OVERVIEW

The reluctance of Indian lenders to finance capex combined with the rise of automation has jammed the ability of the Indian middle class to get jobs & pay hikes. With incomes stagnant and with Income Tax & GST taking away a growing share of the disposable income of the middle class, it has loaded up on debt to finance its lifestyle in a country with soaring aspirations fuelled by social media. Now evidence is growing that 5-10% of middle-class Indians are in a debt trap i.e., they are taking multiple loans to finance day-to-day consumption and keep up with their debt repayments. Consequently, we are likely to see an extended period of depressed consumption for mass market products in sectors like auto, consumer durables, real estate, building materials and FMCG.

“Karl Marx predicted that the petite bourgeoisie was to lose in the course of economic development. Marx wrote in the Communist Manifesto: “The [petty bourgeoise] sink[s] gradually into the proletariat, partly because their diminutive capital does not suffice for the scale on which Modern Industry is carried on, and is swamped in the competition with the large capitalists, partly because their specialized skill is rendered worthless by new methods of production.”” (Source: https://en.wikipedia.org/wiki/Petite_bourgeoisie#cite_note-:0-5)

It started with Rajan’s AQR

In 2015 the then RBI Governor, Raghuram Rajan, made Indian banks do something that they had rarely done before. He made them conduct an Asset Quality Review (AQR) so that the RBI could assess the real level of non-performing assets (NPAs) in the banking system as opposed to the fictitious NPAs many of the banks were then reporting (thereby boosting their profits, their net worth and consequently their share prices).

Whilst the banks hated the AQR, most observers – including us – believed that the RBI Governor had done the right thing (click here to read a former SBI Chairman’s view on AQR: https://indianexpress.com/article/business/banking-and-finance/sbi-chairman-dinesh-kumar-khara-write-off-era-over-asset-quality-review-served-banking-well-9072202/).

However, one unfortunate and unintended consequence of AQR was that in the decade that followed banks became super reluctant to lend to corporates for project finance. Between FY14-24, loan sanctions by banks for projects in India (i.e., capex) have grown at a CAGR of 12%.

This outcome in turn produced two other unfortunate side-effects: (a) it pushed banks to market loans aggressively to India’s middle class and progressively the middle class sank deeper into debt; and (b) the difficulty of accessing capital for projects resulted in the Indian private sector comprehensively throttling off on capex with the result that private sector job creation has been anaemic over the past decade even in years like FY22-24 when the economy was in good shape.

