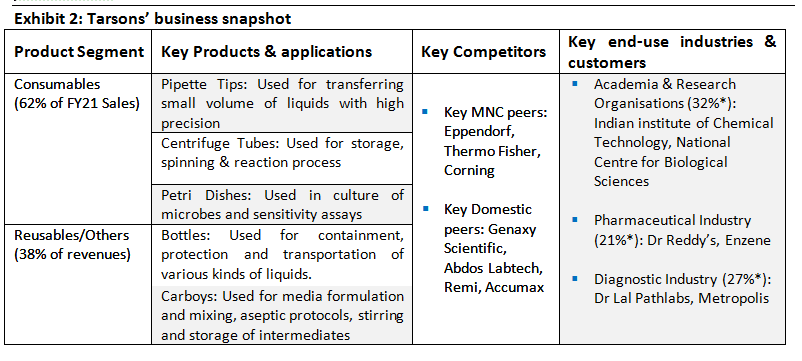

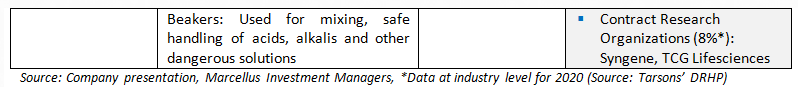

This month we place the spotlight on Tarsons Products Limited (Tarsons), a leading supplier of plastic labware products in India with a growing exports business (1/3rd of revenues). Tarsons enjoys industry leading operating margin (FY17-21 average EBITDA margin nearly 3x the second-best player’s) and significantly superior returns on capital employed vs peers (31% average over FY17-21 vs second best’s 24%). The key success factors for Tarsons have been its difficult to replicate in-house manufacturing set up (vs peers who rely mostly on imports/outsourcing), long standing relationships with distributors and focus on the plastic labware market (heavy reinvestments of operating profits in capacities, automation, market expansion). Significant dependence on a few distributors (particularly in export markets) and all manufacturing facilities in a single state (West Bengal) are key risks.

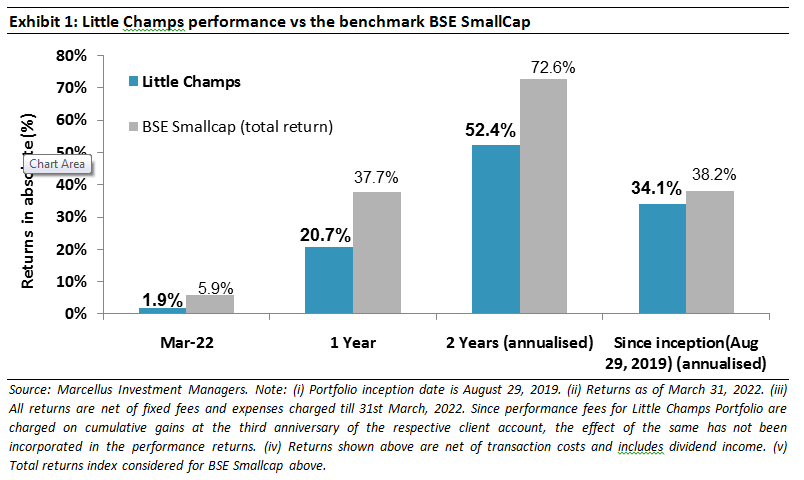

Performance update for the Little Champs Portfolio

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio updates: Addition of Gujarat Ambuja Exports

We have made the following changes to portfolio in the month of March 2022:

Addition of Gujarat Ambuja Exports: Incorporated in 1991, Gujarat Ambuja Exports Limited (GAEL) is engaged in processing of Maize, Soya and Cotton and converting them into Starch & Starch derivatives, Soya meal & Soya oil and Cotton Yarns. Main customers for the company are from the FMCG, Pharma, Textile, Paper and Animal feed industries. Over the last 15 years, company has consciously diversified away from the low margin but highly volatile businesses viz. Soya and Cotton Processing with low barriers to entry. On the other hand, focus has been primarily on the Maize processing segment where the company has been successful in pulling away from competition in profitability, asset turns and return on capital. GAEL’s market leadership in the Maize processing business is underpinned by its efficient manufacturing operations (high level of plant automation, in-house power plants, raw material procurement/storage strategies etc). Furthermore, in the value-added product segments like starch derivatives, considering that products are sold to regulated industries like Pharma and FMCG, getting customer approval involves long gestation periods which acts as barrier to entry. Add to that, the extensive manufacturing footprint spread across India makes GAEL a preferable supplier to its customers. In the maize segment, the company has grown its revenue and EBIT at 11% CAGR and 20% CAGR respectively over the last 5 years (FY16-21) with average ROCE of 21%. With its two new manufacturing facilities coming in Malda (West Bengal) and Sitarganj (Uttarakhand), Gujarat Ambuja is expanding its capacities by 67% and is also entering some new product categories

