The BSE500 index companies (especially the bottom 250 market-cap companies in the index) have witnessed significant moderation in their earnings in recent quarters. This together with their elevated valuations (especially for the smaller cap stocks) represents a formidable challenge for most smidcap portfolios in India. In this difficult environment, the Rising Giants portfolio companies’ earnings continue to hold up (allocation weighted earnings up 12% in 3QFY25) while their valuations have also come off sharply (thanks to EPS growing faster than share prices for many RGP stocks). Moreover, our decision to gradually increase our cash holdings from Aug 2024 onwards has paid off. This cash will provide us an opportunity to buy/increase position in high quality stocks when the smidcap dislocation climaxes.

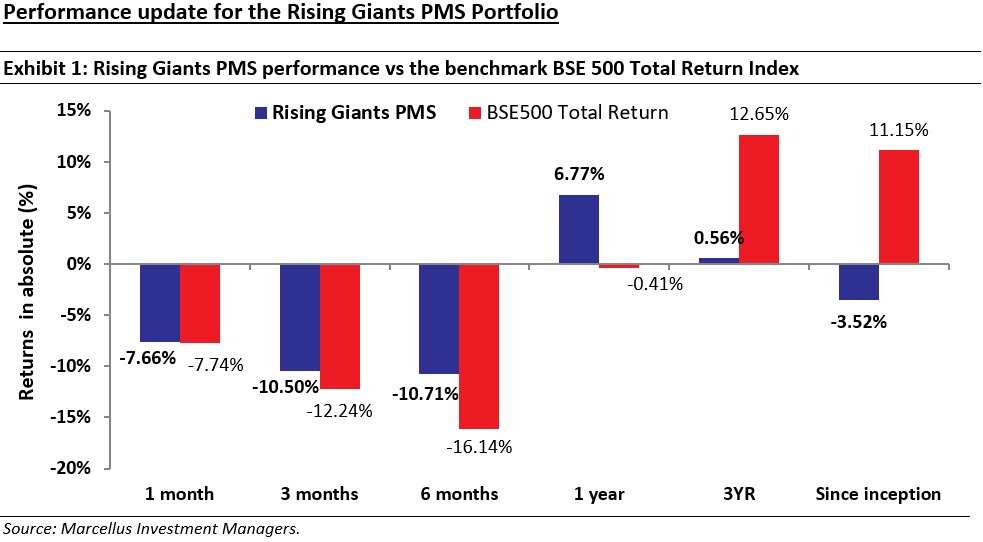

Note: (i) Portfolio inception date is December 27, 2021. (ii) Returns as of February 28, 2025. (iii) Performance data is net of annual performance fees charged for clients whose account anniversary falls up to the last date of the performance period. Since fixed fees and expenses are charged on a quarterly basis, the effect of the same has been incorporated up to 31st Dec 2024. (iv) Total returns index considered for BSE500 above. (v) Performance data is not verified either by Securities and Exchange Board of India or U.S. Securities and Exchange Commission.

For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer the following link, https://www.apmiindia.org/apmi/welcomeiaperformance.htm?action=PMSmenu . Under PMS Provider Name please select Marcellus Investment Managers Private Limited & select your Investment Approach Name for viewing the stated disclosure.

Rising Giants earnings growth continues to hold up amidst slowdown in broader corporate earnings