Stagnant middle-class incomes…

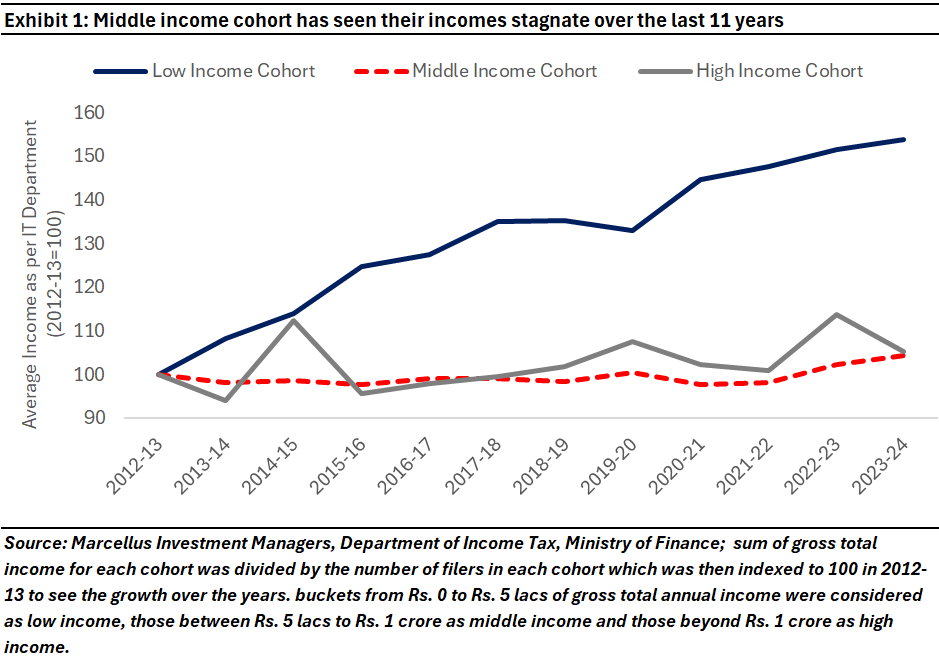

As can be seen in the exhibit below, over the past decade, that 53% of the Indian population that files non-negative tax returns (as of 2023-24) and earns between Rs 5 lacs – 1 crore per annum, has seen its income stagnate (see the dotted red line in exhibit 1). Average annual income for this half of the tax paying population has grown from Rs. 10.23 lacs a decade ago to Rs 10.69 lacs in 2023-24. [Source: Marcellus’ 23rd January 2025 blog, India’s Middle Class is Losing Ground to the Rich & the Poor].

Research from Citigroup shows that after adjusting for inflation, growth in wages for listed Indian firms – a proxy for earnings of urban Indians – has remained below 2% for all the three quarters of 2024, well below the 10-year average of 4.4%. (Source: ET, 13 Nov ’24, https://economictimes.indiatimes.com/news/economy/indicators/indias-middle-class-tightens-its-belt-squeezed-by-food-inflation/articleshow/115242593.cms?from=mdr)

“Wages in urban areas have decreased faster than in rural areas to Rs 12,616 in 2022 from Rs 13,616 in 2012, compared to Rs 8,623 in rural areas from Rs 8,966 over the same period, according to the India Employment Report 2024 released last month.” (source: https://www.business-standard.com/economy/news/real-wage-of-salaried-workers-dipped-in-2012-2022-period-ilo-report-124040100999_1.html)

….alongside rising cost of living, rising tax burden & soaring aspirations…

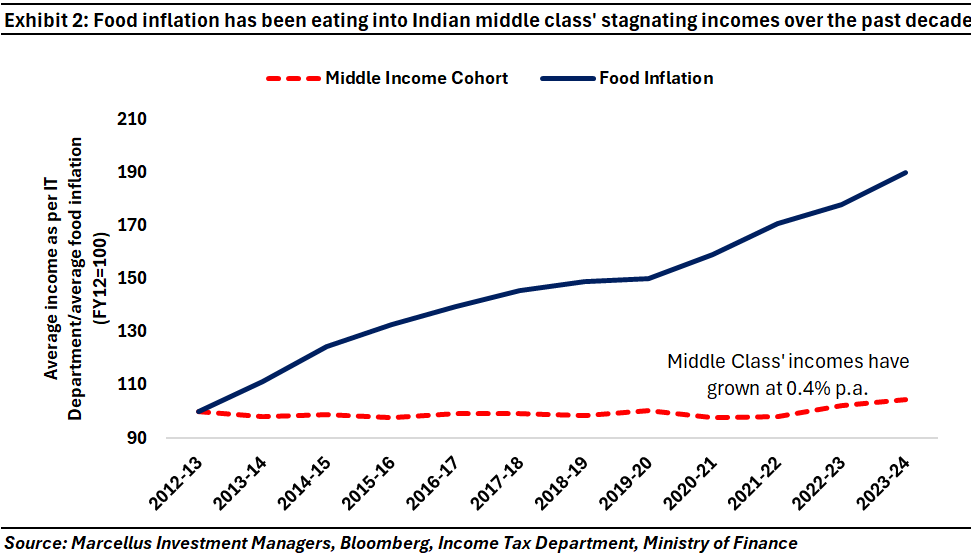

Unfortunately for the middle class, even as its income stagnated over the past decade, the cost of living has risen sharply, especially in the post-Covid era. School fees, rents (or EMIs on home loans), medical insurance premiums and food & FMCG inflation drove a big jump in middle class expenses and squeezed household savings.

“Behind the slowdown in urban demand is the rising cost of food. “The growing food inflation is impacting demand in urban India, particularly for discretionary products,” says Dabur India CEO Mohit Malhotra. Food expenses now constitute 40-50 per cent of a household’s spend, even though the Household Consumption Expenditure Survey reveals a reduction in food expenses in 2023-24—by 3 per cent in urban households and by 6 per cent in rural ones—compared to 2011-12. The middle-class consumer may not be compromising on the quantity she buys, but she may certainly ‘downtrade’—opting for cheaper or unbranded alternatives—or seek value packs with unit price benefits, which does little for a company’s value growth. The sales value of branded edible oil, for instance, dropped by 11 per cent in September 2024, following a 2.3 per cent decrease in September 2023, according to NielsenIQ data.

