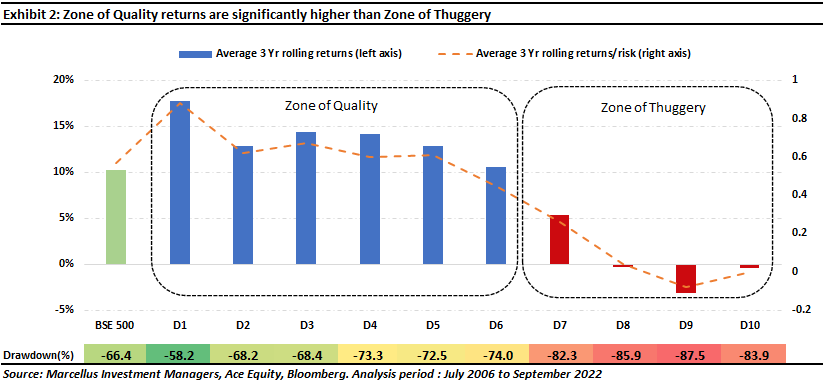

Over the past 16 years, the average return of market cap weighted BSE 500 index has been 10.3% p.a. on a 3-year rolling basis. But the story changes completely when we differentiate between the index constituents based on their accounting quality. There is a clear deterioration in returns and a rapid increase in risk and drawdowns as we move towards the realm of inferior accounting quality. In MeritorQ, we use 11 forensic ratios to evaluate the accounting quality of Indian companies. Accounting quality checks under this framework identify accounting frauds well in advance thus avoiding sudden and permanent loss of capital. Forensic screening step in MeritorQ adds significantly to the overall risk adjusted returns of the strategy and further helps in avoiding value traps.

“It has been far safer to steal large sums with a pen than small sums with a gun” – Warren Buffett

When higher risk does not lead to higher returns

Looking for companies with clean accounts which pass our forensic screening process is an important pillar of the investment process at Marcellus. As we have highlighted previously in “Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation” (2021) and in many of our publications, investing in companies with governance issues and accounting irregularities in a broad-based index like the BSE 500 can lead to permanent loss of capital.

Our analysis shows that roughly 40% of the BSE 500 constituents or ~200 companies exit the index over 10 years due to accounting issues or capital misallocation. Given this perturbingly large number of companies in India which underperform due to accounting issues, investors should attach equal if not more importance to staying away from dubious companies vis-à-vis discovering great companies.

The financial statements of a company provide an avenue for investors to understand and evaluate the operating performance, business strength, and financial health of a company. Hence, if the financial statements themselves are inaccurate, the whole edifice on which the analysis rests, is rendered invalid. As a result, forensic screening of the BSE 500 is the very first step in the MeritorQ investment process.

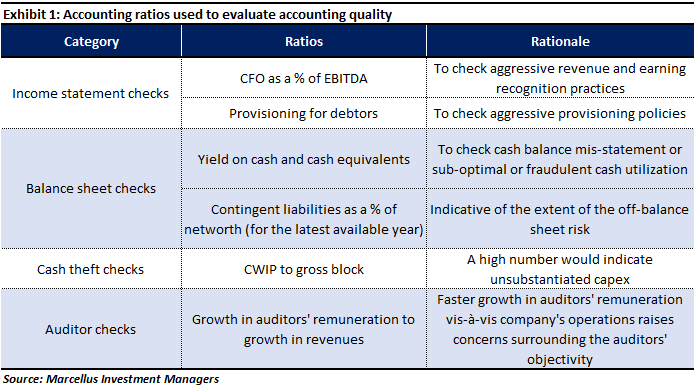

Marcellus’ forensic accounting framework covers checks around every aspect of a listed company’s audited financial statements like the income statement (revenue/ earnings manipulation), the balance sheet (correct representation of assets/liabilities) and the cashflow statement (correct reporting of cashflows). Furthermore, we also use specific ratios to check the quality of the financial auditor. Some of the key ratios in our forensic accounting process are highlighted in exhibit 1.

The benefit of using forensic accounting is tangible. As explained in our newsletter dated December 2022, MeritorQ: The Moneyball of Quality Investing, the forensic screening step by itself adds around 5.5% per annum to the average back-tested returns of the strategy versus an equally weighted portfolio of BSE 500 companies while almost doubling the risk-adjusted returns.

In MeritorQ, the forensic screening process buckets BSE 500 companies (excluding insurance companies) at each semi-annual rebalance date into 10 equal sized buckets (deciles) based on their ranks. These ranks are calculated basis the 11 forensic ratios for non-financial companies – as explained in ‘Diamonds in the Dust: Consistent Compounding for Extraordinary Wealth Creation’ – see chapters 2 & 3 of the book. Banks and lenders are ranked separately over a different set of ratios.

This forensic accounting process results in the cleanest and best companies ending up in the top 3 deciles, questionable ones in the next 3, and earnings manipulators in the bottom 4 deciles. Companies in the bottom 4 deciles (“Zone of Thuggery”) are completely excluded from any further analysis.