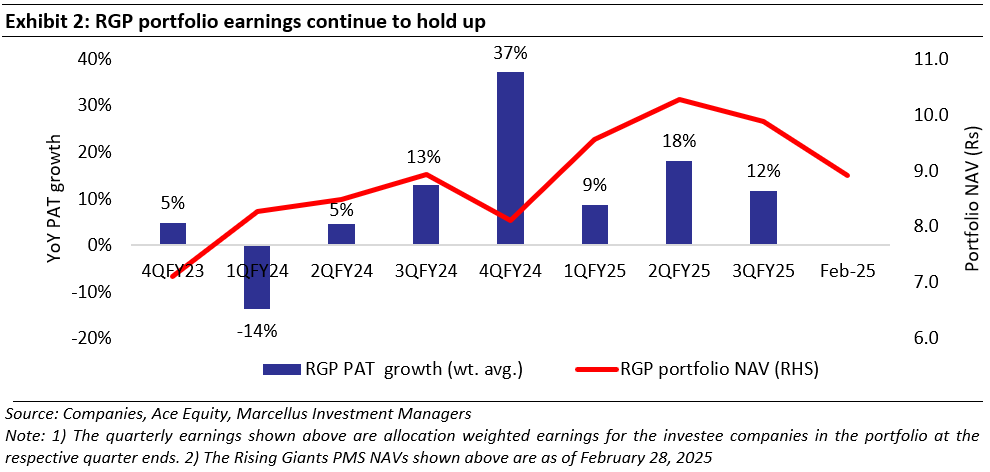

For 3QFY25, the Rising Giants PMS portfolio recorded allocation weighted earnings growth of 12% YoY. This is in addition to the 18% YoY growth witnessed in 2QFY25 earnings.

The key drivers of the double-digit earnings growth in the RGP portfolio in the recent quarters have been:

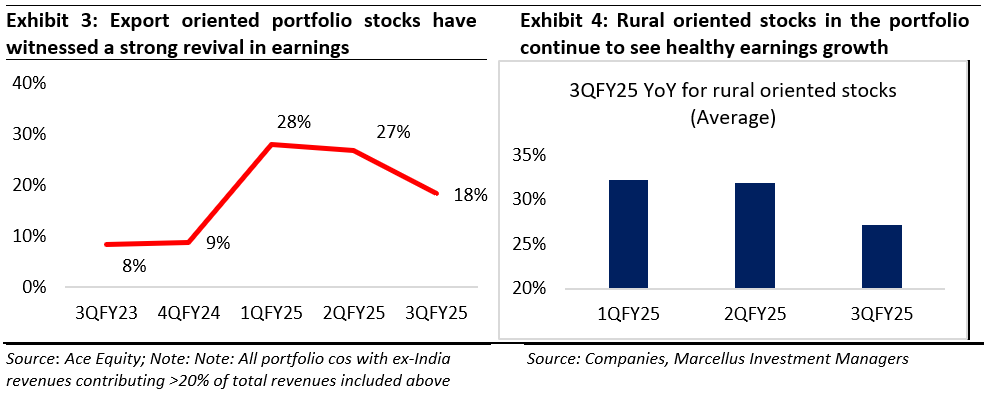

- Green shoots in Export markets. The weakness in the exports markets served as achilles heel for the portfolio in FY24. However, now a revival in export markets has come to the rescue when the domestic macro is not looking good. Most of the Exports oriented companies in RGP portfolio has recorded double-digit growth in 3QFY25. The average YoY PAT growth for the export-oriented portfolio companies in the Rising Giants portfolio has been close to 17% as shown in the exhibit below.

- Rural oriented stocks (eg. Dodla Dairy and Godrej Agrovet) have done well in terms of earnings growth.

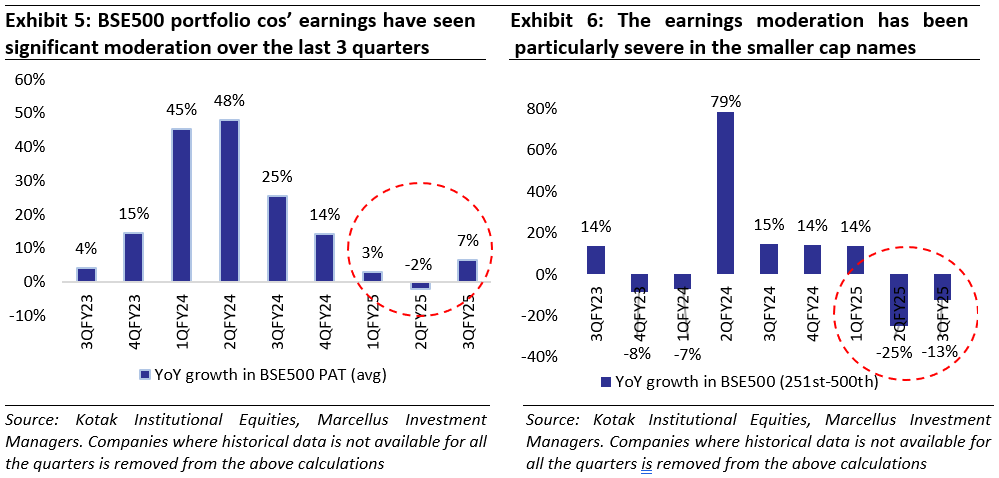

In contrast, there has been a decisive slowdown in the broader corporate earnings…

After growing handsomely over FY24, the wheels of the broader corporate earnings seem to have come off in the last 3 quarters with average YoY PAT growth for BSE500 cos moderating to single digits from 1QFY25. Infact the deceleration in the earnings growth has been much sharper for the smaller cap stocks within BSE 500 – with average double digit YoY PAT declines in 251st to 500th ranked market cap companies within BSE500.