“Firms like HUL, Marico, Dabur and Tata Consumer Products have also been forced to either raise prices of certain products by 3-5 per cent, or resort to ‘shrinkflation’—reducing the weight of products per package—with the increase in prices of key raw materials, such as palm oil, coffee, cocoa and wheat. Palm oil—a key input for personal care and snack brands—has seen a duty hike of 20 per cent; tea, of 30 per cent. The increase in commodity prices, says Jawa of HUL, has affected sales of their tea brands like 3 Roses, Taaza and Red Label, which cater to the price-sensitive middle class, even as premium ones like Lipton and Taj continue to grow.” [Source: Business Today, 27 Jan ’25, https://www.indiatoday.in/magazine/cover-story/story/20250127-middle-class-the-big-squeeze-2666155-2025-01-17]

“In October, India’s consumer price inflation (CPI), a measure of prices of retail goods, rose to a 14-month high of 6.2 per cent… Food inflation was a big culprit—food and beverages inflation stood at 9.7 per cent in October, the vegetable inflation alone clocking above 42.2 per cent, a 57-month high. And though CPI sobered down to 5.2 per cent by December, food inflation remained high at 8.4 per cent. Meanwhile, house rents are rising, telecom bills escalating….” [Source: Business Today, 27 Jan ’25, https://www.indiatoday.in/magazine/cover-story/story/20250127-middle-class-the-big-squeeze-2666155-2025-01-17]

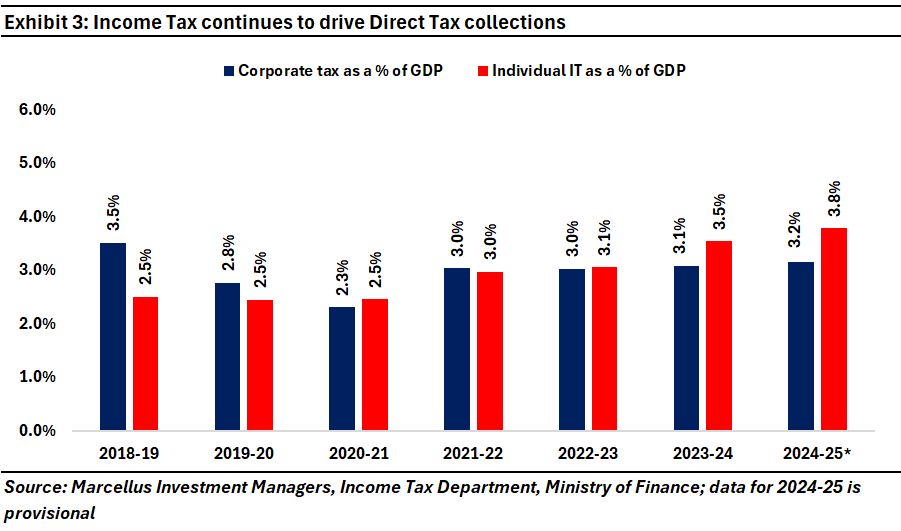

As if stagnant and rising cost of living were not enough, since FY21, the Government has had to rely on the middle class to finance it meagre revenue growth. As shown in the chart below, in the post-Covid world, income taxes as a % of GDP in FY25 are significantly higher than they were before Covid (3.9% now vs 2.4% before Covid). In contrast, the Government’s collections from corporate taxes have fallen significantly (as a % of GDP): 2.8% now vs 3.5% before Covid. Effectively, the Government has shifted a significant part of its tax load away from corporates (through a big cut in the corporate tax rate which the FM announced in Sept 2019) and towards the middle class. The quote from the ‘Communist Manifesto’ cited at the beginning of this note seems increasingly apt in more than one way.