Stock in the Spotlight: Tarsons Products

This month we detail our investment rationale for Tarsons Products. In the previous months we have written on: Garware Technical Fibres (August 2020), GMM Pfaudler (September 2020), V-Mart Retail (October 2020), Alkyl Amines (November 2020), Suprajit Engineering (December 2020), Mold-Tek Packaging (February 2021), Amrutanjan (April 2021), Fine Organics (May 2021), Galaxy Surfactants (December 2021) and Ultramarine & Pigments (February 2022).

Company Background

Tarsons Products (Tarsons) was started in 1983 by Mr. Sanjive Sehgal, Ms. Jyoti Sehgal and Mr. Atul Sehgal as a manufacturer of reusable plastic products. It forayed into plastic labware products in 1984 through the introduction of pipette pipes. Tarsons got a breakthrough in 1994-95 when it imported high end tooling technology which helped improve the quality of the products significantly. The Company has been consistently expanding the product basket over the years and now commands market leadership in several plastic labware products in India across key customer segments. It has also built a sizeable exports business which accounted for 33% of revenues in FY2021. In July 2018, Clear Vision Investments Holding Pte. Ltd. (backed by ADV Partners) bought a 49% stake in Tarsons for ~Rs13 bn from one of the exiting promoter families. Subsequently in the recent IPO (November 2021), Clear Vision sold half of its holdings (now owns 23.4% stake).

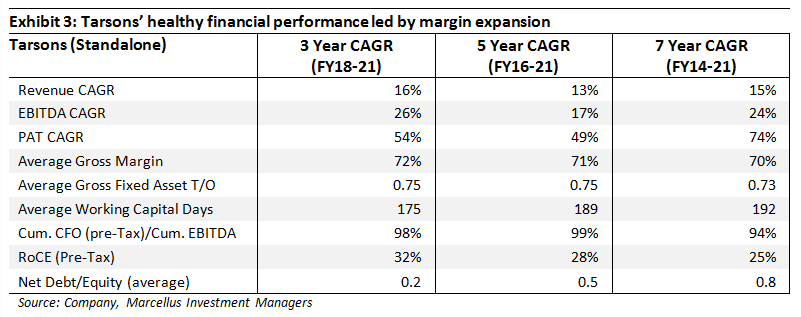

Significant margin and RoCE expansion in the recent years

New product introductions and strong growth in the export markets have been the key revenue growth drivers of Tarsons in recent years. EBITDA and PAT growth have outpaced revenue growth due to improving product mix (including rising share of sterilised products), operating efficiencies and improving pricing. Despite the capital intensive nature of the business (which we delve deeper in following sections), high operating margins have enabled Tarsons to consistently generate healthy RoCEs.

