Marcellus’ fund managers and research analysts continuously evaluate their decision-making to identify mistakes made and hence lessons learnt to help improve the quality of our investment decisions in future. In 2019 and 2020 we lacked granularity in our assessment of capital allocation decisions made by companies in our coverage universe. This resulted in our decision-making on stock selection and position sizing being unduly influenced by the prevailing quality of competitive advantages of the core business, instead of the incremental strengthening and growth of competitive advantages into the long-term future. In this newsletter we highlight two examples of such mistakes from our CCP portfolio constituents of 2019-2020. Such learnings led to the strengthening of our research processes through the introduction of Marcellus’ Longevity Framework which has created greater granularity in the decision-making process of our team.

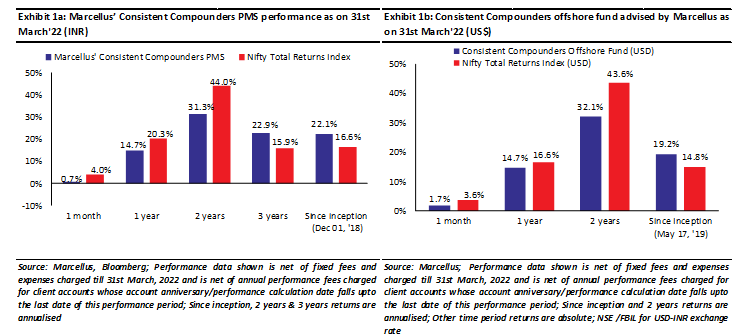

Performance update – as on 31st March 2022

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Mistakes we used to make while assessing capital allocation decisions of our investee companies

“We all make mistakes. If you can’t make mistakes, you can’t make decisions.” – Warren Buffett

One of the biggest areas of learning for Marcellus’ investments team has been around the assessment of the ‘quality of capital allocation decisions’ implemented by companies in our coverage universe.

The capital allocation decision of a company is the single largest source of growth and risk mitigation in the fundamentals of a company, due to the following factors:

• Capital allocation drives the quantum of free cash flows generated by a business:

There can be different areas of capital allocation decisions implemented at a firm to enhance its capabilities eg. R&D, manufacturing processes, supply chain processes, superior technology or some other business domain. The choice of how much to invest, which capability to enhance and how to enhance it drives the creation of competitive advantages and pricing power i.e., the core reason why a customer buys the products and services of the firm.

• Capital allocation drives growth in free cash flows of a business:

Cash, once generated, needs to be redeployed in three ways to drive growth: a) deepen the existing competitive advantages of the business; b) add new revenue growth drivers; and c) radically disrupt the industry construct within which the business operates. Such redeployment of cash drives growth in capital employed and hence growth in revenues, earnings, operating cash flows, and ultimately, free cash flows.

• Capital allocation decision-making is the key responsibility of a high-quality board of directors and management team:

Quality capital allocation decision-making is the key difference between a good quality management team versus a mediocre management team.

Here are two examples of mistakes we have made around the assessment of capital allocation decisions in our portfolio companies:

1. Our position sizing in Page Industries until FY19 did not reflect the firm’s inadequate investments in technology when the going was good (i.e., prior to 2018):

Page Industries reported one of the healthiest and most consistent growth in fundamentals until FY18. Over the five years of FY13-18, Page reported 24% revenue CAGR, 25% PAT CAGR, 57% FCFF CAGR and 60% average ROCE over FY13-18. Over the ten-year period of FY08-18, Page reported 30% revenue CAGR, 31% PAT CAGR and 55% average ROCE over FY08-18. These fundamental strengths were backed by exceptionally strong competitive advantages around the high quality of products offered at affordable prices due to its in-house manufacturing, a distributor-led approach to ensure product availability at MBOs, and an aspirational brand recall created by using European models (instead of Bollywood celebrities). Supporting the strong growth rates was the widening of its product portfolio, initially from men’s innerwear to women’s innerwear, and subsequently from innerwear to outerwear and loungewear.

However, behind the scenes, the firm didn’t invest adequately enough in technology, systems & processes around its distribution and supply chain over the period 2014-2018. Our research carried out until FY19 did not pick up this lack of tech investments and hence the risk of operating inefficiencies in a business which was fast expanding its range of SKUs. This risk played out after GST introduction as working capital of the channel was adversely impacted and Page couldn’t resolve such challenges faced by their dealers and distributors. To make matters worse, some new competitors also capitalised on the opportunity to expand their distribution network by targeting disgruntled channel partners of Page Industries. By the time we became aware of the root cause of the problem (inadequate capital allocation towards systems and processes), the firm’s fundamental growth rates had started moderating significantly – 9% average annual revenue growth reported over the next six quarters (from 2QFY19 to 3QFY20).

