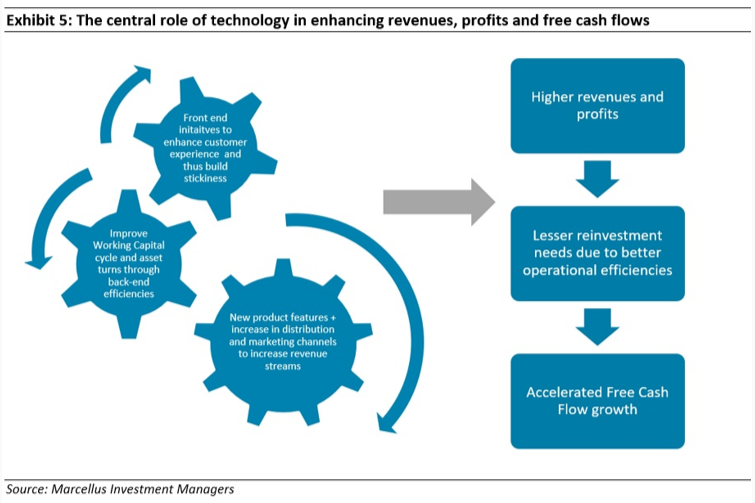

Rising Giants have been at the forefront of implementing tech solutions to sustain their competitive advantages, drive efficiencies (around cost, working capital and asset utilisation) and build scalable organisations (transitioning from single to multi-product & multi-geography companies). At the same time, the relatively low-cost but high impact nature (low marginal cost & ability to scale rapidly) of new age modular technologies like cloud, mobile & software-as-a-service means an acceleration in not only revenue and profits but also the free cash flows for these firms. Furthermore, specific initiatives taken in FY22 (analysed through annual reports) indicate that there is no let down in the tech orientation of most RG portfolio companies.

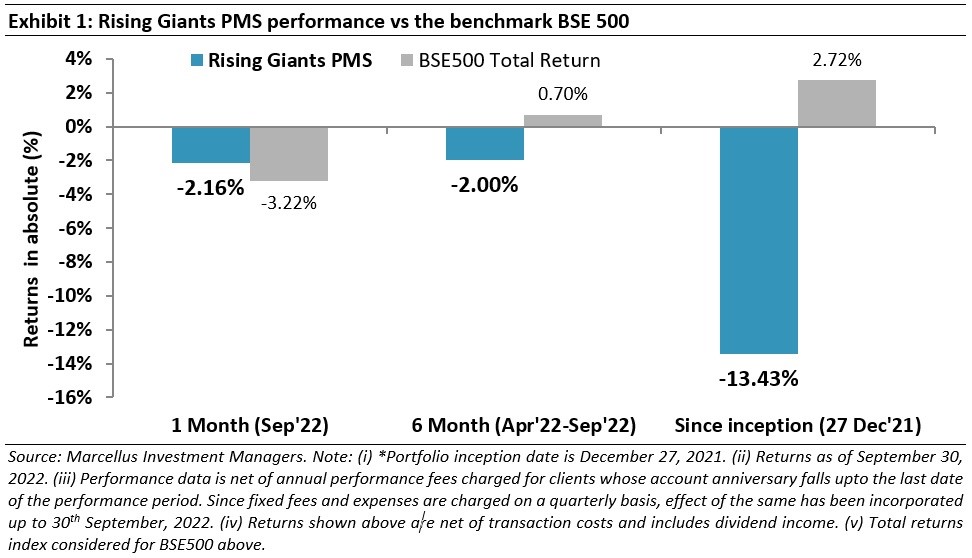

Performance update for the Rising Giants PMS

This portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Well moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

How Rising Giants companies are using technology to scale up revenue, profits and cash flows

As discussed in our earlier newsletters, one of the defining success factors for the Rising Giants (RG) vs their peers have been their high capital reinvestment initiatives to either strengthen the existing business and/or add new growth drivers. In recent quarters, the RG companies have further accelerated their reinvestment levels by capitalising on their war chest built through strong internal accruals and exploiting the market opportunities for consolidation (domestic as well as global) brought upon by Covid-19. For instance, at the portfolio median level, the capex/strategic investments undertaken by RG companies in FY22 is more than 2x the corresponding annual average between the FY19-21 period. More details on the reinvestment initiatives of RG companies (both organic & inorganic) can be found in our August 2022 newsletter.

