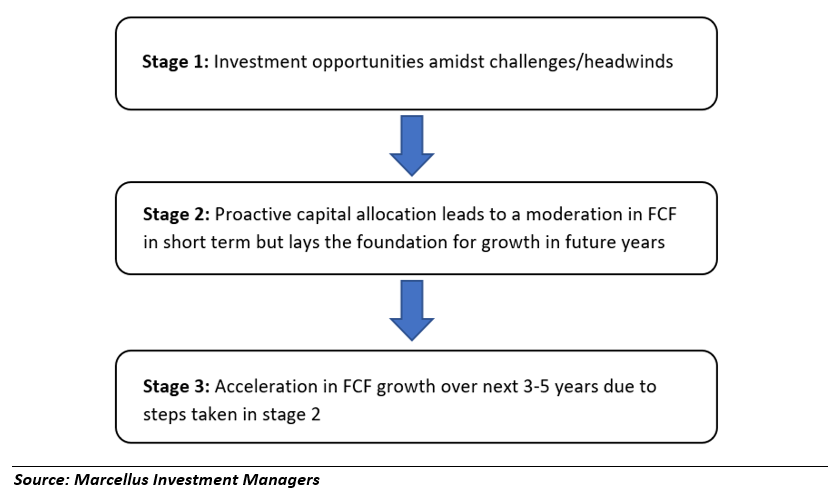

Historically, once every five years, Marcellus’ CCP companies have faced a challenging external environment. In such instances, CCPs have ramped up capex and working capital investments (ex-financials as these parameters are not applicable to them). This has been followed by a sharp acceleration in the franchises’ growth rates in the subsequent 3-4 years. FY22 was one such year where our portfolio companies accelerated capex (around acquisitions & tech investments) and took tactical working capital decisions to benefit from uncertainties around global supply chains and rising input costs. These investments are expected to accelerate market share gains, add revenue growth drivers, and lead to transformation for some businesses as they move from ‘traditional’ to ‘new age’.

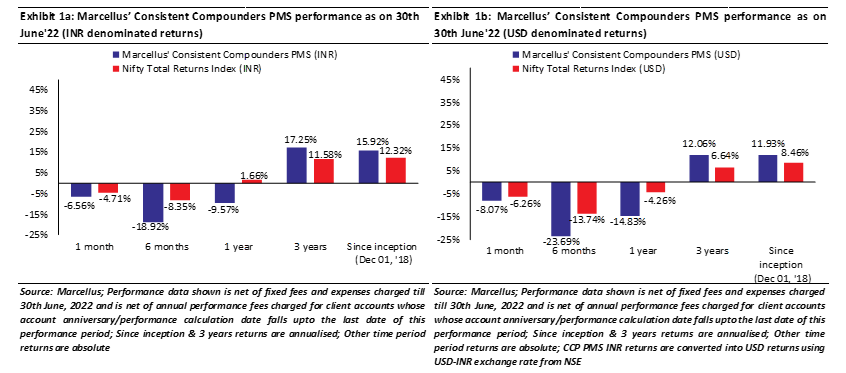

Performance update – as on 30th June’2022

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS portfolio is shown in the charts below.

A simple template adopted by CCP companies historically to benefit from the crisis