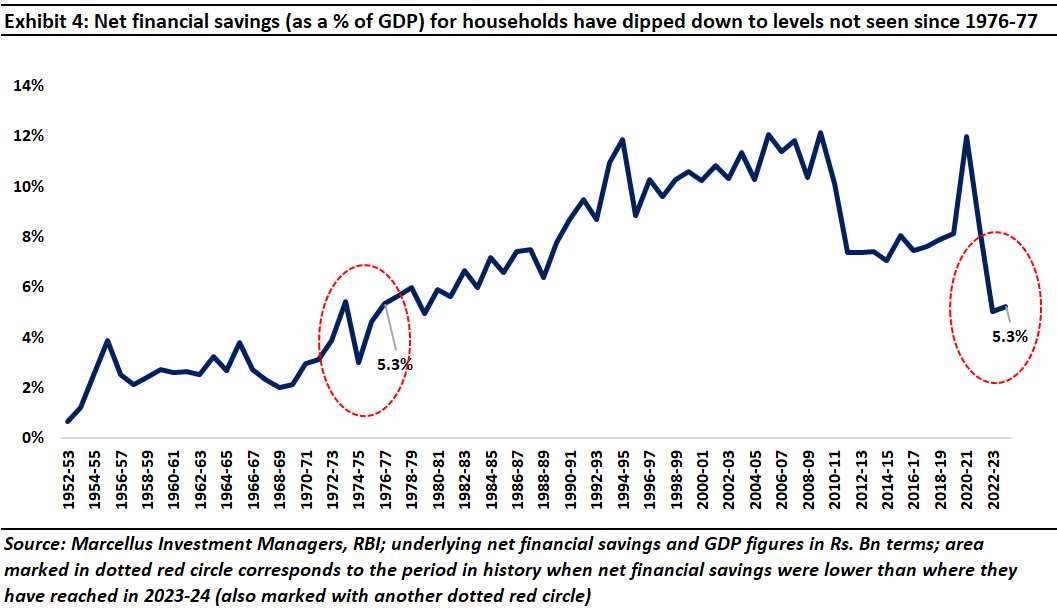

In light of all the above, it is not surprising that the RBI has repeatedly pointed out over the past 6 months that net household savings in India (i.e., household savings less household borrowings) as a % of income is at its lowest since 1977.

In the face of stagnant incomes and rising cost of living, the middle class – given its high aspirational quotient and its addiction to the good life (as displayed on social media) – has chosen to upgrade its lifestyle using the only route open to it, namely, more borrowing. In our travels to small town India, we increasingly hear from the branch managers of India’s leading high street banks that borrowing money to finance a holiday or a high-end smartphone purchase or borrowing money to speculate in the Futures & Options market is increasingly commonplace behaviour in these towns. Branch managers of these banks inform us that such loans are often “pre-approved” by the banks’ lending algos which operate on the basis of the historical credit scores of these borrowers.

In fact, for those in the lower middle class, borrowing money to finance day-to-day expenses is not just increasingly common, but it also doesn’t seem to worry either the borrower or the lender that such state of affairs now exists in one of the poorest nations in the world (as measured by per capita income).