Rising reinvestments is typically a sign of management’s optimism surrounding the business. However, at the same time, increasing investments in new business segments, new geographies and particularly inorganic expansions (a key growth strategy employed by RG companies) can pose challenges around managing a much bigger and more complex organisation. This challenge is usually amplified for small & mid-sized companies which are transitioning from being a tightly managed single product, single geography business to a multi-product, mutli-geography company.

While capital is a key enabler of growth, there are two softer factors that play key roles in successfully and profitably scaling up the businesses:

- Management bandwidth: Smaller companies typically involve a single person at the helm of the affairs with his/her skills (technical, sales and/or managerial) being a key competitive advantage of the company for many years. As the company expands, the rising business complexities (managing newer units, newer geographies, etc) require delegation of key responsibilities to a wider set of people. However, there are many challenges involved in transitioning towards a decentralised management construct in such companies, namely: (i) reluctance on the part of the founder(s) to yield power and delegate responsibilities; (ii) complication arising from too many family members’ involvement in the business; and (iii) inability to attract top quality talent due to the small size of the business and the promoter’s overarching influence. These HR issues eventually become key roadblocks to scale up the business.

We have discussed in detail how RG companies are building management bandwidth to manage larger & more complex organisation in the August 2022 newsletter.

- Tech based systems and process: There are several headwinds typically encountered in scaling up a business such as: (i) catering to varying demographics across various geographies; (ii) driving collaboration between various business functions (Manufacturing, Sales & Marketing, Corporate HQ, etc) spread across multiple locations; and (iii) maintaining the agility to respond to opportunities whilst driving continuous improvement in the business. All of this becomes exponentially more challenging as an organisation gets bigger. Such scalability-oriented challenges can be mitigated through timely investments in tech solutions which utilize data and analytics to institutionalise execution capabilities at the ground level.

Fortunately, the changes in the tech landscape have made the adoption of such IT systems more affordable than before. Until about a decade or so ago, using tech extensively to drive revenue growth or business efficiencies was largely the privilege of large companies due to high fixed cost, hardware-oriented nature of investments. However, over the past decade, the rise of cloud computing and software-as-a-service (SAAS) on the one hand and the rise of mobile as a customer touchpoint has resulted in much wider access for smaller companies to world class technology.

‘Technology’ in and of itself is a broad term that encompasses an array of things including product innovation & R&D, manufacturing process engineering, customer facing systems, etc. In this month’s newsletter, we delve deeper into how RG companies are using Information Technology (IT) systems and processes to manage much bigger & complex organisations and drive business growth. We also touch upon specific tech related initiatives taken by the RG companies in FY22.

The remainder of this newsletter discusses in three parts the key tech related initiatives undertaken by RG companies:

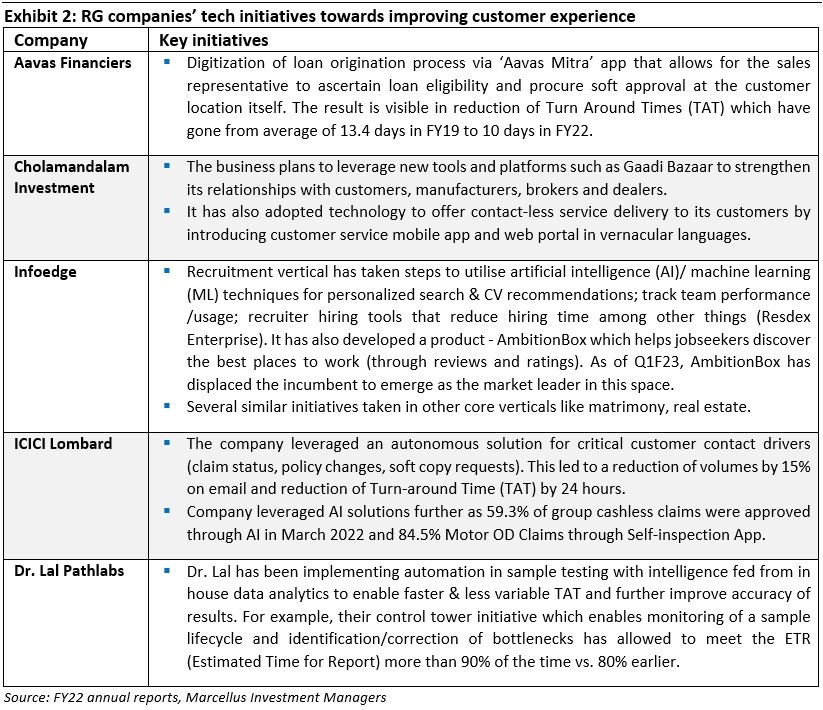

#1 Tech initiatives to enhance the front-end/customer experience

A key competitive advantage of many of the RG companies is the quality of customer experience they offer compared to their peers. Many of the companies in our portfolio have undertaken steps to offer more functionalities in their product/service as well as make the entire journey as seamless as possible for the customer using tech. This is particularly true for B2C and Financial Services focussed portfolio companies. We highlight some of the instances below:

- Aavas Financiers and Cholamandalam Investment use their tech investments behind customer data collection and analysis to help complete credit assessment and provide loan approval to a new customer in a substantially shorter period of time compared to other lenders. This is one of the strongest areas of differentiation for these firms.

- In case of Dr Lal Pathlabs,the test results/diagnosis is the key starting point for a patient’s treatment. Thus, the Turn Around Time (TAT) of test reports, their accuracy and the doctor’s trust in them are the most important drivers in the patients’ decision making behind choosing a diagnostics partner. Dr. Lal has been implementing automation in sample testing with intelligence fed from in-house data analytics to enable faster & less variable TAT and further improving accuracy of results.

Some specific tech initiatives towards improving the customer experience undertaken by the RG companies in FY22 are highlighted in the exhibit below.

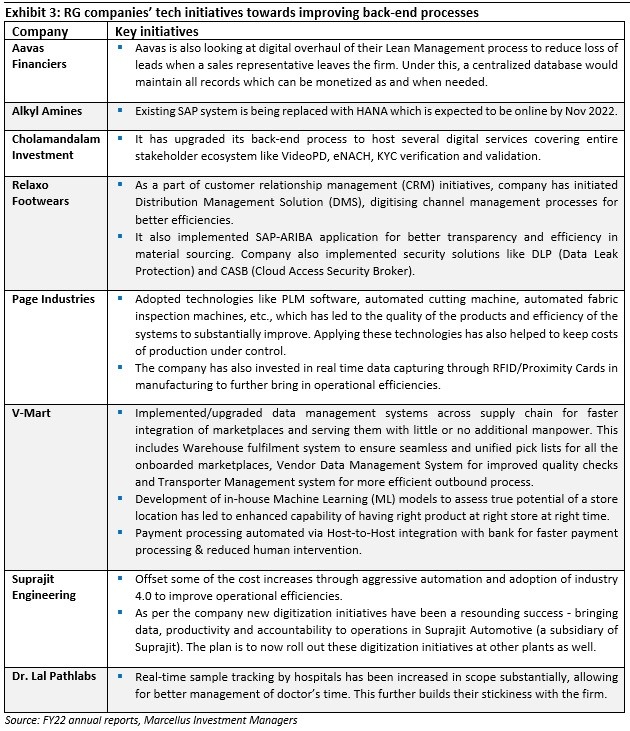

#2 Technology initiatives to improve back-end processes & systems

As discussed earlier, capital allocated towards new products (or new business segments) and geographical expansion has been a key growth driver employed by several RG companies. In this regard, a robust backend that allows seamless interlinkages between different business segments plays a critical role in managing the expanded operations. Tech investments allow this objective to be achieved in turn driving operational efficiencies across the organisation. Some instances of how RG companies have built a robust tech backend to gain competitive advantages are:

One key competitive advantage of Suprajit Engineering is having a multi-locational presence closer to the key customers which facilitates close interactions and involvement of the onsite design/development team with OEM customers, aiding both shorter response time for product development, customising requirements and getting entrenched in the OEMs’ supply chain ecosystem. However, a challenge here is ensuring efficiency levels across such a vast network of plants (including a rising number of global plants due to acquisitions in the recent years). Suprajit is trying to solve this problem through adoption of digitalization initiatives in its plants where all the data around productivity is captured through sensors on a real-time basis and can be accessed anywhere through cloud. This initiative has been currently undertaken in the one of the plants and will be expanded to other plants over time.