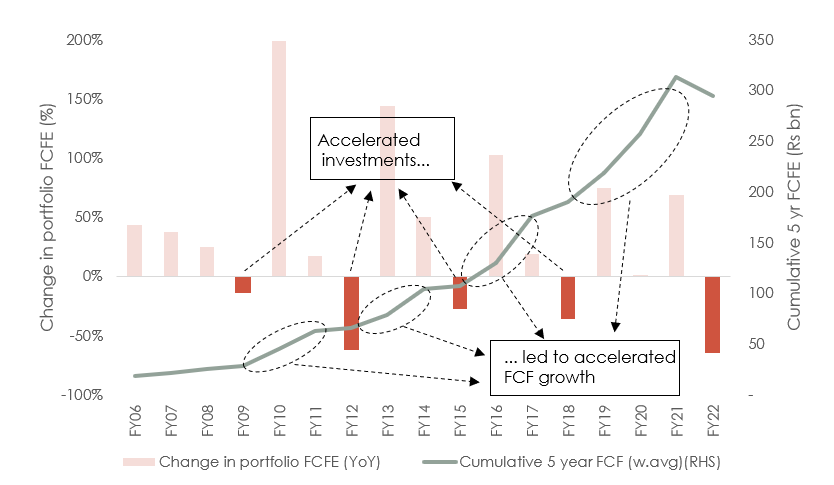

Over the past 15 years, there have been four financial years when our current portfolio companies have reported a decline in their free cashflows (on average across the portfolio). Every such instance of free cashflow decline has been preceded by some challenges in the external environment. More importantly, each time free cash flows of our portfolio companies have declined in a specific year, the next 3-5 years have seen a rapid acceleration of free cash flow growth. For instance:

- During FY09-12, under pressure from commodity price volatility, CCP companies were not only able to mitigate the impact on their margins via timely price hikes but they also put up incremental capacity to benefit from a consumption boom in rural & small-town India because of schemes like MNREGA. For example, Asian Paints reported sales growth of 21% CAGR, Pidilite reported sales growth of 16% CAGR, Nestle reported sales growth of 18% CAGR% over FY09-12. As existing capacities reached peak utilization levels, these companies heavily invested in building new capacities which helped drive the volume growth rate in succeeding years. Asian Paints for example invested ~Rs 1,000crs over FY12 & FY13 to set-up a new plant in Satara (Maharashtra) and expand capacity in Rohtak (Haryana) effectively doubling its capacity from 4.5 KL p.a. to 9.5 KL p.a.. Over FY12-17, Asian Paints’ FCF grew at 37% CAGR.

- In FY18, FCF moderated due to heavy capex done by our portfolio companies even in the face of weak demand as demonetization and GST implementation impacted the cash economy. For e.g. Asian Paints invested ~Rs 1,400crs in FY18 for setting up new plants in Vizag & Mysore. Resultantly, over FY18-22, as the shift from ‘unorganized to organized’ panned out, Asian Paints reported volume growth of ~17% CAGR led by market share gains in paints and entry into adjacencies like putty, waterproofing.

Exhibit 2: Simple framework utilized by CCP companies to accelerate their FCF growth

Exhibit 3: Timely capital allocation decisions by CCP companies has led to impressive FCF compounding

Source: Ace Equity, Marcellus Investment Managers; the above analysis includes the following stocks: Asian Paints, Berger, Nestle, Pidilite, Titan, Divis, Page Inds, TCS and Dr. Lal Pathlabs; Financials stocks not included in the analysis above as concept of Free Cash Flow is not relevant for financials; portfolio FCFE calculated using respective weights of portfolio stocks.

The last couple of years have been another such period of ramped up capex and working capital investments for CCP companies (ex-financials). Even as free cashflows have been compressed in FY22 for the CCP companies, these investments have laid the foundation for accelerated revenue and FCF growth over the next 3-5 years as highlighted below.

Capex initiatives around acquisitions, tech investments and complete business transformations

Acquisitions :

In a normal year, CCP companies prefer to grow their businesses organically. However, over the past two years, there have been a series of acquisitions carried out by many (not all) CCP portfolio companies which have either strengthened their existing core business or have added new products or geographies to their existing core. For instance,

Pidilite

acquired its strongest competitor in epoxy adhesives by buying Huntsman Advanced Materials Solutions (HAMS), which manufactures brands like Araldite and Araseal, in FY21 for Rs 2,100crs. This acquisition makes Pidilite the leadership position in epoxy adhesives – a market where Pidilite had struggled to gain share from Huntsman in the past. Pidilite also acquired a majority stake in tile adhesives and stone care solutions company Tenax in 2020 for Rs 80crs to get entry into the stone/ marble/ granite care solutions market. The acquisitions were fully funded through internal accruals.