…have resulted in a massive increase in middle class borrowing

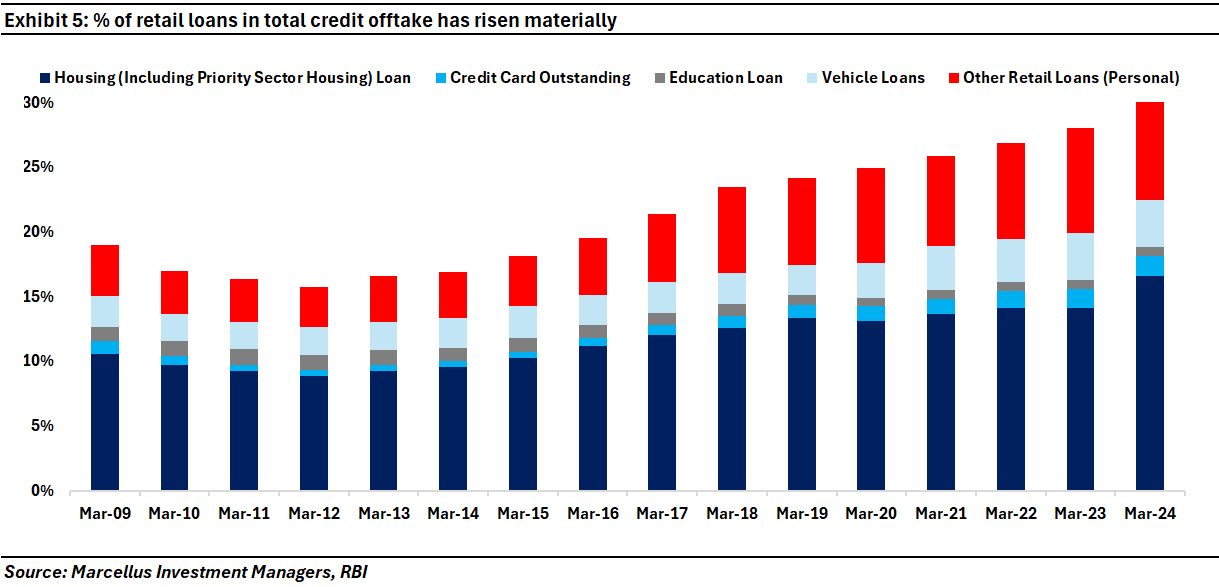

“As per a recent survey by a fintech platform, Saral Credit, about 67 per cent of Indian families have availed of personal loans. Approximately 53 per cent of Indian youth have taken personal loans before reaching the age of 30 years. In addition, during the decade 2014-24, its share in the gross bank credit has increased from 16.9 per cent to 32.4 per cent…

“During the decade 2014-24, such a huge increase in personal loans decreased the share of loans to industries from 42 per cent to 22.2 per cent of gross bank credit..

“In 2024, an estimated 15 to 20 million middle-class Indians, earning between Rs 5 lakh and Rs 30 lakh annually, are relying on instant loans, particularly in tier 2 and tier 3 cities. This group, predominantly aged 25 to 40, includes young professionals, students and micro-entrepreneurs who face rising living costs, stagnant wages and inflation, driving credit dependency for essential expenses…” (Source: Businessworld, 9 Dec 2024, https://www.businessworld.in/article/indias-middle-class-a-debt-fueled-time-bomb-waiting-to-explode-541528#:~:text=The%20debt%20trap%20among%20India’s,families%20vulnerable%20to%20financial%20shocks)

Case study 1: “Rahul Singh, a delivery agent with a food delivery app, said that he had taken credit for home renovation.

“My borrowing behaviour has changed recently only. Initially, I relied on loans primarily for covering essential expenses, such as rent, medical bills and any other unforeseen expenses, which were critical for survival. However, as my income stabilised and I became more aware of the credit options available in the market, I began to view borrowing as a tool for fulfilling my aspirations. One of them being the renovation of my house”, Singh said.

“Today, when I reflect on my borrowing journey, I see a big transformation in both me and my family’s mindset – from borrowing for making ends meet to borrowing for building a brighter future for us all”” (Source: Hindu Business Line 18 Oct ’24, https://www.thehindubusinessline.com/money-and-banking/indias-lower-middle-class-moves-beyond-survival-borrowing-embracing-digital-credit-tools/article68768211.ece)

Case study 2: “Vikas, an auto driver, explained that he had borrowed to purchase a smartphone.

“My borrowing behaviour has shifted significantly when it comes to mobile phones. Initially, I borrowed to purchase basic phone models that met my essential communication needs, was affordable and functional. However, as I gained access to more flexible credit options over time, I borrowed to purchase a smartphone not just out of necessity, but as part of my aspirations to improve my income,” he said…

“For example, my new smartphone helps me to use apps to get customers for a ride and also captures beautiful memories of time spent with my family” Vikas said.” (Source: Hindu Business Line 18 Oct ’24, https://www.thehindubusinessline.com/money-and-banking/indias-lower-middle-class-moves-beyond-survival-borrowing-embracing-digital-credit-tools/article68768211.ece)

Ease of borrowing

UPI, India stack and India’s sophisticated digital ecosystem has made it very easy to borrow money:

“Ashish Tiwari, Chief Marketing Officer, Home Credit India said “Our latest How India Borrows 2024 study highlights a transformational shift in the borrowing behaviour among the lower-middle-class borrowers”.

“It shows an increasing preference towards borrowing for consumer durables and small business ventures and consumer’s growing comfort with app-based banking, chatbots for customer service, WhatsApp payments, and digital literacy, according to Tiwari…

“This reflects not only the evolving financial aspirations of borrowers to enhance their lifestyle and income opportunities, but also the growing role of digital platforms in making credit more accessible, he added.” (Source: Hindu Business Line 18 Oct ’24, https://www.thehindubusinessline.com/money-and-banking/indias-lower-middle-class-moves-beyond-survival-borrowing-embracing-digital-credit-tools/article68768211.ece)