- The key reason for V-Mart’s significantly lower inventory levels vs peers is its heavy investment into technology to automate various aspects of supply chain. For example, V-Mart has automated inward, sorting and outward activities at its central warehouse. Similarly, V-Mart has extensively used technology to become more process oriented and intelligent at merchandise selection & replenishment. Since V-Mart has invested in analytics from an early stage in the firm’s lifecycle, this has helped it become better at forecasting its merchandise sales for different SKUs at different locations and at different points of time. These insights have been used to implement an Auto Replenishment System to refill stores.

Some specific tech initiatives towards improving back-end process undertaken by the RG companies in FY22 are highlighted in the exhibit below.

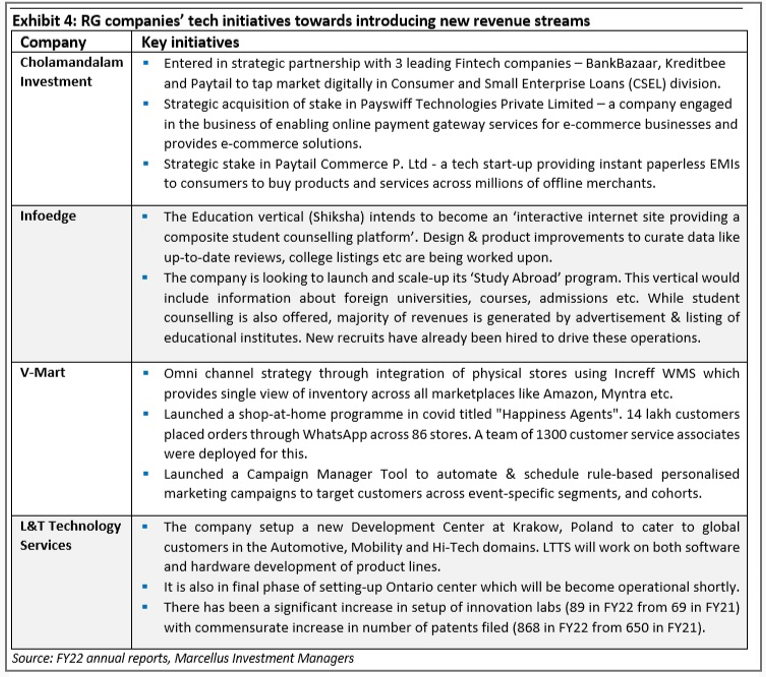

#3 Technology initiatives to create new revenue growth drivers

Alongside attainment of better customer experience & operational efficiencies, technology implementation can also help in developing new potential revenue streams. In their FY22 annual reports, some of our portfolio companies highlighted initiatives around new product introductions, new distribution channels & new marketing campaigns to provide further impetus to their growth trajectories. Some instances:

- VMart is aggressively investing in its omni channel initiative which would open up new customer segments as they can access its products digitally through various marketplaces like Amazon and Myntra. It has also leveraged WhatsApp as a platform for customers to shop from the comfort of their homes resulting in 14 lakh customers placing orders through WhatsApp across 86 stores. Additionally, its Campaign Manager Tool aims to roll out rule-based personalised marketing campaigns to target specific customer cohorts, potentially increasing marketing yields.

- The education vertical of Infoedge intends to provide an entire gamut of services and transform into an ‘interactive internet site providing a composite student counselling platform’. Within this it plans to launch and scale up its ‘Study Abroad’ program which would help add revenues from advertisements and listings of foreign universities.

Some such initiatives undertaken by our portfolio companies in FY22 are highlighted below:

In summary, the initiatives highlighted in FY22 annual reports give us confidence that there’s no let down in terms of Rising Giants being at the forefront of utilizing tech to aid their business evolution. This gives us confidence about the longevity of their competitive advantages which combined with low marginal cost and high impact nature (due to ability to scale rapidly) of technological solutions would drive long term free cashflow compounding.