Dr Lal Pathlabs

acquired Suburban Diagnostics in FY22 for Rs 925cr. This acquisition, which was funded through internal accruals, will help Dr. Lal Pathlabs expand into western India. Given how difficult it is to build trust organically with patients and doctors in the healthcare industry, consolidation of market share through acquisitions is one of the key drivers of growth in Indian diagnostics industry.

ICICI Lombard and HDFC Life

have acquired their competitors, Bharti Axa and Exide Life Insurance respectively in FY22.

Asian Paints

has acquired a couple of companies in its new growth area of Home Décor. To accelerate its home décor journey to achieve this goal, the firm acquired a 49% stake in WhiteTeak – a decorative lightings company for Rs 180crs and a 51% stake in Weatherseal – a uPVC windows company – for Rs 19crs in FY22. Both these acquisitions were fully funded through from internal accruals and these acquisitions were made to accelerate the learning curve in lightings & windows.

Tech investments:

Over the past two decades, a number of our portfolio companies have been at the forefront of making tech investments to aid operating efficiencies (a key reason why in the long run, their FCF growth exceeds earnings growth) and the same trend was visible through last two years as Covid related disruptions played havoc on supply chains. For example:

-

Pidilite:

The company implemented Auto Replenishment System (ARS) for its channel partners and in the process also enabled its salesforce to capture granular data on sales – making them more productive in the process. This will not only help with incremental operating efficiencies, but will also help the company scale better as the complexity of the business increases with the addition of new brands like Roff, Araldite, etc. The company said: “Today we are now getting almost 20% of our dealer orders via genie app where dealers do not actually know salesmen, no distributor comes in, all is done via an app. The same thing is getting extended to contractors, so there is a massive amount of investment in an agile and resilient supply chain, there is a massive investment in the whole digital piece which in a sense we learned during COVID, and we do not want to lose” (source: Q4FY22 Earnings call transcript).

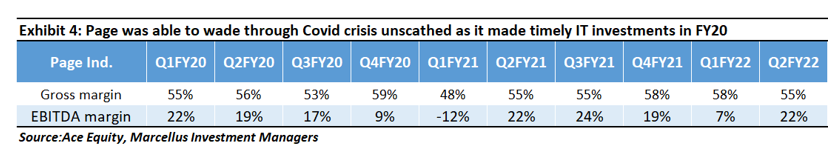

Page industries:

Over the past three years, Page has radically transformed its IT infrastructure and its systems and processes across all its functions to create a seamless & automated supply chain. The system now allows for auto replenishment of the stock – which has led to inventory levels going down for the distributors as well as for Page as neither party sits on dead inventory (items unsold for long time) anymore. The demand forecasting software (Blue Yonder) implemented as part of IT system transformation provides insights into which fast moving goods are likely to sell and hence allows for optimization right from raw material procurement to manufacturing and retail.

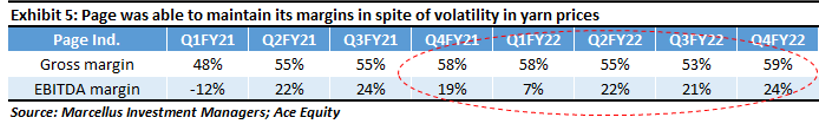

As shown in the table below, the IT investments made by Page over Q1-Q3FY20 led to about 5% points EBITDA margin compression. However, these investments allowed Page to emerge from the Covid crisis relatively unscathed.

Business transformation:

Alongside making investments to aid operating efficiencies, some of our portfolio companies have also allocated capital towards radically transforming their business model.