While there could be many reasons for the same – we believe the two factors are important:

- Decline in consumption, particularly the urban consumption, brought upon by a weakened financial position of the Indian Middle Class. A key underlying reason for this is the job losses coming from technology replacing human jobs amidst cyclical downturn in the economy. The household balance sheets appear to be in the worst shape since nearly 50 years – for instance the level of household savings is at a 50-year low. As a result, we are seeing a broad consumption slowdown across categories ranging from staples to passenger cars. Why is the Indian Middle-Class Suffering?

- Another reason for the earnings conk-off in the recent quarters is the substantial slowdown in Government capex which in fact has helped the relevant companies deliver strong earnings in the previous quarters. From nearly 25% YoY growth in FY23 followed by 28% in FY24, the YTD FY2025 (April – January 2025) government capex is up just 5% YoY.

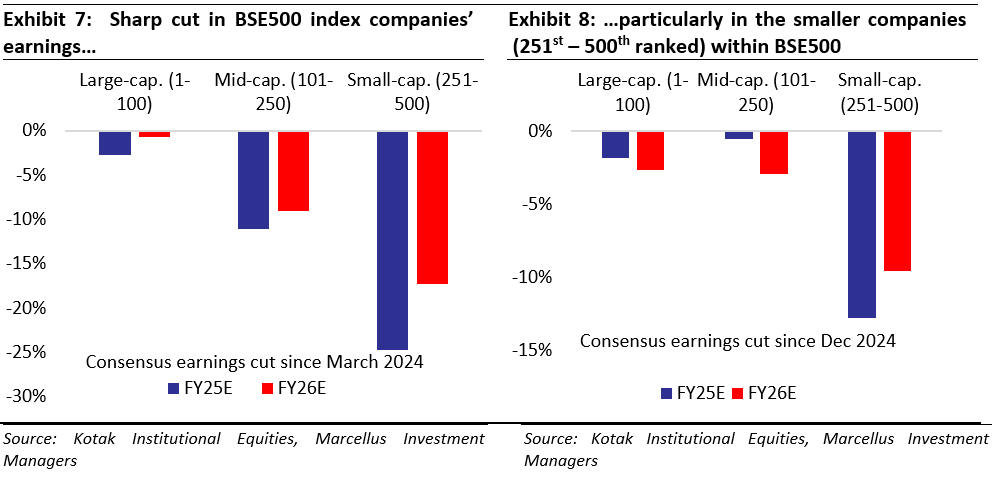

…Leading to sharp cut in consensus estimates

Given this persistent weakness in the index constituents’ earnings over the last few quarters, we have seen consensus downgrading their estimates. Here too, the estimates downgrades have been sharper for the smaller cap stocks (251st – 500th market cap) within the BSE 500. We think the corporate earnings slowdown cycle which seems to have kicked off in the last 2 quarters are likely to last for some time now. In this context, the 30% YoY earnings growth for the smaller cap companies for FY26 built in by consensus look clearly at risk.