Education loans

The financial challenges facing the middle will escalate especially if they and/or their parents have taken on debt to finance education. As explained in our 3 Jan ’25 blog (https://marcellus.in/blogs/university-education-and-the-illusion-of-learning ), a range of data shows that university education in the context of the Indian job market neither improves pay nor increases the likelihood of employment. Given the limited commercial viability of education, it is worrying that Indian students have borrowed in excess of $8bn to fund their education. Not only is the education loans outstanding a very large figure, but it is also growing at a breathtaking rate: “After a robust growth of over 80 per cent and 70 per cent in fiscals 2023 and 2024, respectively, education loan assets under management (AUM) of non-banking finance companies (NBFCs) is expected to grow at a healthy clip of 40-45 per cent to cross Rs 60,000 crore in the current fiscal from Rs 43,000 crore in FY2023-24, according to a Crisil report.” [Source: https://indianexpress.com/article/business/education-loan-aum-of-nbfcs-to-top-rs-60000-crore-this-fiscal-9548846/#:~:text=indicates%2C%20it%20said.-,According%20to%20RBI%20data%2C%20education%20loan%20outstanding%20of%20banks%20was,lakh%20as%20of%20last%20fiscal]

Given that the commercial viability of university education is questionable in the Indian context, it is not surprising to see NPAs on student loans in India are running at 8% (source: https://varthana.com/student/student-loan-debt-in-india-facts-and-figures/). It is highly likely that this NPA ratio will grow in the years ahead.

The middle-class debt trap

The massive increase in middle class borrowing seen over the past decade has exposed these households to a debt trap i.e., a circumstance where borrowers, having borrowed more than they can possibly repay given their modest incomes, are forced to take out fresh loans to repay the already outstanding loans (see https://www.bajajfinserv.in/how-to-get-out-of-a-debt-trap-with-a-personal-loan). The classic signs of a debt trap is borrowers with modest incomes having multiple debts outstanding. This is exactly what the RBI’s latest Financial Stability Review is pointing toward.

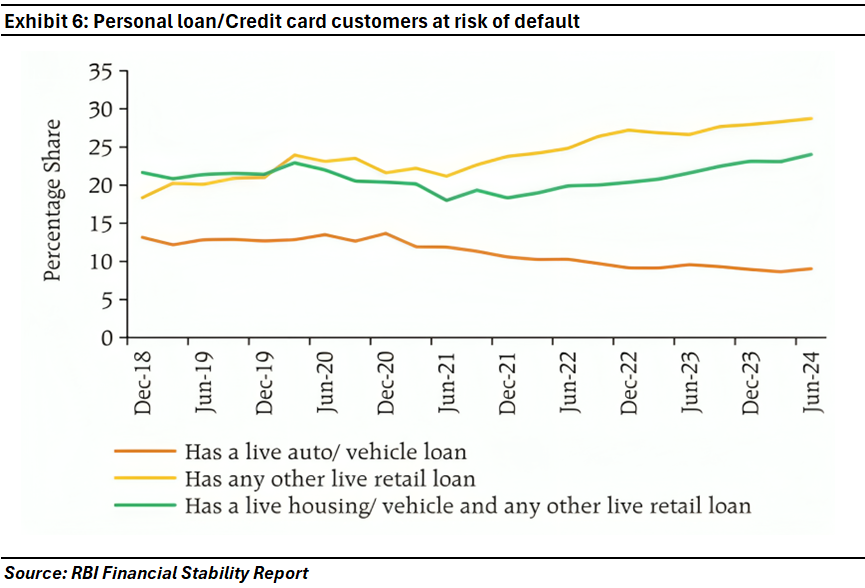

The RBI’s Dec 2024, Financial Stability Review says that nearly half of the borrowers (yellow + green line in the chart shown below) availing credit card and personal loans have another live retail loan outstanding, which are often high-ticket loans (i.e., housing and/or vehicle loan). (Source: https://upstox.com/news/upstox-originals/investing/breaking-down-rbi-s-financial-stability-report/article-139878/)

Now, whilst – in order to be optimistic – we hope that these borrowers with credit card loan and personal loans PLUS another high-ticket loan outstanding (basically, the green line in the chart above) do not default, our scope for optimism is limited when we look at another broad swathe of middle-class borrowers.