-

Bajaj finance:

Bajaj Finance has been actively investing to transform itself its B2C offerings through a ‘super app’ so as to aid its future growth by tapping in to the erstwhile untapped users with high credit quality, as well as mining more wallet share of its existing customers. As highlighted in our CCP Jun’22 newsletter (link) and KCP newsletter dated 17th July’21 (link), “BAF’s biggest strength is use of its proprietary consumer data to selectively target borrowers with higher credit quality, who might not have already got a substantially high rating on the commonly available credit rating agencies’ databases. Out of BAF’s 49 million customers, 27 million customers are its best customers with whom BAF is willing to do business. BAF has another 90 million prospects that they are willing to do business with today and who in general have 80-90% approval rate. The digital infrastructure under business transformation 2.0 is being built to tap these 117 (90+27) million Indians who Bajaj Finance want to do business with. While BAF’s loan book size is only Rs 1.5 lac crores, the 27 million good quality customers have Rs. 6 to 7 lac crores of outstanding credit in India’s lending sector (in addition to the amount outstanding with BAF) thus providing significant headroom to mine wallet share of existing customers.” BAF’s app has already seen 14 million downloads of which there are 8 million active users.

-

Asian Paints:

Asian Paints has been actively pursuing strategy to transform itself from a product company to a services company via active technological investments and strategic acquisitions. As highlighted in our Jun’22 newsletter (link) “Over the last 3 years, Asian Paints has accelerated investments in a platform for end consumers to avail ‘Painting Services’ which will be delivered through its vast network of dealers & empaneled painters. Not only does this service offer the convenience & trust of a branded service to customers, it also improves dealer captivity by offering dealers a chance to earn higher margins (by providing extra services to customers) thereby strengthening its core business. Asian Paints is also foraying into the ‘Home Décor’ space through its network of 30 Beautiful Homes stores and Home Décor service which is currently offered in the top 8 cities. The Beautiful Homes stores offer a ‘digital’ element to customers through its state-of-the-art 3D visualization platform along with touch & feel aspect for all home décor products under one roof. Home Décor service is a customized ‘design to execution’ service offered as a form of convenience in the top 8 cities where the firm has partnered with multiple designers, architects, and end-delivery contractors to offer end-to-end services – from personalised interior design to professional execution – by leveraging its core strength of dealer network and contractors.”

Working capital: Part 1- Tactical call on Raw Material inventory given uncertainties around inflation

Alongside making strategic capex related capital allocation decisions, some of our portfolio companies have also taken tactical calls with respect to working capital management so as to minimize disruptions from Raw Material (RM) pricing and availability. For instance:

Asian Paints

- in its FY22 Annual report mentioned that its free cashflow was impacted due to conscious build up in raw material inventory. Berger Paints also reported free cashflows of only ~Rs 7crs during the year due to the temporary hit to its gross margins, the build up in its raw material inventory and capex of ~Rs 750crs for its new plant at Lucknow.

“We maintained a higher raw material inventory than normal to address raw material supply uncertainties on account of global supply chain disruptions as well as to contain the impact of rising inflation across key raw materials” – Asian Paints’ FY22 Annual Report

Page Industries,

- free cashflow was impacted due to build up in raw material and finished goods inventory: “…This is the strategic move wherein we are seeing huge potential we thought it is good to invest on inventory…. We also have built up some strategic stock as far as raw material is concerned. This is to enable us to insulate to some extent from the volatile input price and the inflationary pressures which we are facing as far as the inputs are concerned, especially in cotton” – Page’s Q4FY22 concall

Page was able to maintain its margins inspite of yarn prices going up by more than 100% due to a combination of both price increase (of ~13%) as well as strategic buying of raw material and build-up of inventory in anticipation of inflation. Inventory days as a result went up from 70 to 90 days.