Our mistake

– The lack of granularity in our capital allocation framework prior to 2019 meant that we didn’t ask all the deep questions we should have asked during our primary data checks on Page. Hence, even though our investments team correctly identified the strengths of Page Industries’ business, the position sizing of the stock did NOT reflect the risks highlighted above. Page Industries was amongst the highest allocation stocks in Marcellus’ CCP portfolio in FY19.

2. We continued to stay invested in ITC until early-2020 despite its lack of capital allocation towards adding new revenue growth drivers. This was because we could not clearly split our assessment of the quality of its formidable moat from its capital allocation decisions while drawing comparisons between ITC and other companies in our coverage universe:

ITC has maintained exceptionally strong competitive advantages in its core business of cigarettes – raw material procurement to deliver consistent quality of finished products (inspite of the fact that the quality of tobacco leaf varies considerably from one crop to another), innovative surrogate marketing initiatives, and massive distribution muscle reaching out to the millions of paanwalas across the country. As a result, the firm has maintained as much as 80% market share in the organised cigarettes industry with ~300% ROCE. Until 6 years ago, ITC’s rate of reinvestment of operating cash flows into the business had held up at ~40%, as the firm invested capital to grow its FMCG, Agri and Paper businesses. However, subsequently rate of reinvestment of capital dropped significantly to a level where ITC started accumulating annually Rs 2000 crores worth of surplus capital on its balance sheet (even after maintaining a ~65% dividend payout ratio). Total accumulated surplus capital by FY20 was Rs 36,000 crores, ~60% of the overall capital employed. As a result, our expected earnings growth rate from ITC remained 11-13% during the period we held it in our portfolio.

Our mistake

– ITC’s modest position size in our portfolio was justified by our low expectations of its fundamental growth rate. However, we did not balance the combination of strong moats (which ITC continues to possess) with its weak rate of its capital reinvestment, while comparing ITC with other stocks in our coverage universe who might be a notch weaker than ITC in their moats but have far better capital allocation.

Process-oriented solution to deepen research on capital allocation intensity and prudence

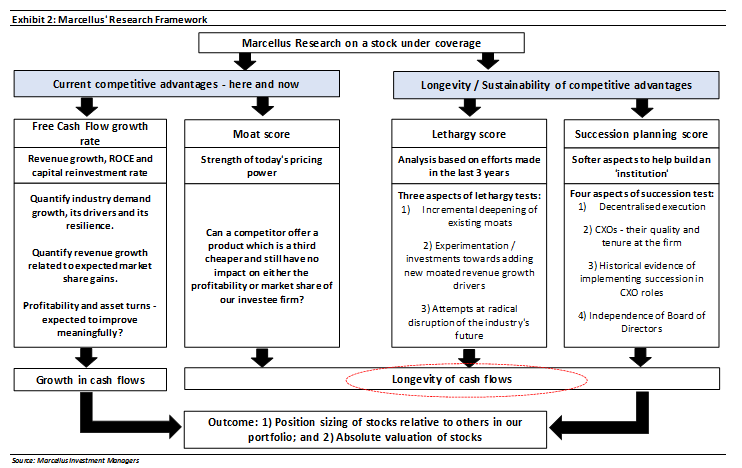

Over the course of 2019-2020, we implemented Marcellus’ Longevity Framework (summarised in the exhibit below) – a process-oriented approach towards conducting research on the drivers of sustainable free cash flow compounding in a business over the long term.

The ‘lethargy score’ segment of our longevity framework requires Marcellus’ research analysts to both classify and quantify, the capital allocation decisions implemented by companies in our coverage universe across three mutually exclusive categories – a) deepening of existing competitive advantages, b) addition of new revenue growth drivers with high pricing power; and c) radical disruption of the industry’s future. This approach has produced the following advantages for Marcellus’ investment decision-making process:

• Avoids biases caused by ‘here and now’ of reported fundamental growth and ROCEs:

The prevalence of competitive advantages in a business is distinct from the sustainability and growth in competitive advantages in future. Hence, even if the existing business has strong competitive advantages, we cannot ignore the efforts (or lack of efforts) which drives sustainability and growth in competitive advantages over the next 5-7 years. This distinction in our research process is important for us and our clients to understand in order to avoid being biased by the strengths or weaknesses of the existing core business and of the recently reported fundamentals.