Around 45% of India’s retail borrowers have lower credit scores (source: https://economictimes.indiatimes.com/industry/banking/finance/banking/share-of-borrowers-rated-prime-on-rise-shows-transunion-cibil-data/articleshow/113608787.cms?from=mdr). Let’s define this segment of borrowers as “subprime”. As per the RBI, subprime borrowers spend 48% of their loans on consumption, compared to super-prime borrowers – those with excellent credit – who only use 31% of their debt that way. (Source: https://upstox.com/news/upstox-originals/investing/breaking-down-rbi-s-financial-stability-report/article-139878/)

Joining the dots between these pieces of data suggests that between 5-10% of India’s retail borrowers are caught in a debt trap. Here is how we join the dots:

- About 67% of Indian families have availed of personal loans (source: Saral Credit, https://www.businessworld.in/article/indias-middle-class-a-debt-fueled-time-bomb-waiting-to-explode-541528#:~:text=The%20debt%20trap%20among%20India’s,families%20vulnerable%20to%20financial%20shocks)

- Around 25% of these borrowers have credit card loan and personal loans PLUS another high-ticket loan outstanding (basically, the green line in the chart above)

- At least 45% of these borrowers are likely to be subprime ((source: https://economictimes.indiatimes.com/industry/banking/finance/banking/share-of-borrowers-rated-prime-on-rise-shows-transunion-cibil-data/articleshow/113608787.cms?from=mdr) and as per the RBI, subprime borrowers spend 48% of their loans on consumption (Source: https://upstox.com/news/upstox-originals/investing/breaking-down-rbi-s-financial-stability-report/article-139878/).

Multiplying the numbers given in the 3 bullets shown above suggests that between 5-10% of India’s retail borrowers are caught in a debt trap where they are using multiple loans to finance day-to-day consumption.

“Debt trap has a significant impact on middle-class households in India, affecting both financial and mental stability and thus, the overall well-being of the family. Over time, this situation can cause stress and affect mental health, potentially leading to strained relationships…” Shah told BW…

“Notably, the Covid-19 pandemic exacerbated these challenges, with household debt rising from 32.5 per cent of GDP in 2019-20 to 37.3 per cent in 2020-21…

“According to a recent report by the RBI, India’s household debt-to-income ratio has risen to 37.3 per cent in 2022, up from 30.4 per cent in 2018.” (Source: Businessworld, 9 Dec 2024, https://www.businessworld.in/article/indias-middle-class-a-debt-fueled-time-bomb-waiting-to-explode-541528#:~:text=The%20debt%20trap%20among%20India’s,families%20vulnerable%20to%20financial%20shocks.)

Investment implications

- We are likely to see an extended slowdown in consumption especially pertaining to the major products that the middle class buys e.g., scooters, entry level cars, entry level consumer durables, rail tickets, FMCG products. “Data from the National Statistical Office (NSO) shows that India’s private consumption growth slowed down to 5.3 per cent in 2022-23, compared to 7.9 per cent in 2019-20.” (Source: Businessworld, 9 Dec 2024, https://www.businessworld.in/article/indias-middle-class-a-debt-fueled-time-bomb-waiting-to-explode-541528#:~:text=The%20debt%20trap%20among%20India’s,families%20vulnerable%20to%20financial%20shocks.

- We are already hearing reports from several Indian cities that supply of new flats is exceeding demand. A corollary of excessive middle-class indebtedness would be slowing demand for real estate and consequently for building materials. More generally, the purchase of anything which the middle class deems to be non-essential is likely to be postponed until the debt burden eases and/or incomes start rising at double digits.

- The combination of rising NPAs and falling savings exerts a double squeeze on low quality lenders and squeezes, both, their earnings growth and the growth in their net worth. That in turn is likely to drag down credit growth in the country as a whole.

The good news is that both the Finance Ministry and the RBI appear to be awake and alive to dangers posed by middle class indebtedness. The FM’s Rs 1 tn Income Tax cut on incomes below Rs 12 lakh was timely. The RBI’s inauguration of its rate cutting cycle on 7th February was just as timely. However, these policy measures are modest, and they will take a few quarters to bite. Until then the consumption slowdown is likely to rumble on.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). The views and opinions expressed in this material are those of the writers/authors and do not necessarily reflect the official policy. This material is for informational and educational purposes only and should not be considered as financial, investment, or other professional advice. The inclusion of any book does not imply endorsement or recommendation by the writers or the publisher of this material.

If you want to read our other published material, please visit https://marcellus.in/insights

The above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.