Exhibit 2 shows the average 3 year rolling returns across forensic deciles over a 16-year period from July-2006 to September-2022. Constituents in each of the decile are equal weighted.

The red line represents the average return per unit of risk as we move from highest accounting decile D1 to the lowest D10. It is clear from this analysis is that as we move towards inferior accounting quality deciles returns decrease, and risk as well as drawdowns increase.

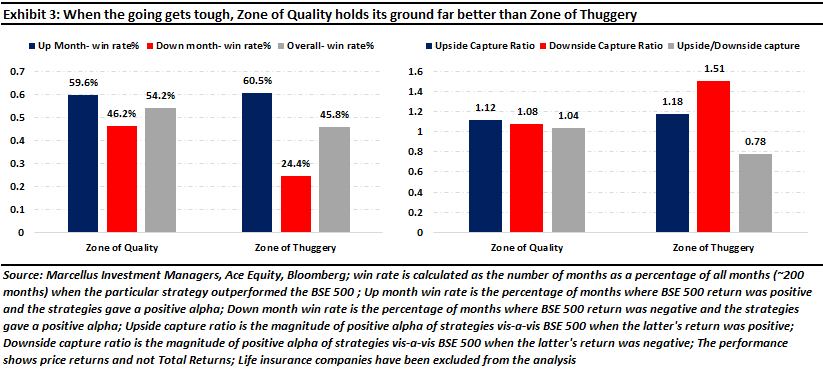

In Exhibit 3 below we show the win rates and capture ratios for both these portfolios. The “Win rate” for a portfolio refers to the percentage of months in which that specific portfolio has outperformed the BSE 500 over the back-test period (which spans around 200 months). An “up-month” refers to a month in which the BSE 500 returns were positive and vice-versa for a “down-month”. The “Capture ratio” refers to sensitivity of the portfolio returns with respect to returns of BSE 500 index.

While the win rates and capture ratios during up months are comparable for the zone of thuggery and zone of quality, the zone of thuggery clearly underperforms the BSE 500 index more often and more severely when the overall market is down .i.e., in the immortal words of Warren Buffet “you only learn who has been swimming naked when the tide goes out” (source: 2007 annual letter to Berkshire Hathaway’s shareholders).

But are we ignoring all the nuances around Management Quality?

A frequent criticism of the automated approach is that machines do not understand qualitative and corporate governance nuances and are probably better employed when outcomes can be neatly classified as black and white. But, as it turns out, humans are not that great at understanding grey areas either. In Marcellus’ 3L3S, we highlighted a piece by Jason Voss (Link) which emphasized how NLP driven Text Based analysis can identify fraud and deception far better than humans. While this analysis was conducted on the US markets, the conclusions reached in this analysis apply universally, one of which is particularly apt in this context –

Trusting our gut does not work: “…research demonstrates we cannot detect deception through body language or gut instinct. In fact, a meta-analysis of our deception-spotting abilities found a global success rate just 4% better than chance…. There is more bad news here (sorry): Finance pros have a strong truth bias. We tend to trust other finance pros way more than we should. Our research found that we only catch a lie in finance 39.4% of the time. So that 51.8% accuracy rate is due to our tendency to believe our fellow finance pros.”

To contextualize this, let’s look at the case study of Manpasand beverages, which started off with its first product, Mango Sip in 1997 and in later years expanded its product portfolio to include fruit drinks in other flavors, as well as carbonated fruit drinks. The company went public in 2015, reporting strong results in run up to the IPO. Here’s how one of the prestigious broking firms in India described Manpasand in a 2018 report.

“Indian Soft Drink Market to grow at 17% volume CAGR versus Global Soft Drink Market’s ~3.4% CAGR by CY2021. Indian Juices Drink segment to outgrow Carbonates segment with 23% volume CAGR over CY16-21 as against 9.6% CAGR expected for the Carbonated Soft Drinks (CSD) segment in the Indian Market; we believe, Mango based drinks will continue to dominate.

MANB sweetly positioned in the Non-Carbonates / Juice Drinks segment which is growing at 2x of Carbonates. Expect MANB to report strong 38% Revenue CAGR at Rs.1,812cr driven by 35% volume CAGR over FY18-20E.

At CMP, MANB trades at 27.2x FY20 Earnings, at a discount to some of its FMCG peers and Global peers. Given robust revenue and earnings growth we value MANB at 34x P/E arriving at a Target Price of Rs.528 per share (25% upside) over 12-18 months horizon.”

Manpasand’s share price fell by ~100% since the publication of this report until 2020 when the stock got delisted (it fell nearly 70% in just 3 months after the publication of this report). This sort of text is routinely published by Indian broking firms. Most of these “research reports” do not contain a single sentence regarding the quality of the financial statements of the firm in question. In contrast, ever since the company went public, as per Marcellus’ forensic accounting framework, the said company has either been in D9 (i.e., the ninth decile) or D10 (i.e., the lowest decile). Delving deeper into the reason for these low rankings, our forensic framework highlighted that:

Over a six-year lookback period, an average company in the BSE 500 universe converts 100% of its operating profits to cash flow. However, Manpasand Beverages has only a 69% conversion rate which ranks it in the bottom 100 of the list.