• Helps in quantifying expectations around working capital efficiencies, asset turnovers and hence free cash flow generation:

As highlighted in one of our recent newsletters (click here), “building an understanding around working capital cycles and asset turnover prospects is far harder than understanding a company’s earnings growth prospects”. The ability to forecast working capital efficiencies and capital expenditure efficiencies requires clarity of thought around what is the nature of capital allocation decisions recently implemented at a firm and which aspect of the business will be impacted by these capital allocation decisions. At Marcellus we make a conscious effort to bring research and clarity of thought to bear on our investee companies’ working capital efficiencies, asset turns and thus free cashflows. Since India’s best franchises consistently grow free cashflows significantly faster than PAT (a 10% point gap in the two growth rates is not uncommon), this helps us avoid dilution in the quality of our position sizing process.

• Clarity of thought around the longevity of greatness and thus fair valuations (i.e. the intrinsic value of a business):

The longevity or sustainability of growth in a company’s free cashflows is the biggest source of undervaluation in the share prices of high quality companies. One of the biggest mistakes made around the expected sustainability of cashflow growth is inadequate understanding of how capital allocation decisions help in avoiding future uncertainties from disruptions / evolutions / market share saturation / intense competition / macro events, etc. In that regard, all components of Marcellus’ Longevity Framework help our Investments team differentiate between rich-valuations and over-valuation. This point is explained further in our 4th Jan 2020 newsletter (click here).

Corrective actions implemented after mistakes were made in our assessment of Page and ITC

Page Industries – corrective action:

After implementing Marcellus’ Longevity Framework, we reduced the allocation of Page Industries in our CCP portfolio in mid-2020. We decided to stay invested in Page Industries since our Investments team kept getting tangible data points on the improvement in the capital allocation discipline of Page. Over the past three years, Page has transformed its IT infrastructure and its systems and processes across all its functions to create a seamless supply chain. Page has invested in a BlueYonder – a supply chain tool which will help them to produce the right SKUs at the right time. Distributor Management System links the distributor and the backend, and the Auto Replenishment System replenishes the distributor whenever the quantity dips below a certain level. At the front end, Page’s sales force is now equipped with handheld tablets which helps collect orders & do billing in real time. Now all orders collected by 2 p.m. are dispatched by evening v/s previously when it took a complete day to fulfil. These investments should help Page manage seamless scalability of the business while improving demand forecasting, customer responsiveness, and inventory reduction.

ITC – corrective action:

We exited from ITC in early-2020, thanks to Marcellus’ Longevity framework suggesting alternative stocks which led to an enhancement in weighted average growth rates, and Longevity Scores of our overall CCP portfolio.

As Bill Gates once said, ‘Learning from mistakes and constantly improving products is a key in all successful companies’. At Marcellus, we constantly try to understand our investee companies’ mistakes and their learnings. In the same spirit, our fund managers and research analysts evaluate their own mistakes and learnings.

Investment implications –

What does our capital allocation assessment indicate about the future growth prospects of our portfolio companies’ fundamentals?

Marcellus’ Longevity Framework has created significant granularity in our assessment of the capital allocation decisions made by our investee companies over the last two years. The disruption caused by the Covid-19 pandemic has given our investee companies three distinct types of opportunities to benefit from:

• Tech investments to further strengthen the core business

when the entire eco-system around these companies (from raw material vendors to end customers) has seen acceleration in technology-adoption. Dr. Lal Pathlabs, Page Industries, Titan and Asian Paints are some of the best examples of companies who have taken such decisions over the past two years. Some of the outcomes of these investments has been that although over the last two years, these companies have seen a 50-80% increase in their distribution network through better supply chain efficiencies, their working capital cycles have reduced, and their asset turnovers are improving further.

• Attempts made to radically disrupt the entire industry through a complete transformation of the business model.

Asian Paints and Bajaj Finance are the best examples from our portfolio in this regard. Bajaj Finance is transitioning from being a lender to becoming a broader fintech company. Asian Paints is transitioning from being a products company to becoming a services company.

• Acquisitions of new businesses at reasonable valuations

which helps accelerate growth prospects in future. Pidilite’s acquisition of Araldite (market leader in epoxy adhesives) and Dr. Lal Pathlabs (acquisition of Suburban Diagnostics) are two such examples from our CCP portfolio.

Taking cognizance of such capital allocation decisions, we keep updating our position sizing and stock selection processes on an ongoing basis to enhance our portfolio’s risk-reward balance.

Regards

Team Marcellus