Our investment case for Tarsons

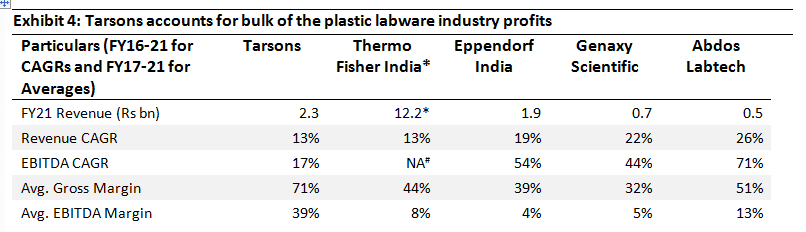

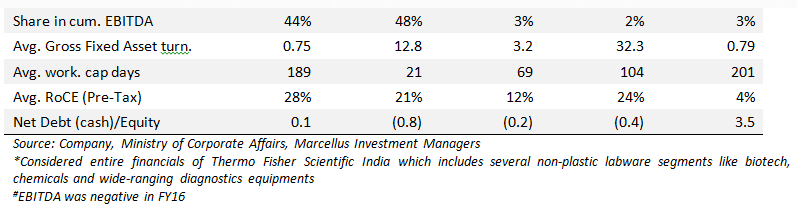

The Indian plastic labware industry has undergone a rapid transformation over the last three decades from being dominated by imports from MNCs to now domestic players like Tarsons accounting for a significant part of the market. Among the top five leading players highlighted in the exhibit below, Tarsons accounted for nearly 44% of the cumulative operating profits over FY17-21 (despite having only 13% share of revenues) thanks to its significantly better operating margin. This share in profits is despite considering the entire operating profits of Thermo Fisher Scientific India which is also present in several non-plastic labware businesses like biotech, chemicals and wide-ranging diagnostics equipments.

Tarsons’ revenue and EBITDA growth over the FY16-21 period has somewhat lagged that of its peers – primarily on account of unprecedented revenue growth witnessed by some peers in FY21 like Genaxy Scientific (revenues up 210%) and Abdos Labtech (revenues up 57%) due to Covid-19 related demand. Tarsons whilst witnessing 30% YoY growth in FY21 couldn’t fully benefit due to capacity constraints (Tarsons has historically been operating at much higher utilisation levels vs peers). However, we believe this Covid-19 related spike witnessed in FY21 is unlikely to sustain going ahead as is also visible in significant tapering down of Covid-19 related test revenues reported by the listed diagnostic companies in the recent quarters. Hence, going forward, plastic labware industry revenue growth will be determined by conventional dynamics like quality, reliability and competitive pricing where Tarsons scores over peers.

Basis our research and our discussions with plastic labware industry sources, we attribute the following reasons to Tarsons’ success:

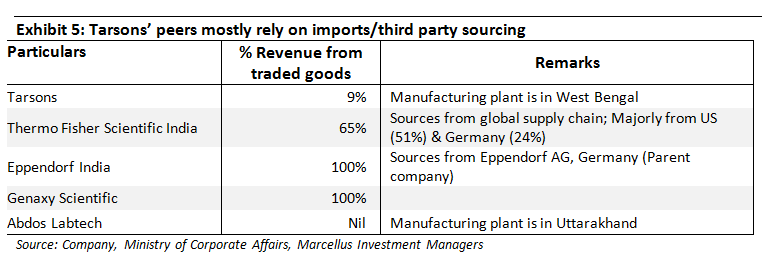

1) Tarsons’ In-house manufacturing – difficult to replicate successfully

Tarsons has by far the largest in-house manufacturing footprint of plastic labware products in India and primarily relies on in-house manufacturing. MNC peers like Thermo Fisher and Eppendorf India mainly rely on imports from their global facilities given the niche size of industry (Rs12bn). On the other hand, domestic peers like Genaxy Scientific outsource production on a job work basis to third parties.

Our channel checks suggest significant positive benefits of in-house manufacturing for players like Tarsons:

Full control on the quality of the product and timelines of delivery; and

Significant cost advantages specially against MNCs who mainly rely on imports. This enables the local manufacturer in India to competitively price its products relative to the imported products.

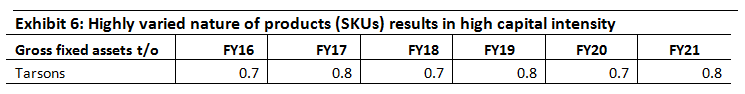

Plastic labware products are manufactured primarily through the injection and blow moulding process. While the manufacturing technology is available to all the players, there are several complexities we describe below which pushes up the capital costs and working capital requirements creating barriers to building an efficient in-house manufacturing set-up:

a) High fixed assets requirements: Tarsons manufactures more than 1700 SKUs across 300 products. Such a varied and broad product basket requires significant investments into moulds – for instance Tarsons uses around 645 moulds. Moulds account for 1/3rd of the total gross block of the company. Furthermore, to match global quality standards, moulds and equipment are mainly imported which pushes up the cost further. Also, the need for an aseptic and ‘free from human touch’ environment requires investments into robotics/automation which also adds on to the capital costs and thus creates obvious economies of scale.