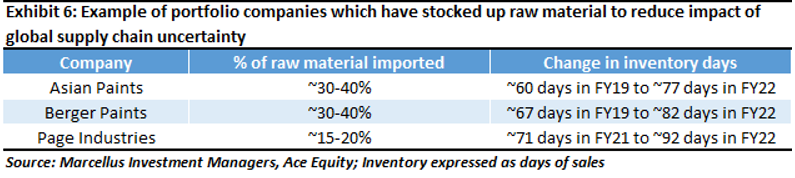

As can be seen in the table below, almost ~20-40% of the raw material for some of our portfolio companies is imported. Hence as the global supply chains were disrupted over the last few months on back of the Russia-Ukraine war and the Chinese lockdowns, it made sense for these companies to load up on cheap raw material when it was available. Resultantly, inventory days for them went up during 4QFY22 vis-à-vis previous years.

Working capital: Part 2- Tactical call on Finished Goods inventory in anticipation of increased demand

The final leg relates to a tactical call taken by some of our portfolio companies with respect to inventory levels of finished goods – which was increased in expectation of a bounce back in consumer demand after seeing a lull during Covid times. For instance, Titan’s free cashflow was negative ~Rs 960 crores during FY22 due to a massive increase in inventory from ~172 days of sales v/s ~142 days of sales in FY21: “In anticipation of a strong Akshaya Tritiya after a gap of 2 years, the Jewellery division has ramped up its Inventory purchases” – Titan’s Q4FY22 Investor Presentation

In the same vein, Pidilite too saw an increase in inventory days from 47 days to 62 days over FY19-22 as the normalcy returned to customer demand: “…this is in preparation for our biggest quarter in the year tends to be part of the April, July quarter. Last year because of all of the issues around the closures etc., so we have basically had whittled down inventory so when you look at the comparison this year we are expecting a normal April to June and we built up the inventory substantially” – Pidilite Q4FY22 concall

Investment implications – Addition of revenue growth drivers, distribution touchpoints and market share gains over the next 3 years-

The steps highlighted above not only improve the longevity of our portfolio companies through addition of incremental revenue growth drivers, but they also help protect margins from the impact of geopolitical uncertainties.

For instance, acquisitions carried out by Asian Paints to catalyze its foray into the Home Décor space have allowed it to offer a comprehensive solution to its customers as well as accelerate the learning curve of building supply chain for various categories in Home Décor. Similarly, acquisition of Suburban by Dr. Lal is expected to accelerate the firm’s growth as the management plans to double Suburban’s business over the next ~2-3 years.

Further, Asian Paints, Page Industries and Pidilite have substantially increased their distribution touchpoints as a result of pro-active steps taken by them to keep augmenting their supply chain efficiencies. For Asian Paints, accelerated investments in a platform to avail painting services not only has the pull of branded service for customers, but it also improves dealer captivity by offering them a chance to earn higher margins (by providing extra services to customers). As a result, the number of dealers associated with Asian Paints has increased from 90k in FY20 to 145k by FY22. Similarly for Page Industries, the benefits of upgraded IT infrastructure is visible in the doubling of multi-brand outlets it services from 55,000 in March 2020 to over 110,000 in March 2022.

Pidilite meanwhile has expanded its distribution in small town India over the last couple of years. “For example, in the year like last year, while most people who are holding their manpower constant, if not cutting down, we actually added people in rural and small town because we saw that growing. We added about 700 new sub-stockists in rural India. We added about 60,000 new outlets. We’re covering 7,000 new villages” – Pidilite’s Q4FY21 concall transcript. This would not have been possible without the tech investments made by the firm in sales & distribution.

Finally, the tactical steps taken with respect to tactical inventory build-up are also expected to help in acceleration of market share gains over the next couple of quarters due to:

- better availability of raw materials (at cheap prices) which would reduce the necessity to raise prices (to the extent the competition would need to raise in order to protect margins); and

- better availability of Finished Goods to meet customer demand (unlike competition which may face stockouts due to sub-optimal demand forecasting and less-than-ideal pre-emptive inventory buildup).