Inferior accounting quality is just one aspect of what ails rogue companies in India. The other aspect of this underbelly of Indian capitalism is crony capitalists. Crony capitalism is a system where individuals with close ties to those in power benefit disproportionately from government policies, often at the expense of fairness and competition. This construct relies on close ties between businesses and politicians, leading to the manipulation of financial information for the personal gain of the promoters of the crony capitalist enterprise. The result is a lack of transparency in financial reporting and lower accounting quality, making it hard for investors and stakeholders to make informed decisions. Crony capitalists may hide debt, bribe officials, exaggerate earnings etc., thus creating a false picture of financial stability and profitability.

Lanco Infratech Ltd is a case in point. Lanco had deep-rooted political connections – its founding chairman was L Rajagopal (some of you may remember him as the “pepper-spray MP” when he sprayed pepper spray on his colleagues right inside the Lok Sabha). On the face of it, Lanco’s financials looked fantastic. Running a highly profitable construction business, Lanco earned EBIT margins almost twice as high as its peers. At the same time, it had a huge order book in excess of Rs 12k crores. However, a deeper analysis of the published financials revealed a complex group structure, especially its special purpose vehicles (SPVs), which accounted for ~85% of this order book. Moreover, it was repeatedly alleged that Lanco was engaging in unfair means to win contracts. This 2012 article highlights the lengths Lanco went to for securing such contracts.

Lanco’s share price rose from listing price of Rs 24 in Nov-2006 to an all-time high of Rs 84 in Dec-2007. However, by the time the above article was published in 2012, Lanco’s share price was Rs 16. The company filed for bankruptcy in 2018.

The forensic screening process is also well suited to MeritorQ’s quantitative approach. As we had highlighted in a previous newsletter dated December 2022, Strength lies in numbers, the ability to analyze a large investment universe of 500 companies in an efficient and consistent manner is an important differentiator and advantage for the quantitative approach compared to a fundamental research process which might be limited by the size of the analyst team. Comparing forensic rankings across around 500 companies at every rebalance, though a data intensive exercise, helps reduce chances of false positives (truly problematic companies misclassified as clean) and false negatives (clean companies classified as questionable).

Forensic screen identifies companies with accounting quality issues before they are known to the world

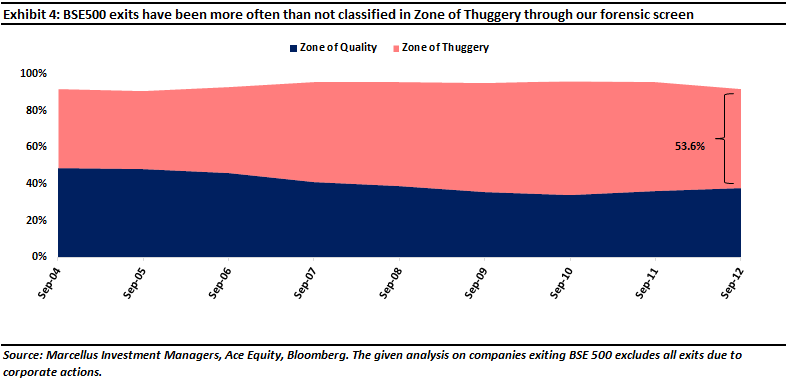

We looked at the accounting deciles of companies between 2004 to 2012 which exited the BSE 500 index over the next 10-year period (2012-2022) due to accounting frauds or corporate governance issues and capital misallocation. We adjusted this number for cases where the exits were due to normal corporate actions like M&A, delisting and spin-offs etc. We found that around 200 companies or 40% of the companies exit the BSE 500 index over the subsequent 10-year period. However, on an average more than 54% of such companies which had exited the index over next 10 years were classified in the zone of thuggery according to our forensics.

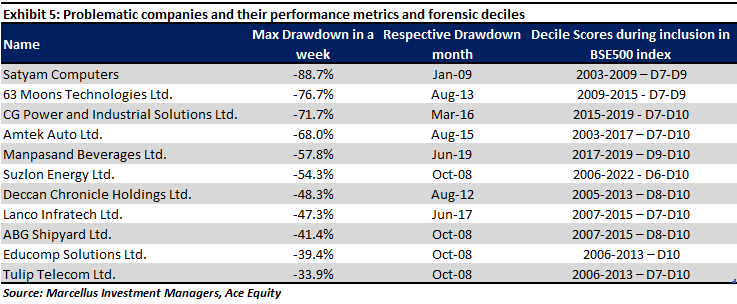

Exhibit 5 highlights some well-known cases over the past decade and shows how the forensic screen in MeritorQ excluded these companies in the back-test before the actual drawdown occurred when the accounting issues were eventually revealed.

|