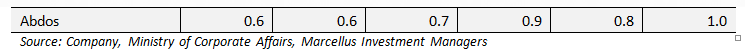

b) High working capital requirements: Given that more than 1700 SKUs need to be manufactured on 60 machines, sizeable inventory needs to be maintained for each SKU due to the long haul between the two production runs of the same SKU. This increases the inventory and thus the working capital requirements of the business. Also, since plastic labware products are to be used in critical industries/applications like Pharma, R&D, only medical grade plastic granules can be used as raw material. This grade of granule is not manufactured in India and needs to be imported from Europe and USA with upfront payments. Moreover, as the granules are imported, it is unviable to follow ‘Just in Time’ inventory management system. Hence a huge stock of raw material inventory needs to be maintained which adds on to the working capital days.

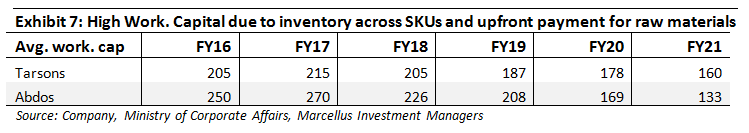

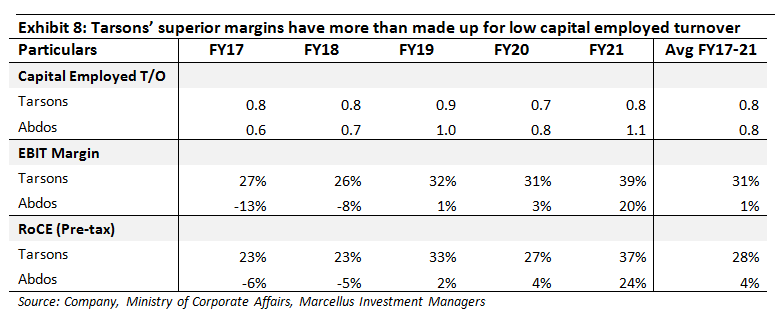

While there are obvious benefits to having an in-house manufacturing as highlighted above, the associated low capital employed turnover makes it imperative for a company to constantly seek to improve margins in order to generate decent returns on capital employed. In this regard, Tarsons, through its investments into automation including robotics, continuous expansion of the product baskets (and thus scale benefits), rising share of sterilised products and focus on operational efficiencies has been able to expand its margin consistently in recent years compared to Abdos Labtech, which has in-house manufacturing, as shown in the exhibit below.

2) Strong and long-standing distribution relationships

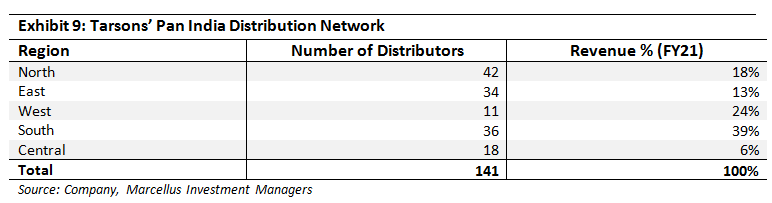

Over the years, Tarsons has built a strong and fairly diversified distribution network of 141 distributors on a pan-India basis as shown in the exhibit below. Given that the end customers are spread out across India, a large number of SKUs (>1,700 SKUs) and the sporadic nature of the customer’s demand, a certain level of inventories need to be maintained. In this context, the distributors acting like stockists maintain 2-3 months of inventories and thus ensure consistent and quick supplies to the end user (also to some extent relieving the balance sheet burden on Tarsons). At the same time, the credit risk of the end-user segments (i.e. the risk of the customer not paying for products delivered) are also assumed by distributors.

Tarsons has been able to maintain longstanding relationships with its distributors – for instance 75-80% of the total distributors have been with Tarsons for more than 2 decades – who have played an important role in the success of Tarsons. On the other hand, distributors have benefited from the strong brand pull created by Tarsons’ sales team, the firm’s products’ quality and other competitive advantages highlighted in the preceding sections creating a mutually win-win situation for both.

