2020). Reason #2 occurs frequently with CCP. Time and again, investors try to predict three layers of uncertainty in their market timing: a) the outcome of an event (like a union budget, demonetisation, general elections in the US / India, Covid-19 pandemic etc); b) direction of the stock market based on the expected outcome of the event; and c) share price movements of CCP stocks based on the direction of the stock market. Effective timing of entry / exits can be had only by getting all these three layers right in an investor’s expectation – which usually happens only if the investor is very lucky (rather than skilled).

An investor in CCP faces the two challenges highlighted above, frequently because of psychological constraints like:

- If the market or portfolio value has gone up by 5% over the last one month, then there could be a psychological constraint against investing today at higher share prices of the same stocks.

- On most occasions, stocks in Marcellus’ CCP portfolio trade at: a) close to their 52 weeks highs; and b) substantially higher P/E multiples compared to the broader market. These aspects bring psychological constraints especially when there is uncertainty around some ongoing / upcoming event. Also, without a high degree of conviction on the differentiated fundamental strengths of CCP Portfolio companies, it can become boring to keep deploying incremental funds in the same set of stocks over long periods of time.

Mr. Mortal_SIP overcomes the challenges highlighted above because the SIP tool takes away any ability of the investor to time entry points for investment of incremental cash inflows in the portfolio. This helps Mr. Mortal_SIP to benefit more from the power of compounding in Marcellus’ CCP compared to Mr. MarketTimer.

Few more mistakes made by investors who attempt market timing with recurring income (instead of an SIP)

In exhibit 2 above, Mr. MarketTimer managed to invest some of his topups on 1st April 2020 and on 1st June 2020 despite significant uncertainty in the external environment on these days. However, in reality, when a crisis such as the ongoing pandemic is intensifying and when markets are falling sharply every day, psychology of a market-timing investor could convince him to wait for another 20% fall in the markets before share prices bottom out. Hence, in reality, Mr. MarketTimer might actually sit on cash for much longer than the algorithm considered above suggests, which will have further drag on the XIRR of Mr. MarketTimer.

Finally, the analysis above highlights only one side of market timing i.e. timing entry points for top-ups. Most investors, when in control of market timing related decisions also attempt the other side i.e. profit booking of existing investments. The drag on XIRR of Mr. MarketTimer highlighted in exhibit 2 above affects only few incremental topup instalments (and not his existing CCP PMS investments). However, in some cases, investors who time stock market movements, might choose to completely exit from their existing holdings hoping to re-enter at lower levels later on. Such investors are likely to face a substantially higher drag on their investment than what has been demonstrated in exhibit 2 above, since they will not participate at all (vs. partial participation of Mr. MarketTimer in exhibit 2 above) in some of the upwards movements in share prices of CCPs.

Investment implications

Consistent Compounders have low correlation with the broader stock market, higher earnings growth than that of the broader stock market, and are massive beneficiaries of disruptions and crisis (unlike the broader stock market). Hence, lumpsum investments of accumulated capital and systematic topups of recurring income into such stocks is better than ad-hoc ways of timing such investments. Since volatility of share prices in the near term is difficult to predict, an SIP tool protects investors from the psychological challenges faced by Mr. MarketTimer.

Note: 1) SIP is a savings tool that should be used to invest only recurring income of an investor. When it comes to consistently compounding portfolios, SIP should NOT replace lumpsum investment of capital already accumulated by an investor; and 2) Choosing an SIP of say Rs 5 lakhs per month in Marcellus’ PMSes does not change the regulatory requirement of Rs 50 lakhs being the minimum amount for funding a new account.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/