Sharp divergence in the valuation between the RGP portfolio and the benchmark

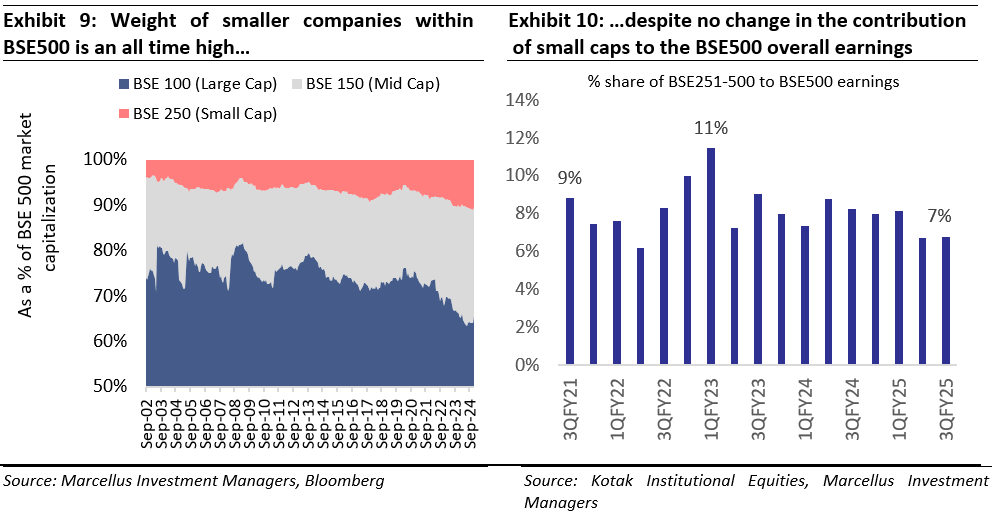

Another cause of worry, besides the deterioration in fundamentals, is the current elevated level of valuations, especially for the smaller cap stocks.

The left-hand exhibit below indicates that within BSE500, the weightage (basis the market capitalisation) of the bottom 250 companies is at a historically high level. This increase in market cap weights, however, doesn’t seem to be justified by the fundamentals. For instance – when we look at the contribution of the earnings of the BSE251st -500th ranked companies within the overall BSE500 – it is one of the lowest currently (refer the right-hand side chart below).

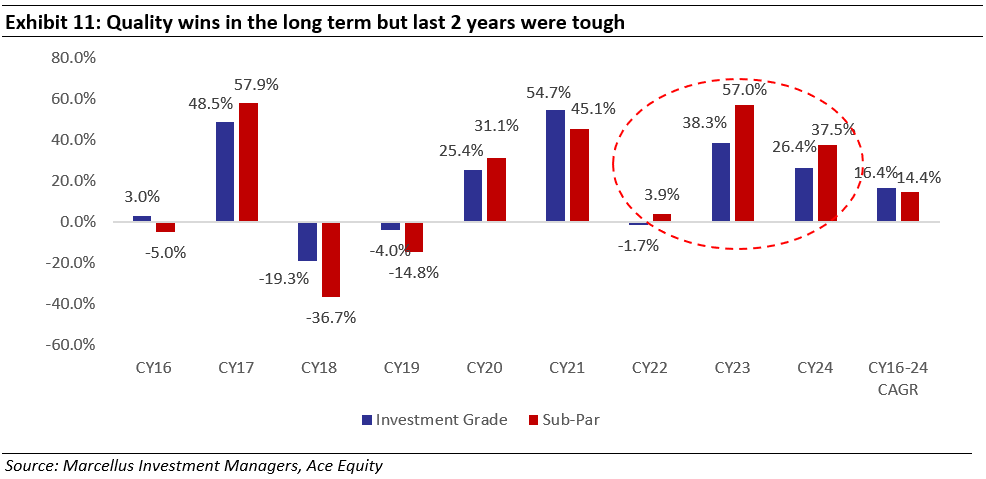

The distribution of the share price performance as per our decile based Forensic framework (D1 being companies with best accounting quality and D10 being the worst) also raises concern. We have seen historically that when bottom decile stocks perform well – it has pointed towards valuation excesses, followed by periods of steep correction in small caps in general and poor accounting quality companies in particular. We have seen bottom decile companies now outperforming the top-decile companies over CY23 and CY24 which is concerning given the historical context explained above.