3) Focus on the core business

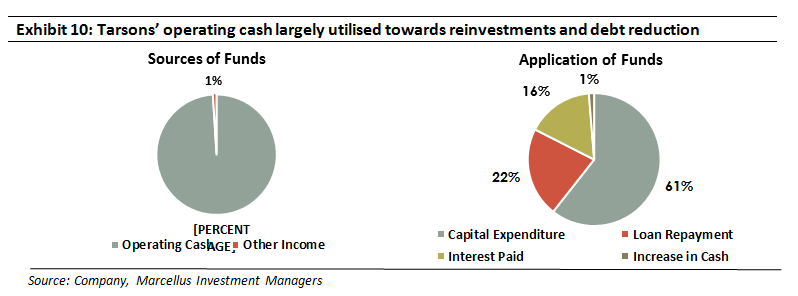

Tarsons management is focused on the plastic labware business with high reinvestments in the core business (60% of the cumulative operating cash generated over FY15-21 has been re-invested in capital expenditure). Besides consistent expansion of the production capacity, investments have also gone into enhancing the production efficiency like automation technologies/robotics and setting up of an R&D centre. Surplus cash post reinvestment has been used to bring down the debt levels and interest payments. Similarly, out of the recent IPO Proceeds of Rs1500m, company has utilised Rs780m to reduce debt and Rs620m is earmarked for new manufacturing facilities.

Growth Opportunities in untapped segments and export markets

a) Domestic Market: The current total market size of Indian Plastic Labware industry is ~Rs.12bn. As per management estimate, Tarsons is currently catering to only ~60% of the plastic labware market. Of the remaining part of the market, Tarsons currently has minimal presence in key segments like PCR and cell culture segments which are dominated by MNC players like Thermo Fisher, Corning, etc. With its upcoming plant at Panchla, Tarsons will be increasing it capacity by 2x and also venture into PCR and Cell Culture segments.

b) Export Market: On the exports front, Tarsons got a breakthrough in 2009 when VWR (a large distributor of research laboratory products and a Fortune 500 company) approached Tarsons to become VWR’s supplier for plastic labware products for the oversees market. VWR’s relationship acted as a stamp of quality for Tarsons and a strong marketing reference for entering new geographies and other distributors. Currently, Tarsons is selling its products via distributors under two sales models. In the ODM Sales model (62% of FY21 export revenue), the distributor sells the product under his own brand name whereas in the Branded Sales model (38% of FY21 export revenue), the distributor sells the product under Tarsons’ brand. Just like the domestic market, in the export market as well Tarsons’ USP is to sell high quality products at lower price points. Exports became a focus area of the company post Mr. Rohan Sehgal (son of Mr. Sanjive Sehgal) joining the business in 2010. Over the last few years, Tarsons has strengthened its export team by recruiting various country/region heads and constantly participates in trade fairs and exhibitions. Going forward, Tarsons plans to increase its exports to over 120 countries (vs 40 countries currently). Given that size of the Global Plastic Labware industry is USD 8.4bn, Tarsons has a long growth runway in the export market.

Key Risks

a) Scope for institutionalisation: Given that Mr. Sanjive Sehgal has grown the business from scratch and heads the manufacturing division, which is a key source of competitive edge of the company, Tarsons needs to focus on putting in place institutional processes to derisk the business. Post Mr. Rohan Sehgal joining the business, he has commenced the institutionalisation process to mitigate this risk. He has set up new departments (eg. R&D), brought in external investors (ADV Partners invested in Tarsons in 2018) and has been recruiting more professionals (Eg. COO, CFO, CMO (Exports), etc.)

b) Dependence on distributors: In India, Tarsons’ top 10 distributors accounted for 56% of domestic sales in FY21. Similarly, in the export markets, the top distributor accounted for a significant share of export sales in FY21. The loss of any distributor can have an impact on the business. However, six out of the top ten domestic distributors have been with Tarsons since inception and three have been with the company for more than a decade. The top distributor on the exports front has also been dealing with the company for 10+ years.

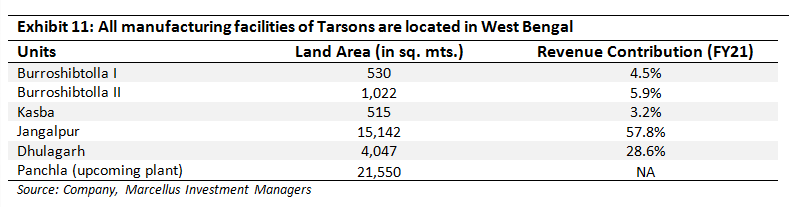

c) Concentration of manufacturing facilities in a single state – West Bengal: All five manufacturing facilities as well as the upcoming plant are concentrated in the state of West Bengal. This exposes the company to any state specific risks which can adversely impact company’s operations.