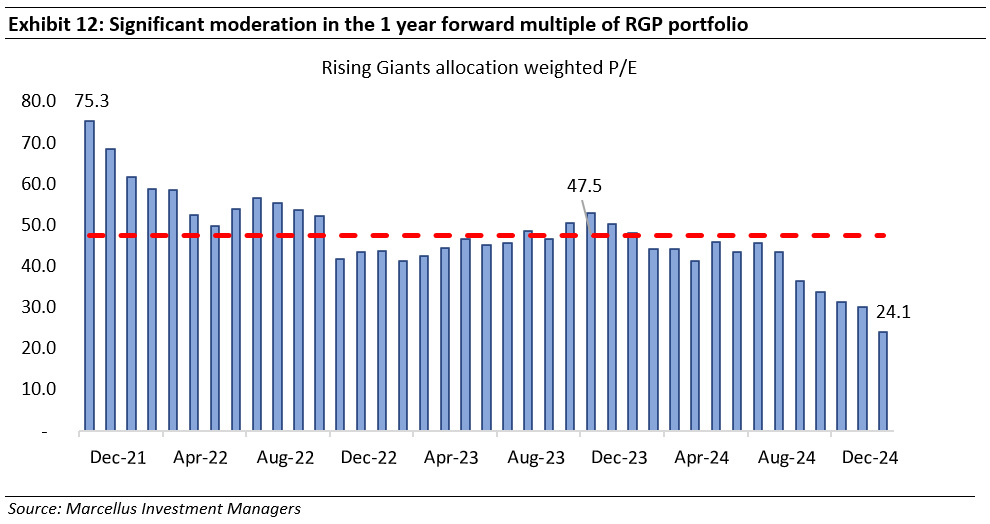

…On the other hand, RGP valuations have a come off

On the positive side, the valuation multiple for the RGP portfolio has come down sharply from the highs of the previous periods as visible in the below exhibit.

Increasing cash position in the current environment to mitigate the likely drawdowns in the small-mid cap space

Given our concern around the small-mid caps valuation in general together with deceleration in the earnings and further – we do anticipate further correction in the space.

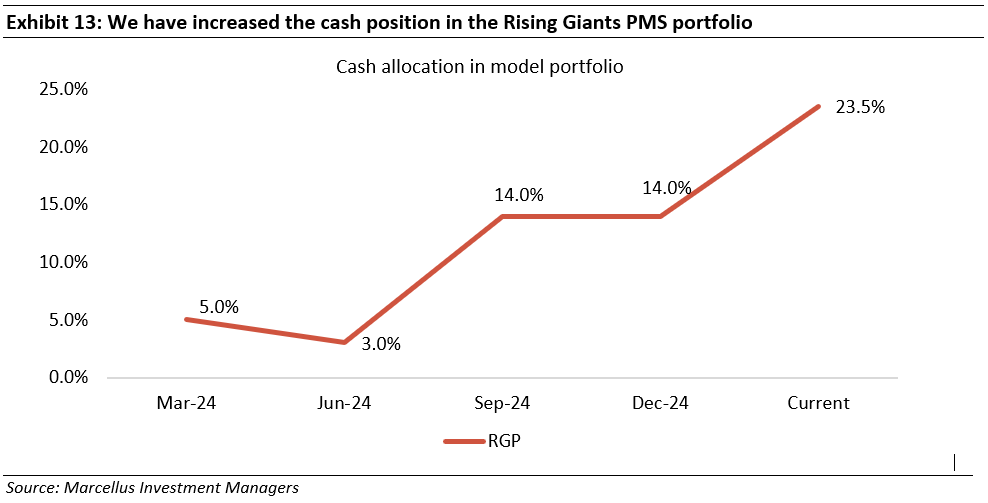

In this context, we have increased the cash position in the portfolio. This we have been doing through the year: For instance – from the low of 3% at June 2024-end; it has now increased to 23.5% as at February 28,205. Infact we are using the recent days pull-back in the markets to further ramp up the cash position.

Two things give us conviction that we are doing the right thing here:

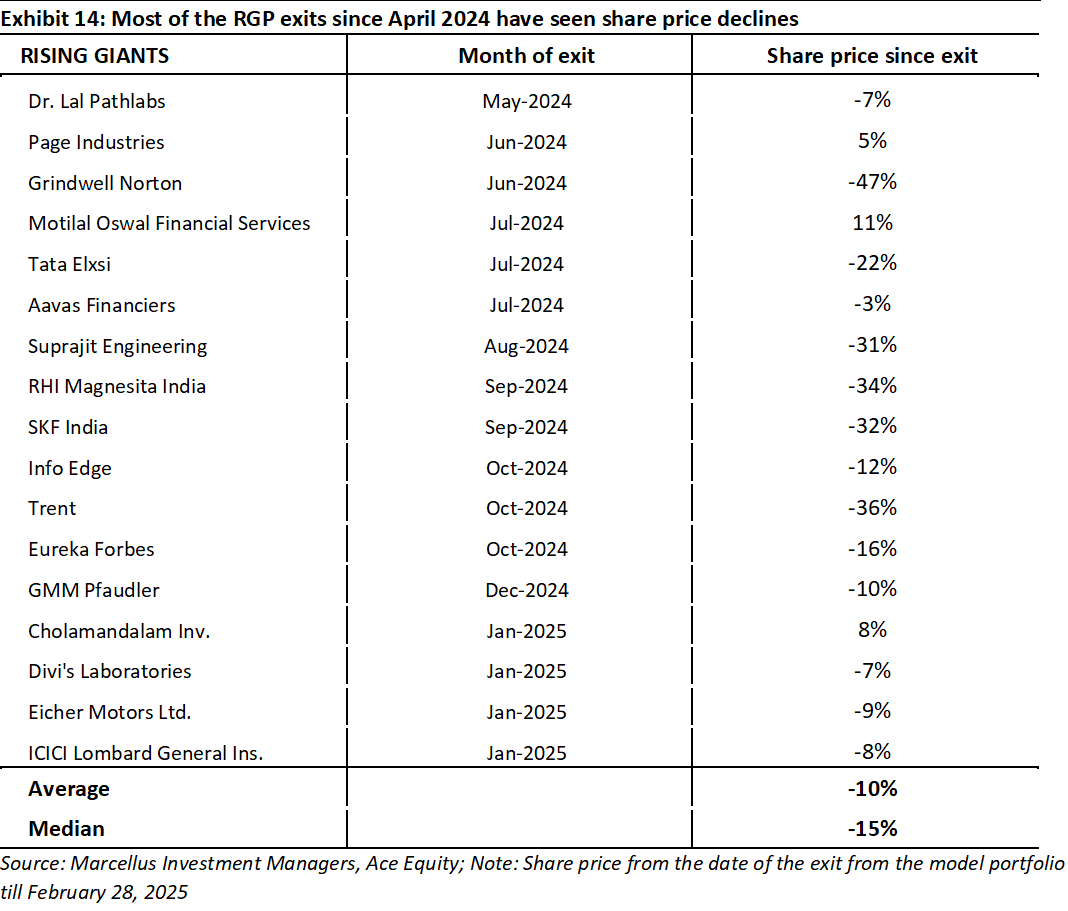

- When we look at stocks that we have exited from the portfolio since April 2024, they have on an average seen 10% decline in their share prices indicating the strategy has worked out so far;

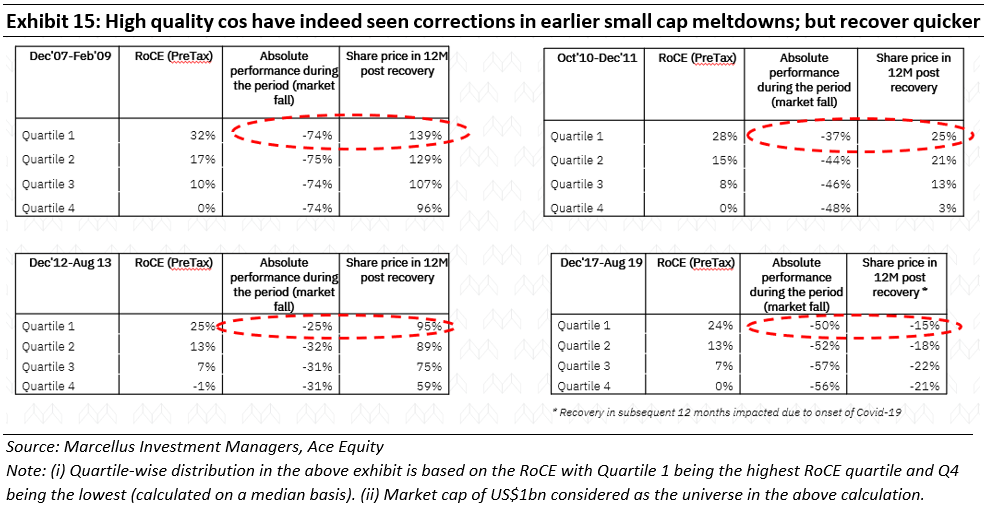

Past precedents show that good quality stocks do fall during periods of market slowdown – hence cash will give some mitigation against these fall. Secondly, we will also get an opportunity to nibble into good quality stocks which can stage a strong comeback once the dust settles.

If you would like to read our other published materials, please visit: https://marcellus.in/